Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ARMSTRONG WORLD INDUSTRIES INC | d808036d8k.htm |

| EX-99.2 - EX-99.2 - ARMSTRONG WORLD INDUSTRIES INC | d808036dex992.htm |

| EX-99.1 - EX-99.1 - ARMSTRONG WORLD INDUSTRIES INC | d808036dex991.htm |

Armstrong

World Industries

Investor

Presentation

October 27, 2014

Exhibit 99.3 |

2

Safe Harbor Statement

Our disclosures in this presentation, including without limitation, those relating to future financial

results guidance, and in our other public documents and comments contain forward-looking

statements within the meaning of the Private Securities Litigation Reform Act. Those

statements provide our future expectations or forecasts and can be identified by our use of words such as "anticipate,"

"estimate," "expect," "project," "intend," "plan,"

"believe," "outlook," "target," "predict," "may," "will," "would," "could," "should," "seek,"

and other words or phrases of similar meaning in connection with any discussion of future operating or

financial performance, including, in this presentation, all statements and projections relating

to the building products “mid-cycle” outlook. Forward-looking

statements, by their nature, address matters that are uncertain and involve risks because they relate

to events and depend on circumstances that may or may not occur in the future. A more

detailed discussion of the risks and uncertainties that may affect our ability to achieve the

projected performance is included in the “Risk Factors” and “Management’s Discussion and Analysis” sections

of our recent reports on Forms 10-K and 10-Q filed with the SEC. As a result, our actual

results may differ materially from our expected results and from those expressed in our

forward-looking statements. Forward-looking statements speak only as of the date

they are made. We undertake no obligation to update any forward-looking statements beyond

what is required under applicable securities law. The information in this presentation is only

effective as of the date given, October 27, 2014, and is subject to change. Any

distribution of this presentation after October 27, 2014 is not intended and will not be construed as updating or confirming such

information.

In addition, we will be referring to “non-GAAP financial measures” within the meaning of

SEC Regulation G. A reconciliation of the differences between these measures

with the most directly comparable financial measures calculated in accordance with GAAP

are can be found in our SEC filings and on the Investor Relations section of our website at www.armstrong.com.

Armstrong competes globally in many diverse markets. References to "market" or

"share" data are simply estimations based on a combination of internal and

external sources and assumptions. They are intended only to assist discussion of the relative

performance of product segments and categories for marketing and related purposes. No conclusion has

been reached or should be reached regarding a "product market," a

"geographic market" or “market share,” as such terms may be used or defined for any

economic, legal or other purpose. |

3

Basis of Presentation Explanation

•

When reporting our financial results within this presentation, we make several

adjustments. Management uses the non-GAAP measures below in managing the

business and believes the adjustments provide meaningful comparisons of

operating performance between periods. As reported results will be footnoted

throughout the presentation. •

We report in comparable dollars to remove

the effects of currency translation on the P&L.

The budgeted exchange rate for 2013 was

used for all currency translations in 2013 and

prior years. Guidance is presented using the

2014 budgeted exchange rate for the year.

•

We remove the impact of discrete expenses

and income. Examples include plant

closures, restructuring actions, and other

large unusual items.

•

Taxes for normalized Net Income and EPS

are calculated using a constant 39% for 2013

results and 2014 guidance, which are based

on the expected full year historical tax rate.

All

figures

throughout

the

presentation

are

in

$

millions

unless

otherwise

noted.

Figures

may

not

add

due to rounding.

Comparable

Dollars

Other

Adjustments

Net Sales

Yes

No

Gross Profit

Yes

Yes

SG&A Expense

Yes

Yes

Equity Earnings

Yes

Yes

Operating Income

Yes

Yes

Net Income

Yes

Yes

Cash Flow

No

No

Return on Capital

Yes

Yes

EBITDA

Yes

Yes

What Items Are Adjusted |

4

Investment Highlights

Diversified $2.7 billion global building products company

with leading positions in most key markets and products

Driving value creation through:

–

Recovery in North America

•

U.S. Commercial is our most profitable business

with 35-45% margins

–

Growth in International Markets

•

Executing on emerging market investments and

recovery in developed markets

–

Leveraging innovation to drive profitable growth

•

Focus on design, environmental leadership, installation

and application enhancements

•

New product benefits to drive improved mix

Focused on creating shareholder value |

Global Business

Overview |

6

35

Manufacturing Facilities

in 8

Countries

30%

% of Sales from Innovative

New Products Introduced in

the Past 5 Years

8,600+

Team Members

Worldwide

Billion Worldwide

Sales

2.7

80%

North American Commercial

Distributors have been with

AWI for 20+

years

100+

Countries have Armstrong

Ceilings or Floors

Customer Relationships

Worldwide

9,000+

80 Billion

Square Feet of Installed

Commercial Space in the

U.S.

Millions of

Installations

Globally

Armstrong Highlights |

Armstrong’s Global Manufacturing Footprint

AUSTRALIA

Braeside

Warren, AR

South Gate, CA

Pensacola, FL

Kankakee, IL

Somerset, KY

West Plains, MO

Jackson, MS

Vicksburg, MS

Millwood, MV

Hilliard, OH

St. Helens, OR

Lancaster, PA

Marietta, PA

Beech Creek, PA

Titusville, PA

Lancaster, PA

Stillwater, OK

Jackson, TN

Oneida, TN

Beverly, WV

USA

Montreal

CANADA

Team Valley

Stafford

UK

Rankwell

AUSTRIA

Pontarlier

FRANCE

Munster

Deimenhorst

Bietigheim

GERMANY

Wujiang

Shanghai

CHINA

#1

in ceilings in Europe

#1

in both floors and

ceilings in North America

#1

in ceilings in India

#1

in ceilings and

Top 3

in floors in China

#1

in both floors and

ceilings in Australia

7 |

8

2013 Business Segment and End-Use Profile

Diversified revenue profile across products and end-use applications

45%

65%

45%

North

America

R&R in

Americas is

closer to 80%

$920

$535

$1,265

$2,720

20%

25%

10%

30%

5%

65%

35%

30%

5%

20%

Hardwood Flooring

Resilient Flooring

Ceilings

(Building Products)

Consolidated

Commercial renovation

Commercial new

Residential renovation

Residental new |

9

EBITDA Performance

EBITDA growth in all businesses despite challenging macro environment

2010 EBITDA

2013 EBITDA

$370M

$310M

Worldwide Ceilings

Worldwide Resilient

Wood

2010

2013

2010

2013

2010

2013

Sales

$1.1B

$1.3B

10.7%

$1.0B

$920M

(9.7%)

$480M

$535M

11.2%

EBITDA as % of Sales

22%

26%

+ 360 bps

7%

10%

+ 370 bps

1%

3%

+ 220 bps

*Pension credit of $48 million in 2010 partially offset corporate expense, but net

pension expense of $3 million in 2013 provided no offset to corporate expense.

Worldwide Ceilings

Worldwide Resilient

Wood

Corporate*

81%

87%

22%

25%

2%

5%

(5%)

(17%) |

10

Key Milestones –

Positive Momentum

Cost

Management

Initiatives

Capital

Market

Activity

Organic

Investment

Portfolio

Management

Management

2010

2011

2012

2013

2014

New CEO and CFO

Leverage recap

and $800M

special dividend

$500M special

dividend

Announced $150M

cost

out initiative

Cost out initiative

raised to

$165M and then

$185M

Cost out initiative

concluded > $200M

in 2012

Simplex ceilings

acquisition

(Architectural

Specialties)

Divestiture of

Cabinets and Patriot

flooring distribution

businesses

Announced organic

investment in emerging

markets –

began construction of 3

plants in China

New global

Ceilings CEO

New CFO and global Flooring CEO

Both internal promotions

Delivered over $40M in manufacturing

productivity in 2013 and through the first nine

months of 2014

Growth through focus on innovation, product

adjacency opportunities, design and

environmental leadership

Completion of Chinese facilities in 2013 and

Russian facility in early 2015

Announced North American LVT

manufacturing investment with expected

completion in 1H 2015

Armstrong repurchases

~5M shares ($260M)

Announced

construction of

Ceilings plant in

Russia |

11

•

North American plants located in key

distribution areas

Over 20 plants in North America –

aids

in distribution, recycling of product and

customer relationships

•

Ability to capitalize on increased volume

Current plants are running at ~70%

capacity utilization; can support increase

in volume

A 10% increase in volume would require

an increase in production workforce by

2%

35% –

45% margins

•

Enormous base of existing installations

creates ability to leverage annuity stream

Positioned for a North American Commercial Recovery

Our most profitable market –

recovery drives strong earnings growth |

12

•

Executing on emerging markets

growth investments

Three China plants up and running

China metal ceilings plant on-line by

2015

Closely monitoring conditions in Russia;

on the ground operations continue as

normal, plant scheduled to begin

shipping Q1 2015

•

Global manufacturing footprint we need

for the coming years is in place

Remain confident on benefits of growth

in key markets, but timing uncertain

•

We have remained agile to market

conditions

Ability to redeploy assets based on

regional opportunities

Positioned for Global Growth |

13

•

Protect and grow

our

North American businesses

•

Invest and grow

in key international

and emerging markets

•

Optimize our portfolio

through

ongoing evaluation of strategic

opportunities by business, by

geography and across the company

•

Seek

adjacent

opportunities

to

expand

our product line and geographic reach

•

Build on our core competency

of

driving specifications in the architect

and designer communities while working

with our distribution partners to create

and enhance value

Armstrong’s Business Priorities |

Armstrong

Ceilings

Overview |

15

Global Ceilings Revenue and Product Mix

Commercially oriented business with diverse end-use applications

Sales by End-use Segment

Office

Retail

Education

Healthcare

Segment

% of Business

Office

30% -

40%

Retail

20% -

30%

Education

15% -

25%

Transportation /

Other

10% -

20%

Healthcare

5% -

15%

(1) Consists of wood, metal and other alternative material ceilings manufactured or

sourced by the company $780

$350

$135

2013 Sales by Geography

Americas

EMEA

Pacific Rim

85%

15%

Sales by Product Form

Mineral Fiber/Grid

Architectural

Specialties (1) |

16

•

Seamless customer relationship –

customers buy an Armstrong ceiling system

•

ROIC >100%

•

Over $225 million in cash dividends

to

Armstrong

from

2011

to

2013

•

8 Manufacturing plants in 5 countries

•

Products and services help drive

specifications and deliver efficiency

to contractors

WAVE –

Armstrong/Worthington 22-Year JV

Integral to Armstrong Ceiling business success |

Strategic Priorities

•

Go-to-market and fulfillment investments

Results 2010 –

2013

•

Americas EBITDA margin

+900 bps

•

>15% sales CAGR

•

Expanded capacity

•

>10% sales CAGR

(2011-2013)

•

•

Differentiated capability build-out

Margin expansion while

investing for growth

Strengthen our position in core markets

•

Position to benefit from commercial recovery

•

Expand margins and drive mix

Build a leadership position in key

emerging markets

Build a global leadership position in

Architectural Specialties

17

1

2

3 |

18

Sales and margin growth despite market challenges

•

Sales up 7% despite flat global volumes

•

EBITDA margins up 350 bps –

price, mix, earnings from WAVE and cost improvement

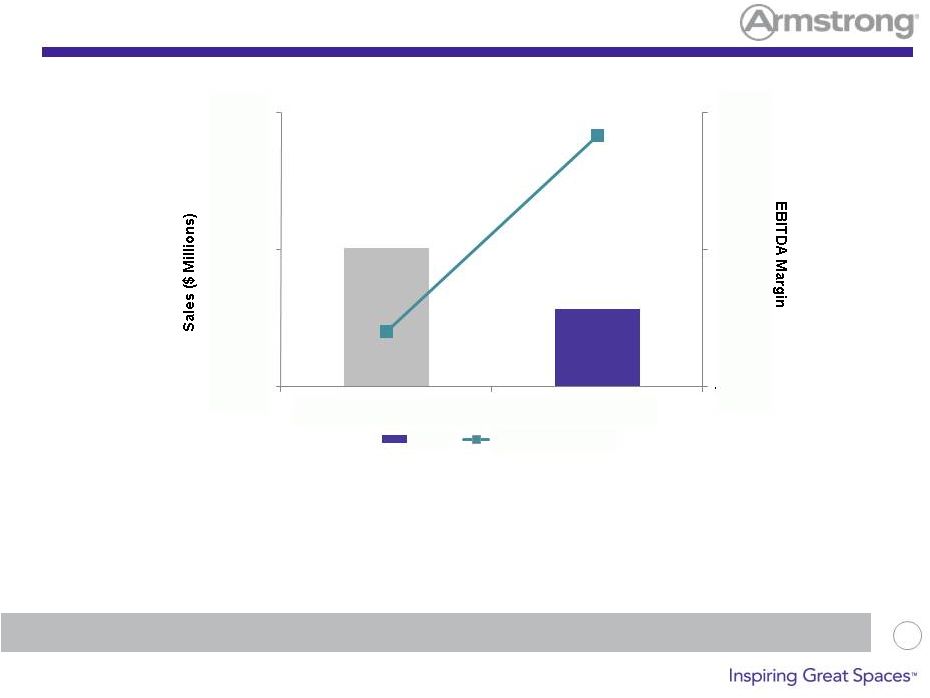

Global Ceiling Sales and EBITDA

20%

22%

24%

26%

1,000

1,100

1,200

1,300

2010

2013

Global Ceiling Sales and EBITDA

Sales

EBITDA Margin |

19

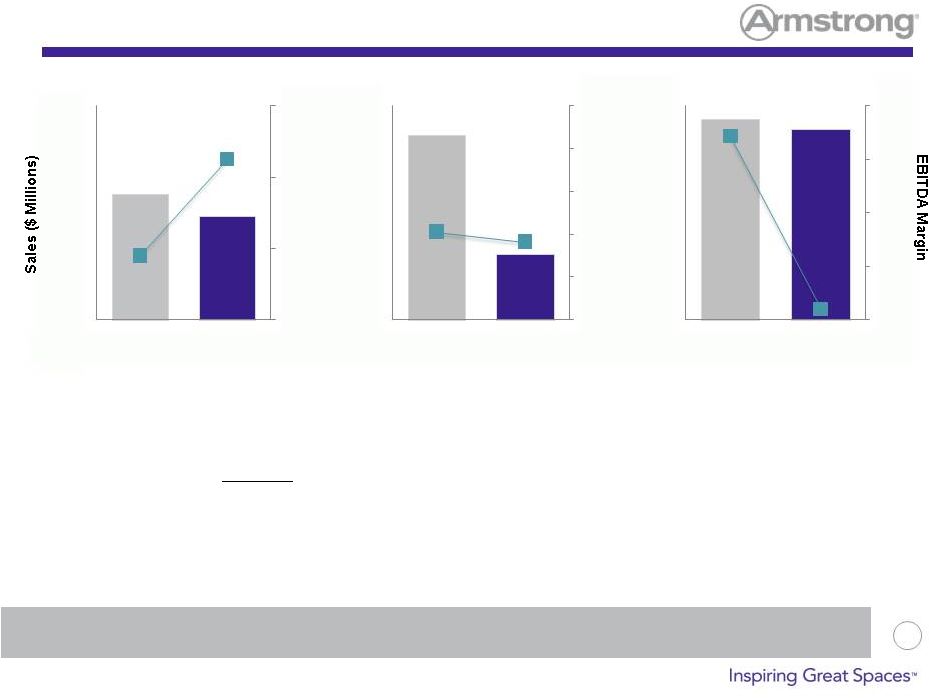

Regional Mix

Global improvements led by North America

•

~20% sales growth in UK,

Russia and Middle East

•

Offset by market contraction

in Continental Europe

•

Significant Russia plant

start-up investment began

in 2013

•

Sales +12% despite

lower volumes

•

EBITDA margin expands

900 bps –

price, mix,

manufacturing productivity,

WAVE earnings

•

Growth in India and

China offset Australia

market decline

•

Remains an investment

story to expand sales

and manufacturing

capacity for region |

20

Architectural Specialties (AS) Overview

•

Specialty ceiling systems targeted at customer

need for a design-oriented aesthetic

•

Same customer as mineral fiber ceilings,

often combined on the same project

•

Many different materials and product forms

•

Lower volume, higher price, sometimes

involving custom design and engineering

What Is AS?

What Makes Armstrong Unique?

Easiest

To Do

Business

With

Global footprint

to support

global projects

Broadest portfolio of

on-trend specialty ceiling

solutions in the world

Consistently

high level

of quality

A “high

touch”

service

model

Enhancing our value to core customers in a differentiated way

|

Investing in Our Global AS Footprint

Network provides advantaged local service and global leverage that aligns with how

our customers do business

Armstrong factory

Engineering office

Montreal,

Canada

Lancaster, US

Stafford, UK

Paris,

France

Moscow,

Russia

St. Gallen, Switz.

Dubai, UAE

Shanghai and

Beijing, China

Mumbai, India

Sydney, Australia

Guangzhou,

China (JV)

Capability and

capacity expansion

completed in 2013

Capability and capacity

expansion underway,

complete in 1Q14

New plant being built for Asia,

co-located with new mineral fiber plant

Stafford, UK

Wujiang, China

Rankweil, Austria

The top 200 global

architects estimate that

~50% of their revenues

come from outside their

home country

Montreal, Canada

21 |

22

The AS Financial Equation

An attractive ROIC-accretive global growth

engine within the ceilings segment

Big Penetration

Opportunity

Attractive Stand-Alone

Economics

Total Ceilings

Portfolio Synergies

•

$2B

market

opportunity

•

Highly incremental –

fragmented regional

competition

•

High incremental

margins

•

Lower fixed asset

intensity = high ROIC

•

Unique multi-product

specifications

•

Customer loyalty

driver

•

“Pull-through”

effect

on core mineral fiber

ceilings |

23

“Freedom Tower”

-

Conde Nast

Recently won the ceilings supply for

Conde Nast, an anchor tenant for this

iconic building, taking 25% of the floors

Why Armstrong:

•

Only company able to combine our

acoustical tile, Architectural Specialties

and grid solutions to effectively meet

customer’s challenging needs

•

Provided design services to enable a

unique visual

•

Ability to support a compressed

construction schedule

Case Study: One World Trade Center |

24

•

Leverage global reach and scale

•

Win specification game

Multi-product offering …

1-stop shopping

Supported with design services

•

Remodel opportunity

•

Prepared for demand uptick

Global Ceilings Summary |

Armstrong

Flooring

Overview |

Global

Flooring Revenue Mix Balanced exposure to Residential and Commercial

recovery Commercial

40%

Residential

60%

Total Business

Remodel

70%

New

30%

Remodel

75%

New

25%

Commercial

Residential

Office 5% -

15%

Retail 15% -

25%

Education 20% -

30%

Healthcare 20% -

30%

Other 15% -

25%

Commercial Sales by End-Use Segment

26 |

•

80%

of

sales

in

North

America

–

the

core

earnings

driver

of

the

business

•

Mix of Commercial and Residential in North America

•

Residential

is

a

North

American

business

–

business

outside

of

North

America is all Commercial

Geographic and Product Mix

2013 Sales by Geography

Total = $1.5B

2013 Sales by Product

27

Residential

~60%

Commercial

~40%

Americas

Commercial

$310

Americas

Residential

$870

EMEA $190

Pacific Rim

$85

Hardwood

36%

Res Tile

7%

Laminate/

Other 8%

Res

Sheet

10%

LVT

7%

Linoleum

Cml Sheet

17%

VCT

15% |

•

Sales down 3% due to volume declines, product exits in Europe and divestiture of

the Patriot distribution business

•

EBITDA margins improve almost 300 bps despite volume declines and investments in

China Global Flooring Total Sales and EBITDA

Aggressively remixing portfolio to faster growth markets and products while

dramatically lowering costs Global Flooring Sales and EBITDA

28

4%

6%

8%

1,400

1,500

1,600

2010

2013

Sales

EBITDA Margin |

29

Resilient Flooring

North American performance drives segment profit growth

•

Sales down only 2%

despite double digit

volume declines

•

Margins expand 675 bps

despite negative volume

leverage (manufacturing

productivity, mix and

price all improve)

•

Dramatic cost actions

have not been

sufficient with

European downturn

•

Structurally

challenged business

•

Sales flat; Weakness

in Australia, but China

sales +60%

•

EBITDA margins

impacted by plant /

commercial investment

in China and Australian

weakness

29

5%

10%

15%

20%

600

650

700

2010

2013

Americas

-5%

-4%

-3%

-2%

-1%

0%

150

250

350

2010

2013

EMEA

-5%

0%

5%

10%

15%

50

75

100

2010

2013

Pacific Rim |

30

Wood –

A Cyclical Business

With the right strategy, Wood can deliver above cost of capital through cycle

•

Leadership share in North America; sales still ~ 40% off peak

•

At

trough

volumes

in

2011

and

2012,

EBITDA

margins

were

+10%

and

ROIC

was

+8%

•

Nearly $50M in commodity inflation in 2013; estimating another $30-$35M in

2014 •

New strategy to cap production, price for anticipated inflation and drive higher

mix resulted improved margins in first nine month of 2014

Wood Sales and EBITDA

30

0%

5%

10%

15%

400

500

600

2010

2011

2012

2013

Sept YTD

2014

Sales

EBITDA Margin |

31

Our Strategy

Residential Flooring

Goals: Extend leadership

share and returns

Commercial Flooring

Goals: Restore wood attractiveness and

extend leadership share and margins in

resilient

Where To Play:

•

•

•

•

Where To Play:

•

•

•

Expand accessories and floor care solutions

Protect our leading share position in Sheet Vinyl

Significantly increase share in fast-growing LVT

Drive disproportionate sales and profit growth in

fast-growing emerging markets

Protect our leading share position in VCT in

North America

Dramatically increase share in fast-growing LVT

Win in the Healthcare, Education and Retail sectors |

32

Retail Case Study –

Why Armstrong

Product Solutions •

Design Leadership •

Brand Recognition

•

LVT in all stores / BBT in most stores

•

Bamboo & striated visual

•

Environmental statement (bio-based tiles)

•

Local access, fast installation and easy to maintain

Partnership

Consultative •

Service •

Reliability

•

2012: Striations bio-based tile as a prototype

•

2013: Over 420 stores refurbished

•

2014: Planning over 460 locations (continued expansion 2015)

Sector: Refresh drives traffic –

likely source of pent up demand |

33

•

Resilient flooring is a valuable franchise

with significant incremental margins

•

Executing our plan to restore Wood

structural attractiveness

•

Driving strong growth in emerging markets

•

Better utilizing our global footprint to lower

costs and speed innovation

•

Clear strategies to win

Armstrong Flooring –

Summary |

Growth through

Innovation |

35

•

Dynamic strategy driven by customer

needs

•

Deploying new product development, R&D,

and technical resources globally to the

highest value creation opportunities

Development of global and multi-

generational product platforms

Patent applications increased more than

5x since 2010

•

Differentiation that is valued by customers

= higher margins

•

Innovation is not limited to just new

products but extends to “how”

we do

business

Renewed Focus on Innovation

Innovation efforts accelerating

* Metric based on % of total sales for products introduced in the last five years.

0

10

20

30

40

2010

2011

2012

2013

Patent Activity

First Filed Utility Applications

0%

10%

20%

30%

2010

2011

2012

2013

New Product Sales* |

Inspiring Great Spaces through Leadership in Product Innovation

Calla™

Now your interior space can have

the smoothest textured mineral fiber

ceiling panel available. A Calla

ceiling has the monolithic visual of

drywall with easy access to the

plenum. Calla is now available in

Colorations™, 14 standard colors or

custom painted colors. Create a

totally integrated system using

Colorations with 9/16" Suprafine®

suspension systems and Axiom®

trim. Calla also offers: sound

absorption (NRC) and sound

blocking (CAC), high light-

reflectance, 68% recycled content.

Architectural Remnants -

Architectural Salvage

Calla Colorations™

Colorfully integrated!

Now you don’t have to choose

between color and acoustics…

Colorations™

on smooth-

textured Calla™

ceiling panels offers

a choice of 13 standard or custom

painted

colors.

Colorations

also

enables a completely harmonized

look with coordinating colors

available for suspension systems

and trim. Collaboration and

partnership with Sherwin Williams

allows for thousands of made to

order custom paint colors

for a truly unique look.

Look

for

Colorations

standard

colors translated on SoundScapes®

Canopies, SoundScapes Shapes,

SoundScapes Systems Blades™,

and

Infusions®

Canopies.

FLIP™

is a hand-held spray

adhesive. This innovative flooring

spray adhesive allows contractors

and installers to turn a small room

in less time, returning the area to a

functional revenue-generating

space quicker.

FasTak™

& iset™

are factory

applied adhesive systems for

residential and commercial LVT

•

Immediate occupancy,

no wet glue

•

Fast & easy install, repair,

and replace

Architectural

Remnants

brings

back timeworn charm. It provides the

look of reclaimed wood flooring with

HYDRACORE™

PLUS,

giving

it

a

more substantial feel and the solid

sound of real hardwood.

VISIONGUARD®

protects the

surface of the floor from stains,

fading, and wear-through and makes

cleaning easy and stress-free.

Received recognition in Better

Homes & Gardens’

Kitchen + Bath

magazine as one of the 30 most

innovative products for 2014, and

was awarded “Best in Innovation”

at

Surfaces in 2014.

SoundScapes Shapes

Innovations in installation and design that inspire customers

36

™

™ |

37

2003

2013

Ultima / Optima

Fissured / Cortega

Acoustics (NRC)

Light Reflect

Recycle Content

Anti Mold/Mildew

Warranty

0.70 / 0.90

0.90

86% / 71%

Yes

30 Years

Acoustics (NRC)

Light Reflect

Recycle Content

Anti Mold/Mildew

Warranty

0.55

0.81 / 0.82

41%

No

1 Year

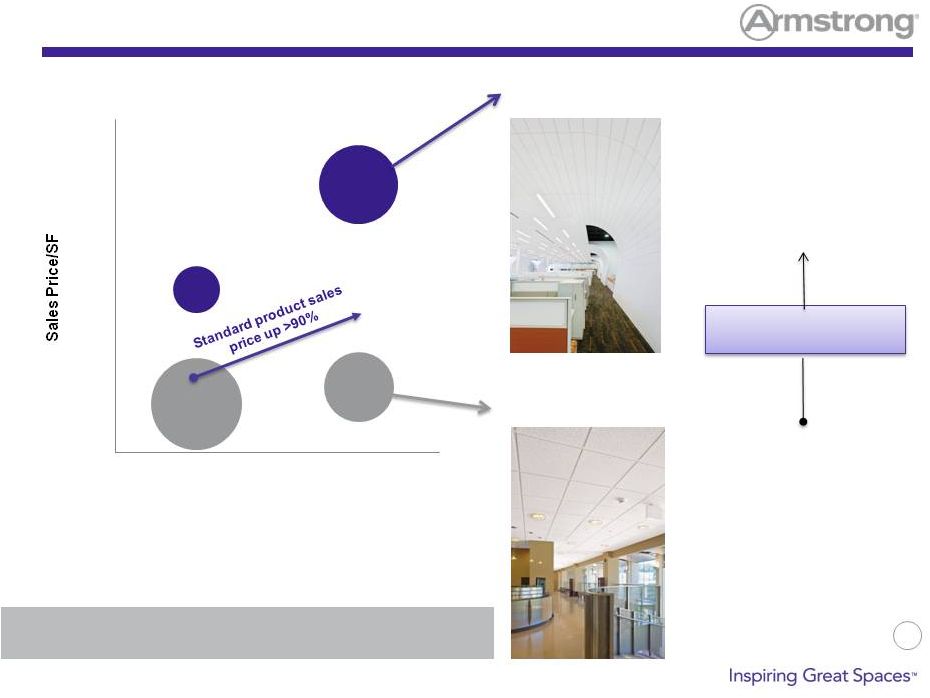

Bubble size represent percent of category sales

Better products yield

better pricing

Mix Evolution -

Ceilings Americas

Innovation enables gains in price and mix

$0.00

$1.00

$2.00

37 |

•

Sales CAGR ~5x volume

growth during this time period

•

Direct Margin $’s grew at a

CAGR of >33%

Mix Revolution -

Residential Floor Tile

Innovation

led

growth

driving

“mix

up”

within

the

category

and

improved

profitability

Alterna -

Allegheny Slate

–

Copper Mountain

Luxe with FasTak –

Groveland -

Natural

•

Growth driven by category expansion, product innovation and new

introductions:

•

Alterna, groutable engineered stone tile utilizes proprietary technology to

mimic the detail, texture and variation of natural stone

•

Luxury vinyl plank offerings such as Luxe, Natural Living, Natural

Personality

•

Present & Future Growth

•

Alterna features multiple sizes and wall installation

•

LVT domestic production enables Armstrong to expand offering and

increase speed to market

•

New

innovations

in

installation

(FasTak)

and

evolution

of

design

establish

Armstrong as the market leader

Standard residential tile

offering in 2008

From:

To:

-

$0.25

$0.50

$0.75

$1.00

$0

$50

$100

$150

2008

2013

$

Sales

ANSP

Residential Tile Growth

38 |

Financial

Summary |

40

•

Positioned to benefit from North American

commercial recovery

•

Capture growth in established international

and emerging markets

•

Maintain a flexible balance sheet

•

Generate significant free cash flow to fund

investments and return value to shareholders

Focused on Value Creation

ROIC is our key long-term financial metric |

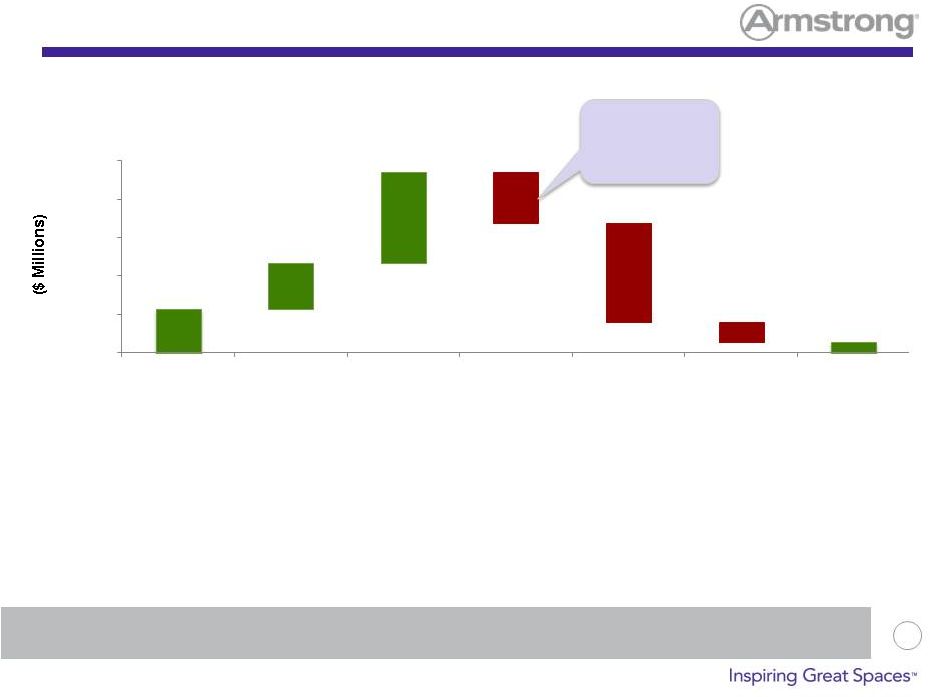

Adjusted EBITDA History

2006

2007

2008

2009

2010

2011

2012

2013

2014 Est.

Sales

$3.26B

$3.30B

$3.14B

$2.66B

$2.65B

$2.68B

$2.62B

$2.72B

$2.68 -

$2.72B

EBITDA

$400M

$433M

$401M

$310M

$310M

$376M

$402M

$371M

$355 -

$375M

EBITDA as % of

Sales

12.3%

13.1%

12.8%

11.6%

11.7%

14.0%

15.3%

13.6%

~13.5%

($430)

($195)

$105

$15

($50)

$215

A history of driving Price > Inflation

$370

$310

$400

Discrete cost-out program 2010

–

2012 drove over $200M of

savings in SG&A and

Manufacturing

$0

$100

$200

$300

$400

$500

$600

$700

$800

2006

Price / Mix

Volume

Input Costs

Mfg Cost

SG&A

WAVE

Pension Credit

2013

41 |

42

Cash Flow History

Significant cash investments and returns to shareholders

•

Created and maintained an efficient balance sheet

•

Cash generation aided by low cash tax rate from Chapter 11 Net Operating Loss

(NOL) carry-forward

•

Prioritized investments in capital expenditures to drive global growth

•

Returned surplus cash via special dividends and share repurchase

$1,180

$135

Includes

$275M of

strategic

investments

$500

$1,000

$1,500

$2,000

$2,500

YE 2009

Borrowing

Cash Flow from

Business

Capex

Special

Dividends

Share

repurchase

YE 2013

$570

($655)

($260)

($1,300)

$600 |

43

Well-positioned and efficient balance sheet

Balance Sheet –

9/30/14

Net Debt

$900M

LTM EBITDA

$370M

Leverage

2.4x

•

No significant maturities until 2018

•

Considerable covenant headroom

•

Recent ratings upgrade to BB

(positive) from S&P

•

Sufficient liquidity

•

Fully funded US pension plan;

no contributions in >20 years

Current Leverage

(65)

75

250

150

-100

100

300

500

Liquidity

LCs

Securitization

Revolver

Cash

$410M

0

250

500

2014

2015

2016

2017

2018

2019

2020

>2020

Maturity Schedule

Term Loans

Other |

44

Path to Growth –

Adjusted EBITDA margin

High incremental margins on additional volume can drive increased margins in

“mid-cycle” 30%

20%

10%

0%

30%

20%

10%

0%

Ceilings

Resilient

Wood

Corp.

TOTAL

2013 Actual

Ceilings

Resilient

Wood

Corp.

TOTAL

“Mid-cycle”

Margin on Incremental

Volume

Ceilings

30% -

45%

Resilient

25% -

35%

Wood

25% -

30% |

45

•

Free cash flow will increase as plant builds

wind down in early 2015

Partially offset by increased US

cash taxes as foreign tax credits

are consumed in 2014 and 2015

•

Prioritize use of capital

Capital expenditures to drive

organic growth

Return value to shareholders

(dividends and/or share repurchases)

Acquisitions

•

Target 2-3x net leverage on trailing

12-month EBITDA

Capital Deployment

Future

cash

distributions

likely

to

be

less

episodic

than

in

the

past |

46

Investment Highlights

Diversified $2.7 billion global building products company

with leading positions in most key markets and products

Driving value creation through:

–

Recovery in North America

•

U.S. Commercial is our most profitable business

with 35-45% margins

–

Growth in International Markets

•

Executing on emerging market investments and

recovery in developed markets

–

Leveraging innovation to drive profitable growth

•

Focus on design, environmental leadership, installation

and application enhancements

•

New product benefits to drive improved mix

Focused on creating shareholder value |

Financial

Overview

Appendix |

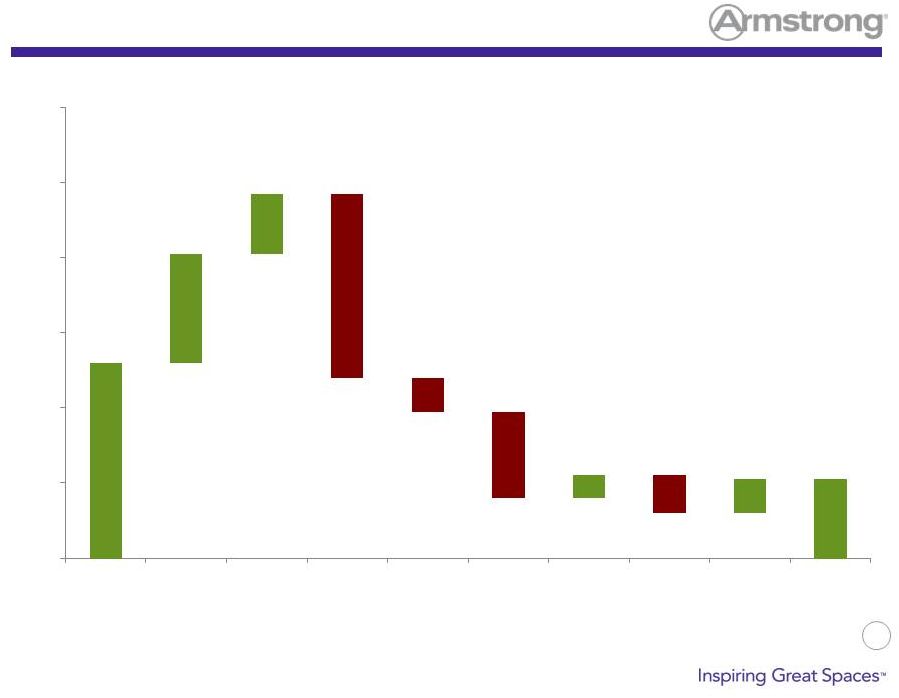

48

$16

EBITDA

Bridge

–

Full

Year

2013

vs.

Prior

Year

($23)

($9)

$29

$6

$371

$402

$350

$370

$390

$410

$430

$450

$470

2012

Price / Mix

Volume

Input

Costs

Mfg Cost

SG&A

WAVE

Pension

Credit

Change in

D&A

2013

($49)

$(10)

$9 |

49

EBITDA

Bridges

-

2014

Results

vs.

PY

($12)

($9)

($25)

($17)

$3

$11

EBITDA Bridge Sept YTD 2014 vs. PY

EBITDA Bridge Q3 2014 vs. PY

$300

$297

$200

$220

$240

$260

$280

$300

$320

$340

$360

2013

Price/Mix

Volume

Input Costs

Mfg Cost

SG&A

WAVE

Pension

Expense

Change in

D&A

2014

($26)

$46

$13

$15

$1

$2

$117

$122

$0

$20

$40

$60

$80

$100

$120

$140

$160

2013

Price/Mix

Volume

Input Costs

Mfg Cost

SG&A

WAVE

Pension

Expense

Change

in D&A

2014

($3)

($1)

$2

($2) |

50

2014 Estimate Range

(1)

2013

(2)

Variance

Net Sales

(3)

2,680

to

2,720

2,700

(1%)

to

1%

Operating Income

(4)

230

to

245

257

(11%)

to

(5%)

EBITDA

355

to

375

366

(3%)

to

2%

Earnings Per Share

(5)

$2.00

to

$2.15

$1.98

1%

to

9%

Free Cash Flow

0

to

40

68

(100%)

to

(41%)

(1)

Guidance is presented using 2014 budgeted foreign exchange rates

(2)

2013 results are presented using 2014 budgeted foreign exchange rates

(3)

2014 and 2013 net sales include the impact of foreign exchange

(4)

As

reported

Operating

Income:

$205

-

$220

million

in

2014

and

$239

million

2013

(5)

As

reported

earnings

per

share:

$1.40

-

$1.55

in

2014

and

$1.71

in

2013

Key Metrics –

Guidance 2014 |

51

2014 Financial Outlook

$30 -

$40 million vs. 2013

Adjusted Gross Margin 0 to 30 bps vs. 2013

Raw Material & Energy Inflation

Manufacturing

Productivity* Earnings

from WAVE Cash Taxes/ETR*

Q4

Capital Spending

Exclusions from EBITDA*

(1)

Net sales include foreign exchange impact

(2)

As reported ETR of 49% for 2014

* Changed from July Outlook

SG&A

16.5% to 17.0% of sales

$0 -

$5 million vs. 2013

$15 -

$25 million; Adjusted long-term ETR of ~39%

(2)

Sales

(1)

$610–

$650 million; EBITDA $55 –

$75 million

$195 -

$215 million

$25 -

$30 million |

52

2013

2012

V

EBITDA–

Adjusted

$371

$402

($31)

Depreciation and Amortization

(109)

(100)

(9)

Operating

Income

–

Adjusted

$262

$302

($40)

Foreign Exchange Movements

(5)

-

(5)

Cost Reduction Initiatives

(18)

(13)

(5)

Accelerated Depreciation and Impairments (not included above)

-

(12)

12

Impairment

-

(6)

6

Operating

Income

–

As

Reported

$239

$271

($32)

Interest (Expense) Income

(67)

(51)

(16)

EBT

$172

$220

($48)

Tax (Expense) Benefit

(71)

(76)

5

Net Income

$101

$144

($43)

Full Year -

Adjusted EBITDA to Reported Net Income |

Management Team |

54

Matthew J. Espe, Chief Executive Officer and

President In July 2010, Matthew J. Espe was appointed CEO of

Armstrong World Industries, Inc., in Lancaster, Pennsylvania.

Matt brings 30 years of experience in sales, marketing, distribution and

management with global manufacturing businesses to Armstrong. In his

previous role at Ricoh Americas Corporation, a subsidiary of Ricoh Company,

Ltd., he served as chairman and CEO. Prior, he was chairman and CEO of IKON Office Solutions, Inc.,

a $4 billion office equipment distributor and services provider with 24,000

employees. Ricoh acquired IKON in 2008. Before joining IKON in 2002, Matt

was president and CEO of GE Lighting. In a career that spanned 22 years there,

he managed multiple business units as well as functions including sales,

marketing, distribution and manufacturing.

Along

with

a

wealth

of

experience,

he

also

brings

a

finely-tuned

global

perspective,

having

led

businesses in Europe, Asia and North America.

Matt is a former director of Unisys Corporation and Graphic Packaging, Inc. He

currently serves on the advisory board

at

the

College

of

Business

and

Economics

at

the

University

of

Idaho

and

on

the

advisory

council

for

Drexel

University's Lebow College of Business, Center for Corporate Governance.

Additionally, Matt is a member of the National Association of Corporate

Directors (NACD) and the Wall Street Journal CEO Council. He graduated from

the University of Idaho with a bachelor's degree in marketing, and received his

MBA from Whittier College. David S. Schulz is senior vice president and CFO

of Armstrong World Industries, Inc., in Lancaster, Pennsylvania.

Mr. Schulz joined Armstrong in 2011 as vice president, finance for Armstrong

Building Products. Prior, he served as CFO of Procter & Gamble

Company’s Americas snacks division, and from 2008 to 2009 as

the

finance

director

for

the

Coffee

business

unit

of

the

J.M.

Smucker

Co.

following

the

merger

of

P&G’s Folgers Coffee Co. with Smucker. His experience covers a wide range

of finance leadership positions encompassing operational finance, planning

and analysis, mergers and acquisitions, and financial reporting. Well known

as a strong business partner, Mr. Schulz actively engages with other

functions to drive improvement. Prior to joining Procter & Gamble, Mr.

Schulz was an officer in the United States Marine Corps.

He earned his bachelor’s degree in finance from Villanova University in 1987

and a master’s degree in management from the U.S. Naval Postgraduate

School in 1993. David S. Schulz, Senior Vice President and

Chief Financial Officer |

55

Don Maier, Executive Vice President,

CEO Armstrong Floor Products Worldwide

Victor Grizzle,

Executive Vice President, CEO Armstrong Building Products

Victor

“Vic”

Grizzle

is

executive

vice

president

and

CEO,

Armstrong

Building

Products,

in

Lancaster,

Pennsylvania.

Mr. Grizzle has 23 years of experience in process improvement, sales, marketing

and global business leadership. He comes to Armstrong from Valmont

Industries, a $2 billion global leader of infrastructure support structures for

utility, telecom and lighting markets, and manufacturer of mechanized irrigation

equipment for large scale farming, where

he

was

group

president

of

Global

Structures,

Coatings

and

Tubing

since

2005.

Prior

to

Valmont,

Mr.

Grizzle

was president of the commercial power division of EaglePicher Corporation, a $700

million diversified manufacturer and marketer of advanced technology and

industrial products for space, defense, automotive, filtration,

pharmaceutical, environmental and commercial applications. Before that, he spent

16 years at General Electric Corporation.

Mr. Grizzle graduated from California Polytechnic University with a Bachelor of

Science in Mechanical Engineering.

Don Maier is the EVP & CEO of Armstrong Floor Products. He joined

Armstrong in January 2010 and was most recently the senior vice president,

Global Operations. Don came to Armstrong from TPG Capital Advisors, the

global buyout group of TPG, a private investment firm. Prior, he held a

steady progression of roles at Hillenbrand Industries, beginning in 1987 as a

manufacturing and product engineer for subsidiary Batesville Casket Company, and

later moving from product development and marketing leadership roles to vice

president, Manufacturing and Operations. In 2002, he became vice president,

Strategy and Business Development, for a larger Hillenbrand subsidiary,

Hill-Rom, a $1.5 billion leading global producer of health care equipment,

technology and workflow IT systems. In 2003, he became vice president and

general manager, and in 2005 he was named senior vice president –

North America. In that role, he had P&L responsibility for a $1.4 billion

business with a $325 million operating budget and $90 million capital

budget. Don is a member of the board of directors of the National Association

of Manufacturers. He holds a bachelor’s degree in Industrial Systems

Engineering from The Ohio State University in Columbus, Ohio, and an MBA,

with a concentration in Marketing, from Xavier University in Cincinnati, Ohio. |

56

Thomas J. Waters, Vice President Treasury & Investor Relations

Thomas J. Waters is Vice President, Treasury and Investor

Relations of Armstrong World Industries, Inc. Mr. Waters

joined

Armstrong

in

1998

as

Manager,

Capital

Markets.

Since

then

he

has

held

the

positions

of Director of Investor Relations, General Manager of Finance and IT for Building

Products Europe, General Manager Financial Planning and Analysis for North

American Floor Products. He was named Treasurer

in

2008,

and

added

investor

relations

responsibilities

in

2010.

Prior to Armstrong, Mr. Waters worked for American Airlines in Dallas, TX in both

Treasury and Operational Finance roles.

Mr. Waters earned a BA from Binghamton University, and a MBA from the Walter A.

Haas School of Business at the University of California, Berkeley.

Kristy Olshan is Investor Relations Manager of Armstrong World Industries, Inc.,

in Lancaster, Pennsylvania.

Mrs. Olshan became Investor Relations Manager in December of 2010 and has

responsibility for managing all external investor communications. Mrs.

Olshan joined Armstrong in November of 2008 as External Reporting Manager.

Prior to Armstrong, Mrs. Olshan spent over 5 years in public accounting as

an auditor and advisor to clients in the construction engineering, banking,

utility, and manufacturing industries with a focus on SEC reporting and

Sarbanes-Oxley compliance. Mrs. Olshan is also a Certified Public

Accountant and member of the AICPA. She previously served on the board

as Treasurer of the York Hospital Auxiliary, a Wellspan affiliated non-profit

organization. Mrs. Olshan earned a bachelor of science

with dual degrees in Business Administration and Accounting, and an MBA from

York College of Pennsylvania. Kristy Olshan, Investor

Relations Manager |

57

Investor Relations Contact Information

Kristy Olshan, CPA, MBA

Investor Relations Manager

Armstrong World Industries

2500 Columbia Avenue

Lancaster, PA

17604

P: 717-396-6354

F: 717-396-6128

E: ksolshan@armstrong.com

Thomas J. Waters

VP, Treasury and Investor Relations

Armstrong World Industries

2500 Columbia Avenue

Lancaster, PA

17604

P: (717) 396-6354

F: (717) 396-6136

E: tjwaters@armstrong.com |