Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Covisint Corp | a8kfy154q2earnings930141.htm |

| EX-99.1 - EXHIBIT 99.1 FINANCIALS AND EXHIBITS - Covisint Corp | exhibit991q220151.htm |

Covisint Corporation Second Quarter Fiscal 2015 Results

2 Forward Looking Statements This presentation contains “forward-looking” statements that involve risks, uncertainties and assumptions. If the risks or uncertainties ever materialize or the assumptions prove incorrect, our results may differ materially from those expressed or implied by such forward-looking statements. All statements other than statements of historical fact could be deemed forward-looking, including, but not limited to, any projections of financial information; any statements about historical results that may suggest trends for our business and results of operations; any statements of the plans, strategies and objectives of management for future operations; any statements of expectation or belief regarding future events, potential markets or market size, technology developments, or enforceability of our intellectual property rights; and any statements of assumptions underlying any of the foregoing. These statements are based on estimates and information available to us at the time of this presentation and are not guarantees of future performance. Actual results could differ materially from our current expectations as a result of many factors, including but not limited to: quarterly fluctuations in our business and results of operations; our ability to address market needs and sell our applications and services successfully; the general market conditions of the industry; and the effects of competition. These and other risks and uncertainties associated with our business are described in our Annual Report on Form 10-K for the fiscal year ended March 31, 2014. We assume no obligation and do not intend to update these forward-looking statements. In addition to U.S. GAAP financials, this presentation includes certain non-GAAP financial measures. These historical and forward-looking non- GAAP measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. A reconciliation between GAAP and non-GAAP measures is included in the appendix to this presentation. Covisint is a registered trademark of Covisint Corporation. This presentation also contains additional trademarks and service marks of ours and of other companies. We do not intend our use or display of other companies’ trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies.

3 FY15: Transition Year • Leadership and Organization – Compuware to complete spin on October 31st – SVP Product and Marketing search nearing conclusion • Software/Services to Software Focus – Sales organization re-focusing message and go-to-market strategy • Strategic Partnerships – Cisco relationship moving to next stage and pipeline of potential strategic partners continues to develop • Cost and Revenue Alignment

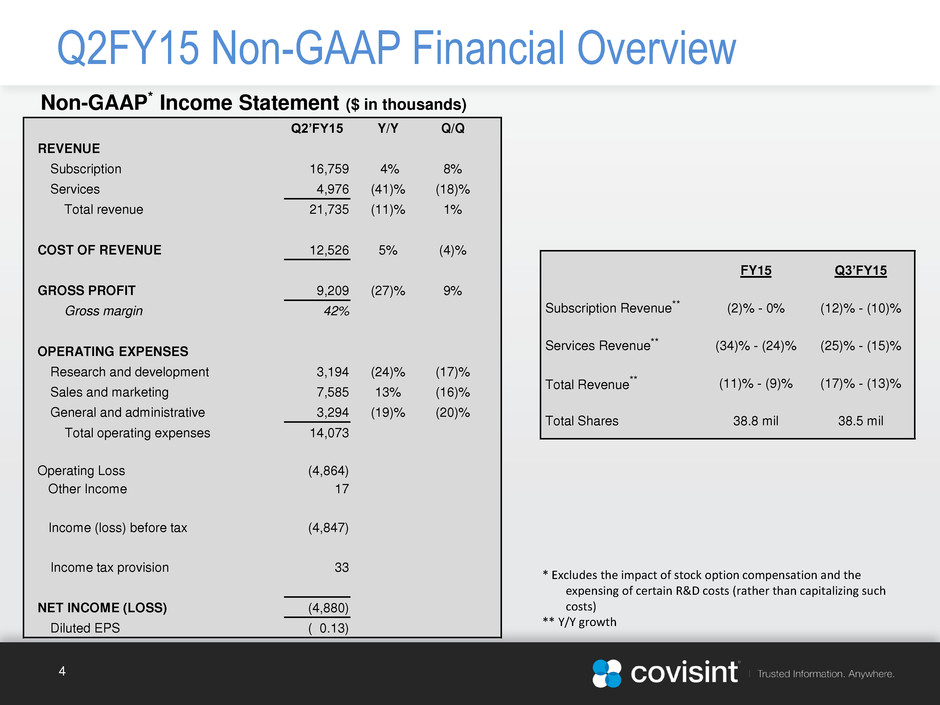

4 Q2FY15 Non-GAAP Financial Overview Non-GAAP* Income Statement ($ in thousands) Q2’FY15 Y/Y Q/Q REVENUE Subscription 16,759 4% 8% Services 4,976 (41)% (18)% Total revenue 21,735 (11)% 1% COST OF REVENUE 12,526 5% (4)% GROSS PROFIT 9,209 (27)% 9% Gross margin 42% OPERATING EXPENSES Research and development 3,194 (24)% (17)% Sales and marketing 7,585 13% (16)% General and administrative 3,294 (19)% (20)% Total operating expenses 14,073 Operating Loss (4,864) Other Income 17 Income (loss) before tax (4,847) Income tax provision 33 NET INCOME (LOSS) (4,880) Diluted EPS ( 0.13) FY15 Q3’FY15 Subscription Revenue** (2)% - 0% (12)% - (10)% Services Revenue** (34)% - (24)% (25)% - (15)% Total Revenue** (11)% - (9)% (17)% - (13)% Total Shares 38.8 mil 38.5 mil * Excludes the impact of stock option compensation and the expensing of certain R&D costs (rather than capitalizing such costs) ** Y/Y growth

Appendix

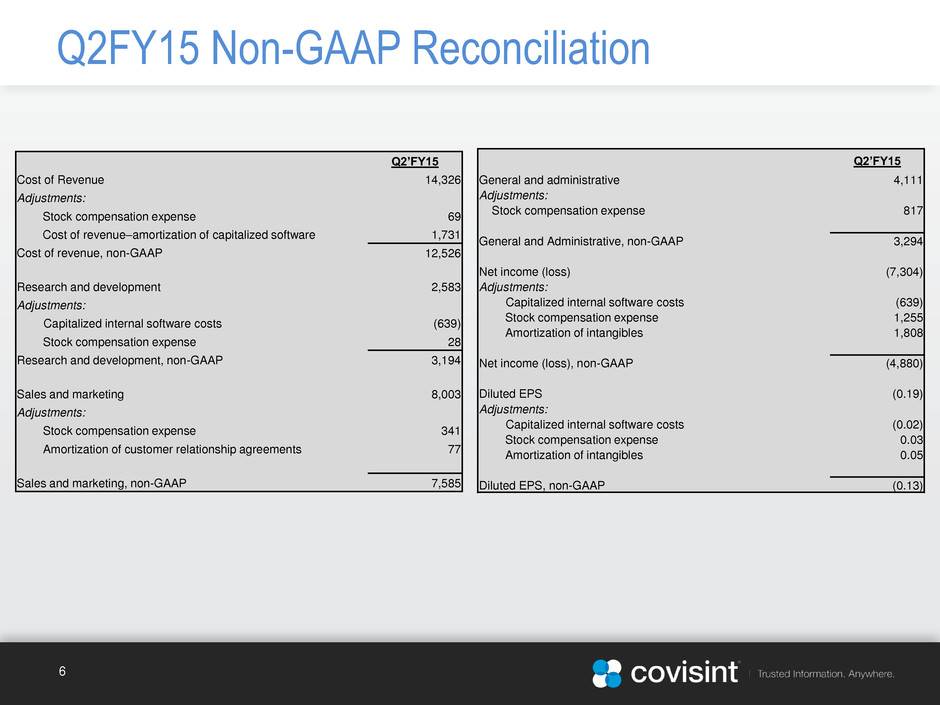

6 Q2FY15 Non-GAAP Reconciliation Q2’FY15 General and administrative 4,111 Adjustments: Stock compensation expense 817 General and Administrative, non-GAAP 3,294 Net income (loss) (7,304) Adjustments: Capitalized internal software costs (639) Stock compensation expense 1,255 Amortization of intangibles 1,808 Net income (loss), non-GAAP (4,880) Diluted EPS (0.19) Adjustments: Capitalized internal software costs (0.02) Stock compensation expense 0.03 Amortization of intangibles 0.05 Diluted EPS, non-GAAP (0.13) Q2’FY15 Cost of Revenue 14,326 Adjustments: Stock compensation expense 69 Cost of revenue–amortization of capitalized software 1,731 Cost of revenue, non-GAAP 12,526 Research and development 2,583 Adjustments: Capitalized internal software costs (639) Stock compensation expense 28 Research and development, non-GAAP 3,194 Sales and marketing 8,003 Adjustments: Stock compensation expense 341 Amortization of customer relationship agreements 77 Sales and marketing, non-GAAP 7,585