Attached files

| file | filename |

|---|---|

| 8-K - CUSTOMERS BANCORP, INC. FORM 8-K - Customers Bancorp, Inc. | customers8k.htm |

| EX-99.1 - EXHIBIT 99.1 - Customers Bancorp, Inc. | ex99-1.htm |

Exhibit 99.2

Highly Focused, Low Risk, Above Average Growth

Bank Holding Company

Investor Presentation

October 2014

NASDAQ: CUBI

Note: All information in this document has been adjusted for the10% stock dividend that was declared on May 15, 2014

to shareholders of record on May 27th payable on June 30, 2014.

to shareholders of record on May 27th payable on June 30, 2014.

2

Forward-Looking Statements

This presentation as well as other written or oral communications made from time to time by us, may contain certain forward-looking information

within the meaning of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. These statements relate to future

events or future predictions, including events or predictions relating to our future financial performance, and are generally identifiable by the use of

forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “plan,” “intend,” “target,” or “anticipates” or the negative thereof

or comparable terminology, or by discussion of strategy or goals that involve risks and uncertainties. These forward-looking statements are only

predictions and estimates regarding future events and circumstances and involve known and unknown risks, uncertainties and other factors that may

cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity,

performance or achievements expressed or implied by such forward-looking statements. This information is based on various assumptions by us that

may not prove to be correct.

within the meaning of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. These statements relate to future

events or future predictions, including events or predictions relating to our future financial performance, and are generally identifiable by the use of

forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “plan,” “intend,” “target,” or “anticipates” or the negative thereof

or comparable terminology, or by discussion of strategy or goals that involve risks and uncertainties. These forward-looking statements are only

predictions and estimates regarding future events and circumstances and involve known and unknown risks, uncertainties and other factors that may

cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity,

performance or achievements expressed or implied by such forward-looking statements. This information is based on various assumptions by us that

may not prove to be correct.

Important factors to consider and evaluate in such forward-looking statements include:

•changes in the external competitive market factors that might impact our results of operations;

•changes in laws and regulations, including without limitation changes in capital requirements under the federal prompt corrective action regulations;

•changes in our business strategy or an inability to execute our strategy due to the occurrence of unanticipated events;

•our ability to identify potential candidates for, and consummate, acquisition or investment transactions;

•the timing of acquisition or investment transactions;

•constraints on our ability to consummate an attractive acquisition or investment transaction because of significant competition for these

opportunities;

opportunities;

•the failure of the Bank to complete any or all of the transactions described herein on the terms currently contemplated;

•local, regional and national economic conditions and events and the impact they may have on us and our customers;

•ability to attract deposits and other sources of liquidity;

•changes in the financial performance and/or condition of our borrowers;

•changes in the level of non-performing and classified assets and charge-offs;

•changes in estimates of future loan loss reserve requirements based upon the periodic review thereof under relevant regulatory and accounting

requirements;

requirements;

•the integration of the Bank’s recent FDIC-assisted acquisitions may present unforeseen challenges;

•inflation, interest rate, securities market and monetary fluctuations;

•the timely development and acceptance of new banking products and services and perceived overall value of these products and services by users;

•changes in consumer spending, borrowing and saving habits;

•technological changes;

3

Forward-Looking Statements

• the ability to increase market share and control expenses;

• continued volatility in the credit and equity markets and its effect on the general economy; and

• the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Public Company

Accounting Oversight Board, the Financial Accounting Standards Board and other accounting standard setters;

Accounting Oversight Board, the Financial Accounting Standards Board and other accounting standard setters;

• the businesses of the Bank and any acquisition targets or merger partners and subsidiaries not integrating successfully or such integration being

more difficult, time-consuming or costly than expected;

more difficult, time-consuming or costly than expected;

• material differences in the actual financial results of merger and acquisition activities compared with expectations, such as with respect to the full

realization of anticipated cost savings and revenue enhancements within the expected time frame;

realization of anticipated cost savings and revenue enhancements within the expected time frame;

• revenues following any merger being lower than expected; and

• deposit attrition, operating costs, customer loss and business disruption following the merger, including, without limitation, difficulties in

maintaining relationships with employees being greater than expected.

maintaining relationships with employees being greater than expected.

These forward-looking statements are subject to significant uncertainties and contingencies, many of which are beyond our control. Although we

believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity,

performance or achievements. Accordingly, there can be no assurance that actual results will meet expectations or will not be materially lower

than the results contemplated in this presentation. You are cautioned not to place undue reliance on these forward-looking statements, which

speak only as of the date of this document or, in the case of documents referred to or incorporated by reference, the dates of those documents.

We do not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after

the date of this document or to reflect the occurrence of unanticipated events, except as may be required under applicable law.

believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity,

performance or achievements. Accordingly, there can be no assurance that actual results will meet expectations or will not be materially lower

than the results contemplated in this presentation. You are cautioned not to place undue reliance on these forward-looking statements, which

speak only as of the date of this document or, in the case of documents referred to or incorporated by reference, the dates of those documents.

We do not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after

the date of this document or to reflect the occurrence of unanticipated events, except as may be required under applicable law.

This presentation is for discussion purposes only, and shall not constitute any offer to sell or the solicitation of an offer to buy any security, nor is it

intended to give rise to any legal relationship between Customers Bancorp, Inc. (the “Company”) and you or any other person, nor is it a

recommendation to buy any securities or enter into any transaction with the Company. The information contained herein is preliminary and

material changes to such information may be made at any time. If any offer of securities is made, it shall be made pursuant to a definitive offering

memorandum or prospectus (“Offering Memorandum”) prepared by or on behalf of the Company, which would contain material information not

contained herein and which shall supersede, amend and supplement this information in its entirety.

intended to give rise to any legal relationship between Customers Bancorp, Inc. (the “Company”) and you or any other person, nor is it a

recommendation to buy any securities or enter into any transaction with the Company. The information contained herein is preliminary and

material changes to such information may be made at any time. If any offer of securities is made, it shall be made pursuant to a definitive offering

memorandum or prospectus (“Offering Memorandum”) prepared by or on behalf of the Company, which would contain material information not

contained herein and which shall supersede, amend and supplement this information in its entirety.

Any decision to invest in the Company’s securities should be made after reviewing an Offering Memorandum, conducting such investigations as the

investor deems necessary or appropriate, and consulting the investor’s own legal, accounting, tax, and other advisors in order to make an

independent determination of the suitability and consequences of an investment in such securities. No offer to purchase securities of the

Company will be made or accepted prior to receipt by an investor of an Offering Memorandum and relevant subscription documentation, all of

which must be reviewed together with the Company’s then-current financial statements and, with respect to the subscription documentation,

completed and returned to the Company in its entirety. Unless purchasing in an offering of securities registered pursuant to the Securities Act of

1933, as amended, all investors must be “accredited investors” as defined in the securities laws of the United States before they can invest in the

Company

investor deems necessary or appropriate, and consulting the investor’s own legal, accounting, tax, and other advisors in order to make an

independent determination of the suitability and consequences of an investment in such securities. No offer to purchase securities of the

Company will be made or accepted prior to receipt by an investor of an Offering Memorandum and relevant subscription documentation, all of

which must be reviewed together with the Company’s then-current financial statements and, with respect to the subscription documentation,

completed and returned to the Company in its entirety. Unless purchasing in an offering of securities registered pursuant to the Securities Act of

1933, as amended, all investors must be “accredited investors” as defined in the securities laws of the United States before they can invest in the

Company

4

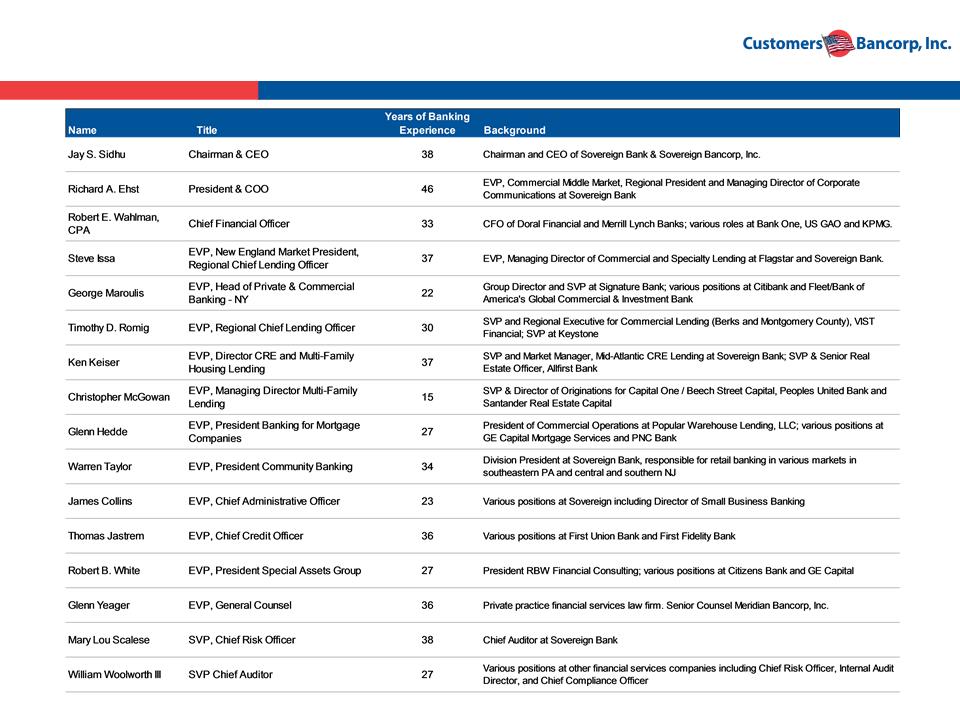

Our Biggest Advantage: A Highly Experienced Management Team

5

Investment Proposition

High Organic Growth, Well Capitalized, Low Risk, Branch Lite Bank in Attractive Markets

§ $6.5 billion asset bank

§ Well capitalized at an estimated 11.0% + total risk based capital and 6.8% tier 1 leverage

§ Target market from Boston to Washington D.C. along interstate 95

Strong Profitability & Growth

§ Q3 2014 earnings up 41% over 3Q 2013 with an ROE of 11%, ROA .80%

§ ROA goal of 1% + and ROE of 12% + within 2-3 years

§ 3.00% net interest margin goal; Targeting efficiency ratio in the 40’s - current margin is 2.79%

and efficiency ratio is 54%

and efficiency ratio is 54%

§ DDA and total deposits compounded annual growth of 100% and 73% respectively since 2009

§ 130% compounded annual growth in core earnings since 2011

Strong Credit Quality

§ No charge-offs on loans originated after 2009

§ 0.18% non-performing loans (non-FDIC covered loans)

§ Total reserves to non-performing loans of 246.4%

* Capital ratios are estimates pending final call report

6

Investment Proposition

Low Interest Rate Risk

§ Approximately 40% of the loan portfolio will re-price within one year (1)

§ 40% of loans have an average life of 3.8 years

§ ~16% of deposits, on average, are non-interest bearing

§ Extending liabilities at this time

§ $150 million in forward starting swaps

§ Neutral to gradually rising rates over next one to two years

Attractive Valuation

§ Current share price ($17.75)(2) is 11.8x estimated 2014 earnings, and 10.0x

estimated 2015 earnings

estimated 2015 earnings

§ Price/tangible book only at 1.1x and 1.0x for 2014 and 2015 respectively

§ Peers trading at 14x earnings and 1.7x price/tangible book

(1) Includes mortgage warehouse

(2) Share price as of Oct 16, 2014

7

Return on Average Equity

Efficiency Ratio

NPAs

Return on Average Assets

Source: SNL Financial on an LTM basis as of 4Q2013

Customers Bancorp Will Become A Stronger Performer

8

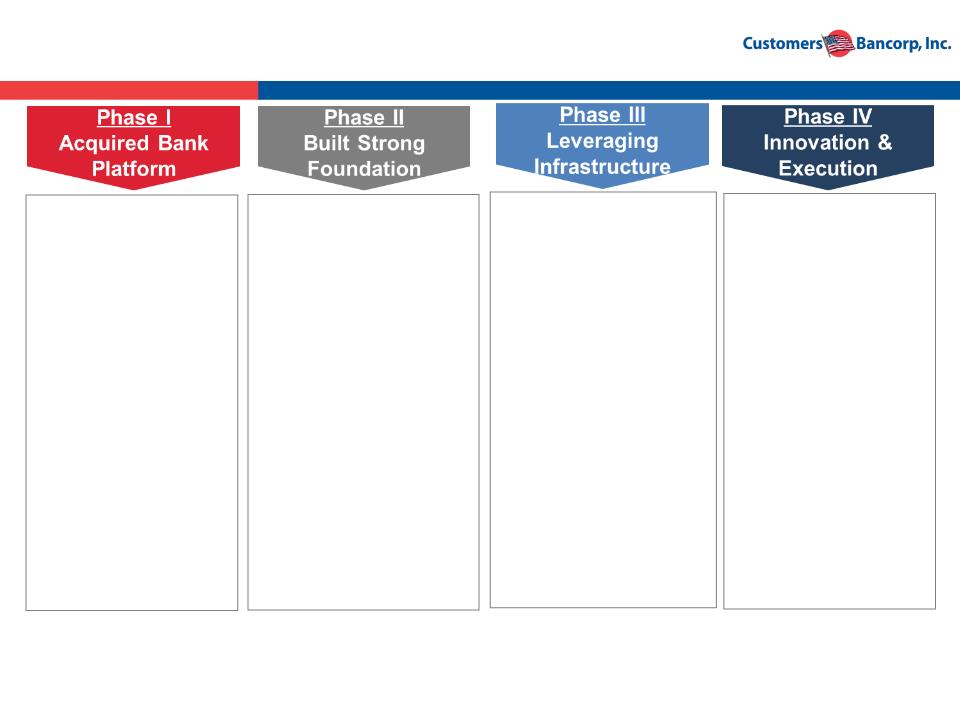

Execution Timeline

§ We invested in and

took control of a $270

million asset

Customers Bank (FKA

New Century Bank)

took control of a $270

million asset

Customers Bank (FKA

New Century Bank)

§ Identified existing

credit problems,

adequately reserved

and recapitalized the

bank

credit problems,

adequately reserved

and recapitalized the

bank

§ Actively worked out

very extensive loan

problems

very extensive loan

problems

§ Recruited experienced

management team

management team

§ Enhanced credit and risk

management

management

§ Developed infrastructure

for organic growth

for organic growth

§ Built out warehouse

lending platform and

doubled deposit and loan

portfolio

lending platform and

doubled deposit and loan

portfolio

§ Completed 3 small

acquisitions:

acquisitions:

– ISN Bank (FDIC-

assisted) ~ $70 mm

assisted) ~ $70 mm

– USA Bank (FDIC-

assisted) ~ $170 mm

assisted) ~ $170 mm

– Berkshire Bancorp

(Whole bank) ~ $85

mm

(Whole bank) ~ $85

mm

§ Recruited proven lending

teams

teams

§ Built out Commercial and

Multi-family lending

platforms

Multi-family lending

platforms

§ De Novo expansion;4-6

sales offices or teams

added each year

sales offices or teams

added each year

§ Continue to show strong

loan and deposit growth

loan and deposit growth

§ Built a “branch lite” high

growth Community Bank

and model for future

growth

growth Community Bank

and model for future

growth

§ Goals to ~12%+ ROE;

~1% ROA

~1% ROA

2009

Assets: $350M

Equity: $22M

2010-2011

Assets: $2.1B

Equity: $148M

2012-2013

Assets: $4.2B

Equity: $400M

3Q 2014

Assets: $6.5B

Equity: $426M

§ Single Point of Contact

Private Banking model

executed - commercial

focus

Private Banking model

executed - commercial

focus

§ Introduce bankmobile -

banking of the future

for consumers

banking of the future

for consumers

§ Continue to show

strong loan and

deposit growth

strong loan and

deposit growth

§ ~12%+ ROE; ~1%

ROA expected within

36 months

ROA expected within

36 months

§ ~$6.5+ billion asset

bank by end of 2014

bank by end of 2014

§ ~$9 billion asset bank

by end of 2019

by end of 2019

9

Disciplined Model for Increasing Shareholder Value

§ Strong organic revenue growth + scalable infrastructure =

sustainable double digit EPS growth and increased shareholder

value

sustainable double digit EPS growth and increased shareholder

value

§ A very robust risk management driven business strategy

§ Build tangible book value per share each quarter via earnings

§ Any book value dilution from any acquisitions must be overcome

within 1-2 years

within 1-2 years

§ Superior execution through proven management team

Disciplined Model for Superior Shareholder Value Creation

10

Banking Strategy

Business Banking Strategy - ~95% of revenues come from business

• Loan and deposit business through these segments:

• Banking Privately Held Businesses

• Banking High Net Worth Families

• Banking Mortgage Companies

Consumer Banking Strategy

• Principal focus is getting deposits in a highly efficient and unique model

while meeting the needs of all the communities in our assessment area

while meeting the needs of all the communities in our assessment area

• Introduce Bank Mobile and Prepaid businesses by late 2014; focus on

Gen Y and under-banked; strategic partnerships for consumer loan

products

Gen Y and under-banked; strategic partnerships for consumer loan

products

11

Consumer Deposit Strategy - High Touch, High Tech

§ Implementation of

technology suite

allows for unique

product offerings:

technology suite

allows for unique

product offerings:

§ Remote account

opening &

deposit capture

opening &

deposit capture

§ Internet/mobile

banking

banking

§ Free ATM

deployment in

U.S.

deployment in

U.S.

Cost of Funds + Branch Operating Expense - Fees = ALL-IN-Cost < Competitors

CUBI All-in cost of 1.75% is less than competitors all-in cost over the long-term

Technology

§ Low cost banking

model allows for

more pricing

flexibility

model allows for

more pricing

flexibility

§ Significantly lower

overhead costs vs. a

traditional branch

overhead costs vs. a

traditional branch

§ Pricing/profitability

measured across

relationship

measured across

relationship

Pricing

§ Experienced

bankers who own a

portfolio of

customers

bankers who own a

portfolio of

customers

§ Customer

acquisition &

retention strongly

incentivized

acquisition &

retention strongly

incentivized

§ Takes banker to the

customer’s home or

office, 12 hours a

day, 7 days a week

customer’s home or

office, 12 hours a

day, 7 days a week

§ Appointment

banking approach

banking approach

§ Customer access to

private bankers

private bankers

§ “Virtual Branches”

out of sales offices

out of sales offices

Sales Force

Concierge Banking

12

Results of Deposit Growth: Organic Growth With Controlled Costs

Source: Company data.

Total Deposit Growth ($mm)

Average DDA Growth ($mm)

Customers strategies of single point of contact and recruiting known teams in target markets produce

rapid deposit growth with low total cost

rapid deposit growth with low total cost

13

Customers Bank Advantage

All Consumer

Products

Products

All Business

Products

Products

All Non-Credit

Products

Products

Client

Makes

One Call

Makes

One Call

Client

Private /

Personal

Bankers

Personal

Bankers

Concierge

Bankers

Bankers

Loan Portfolio Mix ($mm)

Single Point of Contact

High Touch / High Tech

14

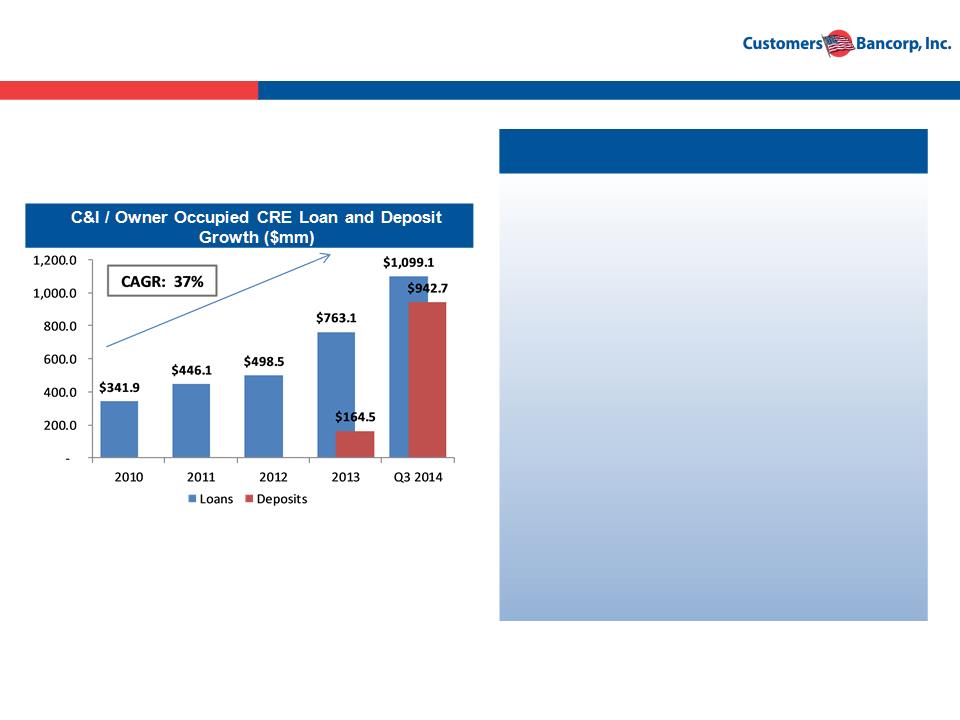

C&I & Owner Occupied CRE Banking Strategy

Small Business

§Target companies with less than $5.0 million

annual revenue

annual revenue

§Principally SBA loans originated by small

business relationship managers or branch

network

business relationship managers or branch

network

§Current focus PA & NJ markets

Private & Commercial

§Target companies with up to $100 million

annual revenues

annual revenues

§Very experienced teams

§Single point of contact

§NE, NY, PA & NJ markets

Banking Privately Held Business

15

Multi-Family Banking Strategy

Banking High Net Worth Families

Multi-Family Loan and Deposit Growth ($mm)

§ Focus on families that have income

producing real estate in their portfolios

producing real estate in their portfolios

§ Private banking approach

§ Focus Markets: New York & Philadelphia

MSAs

MSAs

§ Average Loan Size: $4.0 - $7.0 million

§ Remote banking for deposits and other

relationship based loans

relationship based loans

§ Portfolio grown organically from a start up

with very experienced teams hired in the

past 3 years

with very experienced teams hired in the

past 3 years

§ Strong credit quality niche

§ Interest rate risk managed actively

16

Mortgage Warehouse Banking Strategy

§Private banking focused on mortgage

companies with $5 to $10 million equity

companies with $5 to $10 million equity

§Lower interest rate and credit risk line of

business

business

§~75 strong warehouse clients

§All warehouse loans classified as held for

sale

sale

§All deposits are non-interest bearing DDA’s

§Balances rebounding from 2013 low but not

expected to stay at this level

expected to stay at this level

§Selected lending against servicing portfolios

introduced in 2014

introduced in 2014

Banking Mortgage Companies

17

These Deposit and Lending Strategies Results in Disciplined & Profitable Growth

Core Revenue ($mm)

Core Net Income ($mm) (1)

Source: SNL Financial and Company data.

(1)Core income is net income before extraordinary items.

(2)CAGR calculated from Dec-09 to Sep-14 (annualized).

Net Interest Income ($mm)

• Strategy execution has produced superior growth in revenues and earnings

18

Strong Growth Provides for Shareholder Value Creation

§ Per share tangible book value up consistently each year

§ Focused on continuous growth of TBV aligns executive management compensation with

shareholder value creation

shareholder value creation

§ Any tangible book value dilution from acquisition must be recovered within 1 to 2 years

Note: Shares estimated pending final dividend adjustment

19

§ Innovator /

disruptor

disruptor

§ Differentiated /

Unique model

Unique model

§ Technology savvy

§ Product dominance

The Thesis on Current

U.S. Banking Environment

Credit Improving - Though Banks Face a

Number of Operational Headwinds

§ Credit Improving

4 NPAs and NCOs greatly declining across the sector

§ Asset Generation

4 Banks are starved for interest-earning assets and exploring new asset

classes, competing on price and looking into specialty finance business /

lending

classes, competing on price and looking into specialty finance business /

lending

§ NIM Compression

4 Low rate environment for the foreseeable future will continue to compress NIM

4 Several institutions have undergone balance sheet restructuring to alleviate

near-term NIM pressure

near-term NIM pressure

§ Operational leverage

4 Expense management is top of mind as banks try to improve efficiency in light

of revenue pressure and increased regulatory / compliance costs

of revenue pressure and increased regulatory / compliance costs

Capital Accumulation Continues To

ROI Continues to Trend Below 10% Despite

Being Modestly Higher Than Pre-Recession1

Critical to Have a Winning Business Model

§ Local dominance

§ Strong credit

quality

quality

§ Core deposits

Relationship

Banks

Banks

§ Diversity

§ Cross sell

§ Capital efficiency

§ Higher profitability /

consistent earnings

consistent earnings

Fee Income

Leaders

Leaders

Innovators

20

Customers Bank Views Itself As An Innovator That

Is Poised To Take Advantage Of Changes Taking

Place In The Industry

Is Poised To Take Advantage Of Changes Taking

Place In The Industry

• Changes in technology have resulted in the digitization of consumer and business

transactions and automation of the payment system

transactions and automation of the payment system

• Technology dependent consumers and small businesses are not visiting branches

• Customers are looking for an exceptional experience, no nuisance fees and very

competitive offerings at their fingertips

competitive offerings at their fingertips

• Mobile has become the fastest growing channel for financial services

21

22

Startling Facts About Banks

§ Banks each year charge $32 billion in overdraft fees - that’s

allowing or creating over 1 billion overdrafts each year….Why??

allowing or creating over 1 billion overdrafts each year….Why??

§ Payday lenders charge consumers another $7 billion in fees

§ That’s more than 3x what America spends on Breast Cancer and

Lung Cancer combined

Lung Cancer combined

§ Combined this is about 50% of all America spends on Food Stamps

§ Some of banking industries most profitable consumer customers

hate banks

hate banks

§ Another estimated 25% consumers are unbanked or under banked

This should not be happening in America

We hope to start, in a small way, a new revolution

to address this problem

to address this problem

23

§ New no fee banking vertical supplementing Consumer and Community Banking

§ Marketing Strategy

§ Reach markets through Affinity Banking Groups

§ Revenue generation from debit card interchange and margin from low cost

core deposits

core deposits

§ We are also looking at opportunities in the prepaid card space

§ Total investment not to exceed $5.0 million by end of 2015 but expected to be

offset by revenues

offset by revenues

§ Expected to achieve above average ROA and ROE within 5 years

Mobile Banking - Creating a Virtual Bank for the Future

24

Key Financial Targets for the Next 2-3 Years

Focus in future years

•Single point of contact model - “High touch supported by high tech”

•Only superior credit quality niches

•Above average organic growth

•Expense management

Earnings per share growth estimated at ~ 17% year over year

•Assumes no additional common shares are issued during 2014 or 2015

Expecting banking for mortgage companies balances to remain flat and

continue to shrink as a percentage of total assets

continue to shrink as a percentage of total assets

Strategically aligned technology partners

•Core Banking Platform - Fiserv

•Mobile Banking Platform - Malauzai

Unique branch model

•24 hours concierge bankers

•All-In-Cost (interest expense + operating cost)

•Alternative channels emerging in our model

•Use of technology to reduce branch traffic

•Bank Mobile & prepaid cards

Criteria 2 - 3 Year Targets

Year EPS Guidance

*Efficiency ratio = non-interest expenses/(net interest income + non-interest

income - securities gains)

income - securities gains)

25

Summary

§ Strong high performing $6.5 billion bank with significant growth opportunities

§ Very experienced management team delivers strong results

§ Ranked #1 overall by Bank Director Magazine in the 2012 and 2013 Growth

Leader Rankings

Leader Rankings

§ “High touch, high tech” processes and technologies result in superior growth,

returns and efficiencies

returns and efficiencies

§ Shareholder value results from the combination of increasing tangible book

value with strong and consistent earnings growth

value with strong and consistent earnings growth

§ Attractive risk-reward: growing several times faster than industry average but

yet trading at a significant discount to peers

yet trading at a significant discount to peers

§ Introducing among the 1st mobile banking application for account opening and

complete mobile platform based servicing in the USA

complete mobile platform based servicing in the USA

26

Regional Bank Comparison

High Performance Regional Banks

Source: SNL Financial, Company documents. Market data as of 6/30/2014. Consists of Northeast and Mid-Atlantic banks and thrifts with assets between $3.0 billion and $8.0 billion and most recent quarter core ROAA greater

than 90 bps. Excludes merger targets and MHCs.

than 90 bps. Excludes merger targets and MHCs.

(1)Customers Bancorp NPAs/Assets calculated as non-covered NPAs divided by total assets. Non-covered NPAs excludes accruing TDRs and loans 90+ days past due and still accruing.

(2)Customers Bancorp Price/TBV and Price/2015 EPS based on share price as of Oct 16, 2014.

27

Contacts

Company:

Robert Wahlman, CFO

Tel: 610-743-8074

rwahlman@customersbank.com

rwahlman@customersbank.com

www.customersbank.com

Jay Sidhu

Chairman & CEO

Tel: 610-301-6476

jsidhu@customersbank.com

jsidhu@customersbank.com

www.customersbank.com

Investor Relations:

Ted Haberfield

President, MZ North America

Tel: 760-755-2716

thaberfield@mzgroup.us

www.mzgroup.us

Appendix

29

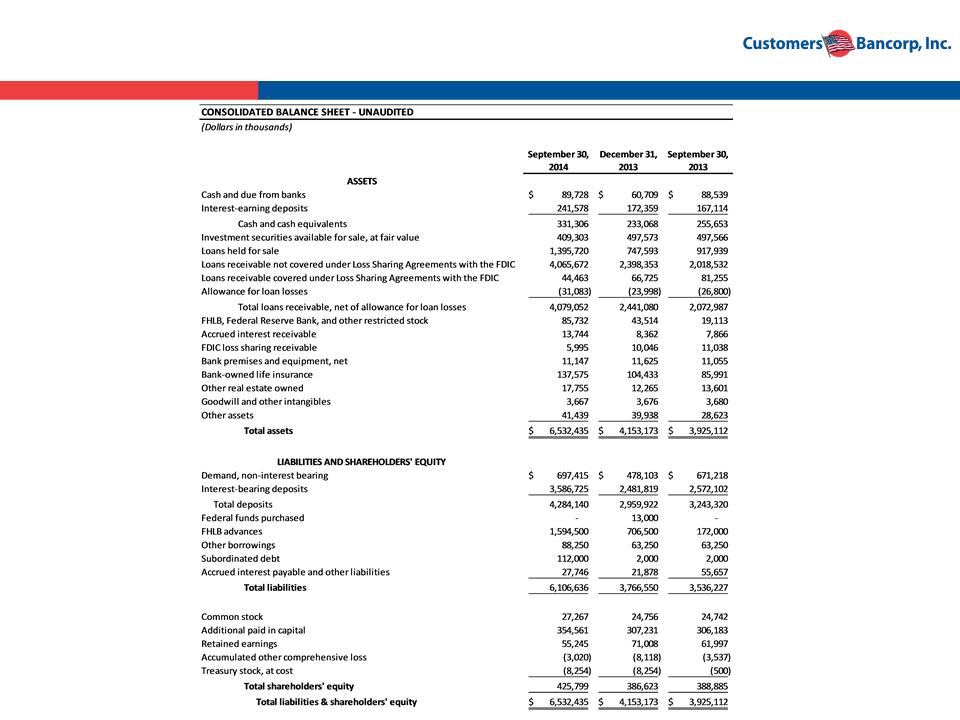

Balance Sheet

30

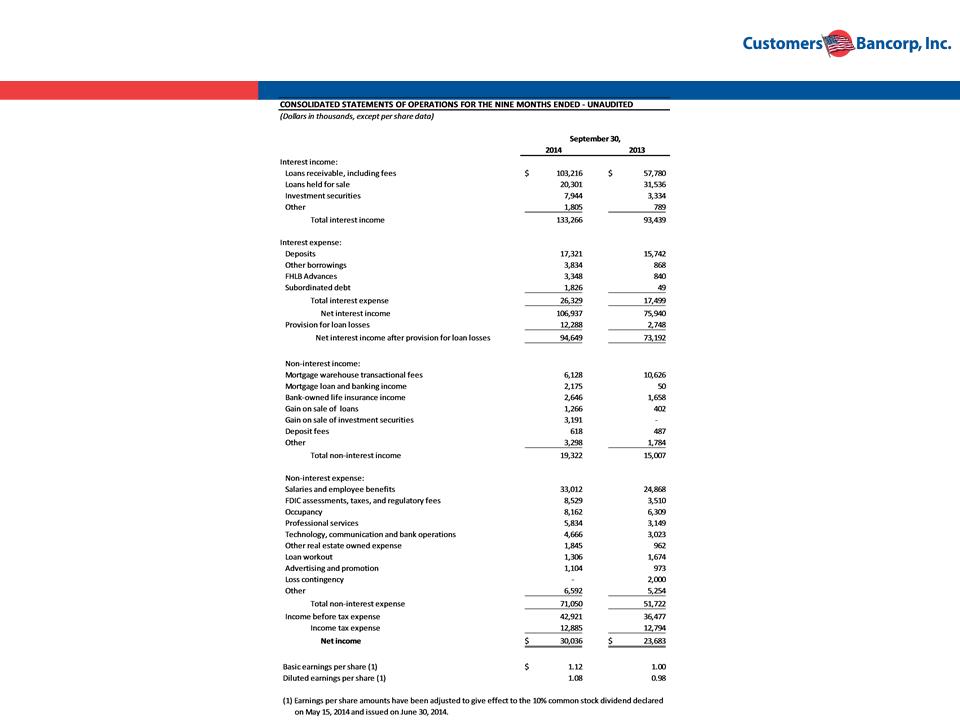

Income Statement

31

Income Statement

32

Net Interest Margin

33

Asset Quality