Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - STERIS CORP | d804033d8k.htm |

| EX-99.4 - EX-99.4 - STERIS CORP | d804033dex994.htm |

| EX-99.1 - EX-99.1 - STERIS CORP | d804033dex991.htm |

| EX-10.2 - EX-10.2 - STERIS CORP | d804033dex102.htm |

| EX-10.1 - EX-10.1 - STERIS CORP | d804033dex101.htm |

| EX-2.2 - EX-2.2 - STERIS CORP | d804033dex22.htm |

| EX-2.1 - EX-2.1 - STERIS CORP | d804033dex21.htm |

| EX-99.3 - EX-99.3 - STERIS CORP | d804033dex993.htm |

STERIS Acquisition

of

Synergy Health

Creating a Global Leader in

Infection Prevention

and

Sterilization

October 13, 2014

Exhibit 99.2 |

1

Forward Looking Statements

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR

INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE

A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION

No Offer or Solicitation

This document is provided for informational purposes only and does not constitute

an offer to sell, or an invitation to subscribe for, purchase or

exchange,

any

securities

or

the

solicitation

of

any

vote

or

approval

in

any

jurisdiction,

nor

shall

there

be

any

sale,

issuance,

exchange

or

transfer

of

the securities referred to in this document in any jurisdiction in contravention of

applicable law. Forward-Looking Statements

This document may contain statements concerning certain trends, expectations,

forecasts, estimates, or other forward-looking information affecting or

relating to Synergy or STERIS or its industry, products or activities that are intended to qualify for the protections afforded "forward-looking

statements" under the Private Securities Litigation Reform Act of 1995 and

other laws and regulations. Forward-looking statements speak only as to

the date of this document and may be identified by the use of

forward-looking terms such as "may," "will,"

"expects," "believes," "anticipates,"

"plans," "estimates," "projects," "targets,"

"forecasts," "outlook," "impact," "potential," "confidence," "improve," "optimistic," "deliver," "comfortable,"

"trend", and "seeks," or the negative of such terms or other

variations on such terms or comparable terminology. Many important factors could

cause actual results to differ materially from those in the forward-looking

statements including, without limitation, disruption of production or

supplies, changes in market conditions, political events, pending or future claims

or litigation, competitive factors, technology advances, actions of

regulatory agencies, and changes in laws, government regulations, labeling or

product approvals or the application or interpretation thereof. Other risk

factors are described herein and in STERIS and Synergy's other securities filings, including Item 1A of STERIS's Annual Report on Form 10-K

for the year ended March 31, 2014 dated May 29, 2014 and in Synergy's annual report

and accounts for the year ended 30 March 2014 (section headed "principal

risks and uncertainties"). Many of these important factors are outside of STERIS’s or Synergy's control. No assurances can be

provided as to any result or the timing of any outcome regarding

matters described herein or otherwise with respect to any regulatory action,

administrative proceedings, government investigations, litigation, warning

letters, consent decree, cost reductions, business strategies, earnings or

revenue trends or future financial results. References to products and the consent

decree are summaries only and should not be considered the specific

terms

of

the

decree

or

product

clearance

or

literature.

Unless

legally

required,

STERIS

and

Synergy

do

not

undertake

to

update

or

revise

any forward-looking statements even if events make clear that any projected

results, express or implied, will not be realized. Other potential risks and

uncertainties that could cause actual results to differ materially from those in the forward-looking statements include, without limitation, (a) the

receipt of approval of both STERIS’s shareholders and Synergy’s

shareholders, (b) the regulatory approvals required for the transaction not being

obtained

on

the

terms

expected

or

on

the

anticipated

schedule,

(c)

the

parties’

ability

to

meet

expectations

regarding

the

timing,

completion

and

accounting and tax treatments of the transaction, (d) the possibility that the

parties may be unable to achieve expected synergies and operating

efficiencies in connection with the transaction within the expected time-frames

or at all and to successfully integrate Synergy’s operations into those

of STERIS, (e) the integration of Synergy’s operations into those of STERIS

being more difficult, time-consuming or costly than expected, |

2

Forward Looking Statements

(f) operating costs, customer loss and business disruption (including, without

limitation, difficulties in maintaining relationships with employees,

customers, clients or suppliers) being greater than expected following the

transaction, (g) the retention of certain key employees of Synergy being

difficult,

(h)

changes

in

tax

laws

or

interpretations

that

could

increase

our

consolidated

tax

liabilities,

including,

if

the

transaction

is

consummated,

changes in tax laws that would result in New STERIS being treated as a domestic

corporation for United States federal tax purposes, (i) the potential for

increased pressure on pricing or costs that leads to erosion of profit margins, (j) the possibility that market demand will not develop for

new technologies, products or applications or services, or business initiatives

will take longer, cost more or produce lower benefits than anticipated,

(k)

the

possibility

that

application

of

or

compliance

with

laws,

court

rulings,

certifications,

regulations,

regulatory

actions,

including

without

limitation

those relating to FDA warning notices or letters, government investigations, the

outcome of any pending FDA requests, inspections or submissions, or

other

requirements

or

standards

may

delay,

limit

or

prevent

new

product

introductions,

affect

the

production

and

marketing

of

existing

products

or services or otherwise affect Company performance, results, prospects or value,

(l) the potential of international unrest, economic downturn or effects of

currencies, tax assessments, adjustments or anticipated rates, raw material costs or availability, benefit or retirement plan costs, or other

regulatory compliance costs, (m) the possibility of reduced demand, or reductions

in the rate of growth in demand, for products and services, (n) the

possibility that anticipated growth, cost savings, new product acceptance, performance or approvals, or other results may not be achieved, or

that transition, labor, competition, timing, execution, regulatory, governmental,

or other issues or risks associated with STERIS and Synergy's businesses,

industry or initiatives including, without limitation, the consent decree or those matters described in STERIS's Form 10-K for the year

ended

March

31,

2014

and

other

securities

filings,

may

adversely

impact

Company

performance,

results,

prospects

or

value,

(o)

the

possibility

that

anticipated financial results or benefits of recent acquisitions, or of STERIS's

restructuring efforts will not be realized or will be other than

anticipated, (p) the effects of the contractions in credit availability, as well as

the ability of STERIS and Synergy's customers and suppliers to adequately

access the credit markets when needed, and (q) those risks described in STERIS's Annual Report on Form 10-K for the year ended

March 31, 2014, and other securities filings.

Important Additional Information Regarding the Transaction Will Be Filed With The

SEC It is expected that the shares of New STERIS to be issued by New STERIS

to Synergy Shareholders in the U.K. law scheme of arrangement transaction that forms a part of the transaction will be issued in

reliance upon the exemption from the registration requirements of the Securities

Act of 1933, as amended, provided by Section 3(a)(10) thereof. In connection

with the issuance of New STERIS shares to STERIS shareholders pursuant to the merger that forms a part of the transaction, New

STERIS will file with the SEC a registration statement on Form S-4 that will

contain a prospectus of New STERIS as well as a proxy statement of

STERIS relating to the merger that forms a part of the transaction, which we refer

to together as the Form S-4/Proxy Statement. INVESTORS AND SECURITY

HOLDERS ARE URGED TO READ THE FORM S-4/PROXY STATEMENT, AND OTHER DOCUMENTS FILED

WITH

THE

SEC

IN

CONNECTION

WITH

THE

TRANSACTION

CAREFULLY

AND

IN

THEIR

ENTIRETY,

BECAUSE

THEY

WILL

CONTAIN

IMPORTANT INFORMATION ABOUT THE TRANSACTION, THE PARTIES TO THE TRANSACTION AND THE

RISKS ASSOCIATED WITH THE TRANSACTION.. . |

3

Forward Looking Statements

Those documents, if and when filed, as well as STERIS’S and New STERIS’s

other public filings with the SEC may be obtained without charge at the

SEC’s website at www.sec.gov, at STERIS’s website at www.steris-ir.com. Security holders and other interested parties will also be able to

obtain, without charge, a copy of the Form S-4/Proxy Statement and other

relevant documents (when available) by directing a request by mail or

telephone Julie_Winter@steris.com or (440) 392-7245. Security holders

may also read and copy any reports, statements and other information

filed

with

the

SEC

at

the

SEC

public

reference

room

at

100

F

Street

N.E.,

Room

1580,

Washington,

D.C.

20549.

Please

call

the

SEC

at

(800)

732-

0330 or visit the SEC’s website for further information on its public

reference room. STERIS, its directors and certain of its executive officers

may be considered participants in the solicitation of proxies in connection with the

transactions contemplated by the Proxy Statement. Information about the directors

and executive officers of STERIS is set forth in its Annual Report on Form

10-K for the year ended 31 March, 2014, which was filed with the SEC on 29 May, 2014, and its proxy statement for its 2014

annual

meeting

of

shareholders,

which

was

filed

with

the

SEC

on

9

June,

2014.

Other

information

regarding

potential

participants

in

the

proxy

solicitations and a description of their direct and indirect interests, by security

holdings or otherwise, will be contained in the Form S-4/Proxy Statement

when it is filed. Synergy and New STERIS are each organised under the laws

of England. Some of the officers and directors of Synergy and New STERIS may be

residents of countries other than the United States. As a result, it may not be

possible to sue Synergy, New STERIS or such persons in a non-US

court

for

violations

of

US

securities

laws.

It

may

be

difficult

to

compel

Synergy,

New

STERIS

and

their

respective

affiliates

to

subject

themselves

to

the jurisdiction and judgment of a US court or for investors to enforce against

them the judgments of US courts. Participants in the Solicitation

STERIS, its directors and certain of its executive officers may be considered

participants in the solicitation of proxies in connection with the

transactions contemplated by the Proxy Statement. Information about the directors

and executive officers of STERIS is set forth in its Annual Report on Form

10-K for the year ended 31 March, 2014, which was filed with the SEC on 29 May, 2014, and its proxy statement for its 2014

annual

meeting

of

shareholders,

which

was

filed

with

the

SEC

on

9

June,

2014.

Other

information

regarding

potential

participants

in

the

proxy

solicitations and a description of their direct and indirect interests, by security

holdings or otherwise, will be contained in the Proxy Statement/Prospectus

when it is filed. Responsibility

The

directors

of

STERIS

accept

responsibility

for

the

information

contained

in

this

document

and,

to

the

best

of

their

knowledge

and

belief

(having

taken

all

reasonable

care

to

ensure

that

such

is

the

case),

the

information

contained

in

this

document

is

in

accordance

with

the

facts

and

it

does

not

omit anything likely to affect the import of such information.

|

4

STERIS Overview

•

A global leader in infection prevention,

decontamination, GI and surgical products

and services

•

$1.9

billion

in

revenue

in

FY15

•

Approximately

8,000

people worldwide

•

Direct sales and service force of over 2,500

team members

•

77%

of

revenue

in

the

United

States

•

Nine

acquisitions in the past three years

Business Mix

by Segment

Note:

Based

on

FY2014

actual

revenues

Geographic Mix

73%

12%

15%

77%

11%

8%

4%

Healthcare

Isomedix

Life Sciences

United States

EMEA

APAC / LATAM

Canada |

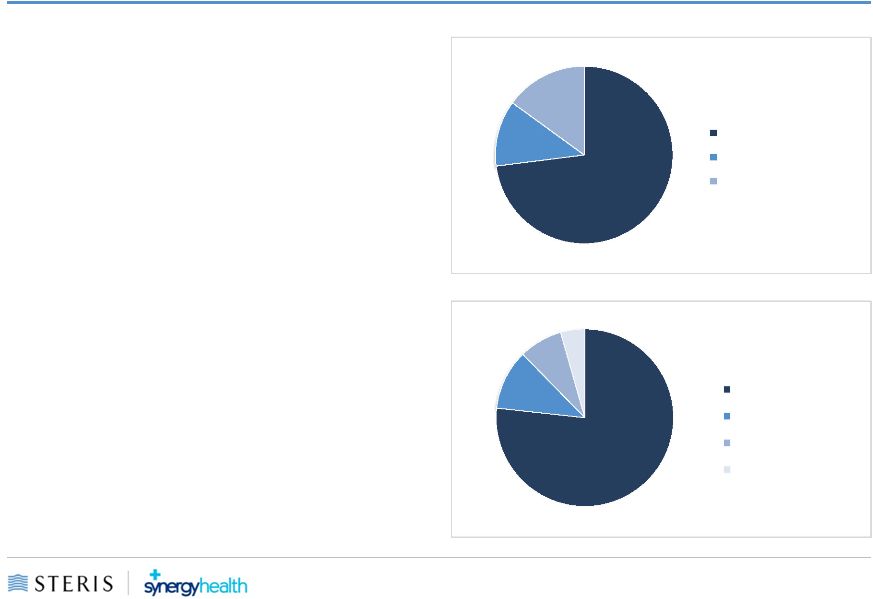

5

Synergy Overview

•

Global leader in outsourced sterilization

services for medical device manufacturers,

hospitals and other industries.

Applied

Sterilisation

Technologies

(AST)

provider of outsourced sterilization to medical device

manufacturers

Hospital Sterilization Services (HSS)

provider of outsourced decontamination services for

reusable medical and surgical equipment

Healthcare Solutions (HCS)

provider of a range of products and services in

managing the environment in a healthcare setting

•

$604

million in revenue in Fiscal Year 2014

•

UK-domiciled

FTSE

250

company

•

6,000

employees worldwide

•

Three

acquisitions

in

the

past

two

years

Note:

Business mix by segment figures pertain to Q1 FY2015

Geographic Mix relates to FY14 results

Business Mix

by Segment

Geographic Mix

25%

Applied Sterilization

Technologies (AST)

Healthcare Solutions

(HCS)

Hospital Sterilisation

Services (HSS)

34%

41%

43%

31%

5%

21%

UK & Ireland

Europe & Middle East

Asia & Africa

Americas |

6

Transaction Overview

Transaction Terms

•

Acquisition of Synergy for $1.9

billion in cash and New STERIS

stock

•

STERIS shareholders to receive

one share of New STERIS for

each STERIS share

•

Synergy shareholders to receive

per-share consideration valued

at £19.50, consisting of £4.39

cash and 0.4308 share of New

STERIS

•

STERIS has secured committed

funding for the transaction

•

New STERIS ownership: 70%

STERIS shareholders / 30%

Synergy shareholders

Substantial Premium to

Synergy Shareholders

•

% premium to last closing

share price

•

% premium to 3-month VWAP

•

% premium to 52-week high

Transaction Structure

•

STERIS and Synergy each to

merge into subsidiaries of a UK

holding company New STERIS

•

New STERIS incorporated in the

UK; New STERIS expected to

retain NYSE listing under ticker

STE

•

New STERIS to maintain

operational headquarters in

Mentor, Ohio

39

32

27 |

7

Strategic Rationale

Create a global

leader in infection

prevention and

sterilization

•

Allows STERIS to better

provide comprehensive

solutions to device

companies and

hospitals around the

world

•

Build on STERIS’s

recent acquisitions to

provide an expanded

suite of integrated,

value-added products

and services to

hospitals globally

Increase portfolio

diversity

•

Create a more balanced

portfolio from which

New STERIS could

deliver products and

services tailored to best

serve the evolving

needs of global

Customers

Increase

geographic

diversity

•

Combines STERIS’s

strength in North

America with Synergy’s

strong positions in

Europe

•

Increases exposure to

emerging markets such

as Asia Pacific and

Latin America

•

Brings together the

geographically

complementary STERIS

Isomedix and Synergy

AST device sterilization

businesses to create a

leading global supplier

to best serve medical

device Customers

Accelerate

growth profile

•

Estimated annual pre-

tax cost synergies of

$30

million

or

more,

which will be phased

50% in fiscal 2016 and

100% thereafter

•

Expected to be

significantly accretive to

adjusted earnings per

diluted

share

in

fiscal

year 2016

and beyond |

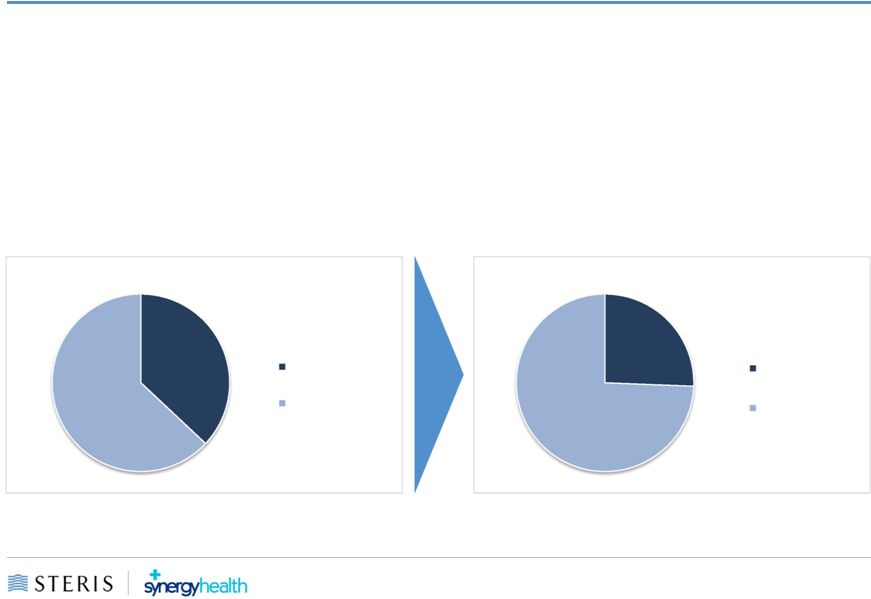

Greater

Portfolio Diversity STERIS

New STERIS

Source:

Company filings and investor presentation.

8

Capital

Recurring

Capital

Recurring

63%

37%

74%

26%

•

More balanced portfolio

from which New STERIS could deliver products and services

tailored

to

best

serve

the

evolving

needs

of

global

Customers

•

Differentiated product

and service offering

•

Potential

to

cross-sell

STERIS’s

products

and

services

to

Synergy’s

Customers

and

vice versa

•

Increases

recurring

revenue

mix

–

combined

58

Isomedix/AST

facilities

in

18

countries |

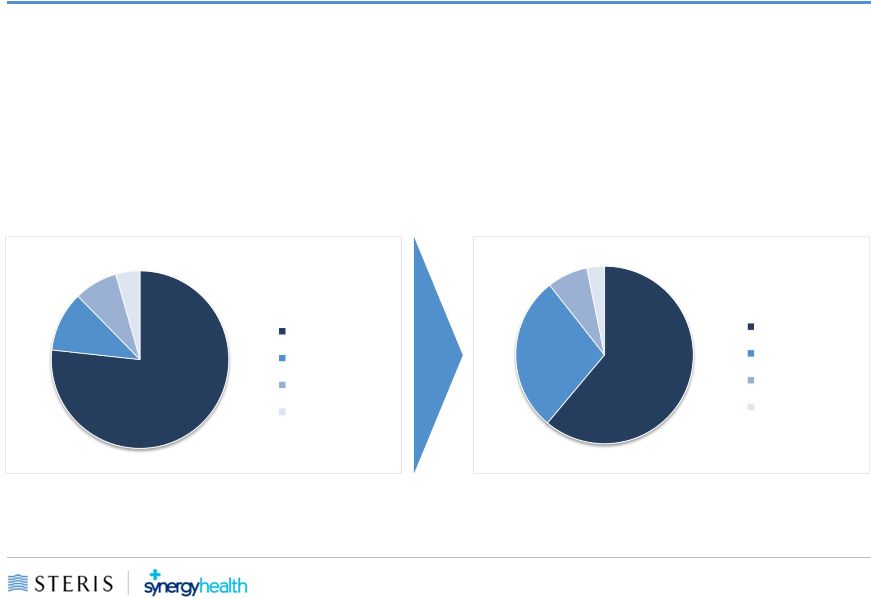

9

Greater Geographic Diversity

•

Combines

STERIS’s strength in North America with

Synergy’s strong positions in

Europe

•

Brings together the geographically complementary

STERIS’s Isomedix and

Synergy’s AST

device sterilization businesses to create a leading global supplier to best serve medical device Customers

Source:

Company filings and investor presentation.

Note:

Based on STERIS FY2014 actual revenues and Synergy management

STERIS

New STERIS

77%

11%

8%

4%

United States

EMEA

APAC / LATAM

Canada

61%

28%

8%

3%

US

EMEA

APAC/LATAM

Canada |

10

Accelerated Growth Profile

Accelerated growth

profile

•

Leverage STERIS's

capabilities and infrastructure

to make Synergy’s products

and services more successful

•

Access Synergy’s Customer

base to cross-sell current and

new STERIS products and

services

$30 million or more

estimated annual pre-

tax cost synergies

•

Optimizing global back-office

•

Leveraging best-

demonstrated practices

across plants

•

In-sourcing consumables

•

Eliminating redundant public

company costs

•

Phased in 50% in fiscal 2016

and 100% thereafter

Compelling financial

benefits and improved

financial flexibility

•

Expected to be significantly

accretive to adjusted earnings

per diluted share in fiscal year

2016 and beyond

•

New STERIS is expected to

have an effective tax rate of

approximately 25% by fiscal

year 2016

•

Provide more flexible access

to New STERIS’s global cash

flows |

11

Logical Extension of STERIS’s Growth Strategy

STERIS track record of executing

value-creating M&A transactions

•

Strengthen core business (VTS Medical and

Eschmann, Biotest)

•

Expand GI business (US Endoscopy)

•

National consolidator of instrument repair

business (Spectrum, TRE, Florida Surgical, Life

Systems, IMS)

Acquisition of Synergy is

consistent with long-term goals

•

Mid-

to high-single digit revenue growth

Market growth

Success with new products

Acquisitions

•

Double-digit earnings per share growth

•

Generate robust annual free cash flows |

12

Efficient Capital Allocation

Reasonable debt-to-capital levels

with access to additional funds

•

Anticipated debt to EBITDA of ~2.9x (an

increase from 2.2x as of June 30, 2014)

•

More flexible access to global cash

•

Revolving credit facility in place to support

operational needs

•

In conjunction with the transaction, STERIS obtained

a 364-Day Bridge Credit Agreement. Bank of

America Merrill Lynch, J.P. Morgan and Key Bank

provided committed financing in conjunction with the

transaction in the amount of approximately $1.6

billion.

Disciplined capital allocation

policies

•

Maintain and grow our dividend responsibly

relative to our growth

•

Invest for growth in our organic businesses

•

Targeted acquisitions in adjacent product and

market areas

•

Reduce total company leverage

•

Share buybacks |

13

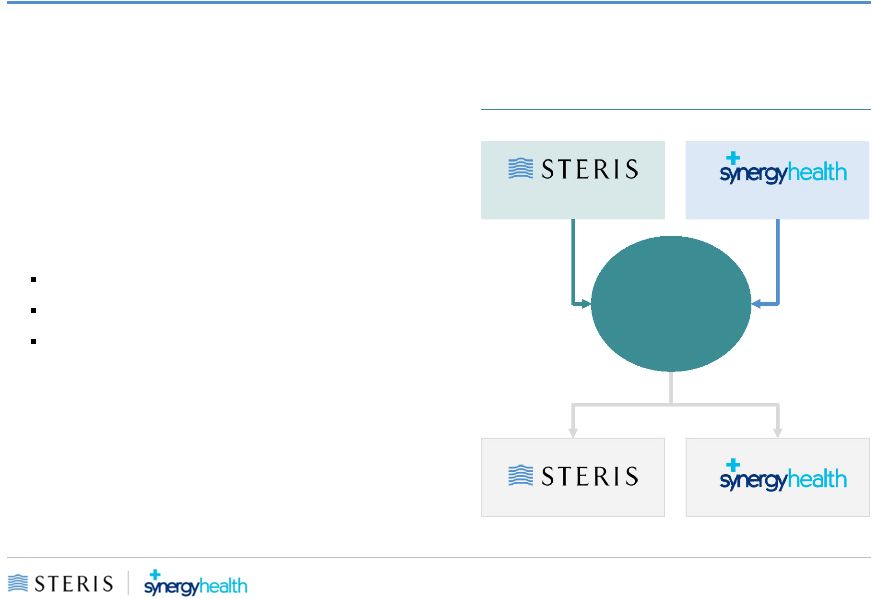

New STERIS Corporate Structure

•

STERIS and Synergy to each merge into

subsidiaries of a new holding company New

STERIS

•

New STERIS to be incorporated in the UK

•

STERIS’s operational headquarters will

remain in Mentor, Ohio

•

New STERIS expected to have a 13 member

Board of Directors

10 current STERIS Directors

Synergy CEO

Two additional members from Synergy Board

•

New STERIS shares expected to be listed on

the New York Stock Exchange under the

ticker STE

~70%

~30%

Note:

Excludes,

for

clarity

only,

US

Acquisition

Co,

into

which

STERIS

will

initially merge, and UK merger sub, into which Synergy will merge.

Post-Closing

Organizational Structure

shareholders

shareholders

New STERIS

(UK-

Incorporated) |

14

Next Steps

Combination to be

implemented by UK

Scheme of Arrangement

•

New STERIS S-4/Proxy

expected to be filed in

November

•

Scheme to become effective

and transaction expected to

be completed by the end of

fiscal 2015

Regulatory approvals

•

Subject to STERIS and

Synergy shareholder

approvals

•

Subject to regulatory review in

the U.S. and U.K.

Next Communications

•

STERIS and Synergy’s 2Q15

earnings calls are scheduled

for November 5, 2014 |