Attached files

| file | filename |

|---|---|

| 8-K/A - 8-K/A - NorthStar Healthcare Income, Inc. | hc8-kaarbors100214.htm |

| EX-99.2 - NorthStar Healthcare Income, Inc. | exhibi992.htm |

| EX-99.1 - NorthStar Healthcare Income, Inc. | exhibit991.htm |

Exhibit 99.3 INDEX TO PRO FORMA FINANCIAL STATEMENTS NorthStar Healthcare Income, Inc. and Subsidiaries Unaudited Pro Forma Condensed Consolidated Financial Information 2 NorthStar Healthcare Income, Inc. and Subsidiaries Unaudited Pro Forma Condensed Consolidated Statement of Operations for the Six Months Ended June 30, 2014 3 NorthStar Healthcare Income, Inc. and Subsidiaries Unaudited Pro Forma Condensed Consolidated Statement of Operations for the Year Ended December 31, 2013 NorthStar Healthcare Income, Inc. and Subsidiaries Unaudited Pro Forma Condensed Consolidated Balance Sheet as of June 30, 2014 4 5 NorthStar Healthcare Income, Inc. and Subsidiaries Notes to Unaudited Pro Forma Condensed Consolidated Financial Statements 6

2 NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL INFORMATION The following unaudited pro forma condensed consolidated balance sheet as of June 30, 2014 is presented as if NorthStar Healthcare Income, Inc. (the “Company”) had acquired a 570-unit portfolio of four senior living facilities located in Long Island, New York (the “Arbors Portfolio”) for a purchase price of $125.0 million, plus closing costs on June 30, 2014. The following unaudited pro forma condensed consolidated statements of operations for the six months ended June 30, 2014 and year ended December 31, 2013 are presented as if the following occurred on January 1, 2013: (i) the Company acquired the Arbors Portfolio; (ii) the Company acquired an independent living facility comprised of 125- units located in Milford, Ohio (“Pinebrook LLC”) and (iii) the Company acquired an equity investment in a $1.05 billion healthcare real estate portfolio comprised of over 8,500 beds across 38 senior housing and 42 skilled nursing facilities (“Formation Portfolio”) The allocation of the purchase price of the Arbors Portfolio reflected in these unaudited pro forma condensed consolidated financial statements has been based upon preliminary estimates of the fair value of assets acquired. A final determination of the fair value of the acquired assets will be based on the valuation of the tangible and intangible assets and liabilities of the Arbors Portfolio that exist, if any, as of the date of the acquisition. Consequently, the preliminary amounts allocated to tangible assets could change significantly from those used in the pro forma condensed consolidated financial statements presented and could result in a material change in depreciation and amortization of tangible assets. The fair value is a preliminary estimate and may be adjusted within one year of the acquisition in accordance with accounting principles accepted in the United States (“U.S. GAAP”). In addition, adjustments have been recorded to reflect cash provided by the Company’s offering proceeds, net of offering costs, through the date of the acquisition. This unaudited pro forma condensed consolidated financial information should be read in conjunction with the historical consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10- K for the year ended December 31, 2013 and the Company’s Quarterly Report on Form 10-Q for the six months ended June 30, 2014 and are not necessarily indicative of what the actual financial position or results of operations would have been had the Company completed the proposed transaction as of the beginning of the period presented, nor is it necessarily indicative of future results. In the opinion of the Company’s management, the pro forma condensed consolidated financial statements include all significant necessary adjustments that can be factually supported to reflect the effects of the acquisition.

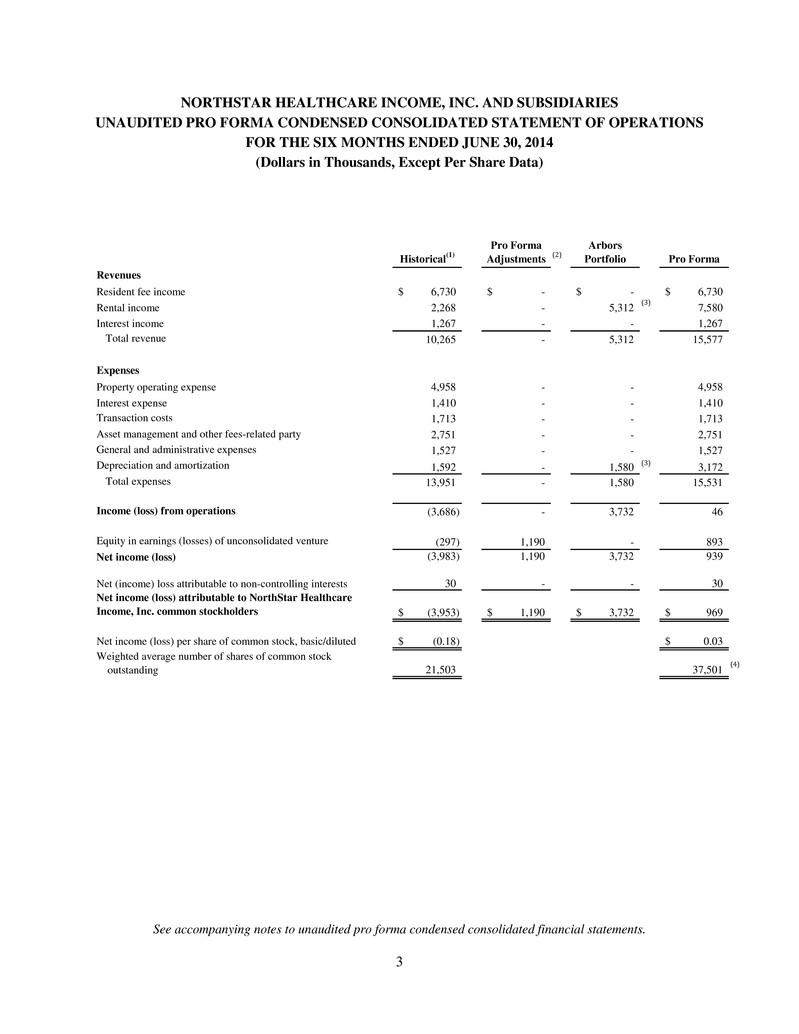

3 NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS FOR THE SIX MONTHS ENDED JUNE 30, 2014 (Dollars in Thousands, Except Per Share Data) Historical(1) Pro Forma Adjustments (2) Arbors Portfolio Pro Forma Revenues Resident fee income 6,730$ -$ -$ 6,730$ Rental income 2,268 - 5,312 (3) 7,580 Interest income 1,267 - - 1,267 Total revenue 10,265 - 5,312 15,577 Expenses Property operating expense 4,958 - - 4,958 Interest expense 1,410 - - 1,410 Transaction costs 1,713 - - 1,713 Asset management and other fees-related party 2,751 - - 2,751 General and administrative expenses 1,527 - - 1,527 Depreciation and amortization 1,592 - 1,580 (3) 3,172 Total expenses 13,951 - 1,580 15,531 Income (loss) from operations (3,686) - 3,732 46 Equity in earnings (losses) of unconsolidated venture (297) 1,190 - 893 Net income (loss) (3,983) 1,190 3,732 939 Net (income) loss attributable to non-controlling interests 30 - - 30 Net income (loss) attributable to NorthStar Healthcare Income, Inc. common stockholders (3,953)$ 1,190$ 3,732$ 969$ Net income (loss) per share of common stock, basic/diluted (0.18)$ 0.03$ Weighted average number of shares of common stock outstanding 21,503 37,501 (4) See accompanying notes to unaudited pro forma condensed consolidated financial statements.

4 NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS FOR THE YEAR ENDED DECEMBER 31, 2013 (Dollars in Thousands, Except Per Share Data) Historical(1) Pro Forma Adjustments (2) Arbors Portfolio Pro Forma Revenues Rental income 488$ -$ 10,623$ (3) 11,111$ Interest income 375 - - 375 Resident fee income 38 2,462 - 2,500 Total revenue 901 2,462 10,623 13,986 Expenses Property operating expense 24 1,092 - 1,116 Interest expense 98 534 - 632 Transaction costs 1,570 (309) - 1,261 Asset management and other fees-related party 1,334 - - 1,334 General and administrative expenses 312 872 - 1,184 Depreciation and amortization 132 415 3,161 (3) 3,708 Total expenses 3,470 2,604 3,161 9,235 Income (loss) from operations (2,569) (142) 7,462 4,751 Equity in earnings (losses) of unconsolidated venture - 1,089 - 1,089 Net income (loss) (2,569) 947 7,462 5,840 Net (income) loss attributable to non-controlling interests 10 14 - 24 Net income (loss) attributable to NorthStar Healthcare Income, Inc. common stockholders (2,559)$ 961$ 7,462$ 5,864$ Net income (loss) per share of common stock, basic/diluted (1.26)$ 0.14$ Weighted average number of shares of common stock outstanding 2,026 41,686 (4) See accompanying notes to unaudited pro forma condensed consolidated financial statements.

5 NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES UNAUDITED PRO FORMA CONDENSED CONSOLIDATED BALANCE SHEET AS OF JUNE 30, 2014 (Dollars in Thousands) Pro Forma Historical(5) Adjustments Pro Forma Assets Cash 80,571$ 18,253$ (6) 98,824$ Restricted cash 6,322 6,322 Operating real estate, net 135,890 125,000 (7) 260,890 Investment in and advances to unconsolidated venture 24,137 24,137 Real estate debt investments, net 106,874 106,874 Receivables, net 3,299 130 (7) 3,429 Deferred costs, net 2,758 2,758 Total assets 359,851$ 143,383$ 503,234$ Liabilities Mortgage notes payable 59,688$ 59,688$ Due to related party - - Escrow deposits payable 2,972 35 (7) 3,007 Distribution payable 1,754 1,754 Accounts payable and accrued expenses 1,902 517 (7) 2,419 Total liabilities 66,316 552 66,868 Equity NorthStar Healthcare Income, Inc. Stockholders' Equity Preferred stock, $0.01 par value; 50,000,000 shares authorized, no shares issued and outstanding as of June 30, 2014 - - Common stock, $0.01 par value; 400,000,000 shares authorized, 34,647,233 shares issued and outstanding as of June 30, 2014 346 160 (6) 506 Additional paid-in capital 306,978 144,235 (6) 451,213 Retained earnings (accumulated deficit) (14,961) (1,564) (7) (16,525) Total NorthStar Healthcare Income, Inc. stockholders' equity 292,363 142,831 435,194 Non-controlling interests 1,172 1,172 Total equity 293,535 142,831 436,366 Total liabilities and equity 359,851$ 143,383$ 503,234$ See accompanying notes to unaudited pro forma condensed consolidated financial statements.

6 NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES NOTES TO UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (1) Represents the Company's condensed consolidated statement of operations for the six months ended June 30, 2014 and the year ended December 31, 2013. (2) In May 2014, the Company, through a general partnership with a subsidiary of NorthStar Realty Finance Corp., entered into a joint venture with an affiliate of Formation Capital, LLC to acquire the Properties. The Company contributed $23.4 million for an approximate 5.6% interest in the Properties. For the six months ended June 30, 2014, the Formation Portfolio generated net income of $6.7 million. For the six months ended June 30, 2014, the impact of adjusting for the effects of the preliminary purchase price allocation of the Formation Portfolio and the removal of transaction costs resulted in net income of $21.1 million. For the six months ended June 30, 2014, the Company’s proportionate interest in earnings from such investment was $1.2 million. The following summarizes the pro forma adjustments related to the transactions (dollars in thousands): Year Ended December 31, 2013 Pinebrook Formation Total Historical (i) Pro Forma Adjustments Pro Forma Adjustments Resident fee income 1,875$ 587$ -$ 2,462$ Total other revenues 1,875 587 - 2,462 Interest expense 623 (89) (ii) - 534 Property operating expense 837 255 - 1,092 Transaction costs - (309) (iii) - (309) General and administrative expenses 658 214 - 872 Depreciation and amortization 488 (73) (iv) - 415 Total expenses 2,606 (2) - 2,604 Income (loss) from operations (731) 589 - (142) Net (income) loss attributable to non-controlling interests - 14 (v) - 14 Equity in earnings (losses) of unconsolidated venture - - 1,089 (vi) 1,089 Net income (loss) attributable to NorthStar Healthcare Income Trust, Inc. common stockholders (731)$ 603$ 1,089$ 961$ (i) Represents audited financial statements of Pinebrook, LLC for the year ended December 31, 2013. Pinebrook, LLC was acquired in December 2013. (ii) Represents the net impact of the interest rate on new borrowings and amortization of deferred financing costs of $0.5 million for Pinebrook, LLC for the year ended December 31, 2013. (iii) Represents adjustments to exclude transaction costs incurred in connection with the transaction. (iv) Represents the decrease in depreciation and amortization expense based on the preliminary purchase price allocation for Pinebrook, LLC. (v) Represents the Company’s non-controlling interest allocation to the joint venture partner based on the terms of the joint venture agreement.

7 (vi) For the year ended December 31, 2013, the Formation Portfolio generated net income of $13.8 million. For the year ended December 31, 2013, the impact of adjusting for the effects of the preliminary purchase price allocation of the Formation Portfolio and the removal of transaction costs resulted in net income of $19.3 million. For the year ended December 31, 2013, the Company’s proportionate interest in earnings from such investment was $1.1 million. (3) The pro forma adjustments represent the acquisition of the Arbors Portfolio as if it had occurred on January 1, 2013 for the statement of operations for the six months ended June 30, 2014 and for the year ended December 31, 2013. The pro forma adjustments include: (i) the Arbors Portfolio’s contractual rent revenue for the six months ended June 30, 2014 and year ended December 31, 2013 was $4.2 million and $8.5 million, respectively and the straight-line rent adjustment for the the six months ended June 30, 2014 and year ended December 31, 2013 was $1.1 million and $2.1 million, respectively; (ii) the value allocated to building and furniture, fixtures and equipment is depreciated based on an estimated useful life of 40 and 10 years, respectively. (4) Amount represents the weighted average number of shares of the Company’s common stock from the initial public offering, at $10.00 per share, required to generate sufficient offering proceeds, net of offering costs, to fund the purchase of the Arbors Portfolio. The calculation assumes these proceeds were raised as of January 1, 2013. (5) Represents the Company’s condensed consolidated balance sheet as of June 30, 2014. (6) The Company issued 15.9 million shares and raised $144.2 million in net offering proceeds for the period from June 30, 2014 through September 9, 2014 and used these proceeds to fund the Arbors Portfolio acquisition. (7) Represents adjustments in connection with the acquisition of the Arbors Portfolio. The Company is in the process of allocating the purchase price. The fair value is a preliminary estimate and may be adjusted within one year of the acquisition in accordance with U.S. GAAP. In addition, the Company recorded $1.6 million one-time transaction costs paid at the time of acquisition.