Attached files

| file | filename |

|---|---|

| 8-K/A - 8-K/A - NorthStar Healthcare Income, Inc. | hc8-kaarbors100214.htm |

| EX-99.1 - NorthStar Healthcare Income, Inc. | exhibit991.htm |

| EX-99.3 - NorthStar Healthcare Income, Inc. | exhibit993.htm |

Exhibit 99.2 FIVE LONG ISLAND PROPERTIES, LLC FINANCIAL STATEMENTS FOR THE SIX MONTHS ENDED JUNE 30, 2014 AND 2013

FIVE LONG ISLAND PROPERTIES, LLC FINANCIAL STATEMENTS FOR THE SIX MONTHS ENDED JUNE 30, 2014 AND 2013 Statements of Financial Position ..............................................................................................2 Statements of Operations ..........................................................................................................3 Statements of Member’s Equity ...............................................................................................4 Statements of Cash Flows .........................................................................................................5 Notes to the Financial Statements............................................................................................6

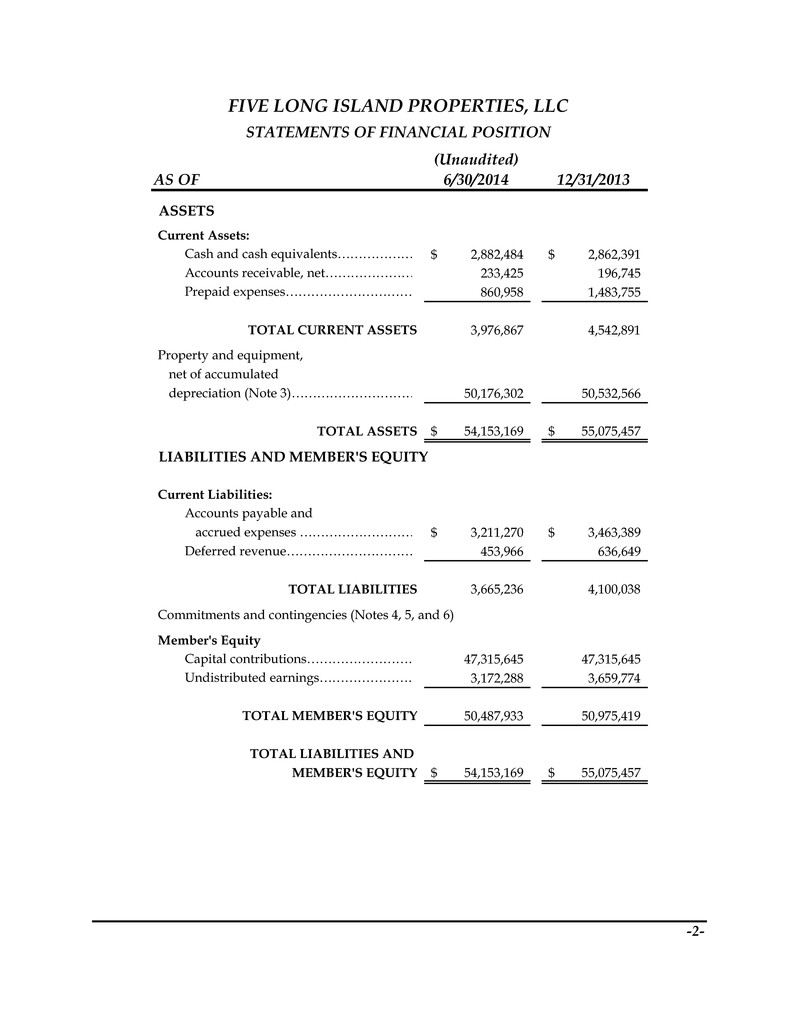

-2- (Unaudited) AS OF 6/30/2014 12/31/2013 ASSETS Current Assets: 2,882,484$ 2,862,391$ 233,425 196,745 860,958 1,483,755 TOTAL CURRENT ASSETS 3,976,867 4,542,891 50,176,302 50,532,566 TOTAL ASSETS 54,153,169$ 55,075,457$ LIABILITIES AND MEMBER'S EQUITY Current Liabilities: 3,211,270$ 3,463,389$ 453,966 636,649 TOTAL LIABILITIES 3,665,236 4,100,038 Commitments and contingencies (Notes 4, 5, and 6) Member's Equity 47,315,645 47,315,645 3,172,288 3,659,774 TOTAL MEMBER'S EQUITY 50,487,933 50,975,419 TOTAL LIABILITIES AND MEMBER'S EQUITY 54,153,169$ 55,075,457$ depreciation (Note 3)………………………… net of accumulated Accounts payable and Deferred revenue………………………… Capital contributions……………………… Undistributed earnings…………………… accrued expenses ……………………… FIVE LONG ISLAND PROPERTIES, LLC Cash and cash equivalents……………… Accounts receivable, net………………… Prepaid expenses………………………… Property and equipment, STATEMENTS OF FINANCIAL POSITION

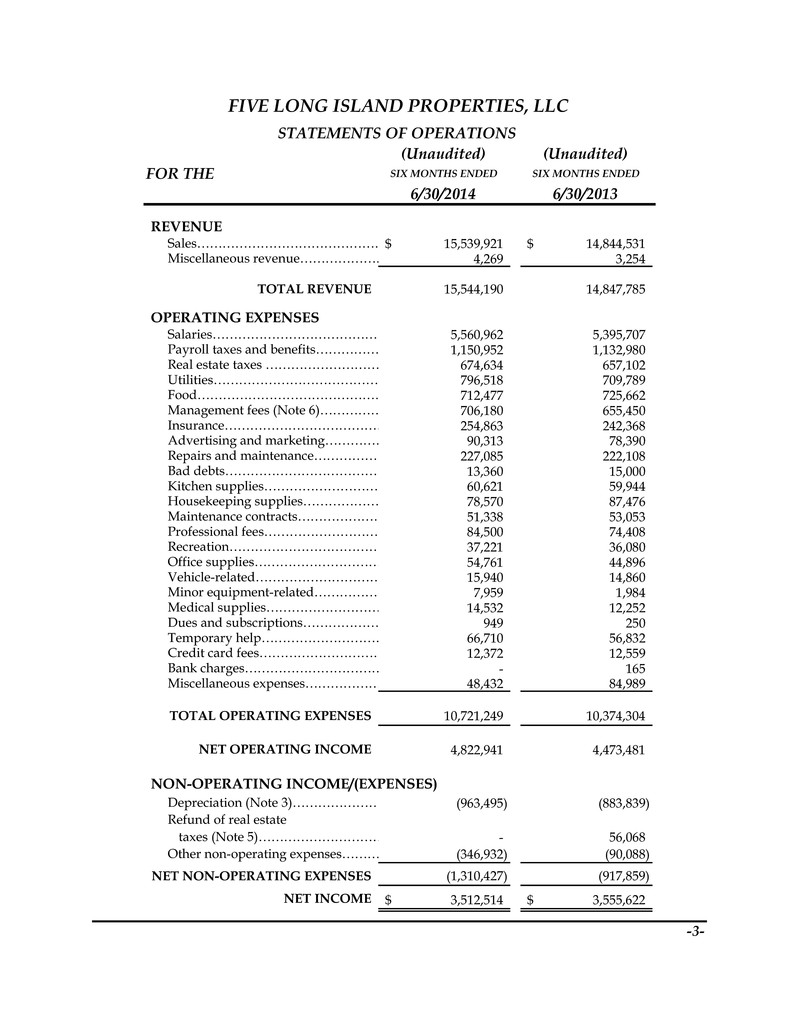

-3- (Unaudited) (Unaudited) FOR THE SIX MONTHS ENDED SIX MONTHS ENDED 6/30/2014 6/30/2013 REVENUE 15,539,921$ 14,844,531$ 4,269 3,254 TOTAL REVENUE 15,544,190 14,847,785 OPERATING EXPENSES 5,560,962 5,395,707 1,150,952 1,132,980 674,634 657,102 796,518 709,789 712,477 725,662 706,180 655,450 254,863 242,368 90,313 78,390 227,085 222,108 13,360 15,000 60,621 59,944 78,570 87,476 51,338 53,053 84,500 74,408 37,221 36,080 54,761 44,896 15,940 14,860 7,959 1,984 14,532 12,252 949 250 66,710 56,832 12,372 12,559 - 165 48,432 84,989 TOTAL OPERATING EXPENSES 10,721,249 10,374,304 NET OPERATING INCOME 4,822,941 4,473,481 NON-OPERATING INCOME/(EXPENSES) (963,495) (883,839) - 56,068 (346,932) (90,088) NET NON-OPERATING EXPENSES (1,310,427) (917,859) NET INCOME 3,512,514$ 3,555,622$ FIVE LONG ISLAND PROPERTIES, LLC Salaries………………………………… Miscellaneous revenue………………… Sales……………………………………… Payroll taxes and benefits…………… STATEMENTS OF OPERATIONS Real estate taxes ……………………… Bank charges…………………………… Temporary help………………………… Food……………………………………… Insurance………………………………… Bad debts……………………………… Management fees (Note 6)…………… Utilities………………………………… Advertising and marketing…………… Dues and subscriptions……………… Repairs and maintenance…………… Kitchen supplies……………………… taxes (Note 5)………………………… Housekeeping supplies……………… Credit card fees………………………… Minor equipment-related…………… Professional fees……………………… Other non-operating expenses……… Depreciation (Note 3)………………… Refund of real estate Miscellaneous expenses……………… Medical supplies……………………… Maintenance contracts………………… Recreation……………………………… Vehicle-related………………………… Office supplies…………………………

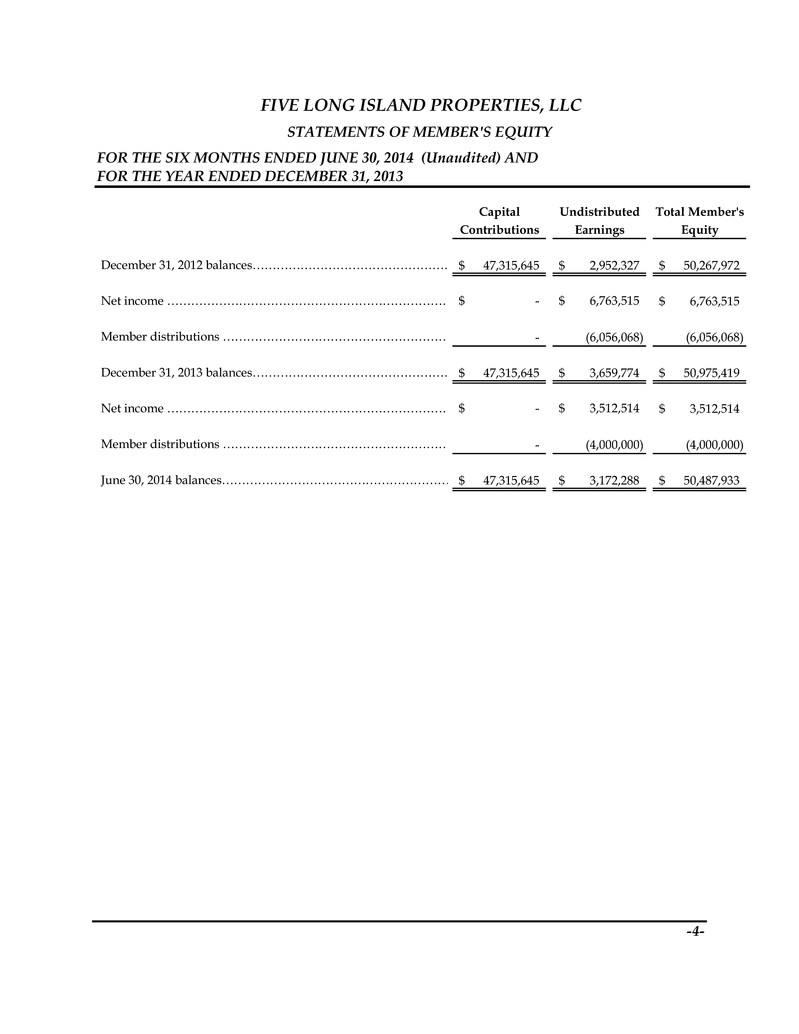

-4- FOR THE SIX MONTHS ENDED JUNE 30, 2014 (Unaudited) AND Capital Undistributed Total Member's Contributions Earnings Equity 47,315,645$ 2,952,327$ 50,267,972$ -$ 6,763,515$ 6,763,515$ - (6,056,068) (6,056,068) 47,315,645$ 3,659,774$ 50,975,419$ -$ 3,512,514$ 3,512,514$ - (4,000,000) (4,000,000) 47,315,645$ 3,172,288$ 50,487,933$ June 30, 2014 balances………………………………………………… Net income ……………………………………………………………… Member distributions ………………………………………………… December 31, 2013 balances…………………………………………… FIVE LONG ISLAND PROPERTIES, LLC STATEMENTS OF MEMBER'S EQUITY FOR THE YEAR ENDED DECEMBER 31, 2013 December 31, 2012 balances…………………………………………… Net income ……………………………………………………………… Member distributions …………………………………………………

-5- (Unaudited) (Unaudited) FOR THE SIX MONTHS ENDED SIX MONTHS ENDED 6/30/2014 6/30/2013 CASH FLOWS FROM OPERATING ACTIVITIES: 3,512,514$ 3,555,622$ Adjustments to reconcile net income to net cash provided by operating activities: 963,495 883,839 13,360 15,000 Changes in operating assets and liabilities: (50,040) 72,420 - - 622,797 151,695 (252,119) (361,768) (182,683) 530,451 NET CASH PROVIDED BY OPERATING ACTIVITIES 4,627,324 4,847,259 CASH FLOWS USED IN INVESTING ACTIVITIES: (607,231) (619,070) CASH FLOWS USED IN FINANCING ACTIVITIES: (4,000,000) (4,056,068) NET CHANGE IN CASH 20,093 172,121 2,862,391 1,530,037 2,882,484$ 1,702,158$ end……………………………………………………………… beginning………………………………………………………… Member distributions……………………………………… Deferred revenue……………………………………… accrued expenses…………………………………… Capital expenditures for Cash and cash equivalents, Cash and cash equivalents, property and equipment………………………………… FIVE LONG ISLAND PROPERTIES, LLC Due from Bad debts……………………………………………… Accounts receivable…………………………………… management company……………………………… Accounts payable and Prepaid expenses……………………………………… Depreciation…………………………………………… Net income…………………………………………………… STATEMENTS OF CASH FLOWS

FIVE LONG ISLAND PROPERTIES, LLC NOTES TO THE FINANCIAL STATEMENTS FOR THE SIX MONTHS ENDED JUNE 30, 2014 AND 2013 (UNAUDITED) -6- NOTE 1 – BUSINESS OVERVIEW This summary of significant accounting policies of Five Long Island Properties, LLC (the “Company”) is presented to assist in understanding the Company’s financial statements. The financial statements and notes are representations of the Company’s management, who is responsible for the integrity and objectivity of the financial statements. These accounting policies conform to accounting principles generally accepted in the United States of America and have been consistently applied in the preparation of the financial statements. Nature of Business Arcadia Management Inc. (“Arcadia”) is the established New York State Department of Health- approved, licensed operator of the five assisted living facilities previously owned by the Company, located in Islandia (two locations), Hauppauge, Bohemia, and Westbury, New York, all of which are concentrated in Long Island, New York. These facilities, known as The Arbors at Islandia East, The Arbors at Islandia West, The Arbors at Hauppauge, The Arbors at Bohemia, and The Arbors at Westbury, are each licensed as adult homes approved to house up to two hundred senior residents needing or wanting supportive services. As the licensed operator, Arcadia is responsible for the day-to-day operations of these facilities in accordance with Articles 28, 36, and 40 of the Public Health Law and Article 7 of the Social Services Law. The goal of Arcadia is to foster independence of its senior residents while protecting their safety and welfare. On September 21, 2005, the Company contracted with Arcadia to perform essentially all managerial, operational, financial, and personnel functions for the Company’s facilities. Arcadia was paid a management fee, subject to contractual increases when certain performance goals were achieved. On September 9, 2014, the Company completed a sale of its operating real estate to an affiliate of NorthStar Healthcare Income, Inc. (“NorthStar Healthcare”), for a cash purchase price of $125 million. Simultaneously, NorthStar Healthcare entered into a net lease and security agreement with Arcadia whereby Arcadia will continue to operate the facilities as a lessee (refer to Note 6). Income Taxes As a limited liability company, the Company’s taxable income or loss is allocated to its single member. Therefore, no provision or liability for income taxes has been included in the financial statements.

FIVE LONG ISLAND PROPERTIES, LLC NOTES TO THE FINANCIAL STATEMENTS FOR THE SIX MONTHS ENDED JUNE 30, 2014 AND 2013 (UNAUDITED) -7- NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Basis of Accounting The Company reports its income and expenses on the accrual basis of accounting. Revenue is recorded when earned and expenses are recorded when incurred. Cash and Cash Equivalents The Company considers deposits that can be redeemed on demand and investments that have original maturities of less than three months, when purchased, to be cash equivalents. The Company maintains its cash in bank deposit accounts which, at times, may exceed federally insured limits. Accounts are guaranteed by the Federal Deposit Insurance Corporation (“FDIC”). Accounts Receivable The Company provides an allowance for doubtful accounts equal to the estimated uncollectible amounts. The Company’s estimate is based on historical collection experience and a review of the current status of accounts receivable. It is reasonably possible that the Company’s estimate of the allowance for doubtful accounts will change. Accounts receivable are presented net of an allowance for doubtful accounts of $386,404 and $374,403 at June 30, 2014 and December 31, 2013, respectively. Bad debts are recorded as expenses when management considers the likelihood of collection as remote. Property and Equipment Property and equipment were stated at original cost. Depreciation on owned and leased assets was computed using the straight-line method at rates based on the estimated useful lives (in years) of individual assets or classes of assets as follows: Buildings and building improvements ............ 39 Furniture and fixtures ........................................ 7 Equipment and vehicles ..................................... 5 Generally a half-year of depreciation was provided for in the years of acquisition and disposal. Repairs and maintenance were expensed as incurred and betterments in excess of $1,000 were capitalized. The related costs and accumulated depreciation or amortization of disposed assets were eliminated, and any gain or loss on disposition was included in income.

FIVE LONG ISLAND PROPERTIES, LLC NOTES TO THE FINANCIAL STATEMENTS FOR THE SIX MONTHS ENDED JUNE 30, 2014 AND 2013 (UNAUDITED) -8- NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) Compensated Absences Employees of the Company are entitled to paid vacation depending on job classification, length of service, and other factors. The Company includes accrued vacation time as part of accounts payable and accrued expenses in the accompanying statements of financial position. Revenue Recognition The Company recognizes revenues as earned. Amounts collected in advance of the period in which service is rendered are recorded as a liability (deferred revenue) in the accompanying statements of financial position. Substantially all revenue earned by the Company is derived from resident housing and related services. Advertising The Company uses advertising to promote its services among the markets it serves. The production costs of advertising are expensed as incurred and are reflected in the accompanying statements of operations. Use of Estimates The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the recorded amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates. Subsequent Events The Company’s operating real estate was sold to NorthStar Healthcare on September 9, 2014 as further described in Note 1. The Company has evaluated events and transactions that occurred between July 1, 2014 and September 30, 2014, which is the date the financial statements were available to be issued, for possible disclosure and recognition in the financial statements.

FIVE LONG ISLAND PROPERTIES, LLC NOTES TO THE FINANCIAL STATEMENTS FOR THE SIX MONTHS ENDED JUNE 30, 2014 AND 2013 (UNAUDITED) -9- NOTE 3 – PROPERTY AND EQUIPMENT Property and equipment consisted of the following at: June 30, 2014 December 31, 2013 Land ......................................................... $ 7,172,339 $ 7,172,339 Buildings and building improvements ...................................... 55,123,145 54,672,633 Furniture and fixtures ............................ 1,074,112 1,004,609 Equipment ............................................... 1,669,288 1,582,074 Vehicles .................................................... 151,517 151,517 Total cost .................................................. 65,190,401 64,583,172 Accumulated depreciation .................... ( 15,014,099) (14,050,606) Property and equipment, net ................ $ 50,176,302 $ 50,532,566 NOTE 4 – DUE FROM MANAGEMENT COMPANY Prior to Arcadia contracting with the Company to manage the properties, certain costs related to Arcadia’s internal operations were paid by the Company. As of December 31, 2013, no amount was due to the Company from Arcadia. From time-to-time, certain other intercompany transactions take place, thus giving rise to immaterial balances owed to/from Arcadia as of June 30, 2014. Such balance is reflected as part of accounts payable and accrued expenses in the accompanying statements of financial position. NOTE 5 – LEGAL MATTERS The Company is subject to various claims and legal proceedings covering a wide range of matters that arise in the ordinary course of its business activities. Management believes that any liability that may ultimately result from the resolution of these matters will not have a material adverse effect on the financial position or results of operations of the Company.

FIVE LONG ISLAND PROPERTIES, LLC NOTES TO THE FINANCIAL STATEMENTS FOR THE SIX MONTHS ENDED JUNE 30, 2014 AND 2013 (UNAUDITED) -10- NOTE 6 – MANAGEMENT FEES AND LEASE Per the management agreement between the Company and Arcadia, Arcadia was entitled to $35,000 per month for back office operations and $30,000 per month for its management fee. Upon signing an extension of the management agreement in September 2013, the monthly back office operations charge increased to $40,000. When net operating profit exceeded $300,000 for the three preceding months, the monthly management fee increased from $30,000 to 3% of revenue for the preceding month. Beginning with the year ended December 31, 2010, the Company and Arcadia agreed to interpret this as Arcadia being entitled to 3% of revenue when net operating profits exceeds $300,000 on average for the three preceding months. The Company averaged more than $300,000 per month in net operating profits during every month of the year ended December 31, 2013, which entitled Arcadia to 3% of revenue. The Company also averaged more than $300,000 per month in net operating profits during every month of the six months ended June 30, 2014 and 2013. Effective September 9, 2014, Arcadia has entered into a 15-year cross-defaulted net lease with NorthStar Healthcare, whereby Arcadia is responsible for substantially all of the operating expenses at each facility. Each lease provides for annual rent escalations equal to the greater of (i) the percentage increase in the consumer price index, or (ii) 2.5%, subject to a maximum annual escalation of 3.0%.