Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Recon Technology, Ltd | v390232_ex99-1.htm |

| 8-K - FORM 8-K - Recon Technology, Ltd | v390232_8k.htm |

Exhibit 99.2

Corporate Presentation October 2014 Recon Technology, Ltd. (Nasdaq: RCON) 1

Safe Harbor Statement This document contains forward - looking statements as defined by the Private Securities Litigation Reform Act of 1995 . Forward - looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, underlying assumptions, and any other statements other than statements of historical facts . These statements are subject to uncertainties and risks including, but not limited to, product and service demand and acceptance, changes in technology, economic conditions, the impact of competition and pricing, government regulation, and other risks contained in statements filed from time to time with the Securities and Exchange Commission . All such forward - looking statements, whether written or oral, and whether made by or on behalf of the company, are expressly qualified by the cautionary statements and any other cautionary statements which may accompany the forward - looking statements . In addition, the company disclaims any obligation to update any forward - looking statements to reflect events or circumstances after the date hereof . Recon assumes no obligation to update the information in this communication, except as otherwise required by law . Readers are cautioned not to place undue reliance on these forward - looking statements, which speak only as of the date hereof . This material is for information purposes only and does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation for any securities, financial instruments, or common or privately issued stock . No offering of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933 , as amended . The statements, information and estimates contained herein are based on information that the presenter believes to be reliable as of today's date, but cannot be represented that such statements, information or estimates are complete or accurate . 2

Company Overview 3

Stock Symbol RCON Stock Price ( 9/25/2014) $4.99 IPO 2009 Revenue (Fiscal Year 2014) $15.2 Million Long - term debt None Average Gross Margin in % 35.03% Shares Outstanding 4.7 M Market Cap. ( 9/25/2014) $23.58 M Directors & Officers Ownership 30% Fiscal Year End June 30th Auditors Friedman LLP Legal EGS Company Overview Turning from net loss to net income in Fiscal year 2013 . 4 Source : Nasdaq

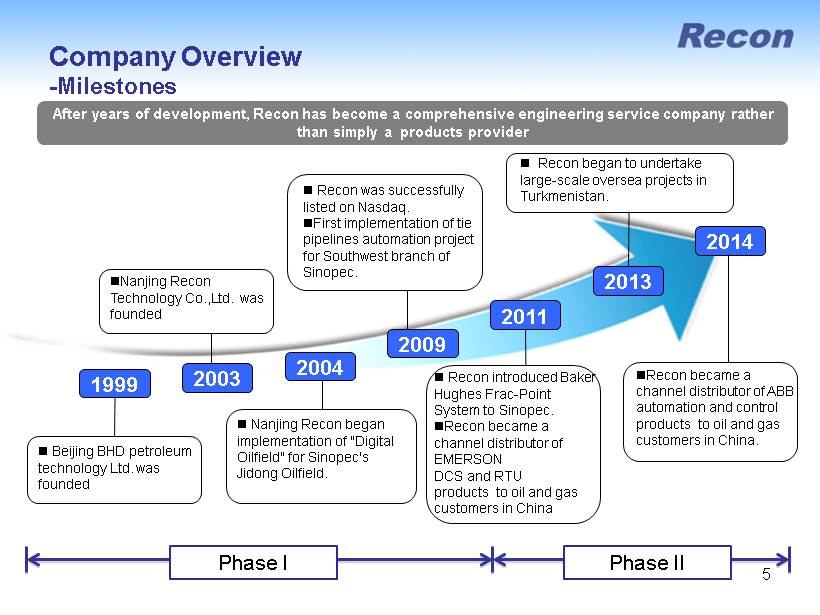

1999 2003 2004 2013 2011 2014 2009 Beijing BHD petroleum technology Ltd. was founded Nanjing Recon Technology Co.,Ltd. was founded N a njing Recon began implementation of "Digital Oilfield" for Sinopec's Jidong Oilfield. Recon was successfully listed on Nasdaq. First implementation of tie pipelines automation project for Southwest branch of Sinopec. Recon introduced Baker Hughes Frac - Point System to S inopec. Recon became a channel distributor of EMERSON DCS and RTU products to oil and gas customers in China Recon began to undertake large - scale oversea projects in Turkmenistan. Company Overview - Milestones After years of development, Recon has become a comprehensive engineering service company rather than simply a products provider Phase I Phase II Recon became a channel distributor of ABB automation and control products to oil and gas customers in China. 5

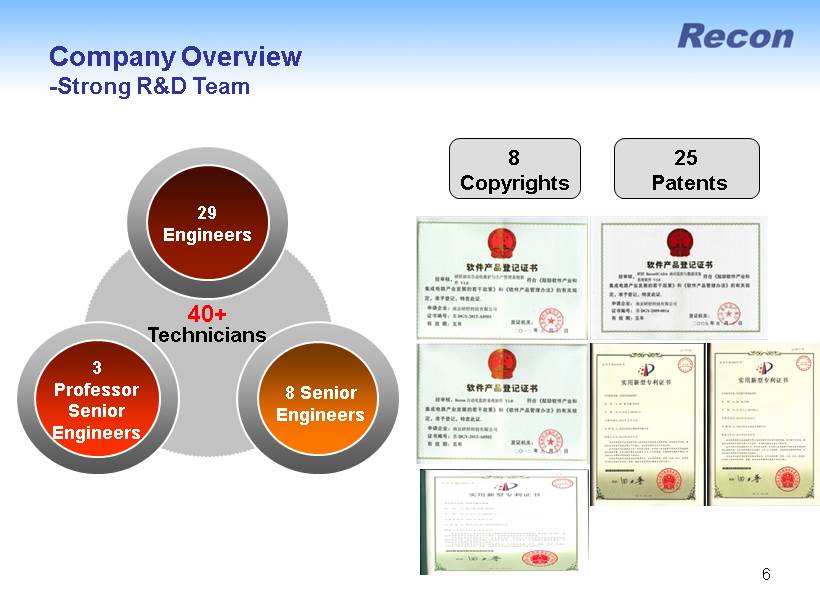

Company Overview - Strong R&D Team 29 Engineers 3 Professor Senior Engineers 8 Senior Engineers 40 + Technicians 8 Copyrights 25 Patents 6

Business Overview 7

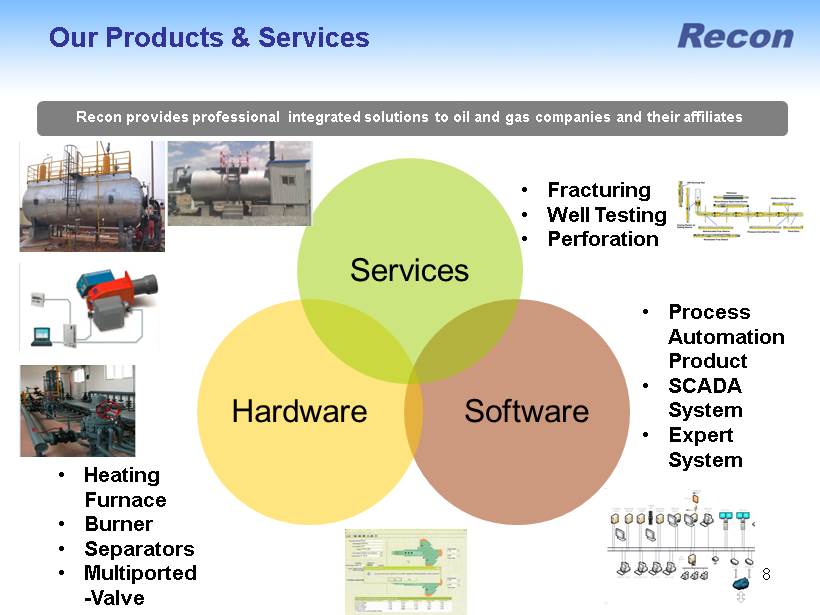

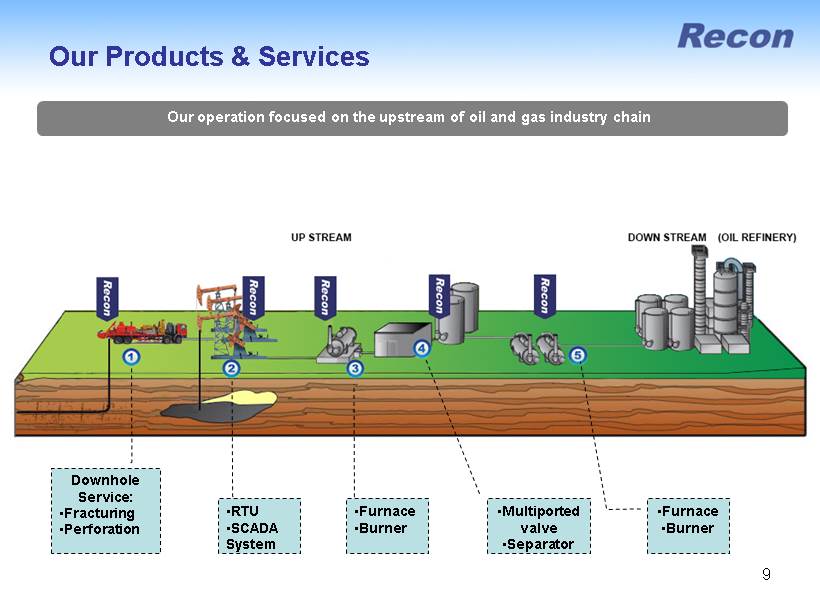

Software Recon provides professional integrated solutions to oil and gas companies and their affiliates Hardware Services • Heating Furnace • Burner • Separators • Multiported - Valve • Process Automation Product • SCADA System • Expert System • Fracturing • Well Testing • Perforation Our Products & Service s 8

Downhole Service: • Fracturing • Perforation • RTU • SCADA System • Furnace • Burner • Multiported valve • Separator • Furnace • Burner Our Products & Service s Our operation focused on the upstream of oil and gas industry chain 9

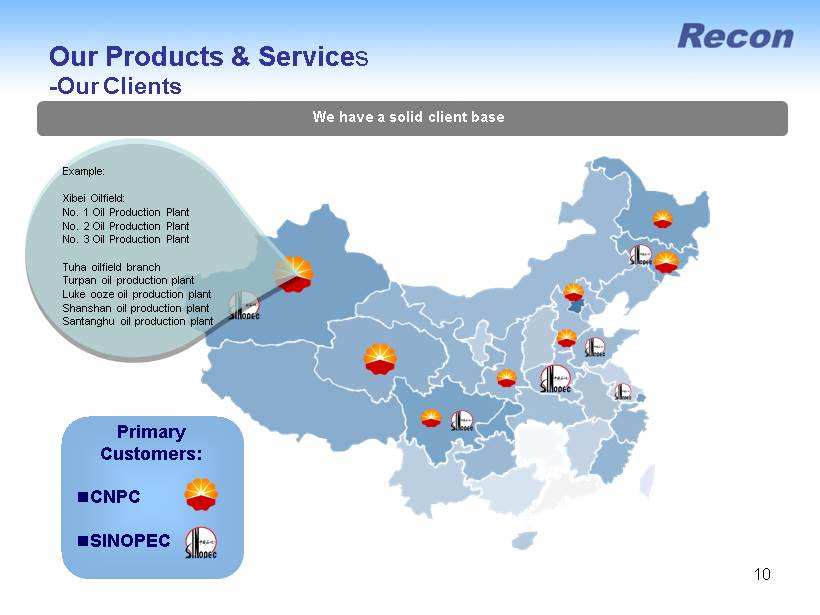

Primary Customers: CNPC SINOPEC Our Products & Service s - Our Clients We have a solid client base 10 Example: Xibei Oilfield: No. 1 Oil Production Plant No. 2 Oil Production Plant No. 3 Oil Production Plant Tuha oilfield branch Turpan oil production plant Luke ooze oil production plant Shanshan oil production plant Santanghu oil production plant

Market - Oilfield Entry Permits Strict industry access standards build a high entry barrier to competitors 11

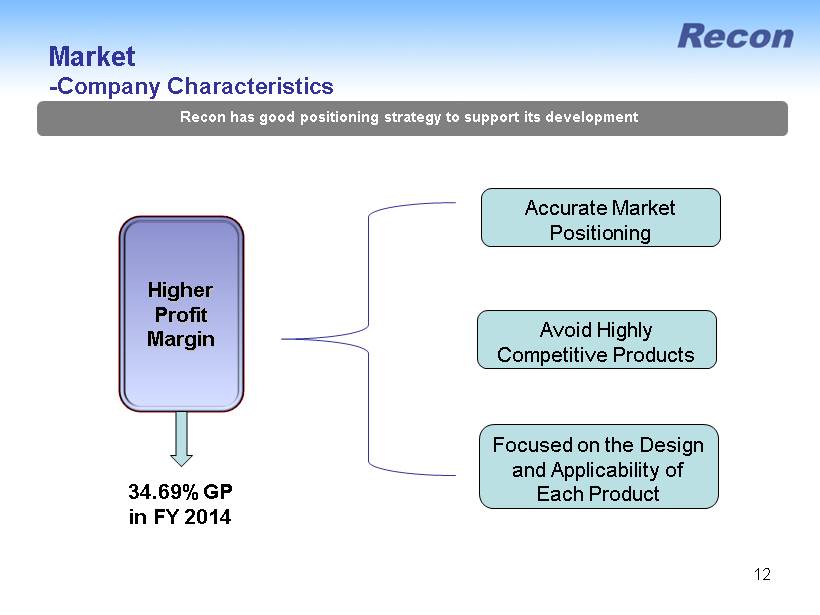

Higher Profit Margin Accurate Market Positioning Avoid Highly Competitive Products Focused on the Design and Applicability of Each Product 34.69% GP in FY 2014 12 Market - Company Characteristics Recon has good positioning strategy to support its development

Automation System Automation System Fracturing Technology Burner Price Advantages Strategic Cooperation Market - Brand Distributor for Multinational Companies 13

20% Average Annual Internal Revenue Growth Expand product lines Geographic Expansion: Kazakhstan, Turkmenistan, Chad and Niger Double Size in 2 - 3 years Organic Growth Acquisitions Further Increase Margins Increase Service Maintain good relationships with customers. Our Growth Strategies - Our Goals (Short - term) We intend to maintain and expand our leadership positions 14

Our Growth Strategies - Business Strategies Parternship with reputable international firms Enhance strategic cooperation with international market leader s Selectively seek acquisition opportunities Acquire oil/gas engineering manufacturers and/or automation products manufacturers and pursue vertical integration Further improve product s efficiency & reduce production costs Achieve greater economies of scale by adopting advanced production technologies Expansion of production for new oil/gas field s discoveries in China and elsewhere. New oil/gas field, such as shale gas production will need more compatible equipment Strategic Cooperation with multinational companies Maintaining competitive advantages, increasing profit margin. Expand products type & fuction to further maximize profitablity Improve products quality & production technology; develop new customized types of oil/gas engineerings 15

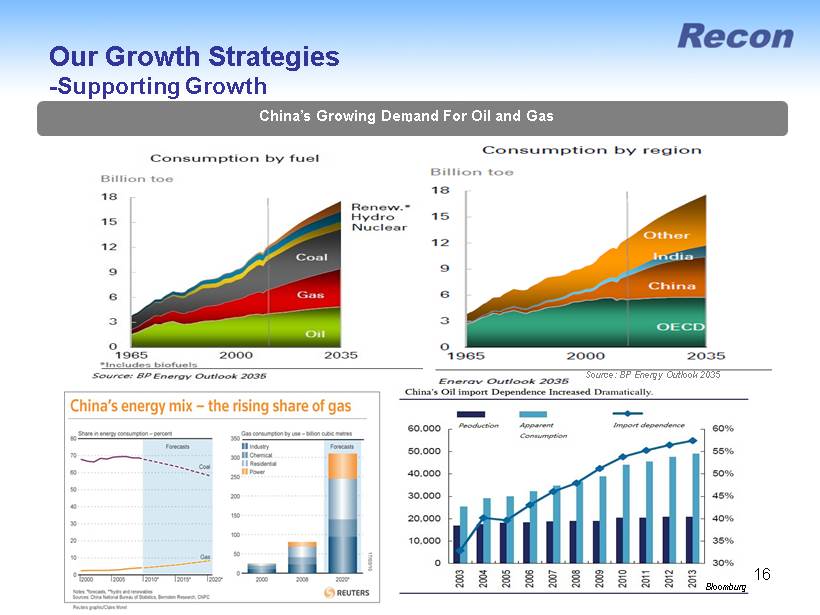

Our Growth Strategies - Supporting Growth . China’s Growing Demand For Oil and Gas 16 Source: BP Energy Outlook 2035 Bloomburg

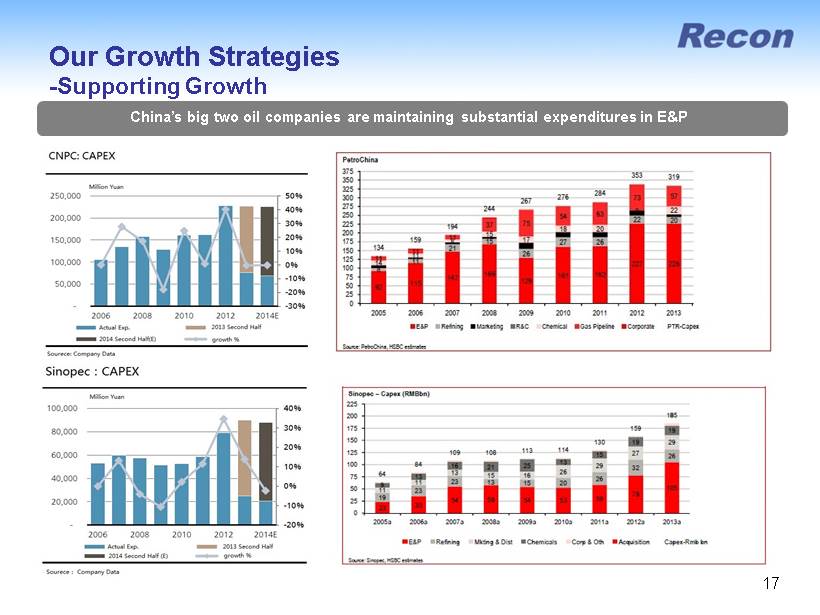

Our Growth Strategies - Supporting Growth China ’ s big two oil companies are maintaining substantial expenditures in E&P 17

China ’ s Continuing Overseas Investment in Oil and Gas High automated technology and products instead of on - site laborers Long term good relationships with our customers • Our Advantages Our Growth Strategies - Supporting Growth 18

Our Growth Strategies - Positive Trends Reform of China SEOs: Diversified Ownership --- More Opportunities for Private Companies, like RCON More Opportunities • Private Capital to sales unit • Distribution Business • Private Investment SINOPEC • Joint Cooperat ion • Jointly Develop Projects • Oil and Gas Exploration CNPC 19

20 Financial Highlights

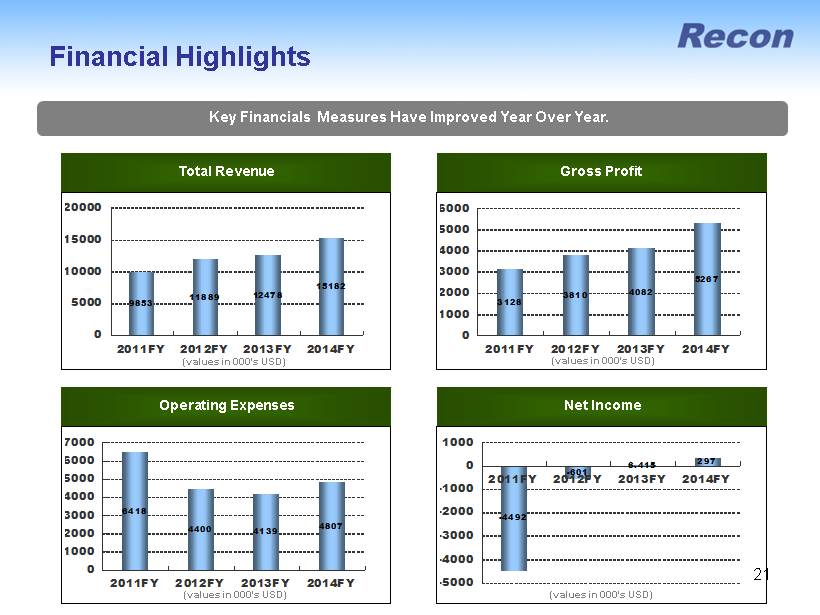

Total Revenue Gross Profit Operating Expenses Net Income 0 1000 2000 3000 4000 5000 6000 2011FY 2012FY 2013FY 2014FY 3128 3810 4082 5267 (values in 000's USD ) -5000 -4000 -3000 -2000 -1000 0 1000 2011FY 2012FY 2013FY 2014FY -4492 -601 6.415 297 (values in 000's USD ) 0 1000 2000 3000 4000 5000 6000 7000 2011FY 2012FY 2013FY 2014FY 6418 4400 4139 4807 (values in 000's USD ) 0 5000 10000 15000 20000 2011FY 2012FY 2013FY 2014FY 9853 11889 12478 15182 (values in 000's USD ) Financial Highlights Key Financials Measures Have Improved Year Over Year . 21

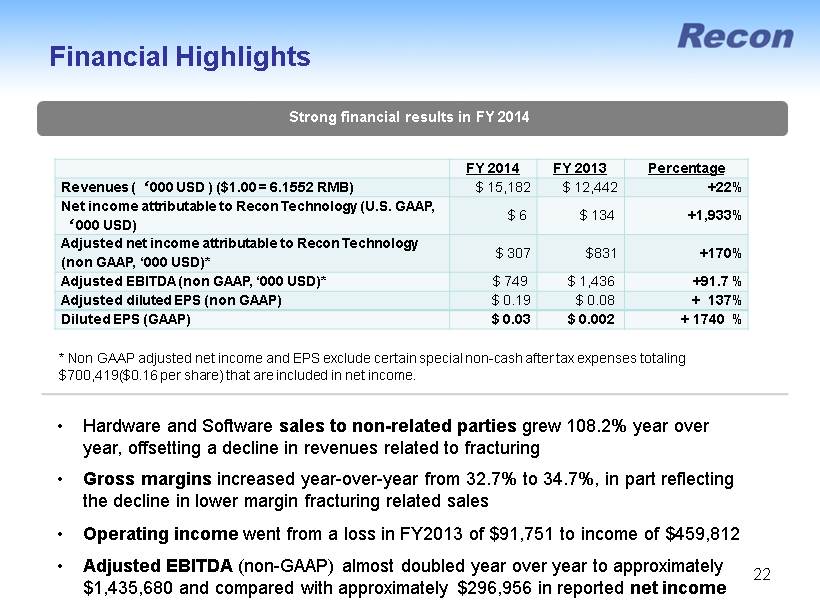

Financial Highlights Strong financial results in FY 2014 FY 2014 FY 2013 Percentage Revenues ( ‘ 000 USD ) ($1.00 = 6.1552 RMB) $ 15,182 $ 12,442 +22% Net income attributable to Recon Technology (U.S. GAAP, ‘ 000 USD) $ 6 $ 134 +1,933% Adjusted net income attributable to Recon Technology (non GAAP, ‘000 USD)* $ 307 $831 +170% Adjusted EBITDA (non GAAP, ‘000 USD)* $ 749 $ 1,436 +91.7 % Adjusted diluted EPS (non GAAP) $ 0.19 $ 0.08 + 137% Diluted EPS (GAAP) $ 0.03 $ 0.002 + 1740 % * Non GAAP adjusted net income and EPS exclude certain special non - cash after tax expenses totaling $700,419($0.16 per share) that are included in net income. • Hardware and Software sales to non - related parties grew 108.2% year over year, offsetting a decline in revenues related to fracturing • Gross margins increased year - over - year from 32.7% to 34.7%, in part reflecting the decline in lower margin fracturing related sales • Operating income went from a loss in FY2013 of $91,751 to income of $459,812 • Adjusted EBITDA (non - GAAP) almost doubled year over year to approximately $1,435,680 and compared with approximately $296,956 in reported net income 22

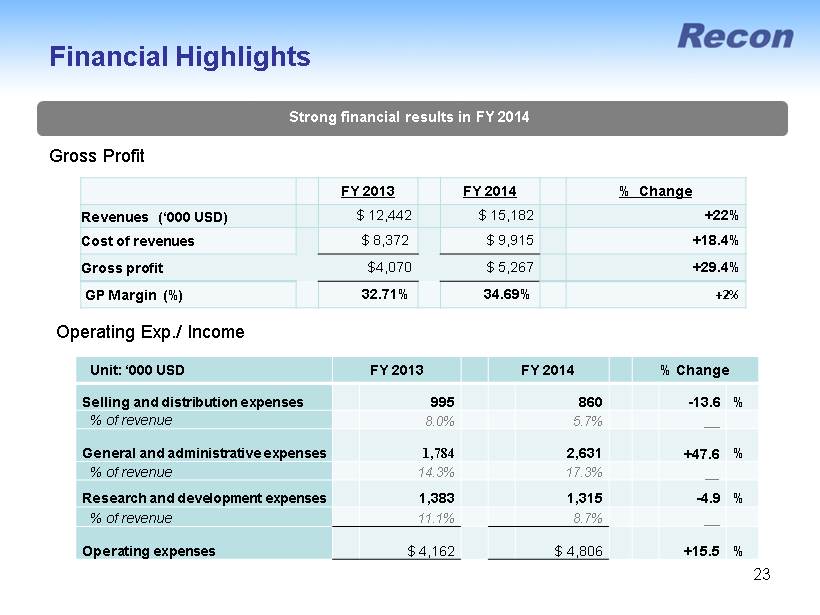

Financial Highlights Gross Profit Operating Exp./ Income FY 2013 FY 2014 % Change Revenues (‘000 USD) $ 12,442 $ 15,182 +22% Cost of revenues $ 8,372 $ 9,915 +18.4% Gross profit $4,070 $ 5,267 +29.4% GP Margin (%) 32.71% 34.69% +2% Unit: ‘000 USD FY 2013 FY 2014 % Change Selling and distribution expenses 995 860 - 13.6 % % of revenue 8.0% 5.7% __ General and administrative expenses 1,784 2,631 +47.6 % % of revenue 14.3% 17.3% __ Research and development expenses 1,383 1,315 - 4.9 % % of revenue 11.1% 8.7% __ Operating expenses $ 4,162 $ 4,806 +15.5 % 23 Strong financial results in FY 2014

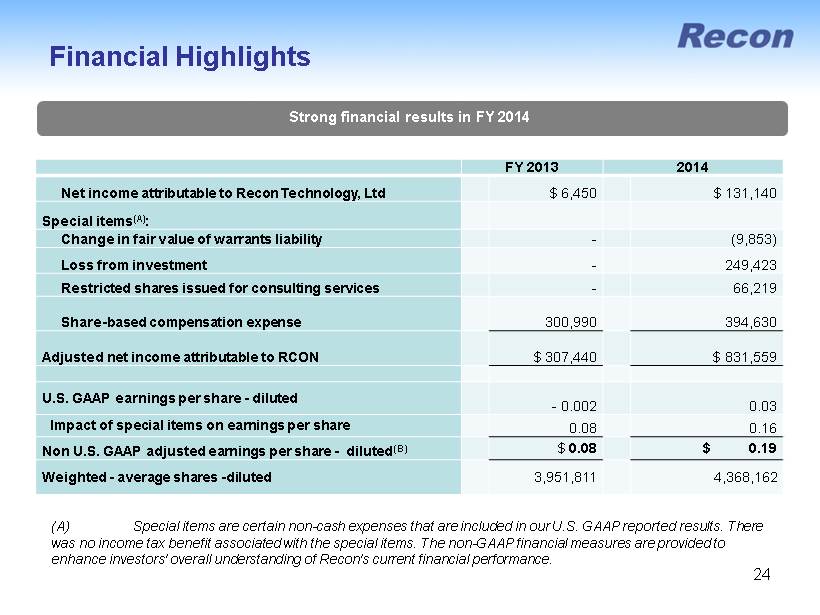

Financial Highlights FY 2013 2014 Net income attributable to Recon Technology, Ltd $ 6,450 $ 131,140 Special items (A) : Change in fair value of warrants liability - (9,853) Loss from investment - 249,423 Restricted shares issued for consulting services - 66,219 Share - based compensation expense 300,990 394,630 Adjusted net income attributable to RCON $ 307,440 $ 831,559 U.S. GAAP earnings per share - diluted - 0.002 0.03 Impact of special items on earnings per share 0.08 0.16 Non U.S. GAAP adjusted earnings per share - diluted (B) $ 0.08 $ 0.19 Weighted - average shares - diluted 3,951,811 4,368,162 (A) Special items are certain non - cash expenses that are included in our U.S. GAAP reported results. There was no income tax benefit associated with the special items. The non - GAAP financial measures are provided to enhance investors' overall understanding of Recon's current financial performance. 24 Strong financial results in FY 2014

Management Team 25

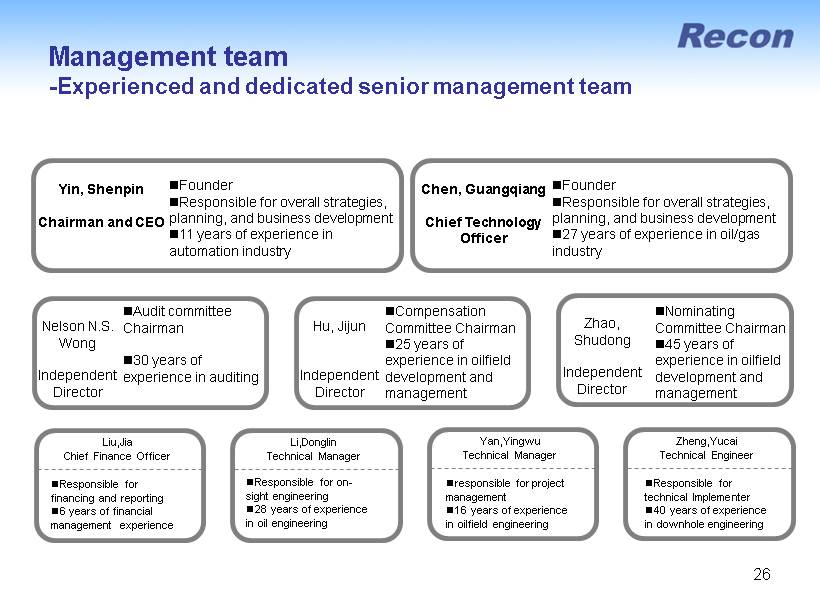

Yin, Shenpin Chairman and CEO Founder Responsible for overall strategies, planning, and business development 11 years of experience in automation industry Chen, Guangqiang Chief Technology Officer Founder Responsible for overall strategies, planning, and business development 27 years of experience in oil/gas industry Nelson N.S. Wong Independent Director Audit committee Chairman 30 years of experience in auditing Hu, Jijun Independent Director Compensation Committee Chairman 25 years of experience in oilfield development and management Zhao, Shudong Independent Director Nominating Committee Chairman 45 years of experience in oilfield development and management Management team - Experienced and dedicated senior management team Liu,Jia Chief Finance Officer Responsible for financ ing and reporting 6 years of financial management experience Li,Donglin T echnical M anager Responsible for on - sight engineering 28 years of experience in oil engineering Zheng,Yucai Technical Engineer Responsible for technical Implementer 40 years of experience in downhole engineering Yan,Yingwu T echnical M anager responsible for project management 16 years of experience in oilfield engineering 26

First & Foremost: Improve Safety, Improve Production, Reduce Costs China ’ s Continuing Demand for Energy No Manufacture: Low Fixed Cost + Bottom Line Improvement Continuing Expanding Product Line Geographic Expansion Shale Gas Opportunity: Fracturing Diversified Ownership Reform in China Potential Acquisitions Summary of Investment Highlights 27

• China: • Liu Jia • Recon Technology, Ltd. • info@recon.cn • +86 (10) 84945799 • U.S. • Ken Donenfeld • DGI Investor Relations • kdonenfeld@dgiir.com • 1 - 212 - 425 - 5700 Contact Info 28