Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BLACKHAWK NETWORK HOLDINGS, INC | form8-k.htm |

| EX-2.1 - EXHIBIT 2.1 - BLACKHAWK NETWORK HOLDINGS, INC | exh-21.htm |

| EX-99.1 - EXHIBIT - BLACKHAWK NETWORK HOLDINGS, INC | exh-991.htm |

| EX-10.1 - EXHIBIT 10.1 - BLACKHAWK NETWORK HOLDINGS, INC | exh-101.htm |

Blackhawk Network to Acquire Parago, Inc. Investor Presentation September 25, 2014

Forward Looking Statements This presentation may contain certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements are indicated by words or phrases such as "guidance," "believes," "expects," "anticipates," "estimates," "plans," "continuing," "ongoing," and similar words or phrases and the negative of such words and phrases. Forward-looking statements are based on our current plans and expectations and involve risks and uncertainties which are, in many instances, beyond our control, and which could cause actual results to differ materially from those included in or contemplated or implied by the forward-looking statements. Such risks and uncertainties include the following: our ability to successfully integrate the acquired companies, including technology platform integration; the risk that we may not be able to achieve the anticipated cost savings across channels and infrastructure; the risk that we are unable to amend our credit facility and make new borrowings as anticipated; our ability to retain and grow the business of the acquired companies as anticipated; our ability to grow adjusted operating revenues and adjusted net income as anticipated, our ability to grow at historic rates or at all, the consequences should we lose one or more of our top distribution partners or fail to attract new distribution partners to our network or if the financial performance of our distribution partners' businesses decline, our reliance on our content providers, the demand for their products and our exclusivity arrangements with them, our reliance on relationships with card issuing banks, the consequences to our future growth if our distribution partners fail to actively and effectively promote our products and services, the requirement that we comply with applicable laws and regulations, including increasingly stringent money-laundering rules and regulations, risks related to our ongoing relationship with Safeway and other risks and uncertainties described in our reports and filings with the Securities and Exchange Commission, including the risks and uncertainties set forth in Item 1A under the heading Risk Factors in our recent Annual Report on Form 10-K. We undertake no obligation to update forward-looking statements to reflect developments or information obtained after the date hereof and disclaim any obligation to do so other than as may be required by law. Blackhawk Network Confidential – Reproduction or Redistribution Prohibited 2

Transactions Overview Blackhawk Network Confidential – Reproduction or Redistribution Prohibited Summary • On September 24, Blackhawk signed a definitive agreement to acquire Parago for approximately $290M in cash from TH Lee Putnam and other investors • Valuation: 12x 2014E Adjusted EBITDA, 10x 2015E Adjusted EBITDA excluding synergies and transition expenses and net of cash tax benefits • Financed with existing liquidity and an upsized credit facility • On August 27, completed the acquisition of CardLab as previously announced Parago Overview • $1B in rewards processed; $500M in prepaid card load value • 250 clients including Fortune 100 and multi-national companies • Highly sticky solutions – integrated into POS/ERP/CRM systems for largest clients CardLab Overview • Online provider of incentives through highly developed self-serve corporate order and customization tool • Focused on SMB and corporate departmental spend for prepaid card incentives and rewards Financial Impact • Slightly accretive to earnings in 2014, with significant upside in 2015 • Identifiable cost savings and revenue upside from content and distribution upsell opportunities • Increase proportion of recurring, predictable revenues with less seasonality 3

Strategic Rationale Blackhawk Network Confidential – Reproduction or Redistribution Prohibited 4 Highly Strategic – Delivers on articulated strategy of gaining scale in the incentives and loyalty space through consolidation – Immediately puts Blackhawk in a leadership position in the space Highly Complementary – Perfect fit with InteliSpend in terms of product and customer mix – Complements Blackhawk’s gift card retail business with a scaled corporate channel Financially Attractive – Recurring revenue model with modest seasonality – Platform synergies from processing, fulfillment, customer care and other common infrastructure – Content and distribution upsell opportunities Highly Complementary – Brings a unique, proprietary, self-service eCommerce platform focused on small order size incentives and rewards – suitable to SMB market and department level incentives – Adds superior technology capabilities around prepaid card design customization Financially Attractive – Back-end cost savings – Potential revenue synergies through upselling CardLab’s broad customer portfolio

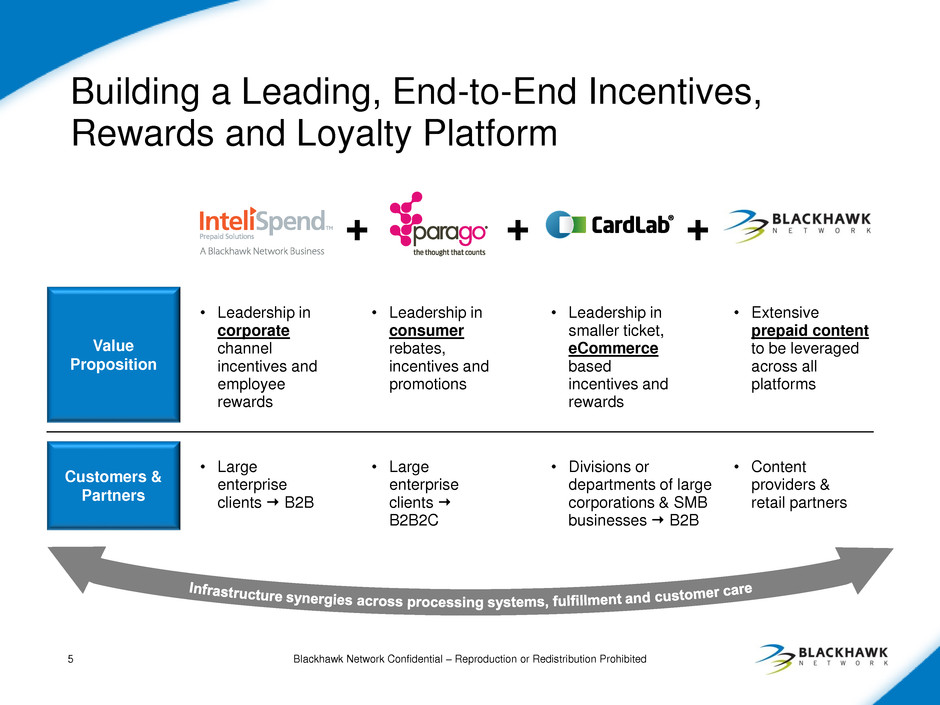

Building a Leading, End-to-End Incentives, Rewards and Loyalty Platform Blackhawk Network Confidential – Reproduction or Redistribution Prohibited Customers & Partners Value Proposition • Leadership in corporate channel incentives and employee rewards 5 • Leadership in consumer rebates, incentives and promotions • Leadership in smaller ticket, eCommerce based incentives and rewards • Extensive prepaid content to be leveraged across all platforms • Large enterprise clients B2B • Large enterprise clients B2B2C • Divisions or departments of large corporations & SMB businesses B2B • Content providers & retail partners + + +

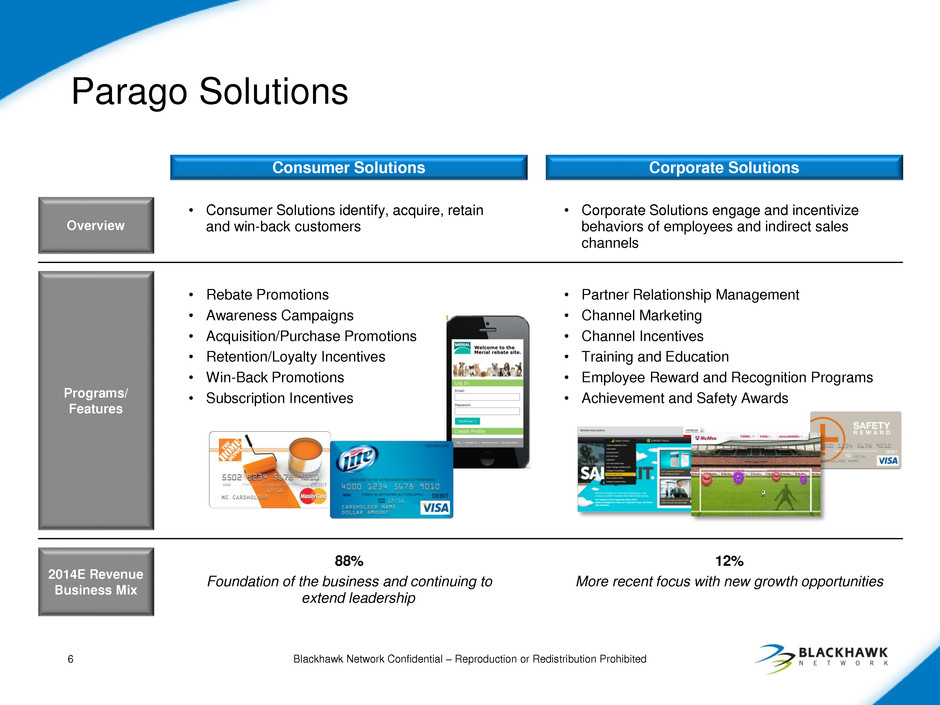

Parago Solutions Blackhawk Network Confidential – Reproduction or Redistribution Prohibited Overview Programs/ Features Consumer Solutions Corporate Solutions 6 2014E Revenue Business Mix 88% Foundation of the business and continuing to extend leadership 12% More recent focus with new growth opportunities • Consumer Solutions identify, acquire, retain and win-back customers • Corporate Solutions engage and incentivize behaviors of employees and indirect sales channels • Rebate Promotions • Awareness Campaigns • Acquisition/Purchase Promotions • Retention/Loyalty Incentives • Win-Back Promotions • Subscription Incentives • Partner Relationship Management • Channel Marketing • Channel Incentives • Training and Education • Employee Reward and Recognition Programs • Achievement and Safety Awards

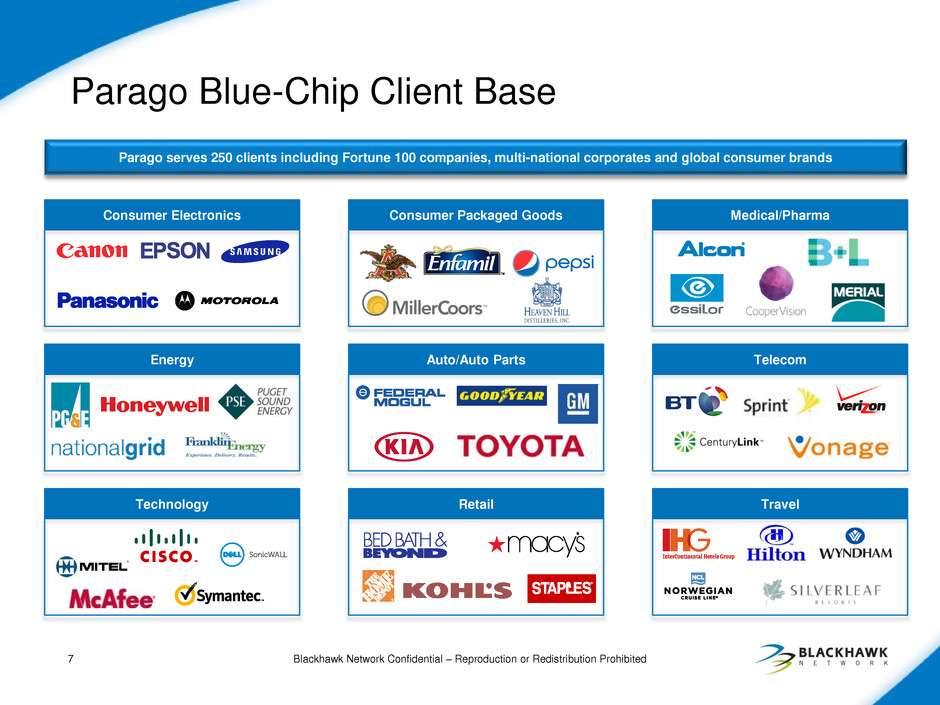

Parago Blue-Chip Client Base Blackhawk Network Confidential – Reproduction or Redistribution Prohibited Parago serves 250 clients including Fortune 100 companies, multi-national corporates and global consumer brands Consumer Electronics Consumer Packaged Goods Medical/Pharma Energy Auto/Auto Parts Telecom Technology Retail Travel 7

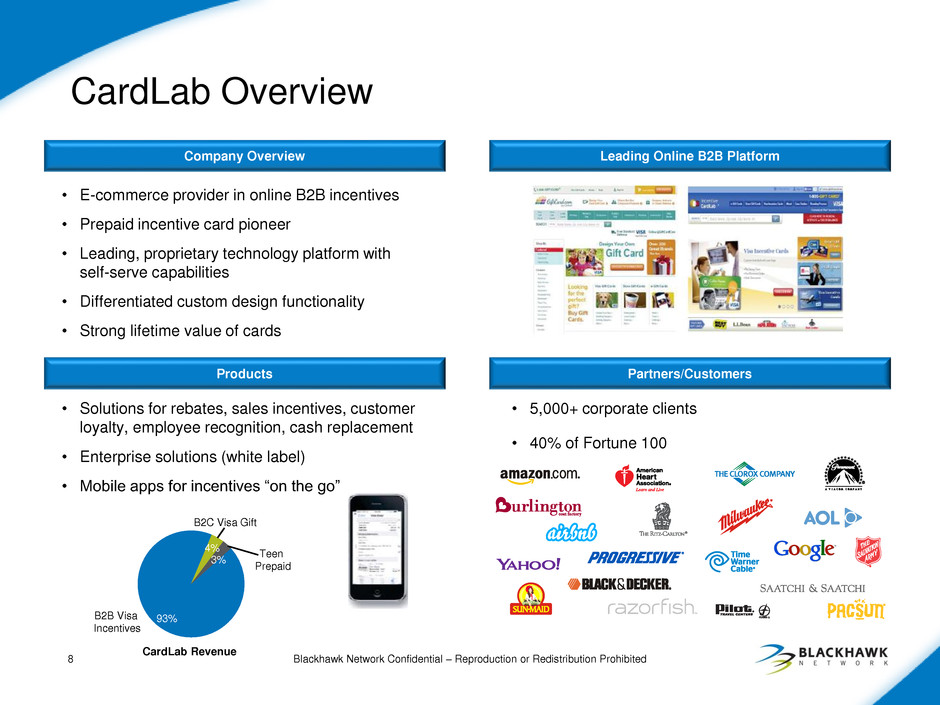

CardLab Overview Blackhawk Network Confidential – Reproduction or Redistribution Prohibited Company Overview Leading Online B2B Platform • E-commerce provider in online B2B incentives • Prepaid incentive card pioneer • Leading, proprietary technology platform with self-serve capabilities • Differentiated custom design functionality • Strong lifetime value of cards 8 Products Partners/Customers • Solutions for rebates, sales incentives, customer loyalty, employee recognition, cash replacement • Enterprise solutions (white label) • Mobile apps for incentives “on the go” • 5,000+ corporate clients • 40% of Fortune 100 93% 4% 3% B2B Visa Incentives B2C Visa Gift Teen Prepaid CardLab Revenue

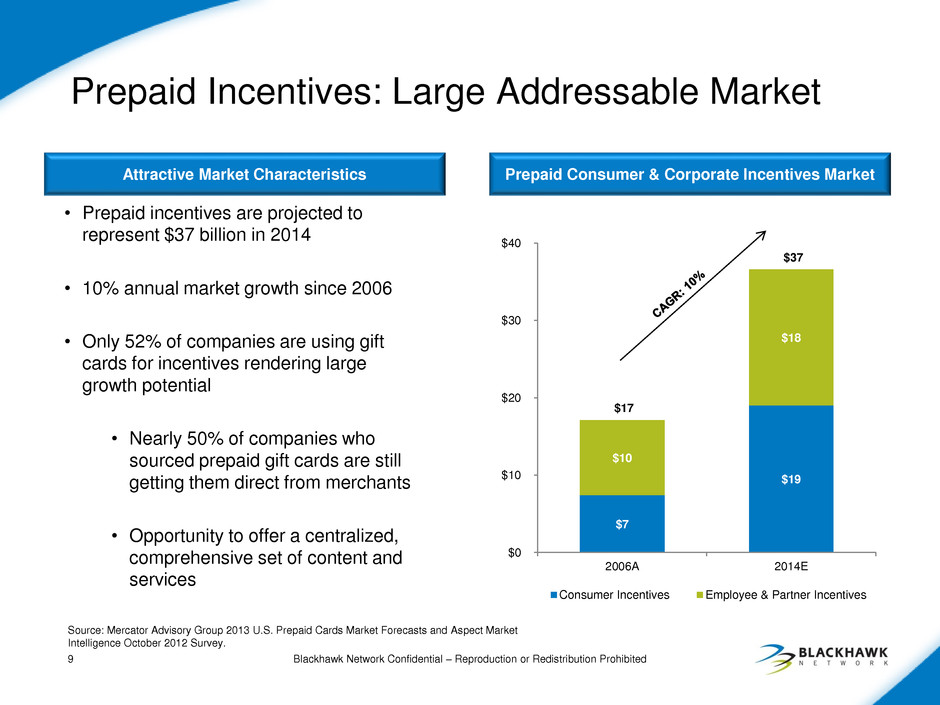

Prepaid Incentives: Large Addressable Market Attractive Market Characteristics Prepaid Consumer & Corporate Incentives Market $7 $19 $10 $18 $0 $10 $20 $30 $40 2006A 2014E Consumer Incentives Employee & Partner Incentives $17 $37 Blackhawk Network Confidential – Reproduction or Redistribution Prohibited 9 Source: Mercator Advisory Group 2013 U.S. Prepaid Cards Market Forecasts and Aspect Market Intelligence October 2012 Survey. • Prepaid incentives are projected to represent $37 billion in 2014 • 10% annual market growth since 2006 • Only 52% of companies are using gift cards for incentives rendering large growth potential • Nearly 50% of companies who sourced prepaid gift cards are still getting them direct from merchants • Opportunity to offer a centralized, comprehensive set of content and services

Consumer 88% Corporate 12% Parago Financial Summary Blackhawk Network Confidential – Reproduction or Redistribution Prohibited Key Financial Indicators Financial Highlights • Recurring and predictable revenue stream with strong customer retention • 80%+ customer retention • Average tenure of Top 10 clients is six years • Little seasonality in the business • 2011 to 2014E Revenue CAGR 18% • Expanding EBITDA margins in the low-to- mid 20% range 2007 2014E Revenue 10 • $1B in rewards processed • $500M in prepaid card load value • 2014E revenue of approx $100M • 2014E Adjusted EBITDA of $22M–$24M

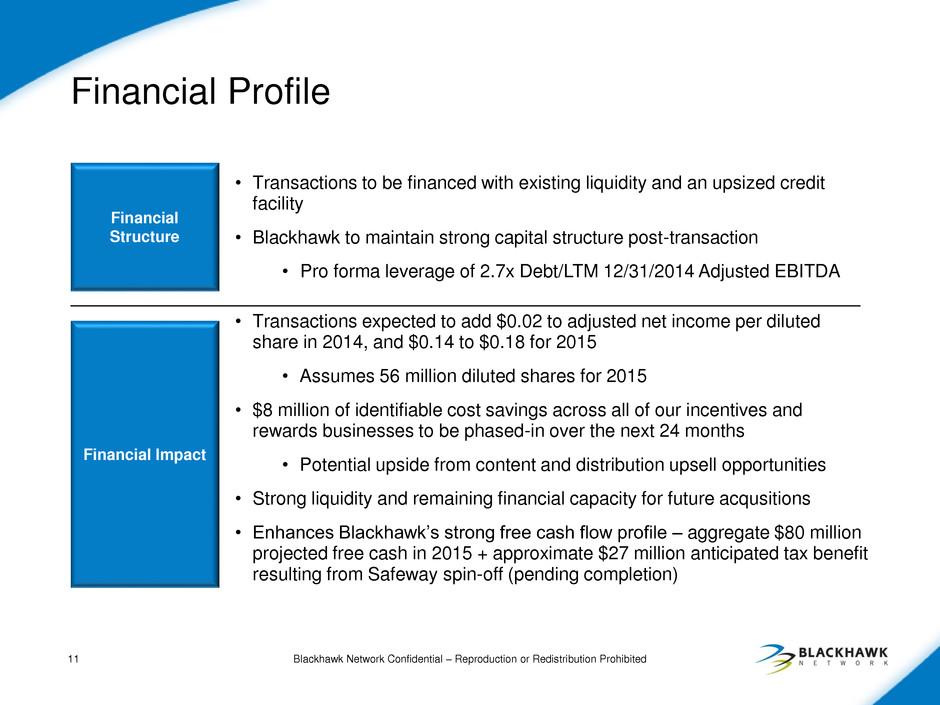

Financial Profile Blackhawk Network Confidential – Reproduction or Redistribution Prohibited Financial Impact Financial Structure • Transactions to be financed with existing liquidity and an upsized credit facility • Blackhawk to maintain strong capital structure post-transaction • Pro forma leverage of 2.7x Debt/LTM 12/31/2014 Adjusted EBITDA • Transactions expected to add $0.02 to adjusted net income per diluted share in 2014, and $0.14 to $0.18 for 2015 • Assumes 56 million diluted shares for 2015 • $8 million of identifiable cost savings across all of our incentives and rewards businesses to be phased-in over the next 24 months • Potential upside from content and distribution upsell opportunities • Strong liquidity and remaining financial capacity for future acqusitions • Enhances Blackhawk’s strong free cash flow profile – aggregate $80 million projected free cash in 2015 + approximate $27 million anticipated tax benefit resulting from Safeway spin-off (pending completion) 11

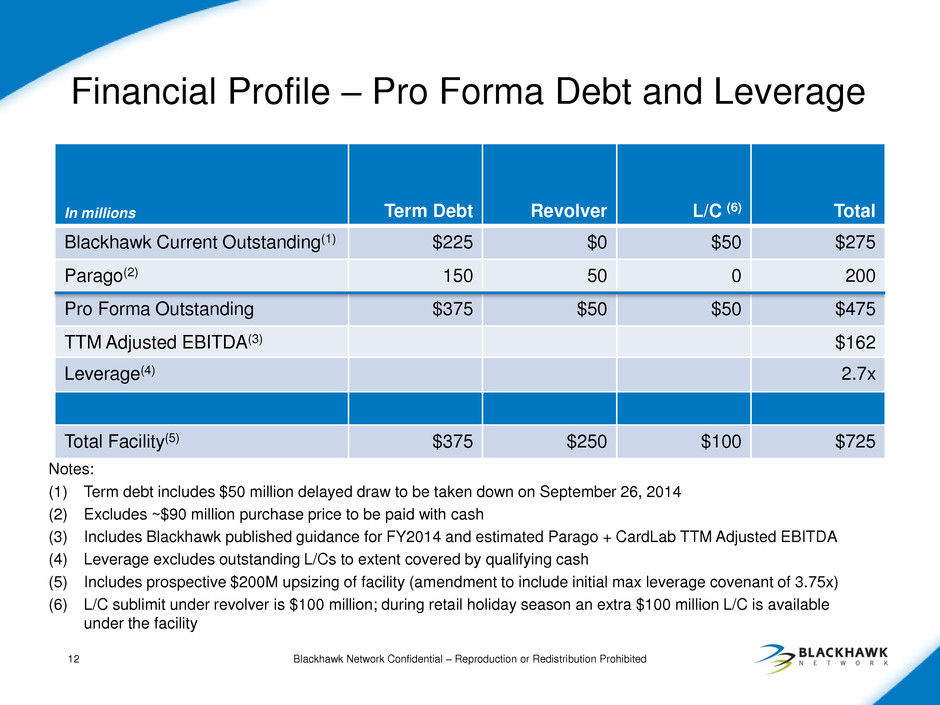

Financial Profile – Pro Forma Debt and Leverage Blackhawk Network Confidential – Reproduction or Redistribution Prohibited 12 In millions Term Debt Revolver L/C (6) Total Blackhawk Current Outstanding(1) $225 $0 $50 $275 Parago(2) 150 50 0 200 Pro Forma Outstanding $375 $50 $50 $475 TTM Adjusted EBITDA(3) $162 Leverage(4) 2.7x Total Facility(5) $375 $250 $100 $725 Notes: (1) Term debt includes $50 million delayed draw to be taken down on September 26, 2014 (2) Excludes ~$90 million purchase price to be paid with cash (3) Includes Blackhawk published guidance for FY2014 and estimated Parago + CardLab TTM Adjusted EBITDA (4) Leverage excludes outstanding L/Cs to extent covered by qualifying cash (5) Includes prospective $200M upsizing of facility (amendment to include initial max leverage covenant of 3.75x) (6) L/C sublimit under revolver is $100 million; during retail holiday season an extra $100 million L/C is available under the facility

Thank You