Attached files

| file | filename |

|---|---|

| 8-K - GULFSLOPE ENERGY, INC. | gspe8k091914.htm |

Exhibit 99.1

Gulfslope Energy Exploring the Gulf of Mexico

This presentation may contain forward-looking statements about the business, financial condition and prospects of the Company. Forward-looking statements can be identified by the use of forward-looking terminology such as “believes,” “projects,” “expects,” “may,” “goal,” “estimates,” “should,” “plans,” “targets,” “intends,” “could,” or “anticipates,” or the negative thereof, or other variations thereon, or comparable terminology, or by discussions of strategy or objectives. Forward-looking statements relate to anticipated or expected events, activities, and trends. Because forward-looking statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties. Forward-looking statements in this presentation include, without limitation, the Company’s expectations of oil and oil equivalents, barrels of oil and gas resources, prospects leased, dollar amounts of value creation, undiscovered resources, drilling success rates, resource information, superior economics, consistent value growth and other performance results. The SEC permits oil and gas companies, in their filings with the SEC to disclose only proved, probable and possible reserves, i.e. Items 1201 through 1208 of Regulation S-K (“SEC Oil and Gas Industry Disclosures”). The estimates of recoverable resources used in this presentation do not comply with the SEC Oil and Gas Industry Disclosures, nor should it be assumed that any recoverable resources will be classified as proved, probable or possible reserves consistent with the SEC Oil and Gas Industry Disclosures. Recoverable resources estimates are undiscovered, highly speculative resources estimated where geological and geophysical data suggest the potential for discovery of petroleum but where the level of proof is insufficient for a classification as reserves or contingent resources. In addition, recoverable resources have a great amount of uncertainty as to their existence, absolute amount, and economic feasibility. Although the Company believes that the expectations reflected in forward-looking statements are reasonable, there can be no assurances that such expectations will prove to be accurate. Potential and existing shareholders are cautioned that such forward-looking statements involve risks and uncertainties. The forward-looking statements contained in this presentation speak only as of the date of this presentation, and the Company expressly disclaims any obligation or undertaking to report any updates or revisions to any such statement to reflect any change in the Company’s expectations or any change in events, conditions or circumstances on which any such statement is based. Certain factors may cause results to differ materially from those anticipated by some of the statements made in this presentation. Please carefully review our filings with the SEC as we have identified many risk factors that impact our business plan. U.S. investors are urged to consider closely the disclosures in our Forms 10-K, 10-Q, 8-K and other filings with the SEC, which can be electronically accessed from our website at www.GulfSlope.com or the SEC's website at http://www.sec.gov/.

Name GulfSlope Energy

Established 2013

Focus Area Offshore Gulf of Mexico

Target Shelf Miocene

Seismic 2.2 MM Acres (440 Blocks)

Lease Blocks 21

Portfolio 17 Drilling Prospects

Ticker GSPE

Market Cap Range $150-$200 MM

Avg. Daily Trading Volume 500,000

Insider Ownership 40%

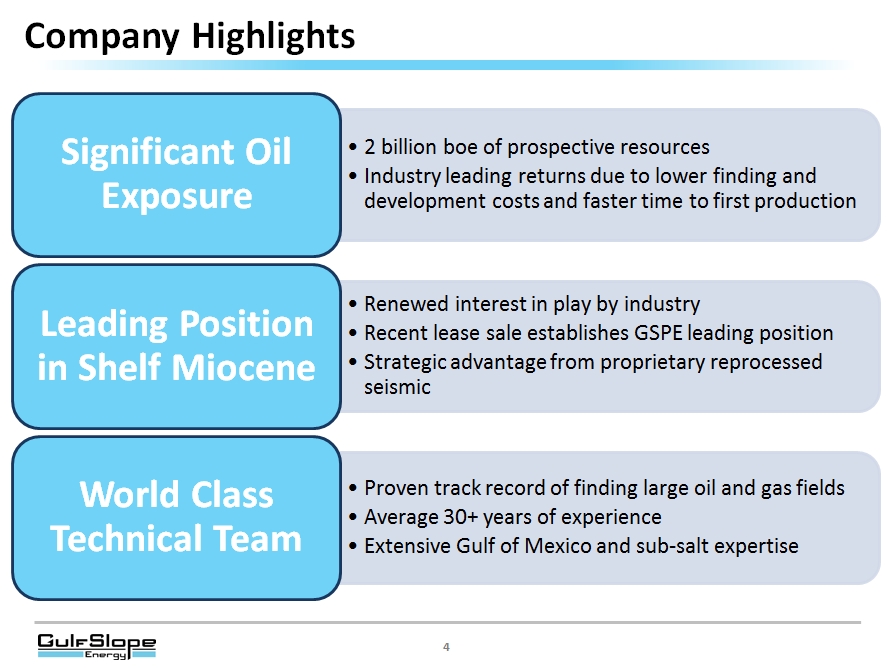

Significant Oil Exposure

2 billion boe of prospective resources

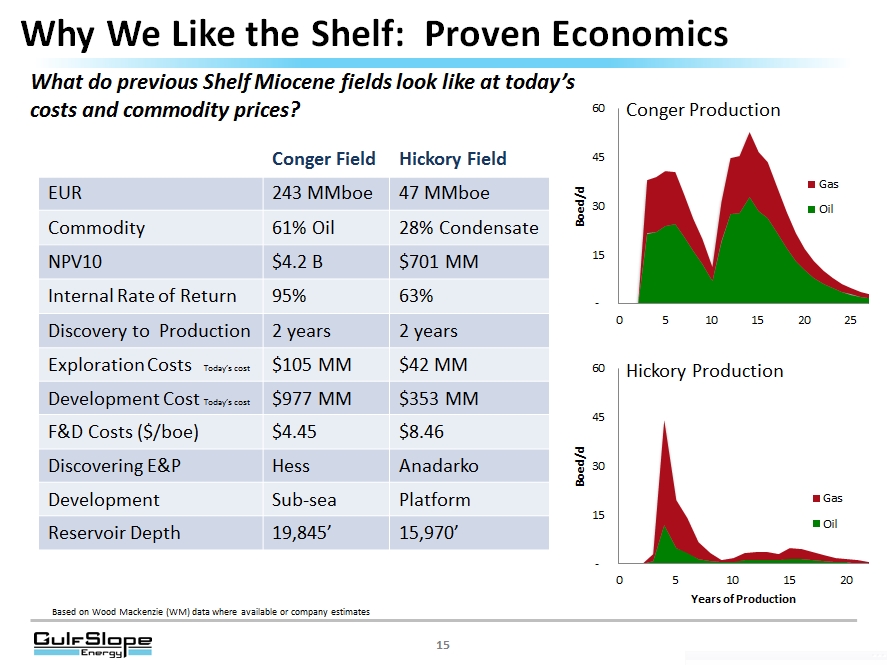

Industry leading returns due to lower finding and development costs and faster time to first production

Leading Position in Shelf Miocene

Renewed interest in play by industry

Recent lease sale establishes GSPE leading position

Strategic advantage from proprietary reprocessed seismic

World Class Technical Team

Proven track record of finding large oil and gas fields

Average 30+ years of experience

Extensive Gulf of Mexico and sub-salt expertise

2 billion boe of prospective resources

Industry leading returns due to lower finding and development costs and faster time to first production

Leading Position in Shelf Miocene

Renewed interest in play by industry

Recent lease sale establishes GSPE leading position

Strategic advantage from proprietary reprocessed seismic

World Class Technical Team

Proven track record of finding large oil and gas fields

Average 30+ years of experience

Extensive Gulf of Mexico and sub-salt expertise

|

•

|

Commence Drilling in 2015

|

|

-

|

High impact exploration

|

|

-

|

Focus on high return oil projects in shallower water

|

|

-

|

Diversify risk through partnering: in progress

|

|

•

|

Grow and Optimize Exploration Portfolio

|

|

-

|

21 Blocks with 17 prospects totaling 2 billion boe of potential resources

|

|

-

|

Generate additional prospects on 2.2 million acres (440 blocks) of 3D seismic

|

|

•

|

Capitalize on Recent Advancements in Sub-Salt Seismic Imaging

|

|

-

|

Deploy specialized technical team for sub-salt exploration

|

|

-

|

Apply modern technologies to producing basins with overlooked exploration potential

|

|

-

|

Continue to extend the prolific deepwater Miocene trend to the adjacent shelf

|

|

•

|

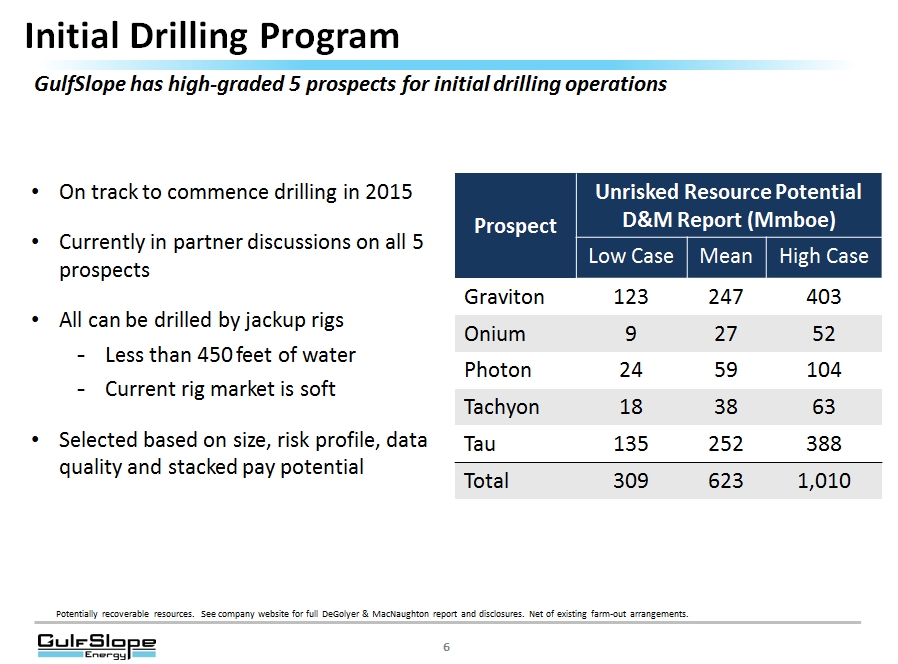

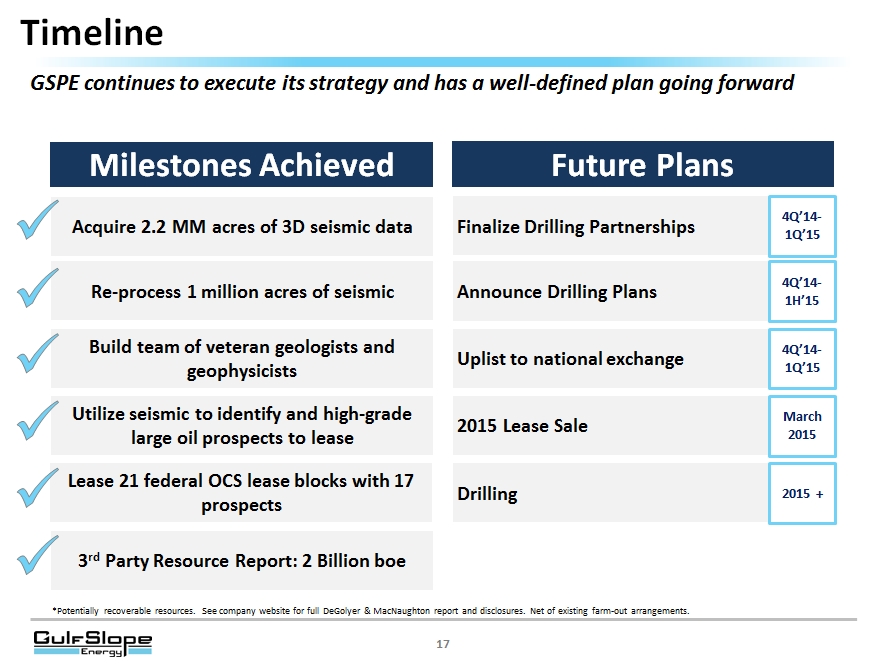

On track to commence drilling in 2015

|

|

•

|

Currently in partner discussions on all 5 prospects

|

|

•

|

All can be drilled by jackup rigs

|

|

-

|

Less than 450 feet of water

|

|

-

|

Current rig market is soft

|

|

•

|

Selected based on size, risk profile, data quality and stacked pay potential

|

DeGolyer and MacNaughton reviewed GulfSlope’s 17 individual prospects:

|

•

|

In-line with previous internal company estimates

|

|

•

|

Consistent with deepwater Miocene evaluations

|

|

•

|

Fully Independent Appraisal

|

|

•

|

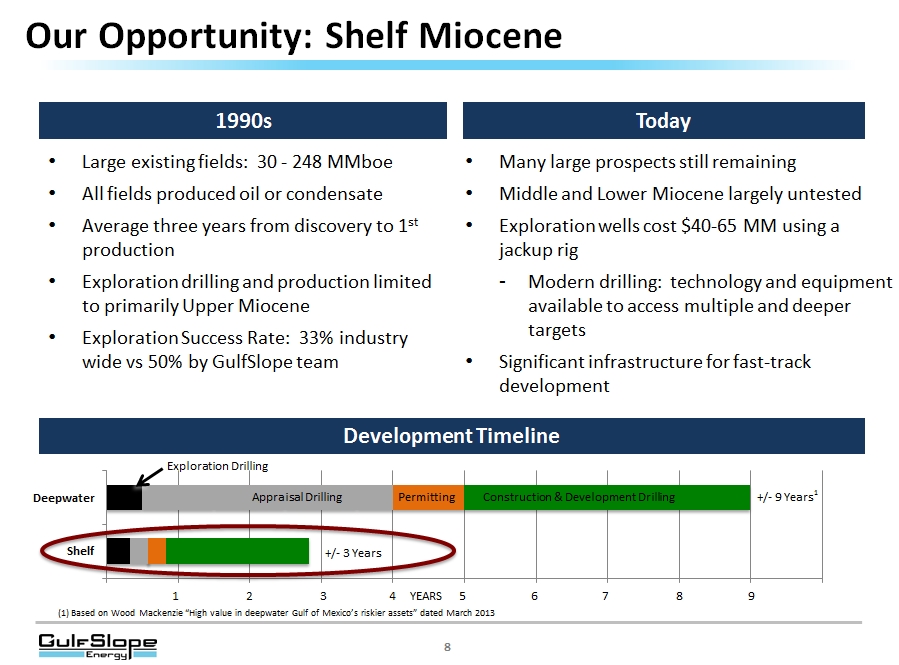

Large existing fields: 30 - 248 MMboe

|

|

•

|

All fields produced oil or condensate

|

|

•

|

Average three years from discovery to 1st production

|

|

•

|

Exploration drilling and production limited to primarily Upper Miocene

|

|

•

|

Exploration Success Rate: 33% industry wide vs 50% by GulfSlope team

|

|

•

|

Many large prospects still remaining

|

|

•

|

Middle and Lower Miocene largely untested

|

|

•

|

Exploration wells cost $40-65 MM using a jackup rig

|

|

-

|

Modern drilling: technology and equipment available to access multiple and deeper targets

|

|

•

|

Significant infrastructure for fast-track development

|

|

•

|

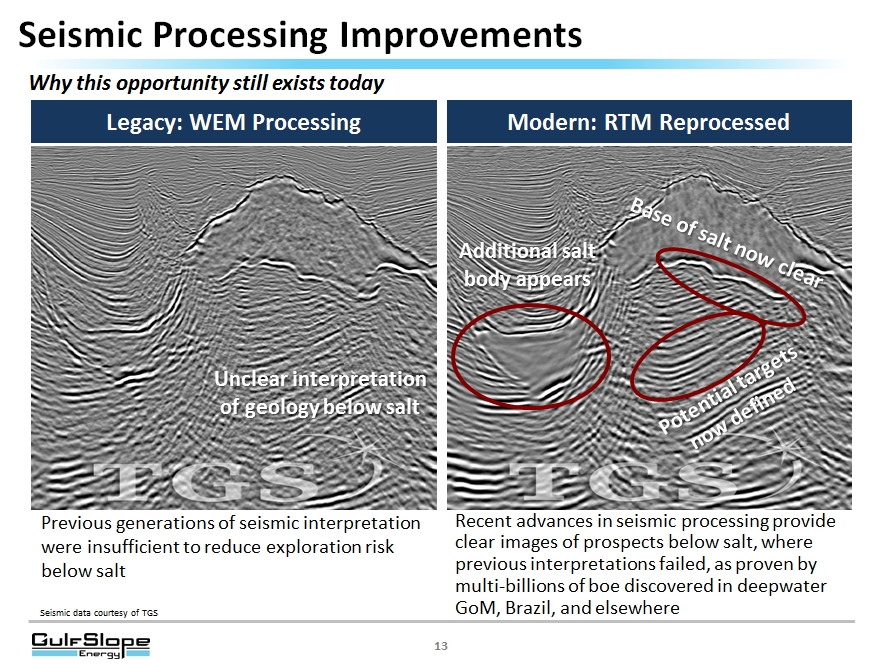

Seismic Processing

|

|

–

|

Advanced algorithms maximize accuracy

|

|

–

|

Processing is now faster and cheaper

|

|

–

|

Reverse Time Migration and other technologies utilized by GulfSlope and industry provide the most accurate view of sub-salt prospects

|

|

•

|

Seismic Capture

|

|

–

|

1990s: 2D and isolated 3D seismic

|

|

–

|

Today: 3D data now standard

|

|

ü

|

Maximize chance of discoveries

|

|

ü

|

Improve resource estimates

|

|

ü

|

Enable a small team to successfully compete

|

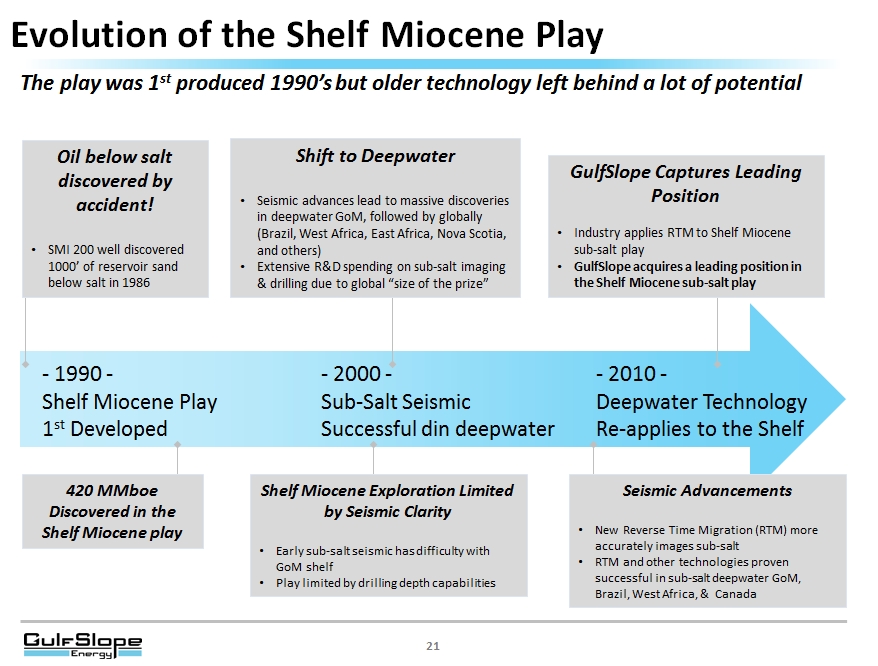

Previous generations of seismic interpretation were insufficient to reduce exploration risk below salt

Recent advances in seismic processing provide clear images of prospects below salt, where previous interpretations failed, as proven by multi-billions of boe discovered in deepwater GoM, Brazil, and elsewhere

|

•

|

Pure Gulf of Mexico oil exploration exposure

|

|

•

|

On track to drill in 2015

|

|

•

|

Portfolio of 17 high impact drilling prospects

|

|

•

|

2 Billion boe* of resources identified

|

|

•

|

Targeting overlooked Shelf Miocene play with proven technology

|

|

•

|

Proven leadership with track record of finding significant oil and gas fields

|

|

•

|

Team fully aligned with investors

|

|

•

|

GulfSlope is well positioned as industry returns to the Shelf Miocene play

|