Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PERDOCEO EDUCATION Corp | d791558d8k.htm |

Confidential –

For Internal Use Only

Career Education

Investor Presentation

Fall 2014

“14

th

Annual BMO

Capital Markets Back

to School Education

Conference”

Exhibit 99.1 |

Confidential –

For Internal Use Only

Cautionary Statements & Disclosures

1

This presentation contains “forward-looking statements,” as defined in Section 21E of

the Securities Exchange Act of 1934, as amended, that reflect our current expectations

regarding our future growth, results of operations, cash flows, performance and business

prospects and opportunities, as well as assumptions made by, and information currently

available to, our management. We have tried to identify forward-looking statements by using words

such as “will,” “believe,” “moving closer to,”

“opportunities,” “expect,” “estimate,” “beginning to” and similar expressions, but these words

are not the exclusive means of identifying forward-looking statements. These statements are based

on information currently available to us and are subject to various risks, uncertainties, and

other factors, including, but not limited to, those discussed in Item 1A,“Risk

Factors” of our Annual Report on Form 10-K for the year ended December 31, 2013 that

could cause our actual growth, results of operations, financial condition, cash flows, performance and

business prospects and opportunities to differ materially from those expressed in, or implied

by, these statements. Except as expressly required by the federal securities laws, we undertake

no obligation to update such factors or to publicly announce the results of any of the

forward-looking statements contained herein to reflect future events, developments, or changed

circumstances or for any other reason.

Certain financial information is presented on a non-GAAP basis. The Company believes

it is useful to present non-GAAP financial measures which exclude certain significant items

as a means to understand the performance of its core business. As a general matter, the

Company uses non-GAAP financial measures in conjunction with results presented in

accordance with GAAP to help analyze the performance of its core business, assist with preparing the

annual operating plan, and measure performance for some forms of compensation. In addition, the

Company believes that non-GAAP financial information is used by analysts and others in the

investment community to analyze the Company's historical results and to provide estimates of

future performance and that failure to report non-GAAP measures could result in a misplaced

perception that the Company's results have underperformed or exceeded expectations. The most directly

comparable GAAP information and a reconciliation between the non-GAAP and GAAP figures are

provided at the end of this presentation, and this presentation (including the reconciliation)

has been posted to our website. |

Confidential –

For Internal Use Only

Agenda

2

•

Education Industry Dynamics

•

Evolution of Career Education

•

Main Objectives of Turnaround Strategy and Progress Report

•

Key Financial Metrics |

Confidential –

For Internal Use Only

U.S. Macro Education Market Drivers

3

•

U.S. population has low level of educational attainment.

•

Approximately

3

million

jobs

are

unfilled

due

to

a

worker

skills

gap

(1)

.

•

Proprietary segment serves an under served demographic with a higher

concentration of minority students and older students than attend traditional

schools.

•

Due to student dependency on tuition assistance (Title IV funds), the

proprietary segment is highly regulated by the Department of Education,

Accreditors and States.

(1)

Source: Bureau of Labor Statistics |

Confidential –

For Internal Use Only

Earnings Power of Postsecondary Education

4

($ 000)

•

Meaningful correlation between post secondary education and lifetime

earnings. •

For-profit college students that earned a Bachelor’s degree earn an

average salary greater

than

those

students

that

earned

their

degrees

from

public

and

private

colleges

(2)

.

(2

) National Center for Education Statistics issued a report in July 2014 which

included data from students who earned a Bachelor’s Degree in

2007-2008. The data from the report was derived from surveys conducted approximately four year’s post graduation.

(1)

Georgetown University Center on Education and the Workforce (June 2010).

$1,198

$1,767

$2,240

$2,255

$3,380

$3,837

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

$4,000

$4,500

High School

Dropout

High School

Graduate

Some College

Associate's

Degree

Bachelor's Degree

Master's Degree

Average Lifetime Earnings

(1) |

Confidential –

For Internal Use Only

Career Education Corporation

5

Career Education is the parent of two regionally accredited Universities

with programs in business studies, information systems and technology,

and

criminal

justice

(primarily

offered

online

and

at

four

small

ground-

based campuses), two regionally accredited Career Schools (Briarcliffe

and Harrington), fifteen nationally accredited Culinary Schools (as well

as one regionally accredited school) and eighteen nationally accredited

allied health, technology and art & design schools.

|

Confidential –

For Internal Use Only

Diverse Portfolio of Career Oriented Schools

6

University

–

Beginning to see favorable business

trends. Goal is to generate modest total student

enrollment growth.

Culinary Arts

–

Recent total student enrollment

growth due to Associate-Degree. Strategy in

place to stabilize performance.

Career Colleges

–

Completed brand

consolidation and expansion of campus mission

statements. In process of adding new programs

to better serve students and accommodate local

workforce demands. Strategy in place to

stabilize performance. |

Confidential –

For Internal Use Only

Diverse Portfolio of Career Oriented Schools

Ongoing operations. Excludes campuses in “teach out.” |

Confidential –

For Internal Use Only

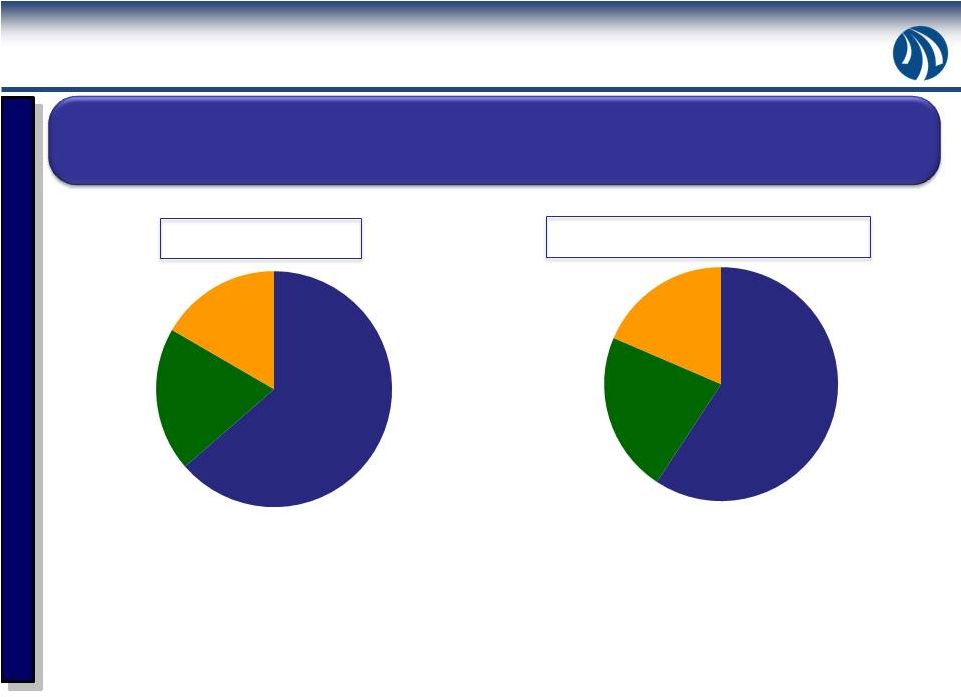

Business Overview

8

Dynamic educational services company committed to quality, career-focused

learning to a diverse student population through online, on-ground and hybrid

learning program offerings.

•

Approximately 30,250 students, or 63% of total enrollments, are online

students. •

Focus on improving the educational experiences and outcomes of students and

helping bridge

the

gap

between

learners

seeking

new

skills

and

employers

looking

for

talent

to

help them succeed.

•

Turnaround process underway, led by seasoned executive management team with

extensive industry experience.

University,

30,600

Career

Colleges,

9,500

Culinary

Arts, 8,000

Enrollments

of

48,100

As of 6/30/14

University,

$549

Career

Colleges,

$206

Culinary

Arts, $172

TTM

Revenue

of

$927

($

in

millions)

Twelve months ended 6/30/14 |

Confidential –

For Internal Use Only

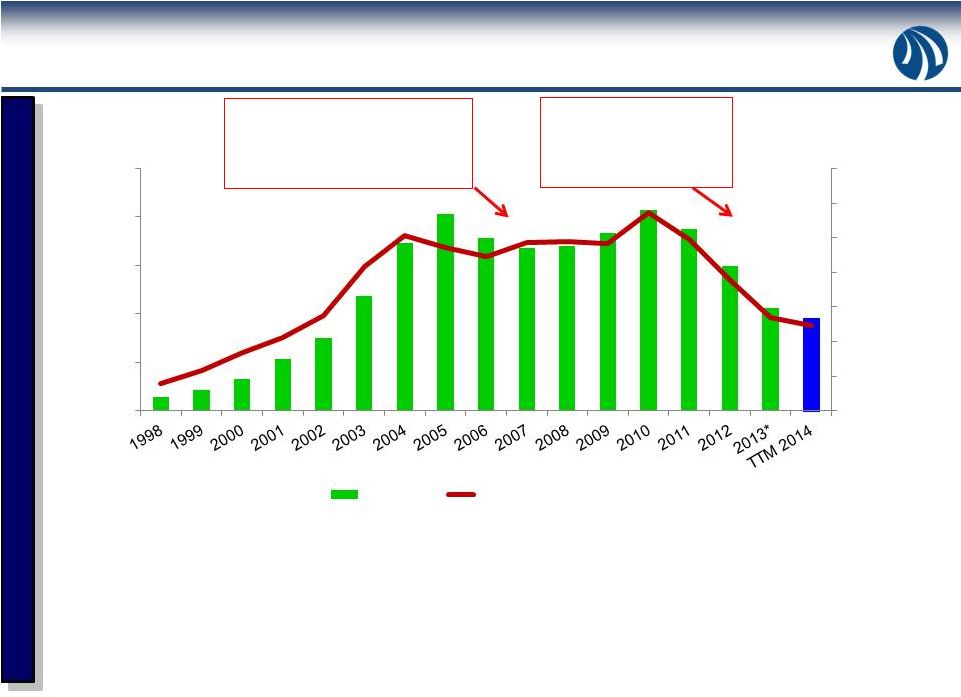

A Summary of Career Education’s History

9

•

Company founded in 1994 and went public in 1998.

•

Business built through a series of acquisitions.

•

Company

and

industry

have

experienced

two

market

downturns

–

the

most

recent

one

being more severe.

Revenue ($ millions)

Heightened regulatory

environment, placement rate

investigation, economic and

competitive pressures and

negative press.

Heightened regulatory environment

(including AIU probationary status that

was lifted late in 2007), economic and

competitive pressures and negative

press.

# of Students

* A portion of the 2013 decrease is due to the Company selling its International

segment. -

20,000

40,000

60,000

80,000

100,000

120,000

140,000

$0

$500

$1,000

$1,500

$2,000

$2,500

Revenue

Total Student Enrollments |

Confidential –

For Internal Use Only

Key Investor Objectives to Turnaround Strategy

10

•

Strengthen Academic Outcomes, Enhance Regulatory Compliance

and Simplify Business Model.

•

Generate Modest University Total Student Enrollment Growth.

•

Stabilize Career School Enrollments.

•

Reduce Organizational Cost Structure.

•

Successfully Complete the Teach Out of Transitional Schools.

We also regularly evaluate the Company’s assets to determine where

best to deploy our capital and structure our organization to provide the

greatest opportunity for long-term, sustainable shareholder growth.

|

Confidential –

For Internal Use Only

Improving Academic Outcomes, Enhanced Regulatory

Compliance and Simplification

11

•

Improvement

in

the

rate

at

which

University

students

continue

on

to

their second class.

•

For the 2013 cohort, more than 90% of our 38 nationally-accredited

ACICS campuses that are not in teach out reported higher placement

rates when compared to the 2012 reporting year.

•

HLC acted to continue their regional accreditation of AIU and CTU in

2014 and 2013, respectively.

•

Consolidation of Health and Design & Technology programs.

•

Brand

consolidation

–

combining

legacy

Sanford-Brown,

IADT

and

Brown College into new Sanford-Brown with an expanded mission

statement. |

Confidential –

For Internal Use Only

Generate Modest University Total Student Enrollment Growth

12

(4,900)

(4,200)

(3,300)

(3,000)

(1,400)

Change in Total Student Enrollments vs. Prior Year Quarter

Q2 2013

Q3 2013

Q4 2013

Q1 2014

Q2 2014

(2,000)

(1,300)

(700)

(800)

(600)

(2,900)

(2,900)

(2,600)

(2,200)

(800)

CTU

AIU |

Confidential –

For Internal Use Only

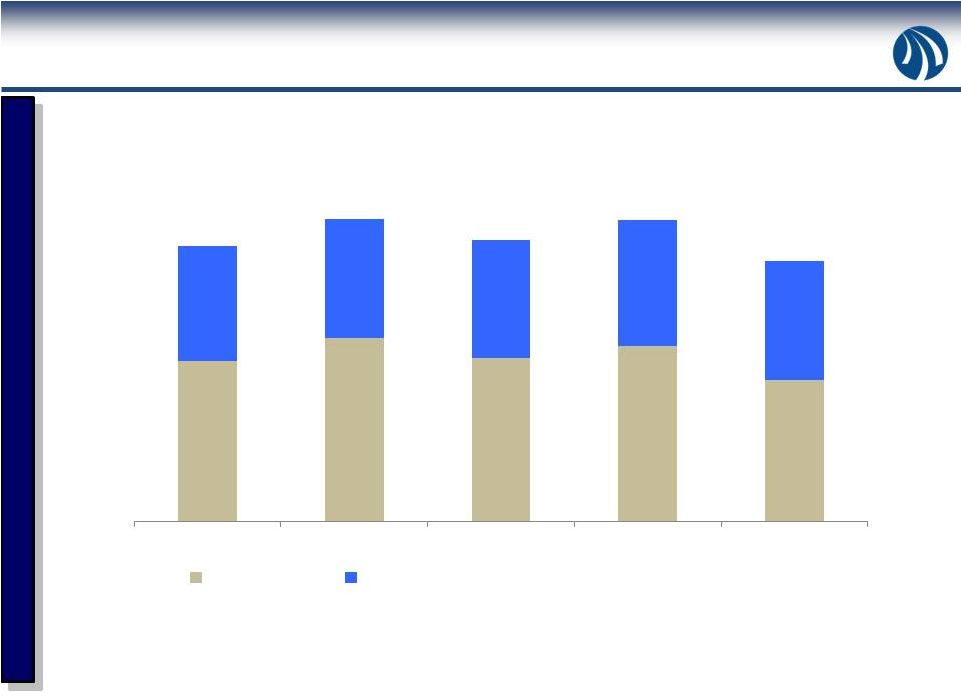

Stabilize

Career

School

Enrollments

-

Total

Student

Enrollments –

Career Schools

13

20,300

18,500

18,900

20,200

17,500

Total Student Enrollments

10,800

12,300

11,000

11,800

9,500

7,700

8,000

7,900

8,400

8,000

2Q 2013

3Q 2013

4Q 2013

1Q 2014

2Q 2014

Career Colleges

Culinary Arts |

Confidential –

For Internal Use Only

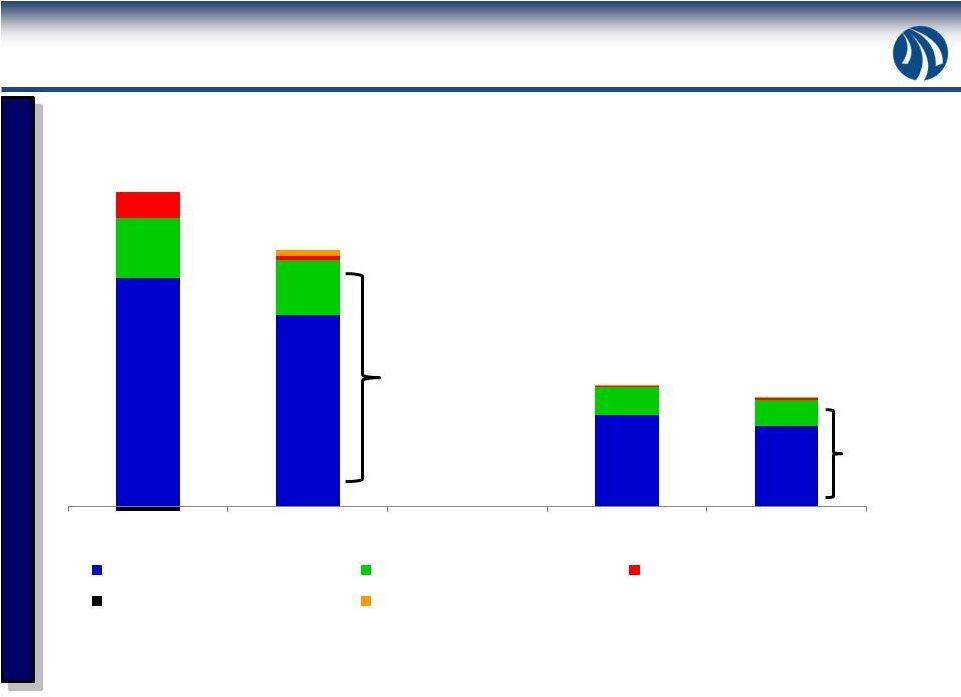

Operating Expenses ($ millions)

Reduce

Organizational

Cost

Structure

–

Progress

Underway

14

$1,542

$1,272

$606

$546

Reduced by

$212 million

Reduced by

$63 million

FY 2012 & FY 2013 data as reported in the Company’s 2013 10-K and

based on schools that were in continuing operations at 12/31/13. YTD

2Q 2013 and YTD 2Q 2014 data as reported in the Company’s 2Q 2014 10-Q and based on schools that were

in continuing operations at 6/30/14.

$1,133

$951

$455

$403

$302

$272

$139

$128

FY 2012

FY 2013

YTD 2Q 2013

YTD 2Q 2014

Other Operating Expenses

Advertising

Impairments

Insurance Recovery

Legal Settlements |

Confidential –

For Internal Use Only

Reduce Organizational Cost Structure -

Additional Opportunities

15

•

Educational services & facilities

-

Additional opportunity to optimize real estate

footprint.

•

Advertising

–

Generate efficiencies / lower lead generator volumes.

•

Administrative expenses

-

As a percentage of revenue, Career Education

administrative expenses are approximately 30%.

–

While industry comparisons can fluctuate in terms of classification of expenses,

the industry average is closer to 20%-22%.

2Q 2014

% of

Revenue

YTD 2Q

2014

% of

Revenue

Total Revenue

$229,292

$470,659

OPERATING EXPENSES

Educational services and facilities

$80,399

35.1%

$162,665

34.6%

General & Administrative:

Advertising

$57,314

25.0%

$127,884

27.2%

Admissions

$30,806

13.4%

$63,669

13.5%

Administrative

$66,276

28.9%

$143,476

30.5%

Bad Debt

$6,474

2.8%

$12,263

2.6%

Total G&A

$160,870

70.2%

$347,292

73.8% |

Confidential –

For Internal Use Only

Successfully Complete Teach Out of Transitional Schools

16

•

Transitional Schools operating losses in FY 2013 were approximately ($77) million

which was primarily cash outflow.

•

This fiscal year (through June 2014), we closed 16 campuses, divested one campus

and are scheduled to close an additional 4 campuses by the end of this

year. •

The 17 campuses that have been closed or divested as of June 2014 generated

approximately ($43) million of operating losses in FY 2013.

32

32

30

21

13

9

5

1

0

2Q 2013

3Q 2013

4Q 2013

1Q 2014

2Q 2014

4Q 2014

4Q 2015

4Q 2016

1Q 2017

# of Transitional Schools |

Confidential –

For Internal Use Only

Financial Overview : Profitable University Segment

17

•

CTU financially strong with trailing twelve month operating margin of 19.7%.

•

AIU moving closer to break-even performance.

University Revenue & Operating Income -

(in $000)

Trailing 12-Months

Revenue and

Operating Income

$549,358

$134,726

$146,492

Quarter Operating

Income

$52,562

$19,626

$18,083

Quarter Revenue

($100,000)

$0

$100,000

$200,000

$300,000

$400,000

$500,000

$600,000

2Q 2014

2Q 2014

2Q 2014

2Q 2013

2Q 2014

2Q 2013

CTU

AIU |

Confidential –

For Internal Use Only

Financial Overview : Improving Adjusted EBITDA

18

Excludes significant items as disclosed in the Non-GAAP reconciliation at the end of these

slides. •

Ongoing EBITDA exhibits seasonality fluctuations due to higher advertising

investments in 1Q and 3Q.

Trailing Twelve Month (TTM)

Adjusted EBITDA –

Ongoing

Operations (in $000)

Quarterly Adjusted EBITDA –

Ongoing Operations (in $000)

TTM 2Q

2014

TTM 1Q

2014

2Q 2014

2Q 2013

1Q 2014

4Q 2013

($35,346)

($44,083)

($3,139)

($11,876)

($14,103)

$139

($18,243)

3Q 2013 |

Confidential –

For Internal Use Only

Financial Overview : Strong Cash Position

19

(In 000’s)

(1) Balances presented above are quarter end balances and include both Continuing and

Discontinued Operations. (2) The increase in 4Q 2013 is attributed to proceeds

from the sale of the Company’s International segment. $363,099

(2)

•

Cash projection for fiscal year 2015 assumes rolling three-month average cash

balance of not less than $190 million, excluding any payments for real

estate buyout transactions or other significant unplanned cash

payments. $241,840

$227,515

$315,661

$274,617

$0

$50,000

$100,000

$150,000

$200,000

$250,000

$300,000

$350,000

$400,000

2Q 2013

3Q 2013

4Q 2013

1Q 2014

2Q 2014

Cash, Cash Equivalents and Short-Term Investments

(1) |

Confidential –

For Internal Use Only

Key Investment Highlights

20

•

Turnaround strategy in place with execution progressing.

•

Favorable industry dynamics in terms of market size and employer

demand for skilled workers.

•

Diverse business model with both online and campus based portfolio

of assets.

•

Strong balance sheet and cash position.

•

Dedicated management team with extensive industry experience.

|

Confidential –

For Internal Use Only

Reconciliation of GAAP to Non-GAAP Items

21

Adjusted EBITDA

Q2 2014

Q1 2014

Q4 2013

Q3 2013

Q2 2013

Pre-tax loss from continuing operations

(33,746)

$

(41,350)

$

(45,319)

$

(56,411)

$

(49,300)

$

Transitional Schools operating loss

(2)

8,841

7,308

11,227

9,004

9,716

Interest (income) expense, net

(177)

(25)

65

16

(548)

Loss (gain) on sale of business

-

-

(68)

39

222

Depreciation and amortization

(3)

12,799

13,305

14,062

14,399

14,749

Stock based compensation

(3)

1,020

1,341

1,580

1,713

1,631

Legal settlements

(3) (4)

1,600

5,850

17,000

300

8,300

7,403

74

4,516

11,513

3,966

(879)

(606)

(2,924)

1,184

(612)

Adjusted EBITDA--Ongoing Operations

(2)

(3,139)

$

(14,103)

$

139

$

(18,243)

$

(11,876)

$

Adjusted EBITDA per diluted share

(0.05)

$

(0.21)

$

0.00

$

(0.27)

$

(0.18)

$

Pre-tax loss from discontinued operations

(10,964)

$

(16,573)

$

119,133

$

(20,290)

$

(16,287)

$

Transitional Schools operating loss

(2)

(8,841)

(7,308)

(11,227)

(9,004)

(9,716)

Loss (gain) on sale of business

311

-

(130,109)

-

-

International Schools operating (income) loss

(7)

-

-

(11,434)

7,608

3,659

Interest (income) expense, net

-

-

(51)

(22)

(14)

Depreciation and amortization

(8)

1,595

2,126

2,364

2,552

2,818

Legal settlements

(8)

-

-

-

-

1,700

51

(7)

2,467

72

-

1,436

3,099

5,766

(3,092)

(2,611)

(16,412)

$

(18,663)

$

(23,091)

$

(22,176)

$

(20,451)

$

Adjusted EBITDA per diluted share

(0.24)

$

(0.28)

$

(0.35)

$

(0.33)

$

(0.31)

$

Asset impairments

(3) (5)

Unused space charges

(3) (6)

Asset impairments

(8)

Unused space charges

(6) (8)

CAREER EDUCATION CORPORATION AND SUBSIDIARIES

(In thousands, except per share amounts)

(2)

Adjusted EBITDA--Transitional and Discontinued Operations UNAUDITED

RECONCILIATION

OF

GAAP

TO

NON-GAAP

ITEMS

(1) |

Confidential –

For Internal Use Only

Reconciliation of GAAP to Non-GAAP Items –

con’t

22

(1)

(2)

(3)

Quarterly amounts relate to ongoing operations, which excludes

Transitional Schools. (4)

Legal

settlement

amounts

are

net

of

insurance

recoveries

and

are

recorded

within

the

following

segments:

Q2 2014

Q1 2014

Q4 2013

Q3 2013

Q2 2013

CTU

-

$

(900)

$

1,300

$

-

$

-

$

Career Colleges

-

-

200

300

8,300

Culinary Arts

2,000

3,000

15,500

-

-

Corporate & Other

(400)

3,750

-

-

-

Total

1,600

$

5,850

$

17,000

$

300

$

8,300

$

(5)

(6)

(7)

(8)

The Company believes it is useful to present non-GAAP financial

measures which exclude certain significant items as a means to understand the performance of its core business. As a general

matter,

the

Company

uses

non-GAAP

financial

measures

in

conjunction

with

results

presented

in

accordance

with

GAAP

to

help

analyze

the

performance

of

its

core

business,

assist

with

preparing

the

annual

operating

plan,

and

measure

performance

for

some

forms

of

compensation.

In

addition,

the

Company

believes

that

non-GAAP

financial

information

is

used

by

analysts

and

others

in

the

investment

community

to

analyze

the

Company's

historical

results

and

to

provide

estimates

of

future

performance

and

that

failure

to

report

non-GAAP

measures

could

result

in

a

misplaced perception that the Company's results have

underperformed or exceeded expectations. Asset

impairments

primarily

relate

to

trade

name

impairment

charges

within

Culinary

Arts

of

$7.4

million,

$10.7

million

and

$2.3

million

which

were

recorded

during

the

second

quarter

of

2014,

third

quarter

of

2013

and

the

second

quarter

of

2013,

respectively,

and

within

Career

Colleges

of

$1.7

million

during

the

second

quarter

of

2013.

Unused

space

charges

represent

the

net

present

value

of

remaining

lease

obligations

less

an

estimated

amount

for

sublease

income

as

well

as

the

subsequent

accretion

of

these

charges.

The International Schools segment was sold during the fourth quarter of

2013. As such, management excludes operations from the International Schools when assessing results and trends of

Transitional Schools and Discontinued Operations.

Quarterly amounts relate to Transitional Schools and Discontinued

Operations, excluding International. We

believe

Adjusted

EBITDA

allows

us

to

compare

our

current

operating

results

with

corresponding

historical

periods

and

with

the

operational

performance

of

other

companies

in

our

industry because it does not give effect to potential differences caused

by items we do not consider reflective of underlying operating performance. We also present Adjusted EBITDA because

we believe it is frequently used by securities analysts, investors and

other interested parties as a measure of performance. In evaluating Adjusted EBITDA, investors should be aware that in the

future we may incur expenses similar to the adjustments presented above.

Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be

unaffected by expenses that are unusual, non-routine or

non-recurring. Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for

net

income

(loss),

operating

income

(loss),

or

any

other

performance

measure

derived

in

accordance

and

reported

under

GAAP

or

as

an

alternative

to

cash

flow

from

operating

activities

or

as

a measure of our liquidity.

Non-GAAP

financial

measures

when

viewed

in

a

reconciliation

to

corresponding

GAAP

financial

measures,

provides

an

additional

way

of

viewing

the

Company's

results

of

operations

and

the

factors

and

trends

affecting

the

Company's

business.

Non-GAAP

financial

measures

should

be

considered

as

a

supplement

to,

and

not

as

a

substitute

for,

or

superior

to,

the

corresponding

financial results presented in accordance with GAAP.

Management assesses results of

operations for ongoing operations, which excludes Transitional Schools,

separately from Transitional Schools. As schools within the Transitional Schools

segment

are

fully

taught-out,

these

schools

will

be

recast

as

components

of

Discontinued

Operations.

As

a

result,

management

views

adjusted

EBITDA

from

ongoing

operations

separately

from Transitional Schools and Discontinued Operations to assess results

and make decisions. Accordingly, Transitional Schools operating loss is added back to pre-tax loss from continuing

operations and subtracted from pre-tax loss from discontinued

operations. |