Attached files

| file | filename |

|---|---|

| 8-K - 8-K - American Residential Properties, Inc. | baml2014globalrealestateco.htm |

AMERICAN RESIDENTIAL PROPERTIES, INC. COMPANY PRESENTATION SEPTEMBER 10-11, 2014

EPS\Management Presentation\American Residential Properties - 602505097 DISCLAIMER AND CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS The information in this presentation has been prepared solely for informational purposes and does not constitute an offer to sell or the solicitation of an offer to purchase any securities. Some of the statements in this presentation constitute forward-looking statements. The forward-looking statements included in this presentation reflect American Residential Properties, Inc.’s (“ARPI’s”) current views about future events and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause ARPI’s actual results to differ significantly from those expressed in any forward-looking statement. Statements regarding the following subjects, among others, may be forward-looking: ARPI’s ability to effectively deploy its capital; ARPI’s business and investment strategy; ARPI’s projected operating results; economic, demographic or real estate developments in ARPI’s markets; home value appreciation, employment growth, residential building permits, median household income and household formation in ARPI’s markets; defaults on, early terminations of or non-renewal of leases by ARPI’s tenants; ARPI’s ability to identify properties to acquire and to complete acquisitions; increased time and/or expense to gain possession and restore properties; ARPI’s ability to successfully operate acquired properties; projected operating costs; rental rates or vacancy rates; ARPI’s ability to obtain financing arrangements; general volatility of the markets in which ARPI participates; ARPI’s expected investments; interest rates and the market value of ARPI’s target assets; impact of changes in governmental regulations, tax law and rates and similar matters; ARPI’s ability to qualify and maintain ARPI’s qualification as a REIT; availability of qualified personnel; estimates relating to ARPI’s ability to make distributions to ARPI’s stockholders in the future; ARPI’s understanding of ARPI’s competition; and market trends in ARPI’s industry, real estate values, the debt securities markets or the general economy. The forward-looking statements are based on the beliefs, assumptions and expectations of ARPI as to future events, taking into account all information currently available to ARPI. Forward-looking statements are not guarantees of future events or of ARPI’s performance. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to ARPI. If a change occurs, ARPI’s business, financial condition, liquidity, cash flows and results of operations may vary materially from those expressed in or implied by the forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made. New risks and uncertainties arise over time, and it is not possible for ARPI to predict the occurrence of those matters or the manner in which they may affect ARPI. ARPI is not obligated to, and does not intend to, update or revise any forward-looking statements contained in this presentation, whether as a result of new information, future events or otherwise. 2

EPS\Management Presentation\American Residential Properties - 602505097 EXECUTIVE SUMMARY 3

EPS\Management Presentation\American Residential Properties - 602505097 WHO IS AMERICAN RESIDENTIAL PROPERTIES, INC.? An Experienced, Internally Managed Single-Family Rental Company with a National Footprint (1) Deutsche Bank, JP Morgan, Citibank, BAML, Morgan Stanley, Key Bank, Barclay’s, Raymond James and Comerica. Public Company • NYSE Listed Company (Ticker: ARPI) Experience & Proven Track Record • Founders have six years of proven single-family rental operating experience, starting with own capital • Extensive history as real estate investment managers as well as expertise with public capital markets and securitization processes Centralized Operating Platform • Fully internalized operating and property management platform since inception • Regional and local leasing and property management infrastructure Resident-Centric Operating Strategy • Resident-centric operating philosophy designed to maximize revenue and resident retention with 24/7 service Diversified, High-Quality Portfolio • As of June 30, 2014: − Own and manage over $1B of assets − Portfolio of 7,205 homes in 38 MSAs in 13 states − Stabilized portfolio occupancy of 95.2% Proven Access to Institutional Capital • Raised over of $1.6B of debt and institutional capital without reliance on private equity Broad-based Banking Support • Nine major financial institutions in $500MM corporate credit facility (with $750MM accordion) providing exceptional financial flexibility(1) Internally Managed & Experienced Independent Directors • Internally managed with clear shareholder and management alignment • Independent members of Board of Directors have extensive public company experience 4

EPS\Management Presentation\American Residential Properties - 602505097 WHAT IS OUR STRATEGY? An Experienced, Internally Managed Single-Family Rental Company with a National Footprint A company with leadership, experience & a fully integrated operating platform – well-positioned to expand its portfolio and operations Disciplined Acquisition Strategy • Focus on markets with robust job growth, population in-migration and dynamic underlying economic fundamentals • Seek strong rental demand with potential for significant rent growth and home price appreciation • Capitalize on all sourcing channels (MLS, portfolio and auction) • Target newer homes with 3 to 4 bedrooms in good school districts within family-oriented communities Scale & Operational Efficiencies • National purchasing programs with major suppliers including Pittsburgh Paints, The Home Depot and Sears • In-house property inspectors, leasing teams and maintenance technicians Research & Technology • Utilize advanced geocoding technology to analyze variables on a street-by-street basis • Proprietary Enterprise Management System software developed to manage workflow and capture data from acquisition to restoration, leasing life-cycles, re-tenancy and routine maintenance • Electronic access to properties as well as mobile application integration for vendors and leasing agents Supply & Demand Fundamentals • Declining homeownership rate (64.7%(1)) and growing preference to rent among millennials • Tighter mortgage underwriting standards, inability to fund down payment and credit challenges • Looming housing shortage due to lack of builder activity (2008-2013) Benefits Relative to Multi-Family • Larger living spaces at lower rents ($0.68 PSF for ARPI portfolio) • Lower turnover (26% vs 54%(2)) and longer resident tenure • Similar occupancy rates on a stabilized basis with substantial rent growth potential Extraordinary Opportunity • Tremendous asset base - 14.7MM single-family rental homes totaling $2.7 trillion(3) • Fragmented cottage industry with operating inefficiencies and lack of professional management (1) U.S. Census Bureau, July 2014 (2) National Apartment Association, 2013 Survey of Operating Income & Expenses in Rental Apartment Communities (3) John Burns Real Estate Consulting, LLC, U.S Housing Forecast & Analysis, August 2014 5

EPS\Management Presentation\American Residential Properties - 602505097 AN EXPERIENCED OPERATING COMPANY 6

EPS\Management Presentation\American Residential Properties - 602505097 HOW DID WE BUILD THE COMPANY? One of first to raise institutional equity dedicated to SFR opportunity First to obtain structured credit facility for SFR from national commercial bank (Wells Fargo) Internalized operating & property management platform Raised $371MM of equity in two Rule 144A offerings to institutional investors Expanded operations into ten states Raised $287MM of equity through IPO & expanded into 13 states Secured $380MM credit facility with accordion up to $500MM Established national purchasing programs Issued $115MM of five-year convertible notes Co-founders’ experience running businesses that relied on scaled operational efficiencies Extensive understanding of financing, capital markets & institutional equity Systematic & Disciplined Evolution of a SFR Pioneer 2010 2013 2012 Pre-2008 It is not what we will do…it is what we have been doing for the past six years Formed Phoenix Fund I Formed ARPI ARPI IPO Recognized unique opportunity Invested own capital to develop institutional standards, acquisition & operating platform Began acquiring, restoring & operating SFR homes 2008 Founded ARP LLC Expanded regional infrastructure Opened internal leasing office in Phoenix Expanded credit facility to $500MM with accordion up to $750MM Completed $342MM securitization transaction 2014 First Full Year on NYSE 7

EPS\Management Presentation\American Residential Properties - 602505097 WHO RUNS & OVERSEES THE COMPANY? Experienced Senior Management & Independent Directors Experienced Senior Management Team Real Estate Experience Stephen Schmitz Laurie Hawkes Shant Koumriqian Lani Porter Jay Byce Patricia Dietz Chairman & CEO Co-Founder Director, President & COO Co-Founder CFO SVP of Operations SVP of Investments General Counsel & CCO > 30 years > 30 years 19 years 19 years > 15 years 15 years Relevant Prior Experience • CIO of Franchise Finance Corporation of America (NYSE: FFA) • President & Partner at U.S. Realty Advisors, a $3 B Private RE Firm • Managing Director at CS First Boston & Salomon Brothers specializing in Real Estate & Mortgage Investment Banking • CFO of MPG Office Trust (NYSE: MPG) • Senior level management and audit positions at Arthur Andersen & Deloitte • COO at nCommand, developed virtual loan process for mortgages • Director of Operations at Hometown Mortgage • CFO & VP of Operations at Accruent • Managing Director at Colony American Homes, LLC, with responsibility for acquiring over 6000 homes • VP at Regions Bank • Senior Counsel, Vice President & Assistant Secretary at GE Capital, Franchise Finance • Vice President of Legal Services at Fidelity National Information Services Independent Directors Public Company Experience Douglas Benham David Brain Keith Guericke Todd Mansfield 10 years 15 years > 20 years 20 years Relevant Experience • Former CEO of Arby’s Inc. • Former Director of Sonic Corp. (NASDAQ: SONC) & O’Charley’s, Inc. (NASDAQ: CHUX) • President & CEO, EPR Properties (NYSE: EPR) • Former CEO & current Director & Vice Chairman, Essex Property Trust (NYSE: ESS) • President & CEO, Crescent Communities, LLC • Former EVP at The Walt Disney Company (NYSE: DIS) 8 Clear alignment between ARPI management and shareholders

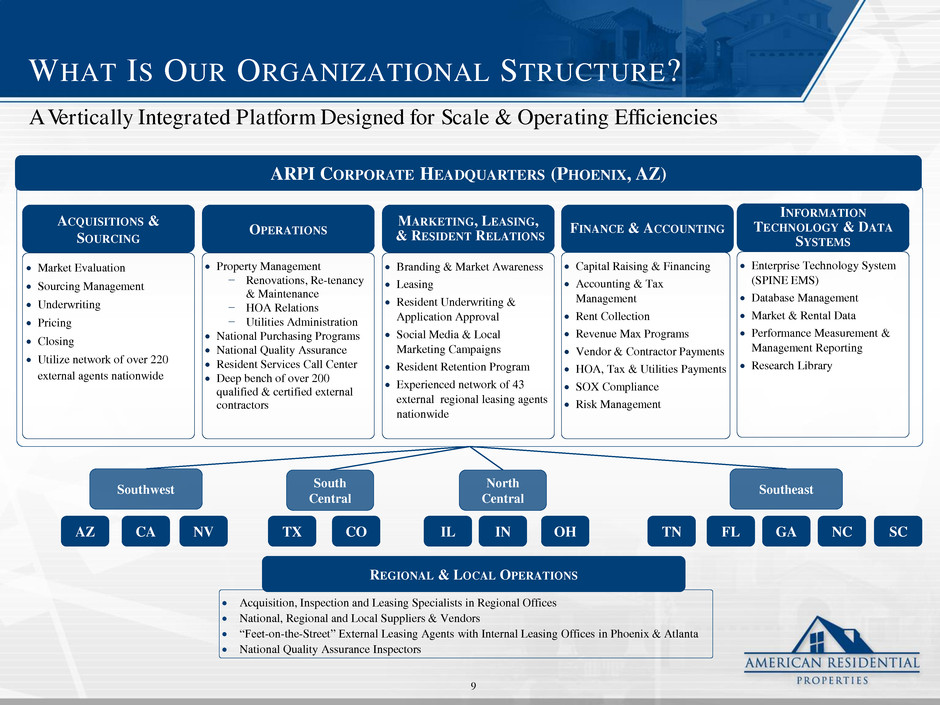

EPS\Management Presentation\American Residential Properties - 602505097 WHAT IS OUR ORGANIZATIONAL STRUCTURE? Market Evaluation Sourcing Management Underwriting Pricing Closing Utilize network of over 220 external agents nationwide ACQUISITIONS & SOURCING Property Management − Renovations, Re-tenancy & Maintenance − HOA Relations − Utilities Administration National Purchasing Programs National Quality Assurance Resident Services Call Center Deep bench of over 200 qualified & certified external contractors OPERATIONS Branding & Market Awareness Leasing Resident Underwriting & Application Approval Social Media & Local Marketing Campaigns Resident Retention Program Experienced network of 43 external regional leasing agents nationwide MARKETING, LEASING, & RESIDENT RELATIONS Capital Raising & Financing Accounting & Tax Management Rent Collection Revenue Max Programs Vendor & Contractor Payments HOA, Tax & Utilities Payments SOX Compliance Risk Management FINANCE & ACCOUNTING CA AZ NV TX IL IN FL GA NC Acquisition, Inspection and Leasing Specialists in Regional Offices National, Regional and Local Suppliers & Vendors “Feet-on-the-Street” External Leasing Agents with Internal Leasing Offices in Phoenix & Atlanta National Quality Assurance Inspectors REGIONAL & LOCAL OPERATIONS North Central Southeast ARPI CORPORATE HEADQUARTERS (PHOENIX, AZ) South Central A Vertically Integrated Platform Designed for Scale & Operating Efficiencies SC Southwest CO TN OH 9 Enterprise Technology System (SPINE EMS) Database Management Market & Rental Data Performance Measurement & Management Reporting Research Library INFORMATION TECHNOLOGY & DATA SYSTEMS

EPS\Management Presentation\American Residential Properties - 602505097 WHERE DO WE OWN PROPERTIES? Homes Owned 7,205 States 13 Average Age 19 years Average Size 1,760 sq. ft. Average Investment $139,748 Average Monthly Rent(2) $1,222 Total Occupancy 88.6% Stabilized Occupancy(3) 95.2% Markets with Job & Population Growth with Potential Rent & Home Price Appreciation Portfolio Overview(1) ARPI Corporate Headquarters Regional Office ARPI Market Phoenix, AZ 19% Houston, TX 15% Dallas-Fort Worth, TX 10% Indianapolis, IN 8% Chicago, IL 7% Atlanta, GA 7% Nashville, TN 7% Winston-Salem, NC 3% Charlotte, NC 3% Inland Empire, CA 3% All Other Markets 18% Portfolio Distribution(4) (1) As of June 30, 2014 (2) Average monthly rent for self-managed properties (3) Properties are considered stabilized when renovations have been completed and the properties have been leased or available for rent for a period of greater than 90 days. Properties with in-place leases at the date of acquisition are also considered stabilized even though these properties have not been renovated by us and may require future renovations to meet our standards. (4) By number of homes owned as of June 30, 2014 10

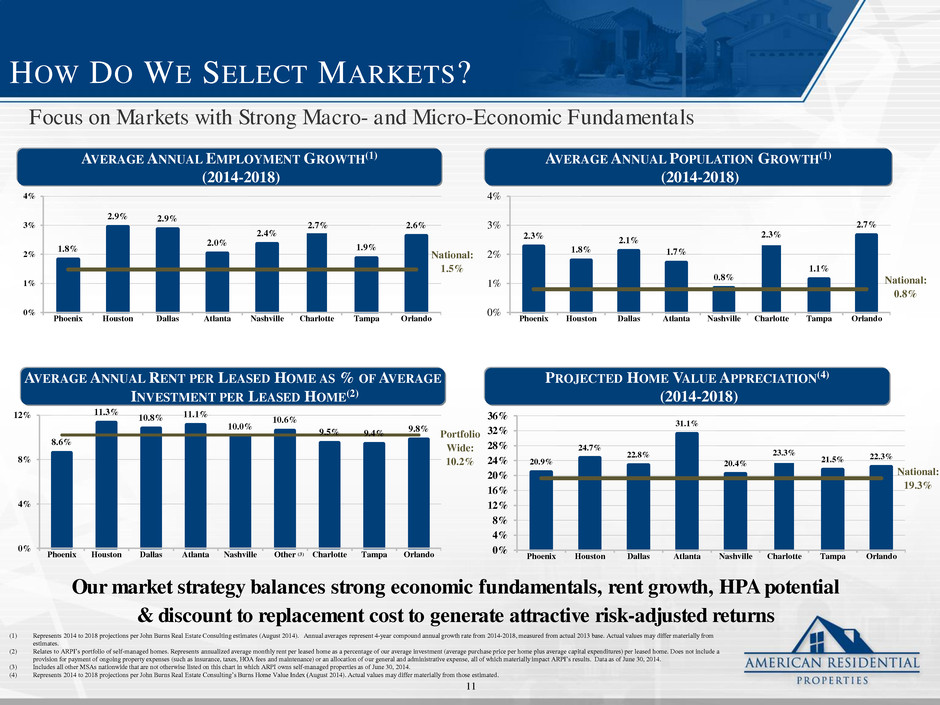

EPS\Management Presentation\American Residential Properties - 602505097 HOW DO WE SELECT MARKETS? Our market strategy balances strong economic fundamentals, rent growth, HPA potential & discount to replacement cost to generate attractive risk-adjusted returns AVERAGE ANNUAL EMPLOYMENT GROWTH(1) (2014-2018) 1.8% 2.9% 2.9% 2.0% 2.4% 2.7% 1.9% 2.6% 0% 1% 2% 3% 4% Phoenix Houston Dallas Atlanta Nashville Charlotte Tampa Orlando National: 1.5% AVERAGE ANNUAL POPULATION GROWTH(1) (2014-2018) 2.3% 1.8% 2.1% 1.7% 0.8% 2.3% 1.1% 2.7% 0% 1% 2% 3% 4% Phoenix Houston Dallas Atlanta Nashville Charlotte Tampa Orlando National: 0.8% AVERAGE ANNUAL RENT PER LEASED HOME AS % OF AVERAGE INVESTMENT PER LEASED HOME(2) PROJECTED HOME VALUE APPRECIATION(4) (2014-2018) 8.6% 11.3% 10.8% 11.1% 10.0% 10.6% 9.5% 9.4% 9.8% 0% 4% 8% 12% Phoenix Houston Dallas Atlanta Nashville Other Charlotte Tampa Orlando Portfolio Wide: 10.2% 20.9% 24.7% 22.8% 31.1% 20.4% 23.3% 21.5% 22.3% 0% 4% 8% 12% 16% 20% 24% 28% 32% 36% Phoenix Houston Dallas Atlanta Nashville Charlotte Tampa Orlando National: 19.3% (3) (1) Represents 2014 to 2018 projections per John Burns Real Estate Consulting estimates (August 2014). Annual averages represent 4-year compound annual growth rate from 2014-2018, measured from actual 2013 base. Actual values may differ materially from estimates. (2) Relates to ARPI’s portfolio of self-managed homes. Represents annualized average monthly rent per leased home as a percentage of our average investment (average purchase price per home plus average capital expenditures) per leased home. Does not include a provision for payment of ongoing property expenses (such as insurance, taxes, HOA fees and maintenance) or an allocation of our general and administrative expense, all of which materially impact ARPI’s results. Data as of June 30, 2014. (3) Includes all other MSAs nationwide that are not otherwise listed on this chart in which ARPI owns self-managed properties as of June 30, 2014. (4) Represents 2014 to 2018 projections per John Burns Real Estate Consulting’s Burns Home Value Index (August 2014). Actual values may differ materially from those estimated. Focus on Markets with Strong Macro- and Micro-Economic Fundamentals 11

EPS\Management Presentation\American Residential Properties - 602505097 HOW DO WE ACQUIRE PROPERTIES? Disciplined Acquisition Platform Utilizing Market Knowledge and Technology School scores / educational attainment levels Low crime index Attractive rental fundamentals / family-friendliness metrics Proximity to lifestyle amenities Driving distance to employment centers Access to major transportation routes Low 3 & 4 bedroom single-family vacancy rates / rental saturation CRITICAL SUBMARKET CHARACTERISTICS Analyze submarket rental supply / demand fundamentals Rents/ acquisition yields / above average median income levels 3 & 4 bedroom, detached, entry-level homes Generally post-1990 construction Light-to-moderate restoration needs (typically 5% to 15% of purchase price) Avoid FEMA Special Flood Hazard Areas DISCIPLINED ACQUISITION CRITERIA CUMULATIVE ACQUISITION VOLUME AND CHANNEL TYPE (Q2 2012 – Q2 2014) CUMULATIVE ACQUISITIONS BY CHANNEL TYPE (JUNE 2012 – JUNE 2014) 12 MLS 41% Auction 7% Portfolio 52% 0 1000 2000 3000 4000 5000 6000 7000 8000 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Cumulative MLS Acquisitions Cumulative Auction Acquisitions Cumulative Portfolio Acquisitions 70 729 1,775 2,531 4,089 5,440 6,073 6,762 7,205

EPS\Management Presentation\American Residential Properties - 602505097 HOW DO WE RESTORE & MAINTAIN PROPERTIES? • Electronic access management • Project evaluation, pricing & project management via mobile applications • Restoration costs average between 5% to 15% of purchase price • Vendor qualifications & quality assurance programs • In-house 24/7 Resident Services Center • Expansion of national purchasing programs Building on our experience, we are adhering to a uniform approach to restoration & maintenance across geographic markets RESTORATION & MAINTENANCE 13 Focus on Cost Effectiveness, Expediency, and Quality Control

EPS\Management Presentation\American Residential Properties - 602505097 COMMUNICATIONS • Resident Orientation Manual for Home Operation & Maintenance • Surveys for New Move-in, Maintenance Request Follow-up & Move-out • Monthly “Welcome Home” Resident newsletter • Broker Communications Blast (social media invitations, weekly “Hot List” blasts) SOCIAL MEDIA • Regular posts/updates on Facebook, Twitter, Pinterest & YouTube • Quarterly Social Media Resident Contests • Designing Spaces TV Segments on Lifetime Network • Holiday contests and promotions RESIDENT PROMOTIONS • Resident Gift Bags • Custom ARPI Door Mats & Key Fobs Broker e-blast of “Hot List” properties ADVERTISING • Zillow • Multiple Listing Service • Trulia • “For Rent” Yard Signs • Rentals.com WHAT IS OUR MARKETING & BRANDING STRATEGY? Resident Retention is Key to Revenue and Shareholder Value • ARPI website • Craigslist • Hot Pads • Weekly “Hot List: email blast to external brokers in each MSA 14

EPS\Management Presentation\American Residential Properties - 602505097 Average tenure at current job is six years Typically two-income household Average head of household is in late 30s Average of two children per household Rental rate as percentage of household income approximately 19% SAMPLE PROFILE OF ARPI RESIDENTS (1) The averages/ratios are based on information derived from only that portion of leases in ARP’s portfolio entered into between approximately May 2013 to June 30, 2014 and does not reflect any lease entered into prior to such date or any lease of a property where such property was acquired by ARPI in a portfolio acquisition. (2) Figures include only leases underwritten by ARPI. These figures do not reflect inherited leases where there is a tenant in place at time of acquisition. (3) Median Household income based on 2013 US Government Department of Justice, two-income household. (4) Excludes Colorado (< 5 properties). SAMPLE RESIDENT PROFILE(1) Average Resident in sample is part of a two-income household with stable income Region Southwest South- Central(4) Midwest Southeast Sample Resident Profile Statistics(1) AZ CA NV TX IN OH TN NC SC GA FL TOTAL Average Rental Rate $1,036 $1,304 $1,033 $1,430 $823 $1,432 $1,359 $1,152 $1,174 $1,114 $960 $1,222 Average Rental Price/SF $0.61 $0.75 $0.67 $0.72 $0.61 $0.78 $0.73 $0.69 $0.74 $0.57 $0.59 $0.68 Average ARPI Household Income (2) $62,493 $69,461 $59,656 $87,388 $50,094 $79,849 $92,249 $71,113 $54,743 $69,685 $51,654 $77,028 State Median Household Income(3) $54,000 $61,752 $54,545 $54,762 $51,551 $52,139 $47,631 $50,762 $49,523 $50,901 $50,711 $53,159 Ratio of ARPI Household Income to State Median Household Income(2) 1.16 1.12 1.09 1.60 0.97 1.53 1.94 1.40 1.11 1.37 1.02 1.45 Average ARPI Income to Rent Ratio(2) 5.03 4.44 4.81 5.09 5.07 4.65 5.66 5.14 3.89 5.21 4.48 5.25 Average ARPI Rent to Income Ratio(2) 19.89% 22.53% 20.78% 19.64% 19.71% 21.52% 17.68% 19.44% 25.73% 19.18% 22.30% 19.04% Average Renewal Rent Increase 3.13% 3.64% 3.14% 2.67% 2.80% 7.54% 3.06% 2.97% 3.04% 2.13% 6.34% 3.13% 15

EPS\Management Presentation\American Residential Properties - 602505097 WHAT IS OUR CAPITAL STRUCTURE? Demonstrated experience with long track record of raising equity and debt capital Growth-Oriented Capital Structure Adequate liquidity to finance external growth (1) Based on 33.2 million shares, including RSUs, OP units, LTIP units (vested and unvested) and a $19.45 closing price on September 8, 2014 (2) Pro forma outstanding debt balance, assuming outstanding credit facility balance of $364 million (as of June 30, 2014) is reduced by net proceeds from the $342 million Asset Backed Securitization (completed August 26, 2014) (3) As of June 30, 2014 (4) Pro forma for pay down of outstanding balance on credit facility of $364 million (as of June 30, 2014) using net proceeds from the $342 million Asset- Backed Securitization (completed August 26, 2014). Availability under $500 million credit facility is subject to borrowing base limitations which may limit ARPI’s ability to fully draw on this facility (does not include the accordion feature up to $750 million) 16 Equity Market Capitalization(1) $ 646 Outstanding Under Credit Facility(2) $ 42 Exchangeable Senior Notes(3) $ 115 Asset-Backed Securitization(2) $ 342 Total Capitalization $ 1,145 Debt / Total Capitalization 44% PRO FORMA CAPITALIZATION ($MM) PRO FORMA LIQUIDITY ($MM) Cash and Cash Equivalents(3) $ 38 Undrawn Credit Facility(4) $ 458 Total Liquidity $ 496

EPS\Management Presentation\American Residential Properties - 602505097 THE OPPORTUNITY & FUTURE GROWTH 17

EPS\Management Presentation\American Residential Properties - 602505097 WHAT ARE THE OPPORTUNITIES FOR FUTURE GROWTH? Robust Investment Pipeline, Growing Rental Demand & Potential Housing Shortage • Foreclosure inventory- Over 4 MM non-performing mortgages (1) • Consolidation - Sub-scale SFR operators with limited capital access • Existing SFR market - 35% of total rental market (~$2.7 trillion)(1) ROBUST SUPPLY PIPELINE • Financial crisis- Housing crash created 6 MM+ potential rental households • Credit challenges -Families unable to afford down payment or obtain mortgage financing • Millennials –Prefer flexibility of renting for job mobility and maintenance services • Housing Shortage – New inventory (2008-2013) has not kept pace with population growth SOLID AND INCREASING DEMAND (1) John Burns Real Estate Consulting, LLC, August 2014. 65% 23% 12% Type Homes (millions) Total 133.2 Owner Occupied 77.1 Multi-Family Rental 27.4 Single-Family Rental 14.7 Vacant 14.0 Source: John Burns Real Estate Consulting, LLC, (US Housing Analysis and Forecast, August 2014) Owner Occupied Multi-Family Rental OCCUPIED HOMES SFR ~$2.7 trillion LONG-ESTABLISHED COMPONENT OF U.S. HOUSING MARKET • 1 in 8 occupied single-family homes are rentals (1) • ~35% of the total rental market is SFR (~$2.7 trillion) • Opportunity may dwarf multi-family public REIT market • Highly fragmented ownership • “Mom & pop” and regional owners / operators 18

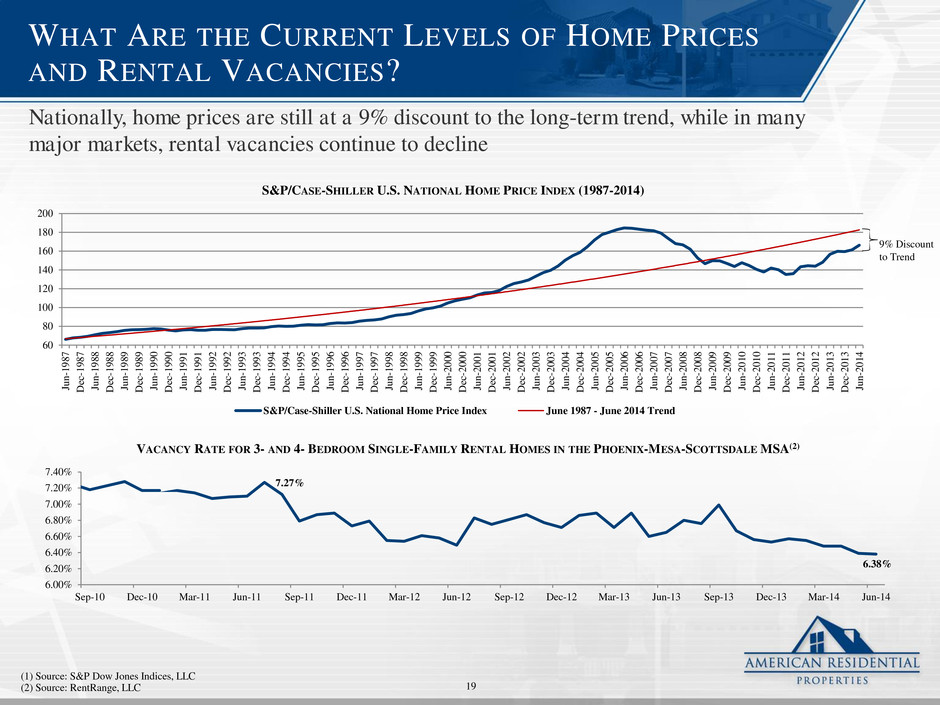

EPS\Management Presentation\American Residential Properties - 602505097 WHAT ARE THE CURRENT LEVELS OF HOME PRICES AND RENTAL VACANCIES? (1) Source: S&P Dow Jones Indices, LLC (2) Source: RentRange, LLC Nationally, home prices are still at a 9% discount to the long-term trend, while in many major markets, rental vacancies continue to decline 7.27% 6.38% 6.00% 6.20% 6.40% 6.60% 6.80% 7.00% 7.20% 7.40% Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Mar-12 Jun-12 Sep-12 Dec-12 Mar-13 Jun-13 Sep-13 Dec-13 Mar-14 Jun-14 VACANCY RATE FOR 3- AND 4- BEDROOM SINGLE-FAMILY RENTAL HOMES IN THE PHOENIX-MESA-SCOTTSDALE MSA(2) 19 60 80 100 120 140 160 180 200 Ju n -1 9 8 7 D ec -1 9 8 7 Ju n -1 9 8 8 D ec -1 9 8 8 Ju n -1 9 8 9 D ec -1 9 8 9 Ju n -1 9 9 0 D ec -1 9 9 0 Ju n -1 9 9 1 D ec -1 9 9 1 Ju n -1 9 9 2 D ec -1 9 9 2 Ju n -1 9 9 3 D ec -1 9 9 3 Ju n -1 9 9 4 D ec -1 9 9 4 Ju n -1 9 9 5 D ec -1 9 9 5 Ju n -1 9 9 6 D ec -1 9 9 6 Ju n -1 9 9 7 D ec -1 9 9 7 Ju n -1 9 9 8 D ec -1 9 9 8 Ju n -1 9 9 9 D ec -1 9 9 9 Ju n -2 0 0 0 D ec -2 0 0 0 Ju n -2 0 0 1 D ec -2 0 0 1 Ju n -2 0 0 2 D ec -2 0 0 2 Ju n -2 0 0 3 D ec -2 0 0 3 Ju n -2 0 0 4 D ec -2 0 0 4 Ju n -2 0 0 5 D ec -2 0 0 5 Ju n -2 0 0 6 D ec -2 0 0 6 Ju n -2 0 0 7 D ec -2 0 0 7 Ju n -2 0 0 8 D ec -2 0 0 8 Ju n -2 0 0 9 D ec -2 0 0 9 Ju n -2 0 1 0 D ec -2 0 1 0 Ju n -2 0 1 1 D ec -2 0 1 1 Ju n -2 0 1 2 D ec -2 0 1 2 Ju n -2 0 1 3 D ec -2 0 1 3 Ju n -2 0 1 4 S&P/CASE-SHILLER U.S. NATIONAL HOME PRICE INDEX (1987-2014) S&P/Case-Shiller U.S. National Home Price Index June 1987 - June 2014 Trend 9% Discount to Trend

EPS\Management Presentation\American Residential Properties - 602505097 AMERICAN RESIDENTIAL PROPERTIES, INC. ________________________________________________ Note: Properties pictured throughout the presentation are sample properties included in the ARPI’s portfolio, but not necessarily representative of all properties in the portfolio. RALEIGH, NC DALLAS, TX PHOENIX, AZ NASHVILLE, TN CORPUS CHRISTI, TX RIVERSIDE, CA 20

EPS\Management Presentation\American Residential Properties - 602505097 WHAT DIFFERENTIATES US? • Six years of actual operating experience • Proven track record with operational transparency • Internally managed • Disciplined acquisition & intelligent aggregation strategy • Resident-centric operating philosophy • Advanced operating systems & technology • Long-term growth-oriented business with attractive returns A Premier SFR Operating Company Focused on Delivering a Best-in-Class Rental Experience 21

EPS\Management Presentation\American Residential Properties - 602505097 APPENDIX 22

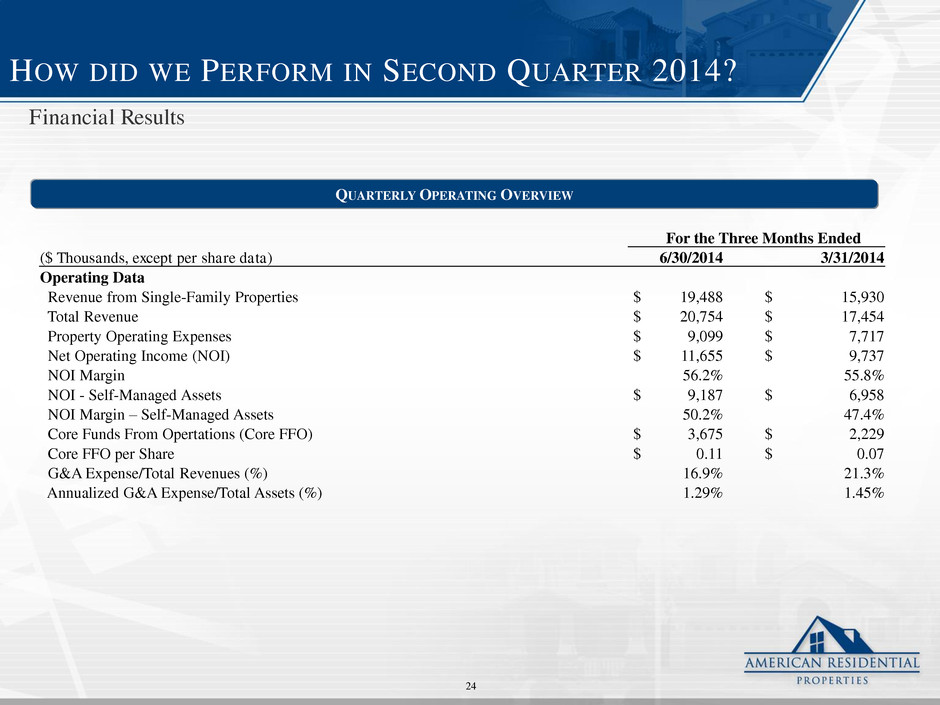

EPS\Management Presentation\American Residential Properties - 602505097 HOW DID WE PERFORM IN SECOND QUARTER 2014? Total Revenue of $20.8 million, a 19% increase over first quarter 2014 Net Operating Income (NOI) of $11.7 million, a 20% increase over first quarter 2014 Acquired 443 homes, bringing our portfolio to 7,205 homes Total assets of $1.1 billion as of June 30, 2014 Restored 806 homes in the quarter Stabilized Occupancy of 95% as of June 30, 2014 Total Occupancy of 89% as of June 30, 2014 Resident Retention of 74% for the quarter Renewal rent increases averaging 3.1% for the quarter Expanded our credit facility to $500 million with accordion feature to $750 million 23 Strong Progress in Occupancy and Financial Stability

EPS\Management Presentation\American Residential Properties - 602505097 HOW DID WE PERFORM IN SECOND QUARTER 2014? 24 For the Three Months Ended ($ Thousands, except per share data) 6/30/2014 3/31/2014 Operating Data Revenue from Single-Family Properties $ 19,488 $ 15,930 Total Revenue $ 20,754 $ 17,454 Property Operating Expenses $ 9,099 $ 7,717 Net Operating Income (NOI) $ 11,655 $ 9,737 NOI Margin 56.2% 55.8% NOI - Self-Managed Assets $ 9,187 $ 6,958 NOI Margin – Self-Managed Assets 50.2% 47.4% Core Funds From Opertations (Core FFO) $ 3,675 $ 2,229 Core FFO per Share $ 0.11 $ 0.07 G&A Expense/Total Revenues (%) 16.9% 21.3% Annualized G&A Expense/Total Assets (%) 1.29% 1.45% QUARTERLY OPERATING OVERVIEW Financial Results

EPS\Management Presentation\American Residential Properties - 602505097 STRATEGICALLY ACQUIRED PORTFOLIO See Supplemental Notes hereto for footnotes references above 25 Per Leased Home MSA / Metro Division Number of Homes Average Purchase Price Per Home(1) Average Capital Expenditures Per Home(2) Aggregate Investment Per Home (3) Aggregate Investment (in Thousands) Percentage Leased Average Age (Years) Average Size (Sq. Ft.) Average Monthly Rent Average Annual Gross Rent as a % of Average Investment(4) Phoenix, AZ 1,381 $138,085 $7,184 $145,269 $200,617 94.9% 17 1,713 $1,036 8.6% Houston, TX 1,071 $140,839 $6,411 $147,250 $157,705 94.9% 7 1,928 $1,381 11.3% Dallas-Fort Worth, TX 753 $149,891 $10,559 $160,450 $120,819 94.3% 11 2,095 $1,447 10.8% Nashville, TN 477 $154,892 $9,819 $164,711 $78,567 89.7% 10 1,868 $1,359 10.0% Atlanta, GA 480 $114,373 $9,587 $123,960 $59,501 65.0% 17 1,960 $1,114 11.1% Other Texas 307 $162,875 $11,206 $174,081 $53,443 95.4% 10 1,967 $1,561 10.8% Florida 419 $112,884 $5,911 $118,795 $49,775 62.8% 13 1,620 $960 11.1% Inland Empire, CA 213 $156,562 $23,912 $180,474 $38,441 93.4% 16 1,915 $1,400 9.3% Charlotte, NC-SC 223 $143,531 $7,756 $151,287 $33,737 93.3% 9 1,995 $1,190 9.5% Indianapolis, IN 456 $65,409 $4,260 $69,669 $31,769 61.4% 50 1,349 $823 13.9% Raleigh, NC 206 $141,220 $7,100 $148,320 $30,554 87.4% 8 1,710 $1,222 9.8% Winston-Salem, NC 234 $122,619 $2,868 $125,487 $29,364 98.3% 12 1,421 $1,074 10.3% Other California 82 $109,989 $21,121 $131,110 $10,751 91.5% 36 1,336 $1,051 9.5% Las Vegas, NV 68 $97,742 $11,567 $109,309 $7,433 92.6% 15 1,553 $1,033 11.3% Other 225 $139,782 $6,934 $146,716 $33,011 92.9% 9 1,605 $1,256 10.1% Total / Wtd. Avg. 6,595 $133,521 $8,327 $141,848 $935,487 87.6% 15 1,797 $1,222 10.2% Self-Managed Properties (as of June 30, 2014)

EPS\Management Presentation\American Residential Properties - 602505097 STRATEGICALLY ACQUIRED PORTFOLIO See Supplemental Notes hereto for footnotes references above 26 MSA / Metro Division Number of Homes Aggregate Investment (in Thousands) Average Investment Per Home(1) Percent Leased(2) Average Age (Years) Average Size (Sq. Ft.) Phoenix, AZ 1,381 $200,617 $145,269 94.9% 17 1,713 Houston, TX 1,071 $157,705 $147,250 94.9% 7 1,928 Dallas-Fort Worth, TX 753 $120,819 $160,450 94.3% 11 2,095 Nashville, TN 477 $78,567 $164,711 89.7% 10 1,868 Chicago, IL 511 $66,787 $130,699 100.0% 55 1,404 Atlanta, GA 480 $59,501 $123,960 65.0% 17 1,960 Other Texas 307 $53,443 $174,081 95.4% 10 1,967 Florida 419 $49,775 $118,795 62.8% 13 1,620 Inland Empire, CA 213 $38,441 $180,474 93.4% 16 1,915 Indianapolis, IN 555 $36,382 $65,553 68.3% 52 1,316 Charlotte, NC-SC 223 $33,737 $151,287 93.3% 9 1,995 Raleigh, NC 206 $30,554 $148,320 87.4% 8 1,710 Winston-Salem, NC 234 $29,364 $125,487 98.3% 12 1,421 Other California 82 $10,751 $131,110 91.5% 36 1,336 Las Vegas, NV 68 $7,433 $109,309 92.6% 15 1,553 Other 225 $33,011 $146,716 92.9% 9 1,605 Total / Wtd. Avg 7,205 $1,006,887 $139,748 88.6% 19 1,760 Total Portfolio (as of June 30, 2014)

EPS\Management Presentation\American Residential Properties - 602505097 WHAT IS THE PROFILE OF THE PORTFOLIO BY GEOGRAPHIC DISTRIBUTION? 27 Phoenix, AZ $200,617 20% Houston, TX $157,705 16% Dallas-Fort Worth, TX $120,819 12% Nashville, TN $78,567 8% Chicago, IL $66,787 7% Atlanta, GA $59,501 6% Other Texas $53,443 5% Florida $49,775 5% Inland Empire, CA $38,441 4% Indianapolis, IN $36,382 4% Charlotte, NC-SC $33,737 3% Other MSA $33,011 3% Raleigh, NC $30,554 3% Winston-Salem, NC $29,364 3% Other California $10,751 1% Las Vegas, NV $7,433 1% Distribution by Market as a % of Total Investment (in thousands)- June 30, 2014

EPS\Management Presentation\American Residential Properties - 602505097 HOW MUCH HAVE HOME PRICES APPRECIATED? Uneven Recovery has Created Opportunities to Buy at a Discount in Select Markets 28 ARPI Portfolio(1) HPA Trends(2)(3) Market Homes Total Investment (Millions) % of Total Investment Since Q2 2012 Last 12 Months Phoenix, AZ 1,381 $200.6 19.9% 36.0% 9.8% Houston, TX 1,071 $157.7 15.7% 21.6% 10.2% Dallas-Fort Worth, TX 753 $120.8 12.0% 16.3% 7.0% Nashville, TN 477 $78.6 7.8% 17.3% 7.7% Chicago, IL 511 $66.8 6.6% 12.3% 4.4% Atlanta, GA 480 $59.5 5.9% 25.6% 10.4% Other Texas 307 $53.4 5.3% 15.1% 9.6% Florida 419 $49.8 4.9% 22.4% 8.6% Inland Empire, CA 213 $38.4 3.8% 39.8% 14.2% Indianapolis, IN 555 $36.4 3.6% 7.9% 4.7% Charlotte, NC-SC 223 $33.7 3.3% 13.3% 6.0% Raleigh, NC 206 $30.6 3.0% 9.5% 4.5% Winston-Salem, NC 234 $29.4 2.9% 5.4% 3.0% Other California 82 $10.8 1.2% 37.0% 17.6% Las Vegas, NV 68 $7.4 0.8% 50.3% 17.5% Other MSA/Metro Divisions 225 $33.0 3.3% 8.7% 5.0% Total / Weighted Averages 7,205 $1,006.9 100.0% 21.8%(4) 8.4%(4) Source for HPA: FHFA Purchase-Only & All Transactions Index as of June 30, 2014 See Supplemental Notes hereto for footnotes references above

EPS\Management Presentation\American Residential Properties - 602505097 NOI RECONCILIATION 29 Three Months Ended 6/30/2014 3/31/2014 12/31/2013 9/30/2013 6/30/2013 Loss from continuing operations before equity in net (loss) income of unconsolidated ventures $ (7,646) $ (7,744) $ (8,467) $ (4,638) $ (8,157) Acquisition 14 67 140 301 1,674 Depreciation and amortization 10,920 9,464 7,826 6,589 4,638 General, administrative and other 3,498 3,720 4,056 3,105 6,676 Interest 4,869 4,230 2,856 1,204 682 Net Operating Income $ 11,655 $ 9,737 $ 6,411 $ 6,561 $ 5,513 Preferred operator rental revenue (1,310) (1,368) (926) (1,948) (1,999) Mortgage financing revenue (1,158) (1,411) (1,515) (1,488) (1,340) NOI – Self Managed Assets $ 9,187 $ 6,958 $ 3,970 $ 3,125 $ 2,174 Net Operating Income (NOI) and NOI margin are supplemental non-GAAP financial measures. NOI excludes acquisition, depreciation and amortization, general, administrative and other and interest expenses. We consider NOI to be a meaningful financial measure because we believe it is helpful to investors in understanding operating performance and operating margin of our single-family rental properties. NOI should not be used as a substitute for net income (loss) or net cash flows from operating activities (as computed in accordance with GAAP). Reconciliation of NOI to Net Loss in Accordance with GAAP ($ Amounts in Thousands)

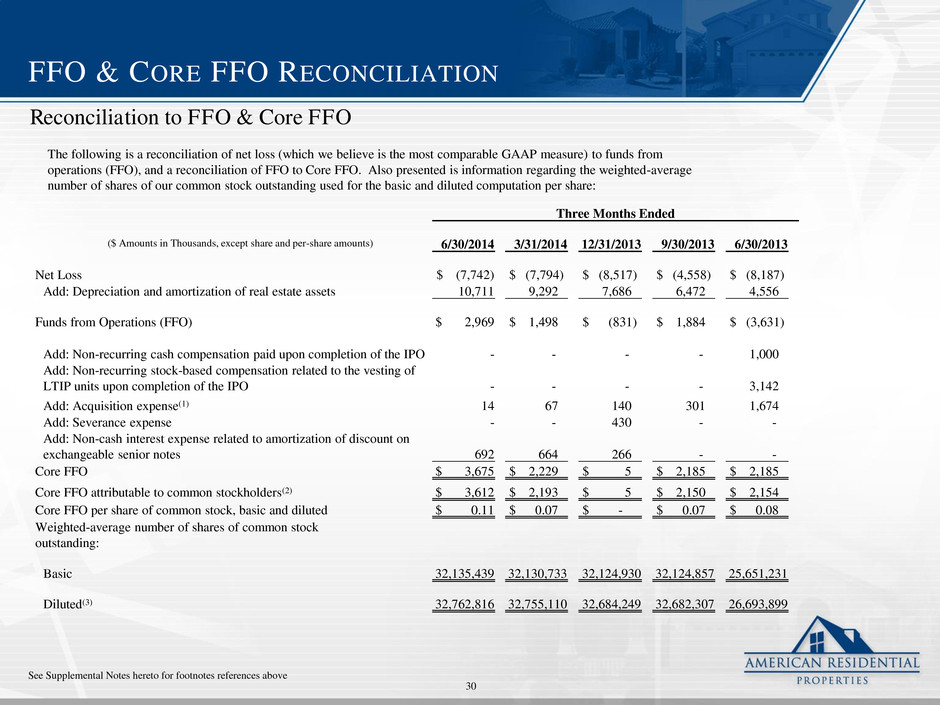

EPS\Management Presentation\American Residential Properties - 602505097 FFO & CORE FFO RECONCILIATION 30 Three Months Ended 6/30/2014 3/31/2014 12/31/2013 9/30/2013 6/30/2013 Net Loss $ (7,742) $ (7,794) $ (8,517) $ (4,558) $ (8,187) Add: Depreciation and amortization of real estate assets 10,711 9,292 7,686 6,472 4,556 Funds from Operations (FFO) $ 2,969 $ 1,498 $ (831) $ 1,884 $ (3,631) Add: Non-recurring cash compensation paid upon completion of the IPO - - - - 1,000 Add: Non-recurring stock-based compensation related to the vesting of LTIP units upon completion of the IPO - - - - 3,142 Add: Acquisition expense(1) 14 67 140 301 1,674 Add: Severance expense - - 430 - - Add: Non-cash interest expense related to amortization of discount on exchangeable senior notes 692 664 266 - - Core FFO $ 3,675 $ 2,229 $ 5 $ 2,185 $ 2,185 Core FFO attributable to common stockholders(2) $ 3,612 $ 2,193 $ 5 $ 2,150 $ 2,154 Core FFO per share of common stock, basic and diluted $ 0.11 $ 0.07 $ - $ 0.07 $ 0.08 Weighted-average number of shares of common stock outstanding: Basic 32,135,439 32,130,733 32,124,930 32,124,857 25,651,231 Diluted(3) 32,762,816 32,755,110 32,684,249 32,682,307 26,693,899 Reconciliation to FFO & Core FFO The following is a reconciliation of net loss (which we believe is the most comparable GAAP measure) to funds from operations (FFO), and a reconciliation of FFO to Core FFO. Also presented is information regarding the weighted-average number of shares of our common stock outstanding used for the basic and diluted computation per share: See Supplemental Notes hereto for footnotes references above ($ Amounts in Thousands, except share and per-share amounts)

EPS\Management Presentation\American Residential Properties - 602505097 SUPPLEMENTAL NOTES (1) Average purchase price includes broker commissions and closing costs (2) Represents average capital expenditures per home as of June 30, 2014. Does not include additional expected or future capital expenditures (3) Represents average purchase price plus average capital expenditures (4) Represents annualized average monthly rent per leased home as a percentage of our average investment (average purchase price per home plus average capital expenditures) per leased home. Does not include a provision for payment of ongoing property expenses (such as insurance, taxes, HOA fees and maintenance) or an allocation of our general and administrative expense, all of which materially impact our results. Accordingly, it should not be interpreted as a measure of profitability, and its utility in evaluating our business is limited. Average monthly rent for leased homes may not be indicative of average rents we may achieve on our vacant homes Page 25 Page 26 (1) For self-managed homes, represents average purchase price (including broker commissions and closing costs) plus average capital expenditures. For preferred operator program homes, represents purchase price (including broker commissions and closing costs) paid by us for the portfolio divided by the number of homes in the portfolio and does not include past, expected or budgeted general and administrative expenses associated with ongoing monitoring activities of our investment. The preferred operator is obligated to pay for all taxes, insurance, other expenses and capital expenditures (including significant capital improvements) required for the management, operation and maintenance of the properties. Accordingly, absent a default by the preferred operator under a long-term lease agreement with us, we expect to incur no expenses related to properties under our preferred operator program, other than general and administrative expenses associated with ongoing monitoring activities of our investment (2) Includes both self-managed homes and preferred operator program homes. We classify homes in our preferred operator program as 100% leased, because each preferred operator is obligated to pay us 100% of the base rent specified in the applicable lease irrespective of whether or not the homes are occupied by residential sub-tenants. This does not mean that 100% of the homes leased to preferred operators are occupied by residential sub-tenants. If a preferred operator is unable to lease a material portion of the homes it leases from us to residential sub-tenants, it may adversely affect such operator’s ability to pay rent to us under the lease. We are also eligible to receive percentage rents on a quarterly basis equal to a fixed percentage of gross revenue that the preferred operator collects from its residential sub-tenants who occupy the homes Page 28 (1) As of June 30, 2014 (2) FHFA Purchase-Only & All Transactions Index as of Q2 2014 (3) Represents HPA for the applicable metropolitan statistical area (MSA). ARPI’s portfolio in each market may not be representative of the entire MSA; therefore, the HPA experienced by ARPI’s portfolio in each market may not be the same as the HPA experienced in the entire MSA and could be materially different. (4) Weighted average HPA is calculated by applying the percentage of ARPI’s total portfolio invested in each of the applicable markets as of June 30, 2014 to the HPA experienced in the applicable market as a whole during the periods presented. ARPI’s portfolio in each market includes homes purchased by ARPI only in certain sub- markets within each of the MSAs. In addition, ARPI’s portfolio in each market includes homes purchased at different times, including recently after the applicable market had already experienced a portion of the HPA shown. Therefore, the HPA experienced by ARPI’s portfolio in each market is likely not the same as the HPA experienced in the entire MSA during the periods presented and the weighted average HPA figures shown are not indicative of the actual HPA experienced by ARPI. Page 30 (1) Includes acquisition expenses primarily related to costs incurred on acquired properties subject to an existing lease and accounted for as a business combination, in accordance with GAAP. (2) Based on a weighted-average interest in the Company’s operating partnership of approximately 98.29%, 98.39%, 98.40%, 98.41%, and 98.60%, for the three months ended June 30, 2014, March 31, 2014, December 31, 2013, September 30, 2013, and June 30, 2013, respectively. (3) Assumes the issuance of potentially issuable shares unless the result would be anti-dilutive. Potentially issuable shares include operating partnership units, vested LTIP units, unvested LTIP units and unvested restricted common stock. 31