Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TIER REIT INC | q22014quarterlysummary.htm |

Strategic Overview Over the past two years, we have taken steps to substantially strengthen the Company’s financial position and our property operating fundamentals. Having made substantial progress in these efforts, we have entered into the next phase of our strategic plan, which includes working to position the Company to reinstate distributions and create liquidity for our stockholders. If we are able to overcome the following obstacles, we believe the Company will be positioned to reinstate distributions by late 2015: first, we must continue to lease the portfolio and increase occupancy to drive internal growth and generate an increase in cash flow; second, we must lower our leverage and reduce our borrowing costs; and lastly, we need to continue to sharpen our geographic focus. Operating Results and Debt Maturities Modified Funds from Operations (MFFO) for the second quarter was $0.05 per common share, or $16.2 million, an increase of $0.01 per common share from the $11.5 million in the first quarter of 2014. This increase was achieved by increasing our occupancy, which bolstered revenue, and by reducing property operating expenses. Our primary financing objective over the next six to 12 months is to take advantage of the strong real estate capital markets to optimize the Company’s debt leverage structure and lower our borrowing costs. In 2015 and 2016, we have $1.2 billion of mortgage debt maturing and we are proactively developing strategies to address it by: accelerating debt maturities through the sale of certain non-strategic assets; evaluating opportunities to issue attractively priced debt; and managing resources to provide sufficient capital as debt is refinanced through 2016. We anticipate utilizing all of these strategies to repay or reduce our upcoming debt maturities. TIERREIT.COM Second Quarter Report Quarter ended June 30, 2014 Terrace Office Park, Austin, TX Portfolio Summary As of June 30, 2014 38 operating properties 14.4 million square feet (at ownership share) 86% occupancy 19 MARKETS Burnett Plaza Fort Worth, TX Burnett Plaza–Fort Worth, TX, Winner of the 2013-2014 International TOBY Award for Outstanding Building of the Year. After competing against other regional winners from New York, Chicago and Los Angeles, Burnett Plaza was awarded the International Award for its commitment to tenant relations, energy conservation and sustainability, among other characteristics.

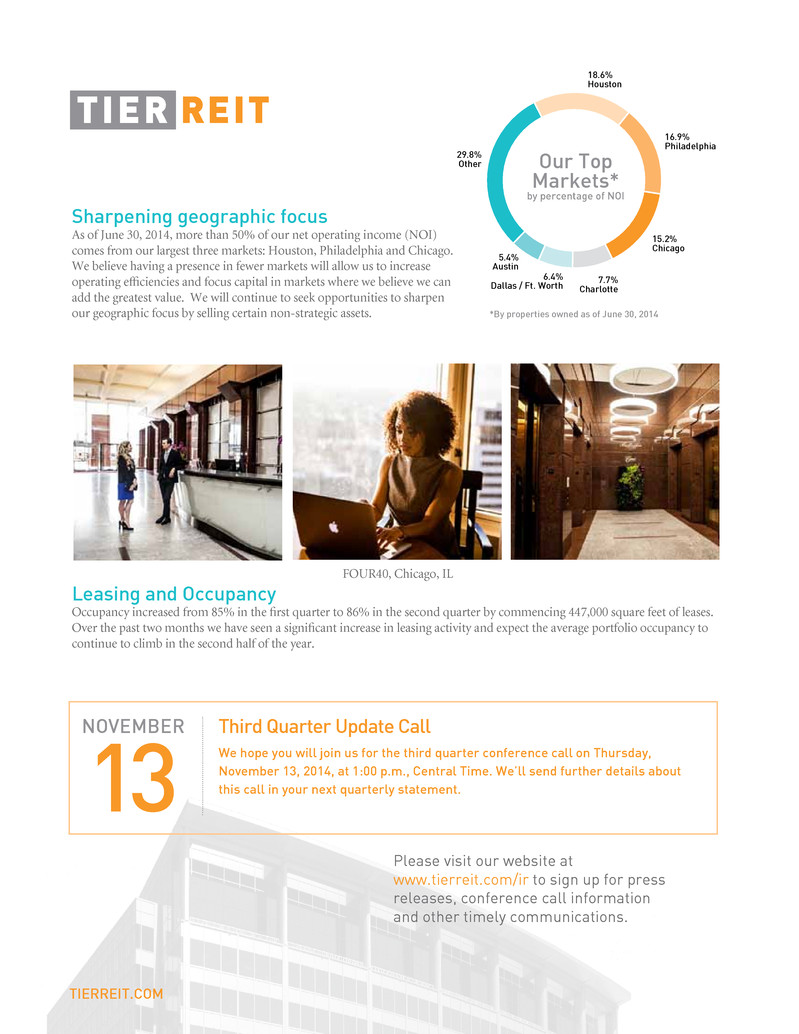

TIERREIT.COM 15.2% Chicago 18.6% Houston 16.9% Philadelphia 29.8% Other 6.4% Dallas / Ft. Worth 7.7% Charlotte Our Top Markets* by percentage of NOI *By properties owned as of June 30, 2014 Third Quarter Update Call We hope you will join us for the third quarter conference call on Thursday, November 13, 2014, at 1:00 p.m., Central Time. We’ll send further details about this call in your next quarterly statement. NOVEMBER 13 Please visit our website at www.tierreit.com/ir to sign up for press releases, conference call information and other timely communications. Leasing and Occupancy Occupancy increased from 85% in the first quarter to 86% in the second quarter by commencing 447,000 square feet of leases. Over the past two months we have seen a significant increase in leasing activity and expect the average portfolio occupancy to continue to climb in the second half of the year. FOUR40, Chicago, IL 5.4% Austin Sharpening geographic focus As of June 30, 2014, more than 50% of our net operating income (NOI) comes from our largest three markets: Houston, Philadelphia and Chicago. We believe having a presence in fewer markets will allow us to increase operating efficiencies and focus capital in markets where we believe we can add the greatest value. We will continue to seek opportunities to sharpen our geographic focus by selling certain non-strategic assets.

TIERREIT.COM Financial Highlights 3 mos. ended 3 mos. ended (in thousands, except per share data) June 30, 2014 March 31, 2014 MFFO attributable to common shareholders $ 16,214 $ 11,459 MFFO per common share - basic and diluted $ 0.05 $ 0.04 As of As of (in thousands) June 30, 2014 Dec. 31, 2013 Total assets $ 2,363,565 $ 2,436,225 Total liabilities $ 1,606,773 $ 1,632,966 Reconciliation of Net Loss to Funds From Operations (FFO) and Modified Funds from Operations (MMFO) attributable to common stockholders 3 mos. ended 3 mos. ended (in thousands, except per share data) June 30, 2014 March 31, 2014 Net loss $ (17,300) $ (29,657) Net loss attributable to noncontrolling interests 21 43 Adjustments (1): Real estate depreciation and amortization from consolidated properties 35,120 34,622 Real estate depreciation and amortization from unconsolidated properties 1,278 1,301 Impairment of depreciable real estate assets - 8,225 Noncontrolling interest (OP units) share of above adjustments (53) (64) FFO attributable to common stockholders $ 19,066 $ 14,470 Adjustments (1)(2): Straight-line rent adjustment (1,646) (1,765) Amortization of above- and below-market rents, net (1,210) (1,250) Noncontrolling interest (OP units) share of above adjustments 4 4 MFFO attributable to common stockholders $ 16,214 $ 11,459 Weighted average common shares outstanding - basic 299,264 299,229 Weighted average common shares outstanding - diluted (3) 299,624 299,940 Net loss per common share - basic and diluted (3) $ (0.06) $ (0.10) FFO per common share - basic and diluted $ 0.06 $ 0.05 MFFO per common share - basic and diluted $ 0.05 $ 0.04 (1) Reflects the adjustments of continuing operations, as well as discontinued operations. (2) Includes adjustments for unconsolidated properties and noncontrolling interests. (3) There are no dilutive securities for purposes of calculating the net loss per common share.

TIERREIT.COM Investor Information A copy of the Company’s Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission, is available without charge at sec.gov, at our website at tierreit.com or by written request to the Company at the address below. For additional information about TIER REIT please contact us at: Corporate Office-Dallas 17300 Dallas Parkway Suite 1010 Dallas, TX 75248 p: 972.931.4300 e: ir@tierreit.com Forward-Looking Statements This quarterly summary contains forward-looking statements relating to the business and financial outlook of TIER REIT that are based on our current expectations, estimates, forecasts, and projections and are not guarantees of future performance. Actual results may differ materially from those expressed in these forward-looking statements, and you should not place undue reliance on any such statements. A number of important factors could cause actual results to differ materially from the forward-looking statements contained in this quarterly summary. Such factors include those described in the Risk Factors section of our Annual Report on Form 10-K for the year ended December 31, 2013. Forward-looking statements in this document speak only as of the date on which such statements were made, and we undertake no obligation to update any such statements that may become untrue because of subsequent events. We claim the safe harbor protection for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Stockholders with questions about their account, statements, address changes, ownership changes or other administrative matters, please call or email: p: 866.655.3650 e: shareholder-services@tierreit.com