Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PROVIDENT FINANCIAL SERVICES INC | d780365d8k.htm |

Exhibit 99.1 |

Forward Looking

Statements 2

Certain statements contained herein are "forward-looking statements" within the

meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. Such forward-looking statements may be identified by reference

to a future period or periods, or by the use of forward-looking terminology, such as "may," "will," "believe,"

"expect,"

"estimate,"

"anticipate,"

"continue,"

or

similar

terms

or

variations

on

those

terms,

or

the

negative

of

those

terms. Forward-looking statements are subject to numerous risks and uncertainties,

including, but not limited to, those related to the economic environment, particularly in

the market areas in which Provident Financial Services, Inc. (the “Company”)

operates, competitive products and pricing, fiscal and monetary policies of the U.S. Government, changes in

government regulations affecting financial institutions, including regulatory fees and capital

requirements, changes in prevailing

interest

rates,

acquisitions

and

the

integration

of

acquired

businesses,

credit

risk

management,

asset-liability

management, the financial and securities markets and the availability of and costs associated

with sources of liquidity. The Company cautions readers not to place undue reliance on

any such forward-looking statements, which speak only as of the

date

made.

The

Company

also

advises

readers

that

the

factors

listed

above

could

affect

the

Company's

financial

performance and could cause the Company's actual results for future periods to differ materially

from any opinions or statements expressed with respect to future periods in any current

statements. The Company does not have any obligation to update any forward-looking

statements to reflect events or circumstances after the date of such statement. A

detailed discussion of factors that could affect our results is included in our SEC filings, including the “Risk Factors”

section of our Annual Report on Form 10-K for the year ended December 31, 2013.

|

At

6/30/14 Total Assets

$8.4 B

Total Loans

$5.9 B

Total Investments

$1.7 B

Total Deposits

$5.8 B

Tangible Common Equity

$716 M

87 branch offices and 4 LPOs in NJ

and Eastern PA

Market Capitalization (8/25/14)

$1.0 B

3 Mo. Average Daily Shares Traded

(8/25/14)

192,000

(NYSE:PFS)

3 |

EPS Growth

Opportunities 4

Recent expansion in Eastern PA and Western NJ

Growth of Wealth Management Business

Entry into Asset Based Lending

Capital strength to fund accretive acquisitions and stock

buybacks

Expense management remains a priority |

Team Capital

Acquisition Announced 12/19/13

Closed 5/30/14

Systems Converted 8/30/14

12 branches: Lehigh Valley (3),

Bucks (2), NJ (7)

$964M FV of Assets Acquired

$634M FV of Loans Acquired

$770M FV of Deposits Acquired

$40M of Goodwill Created

Provident Bank

Team Capital Bank

5 |

Pennsylvania

Market Entry Team’s Pennsylvania markets have an attractive business climate due to

proximity to large markets such as Philadelphia and New York, lower tax rates and

affordable real estate A large number of Fortune 500 companies have established

warehouses and distribution centers within the region, including Amazon,

Coca-Cola, WalMart, Nestle and Kraft This entry positions Provident to take advantage

of key demographic trends, including Lehigh County had the fastest population growth

from 2010-2012 across Pennsylvania Lehigh

Valley

is

the

third

most

populous

region

in

Pennsylvania,

while

Bucks

County

has

the

fourth

largest

county population

Source: Pennsylvania State Data Center, 2010 U.S. Census, SNL Financial, Deposit data as

of 9/30/13. 6

Lehigh Valley

1

Bucks

County

Pennsylvania

PFS Legacy

Markets

2

Population (2012):

651,240

629,397

12,807,296

577,234

Projected 5

-Year Population Growth:

2.4%

0.7%

1.5%

1.3%

# of Businesses:

23,592

27,664

496,809

22,873

Median Household Income:

$55,180

$73,557

$49,167

$69,276

Projected 5-Year HHI Growth:

20.6

14.4

16.3

14.8

Lehigh Valley Pennsylvania region consists of Lehigh and Northampton counties.

Represents median of Provident’s legacy markets.

1.

2. |

Financial Impact

of Team Acquisition 7

5% EPS accretion projected in 2015

TBV per share dilution of 3.5% with projected earn-back

< 4 years

IRR > 15%

On track to meet or exceed 25% annualized cost saves |

Growing Wealth

Management Business 8

Acquired Beacon Trust in August 2011

wholly owned subsidiary of Provident Bank

AUM at 6/30/14 $1.0 billion

AUA at 6/30/14 including managed ETF indices $2.0 billion

Average revenue per managed dollar 74 bps, compared with

57 bps median for similarly sized firms

Net income contribution projected at $750 thousand for 2014

Actively exploring additional acquisition opportunities |

Asset Based

Lending 9

Acquired a team of 3 experienced individuals in August 2014

Acquired a loan book of $47 million in commitments with

outstandings of $25 million

Growth expectations of approximately $20 million in 2015

Generates increased fee income

Enhances credit controls over existing monitored lines |

Strong Capital

Position / Capital Formation 10

6/30/2014

Tangible Common Equity

8.90%

Tier 1 Leverage

9.60%

Total Risk-based

12.95%

Dividend payout ratio (last twelve months)

51.72%

Provides ability to pursue accretive acquisitions and/or

repurchase common stock |

Expense

Management 11

An historical strength of the current management team:

Efficiency Ratio

6 months

Years

2014*

2013

2012

2011

2010

59.84%

57.18%

57.03%

57.31%

57.69%

* Excludes Team Capital acquisition related items and lump sum pension distribution

costs. |

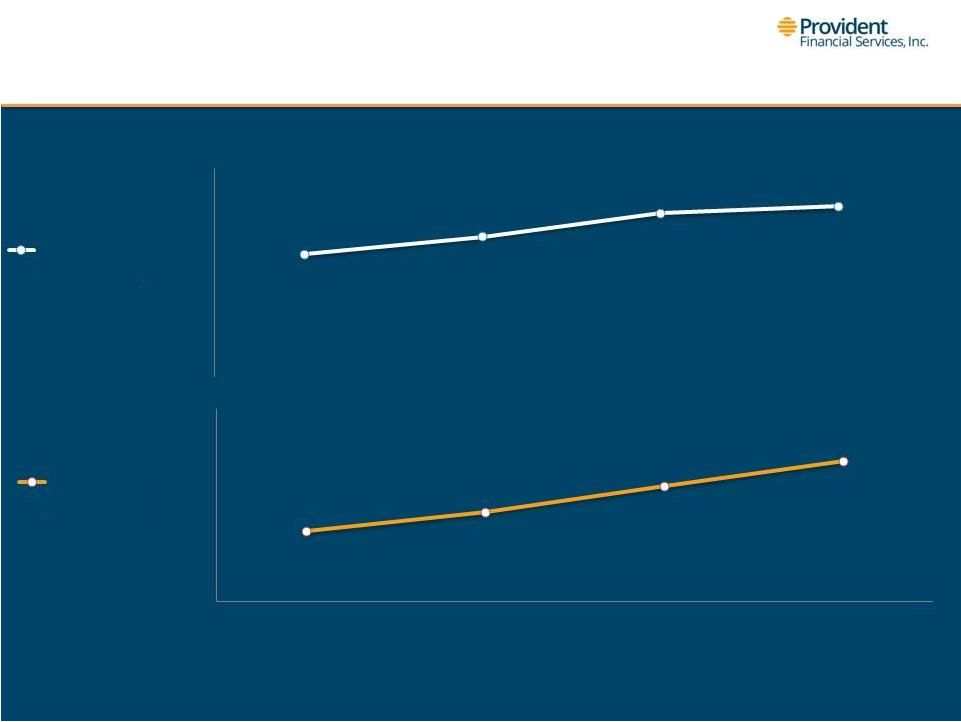

12/13/10

12/31/11

12/31/12

12/31/13

Enhancing Shareholder Value

12

$0.88

$1.01

$1.18

$1.23

Earnings per

Share 12%

CAGR

$9.47

$9.87

$10.40

$10.92

TBV per

Share 5%

CAGR |

Return of

Capital 10% CAGR

$13.19 Average

$13.19 Average

Cost per Share

Cost per Share

Enhancing Shareholder Value

13

Regular Dividends

$26.8 M

Regular Dividends

$28.7 M

Regular Dividends

$32.2 M

Special Dividend

$12.0 M

$-

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

2011

2012

2013

Stock Repurchases

$4.1 M

Stock Repurchases

$9.4M

Stock Repurchases

$5.9 M

$30.9 M

$50.1 M

$38.2 M |

Increasing

Profitability (*in millions)

$49.7

$57.3

$67.3

$70.5

0.73%

0.83%

0.94%

0.97%

$-

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

$70.0

$80.0

0.50%

0.60%

0.70%

0.80%

0.90%

1.00%

1.10%

12/31/10

12/31/11

12/31/12

12/31/13

Net Income*

ROAA

14 |

Increasing

Profitability 8.97%

9.81%

10.88%

11.04%

5.46%

6.09%

6.88%

7.08%

12/31/10

12/31/11

12/31/12

12/31/13

ROATE

ROAE

15 |

Capable Risk

Management 16

ERM Process

Diversified Loan Portfolio

Disciplined Loan Growth

Solid Credit Quality

Well-managed Interest Rate Risk

Plain Vanilla Investment Portfolio

$10 billion Threshold Readiness |

Diversified Loan

Portfolio - 6/30/14

Total Loans: $5.9 billion

Average Loan Yield: 4.25%

Duration: 2.5 years

Residential

21%

Commercial

Mortgage

28%

16%

Commercial

20%

Consumer

11%

Construction

4%

Multi-family

17 |

Commercial Real

Estate - 6/30/14

Multi-family

36%

Retail

20%

Office

16%

Industrial

11%

3%

Residential

3%

Hotel

3%

Land

1%

Other

Special Use

Mixed Used

6%

1%

18 |

Asset Quality

Trend $135.4 M

$

82.2 M

1.91%

1.53%

1.10%

0.86%

0.52%

0.43%

0.22%

0.10%

2011

2012

2013

6/30/2014

NPAs

NPAs/Assets

Annualized NCOs

$111.5 M

$72.3 M

19 |

Investment

Portfolio – 6/30/14

Agency Notes-

Fixed

6%

Corporate

Notes -

Fixed

1%

Agency MBS -

ARM

5%

Agency CMBS -

Fixed

1%

Agency MBS -

Fixed

36%

Agency CMO -

Fixed

23%

Municipal

28%

Weighted Average Life:

AFS

3.7 yrs

HTM

5.0 yrs

Combined Duration: 4.1 yrs

20 |

21

Notable Items

IPO 2003

Acquired

First

Sentinel

Bancorp

–

2004

Acquired

First

Morris

Bank

and

Trust

–

2007

Acquired

Beacon

Trust

Company

–

2011

Acquired

Team

Capital

Bank

–

2014

Shifted to a community bank balance sheet

69% commercial loans

85% core deposits

17%

CAGR

NIB

deposits

2010

–

2013

No TARP

No dilutive stock offerings

No debt restructurings

No discounted bulk asset sales

No material credit losses or OTTI charges |