Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PBF Energy Inc. | pbfenergy9-03x14.htm |

PBF Energy September 2014

2 Safe Harbor Statements This presentation contains forward-looking statements made by PBF Energy Inc. (the “Company” or “PBF”) and its management. Such statements are based on current expectations, forecasts and projections, including, but not limited to, anticipated financial and operating results, plans, objectives, expectations and intentions that are not historical in nature. Forward-looking statements should not be read as a guarantee of future performance or results, and may not necessarily be accurate indications of the times at, or by which, such performance or results will be achieved. Forward-looking statements are based on information available at the time, and are subject to various risks and uncertainties that could cause the Company’s actual performance or results to differ materially from those expressed in such statements. Factors that could impact such differences include, but are not limited to, changes in general economic conditions; volatility of crude oil and other feedstock prices; fluctuations in the prices of refined products; the impact of disruptions to crude or feedstock supply to any of our refineries, including disruptions due to problems with third party logistics infrastructure; effects of litigation and government investigations; the timing and announcement of any potential acquisitions and subsequent impact of any future acquisitions on our capital structure, financial condition or results of operations; changes or proposed changes in laws or regulations or differing interpretations or enforcement thereof affecting our business or industry, including any lifting by the federal government of the restrictions on exporting U.S. crude oil; actions taken or non-performance by third parties, including suppliers, contractors, operators, transporters and customers; adequacy, availability and cost of capital; work stoppages or other labor interruptions; operating hazards, natural disasters, weather-related delays, casualty losses and other matters beyond our control; inability to complete capital expenditures, or construction projects that exceed anticipated or budgeted amounts; inability to successfully integrate acquired refineries or other acquired businesses or operations; effects of existing and future laws and governmental regulations, including environmental, health and safety regulations; and, various other factors. Forward-looking statements reflect information, facts and circumstances only as of the date they are made. The Company assumes no responsibility or obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information after such date.

3 PBF Energy Company Profile Market capitalization of $2.7 billion and enterprise value of $3.5 billion (1) Ba3 / BB- credit ratings Owns three oil refineries in Ohio, Delaware and New Jersey Aggregate throughput capacity of ~540,000 bpd Weighted-average Nelson Complexity of 11.3 Access to East Coast rail infrastructure results in the entire system having access to WTI-based, cost advantaged crude supply PBF's core strategy is to grow and diversify through acquisitions Region Throughput Capacity (bpd) Date Acquired Nelson Complexity Mid-continent 170,000 Early 2011 9.2 East Coast 370,000 2010 12.2 Total 540,000 11.3 (2) ___________________________ 1. As of 8/25/2014 2. Represents weighted average Nelson Complexity for PBF’s three refineries Paulsboro Delaware City Toledo PBF is the 5th largest independent refiner

4 PBF Logistics launched its initial public offering on April 30, 2014 and commenced trading on the NYSE on May 9, 2014 Market Cap of ~$800 million as of 9/2/14 PBF Energy owns 50.2% of PBFX, 100% of the GP and IDRs PBFX’s assets consist of a light crude oil rail unloading terminal at the Delaware City refinery and a crude oil truck unloading terminal at the Toledo refinery Rail terminal current capacity of 130,000 bpd Truck terminal current capacity of 15,000 bpd $275 million undrawn revolving credit facility provides flexibility to fund potential acquisitions and organic growth projects Significant portfolio of logistics assets retained at PBF that support refinery operations Further information can be found in PBF Logistic’s SEC filings located at www.pbflogistics.com or on the SEC website PBF Logistics LP Company Profile

5 Increasing Shareholder Value in 2014 Implemented several projects which enhance margin by over $170 million on an annualized basis Launched PBFX which strengthened the balance sheet and provides PBF with a valuable partner for growth Successfully increased size of Asset-backed Revolving Credit Facility from $1.6 billion to $2.5 billion, with an accordion to $2.75 billion, concurrent with exiting our mid-continent crude supply agreement with Morgan Stanley Supported a quarterly dividend rate of $0.30 per share or an annualized 4.3% dividend yield(2) Announced a $200 million, two-year share repurchase program representing approximately 7% of the total shares outstanding(1,2) Private Equity sponsors have sold down to less than 4%(1) ownership through three secondary offerings and are no longer represented on the Board of Directors (1) Based on 97.4 million shares on a fully-diluted, fully-exchanged basis (2) Based on common share market price as of the close of business on 8/25/14

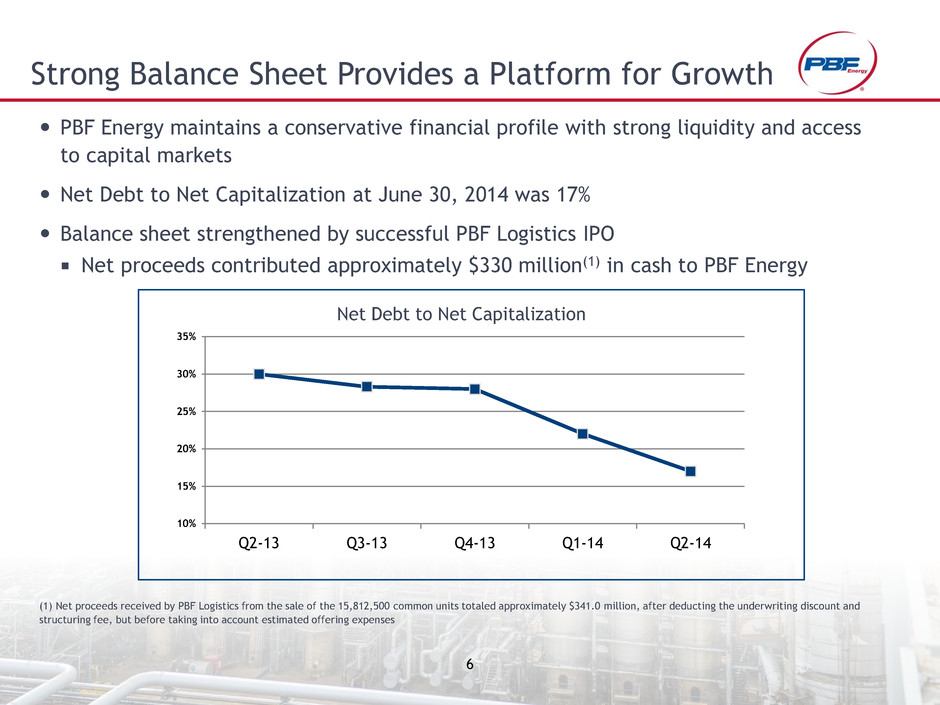

6 PBF Energy maintains a conservative financial profile with strong liquidity and access to capital markets Net Debt to Net Capitalization at June 30, 2014 was 17% Balance sheet strengthened by successful PBF Logistics IPO Net proceeds contributed approximately $330 million(1) in cash to PBF Energy Strong Balance Sheet Provides a Platform for Growth 10% 15% 20% 25% 30% 35% Q2-13 Q3-13 Q4-13 Q1-14 Q2-14 (1) Net proceeds received by PBF Logistics from the sale of the 15,812,500 common units totaled approximately $341.0 million, after deducting the underwriting discount and structuring fee, but before taking into account estimated offering expenses Net Debt to Net Capitalization

7 U.S. Refining Industry Landscape Inexpensive Natural Gas Growth in supply driving decline in U.S. natural gas pricing U.S. natural gas, 2014 year-to-date, prices almost 60% below European natural gas North American Crude Oil Production Secular growth in North American crude oil production Favorable price dislocations between North American crude and rest of world Complex Refineries Higher complexity than Atlantic Basin Competition U.S. average refinery Nelson Complexity of 10.8 versus Western European average refinery Nelson Complexity of 7.8 Product Exports Cost and technological advantages have spurred export opportunities East Coast to Europe, West Africa, and Latin America

8 Strong Fundamentals for Industry and PBF Reached inflection point with growth of domestic crude oil and natural gas in 2010- 2011 Bakken crude production has grown over 400% (910 mbpd) from 2010 through 2014 Pushes barrels South (via pipeline and rail), East and West (primarily by rail) Ultimately displaces USGC imports Canadian crude production has grown by over 30% (850 mbpd) from 2010 to 2014 Bitumen by rail advantaged versus pipeline transportation of diluted crudes Low-cost natural gas versus Europe Proximity to increasing domestic supply such as the Marcellus Shale development 5.2 5.5 8.5 9.0 9.6 2.5 2.8 3.7 3.9 4.9 7.7 8.3 12.2 12.9 14.4 - 2.0 4.0 6.0 8.0 10.0 12.0 14.0 16.0 2005 2010 2014 2015 2020 M M b p d US Canada Source: EIA, CAPP 0 2 4 6 8 10 12 14 16 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 Henry Hub ICE Natural Gas ($/MMBtu) Source: Bloomberg

9 PBF’s Crude-by-Rail Program Planned Leased or Owned Railcars Note: Schedule is subject to change based on current company plans and on current third party railcar manufacturer delivery schedules East Coast access to cost-advantaged North American crude oil provides optionality 130,000 bpd PBFX-owned light crude oil unloading facility 80,000 bpd PBF-owned heavy crude oil unloading capacity Longer-term focus on logistics Rail services agreements with Norfolk Southern, BNSF, Savage Supply agreement with Continental Resources for Bakken Potential opportunities for participation in logistics projects 2,120 2,347 3,600 1,359 2,221 2,300 - 1,000 2,000 3,000 4,000 5,000 6,000 7,000 2Q14 4Q14 4Q15 Coiled & Insulated General Purpose 5,900 4,658 3,479 PBF will lead the way on rail safety All crude oil delivered to our Delaware City refinery is transported in the new-style DOT-111A rail cars PBF supports increased efforts to enhance the safety of rail operations through the use of a modernized rail fleet, improved operating standards, increased rail inspection and maintenance activities to ensure the safe transport of all crude oil and products

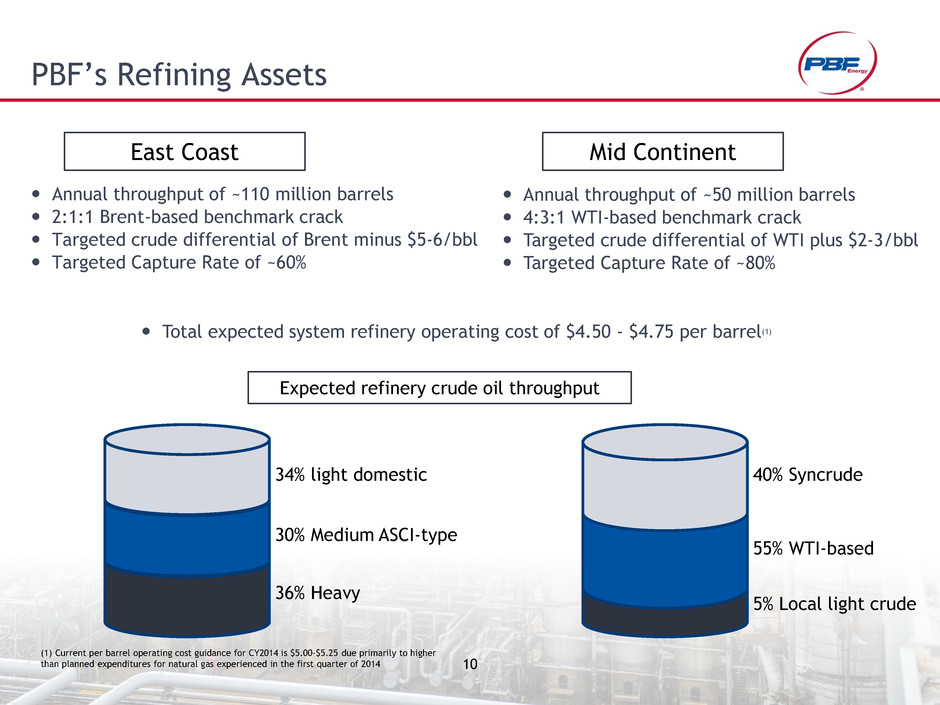

10 PBF’s Refining Assets Annual throughput of ~110 million barrels 2:1:1 Brent-based benchmark crack Targeted crude differential of Brent minus $5-6/bbl Targeted Capture Rate of ~60% Annual throughput of ~50 million barrels 4:3:1 WTI-based benchmark crack Targeted crude differential of WTI plus $2-3/bbl Targeted Capture Rate of ~80% East Coast Mid Continent 34% light domestic Expected refinery crude oil throughput 30% Medium ASCI-type 36% Heavy 40% Syncrude 55% WTI-based 5% Local light crude Total expected system refinery operating cost of $4.50 - $4.75 per barrel(1) (1) Current per barrel operating cost guidance for CY2014 is $5.00-$5.25 due primarily to higher than planned expenditures for natural gas experienced in the first quarter of 2014

11 PBF’s 2014 margin improvement initiatives *Figures provided do not indicate a full year of margin contribution in 2014 but are estimates based on a full year of operations using historical prices and subject to change based on project completion timelines, cost of RINs, market and other factors Total margin uplift...........~$170 million/yr* Improved East Coast distillate yield Converted 100% of 2000ppm Heating Oil into either Ultra Low Sulfur Diesel (ULSD) or Ultra Low Sulfur Heating Oil (ULSHO) Based on 2013 pricing, this is a potential margin swing of $3.00 per barrel on these distillate barrels Could impact 20 million barrels per year Optimized commercial operations PBF now sells its products on the East Coast directly to the market Achieving, on average, 50 cents per barrel higher netback Toledo process improvements New crude tank improves feedstock flexibility and minimizes disruptions Increased jet fuel production and sales by 15% to 20% Improved FCC performance and yield following turnaround ......................................margin uplift...........~$60 million/yr* ........................................margin uplift...........~$50 million/yr* .............................................margin uplift...........~$60 million/yr*

12 Increasing Shareholder Value in 2014 Operate safely and efficiently Maintain capital discipline and conservative balance sheet Invest in margin improvement projects Grow through strategic acquisitions Return cash to investors through dividends and buybacks

Appendix

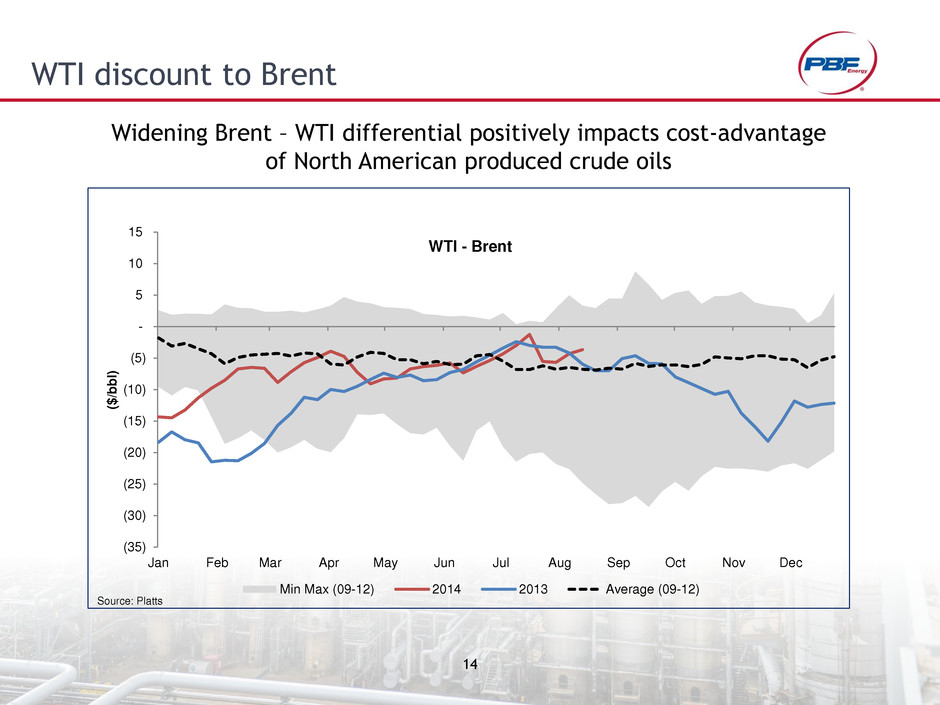

14 WTI discount to Brent Widening Brent – WTI differential positively impacts cost-advantage of North American produced crude oils (35) (30) (25) (20) (15) (10) (5) - 5 10 15 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec ($/b b l) WTI - Brent Min Max (09-12) 2014 2013 Average (09-12) Source: Platts

15 WCS discount to Brent Expanding differentials positively impact rail economics for Canadian Heavy crude oil processed at PBF’s East Coast refineries (70) (60) (50) (40) (30) (20) (10) - 10 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec ($/b b l) WCS - Brent Min Max (09-12) 2014 2013 Average (09-12) Source: Platts

16 ASCI discount to Brent ASCI is an indicator for medium-sour barrels processed at PBF’s East Coast facilities (25) (20) (15) (10) (5) - 5 10 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec ($/b b l) ASCI - Brent Min Max (07-12) 2014 2013 Average (07-12) Source: Platts, Argus

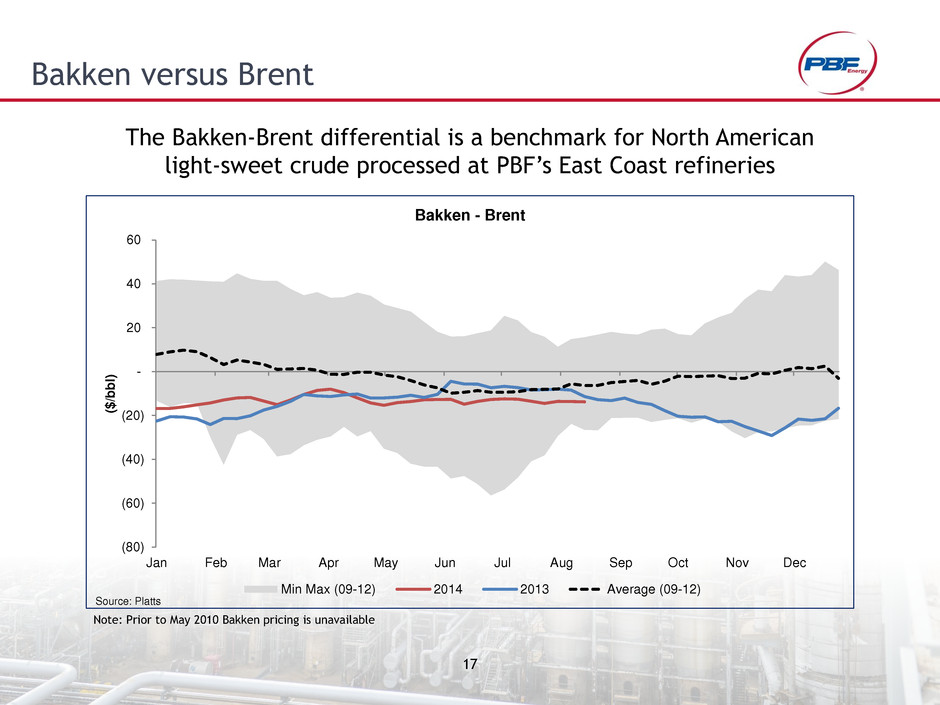

17 Bakken versus Brent The Bakken-Brent differential is a benchmark for North American light-sweet crude processed at PBF’s East Coast refineries Note: Prior to May 2010 Bakken pricing is unavailable (80) (60) (40) (20) - 20 40 60 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec ($/b b l) Bakken - Brent Min Max (09-12) 2014 2013 Average (09-12) Source: Platts

18 Canadian Syncrude Differential versus WTI Toledo processes approximately 35% to 40% Syncrude (25) (20) (15) (10) (5) - 5 10 15 20 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec ($/b b l) Syncrude - WTI Min Max (07-12) 2014 2013 Average (07-12) Source: Platts

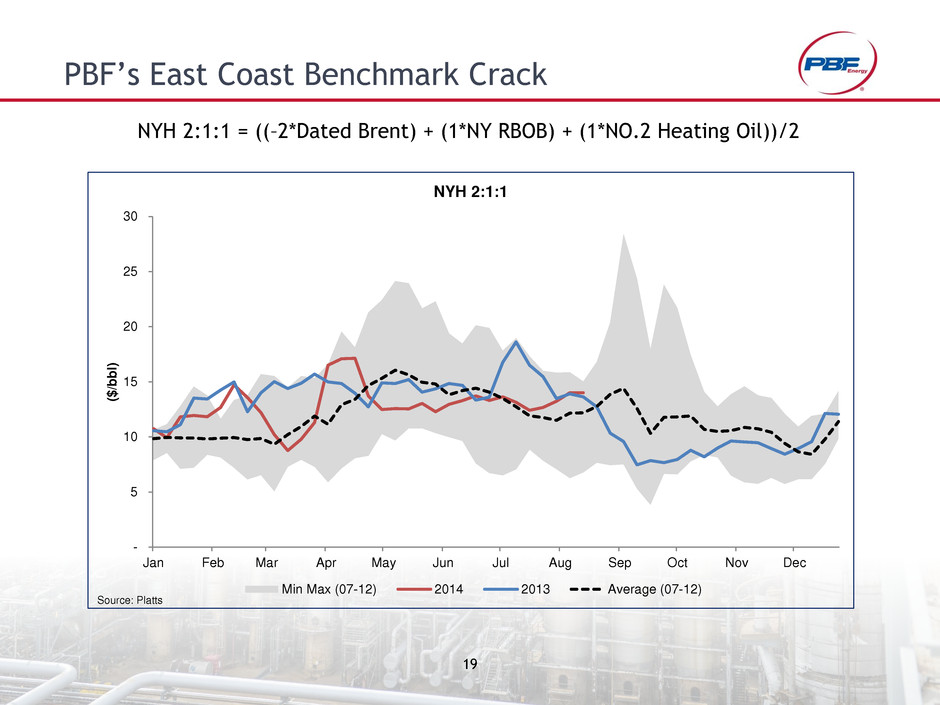

19 PBF’s East Coast Benchmark Crack NYH 2:1:1 = ((–2*Dated Brent) + (1*NY RBOB) + (1*NO.2 Heating Oil))/2 - 5 10 15 20 25 30 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec ($/b b l) NYH 2:1:1 Min Max (07-12) 2014 2013 Average (07-12) Source: Platts

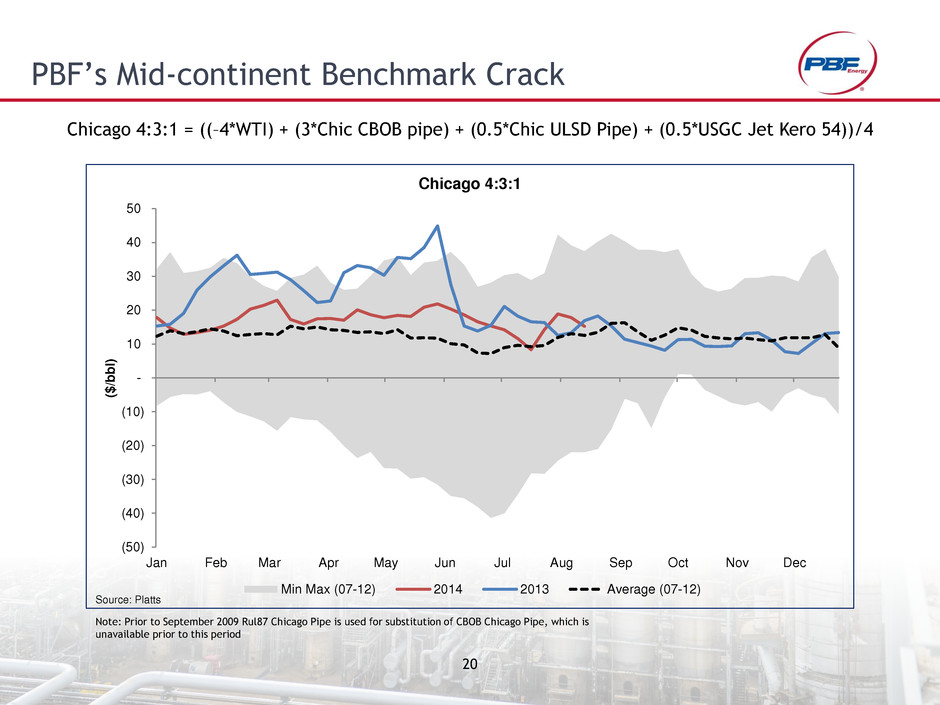

20 PBF’s Mid-continent Benchmark Crack Chicago 4:3:1 = ((–4*WTI) + (3*Chic CBOB pipe) + (0.5*Chic ULSD Pipe) + (0.5*USGC Jet Kero 54))/4 Note: Prior to September 2009 Rul87 Chicago Pipe is used for substitution of CBOB Chicago Pipe, which is unavailable prior to this period (50) (40) (30) (20) (10) - 10 20 30 40 50 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec ($/b b l) Chicago 4:3:1 Min Max (07-12) 2014 2013 Average (07-12) Source: Platts

2 1