Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DONEGAL GROUP INC | d780397d8k.htm |

Investor

Presentation

September 2014

Pursuing Effective

Business Strategy in

Regional Insurance

Markets

Exhibit 99.1 |

Forward-Looking Statements

The Company bases all statements made in this presentation that are not historic facts on its

current expectations. These statements are forward-looking in nature (as defined

in the Private Securities Litigation Reform Act of 1995) and involve a number of risks

and uncertainties. Actual results could vary materially. Factors that could cause

actual results to vary materially include: the Company’s

ability

to

maintain

profitable

operations,

the

adequacy

of

the

loss

and

loss

expense

reserves of the Company’s insurance subsidiaries, business and economic conditions in

the areas in which the Company operates, interest rates, competition from various

insurance and other financial businesses, terrorism, the availability and cost of

reinsurance, adverse and catastrophic weather events, legal and judicial developments,

changes in regulatory requirements, the Company’s ability to integrate and manage

successfully the companies it may acquire from time to time and other risks the

Company describes from time to time in the periodic reports it files with the

Securities and Exchange Commission. You should not place undue reliance on any such

forward-looking statements. The Company disclaims any obligation to update such

statements or to

announce publicly the results of any revisions that it may make to any forward-looking

statements to reflect the occurrence of anticipated or unanticipated events or

circumstances after the date of such statements.

Reconciliations of non-GAAP data are included in the Company’s news releases

regarding quarterly

financial

results,

available

on

the

Company’s

website

at

investors.donegalgroup.com. 2

|

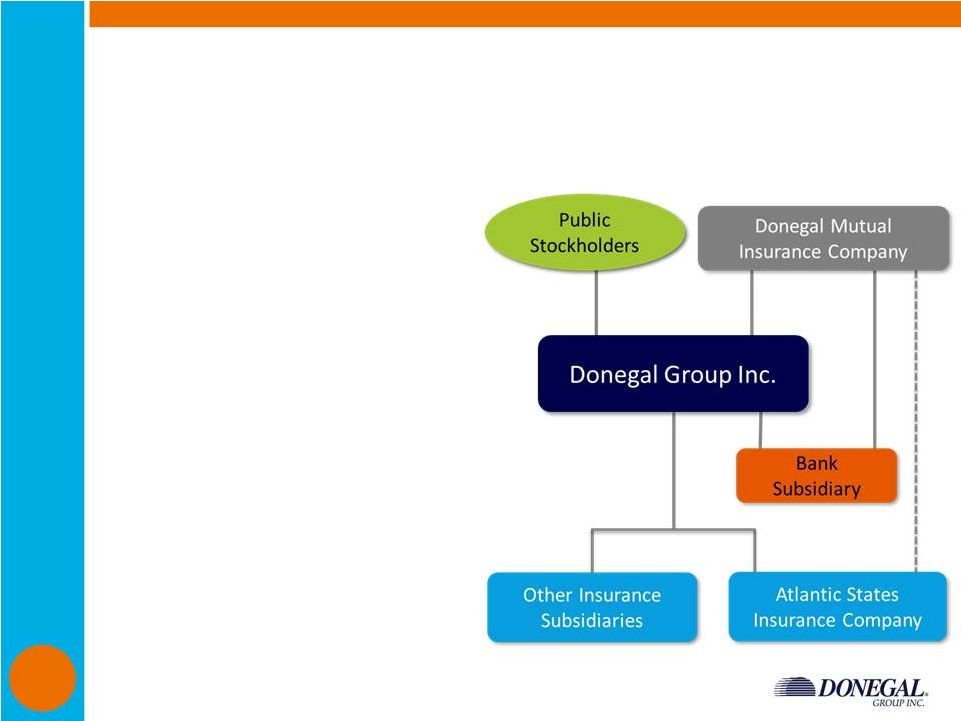

Insurance

Holding Company With Mutual Affiliate

•

Regional property and casualty insurance group

–

22 Mid-Atlantic, Midwestern, New England and Southern

states

–

Distribution force of approximately 2,600 independent

agencies

–

Completed 10 M&A transactions since 1988

•

Interrelated operations and pooling agreement

with Donegal Mutual since inception in 1986

•

DGICA and DGICB trade on NASDAQ exchange

–

DGICA dividend yield of 3.3%

–

DGICA shares have 1/10 vote; DGICB shares have one

vote

3 |

Structure

Provides Stability to Pursue Successful Long-Term Business Strategy

•

Outperform industry in

service, profitability

and book value growth

•

Drive revenues with

organic growth and

opportunistic

transactions

•

Focus on margin

enhancements and

investment

contributions

4

(Detailed organizational chart included in Supplemental Information – see page 29)

|

Objective:

Outperform Industry Service, Profitability and Book Value Growth

5

Change in Net Written Premiums

DGI CAGR: 10% Peer CAGR: 4%

GAAP Combined Ratio

DGI Avg: 98% Peer Avg: 100%

Change in Book Value

DGI CAGR: 2% Peer CAGR: 4%

Donegal Group

Peer Group*

* Peer Group consists of CINF, EMCI, HMN, THG, SIGI, STFC, UFCS (Source: Bloomberg)

-5%

0%

5%

10%

15%

20%

25%

30%

35%

40%

80%

85%

90%

95%

100%

105%

110%

115%

-20%

-15%

-10%

-5%

0%

5%

10%

15%

20% |

2013: Strong

Growth and Profitability Operating EPS* of 96¢

vs. 73¢

in 2012

•

7.4% increase in net written premiums

–

Driven by strong commercial lines growth

•

97.4% statutory combined ratio

–

Q3 and Q4 combined ratios of 96.0% and 95.4% were

lowest for any period in past five years

–

Measurable progress from rate increases and underwriting

initiatives

–

Weather losses and large fire losses below prior year level

•

Book value per share at $15.02 vs. $15.63 at year-

end 2012

–

Interest-rate-driven mark-to-market adjustments

6

* Reconciliations and definitions of non-GAAP data also are available on our

website Additional

details

are

available

at

investors.donegalgroup.com |

1H14: Favorable

Core Underwriting Results Despite Weather and Other Loss Activity

•

8.4% increase in net written premiums

–

Driven by rate increases and 13.4% commercial lines

growth

•

102.7% statutory combined ratio

–

Improvements in homeowners and casualty loss ratios

–

$26.9 million weather-related losses far exceeded previous

five-year first-half average of $18.8 million

–

$19.4 million in large fire losses also above average

•

Book value per share at $15.25 compared with

$15.02 at year-end 2013

7 |

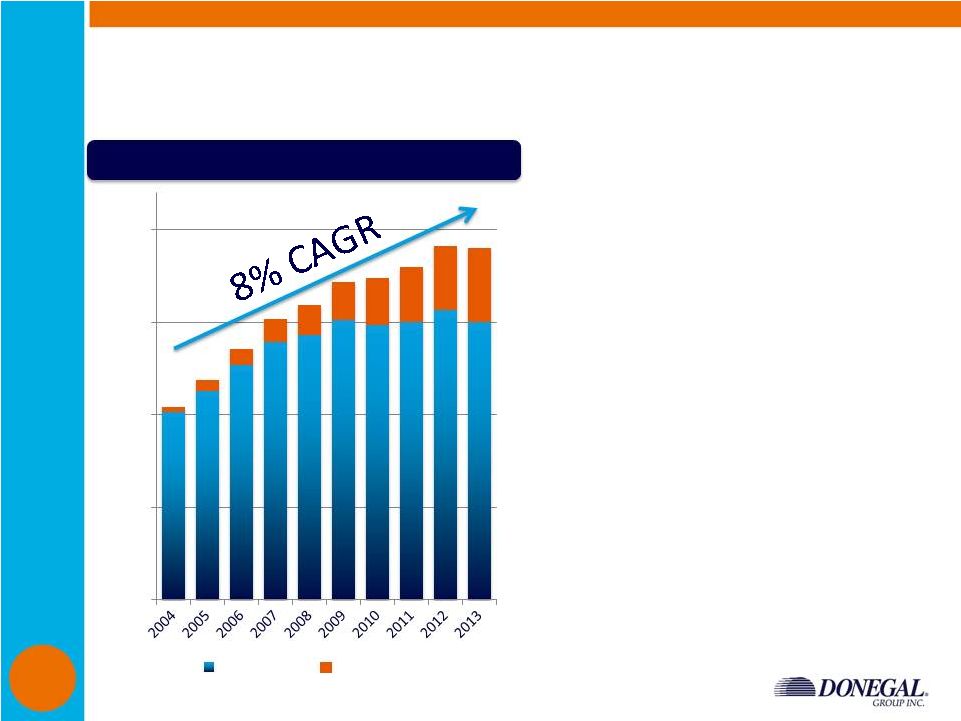

Drive Revenues

with Organic Growth and Opportunistic Transactions

8

$283

$302

$207

$307

$314

$365

$363

$392

$454

$496

Net Written Premiums

(dollars in millions)

$533

8

Michigan

Sheboygan

Peninsula

Le Mars

January 2004

Acquired Le Mars and Peninsula

Southern

Atlantic States

December

2008

Acquired Sheboygan Falls

Implemented Pooling Change

December 2010

Acquired Michigan

Implemented 25% Quota Share

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013 |

Focus on

Underwriting Profitability to Enhance Margins

Donegal Insurance Group (SNL P&C Group)

SNL P&C Industry (Aggregate)

9

Personal Lines Loss Ratio

Commercial Lines Loss Ratio

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

2006

2007

2008

2009

2010

2011

2012

2013

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

2006

2007

2008

2009

2010

2011

2012

2013 |

10

Achieve Book Value Growth

By Implementing

Plan

Pursue quality premium growth and enhance

underwriting profitability

Support insurance operations with conservative

investment strategy |

Maintain

Multi-faceted Regional Growth Strategy

•

$533 million in 2013 net written premiums across

22 states in four operating regions

–

$720 million in direct written premiums for

insurance

group*

•

10 M&A transactions since

1988

•

Acquisition criteria:

–

Serving attractive

geography

–

Favorable regulatory,

legislative and judicial environments

–

Similar personal/commercial

business mix

–

Premium volume

up to $100

million

11

11

* Includes Donegal Mutual Insurance Company and Southern Mutual Insurance Company

|

Example:

Michigan Insurance Company •

Attractive franchise

acquired in 2010

•

Potential for increased

premium contribution

•

Track record of

profitability

•

Provided entry into

new state as part of

Midwest expansion

strategy

–

Capable management

team

–

Quality agency

distribution system

–

Diversified mix of

business

(Dollars in millions)

2014

2013

2012

2011

2010

(under

prior

owner)

Direct written

premiums

$116**

$112

$111

$108

$105

External quota share

20%

30%

40%

50%

75%

Ceded to Donegal

Mutual*

25%

25%

25%

25%

N/A

Retained by MICO

55%

45%

35%

25%

25%

Included in DGI NPW

$74**

$62

$57

$46

N/A

Statutory combined

ratio

N/A

99%

94%

95%

97%

* Premiums ceded to Donegal Mutual are included in pooling

agreement with Atlantic States (80% to DGI)

** Projected based

on estimated 2014 growth rate 12

|

Continue

Strategic Efforts to Balance Business

Mix

•

Commercial lines =

44% of NWP in 1H 2014

–

Commercial lines renewal

premiums increases in 5-

7% range

–

Ongoing emphasis on new

business growth in all

regions

•

Personal lines =

56% of NWP in 1H 2014

–

Rate increases in 3-

8%

range

–

Modest exposure growth in

addition to MICO premiums

retained

Net Written Premiums by Line of Business

(June 30, 2014)

13

Homeowners

18%

Other

Personal

3%

Personal

Auto

35%

Commercial

Auto

12%

Other

Commercial

1%

Multi Peril

15%

Workers'

Comp

16% |

Emphasize

Growth in Commercial Lines •

95.7% statutory combined

ratio for 2013

•

Introduce core Donegal

products in new regions

•

Growth focus on accounts

with premiums in $10,000

to $75,000 range

•

Expand appetite within

classes and lines already

written:

–

Add related classes

–

Appropriately use

reinsurance

•

Disciplined underwriting:

–

Large account reviews

–

Loss control

14

50.0%

55.0%

60.0%

65.0%

70.0%

75.0%

80.0%

85.0%

90.0%

95.0%

100.0%

-

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

90,000

2008

2009

2010

2011

2012

2013

In-Force Policy Count

Retention Levels |

Focus on

Personal Lines Profitability •

98.8% statutory combined

ratio for 2013

•

Focus on the preferred

and superior risk markets

•

Underwriting initiatives:

–

Rate increases in virtually

every jurisdiction

–

New and renewal

inspections

–

Seek geographic spread of

risk

–

Balance portfolio

(auto/home)

15

50.0%

55.0%

60.0%

65.0%

70.0%

75.0%

80.0%

85.0%

90.0%

95.0%

100.0%

-

50,000

100,000

150,000

200,000

250,000

300,000

350,000

400,000

450,000

500,000

2008

2009

2010

2011

2012

2013

In-Force Policy Count

Retention Levels |

Organic Growth

Centered on Relationships with ~2,600 Independent Agencies

•

Ongoing objectives:

–

Achieve top three ranking within appointed agencies in

lines of business

we write

–

Cultivate relationships with existing agencies to expand

writings

–

Leverage “regional”

advantages and maintain personal

relationships as agencies grow and consolidate

•

Continuing focus on commercial lines growth:

–

Emphasize expanded commercial lines products and

capabilities in current agencies

–

Appoint commercial lines focused agencies to expand

distribution in key geographies

–

Strengthen relationships with agencies appointed in

recent

years

16 |

Support Agents

with Best-In-Class Technology 17

Call

Center

Service

Center

ClaimCenter

ImageRight

Mobile App |

Drive Increased

Efficiency with Automation •

Current infrastructure can

support premium growth

•

Premiums per employee

rising due to underwriting

systems

•

Claims system allows

more rapid and efficient

claims handling

•

Mutual affiliation provides

opportunities for

operational and expense

synergies

•

Statutory expense ratio of

30.2% for 2013 vs. 29.3%

for 2012

(Dollars in thousands)

Direct Premiums per Employee

Direct Premiums per Employee

18

$200

$300

$400

$500

$600

$700

$800

$900

$1,000 |

Enhance

Underwriting Profitability to Improve Operating Margins

•

Sustain pricing discipline and conservative

underwriting

•

Manage exposure to catastrophe/unusual weather

events

–

Reinsurance coverage in excess of a 250-year event

•

Link employee incentive compensation directly to

underwriting performance

•

Focus on rate adequacy and pricing sophistication

•

Leverage centralized oversight of regional

underwriting

•

Emphasize IT-based programs such as automated

decision trees and predictive modeling

19 |

Employ

Sophisticated Pricing and Actuarial Tools

•

Predictive modeling tools

enhance our ability to

appropriately price our

products

–

Sophisticated predictive

modeling algorithms for

pricing/tiering risks

–

Territorial segmentation

and analysis of

environmental factors that

affect loss experience

–

Exploring tools that allow

consideration of vehicle-

specific data in pricing

•

External information

sources allow us to

develop price

optimization strategies

•

Formal schedule of

regular rate adequacy

reviews for all lines of

business, including GLM

analysis on claim costs

and agency performance

•

Telematics/usage-based

insurance initiatives

20 |

Maintain

Emphasis on Reserve Adequacy •

Reserves at $266 million

at year-end 2013

–

Midpoint of actuarial

range

–

Conservative reinsurance

program limits volatility

•

Emphasis on faster

claims settlements to

reduce longer-term

exposures

•

2013 development of

$10

million within

targeted range

Reserve Range at 12/31/2013

Low $238,800

High $295,500

Selected at midpoint

Values shown are selected reserves

Vertical bars represent actuarial ranges

(dollars in thousands, net of reinsurance)

21

Established Reserves at Year-end

$180,262

$217,897

$243,015

$250,936

$265,605

2009

2010

2011

2012

2013

Development

(Favorable)

$9,823 ($2,885)

($168) $7,596 $10,358

6.1%

(1.6%) --

3.1% 4.1

% |

22

Achieve Book Value Growth

By Implementing

Plan

Pursue quality premium growth and enhance

underwriting profitability

Support insurance operations with conservative

investment strategy |

Maintain

Conservative Investment Mix •

89% of portfolio invested

in fixed maturities at

June 30, 2014

–

Effective duration =

4.7

years

–

Tax equivalent yield =

3.1%

•

Emphasis on quality

–

74% AA-rated or better

–

93% A-rated or better

•

Liquidity managed

through laddering

* Excluding investments in affiliates

$781 Million in Invested Assets*

(as of June 30, 2014)

23

Short-Term

Securities

4%

Treasury

3%

Agency

6%

Corporate

15%

Mortgage

Backed

Securities

(MBS)

23%

Taxable

Munis

1%

Tax-Exempt

Municipals

45%

Equity

3% |

Donegal

Financial Services Corporation Bank Investment = 5% of Invested Assets

•

DFSC owns 100% of Union Community Bank

–

Serves Lancaster County (location of Donegal

headquarters)

•

Expanded to 13 branches via acquisition in 2011

–

Added scale to banking operation

–

Enhanced value of historic bank investment

–

Increased potential for bottom-line contribution

•

DGI owns approximately 48% of DFSC

–

52% owned by Donegal Mutual

•

Union Community Bank is financially strong and

profitable

24 |

Union Community

Bank (48% owned by Donegal Group Inc.)

•

2013 financial results:

–

$513

million in assets at year-end 2013

–

$6.3 million in 2013 net income

•

Excellent capital ratios at June 30, 2014:

25

Tier 1 capital to average total assets

16.01%

Tier 1 capital to risk-weighted assets

24.77%

Risk-based capital to risk-weighted assets

27.06% |

Review:

Long-Term Business Strategy for Growth and Success

•

Maximize benefits of regional business approach

•

Outperform industry in service, profitability and

book

value growth

•

Drive revenues with organic growth and

opportunistic transactions

•

Focus on margin enhancements and investment

contributions

26 |

Strong Capital

+ Solid Plan to Drive Results •

Rated A (Excellent) by

A.M.

Best

–

Debt-to-capital of

approximately 16%

–

Premium-to-surplus of

approximately 1.6-to-1

•

Dividend yield of 3.3%

for Class A shares

–

3% increase in April 2014

•

Authorization for

repurchase of up to

500,000 shares of

Class

A common stock

Book Value Plus Cumulative Dividends

Book Value Plus Cumulative Dividends

27

$-

$5.00

$10.00

$15.00

$20.00

Book Value

Dividends Paid |

Supplemental

Information 28 |

Structure

Provides Flexibility and Capacity 29

(1)

Because

of

the

different

relative

voting

power

of

Class

A

common

stock

and

Class

B

common

stock,

public

stockholders

hold

approximately

35%

of

the

aggregate

voting power of the combined classes, and Donegal Mutual holds approximately 65% of the

aggregate voting power of the combined classes. 100%

Reinsurance

= P&C Insurance Subsidiaries

= Thrift Holding Company/State Savings Bank

POOLING

AGREEMENT

100%

100%

80%

20%

Sheboygan Falls

Insurance

Company

Michigan

Insurance

Company

Southern

Insurance

Company of

Virginia

Le Mars

Insurance

Company

The Peninsula

Insurance

Company

Atlantic States

Insurance

Company

Southern Mutual

Insurance

Company

Peninsula

Indemnity

Company

100%

100%

100%

100%

100%

55%

(1)

45%

(1)

52%

48%

Donegal Group Inc.

Donegal Group Inc.

Public

Stockholders

Donegal Mutual

Insurance Company

Donegal Financial Services

Corporation

(Union Community Bank) |

History of

Contributing Transactions Company

Le Mars

Peninsula

Sheboygan

Southern

Mutual

Michigan

Year Acquired

2004

2004

2008

2009

2010

Company Type

Mutual

Stock

Mutual

Mutual

Stock

Primary Product Line

Personal

Niche

Personal

Personal

Pers./Comm.

Geographic Focus

Midwest

Mid-Atlantic

Wisconsin

Georgia/

South

Carolina

Michigan

Transaction Type

Demutualization

Purchase

Demutualization

Affiliation

Purchase

Net Premiums Acquired

$20 million

$34 million

$8 million

$11 million

$27 million*

Acquisition Price

$4 million

$24 million

$4 million

N/A

$42 million

Avg. Growth Rate**

5%

3%

13%

N/A

16%

Avg. Combined Ratio**

93%

94%

103%

N/A

96%

* Michigan's direct premiums written were $105 million in 2010

** Since acquisition

30 |

Net Premiums

Written by Line of Business (in millions)

Q2 14

Q1 14

Q4 13

Q3 13

Q2 13

Q1 13

Q4 12

Q3 12

Personal lines:

Automobile

$52.0

$50.5

$46.7

$50.9

$50.2

$48.6

$45.6

$51.4

Homeowners

31.1

22.9

25.7

29.8

29.1

21.9

22.3

27.6

Other

4.6

3.8

4.0

4.2

4.3

3.4

4.0

4.2

Total personal lines

87.7

77.2

76.4

84.8

83.6

73.8

71.9

83.1

Commercial lines:

Automobile

17.5

17.3

13.0

14.0

15.7

15.5

12.0

12.5

Workers’

compensation

22.4

26.6

16.3

18.3

19.7

23.2

14.3

16.1

Commercial multi-peril

21.7

22.1

16.8

18.0

20.0

19.7

14.7

15.9

Other

2.1

1.4

1.3

1.4

1.6

0.3

1.8

1.7

Total commercial lines

63.7

67.4

47.4

51.8

57.0

58.6

42.8

46.2

Total net premiums written

$151.4

$144.6

$123.8

$136.6

$140.6

$132.5

$114.7

$129.3

31 |

Combined Ratio

Analyses (percent)

Q2 14

Q1 14

Q4 13

Q3 13

Q2 13

Q1 13

Q4 12

Q3 12

Stat combined ratios:

Personal lines

99.5

102.7

99.3

97.9

100.2

98.1

108.9

101.3

Commercial lines

105.8

104.3

89.4

93.0

101.4

98.4

88.5

91.4

Total lines

102.1

103.2

95.4

96.0

100.6

98.0

101.2

97.6

GAAP combined ratios (total lines):

Loss ratio (non-weather)

63.2

61.7

59.1

57.8

63.1

64.1

68.2

58.6

Loss ratio (weather-related)

8.5

11.4

3.5

7.2

7.4

4.5

3.9

9.3

Expense ratio

31.9

31.3

31.9

32.3

32.3

30.7

29.3

31.4

Dividend ratio

0.4

0.3

0.4

0.3

0.3

0.4

0.3

0.3

Combined ratio

104.0

104.7

94.9

97.6

103.1

99.7

101.7

99.6

GAAP supplemental ratios:

Fire losses greater than $50,000

6.8

7.6

4.8

2.4

4.4

6.5

5.5

5.5

Development on prior year loss reserves

4.4

-0.3

0.1

2.4

3.7

1.5

1.6

2.4

32 |