Attached files

| file | filename |

|---|---|

| EX-99.3 - RECONCILIATION OF NON-GAAP FINANCIAL MEASURES - INTERSECTIONS INC | intersections-ex993_082714.htm |

| EX-99.1 - PRESS RELEASE - INTERSECTIONS INC | intersections-ex991_082714.htm |

| 8-K/A - CURRENT REPORT - INTERSECTIONS INC | intersections-8ka_082714.htm |

Exhibit 99.2

Mid-Year 2014 Business Update

August 27, 2014

1

Forward Looking Statements

Statements in this presentation relating to future plans, results, performance,

expectations, achievements and the like are considered “forward-looking statements.”

These forward-looking statements involve known and unknown risks and are subject to

change based on various factors and uncertainties that may cause actual results to differ

materially from those expressed or implied by those statements, including the impact of

the regulatory environment on our business and our ability to execute our business

strategy. Factors and uncertainties that may cause actual results to differ include but are

not limited to the risks disclosed in the Company’s filings with the SEC, as well as the risk

that the Company will not successfully implement the new plan, the risk that the

implementation of the new plan will be delayed, including as a result of labor and

employment laws, rules and regulations, the risk that the plan will not result in the

anticipated benefits or cost savings, the risk that the new plan will negatively impact the

Company’s ability to successfully operate its business or retain its key employees and the

risk that the Company’s plans for new product introductions will be successful. The

Company undertakes no obligation to revise or update any forward-looking statements

unless required by applicable law.

expectations, achievements and the like are considered “forward-looking statements.”

These forward-looking statements involve known and unknown risks and are subject to

change based on various factors and uncertainties that may cause actual results to differ

materially from those expressed or implied by those statements, including the impact of

the regulatory environment on our business and our ability to execute our business

strategy. Factors and uncertainties that may cause actual results to differ include but are

not limited to the risks disclosed in the Company’s filings with the SEC, as well as the risk

that the Company will not successfully implement the new plan, the risk that the

implementation of the new plan will be delayed, including as a result of labor and

employment laws, rules and regulations, the risk that the plan will not result in the

anticipated benefits or cost savings, the risk that the new plan will negatively impact the

Company’s ability to successfully operate its business or retain its key employees and the

risk that the Company’s plans for new product introductions will be successful. The

Company undertakes no obligation to revise or update any forward-looking statements

unless required by applicable law.

2

About Intersections Inc.

Intersections Inc. (Nasdaq: INTX) is a leading provider of identity risk management,

privacy protection and other subscription based services for consumers. Our core

services monitor personal information for our consumers, aggregate it into digestible,

consumer-friendly reports and alerts, and provide personalized education and support to

help our customers understand their information and take the actions they deem

appropriate. Since our business was founded in 1996, Intersections has protected the

identities of more than 36 million consumers. Over the last three years we have created,

and plan in the fourth quarter of 2014 to commence selling, a health monitoring service

for animals. This service will collect, store, analyze and deliver important information

regarding an animal’s health and will be supported by a robust cloud based information

system. To learn more, visit www.intersections.com.

privacy protection and other subscription based services for consumers. Our core

services monitor personal information for our consumers, aggregate it into digestible,

consumer-friendly reports and alerts, and provide personalized education and support to

help our customers understand their information and take the actions they deem

appropriate. Since our business was founded in 1996, Intersections has protected the

identities of more than 36 million consumers. Over the last three years we have created,

and plan in the fourth quarter of 2014 to commence selling, a health monitoring service

for animals. This service will collect, store, analyze and deliver important information

regarding an animal’s health and will be supported by a robust cloud based information

system. To learn more, visit www.intersections.com.

3

Mid-Year 2014 Business Update

4

► In our March 2014 Business Update we provided an initial glimpse into some of the

exciting initiatives we are working on to restore growth at Intersections.

exciting initiatives we are working on to restore growth at Intersections.

► As previously discussed, the large U.S. financial institutions have stopped marketing

add on products like ours. As a result, revenue from our private label subscriber base,

comprised primarily of subscribers from large U.S. financial institutions, has declined

from $274 million in FY 2011 to approximately $152 million estimated for FY 2014.

add on products like ours. As a result, revenue from our private label subscriber base,

comprised primarily of subscribers from large U.S. financial institutions, has declined

from $274 million in FY 2011 to approximately $152 million estimated for FY 2014.

► The purpose of this presentation is to provide an update on:

o Our ongoing plans to reorganize and refocus our product lines

o The progress of our product line growth initiatives

o Guidance on where we believe Intersections is headed in light of these changes and initiatives

Intersections’ New Strategic Vision

5

► We are transforming Intersections into the more dynamic, entrepreneurial and agile

marketing and product business discussed in our March 2014 Business Update.

marketing and product business discussed in our March 2014 Business Update.

► We are on the path to achieving our goals of:

o Focusing on our IDENTITY GUARD® brand as the growth engine for our identity theft and

privacy protection solutions through both new partners and directly to consumers

privacy protection solutions through both new partners and directly to consumers

o Continuing to provide top notch service for our existing private label subscriber base,

comprised mostly of our existing financial institution subscribers

comprised mostly of our existing financial institution subscribers

o Building our Canadian business lines through new products and new channels

o Launching our cutting edge VoyceTM product and becoming the leading player in the pet

health and wellness space

health and wellness space

o Reinvigorating our insurance business through new products and marketing channels

o Accelerating Captira Analytical’s efforts to transform the bail bond technology support space

Reshaping Intersections

6

► Working with a noted corporate transformation consulting firm we have

formulated and begun executing a detailed plan to streamline operations and

define our new operating model.

formulated and begun executing a detailed plan to streamline operations and

define our new operating model.

► This plan was carefully vetted to maximize positive cash flow, to comply with

existing agreements with our large U.S. financial institution partners, and to adhere

to regulatory and compliance requirements.

existing agreements with our large U.S. financial institution partners, and to adhere

to regulatory and compliance requirements.

► Key leadership changes have already been announced, and we are in the process of

making some reductions in overall staff and in our cost structure.

making some reductions in overall staff and in our cost structure.

► We expect our plan to streamline operations will generate cost savings of between

$15 and $19 million annualized by the end of 2015.

$15 and $19 million annualized by the end of 2015.

o We currently estimate charges of approximately $3.5 to $3.9 million for severance and related

restructuring fees, which largely will be recognized in the 3rd Quarter of 2014.

restructuring fees, which largely will be recognized in the 3rd Quarter of 2014.

Redirecting Intersections

7

► Defining our new operating model and refocusing our product lines and business

approach overall are as important as identifying cost savings opportunities.

approach overall are as important as identifying cost savings opportunities.

► We expect each product line to be managed by an executive with P&L responsibility.

► We expect the product lines to be:

o The IDENTITY GUARD® branded products in the U.S. and our Canadian branded products

o Our existing private label subscriber base, comprised primarily of U.S. financial institution

subscribers

subscribers

o Insurance products

o The VoyceTM product and other pet health and wellness services

o Bail bonds industry software solutions

8

Identity Guard® Product Line

► We offer our identity theft and privacy protection products through two established

brands, IDENTITY GUARD® in the U.S. and CREDIT ALERT® in Canada.

brands, IDENTITY GUARD® in the U.S. and CREDIT ALERT® in Canada.

► Together, we expect our IDENTITY GUARD® brand and Canadian product lines to end FY

2014 with approximately $78 million in revenue. By 2016 we expect revenue for these

product lines to grow in the range of approximately 150% to 190%.

2014 with approximately $78 million in revenue. By 2016 we expect revenue for these

product lines to grow in the range of approximately 150% to 190%.

► Our strategies include:

o Streamlining and re-organizing resources, IT systems and operational processes to improve

agility and ensure success

agility and ensure success

o Continuing to design solutions and source new products to uniquely solve consumers’ identity

and privacy protection needs

and privacy protection needs

o Increasing our successful direct-to-consumer marketing

o Expanding through new and existing partners and affiliates

o Enhancing our sales and distribution capabilities and discipline

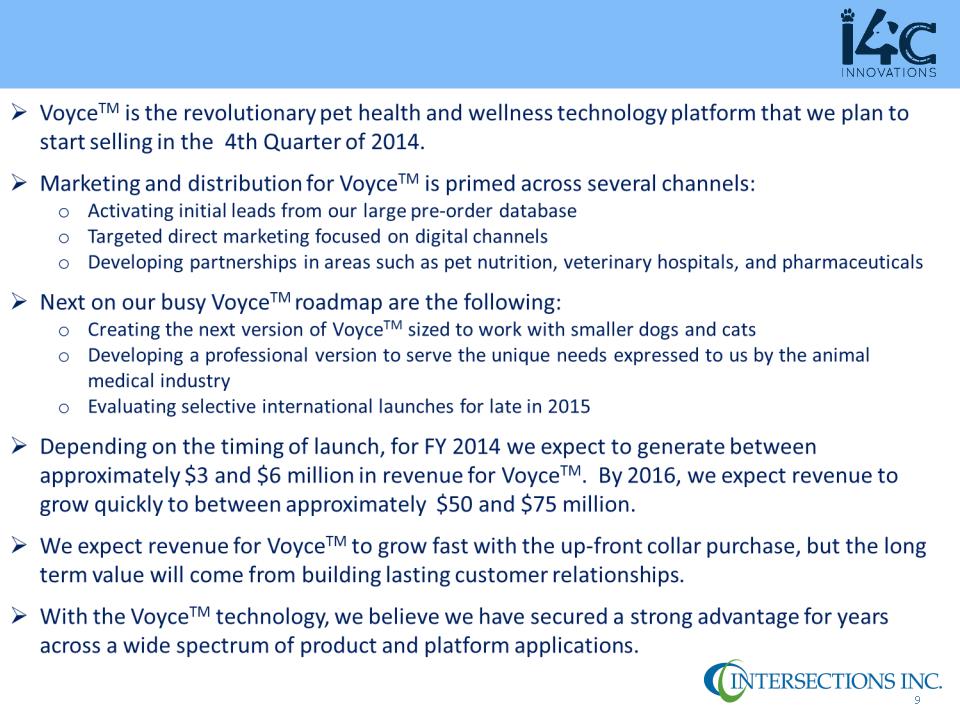

Pet Health and Wellness Product Line

10

Insurance Services Product Line

Ø We currently provide consumer services, including accidental death and disability

insurance plans and membership programs as part of our insurance services product line.

insurance plans and membership programs as part of our insurance services product line.

Ø We plan to re-energize growth in our insurance services through:

o Our recent launch of a pet insurance product called PetStrengthTM

o Launching more new insurance products

o Expanding marketing channels and adding new partners

Ø In 2014 we expect to generate approximately $17 million in revenue for our insurance

services. By 2016 we expect revenue to resume a growth trajectory after dipping in

2015.

services. By 2016 we expect revenue to resume a growth trajectory after dipping in

2015.

11

Bail Bonds Software Product Line

Ø Captira is a pioneer and the preeminent provider of software-as-a-service solutions to the

bail bond industry.

bail bond industry.

Ø Captira’s proprietary solutions provide easy and efficient ways for bail bondsmen, general

agents and sureties to organize and share data and make better underwriting decisions.

agents and sureties to organize and share data and make better underwriting decisions.

Ø Leveraging its existing software platform, Captira will be expanding into similarly

challenged and underserved related industries.

challenged and underserved related industries.

Ø We expect Captira’s revenue to grow from a forecasted $2.2 million in FY 2014 to

between approximately $5 and $6 million by FY 2016.

between approximately $5 and $6 million by FY 2016.

Ø We expect that this growth will come from:

o Continued penetration of bail bondsmen agencies

o Expanding to new related industries

Updated Guidance

12

We are lowering our prior revenue guidance primarily because:

– The launch date for VoyceTM has been delayed by approximately one quarter

– The sales ramp for IDENTITY GUARD® and new business is slower than originally expected

$ in Millions

2014 to 2015 Revenue Bridge (High Case)

13

$ in Millions

Our confidence and excitement in our product lines is the highest it has been for years.

2015 Adj. EBITDA Growth

14

Conclusion

15

► We like where we are in our continued transformation, and look forward to taking the

steps to reach and sustain profitability for each of our product lines.

steps to reach and sustain profitability for each of our product lines.

► We are entering 2015 with momentum.

► Execution of cost savings is straightforward and necessary.

► Given the resources needed to continue to transform Intersections and drive our

product line growth initiatives we will not be paying dividends in the near term.

product line growth initiatives we will not be paying dividends in the near term.

► In the future we expect to be in a position to provide more transparency and tracking

for all stakeholders so they may watch our progress.

for all stakeholders so they may watch our progress.

► We believe the end result will be a stronger, nimbler and more diversified Intersections,

less concentration overhang, and multiple product lines generating long-term profitable

growth.

less concentration overhang, and multiple product lines generating long-term profitable

growth.

Reconciliation of Non-GAAP Financial Measures (High Case)

16

Reconciliation of Non-GAAP Financial Measures (cont’d)

17

This presentation presents several Non-GAAP financial measures, which we believe are

important to investors and we utilize in managing our business. These Non-GAAP financial

measures should be reviewed in conjunction with the relevant GAAP financial measures

and are not presented as alternative measures of operating income, operating margin, net

income or earnings per share as determined in accordance with GAAP. Intersections'

Consolidated Financial Statements and reconciliations of these non-GAAP financial

measures to the most directly comparable GAAP financial measures and related notes can

be found in the "GAAP and Non-GAAP Measures" link under the "Investor & Media" page

on our website at www.intersections.com.

important to investors and we utilize in managing our business. These Non-GAAP financial

measures should be reviewed in conjunction with the relevant GAAP financial measures

and are not presented as alternative measures of operating income, operating margin, net

income or earnings per share as determined in accordance with GAAP. Intersections'

Consolidated Financial Statements and reconciliations of these non-GAAP financial

measures to the most directly comparable GAAP financial measures and related notes can

be found in the "GAAP and Non-GAAP Measures" link under the "Investor & Media" page

on our website at www.intersections.com.

Corporate Headquarters

Intersections Inc.

3901 Stonecroft Boulevard

Chantilly, VA 20151

Toll-free: 800.695.7536

www.intersections.com

Investor Relations

Eric S. Miller

IR@intersections.com

Tel: 703.488.6100