Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Tecnoglass Inc. | v387667_8k.htm |

Tecnoglass, Inc. (NASDAQ: TGLS; OTCBB: TGLSW) is a leading manufacturer of hi - spec, architectural glass and windows for the global residential and commercial construction industries. Located in Barranquilla, Colombia, Tecnoglass is the only Colombian - headquartered company listed on NASDAQ. • Tecnoglass believes it is the #1 glass transformation company in Colombia, with ~40% market share. • Glass Magazine ranked Tecnoglass as the second largest glass fabricator serving the U.S. market in 2013. • Tecnoglass serves 800+ customers in North, Central and South America; in 2013, ~ 36% of sales were to the U.S. • Tecnoglass is authorized to sell hurricane windows in Miami - Dade County, FL, one of the most demanding certifications in the world for manufacturers of windows and window frames. • Investing in manufacturing facilities in order to meet anticipated global demand: • $29 million capital improvement plan completed in 2013. • New construction underway that expands manufacturing facility footprint to 2.3 million square feet, and enhances internal manufacturing capabilities. • Significant growth (2012 - 2013) in revenue and Adjusted EBITDA, with continued growth expected in 2014. • Increased bonding capacity to $500 million on combined projects, $50 million on single projects. • July 2014 acquisition of selected assets of RC Aluminum Industries adds $70 million in backlog, as well as Miami - Dade Notice of Acceptance for more than 50 products manufactured and sold by RC Aluminum. Investment Highlights A. Lorne Weil, Non - Executive Chairman lorne.weil@tecnoglass.com Devin Sullivan Senior Vice President (212) 836 - 9608 dsullivan@equityny.co m José M. Daes, Chief Executive Officer jdaes@energiasolarsa.com $42.8 $47.9 $7.8 $1.3 Colombia United States Panama Other First Half 2014 Revenue Breakdown 43% 48% 8 % 1 % Christian Daes, Chief Operating Officer chris@tecnoglass.com Park Square at Doral (Miami, FL) Trump Plaza (Panama) South Dade Miami Cultural Arts Center (Miami, FL) The W Hotel (Ft. Lauderdale, FL) Miami Courthouse (Miami, FL) 4 Waterway Square (The Woodlands, TX) Aeropuerto El Dorado (Bogota) Representative Projects State - of - the - Art Facility

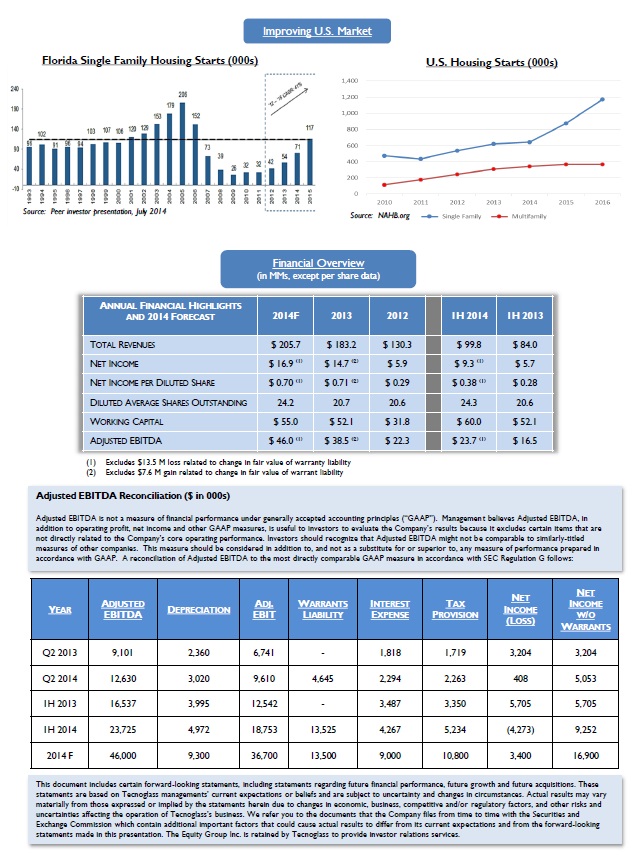

This document includes certain forward - looking statements, including statements regarding future financial performance, future g rowth and future acquisitions. These statements are based on Tecnoglass managements’ current expectations or beliefs and are subject to uncertainty and changes in circumstances. Actual results may vary materially from those expressed or implied by the statements herein due to changes in economic, business, competitive and/or regulatory factors, and other risks and uncertainties affecting the operation of Tecnoglass’s business. We refer you to the documents that the Company files from time to time with the Securities and Exchange Commission which cont ain additional important factors that could cause actual results to differ from its current expectations and from the forward - lookin g statements made in this presentation. The Equity Group Inc. is retained by Tecnoglass to provide investor relations services. Adjusted EBITDA Reconciliation ($ in 000s) Adjusted EBITDA is not a measure of financial performance under generally accepted accounting principles (“GAAP”). Managemen t b elieves Adjusted EBITDA, in addition to operating profit, net income and other GAAP measures, is useful to investors to evaluate the Com pany’s results because it excludes certain items that are not directly related to the Company’s core operating performance. Investors should re cognize that Adjusted EBITDA might not be com

parable to similarly - titled measures of other companies. This measure should be considered in a ddition to, and not as a substitute for or superior to, any measure of performance prepared in accordance with GAAP. A reconciliation of Ad justed EBITDA to the most directly comparable GAAP measure in accordance with SEC Regulation G follows: Financial Overview (in MMs, except per share data) A NNUAL F INANCIAL H IGHLIGHTS AND 2014 F ORECAST 2014F 2013 2012 1H 2014 1H 2013 T OTAL R EVENUES $ 205.7 $ 183.2 $ 130.3 $ 99.8 $ 84.0 N ET I NCOME $ 16.9 (1) $ 14.7 (2) $ 5.9 $ 9.3 (1) $ 5.7 N ET I NCOME PER D ILUTED S HARE $ 0.70 (1) $ 0.71 (2) $ 0.29 $ 0.38 (1) $ 0.28 D ILUTED A VERAGE S HARES O UTSTANDING 24.2 20.7 20.6 24.3 20.6 W ORKING C APITAL $ 55.0 $ 52.1 $ 31.8 $ 60.0 $ 52.1 A DJUSTED EBITDA $ 46.0 (1) $ 38.5 (2) $ 22.3 $ 23.7 (1) $ 16.5 (1) Excludes $13.5 M loss related to change in fair value of warranty liability (2) Excludes $7.6 M gain related to change in fair value of warrant liability Y EAR A DJUSTED EBITDA D EPRECIATION A DJ . EBIT W ARRANTS L IABILITY I NTEREST E XPENSE T AX P ROVISION N ET I NCOME (L OSS ) N ET I NCOME W / O W ARRANTS Q2 2013 9,101 2,360 6,741 - 1,818 1,719 3,204 3,204 Q2 2014 12,630 3,020 9,610 4,645 2,294 2,263 408 5,053 1H 2013 16,537 3,995 12,542 - 3,487 3,350 5,705 5,705 1H 2014 23,725 4,972 18,753 13,525 4,267 5,234 (4,273) 9,252 2014 F 46,000 9,300 36,700 13,500 9,000 10,800 3,400 16,900 Improving U.S. Market Source: Peer investor presentation, July 2014 Source: NAHB.org Florida Single Family Housing Starts (000s) U.S. Housing Starts (000s)