Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Norcraft Companies, Inc. | investorpresentation8k2q14.htm |

Norcraft Companies Investor Presentation August 2014

2 Disclaimer DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS: The information contained in this presentation is for informational purposes only. Certain information contained in this presentation, particularly information regarding future economic performance, finances, and expectations and objectives of management constitutes forward-looking statements. Forward- looking statements can be identified by the fact that they do not relate strictly to historical or current facts and generally contain words such as "believes," "expects," "may," "will," "should," "seeks," "approximately," "intends," "plans," "estimates" or "anticipates" or similar expressions. Our forward- looking statements are subject to risks and uncertainties, which may cause actual results to differ materially from those projected or implied by the forward-looking statement. Forward-looking statements are based on current expectations and assumptions and currently available data and are neither predictions nor guarantees of future events or performance. You should not place undue reliance on forward-looking statements, which speak only as of the date hereof. We do not undertake any responsibility to update or revise any forward-looking statements after they are made, whether as a result of new information, future events, or otherwise, except as required by applicable law. For a discussion of additional risks that you should consider before investing, you should review the “Risk Factors” section of the 10-K that we filed publicly with the Securities and Exchange Commission on March 31, 2014. Financial Measures highlighted in this presentation may be non-GAAP financial measures such as Earnings Before Interest Expense, Income Tax, Depreciation and Amortization (“EBITDA”), Adjusted EBITDA and Free Cash Flow. Comparable GAAP financial measures and a reconciliation of GAAP financial measures to non-GAAP financial measures are available in the Appendix to this presentation.

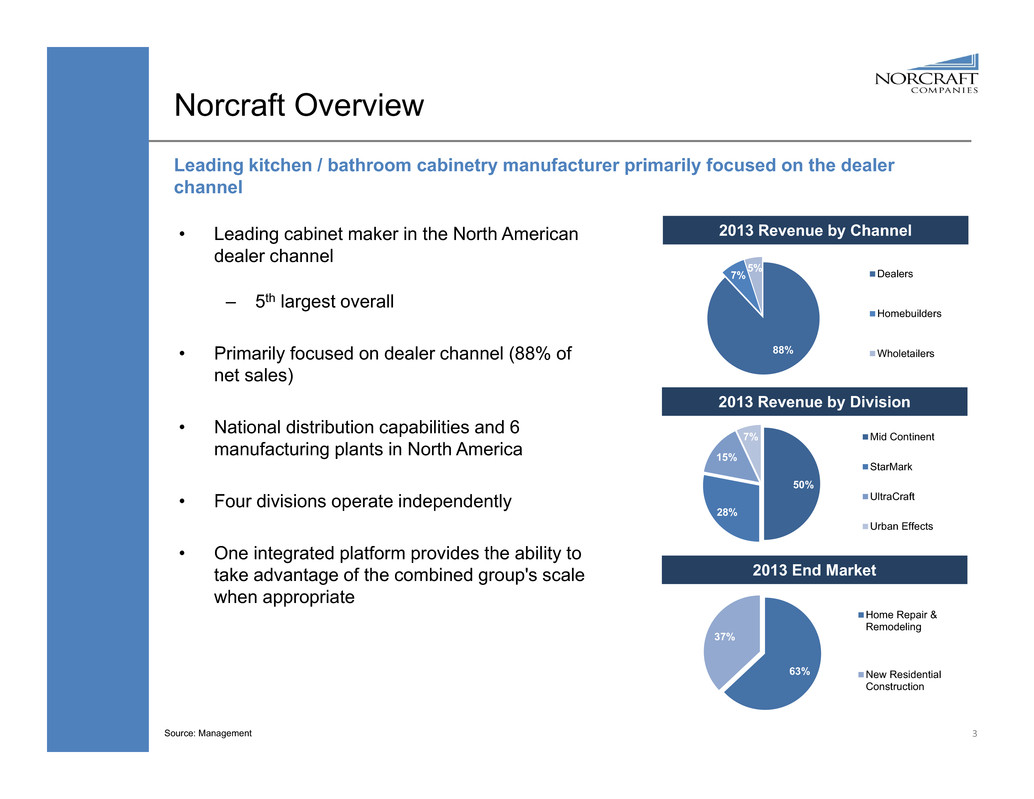

Norcraft Overview Leading kitchen / bathroom cabinetry manufacturer primarily focused on the dealer channel 3 • Leading cabinet maker in the North American dealer channel – 5th largest overall • Primarily focused on dealer channel (88% of net sales) • National distribution capabilities and 6 manufacturing plants in North America • Four divisions operate independently • One integrated platform provides the ability to take advantage of the combined group's scale when appropriate 2013 Revenue by Division 2013 End Market 50% 28% 15% 7% Mid Continent StarMark UltraCraft Urban Effects 63% 37% Home Repair & Remodeling New Residential Construction 2013 Revenue by Channel 88% 7% 5% Dealers Homebuilders Wholetailers Source: Management

Experienced & Aligned Management Team Name Years with Norcraft Years in Industry Position Mark Buller 10 25 Chairman and Chief Executive Officer Leigh Ginter 16 22 Chief Financial Officer Kurt Wanninger 8 15 President, Mid Continent John Swedeen 15 29 President, StarMark Simon Solomon 18 35 President, UltraCraft Phil Buller 10 18 General Manager, Urban Effects Mark Buller Kurt Wanninger Simon S lomon John Swedeen Phil Buller Leigh Ginter 4 • Highly experienced management team led by CEO Mark Buller, who has spent more than 25 years in the cabinet industry • The Buller family has been a leader (investing and managing) in the cabinet industry for over 40 years • Significant ownership position of the Company post-IPO Highlights

Culture and Track Record of Operational Excellence Strategic initiatives have resulted in industry leading EBITDA margins and consistently taking market share during the downturn and the early stages of the recovery 18.2% 15.4% 14.6% 14.9% 13.7% 11.7% 12.5% 13.0%12.5% 6.6% 2.5% -0.9% -0.9% 1.2% 5.1% 5.7% -5.0% 0.0% 5.0% 10.0% 15.0% 20.0% 2007 2008 2009 2010 2011 2012 2013 LTM 2Q 2014 NCFT Peers Historical Adjusted EBITDA Margins vs. Peers(1) (2) Source: Company filings. (1) Peers include cabinet segments or operations of publicly traded manufacturers (2) Please see Appendix for reconciliation of net income (loss) to Adjusted EBITDA 5 -10.5% -15.9% -25.6% 6.4% 2.6% 7.2% 17.6% 13.1% -11.5% -20.2% -26.4% -12.5% 5.7% 5.6% 15.1% 11.5% -35.0% -25.0% -15.0% -5.0% 5.0% 15.0% 25.0% 2007 2008 2009 2010 2011 2012 2013 LTM 2Q 2014 NCFT Peers Historical Sales Growth vs. Peers(1)

Recent Performance 6 • Net sales increased 8.1% YoY to $97.6 million in second quarter 2014 • Improving industry demand for quality cabinetry continues, but at a more subdued pace than originally expected • Implemented price increases of approximately 2% - 4% across all divisions • Adjusted EBITDA increased 18.2% YoY to $14.9 million in second quarter 2014 • EBITDA Margin increased 130 bps with improvement in both gross margin and SG&A • Continued to focus on profitable growth by walking away from ~25 thousand units of lower margin business • Interest expense down 66.4% YoY for full year 2014 • $2.2 million in second quarter 2014 vs. $6.5 million in prior year quarter • Full year 2014 projected to be $8.5 million vs. $25.3 million in 2013

Attractive Portfolio of Brands Comprehensive branded portfolio covering a large range of price points, styles, materials and customization levels Each brand represents a distinct product line with little to no overlap. Ability to aggressively market each brand to a broad range of customers 7 Division Mid Continent Cabinetry StarMark Cabinetry UltraCraft Cabinetry Urban Effects 2013 Sales $170 million $95 million $51 million $24 million % of Total 2013 Sales 50% 28% 15% 7% Year Established 1966 1978 1986 2007 Brands Average Price per Cabinet Signature Series: Medium Pro Series: Low Brookwood: High Fieldstone: High StarMark: Medium-High Destiny: High Vision: Medium Urban Effects: Medium Product Type Stock and Semi-custom Semi-custom Semi-custom Semi-custom Framed / Full Access Framed Framed Full Access Full Access Source: Management

Brand-Driven Organizational Structure Unique organizational structure provides the Company with a competitive advantage Norcraft’s Unique Organizational Advantage: Accountability Enhanced responsibility Focus Entrepreneurial culture Combined group synergies Mark Buller Chairman and CEO Leigh Ginter CFO Kurt Wanninger President John Swedeen President Simon Solomon President Phil Buller General Manager In contrast to Norcraft, competitors are organized by key responsibilities rather than by brand 8

Stock 45% Semi-Custom 47% Custom 8% Comprehensive and Differentiated Product Offering Focus on the larger stock and semi-custom cabinet segments offering a comprehensive product set across a variety of price points 2012 US Market Segmentation Stock 7% Semi-Custom 93% 2013 Norcraft Sales Mix Source: Freedonia, KCMA. Norcraft’s Target Market 9Source: Management, KCMA. (1) Market size as of 2011 Total Cabinet Market: $10.3 billion(1) Full Access 22% of Norcraft Sales Framed 78% of Norcraft Sales PRO Series Signature Series High Medium Low Pricing Tier

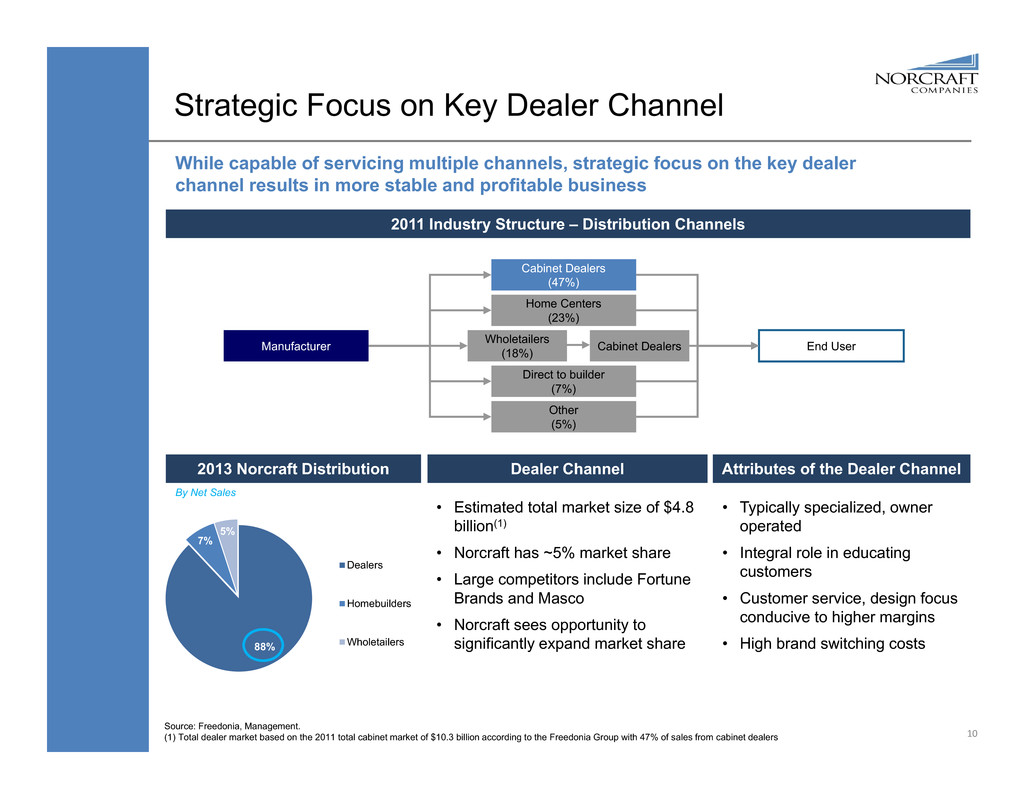

Strategic Focus on Key Dealer Channel 2013 Norcraft Distribution While capable of servicing multiple channels, strategic focus on the key dealer channel results in more stable and profitable business 88% 7% 5% Dealers Homebuilders Wholetailers 10 Source: Freedonia, Management. (1) Total dealer market based on the 2011 total cabinet market of $10.3 billion according to the Freedonia Group with 47% of sales from cabinet dealers Dealer Channel 2011 Industry Structure – Distribution Channels Manufacturer Home Centers (23%) End User Cabinet Dealers (47%) Wholetailers (18%) Direct to builder (7%) Other (5%) Attributes of the Dealer Channel • Typically specialized, owner operated • Integral role in educating customers • Customer service, design focus conducive to higher margins • High brand switching costs Cabinet Dealers By Net Sales • Estimated total market size of $4.8 billion(1) • Norcraft has ~5% market share • Large competitors include Fortune Brands and Masco • Norcraft sees opportunity to significantly expand market share

• Norcraft has a 95% customer retention rate(1) since 2012 • Top 50 customers have average tenure of over 14 years(2) 11 Unique Value Proposition Facilitates Entrenched Customer Relationships • Innovative products • Attractive programs and value proposition Value Proposition Maintains a large and diverse network of nearly 2,000 active customers including 1,700 cabinet dealers and wholetailers C u s t o m e r A c q u i s i t i o n • Outstanding customer service • Deliver the product on-time, complete with the right quality • Continually introduce innovative new products C u s t o m e r R e t e n t i o n • National network of sales representatives with deep customer relationships − 122 of Norcraft’s 130 sales representatives sell only one brand • In 2011 - 2012, Norcraft increased the sales force by 24% to meet increasing demand from market growth and share gains N a t i o n a l P l a t f o r m (1) Excludes customers with under $100,000 in sales (2) As of December 2013

Semi-Custom Market Share Expanding Committed to achieving profitable market share growth through a focus on customer service and new product introductions in the Semi-Custom market 12 • Sales growth in excess of the cabinet industry every year since 2009 • Maintaining industry leading margins • Increase share of wallet by winning greater share of business at existing customers • Win new customer accounts and expand geographic footprint • New product introductions • Focus on implementing price increases and reducing promos with improving market dynamics Highlights (1) Source: KCMA, Management 7.0% 3.5% 6.2% 19.9% 16.0% 0.7% 0.4% 5.6% 16.3% 13.4% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 2010 2011 2012 2013 LTM 2Q 2014 Consolidated NCFT Semi-Custom Sales Growth Industry Semi-Custom Sales Growth Sales Growth & Market Share +260 bps +60 bps +290 bps Represents Outperformance Relative to Industry +630 bps +360 bps

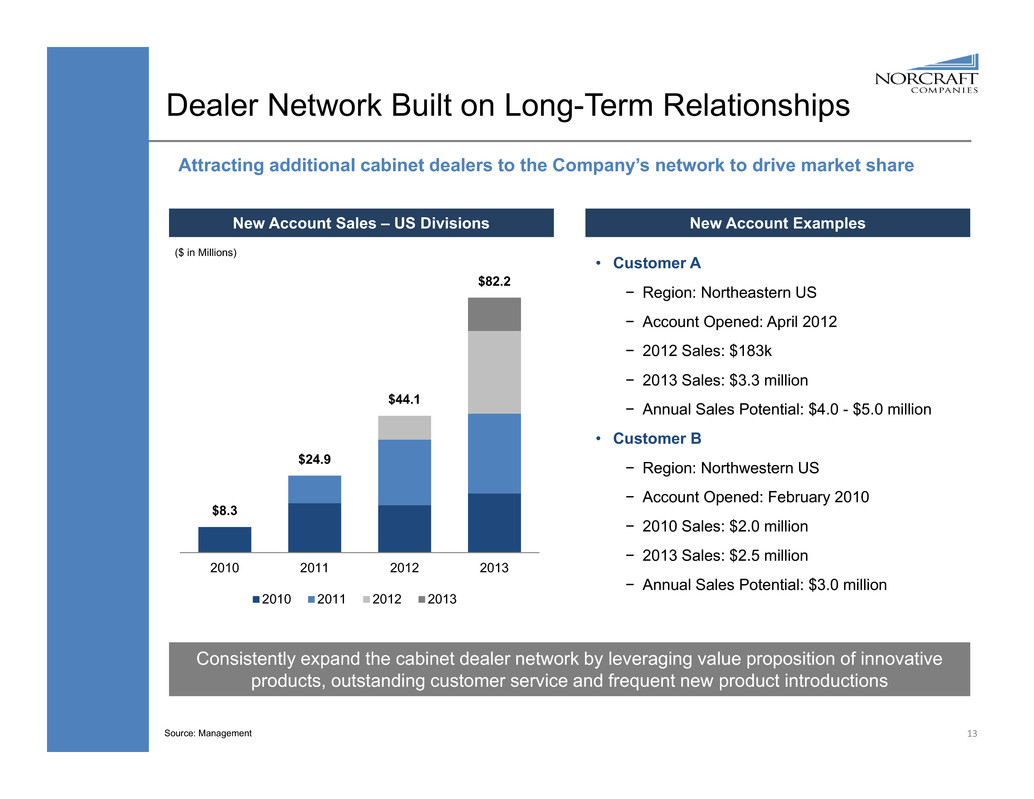

Dealer Network Built on Long-Term Relationships 13 New Account Sales – US Divisions ($ in Millions) Source: Management Attracting additional cabinet dealers to the Company’s network to drive market share Consistently expand the cabinet dealer network by leveraging value proposition of innovative products, outstanding customer service and frequent new product introductions New Account Examples • Customer A − Region: Northeastern US − Account Opened: April 2012 − 2012 Sales: $183k − 2013 Sales: $3.3 million − Annual Sales Potential: $4.0 - $5.0 million • Customer B − Region: Northwestern US − Account Opened: February 2010 − 2010 Sales: $2.0 million − 2013 Sales: $2.5 million − Annual Sales Potential: $3.0 million $8.3 $24.9 $44.1 $82.2 2010 2011 2012 2013 2010 2011 2012 2013

Product Innovation New Product Introduction Sales – US Divisions ($ in Millions) Source: Management Frequent and successful new product innovation drives organic growth % of sales 3.0% 12.1% 28.1% 34.0% 14 $7.8 $32.7 $81.2 $115.0 2010 2011 2012 2013 2010 2011 2012 2013

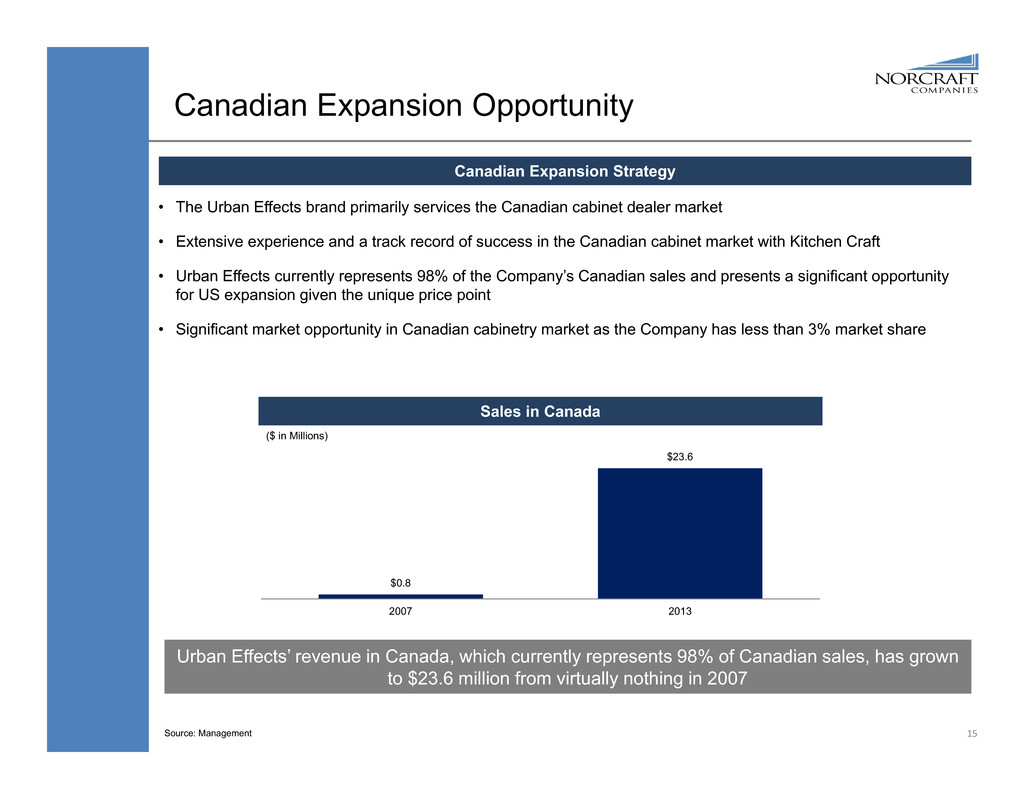

15 Canadian Expansion Opportunity Canadian Expansion Strategy • The Urban Effects brand primarily services the Canadian cabinet dealer market • Extensive experience and a track record of success in the Canadian cabinet market with Kitchen Craft • Urban Effects currently represents 98% of the Company’s Canadian sales and presents a significant opportunity for US expansion given the unique price point • Significant market opportunity in Canadian cabinetry market as the Company has less than 3% market share Urban Effects’ revenue in Canada, which currently represents 98% of Canadian sales, has grown to $23.6 million from virtually nothing in 2007 ($ in Millions) Sales in Canada $0.8 $23.6 2007 2013 Source: Management

16 Financial Overview $440.5 $394.0 $331.5 $246.8 $262.6 $269.3 $288.8 $339.7 $353.7 8.9% -10.5% -15.9% -25.6% 6.4% 2.6% 7.2% 17.6% 13.1% 2006 2007 2008 2009 2010 2011 2012 2013 LTM 2Q14 ($ in Millions) ($ in Millions) Net Sales & Growth Adjusted EBITDA & Margin(1) CapEx / Display Cabinets & Working Capital $79.5 $71.7 $51.2 $36.1 $39.0 $36.8 $33.7 $42.5 $45.8 18.0% 18.2% 15.4% 14.6% 14.9% 13.7% 11.7% 12.5% 13.0% 2006 2007 2008 2009 2010 2011 2012 2013 LTM 2Q14 ($ in Millions) Unlevered Free Cash Flow (1) (2) $71.3 $61.9 $49.9 $34.8 $33.6 $23.4 $25.5 $38.2 $40.1 16.2% 15.7% 15.0% 14.1% 12.8% 8.7% 8.8% 11.3% 11.3% 2006 2007 2008 2009 2010 2011 2012 2013 LTM 2Q14 Unlevered FCF Unlevered FCF (% of LTM Sales) 6.7% 6.4% 6.0% 6.3% 5.3% 7.5% 7.4% 5.1% 5.9% 2.9% 3.7% 2.1% 2.3% 2.5% 2.8% 2.6% 2.4% 2.4% 2006 2007 2008 2009 2010 2011 2012 2013 LTM 2Q14 Working Capital (% of LTM Sales) Capex/Display (% of LTM Sales) Source: Management (1) Please see appendix for reconciliation of net income (loss) to Adjusted EBITDA (2) Defined as Adjusted EBITDA less Capex/Display Cabinets and change in Working Capital

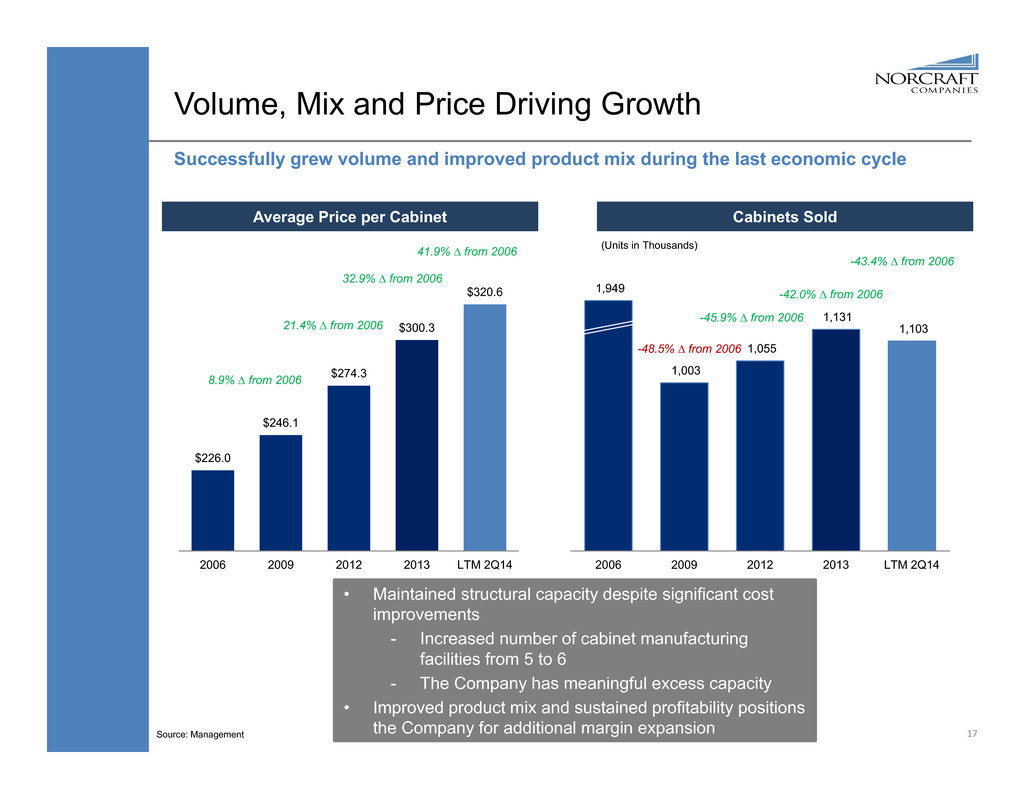

17 Successfully grew volume and improved product mix during the last economic cycle Mid Continent 50% $226.0 $246.1 $274.3 $300.3 $320.6 2006 2009 2012 2013 LTM 2Q14 41.9% ∆ from 2006 Average Price per Cabinet Cabinets Sold Volume, Mix and Price Driving Growth Source: Management 8.9% ∆ from 2006 21.4% ∆ from 2006 1,949 1,003 1,055 1,131 1,103 2006 2009 2012 2013 LTM 2Q14 -43.4% ∆ from 2006 (Units in Thousands) -48.5% ∆ from 2006 -45.9% ∆ from 2006 • Maintained structural capacity despite significant cost improvements - Increased number of cabinet manufacturing facilities from 5 to 6 - The Company has meaningful excess capacity • Improved product mix and sustained profitability positions the Company for additional margin expansion -42.0% ∆ from 2006 32.9% ∆ from 2006

18 Capital Structure Overview 3.2x 3.2x 4.0x 5.9x 5.3x 5.9x 6.4x 2.6x 2.3x 2006 2007 2008 2009 2010 2011 2012 2013 LTM 6/30/14 3.5x 3.0x 2.1x 1.4x 1.5x 1.4x 1.3x 4.9x 5.2x 2006 2007 2008 2009 2010 2011 2012 PF 2013 PF 6/30/14 Net Debt / Adjusted EBITDA(1) Adjusted EBITDA(1) / Cash Interest ($ in millions) 6/30/14 Coupon Maturity Cash $46.5 ABL Revolver 0.0 L+250 bps 2018 First Lien Term Loan 149.6 L+425 bps 2020 Total First-Lien Debt $149.6 Total Debt $149.6 Capital Structure • Norcraft has been able to reduce net leverage from 6.4x in 2012 to 2.3x as of 2Q 2014 • In November 2013, Norcraft entered into a new $150 million senior secured first lien term loan facility as well as a new $25 million senior secured first-lien ABL revolver • The Company was able to redeem its existing $240 million 10.5% second lien notes using net IPO proceeds as well as proceeds from the first lien term loan Source: Management (1) Please see appendix for reconciliation of net income (loss) to Adjusted EBITDA

Source: Management (1) Excludes $1.1 million of restructuring cost associated with initial public offering in 3Q13 (2) Excludes $1.5 million of restructuring cost associated with initial public offering in 2H13 (3) Please see appendix for reconciliation of net income (loss) to Adjusted EBITDA 19 Driving Improved Profitability Significant margin expansion opportunity 19.0% 11.7% 13.0% Peak (2007) Trough (2012) LTM 2Q14 Adjusted EBITDA Margin (3) Highly focused on increasing Adjusted EBITDA margin through a combination of leveraging fixed costs, operational improvements and improved product mix Recent strategic investments provide the capacity required in order to benefit from the increased sales from the housing recovery SG&A as Percentage of Sales 20.1% 17.6% 17.6% Peak (2009) Trough (3Q13 LTM) LTM 2Q14 (1) Margin Expansion Opportunity: • Leveraging improved cost structure • Capitalize on recent investments in sales force and manufacturing • Improved product mix Gross Margin 33.5% 25.3% 26.4% Peak (3Q07 LTM) Trough (2Q13 LTM) LTM 2Q14 (2)

20 Financial Results 1Q 13 1Q 14 2Q 13 2Q 14 2013 2Q 14 LTM Revenue $77.4 $84.0 $90.3 $97.6 $339.7 $353.7 YoY Change 14.0% 8.6% 19.1% 8.1% 17.6% 13.1% Gross Profit 19.8 21.5 24.2 27.0 89.0 93.5 Gross Margin 25.6% 25.6% 26.8% 27.7% 26.2% 26.4% SG&A(1) 13.9 14.7 15.2 15.9 60.8 62.4 SG&A % of Sales 17.9% 17.5% 16.8% 16.3% 17.9% 17.6% Adj. EBITDA(2) $9.5 $10.6 $12.6 $14.9 $42.5 $45.8 Adj. EBITDA Margin 12.3% 12.6% 13.9% 15.2% 12.5% 13.0% YoY Change 15.1% 11.1% 21.4% 18.2% 26.2% 23.4% ($ in Millions) Recent LTM Adjusted EBITDA by Quarters(2) ($ in Millions) Source: Management. (1) 3Q13 and 4Q13 exclude $1.1 and $0.4 million, respectively, of restructuring cost associated with the initial public offering (2) Please see appendix for a reconciliation of net income (loss) to Adjusted EBITDA $33.7 $34.9 $37.1 $40.4 $42.5 $45.8 11.7% 11.7% 11.9% 12.2% 12.5% 13.0% 4Q 12 1Q 13 2Q 13 3Q 13 4Q 13 2Q 14 LTM Adj. EBITDA Margin

21 Industry Growth Outlook in Housing, R&R and Cabinetry Demand Capitalizing on the continued recovery in the new housing construction and repair and remodeling markets Norcraft Revenues by End Market Housing Starts Repair & Remodeling $148 $141 $122 $115 $119 $125 $129 $134 $144 $151 $159 ($ in Billions) Source: FMI Construction Report 2006 2013 Repair & Remodel 63% New Construction 37% Repair & Remodel 48% New Construction 52% Source: Management Existing Home Sales 1,812 1,342 900 554 586 612 783 925 1,060 1,370 1,570 (Units in Thousands) Source: US Census Bureau and S&P Average new home starts per year from 1968 to 2012: 1.5 million 6.5 5.0 4.1 4.3 4.2 4.3 4.7 5.1 5.6 6.0 5.8 (Units in Millions) Source: Global Insight

(31%) (33%) (34%) (52%) (38%) (13%) 13% 33% 15% (21%) (22%) (19%) (17%) 1% 11% 20% 29% 32% 29% 41% 34% 25% 7% 1% (5%) 1Q08 3Q08 1Q09 3Q09 1Q10 3Q10 1Q11 3Q11 1Q12 3Q12 1Q13 3Q13 1Q14 While New Home Order Volumes are Moderating… Expiration of Federal Homebuyer Tax Credits 22 Homebuilder Order Trends Although homebuilder net new orders have been slowing, prices per unit have been increasing. Source: Company filings, Capital IQ (1) Includes homebuilders that have reported Q1 2014 earnings Median Year-over-Year Unit Change in Net New Orders for Public Homebuilders (1) …Average Prices Continue to Rise Median Year-over-Year Average Price Change in Backlog for Public Homebuilders (12%) (12%) (15%) (10%) (10%) (11%) (9%) (3%) (1%) 4% 5% (0%) (0%) (2%) 0% 2% 2% 5% 8% 10% 12% 13% 13% 13% 12% 1Q08 3Q08 1Q09 3Q09 1Q10 3Q10 1Q11 3Q11 1Q12 3Q12 1Q13 3Q13 1Q14 (1)

Appendix 23

Company History • Norcraft raised $118 million in an Initial Public Offering in November 2013 • Norcraft has been able to outperform its peers in terms of market share and EBITDA margin largely driven by continual product line refinement and cost initiatives throughout the economic downturn • Omega Cabinets sold to Fortune Brands for $538 million. Mark subsequently left the company • Norcraft acquired the StarMark and Fieldstone brands with the acquisition of StarMark, Inc. to expand its product offering and customer base through the addition of a semi-custom framed cabinetry line • Marshall Millworks, Inc. founded in Minnesota • For the next 32 years, Marshall Millworks sold its products under the Mid Continent brand • Norcraft transitioned its Winnipeg plant from a component manufacturer providing door and frame parts for the Mid Continent division to the complete full access cabinet line product manufacturer for the Urban Effects division in Canada • Marshall Millworks subsequently changed its name to Norcraft Companies, Inc. • Mark Buller became president of Kitchen Craft • Herb Buller, the father of Mark Buller, co-founded Kitchen Craft, a Canadian cabinetry maker, beginning the long history of Buller family management in the cabinet industry • Kitchen Craft acquired by Omega Cabinets. Mark Buller eventually appointed CEO of Omega • Mark Buller, together with his family and senior management, SKM Equity Fund III and Trimaran Fund II, acquired Norcraft from the then-existing unitholders, issuing public debt as part of the acquisition Buller Family History Norcraft History • Norcraft acquired The UltraCraft Company, located in Liberty, North Carolina to expand its product offering and customer base through the addition of a semi-custom full access cabinetry line 1966 1971 1996 1998 2000 2002 2003 2007 1999 2007 ‐ Present 24

25 Non-GAAP Reconciliations Source: Management Figures may not add up to totals due to rounding FY Quarter LTM 2006 2007 2008 2009 2010 2011 2012 2013 6/30/13 6/30/14 6/30/13 9/30/13 3/31/14 6/30/14 Net Income (Loss) $39.5 $29.2 ($68.0) ($11.5) ($2.3) ($6.7) ($9.6) ($15.2) $1.8 $4.8 ($6.0) ($3.7) ($11.5) ($8.5) Interest Expense, net 22.7 23.6 24.7 26.3 25.3 25.7 25.8 25.3 6.5 2.2 25.8 25.8 21.0 16.7 Depreciation 4.7 5.5 6.3 5.8 5.7 4.9 4.7 4.3 1.1 1.0 4.5 4.5 4.3 4.2 Taxes ‐ ‐ ‐ ‐ ‐ ‐ ‐ 1.0 ‐ 1.2 ‐ ‐ 1.5 2.6 Amortization of deferred financing costs 1.5 1.5 1.5 4.1 1.6 3.0 3.1 3.0 0.8 0.2 3.1 3.1 2.4 1.7 Amortization of customer relationships 4.5 4.5 4.5 4.5 4.5 4.5 4.5 4.5 1.1 1.1 4.5 4.5 4.5 4.5 Display cabinet amortization 5.6 6.7 7.1 5.3 4.1 4.0 4.1 4.3 1.1 1.1 4.2 4.2 4.3 4.3 Other, net 0.1 0.2 0.1 ‐ 0.0 0.1 ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ EBITDA $78.5 $71.1 ($23.8) $34.6 $39.0 $35.6 $32.7 $27.2 $12.3 $11.5 $36.1 $38.4 $26.4 $25.5 Supplemental adjustments Charge for impairment of goodwill and brand names ‐ ‐ 73.9 ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ Gain on sales and use tax refund ‐ ‐ ‐ (1.1) (1.0) ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ Loss on debt extinguishment ‐ ‐ ‐ 1.6 ‐ 0.2 ‐ 12.5 ‐ ‐ ‐ ‐ 12.5 12.5 Gain on insurance proceeds ‐ (0.4) ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ Restructuring cost associated with contemplated initial public offering ‐ ‐ ‐ ‐ ‐ ‐ ‐ 1.5 ‐ ‐ ‐ 1.1 1.5 1.5 Management Fee 1.0 1.0 1.0 1.0 1.0 1.0 1.0 0.9 0.3 ‐ 1.0 1.0 0.6 0.4 Expense related tax receivable agreements ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ 2.8 0 0 1.6 4.5 Stock Compensation Charge ‐ ‐ ‐ ‐ ‐ ‐ ‐ 0.3 ‐ 0.5 ‐ ‐‐ 0.9 1.4 Adjusted EBITDA $79.5 $71.7 $51.2 $36.1 $39.0 $36.8 $33.7 $42.5 $12.6 $14.9 $37.1 $40.4 $43.5 $45.8 ($ in Millions) Reconciliation of Net Income (Loss) to Adjusted EBITDA

Historical Free Cash Flow Profile 26 Source: Management Figures may not add up to totals due to rounding (1) Please see appendix for a reconciliation of net income (loss) to Adjusted EBITDA $ in Millions 2006 2007 2008 2009 2010 2011 2012 2013 LTM 6/30/14 Adjusted EBITDA(1) $79.5 $71.7 $51.2 $36.1 $39.0 $36.8 $33.7 $42.5 $45.8 Less: Capex/Displays (12.7) (14.7) (7.1) (5.7) (6.5) (7.4) (7.4) (8.1) (8.5) Change in Working Capital 4.5 4.9 5.7 4.4 1.0 (5.9) (0.7) 3.9 2.8 Unlevered Free Cash Flow $71.3 $61.9 $49.9 $34.8 $33.6 $23.4 $25.5 $38.2 $40.1 Less: Cash Interest Expense (22.7) (23.6) (24.7) (26.3) (25.3) (25.7) (25.8) (25.3) (16.7) Less: Taxes - - - - - - - (1.0) (2.7) Change in Accrued Interest Payable - 0.1 3.8 (3.2) (0.4) (4.4) (0.1) (0.9) (1.4) Free Cash Flow $48.6 $38.3 $29.0 $5.3 $7.9 ($6.7) ($0.4) $11.0 $19.3 Net Debt / Adjusted EBITDA(1) 3.2x 3.2x 4.0x 5.9x 5.3x 5.9x 6.4x 2.6x 2.3x 2006 2007 2008 2009 2010 2011 2012 2013 LTM 6/30/14