Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT - NORTHSTAR REALTY FINANCE CORP. | exhibit993-griffinroo3year.htm |

| EX-99.2 - EXHIBIT - NORTHSTAR REALTY FINANCE CORP. | exhibit992-griffin10q.htm |

| EX-99.1 - EXHIBIT - NORTHSTAR REALTY FINANCE CORP. | exhibit991-griffin10ka.htm |

| EX-99.5 - EXHIBIT - NORTHSTAR REALTY FINANCE CORP. | exhibit995-giffinproformar.htm |

| EX-23.1 - EXHIBIT - NORTHSTAR REALTY FINANCE CORP. | exhibit231-consent.htm |

| EX-99.4 - EXHIBIT - NORTHSTAR REALTY FINANCE CORP. | exhibit994-griffinroo3and6.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 19, 2014

NorthStar Realty Finance Corp.

(Exact name of registrant as specified in its charter)

Maryland (State or other jurisdiction of incorporation) | 001-32330 (Commission File Number) | 02-0732285 (I.R.S. Employer Identification No.) | ||

399 Park Avenue, 18th Floor, New York, NY | 10022 | |

(Address of principal executive offices) | (Zip Code) | |

(212) 547-2600

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

ý Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01. Other Events.

This Current Report on Form 8-K is being filed by NorthStar Realty Finance Corp., a Maryland corporation (the “Company” or “NorthStar”), to provide certain financial information with respect to Griffin-American Healthcare REIT II, Inc., a Maryland corporation (“Griffin-American”), and the Company’s pending acquisition of Griffin-American. As previously disclosed in its Current Report on Form 8-K filed on August 5, 2014, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Griffin-American, Griffin-American Healthcare REIT II Holdings, LP, a Delaware limited partnership (“Griffin-American Operating Partnership”), NRF Healthcare Subsidiary, LLC, a Delaware limited liability company and direct wholly owned subsidiary of the Company (“Merger Sub”), and NRF OP Healthcare Subsidiary, LLC, a Delaware limited liability company and direct wholly owned subsidiary of Merger Sub (“Partnership Merger Sub”), pursuant to which Griffin-American will be merged with and into Merger Sub (the “Parent Merger”) and Partnership Merger Sub will merge with and into Griffin-American Operating Partnership (the “Partnership Merger” and, together with the Parent Merger, the “Merger”), with Merger Sub continuing as the surviving entity of the Merger and Griffin-American Operating Partnership continuing as the surviving entity of the Partnership Merger. The Merger Agreement was unanimously approved by the boards of directors of both the Company and Griffin-American.

Griffin-American was formed as a Maryland corporation on January 7, 2009. Griffin-American invests in a diversified portfolio of real estate properties, focusing primarily on medical office buildings and healthcare-related facilities. Griffin-American has also strategically originated loans and may acquire secured loans and other real estate-related investments. Griffin-American also operates healthcare-related facilities utilizing the structure permitted by the REIT Investment Diversification and Empowerment Act of 2007, which is commonly referred to as a “RIDEA” structure. Griffin-American generally seeks investments that produce current income. Griffin-American qualified and elected to be taxed as a REIT under the Internal Revenue Code of 1986, as amended, beginning with its taxable year ended December 31, 2010.

Griffin-American was initially capitalized on February 4, 2009. Griffin-American commenced an initial public offering of shares of Griffin-American common stock on August 24, 2009, which was terminated on February 14, 2013, and commenced a follow-on public offering on February 14, 2013, which was terminated on October 30, 2013.

The Combined Company

Following the closing of the Merger, the Company will have approximately $10 billion of owned real estate, representing approximately 75% of its assets on a pro forma basis and it will continue to pursue a strategy of acquiring diversified commercial real estate (“CRE”) investments that produce attractive risk adjusted returns.

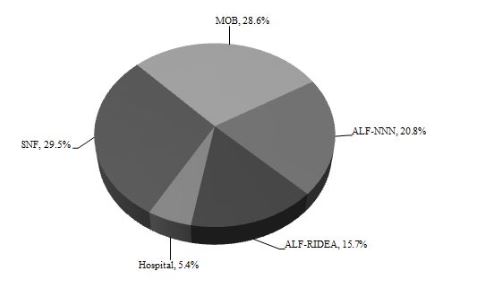

The Company believes the Merger will create a best in class healthcare real estate portfolio with substantial size, stability and diversification. On a pro forma basis, the Company’s portfolio of healthcare assets will be located throughout the United States and the United Kingdom and will be diversified by asset class as reflected below:

Healthcare by Property Type(1) |

|

(1) Based on net cash flow. |

The Company further believes the Merger will create a healthcare portfolio that produces a stable long-term cash flow stream and will enhance the safety and predictability of its dividend while maintaining opportunities for growth. The Merger will expand the Company’s relationships with tenants and operators within the current Griffin-American network and, as has been its experience in the past, the Company expects these relationships to produce future acquisition and development opportunities. Finally, the Merger expands the Company’s ability to unlock asset and enterprise value through strategic transactions that it may consider in the future.

Summary of Business

The Company’s primary businesses following the Merger will be consistent with its primary businesses before the Merger and are summarized as follows:

• | Real Estate - NorthStar’s real estate business concentrates on various types of investments in commercial real estate located throughout the United States that include healthcare, manufactured housing communities, hotel, net lease and multifamily properties. In addition, NorthStar’s real estate business includes PE Investments (as described further below) diversified by property type and geography. |

• | Healthcare - NorthStar’s healthcare properties will constitute 58.2% of its owned real estate following the Merger and are described in more detail above. |

• | Manufactured Housing - NorthStar’s manufactured housing communities portfolio focuses on owning pad rental sites located throughout the United States. |

• | Hotel - NorthStar’s hotel portfolio is a geographically diverse portfolio primarily comprised of extended stay hotels and premium branded select service hotels located primarily in major metropolitan markets with the majority affiliated with top hotel brands. |

• | Net Lease - NorthStar’s net lease properties, outside of its healthcare portfolio, are primarily office, industrial and retail properties typically under net leases to corporate tenants. |

• | Multifamily - NorthStar’s multifamily portfolio primarily focuses on owning properties located in suburban markets that are best suited to capture the formation of new households. |

• | PE Investments - NorthStar’s real estate business also includes investments (directly or indirectly in joint ventures) owning limited partnership interests in real estate private equity funds (“PE Investments”) managed by institutional quality sponsors and diversified by property type and geography. |

• | Commercial Real Estate Debt - NorthStar’s CRE debt business is focused on originating, structuring, acquiring and managing senior and subordinate debt investments secured primarily by commercial real estate and includes first mortgage loans, subordinate interests, mezzanine loans and preferred equity interests. NorthStar may from time to time take title to collateral in connection with a CRE debt investment as real estate owned, which would be included in its CRE debt business. |

• | Commercial Real Estate Securities - NorthStar’s CRE securities business is predominantly comprised of N-Star collateralized debt obligation (“CDO”) bonds and N-Star CDO equity of its deconsolidated N-Star CDOs and includes other securities which are mostly conduit commercial mortgage-backed securities (“CMBS”), meaning each asset is a pool backed by a large number of commercial real estate loans. NorthStar also invests in opportunistic CRE securities such as an investment in a “B-piece” CMBS. |

The Company has the ability to invest in a broad spectrum of commercial real estate assets and seeks to provide attractive risk-adjusted returns. Its ability to invest across the CRE market creates complementary and overlapping sources of investment opportunities based upon common reliance on real estate fundamentals and application of similar portfolio management skills to maximize value and to protect capital. Additionally, the Company may pursue opportunistic investments across all of its business lines including CRE equity and debt investments. Examples of opportunistic investments include PE Investments, strategic joint ventures and repurchasing its CDO bonds at a discount to their principal amount.

The Company’s financing strategy focuses on match funding its assets and liabilities by having similar maturities and like-kind interest rate benchmarks (fixed or floating) to manage refinancing and interest rate risk. In terms of its CRE debt and securities investments and its real estate portfolio, the Company pursues a variety of financing arrangements such as securitization financing transactions, credit facilities, mortgage notes and other term borrowings. The amount of the Company’s borrowings depends upon the nature and credit quality of its assets, the structure of its financings and where possible, the Company seeks to limit its reliance on recourse borrowings. The Company’s real estate portfolio is predominantly financed with non-recourse, non-mark-to-market mortgage notes.

The Company believes that it maintains a competitive advantage through a combination of deep industry relationships and access to market leading CRE credit underwriting and capital markets expertise which enables it to manage credit risk across its business lines as well as to structure and finance its assets efficiently. The Company’s ability to invest across the spectrum of commercial real estate investments allows it to take advantage of complementary and overlapping sources of investment opportunities based on a common reliance on CRE fundamentals and application of similar underwriting and asset management skills as it seeks to maximize stockholder value and to protect its capital.

The financial statements listed under Item 9.01(a) are filed as part of this Current Report on Form 8-K.

Also included in this filing as Exhibits 99.3 and 99.4 are Griffin-American’s Results of Operations for the periods described in Item 9.01(a) below, and included as Exhibit 99.5 is the pro forma financial information described in Item 9.01(b) below, respectively.

Cautionary Statement Regarding Forward-Looking Statements

Certain items in this Current Report on Form 8-K may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which can be identified by words like “may,” “should,” “potential,” “expect,” “anticipate,” “estimate,” “believe,” “could,” “project,” predict,” “continue,” “will,” “would,” “seek,” “future,” “intends” and similar expressions, including statements about future results, projected yields, rates of return and performance, projected cash available for distribution, projected cash from any single source of investment or fee stream, projected expenses, expected and weighted average return on equity, market and industry trends, investment opportunities, business conditions and other matters. These statements are based on management’s current expectations and beliefs and are subject to a number of trends and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements; the Company can give no assurance that its expectations will be attained. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions underlying any forward-looking statements will not materialize or will vary significantly from actual results. Variations of assumptions and results may be material. The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement; (2) the inability to complete the Merger or failure to satisfy other conditions to completion of the Merger; (3) the inability to complete the Merger within the expected time period or at all, including due to the failure to obtain the Griffin-American stockholder approval, the Company’s stockholder approval or the failure to satisfy other conditions to completion of the Merger, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the Merger; (4) risks related to disruption of management’s attention from the ongoing business operations due to the Merger; (5) the effect of the announcement of the Merger on the Company’s or Griffin-American’s relationships with their respective customers, tenants, lenders, operating results and businesses generally; (6) the scalability of the Company’s investment platform, in particular, the healthcare real estate portfolio; (7) the size and timing of offerings or capital raises; (8) the performance of Griffin-American’s portfolio and the Company’s healthcare real estate portfolio generally; (9) the ability to execute upon, and realize any benefits from, potential value creation opportunities through strategic transactions and relationships in the future or at all; (10) the stability of long-term cash flow streams; (11) the ability to enhance dividend safety and growth potential; (12) the ability to achieve multiple expansion; (13) the ability to achieve EBITDAR coverage, dividend yields and implied cap rates similar to other diversified healthcare REITs or at all; (14) the projected net operating income of the Company’s portfolio and Griffin-American’s portfolio and associated cap rate, including the ability to achieve the growth, obtain the lease payments and step ups in contractual lease payments, and maintain dividend payments, at current or anticipated levels, or at all; (15) the ability to opportunistically participate in commercial real estate refinancings; (16) the ability to realize upon attractive investment opportunities; (17) the Company’s ability to finance the Merger; (18) the Company’s future cash available for distribution; and (19) the projected returns on, and cash earned from, investments, including investments funded by drawings from the Company’s credit facility and securities offerings. The Company does not guarantee that the assumptions underlying such forward-looking statements are free from errors. The Company undertakes no obligation to publicly update any information whether as a result of new information, future events, or otherwise. Additional factors that could cause actual results to differ materially from those in the forward-looking statements are specified in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013, and its other filings with the Securities and Exchange Commission and Griffin-American’s Annual Report on Form 10-K for the year ended December 31, 2013, and its other filings with the SEC. Such forward-looking statements speak only as of the date of this Current Report on Form 8-K. The Company expressly disclaims any obligation to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in its expectations with regard thereto or change in events, conditions or circumstances on which any statement is based.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

This document relates to a proposed transaction between the Company and Griffin-American, which will become the subject of a registration statement and joint proxy statement/prospectus forming a part thereof to be filed with the SEC by the Company. This document is not a substitute for the registration statement and joint proxy statement/prospectus that the Company will file with the SEC or any other documents that it may file with the SEC or send to shareholders in connection with the proposed transaction. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED

TRANSACTION AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

You will be able to obtain a free copy of the joint proxy statement/prospectus, as well as other filings containing information about the Company and Griffin-American, at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, in the Investor Relations portion of the Company’s website at http://www.nrfc.com under the heading “Investor Relations” and then under “SEC Filings” and copies of the documents filed by Griffin-American with the SEC are available free of charge on Griffin-American’s website at http://www.griffincapital.com/griffin-american-healthcare-reit-ii under the heading “News and SEC Filings” and then under “SEC Filings”.

Participants in Solicitation

The Company, Griffin-American and their respective directors and executive officers and certain members of management and employees may be deemed to be participants in the solicitation of proxies from the stockholders of the Company and Griffin-American in connection with the proposed transaction. Information about the directors and executive officers of the Company and their ownership of Company common stock is set forth in the Company’s Annual Report on Form 10-K, as amended, for the year ended December 31, 2013. Information about the directors and executive officers of Griffin-American and their ownership of Griffin-American common stock is set forth in the proxy statement for Griffin-American’s 2013 annual meeting of stockholders, as filed with the SEC on Schedule 14A on September 23, 2013. Additional information regarding the interests of those persons and other persons who may be deemed participants in the proposed transaction may be obtained by reading the joint proxy statement/prospectus regarding the proposed transaction when it becomes available. You may obtain free copies of this document as described in the preceding paragraph.

Item 9.01. Financial Statements and Exhibits.

(a) Financial Statements

Audited consolidated financial statements of Griffin-American Healthcare REIT II, Inc. comprised of consolidated balance sheets as of December 31, 2013 and 2012, and the related consolidated statements of operations and comprehensive income (loss), equity and cash flows for each of the three years in the period ended December 31, 2013, the notes related thereto, the financial statement schedule for the year ended December 31, 2013 and the Report of the Independent Registered Public Accounting Firm, attached as Exhibit 99.1 hereto.

Unaudited condensed consolidated financial statements of Griffin-American Healthcare REIT II, Inc. comprised of condensed consolidated balance sheets as of June 30, 2014, the condensed consolidated statements of operations and comprehensive income for the three and six months ended June 30, 2014 and 2013, the condensed consolidated statements of equity for the six months ended June 30, 2014 and the condensed consolidated statements of cash flows for the six months ended June 30, 2014 and 2013 and the notes related thereto, attached as Exhibit 99.2 hereto.

(b) Pro Forma Financial Information.

The following unaudited pro forma condensed consolidated financial information of the Company and its subsidiaries, giving effect to the Merger and the spin-off of the Company's asset management business into a separate publicly-traded company, NorthStar Asset Management Group Inc. (NYSE: NSAM), is included in Exhibit 99.5 hereto:

• | Unaudited Pro Forma Condensed Consolidated Balance Sheet of NorthStar Realty Finance Corp. and subsidiaries as of June 30, 2014 |

• | Unaudited Pro Forma Condensed Consolidated Statement of Operations of NorthStar Realty Finance Corp. and subsidiaries, for the year ended December 31, 2013 |

• | Unaudited Pro Forma Condensed Consolidated Statement of Operations of NorthStar Realty Finance Corp. and subsidiaries, for the six months ended June 30, 2014 |

• | Notes to Unaudited Pro Forma Condensed Consolidated Financial Statements of NorthStar Realty Finance Corp. and subsidiaries |

(d) Exhibits.

Exhibit Number | Description | |

23.1 | Consent of Ernst & Young LLP | |

99.1 | Audited consolidated financial statements of Griffin-American Healthcare REIT II, Inc. as of December 31, 2013 and December 31, 2012 and for each of the three years in the period ended December 31, 2013, the notes related thereto, the financial statement schedule for the year ended December 31, 2013 and the Report of the Independent Registered Public Accounting Firm, from its Annual Report on Form 10-K for the year ended December 31, 2013 | |

99.2 | Unaudited condensed consolidated financial statements of Griffin-American Healthcare REIT II, Inc. for the three and six months ended June 30, 2014 and June 30, 2013 and the notes related thereto, from its Quarterly Report on Form 10-Q for the quarter ended June 30, 2014 | |

99.3 | Results of Operations of Griffin-American Healthcare REIT II, Inc. for the three years ended December 31, 2013 from its Annual Report on Form 10-K for the year ended December 31, 2013 | |

99.4 | Results of Operations of Griffin-American Healthcare REIT II, Inc. for the three and six months ended June 30, 2014 and 2013 from its Quarterly Report on Form 10-Q for the quarter ended June 30, 2014 | |

99.5 | Unaudited Pro Forma Condensed Consolidated Financial Information of NorthStar Realty Finance Corp. | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

NorthStar Realty Finance Corp. (Registrant) | ||

Date: August 19, 2014 | By: | /s/ Ronald J. Lieberman |

Ronald J. Lieberman Executive Vice President, General Counsel and Secretary | ||

EXHIBIT INDEX

Exhibit Number | Description | |

23.1 | Consent of Ernst & Young LLP | |

99.1 | Audited consolidated financial statements of Griffin-American Healthcare REIT II, Inc. as of December 31, 2013 and December 31, 2012 and for each of the three years in the period ended December 31, 2013, the notes related thereto, the financial statement schedule for the year ended December 31, 2013 and the Report of the Independent Registered Public Accounting Firm, from its Annual Report on Form 10-K for the year ended December 31, 2013 | |

99.2 | Unaudited condensed consolidated financial statements of Griffin-American Healthcare REIT II, Inc. for the three and six months ended June 30, 2014 and June 30, 2013 and the notes related thereto, from its Quarterly Report on Form 10-Q for the quarter ended June 30, 2014 | |

99.3 | Results of Operations of Griffin-American Healthcare REIT II, Inc. for the three years ended December 31, 2013 from its Annual Report on Form 10-K for the year ended December 31, 2013 | |

99.4 | Results of Operations of Griffin-American Healthcare REIT II, Inc. for the three and six months ended June 30, 2014 and 2013 from its Quarterly Report on Form 10-Q for the quarter ended June 30, 2014 | |

99.5 | Unaudited Pro Forma Condensed Consolidated Financial Information of NorthStar Realty Finance Corp. | |