Attached files

| file | filename |

|---|---|

| 8-K - ROSE 8K IR AUGUST PRESENTATION - NBL Texas, LLC | rose8k_iraugpresentation.htm |

Rosetta Resources Inc.

Investor Presentation

Investor Presentation

August 2014

PERMIAN BASIN + EAGLE FORD

Cautionary Statements

2

|

Test Future

Growth Opportunities to Expand Inventory |

• Advancing delineation of Delaware Basin multi-stacked lateral potential

• Refining and expanding testing of Upper Eagle Ford pilots

• Assessing Gaines County acreage in Midland Basin

• Pursuing new growth targets through bolt-on acquisitions in core areas

|

|

|

|

|

|

|

|

Successfully

Execute Business Plan

|

• Grow total production and liquids volumes while applying cross-basin

knowledge • Continue to improve performance of drilling and completion operations

• Maintain competitive overall cost structure and margins

• Capture firm transportation and processing capacity

|

|

|

|

|

|

|

|

Maintain

Financial Strength

& Flexibility |

• Actively manage strong balance sheet for optimum financial flexibility

• Maintain adequate liquidity throughout cycles

• Manage exposure to commodity price risk through prudent hedging

program |

|

|

|

Company Strategy - Key Elements

3

Rosetta Resources Overview

Permian

Gaines Co. ~13,000 net acres

Midland Basin - Exploratory

Reeves Co. ~47,000 net acres

Delaware Basin - Delineating

Permian

Eagle Ford

~60,000 net acres (100% operated)

Central Dimmit Co. Area

~8,500 net acres, Dimmit Co.

~8,500 net acres, Dimmit Co.

Tom Hanks

~3,500 net acres, LaSalle Co.

~3,500 net acres, LaSalle Co.

Lopez

~500 net acres,

~500 net acres,

Live Oak Co.

Karnes Trough

~1,900 net acres in oil window

~1,900 net acres in oil window

Dewitt & Gonzales Co.

Briscoe Ranch

~3,600 net acres, Dimmit Co.

~3,600 net acres, Dimmit Co.

Encinal

~12,700 net acres, Webb & LaSalle Co.

~12,700 net acres, Webb & LaSalle Co.

Steiren Area

~2,500 net acres in oil window

~2,500 net acres in oil window

Atascosa Co.

Gates Ranch

~26,200 net acres, Webb Co.

~26,200 net acres, Webb Co.

0

10

20

Miles

|

Market Summary

(August 8, 2014 Close)

|

Ticker:

|

ROSE

|

|

Market

capitalization: |

$3.2 billion

|

|

|

Share price:

|

$52.28

|

|

|

Enterprise value:

|

$5.0 billion

|

Note: Acreage numbers are rounded

4

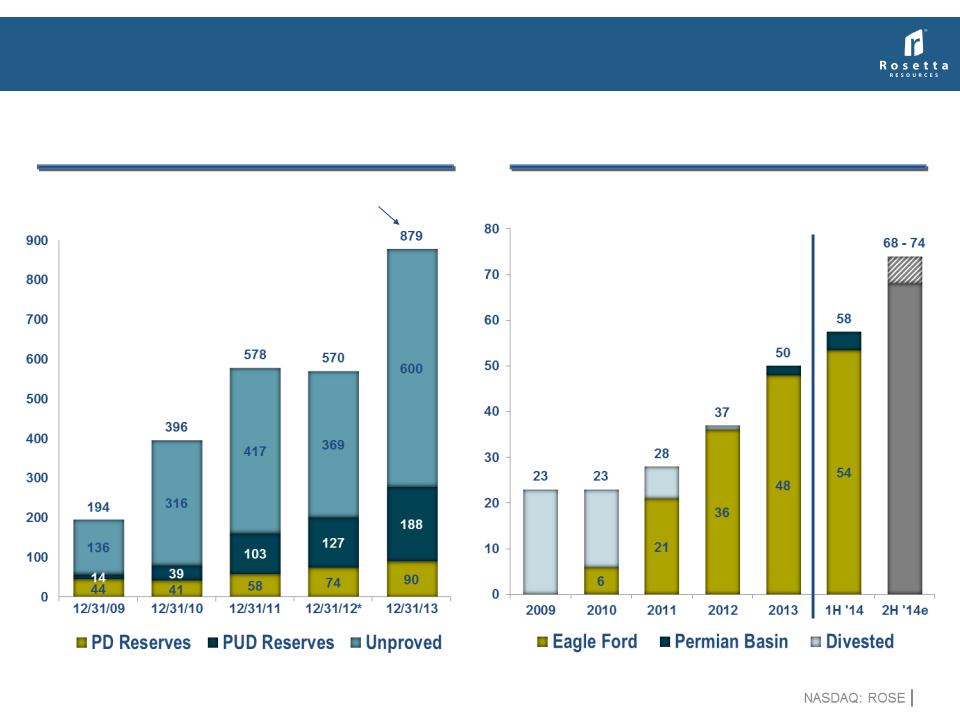

Permian ~288 MMBoe

Strong Growth Track Record

Net Risked Resource Potential

(MMBoe)

Net Production

(MBoe/d)

68

74

5

*Post-Divestiture

Total Company

Estimate Range

2014 Capital Program - $1.2 Billion1

6

1. 2014 Guidance; Includes capitalized interest and other corporate costs; Excludes acquisition capital.

2. Drill & Complete includes well flow lines.

Other

7%

Permian Op

24%

Eagle Ford

66%

Other

7%

Central

Facilities

11%

Drill & Complete2

82%

Generate ~30% production growth over 2013

· Continued focus on oil and liquids-rich

development

development

· Eagle Ford - Four to five rigs

§ Drill ~90-95 and complete ~95-100 gross wells

· Permian Delaware Basin - Five to six rigs

§ Drill ~48-52 and complete ~35-40 gross operated wells

§ Primary focus shifts to 100% horizontal drilling by 2015

· Accelerate central facilities to support

planned 2014 and 2015 well programs

planned 2014 and 2015 well programs

Permian

Non-Op

3%

Total Company Inventory

+/- 1,500 net wells -- remaining as of 6/30/2014 (excluding Upper Eagle Ford & Gaines Co.)

+/- 1,500 net wells -- remaining as of 6/30/2014 (excluding Upper Eagle Ford & Gaines Co.)

7

|

Asset Name

|

Net acres

|

Wells

completed

by Rosetta

|

Wells awaiting

completion |

Well Spacing

|

Remaining

net locations1

|

Avg Cost / Well

$M (5000’ lateral)

|

|

Gates Ranch

(100% WI / 75% NRI) |

26,200

|

175

(includes 8 UEF)

|

33

|

55

|

264

|

$5.5 - $6.0

|

|

Briscoe Ranch

(100% WI / 81.3% NRI) |

3,600

|

29

|

4

|

50

|

39

|

|

|

Central Dimmit2

(100% WI / 75 - 77% NRI) |

8,500

|

19

|

11

|

60

|

99

|

|

|

Tom Hanks

(100% WI / 77% NRI) |

3,500

|

15

|

1

|

50

|

40

|

|

|

Lopez

(100% WI / 75% NRI) |

500

|

3

|

-

|

50

|

5

|

$7.5 - $8.0

|

|

Steiren (Undelineated)

(100% WI / 75 - 77% NRI) |

2,500

|

-

|

-

|

50

|

24

|

$5.5 - $6.0

|

|

Encinal

(100% WI / 75 - 77% NRI) |

12,700

|

5

|

1

|

80

|

83

|

$6.0 - $6.5

|

|

Total Eagle Ford3 Inventory

|

57,500

|

246

|

50

|

50 - 80

|

554

|

$5.5 - $8.0

|

|

Permian 3rd Bone Spring Hz4

|

47,000

(Reeves Co)

|

-

|

1

|

80

|

237

|

$8.0 - $9.0

|

|

Permian WC ‘A’ Hz4

|

8

|

4

|

80

|

401

|

||

|

Permian WC ‘B’ Hz4

|

-

|

-

|

80

|

158

|

||

|

Permian WC ’C’ Hz4

|

1

|

-

|

80

|

105

|

||

|

Total Company Inventory

|

104,500

|

255

|

55

|

50 - 80

|

1,455

|

$5.5 - $9.0

|

1. Remaining net locations may vary based on changes in well lateral lengths

2. Central Dimmit includes L&E, Vivion and Light Ranch

3. Excludes producing areas in Karnes Trough that are fully developed (26 completions)

4. Horizontal operated and non-operated project count includes potential in multiple horizons (Wolfcamp A, B, C, and 3rd Bone Spring); assuming 660’ between laterals or 80-acre spacing

PERMIAN BASIN DIVISION

Permian Division - Reeves County

~47,000 net acres

~47,000 net acres

9

|

2014 Activity Summary - 1st Six Mos.

|

|||

|

Reeves County (Op)

|

Vertical

|

Horizontal

|

TOTAL

|

|

Wells Drilled

by Rosetta

|

12

|

13

|

25

|

|

Wells Completed

by Rosetta

|

17

|

7

|

24

|

|

Wells Placed

on Production

|

16

|

7

|

23

|

|

Wells Drilled &

Uncompleted

|

3

|

5

|

8

|

·Successfully completed five horizontal wells

testing WC ‘A’, & WC ‘C ’ in 2Q and one 3rd Bone

Spring hz well in early July; total average 7-day IP

~1,250 Boe/d

testing WC ‘A’, & WC ‘C ’ in 2Q and one 3rd Bone

Spring hz well in early July; total average 7-day IP

~1,250 Boe/d

·Revised completion design, resulting in best well

results to date including a WC ‘A’ well 7-day IP

~2,000 Boe/d

results to date including a WC ‘A’ well 7-day IP

~2,000 Boe/d

·Produced 4.5 MBoe/d, an increase of five percent

versus first quarter despite no contribution from

newest horizontal well completions

versus first quarter despite no contribution from

newest horizontal well completions

Regional structure map of the Permian Basin

Modified by Beaubouef at al. (1999) from Wright. 1962 and Fitchen 1997

Permian Asset Potential

Stacked Zones Provide Collection of Horizontal Development Opportunities

Stacked Zones Provide Collection of Horizontal Development Opportunities

Primary

Completion

Targets

Completion

Targets

In comparison, the lower Eagle

Ford reservoir thickness is

Ford reservoir thickness is

~100 feet at Gates Ranch

1,300’

10

Rosetta’s Reeves Co.

acreage position

acreage position

Rosetta’s Gaines Co.

acreage position

acreage position

(Exploratory)

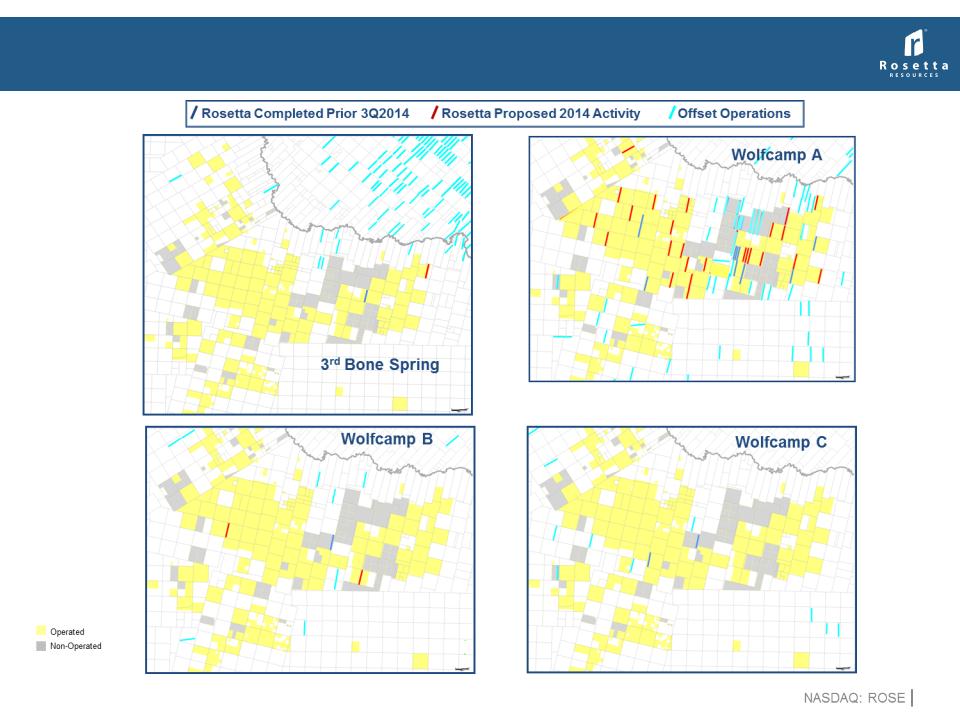

Permian - Horizontal Development Plan 6/30/2014

11

Permian Asset Potential

Multiple Benches in Delineation Phase Across Rosetta’s Acreage

Multiple Benches in Delineation Phase Across Rosetta’s Acreage

12

Reeves County Horizontal Delineation Program

Recent Well Performance Reflecting Enhanced Completion Design

Recent Well Performance Reflecting Enhanced Completion Design

|

|

Early Design

|

New Design

|

|

Average Lateral Length

|

5,000’

|

5,000’

|

|

# of Stages

|

17

|

19

|

|

Spacing between stages

|

290’

|

260’

|

|

Proppant Type

|

Sand

|

Sand

|

|

Proppant per Stage, lbs

|

240,000

|

310,000

|

|

Proppant per Lateral Ft, lbs

|

830

|

1,200

|

· Addition of slickwater fluid component to activate natural features and

increase fracture complexity

increase fracture complexity

· Shorter stage spacing to create larger stimulated rock volume (SRV)

· Increased proppant volume to focus on creating larger SRV

13

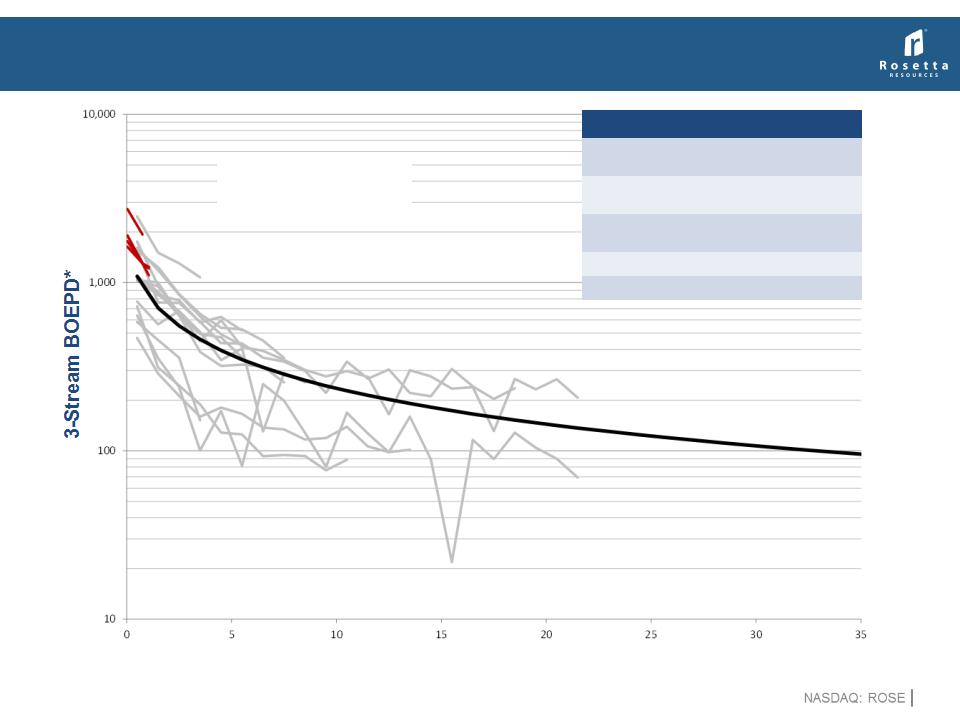

Permian - Reeves County

Upper Wolfcamp Horizontal Type Curve (1/30/2014)

Upper Wolfcamp Horizontal Type Curve (1/30/2014)

14

Months on Production

|

P50 Type Curve

|

|

|

Average Well Costs

($MM)

|

$8.5 ($8-$9 range)

|

|

30-Day IP Rate

Boe/d (gross)

|

1,090

|

|

Composite EUR

MBoe (gross)

|

550 (500-600 range)

|

|

% Oil

|

74%

|

|

% NGL

|

10%

|

*All production data normalized to 5,000' lateral length; well production data updated as of 8/8/2014.

Note: Rosetta reports reserves and production in 3-stream.

Rosetta assumptions for gas shrink and NGL yield applied to offset operators’ 2-stream public data.

|

2Q WC ‘A’ Completions

30-Day Avg (BOEPD)

Normalized to 5000’

|

|

|

Calamity Jane 22 1H

|

2,217

|

|

Black Jack 16 1H

|

1,623

|

|

Black Jack 16 3H

|

1,387

|

|

Black Jack 16 2H

|

1,456

|

SOUTH TEXAS DIVISION

South Texas Division - Eagle Ford

16

|

2014 Activity Summary - 1st Six Mos.

|

||||||

|

|

Gates

Ranch

|

Briscoe

Ranch

|

Central

Dimmit

|

Tom

Hanks

|

Encinal

|

TOTAL

|

|

Wells Drilled

by Rosetta

|

40

|

1

|

11

|

2

|

2

|

56

|

|

Wells

Completed

|

35

|

13

|

7

|

11

|

1

|

67

|

|

Wells Placed

on Production

|

31

|

13

|

7

|

11

|

1

|

63

|

|

Wells Drilled &

Uncompleted

|

33

|

4

|

11

|

1

|

1

|

50

|

·Produced 57 MBoe/d, an increase of

21 percent from 2013 and 14 percent

versus first quarter

21 percent from 2013 and 14 percent

versus first quarter

·Revised completion design resulting

in projected well cost savings of

~$500,000 per well

in projected well cost savings of

~$500,000 per well

·Testing potential of Upper Eagle Ford

across multiple areas

across multiple areas

Gates Ranch

~26,200 net acres in Webb County

~26,200 net acres in Webb County

17

|

Eagle Ford - Jun 30, 2014 Summary

|

|

|

Completions to date:

|

175 gross completions

|

|

Locations remaining:

|

264 net well locations1

|

|

|

|

|

Average2 Lower EF Well Characteristics

|

|

|

Well Costs:

|

$5.5 - $6.0 MM

|

|

Spacing:

|

55 acres (475 feet apart)

|

|

P50 Composite EUR:

|

1.67 MMBoe (0.7 - 2.7 range)

|

|

Condensate Yield:

|

55 Bbls/MMcf (30 - 80 range)

|

|

NGL Yield:

|

110 Bbls/MMcf

|

|

Shrinkage:

|

23%

|

1. Under current 55-acre spacing assumptions

2. Based on 5,000’ lateral length and 15-stage completion

18

Lower

Eagle Ford

Assumed

Drainage

Drainage

+/- 150 ft

Upper

Eagle Ford

Assumed

Drainage

Drainage

+/- 110 ft

Upper Eagle Ford Pilot Program

Pilot 4: East Gates Row 3 in Northern Webb County

Pilot 4: East Gates Row 3 in Northern Webb County

BVP 51

BVP 52

BVP 53

BVP 54

BVP 50

Varied Targeted Landing

Depth

Depth

Varied Completion Designs

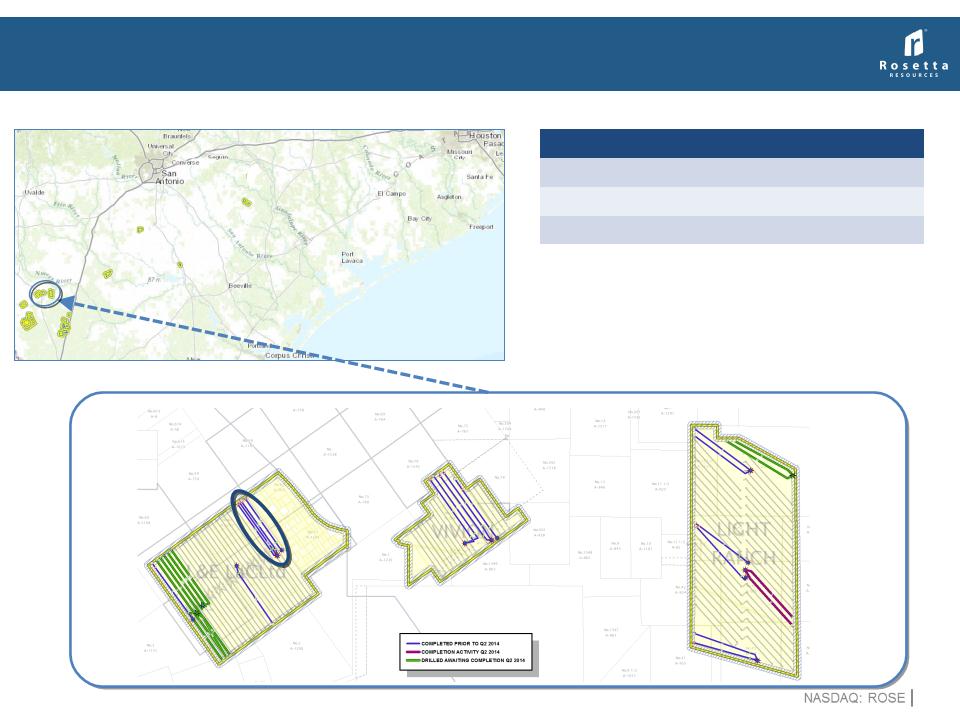

Central Dimmit County Area

~8,500 net acres located in Dimmit County

~8,500 net acres located in Dimmit County

19

|

Jun 30, 2014 Summary

|

|

|

Completions to date:

|

19 gross completions

|

|

Locations remaining:

|

99 net well locations

|

|

Average Well Costs:

|

$5.5 - $6.0 MM

|

|

|

|

Lasseter & Eppright

Light Ranch

2 completions

Vivion

3rd Upper

EF Pilot

EF Pilot

20

Upper Eagle Ford Pilot Program

Pilot 3: L&E Asset in Central Dimmit County

Pilot 3: L&E Asset in Central Dimmit County

|

|

Past Design

|

New Design

|

|

Average Lateral Length

|

5,000’

|

5,000’

|

|

# of Stages

|

15

|

15

|

|

Spacing between stages

|

300

|

300

|

|

Proppant Type

|

Ceramic

|

Sand

|

|

Proppant per Stage, lbs

|

275,000

|

Up to 500,000

|

|

Proppant per Lateral Ft, lbs

|

825

|

1,500+

|

· Shifting focus of completion design with change in proppant

§ Past Focus: Maximize conductivity

§ New Focus: Maximize stimulated rock volume while obtaining necessary conductivity for optimum flow

· Replacing ceramic proppant with sand pumped in much larger volumes

§ Analyzed performance of 12 Gates Ranch sand wells vs offsetting ceramic wells

· Change applies to Gates Ranch, Briscoe Ranch, L&E, Vivion and Tom Hanks

21

Eagle Ford Horizontal Program

Well Cost Guidance Reduced by $500M Reflecting Change in Completion Design

Well Cost Guidance Reduced by $500M Reflecting Change in Completion Design

MARKETING AND FINANCIAL OVERVIEW

Gas Transportation Capacity

Firm gross wellhead transportation and processing

• 295 MMcf/d today, ramping up to 345 MMcf/d by year-end 2014

Six processing options - Gathering (Plant)

• Regency (Enterprise Plants)

• Energy Transfer “ETC” Dos Hermanas (Exxon King Ranch)

• Eagle Ford Gathering (Kinder Morgan Houston Central)

• ETC Rich Eagle Ford Mainline (LaGrange / Jackson / Kennedy)

Oil Transportation Capacity

Gates Ranch, Briscoe Ranch & Central Dimmit County

• Plains Crude Gathering - Firm gathering capacity of 25,000 Bbls/d to

Gardendale hub with up to 60,000 Bbls storage; operating since April 2012

Gardendale hub with up to 60,000 Bbls storage; operating since April 2012

• All condensate is stabilized with distillation tower methodology

• Access to truck and rail loading and pipeline connections to the Gulf Coast

Eagle Ford Multiple Takeaway Options

Gates Ranch NGL

Breakdown June 2014

23

Gates Ranch

Condensate

Stabilization

Stabilization

Permian Basin Marketing

· Oil

§ Currently trucked from leases

§ Gathering options under evaluation

§ Oil gravity averages 44 degrees and receives no gravity deducts

§ New Permian takeaway pipelines on the way (Bridge Tex, PE2, Cactus)

§ Short-term Midland-Cushing basis weakness should improve by early 4Q 2014

· Natural Gas

§ Gas is rich and is processed at two plants

§ Most leases under long-term gathering agreement

§ Residue gas sales tied to Waha and Permian indices

· NGLs

§ NGLs extracted under firm, multi-year gathering/processing agreements

§ Combination of net proceeds and Mont Belvieu pricing

24

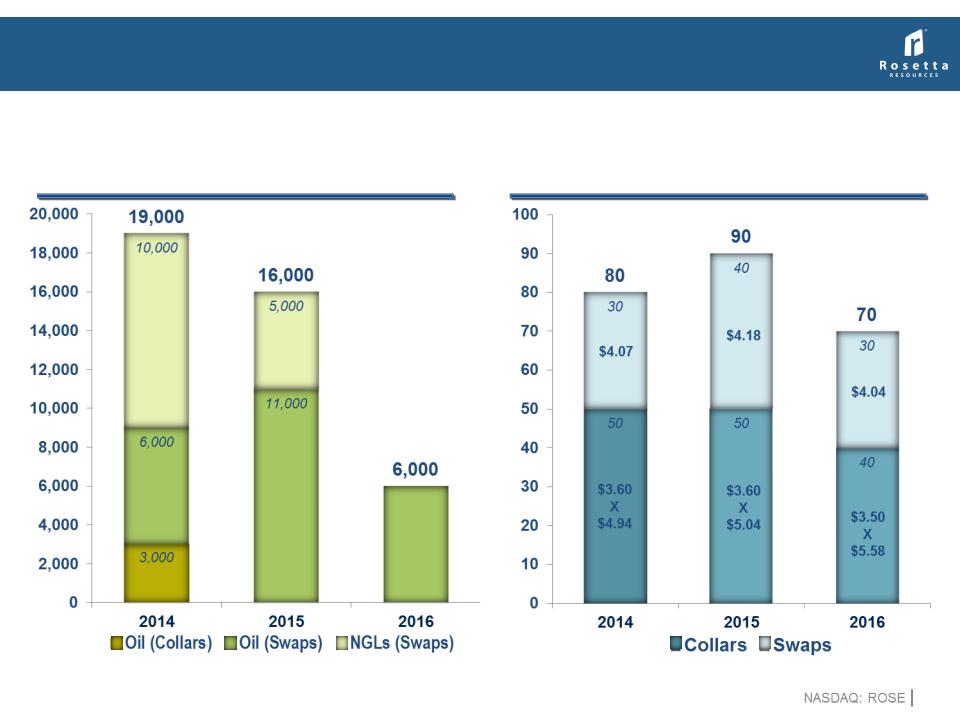

Commodity Derivatives Position - August 12, 2014

Hedged approximately 50% of 2014 equivalent production

Hedged approximately 50% of 2014 equivalent production

$37.10

$83.33

X

$109.63

$93.13

$89.51

$90.28

$31.87

25

Liquid Derivatives

(Bbls/d)

Natural Gas Derivatives

(MMBtu/d x 1,000)

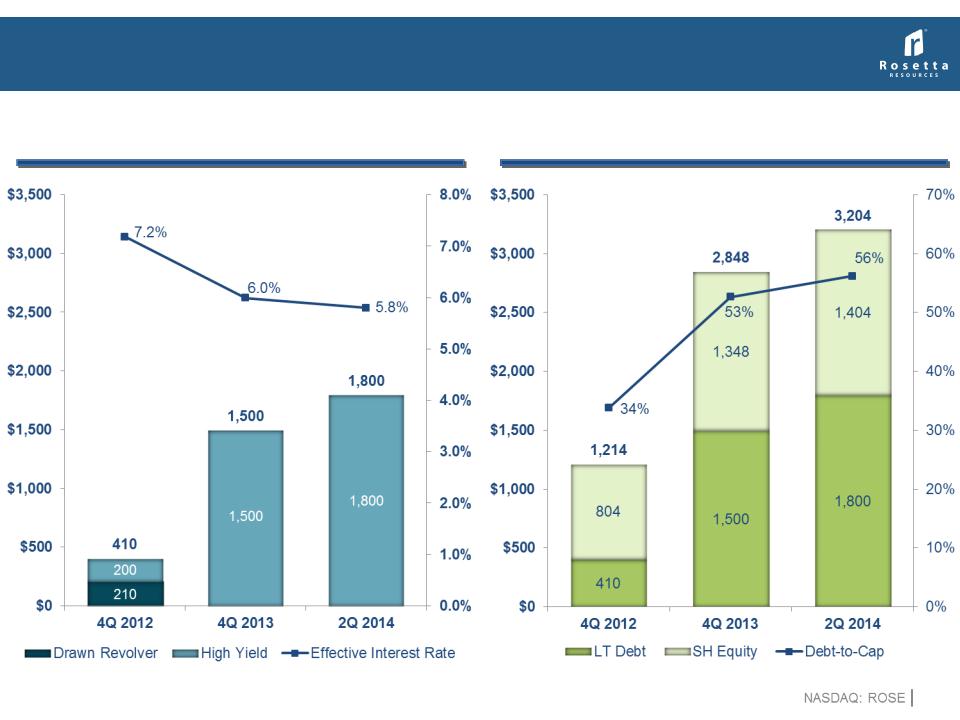

Debt and Capital Structure

26

($MM)

($MM)

Capital Structure

Debt Structure

Liquidity

27

· Adequate liquidity to fund 2014

$1.2 billion capital program

· $950 million borrowing base

· $800 million committed amount

§ No amounts outstanding

Total Liquidity

(Millions)

Investment Summary

• Drill-bit focused producer with core acreage positions in Eagle Ford

and Permian Basin plays

and Permian Basin plays

• Attractive core Delaware Basin position gaining momentum

• Successful operator in the high-return Eagle Ford area, reducing well

costs adding significant net asset value

costs adding significant net asset value

• Large inventory of future growth opportunities with multiple stacked

lateral potential

lateral potential

• Solid reputation of financial strength and business flexibility to support

growth

growth

Rosetta Resources - Growing Value in a Rock Solid Combination

PERMIAN BASIN + EAGLE FORD

28

APPENDIX

Attractive Well Economics (Typical Well)

30

Well Cost Performance - Permian Horizontals

Well Cost Performance - Gates Ranch

*Note: 2014 Current Estimate

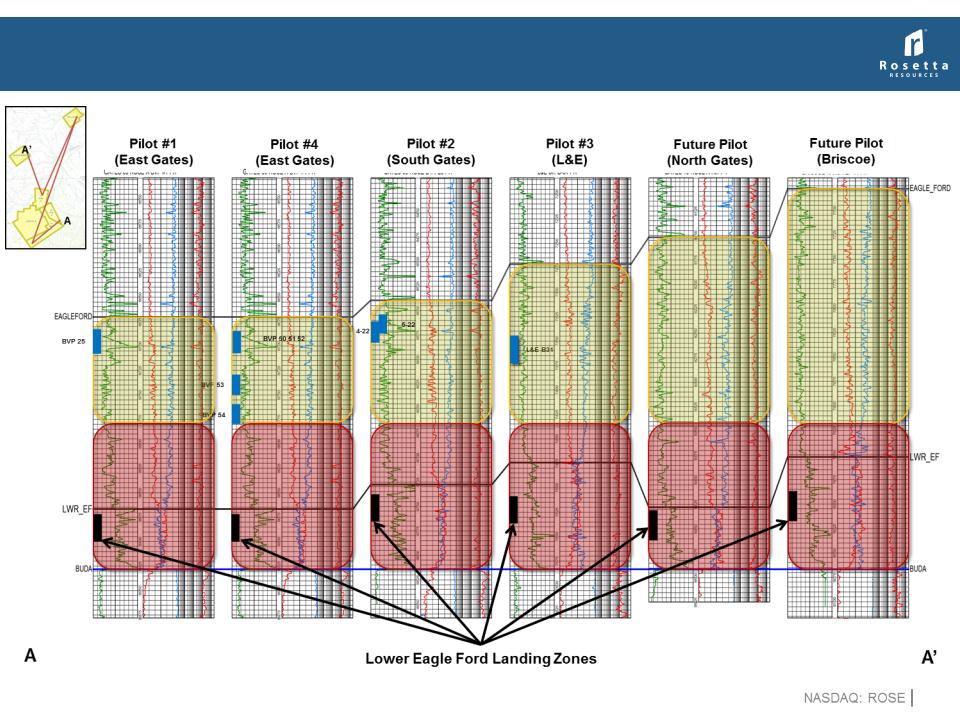

Upper Eagle Ford Pilot Program

Future Plans are to pilot test the Upper Eagle Ford at North Gates & Brisco Ranch ...

Future Plans are to pilot test the Upper Eagle Ford at North Gates & Brisco Ranch ...

33