Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT OF MATERIAL EVENTS OR CORPORATE CHANGES - TIER REIT INC | a14-19020_18k.htm |

Exhibit 99.1

|

|

Second Quarter 2014 Conference Call August 14, 2014 TIERREIT.COM © 2014 TIER REIT, Inc. Burnett Plaza–Ft. Worth, TX Winner of the 2013-2014 International TOBY Award As Outstanding Building of the Year |

|

|

Forward-Looking Statements This presentation contains forward-looking statements, including discussion and analysis of the financial condition of us and our subsidiaries and other matters. These forward-looking statements are not historical facts but are the intent, belief or current expectations of our management based on their knowledge and understanding of our business and industry. Words such as “may,” “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “would,” “could,” “should” and variations of these words and similar expressions are intended to identify forward-looking statements. We intend that such forward-looking statements be subject to the safe harbor provisions created by Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. Forward-looking statements that were true at the time made may ultimately prove to be incorrect or false. We caution you not to place undue reliance on forward-looking statements, which reflect our management’s view only as of the date of this presentation. We undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results. |

|

|

Forward-Looking Statements Factors that could cause actual results to differ materially from any forward-looking statements made in the presentation include but are not limited to: market and economic challenges experienced by the U.S. economy or real estate industry as a whole and the local economic conditions in the markets in which our properties are located; our ability to renew expiring leases and lease vacant spaces at favorable rates or at all; the inability of tenants to continue paying their rent obligations due to bankruptcy, insolvency or a general downturn in their business; the availability of cash flow from operating activities to fund distributions and capital expenditures; our ability to raise capital in the future by issuing additional equity or debt securities, selling our assets or otherwise to fund our future capital needs; our ability to strategically acquire or dispose of assets on favorable terms; our level of debt and the terms and limitations imposed on us by our debt agreements; our ability to retain our executive officers and other key personnel; conflicts of interest and competing demands faced by certain of our directors; limitations on our ability to terminate our property management agreement and certain services under our administrative services agreement; unfavorable changes in laws or regulations impacting our business or our assets; and factors that could affect our ability to qualify as a real estate investment trust. The forward-looking statements should be read in light of these and other risk factors identified in the “Risk Factors” section of our 2013 Annual Report on Form 10-K for the year ended December 31, 2013, as filed with the Securities and Exchange Commission. |

|

|

Company Objectives Maximize stockholder value Generate cash flow sufficient to reinstate distributions Provide stockholder liquidity |

|

|

Strategic Plan Positioning the Company for Liquidity and Reinstatement of Distributions Lease the portfolio and increase occupancy to drive internal growth Capitalize on strong debt markets to optimize leverage structure and lower borrowing costs Sharpen the geographic focus by selling non-strategic assets Redeploy capital in an accretive manner to provide external growth |

|

|

*Measured by percent of net operating income generated during the three months ended June 30, 2014. Portfolio Characteristics as of June 30, 2014 Includes our pro rata ownership share of unconsolidated properties. Market Presence* Operating properties 38 Square feet(1) 14.4 million Occupancy(1) 86% Markets 19 |

|

|

Second Quarter 2014 Operating Results and Highlights Diluted MFFO for the second quarter was $0.05 per common share An increase of $0.01 per common share as compared to the first quarter 2014 Leased 447,000 SF during the quarter Increased occupancy to 86% Increased same store cash NOI in the second quarter as compared to the first quarter by $3.2 million, or 8.7% Primarily due to growth in same store occupancy and reductions in property operating expense Two BriarLake Plaza base building construction was completed Repaid our only remaining 2014 debt maturity of $26.3 million with cash on hand Note: Reconciliations of net income (loss) to MFFO attributable to common stockholders and same store cash NOI are contained in the Current Report on Form 8-K filed on August 14, 2014. |

|

|

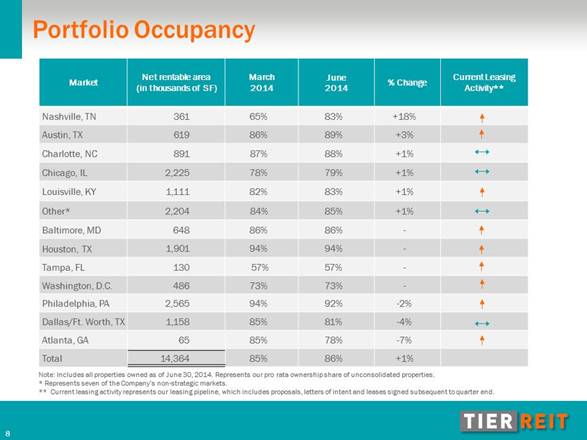

Portfolio Occupancy Market Net rentable area (in thousands of SF) March 2014 June 2014 % Change Current Leasing Activity** Nashville, TN 361 65% 83% +18% Austin, TX 619 86% 89% +3% Charlotte, NC 891 87% 88% +1% Chicago, IL 2,225 78% 79% +1% Louisville, KY 1,111 82% 83% +1% Other* 2,204 84% 85% +1% Baltimore, MD 648 86% 86% - Houston, TX 1,901 94% 94% - Tampa, FL 130 57% 57% - Washington, D.C. 486 73% 73% - Philadelphia, PA 2,565 94% 92% -2% Dallas/Ft. Worth, TX 1,158 85% 81% -4% Atlanta, GA 65 85% 78% -7% Total 14,364 85% 86% +1% Note: Includes all properties owned as of June 30, 2014. Represents our pro rata ownership share of unconsolidated properties. * Represents seven of the Company’s non-strategic markets. ** Current leasing activity represents our leasing pipeline, which includes proposals, letters of intent and leases signed subsequent to quarter end. |

|

|

Debt Maturities as of June 30, 2014 (includes share of unconsolidated debt) (In Millions) $195 - 222 S. Riverside Plaza $150 - Bank of America Plaza $126 - The Terrace Office Park $100 - 1325 G Street $97 - Fifth Third Cleveland & Columbus $65 - Three Parkway $48 – Woodcrest Corporate Center $33 – Two BriarLake Plaza $24 – Plaza at MetroCenter (1) Weighted average interest rate $103 – Burnett Plaza $92 - Louisville $59 - United Plaza $54 – Lawson Commons $43 - Loop Central $33 – 250 W. Pratt $26 - Other $410 (5.2%)1 $838 (5.7%)1 $139 (5.5%)1 $145 (5.5%)1 |

|

|

Strategic Plan Capitalize on strong debt markets to optimize leverage structure and lower borrowing costs Accelerate the refinance/repayment of $1.2 billion above-market mortgage debt maturing through 2016 by: Selling non-strategic properties and using net proceeds to repay or reduce 2015/2016 debt maturities Evaluate opportunities to issue new attractively priced debt Manage resources to provide sufficient capital to right-size overall company leverage as debt is refinanced through 2016 |

|

|

250 West Pratt Baltimore, MD Wanamaker Building Philadelphia, PA The Terrace Austin, TX Burnett Plaza Fort Worth, TX Three Eldridge Place Houston, TX FOUR40 Chicago, IL Colorado Building Washington, D.C. BriarLake Houston, TX Bank of America Plaza Charlotte, NC |

|

|

Playback Information An audio link for a playback of today’s call will be on our website at www.tierreit.com/ir A recorded playback of today’s call will also be available for 30 days by calling toll free (800) 633-8284 and using passcode 21718884 Today’s presentation has been filed with the SEC on Form 8-K and is available on our website at www.tierreit.com/ir under the heading SEC Filings Save the date! TIER REIT’s third quarter conference call will be held on Thursday, November 13, 2014. Please check our website for details, and sign up at www.tierreit.com/ir for conference call information and other timely communications |

|

|

Questions Terrace Office Park Austin, TX |

|

|

Playback Information An audio link for a playback of today’s call will be on our website at www.tierreit.com/ir A recorded playback of today’s call will also be available for 30 days by calling toll free (800) 633-8284 and using passcode 21718884 Today’s presentation has been filed with the SEC on Form 8-K and is available on our website at www.tierreit.com/ir under the heading SEC Filings Save the date! TIER REIT’s third quarter conference call will be held on Thursday, November 13, 2014. Please check our website for details, and sign up at www.tierreit.com/ir for conference call information and other timely communications |