Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CNL LIFESTYLE PROPERTIES INC | d773183d8k.htm |

| EX-99.1 - PRESS RELEASE - CNL LIFESTYLE PROPERTIES INC | d773183dex991.htm |

CNL Lifestyle

Properties, Inc. CNL Lifestyle Properties, Inc.

Owning

Owning

America’s

America’s

Lifestyle

Lifestyle

®

®

Second Quarter 2014 Update

Second Quarter 2014 Update

August 14, 2014

August 14, 2014

Exhibit 99.2 |

2

Forward Looking Statements

Certain statements in this document may constitute forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and

of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). CNL Lifestyle Properties, Inc. (herein also referred to as the “Company”)

intends that all such forward-looking statements be covered by the safe-harbor provisions for

forward-looking statements of Section 27A of the Securities Act and Section 21E of the

Exchange Act, as applicable.

All statements, other than statements that relate solely to historical facts, including, among others,

statements regarding the Company’s future financial position, business strategy, projected

levels of growth, projected costs and projected financing needs, are forward-looking statements. Those statements include statements regarding the intent,

belief or current expectations of the management team, as well as the assumptions on which such

statements are based, and generally are identified by the use of words such as “may,”

“will,” “seeks,” “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” “should,” “continues,” “pro forma” or similar

expressions. Forward-looking statements are not guarantees of future performance and actual

results may differ materially from those contemplated by such forward-looking statements due to a variety of

risks, uncertainties and other factors, including but not limited to, the factors detailed in our

Annual Report on Form 10-K for the year ended December 31, 2013, and other documents filed

from time to time with the Securities and Exchange Commission.

Many of these factors are beyond the Company’s ability to control or predict. Such factors

include, but are not limited to: changes in general economic conditions in the U.S. or globally

(including financial market fluctuations); risks associated with our investment strategy; risks associated with the real estate markets in which the Company invests;

risks of doing business internationally and global expansion, including unfamiliarity with new markets

and currency risks; risks associated with the use of debt to finance the Company’s

business activities, including refinancing and interest rate risk and the Company’s failure to comply with its debt covenants; the Company’s failure to obtain, renew

or extend necessary financing or to access the debt or equity markets; competition for properties

and/or tenants in the markets in which the Company engages in business; the impact of current

and future environmental, zoning and other governmental regulations affecting the Company’s properties; the Company’s ability to make necessary

improvements to properties on a timely or cost-efficient basis; risks related to development

projects or acquired property value-add conversions, if applicable (including construction

delays, cost overruns, the Company’s inability to obtain necessary permits and/or public opposition to these activities); defaults on or non-renewal of leases by

tenants; failure to lease properties at all or on favorable terms; unknown liabilities in connection

with acquired properties or liabilities caused by property managers or operators; the

Company’s failure to successfully manage growth or integrate acquired properties and operations; material adverse actions or omissions by any joint venture

partners; increases in operating costs and other expense items and costs, uninsured losses or losses

in excess of the Company’s insurance coverage; the impact of outstanding or potential

litigation; risks associated with the Company’s tax structuring; the Company’s failure to qualify and maintain its status as a real estate investment trust

and the Company’s ability to protect its intellectual property and the value of its brand.

Management believes these forward-looking statements are reasonable; however, such

statements are necessarily dependent on assumptions, data or methods that may be incorrect or

imprecise and the Company may not be able to realize them. Investors are cautioned not to

place undue reliance on any forward-looking statements which are based on current expectations. All written and oral forward-looking statements attributable

to the Company or persons acting on its behalf are qualified in their entirety by these cautionary

statements. Further, forward-looking statements speak only as of the date they are

made and the Company undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated

events or changes to future operating results over time unless otherwise required by law. |

Portfolio of 151 lifestyle-oriented

properties and five loans as of

August 8, 2014

Diversified by asset type,

geography and operator

Iconic assets and industry-

leading operators

Ski & Mountain

Golf

Attractions

Senior Housing

Marinas

Additional

•

24 properties

•

48 properties

•

24 properties

•

36 properties

•

17 properties

•

2 properties

CNL Lifestyle Properties, Inc.

Summary REIT Information

GAAP Total Assets

$2.7 billion

Property

Focus

Demographically Driven / Lifestyle-Oriented

Geographic

Diversification

37 states and 2 Canadian provinces

Established Assets

Conservative

Capital Structure

Leasing

and Preferred Return Structures

Diversified Portfolio

Exit

Strategy

The

board

of

directors

will

consider

a listing, merger,

sale or other liquidity opportunities on or before

December 31, 2015

3 |

Recent Highlights

Entered into a purchase and sale agreement to sell our 48-property golf

portfolio in June 2014 for $320 million and we expect the transaction to be

completed in 2014; Net proceeds after retiring existing golf debt will be

used to retire other secured debt, make capital expenditures at other

properties or acquire additional properties

Jefferies LLC, a leading global investment banking and advisory firm, is currently

assisting in the evaluation of various strategic alternatives to

provide liquidity to

shareholders

Acquired three senior housing communities in Q2 2014 totaling $38 million and

three

additional

senior

housing

communities

in

July

totaling

$67

million

Over $5 million of owner capital invested into various portfolio

assets in Q2 2014

In June 2014, we completed the sale of our only multi-family residential

property, Mizner Court, and received approximately $73.5 million in

proceeds, which were primarily used to retire debt

Expected to complete the acquisition of two additional senior housing

communities in September totaling $34 million

4 |

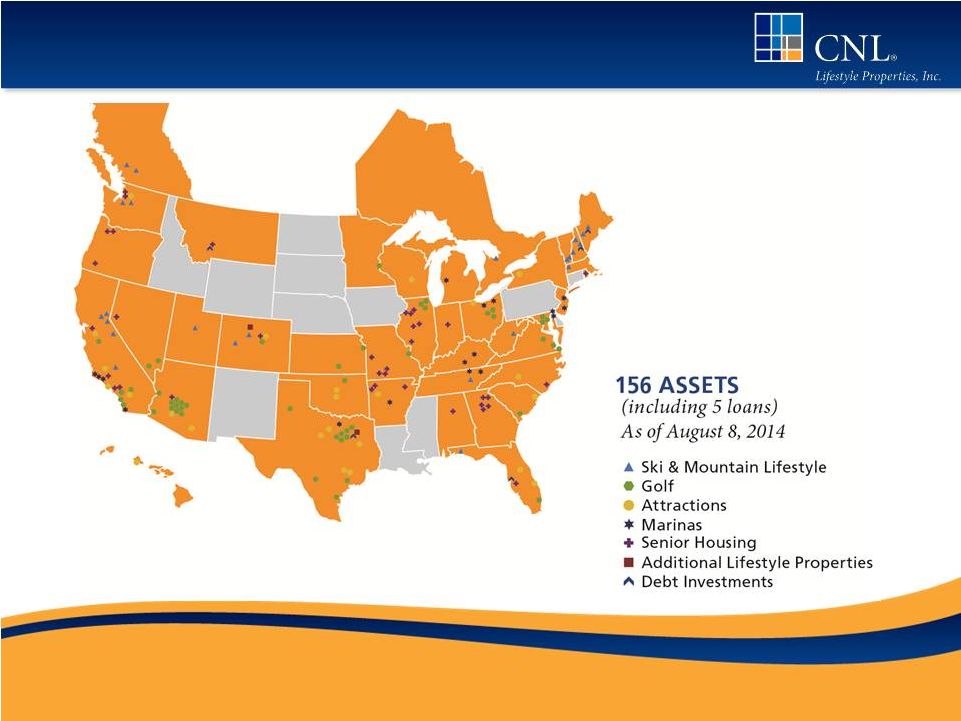

Geographic Diversification

5 |

The portfolio is broadly diversified across asset classes to

mitigate against seasonality and volatility

Sector Diversification

As of August 8, 2014

Ski & Mountain Lifestyle (24)

Golf (48)

Attractions (24)

Senior Housing (36)

Marinas (17)

Additional Lifestyle Properties (2)

By Initial Purchase Price

6 |

Sector Performance

7

151 properties as of August 8, 2014

Source: CNL Lifestyle Properties, Inc. June 30, 2014, Form 10-Q

Past performance is not indicative of future returns.

Ski & Mountain

24 properties

-

Late season favorable

conditions. Summer

operations (zip-lining,

mountain biking and scenic

lift rides) have been strong

and have driven revenue

and EBITDA up in Q2

versus prior year.

Golf

48 properties

-

Golf rounds are down -

consistent with the 2.1%

industry decrease in

overall rounds played

YTD through June 2014

as reported by Golf

Datatech. Our property

EBITDA is up slightly.

Attractions

24 properties

-

Increase in revenue YTD

due to early season efforts

to drive activity and

visitation resulting in a

significant increase in

season pass sales over

prior year.

Senior Housing

36 properties

-

Occupancy slightly off while

Revenue per Occupied Unit is

up over the last year. Average

occupancy for the entire

portfolio was 91.0% for the

quarter ended June 30, 2014,

exceeding the industry

average of 90.2%. Certain

locations had increased labor

and R&M costs caused by

severe winter storms.

Marinas

17 properties

-

Revenue and EBITDA were

down slightly in Q2

compared to the prior year.

Management

proactively

transitioned the last four

leased marinas to managed

structures in April 2014

which have impacted

revenue and earnings

during

transition.

Additional Lifestyle

2

properties

-

Steady performance at

Dallas Market Center.

Multi-family property sold

in June. |

Same-Store Property Performance

8

Three Months Ended June 30, 2014, Compared to Same Period 2013

Note: Includes results for comparable consolidated leased and managed properties

owned for the entirety of 2014 and 2013. Source: CNL Lifestyle

Properties, Inc. June 30, 2014, Form 10-Q The

increase

in

both

revenue

and

EBITDA

are

primarily

due

to

the

performance

of

the

ski

and

mountain

lifestyle and attractions sectors

Ski

and

mountain

lifestyle

properties

experienced

favorable

late

season

conditions

in

certain

locations,

inclusive

of

both

snowfall

and

temperatures

allowing

some

of

our

properties

to

remain

in

operations

through

April; In addition, summer operations (zip lining, scenic lift rides and mountain

biking) were strong due to favorable weather conditions in June

The attractions sector experienced an increase in revenues due to early season

efforts to drive activity and visitation, which resulted in a significant

increase in season pass sales compared to the prior year The marina and

senior housing sectors were impacted due to the transition of the properties to multiple new

managers and higher weather related repairs and maintenance expenses, however, we

expect to see performance upside over the long term as a result of the

changes # of

Properties

Revenue

EBITDA

Ski and Mountain Lifestyle

17

12.7%

22.6%

Golf

48

-0.8%

1.0%

Attractions

21

8.4%

21.3%

Senior Housing

20

3.3%

-3.4%

Marinas

17

-2.3%

-0.8%

123

5.9%

35.3% |

Same-Store Property Performance

9

Six Months Ended June 30, 2014, Compared to Same Period 2013

Note: Includes results for comparable consolidated leased and managed properties

owned for the entirety of 2014 and 2013. Source: CNL Lifestyle

Properties, Inc. June 30, 2014, Form 10-Q The decreases in both revenue

and EBITDA are primarily due to the performance of the ski and mountain

lifestyle

and

marina

sectors

-

Ski

resorts

in

the

West

(particularly

California)

experienced

unusually

warm,

drought

conditions

causing

poor

operating

results

as

compared

to

the

2012/2013

ski

season

Marina sector was down due to record-breaking cold temperatures and ice storms

which resulted in the temporary

closure

of

our

largest

marina,

reducing

operating

results

-

the

marinas

were

also

impacted

by

our

proactive

transition

of

the

properties

to

multiple

new

managers,

which

was

completed

in

April

2014

Attractions

portfolio

benefited

from

the

warm,

dry

conditions

in

Southern

California

and

tight

expense

controls

at many properties throughout the offseason

TTM lease coverage was 1.46x through Q2 2014 primarily due to the addition of the

senior housing assets improved performance for the leased attraction

portfolio # of

Properties

Revenue

EBITDA

Ski and Mountain Lifestyle

17

-3.5%

-5.5%

Golf

48

-0.8%

0.4%

Attractions

21

8.3%

72.8%

Senior Housing

20

3.4%

-4.1%

Marinas

17

-6.3%

-16.9%

123

-0.6%

-1.6% |

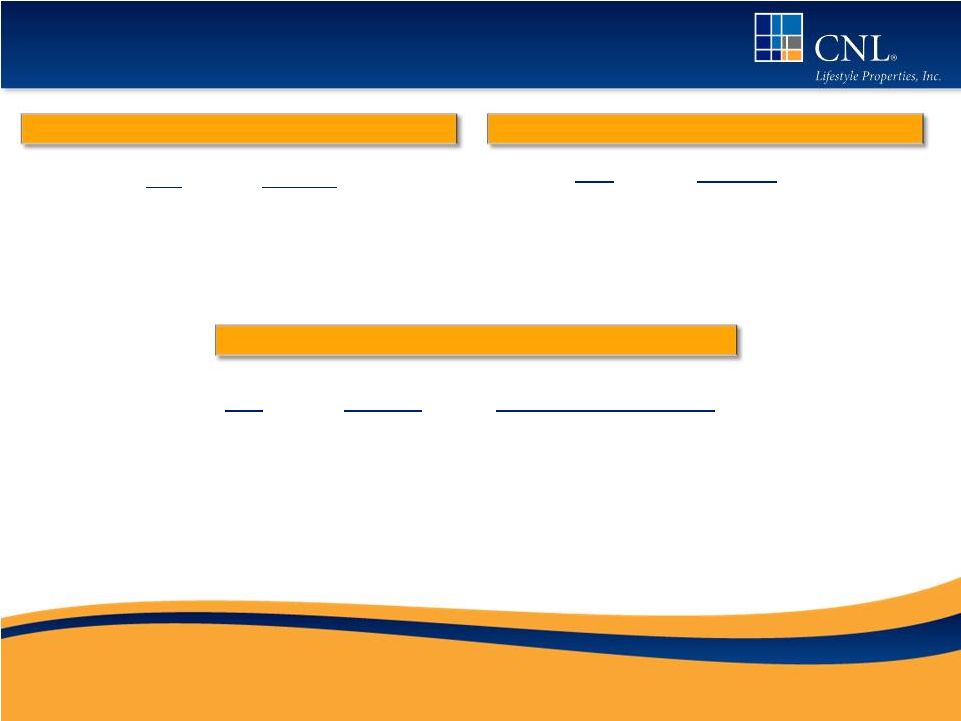

Full Year Financial Summary (in Millions)

FFO

Adjusted EBITDA

10

MFFO

Source: CNL Lifestyle Properties, Inc. 2013 Form 10-K and June 30, 2014, Form

10-Q The

Company

believes

that

its

presentation

of

historical

non-GAAP

financial

measures

provides

useful

supplementary

information

to

and

facilitates

additional

analysis

by

investors.

These

historical

non-GAAP

financial

measures

are

in

addition

to,

not

a

substitute

for,

or

superior

to,

measures

of

financial

performance

prepared

in

accordance

with

U.S.

Generally

Accepted Accounting Principles. See reconciliation to GAAP net income (loss)

contained in the Appendix. Past performance is not indicative of future

returns. Trailing 12 month 2014 FFO higher due to:

An increase in rental income from properties acquired after Q2 2013

and increases in same store rents and NOI

Reduced asset management fees due to the sale of 42 senior

housing properties held in three unconsolidated joint ventures and a

reduction in fees charged by our Advisor, effective April 1, 2014, as

well as a reduction in bad debt expense

Partially offset by an increase in interest expense and loan cost

amortization from additional borrowings, a loan loss provision and a

reduction in FFO contribution from the sale of 42 senior housing

properties held in three unconsolidated joint ventures

|

Credit Metrics

Interest Coverage (1)

(1) Calculated as adjusted EBITDA divided by interest

expense (2) Net debt is total debt less cash

(3) Debt includes line of credit

Net Debt / Adjusted EBITDA (2)

11

Debt / GAAP Total Assets (3)

Source: CNL Lifestyle Properties, Inc. 2013 Form 10-K and June 30, 2014, Form

10-Q The

Company

believes

that

its

presentation

of

historical

non-GAAP

financial

measures

provides

useful

supplementary

information

to

and

facilitates

additional

analysis

by

investors.

These

historical

non-GAAP

financial

measures

are

in

addition

to,

not

a

substitute

for,

or

superior

to,

measures

of

financial

performance

prepared

in

accordance

with

U.S.

Generally

Accepted Accounting Principles. See reconciliation to GAAP net income (loss)

contained in the Appendix. Past performance is not indicative of future

returns. Year

Coverage

2011

2.4x

2012

2.5x

2013

2.6x

TTM June 2014

2.4x

Year

Coverage

2011

5.5x

2012

6.3x

2013

6.1x

Jun-14

6.2x

Consolidated

Leverage Including Share

Year

Coverage

of Unconsolidated Entities

2011

32.0%

43.3%

2012

38.7%

45.3%

2013

44.6%

48.1%

June 2014

46.3%

49.4% |

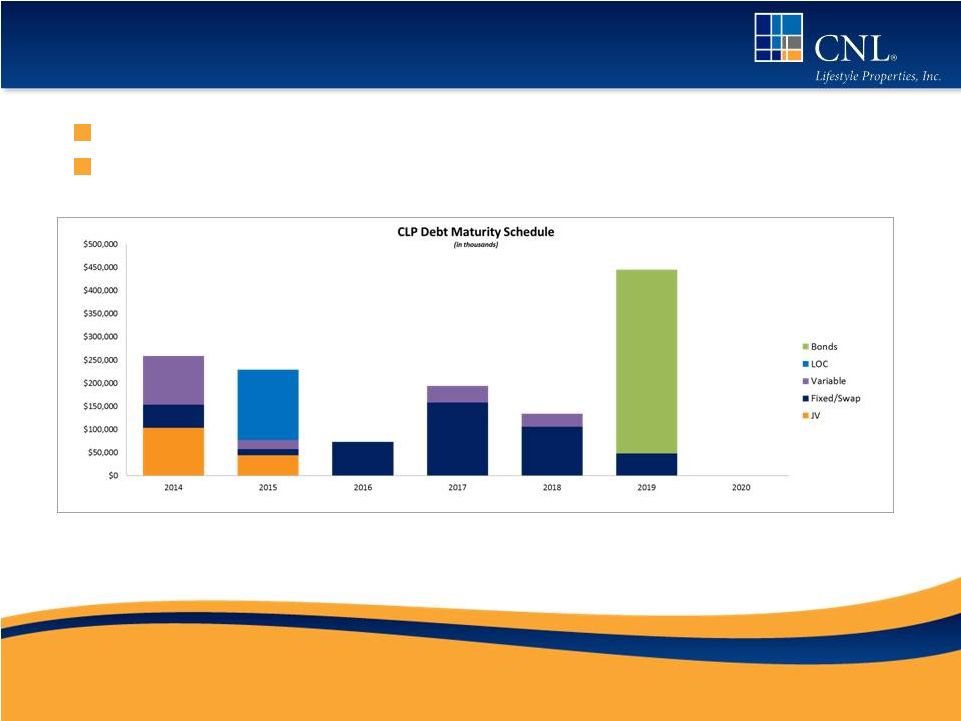

Key

Credit Information 12

Weighted average interest rate is 5.70% (5.98% without JV debt)

72% fixed rate debt, 3% hedged and 25% variable rate debt

Note: Chart as of June 30, 2014. 2014 maturities are expected to be

refinanced or retired with proceeds from asset sales. |

Contact Information

13

For more information about

CNL Lifestyle Properties, please contact

CNL Client Services at 866-650-0650. |

Appendix

14

Appendix |

Reconciliation of FFO and MFFO to Net Loss

15

Source: CNL Lifestyle Properties, Inc. June 30, 2014, Form 10-Q

The

Company

believes

that

its

presentation

of

historical

non-GAAP

financial

measures

provides

useful

supplementary

information

to

and

facilitates

additional

analysis

by

investors.

These

historical

non-GAAP

financial

measures

are

in

addition

to,

not

a

substitute

for,

or

superior

to,

measures

of

financial

performance

prepared

in

accordance

with

U.S.

Generally

Accepted Accounting Principles.

Past performance is not indicative of future returns.

2014

2013

2014

2013

Net loss

(8,505)

$

(55,205)

$

(28,858)

$

(78,504)

$

Adjustments:

Depreciation and amortization:

(1)

Continuing operations

31,098

28,837

63,032

57,595

Discontinued operations

-

7,796

4,925

15,221

Impairment of real estate assets:

(1)

Continuing operations

-

42,451

-

42,451

Discontinued operations

1,150

-

4,464

-

(Gain) loss on sale of

real estate investment: (1)

Discontinued operations

73

(2,080)

70

(2,083)

Net effect of FFO adjustment from unconsolidated entities:

(2)

Continuing operations

6,658

4,293

8,389

10,337

Total funds from operations

30,474

26,092

52,022

45,017

Acquisition fees and expenses:

(3)

Continuing operations

1,279

546

2,003

913

Straight-line adjustments for leases and notes receivable:

(1)(4)

Continuing operations

(2,737)

(771)

(6,164)

(1,042)

Discontinued operations

-

(321)

-

(536)

(Gain) loss from early

extinguishment of debt: (5)

Continuing operations

600

-

600

-

Discontinued operations

(266)

-

(266)

-

Amortization of above/below market

intangible assets and liabilities (1)

Continuing operations

7

(1)

24

(2)

Discontinued operations

-

349

359

683

Loan loss

provision: (6)

Continuing operations

2,520

-

2,520

-

Accretion of discounts/amortization

of premiums: Continuing

operations 3

3

6

6

MFFO adjustments from

unconsolidated entities: (2)

Straight-line adjustments for leases and notes

receivable: (4)

Continuing operations 48

(78)

62

(146)

Amortization of above/below market intangible

assets and liabilities:

Continuing operations (88)

(3)

(76)

(7)

Modified funds

from operations 31,840

$

25,816

$

51,090

$

44,886

$

Weighted average number of shares of common stock

324,197

317,959

323,424

317,175

outstanding (basic and diluted)

FFO per share (basic and diluted)

0.09

$

0.08

$

0.16

$

0.14

$

MFFO per share (basic and diluted)

0.10

$

0.08

$

0.16

$

0.14

$

Quarter Ended

June 30,

Six Months Ended

June 30,

(1)

Includes

amounts

related

to

the

properties

that

are

classified

as

assets

held

for

sale

and

for

which the

related results are classified as income (loss) from discontinued

operations in the accompanying condensed

consolidated

statements

of

operations.

(2)

This

amount

represents

our

share

of

the

FFO

or

MFFO

adjustments

allowable

under

the

NAREIT

or

IPA

definitions,

respectively,

multiplied

by

the

percentage

of

income

or

loss

recognized

under

the HLBV

method.

(3)

In

evaluating

investments

in

real

estate,

management

differentiates

the

costs

to

acquire

the

investment

from

the

operations

derived

from

the

investment.

By

adding

back

acquisition

fees

and

expense

relating

to

business

combinations,

management

believes

MFFO

provides

useful

supplemental

information

of

its

operating

performance

and

will

also

allow

comparability

between

real

estate

entities

regardless

of

their

level

of

acquisition

activities.

Acquisition

fees

and

expenses

include

payments

to

our

advisor

or

third

parties.

Acquisition

fees

and

expenses

relating

to

business

combinations

under

GAAP

are

considered

operating

expenses

and

as

expenses

included

in

the

determination

of

net

income

(loss)

and

income

(loss)

from

continuing

operations,

both

of

which

are

performance

measures

under

GAAP.

All

paid

and

accrued

acquisition

fees

and

expenses

will

have

negative

effects

on

returns

to

investors,

the

potential

for

future

distributions,

and

cash

flows

generated

by

us,

unless

earnings

from

operations

or

net

sales

proceeds

from

the

disposition of

properties

are

generated

to

cover

the

purchase

price

of

the

property.

(4)

Under

GAAP,

rental

receipts

are

allocated

to

periods

using

various

methodologies.

This

may

result

in

income

recognition

that

is

significantly

different

than

underlying

contract

terms. By

adjusting

for

these

items

(to

reflect

such

payments

from

a

GAAP

accrual

basis

to

a

cash

basis of

disclosing

the

rent

and

lease

payments),

MFFO

provides

useful

supplemental

information

on the

realized

economic

impact

of

lease

terms

and

debt

investments,

providing

insight

on

the

contractual

cash

flows

of

such

lease

terms

and

debt

investments,

and

aligns

results

with

management’s

analysis of

operating performance.

(5)

(Gain)

loss

from

early

extinguishment

of

debt

includes

swap

breakage

fees,

write-off of

unamortized

loan

costs

and

reclassification

of

loss

on

termination

of

cash

flow

hedges

from

other

comprehensive

income

(loss)

into

interest

expense.

(6)

In

June

2014,

we

recorded

a

loan

loss

provision

on

one

of

our

mortgages

and

other

notes

receivable

as

a

result

of

uncertainty

related

to

the

collectability

of

the

note

receivable. |

Reconciliation of Adjusted EBITDA to Net

Income (Loss)

16

Source: CNL Lifestyle Properties, Inc. June 30, 2014, Form 10-Q

The

Company

believes

that

its

presentation

of

historical

non-GAAP

financial

measures

provides

useful

supplementary

information

to

and

facilitates

additional

analysis

by

investors.

These

historical

non-GAAP

financial

measures

are

in

addition

to,

not

a

substitute

for,

or

superior

to,

measures

of

financial

performance

prepared

in

accordance

with

U.S.

Generally

Accepted Accounting Principles.

Past performance is not indicative of future returns.

2014

2013

2014

2013

Net loss

(8,505)

$

(55,205)

$

(28,858)

$

(78,504)

$

(Income) loss from discontinued operations

(7,936)

(1,486)

(6,328)

155

Interest and other income

(89)

(71)

(91)

(397)

Interest expense and loan cost amortization

19,707

16,397

38,767

32,661

Equity in (earnings) loss of unconsolidated entities

(1)

526

(6,159)

(3,773)

(5,036)

Depreciation and amortization

31,098

28,837

63,032

57,595

Impairment provision

-

42,451

-

42,451

Loss from extinguishment of debt

196

-

196

-

Loan loss provision

2,520

-

2,520

-

Recovery on lease terminations

(741)

-

(741)

-

Straight-line adjustments for

leases and notes receivables (2)

(2,737)

(1,092)

(6,164)

(1,578)

Cash distributions from unconsolidated entities

(1)

3,455

8,787

6,575

20,113

Adjusted EBITDA

37,494

$

32,459

$

65,135

$

67,460

$

Quarter Ended

June 30,

Six Months Ended

June 30,

(1) Investments in our unconsolidated joint ventures are accounted for under the

HLBV method of accounting. Under this method, we recognize income or loss based on the change in liquidating

proceeds

we

would

receive

from

a

hypothetical

liquidation

of

our

investments

based

on

depreciated

book

value.

We

adjust

EBITDA

for

equity

in

earnings

(loss)

of

our

unconsolidated

entities

because

we

believe

this

is

not

reflective

of

the

joint

ventures’

operating

performance

or

cash

flows

available

for

distributions

to

us.

We

believe

cash

distributions

from

our

unconsolidated

entities,

exclusive

of

any

financing

transactions,

are

reflective

of

their

operating

performance

and

its

impact

to

us

and

have

been

added

back

to

adjusted

EBITDA

above.

(2) We believe that adjusting for straight-line adjustments for leased

properties and mortgages and other notes receivable is appropriate because they are non-cash adjustments and reflect the actual cash

receipts received by us from our tenants and borrowers.

|