Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT - BODY CENTRAL CORP | body-20140628earningspress.htm |

| 8-K - 8-K - BODY CENTRAL CORP | body-201406288kearningsrel.htm |

Business Update August 12, 2014 AUGUST 14, 2014

2 Safe Harbor Statement This presentation contains statements that are, or may be considered to be, forward-looking statements. All statements that are not historical facts, including statements about our beliefs or expectations, are “forward-looking statements” within the meaning of The Private Securities Litigation Reform Act of 1995. These statements may be identified by such forward-looking terminology as “expect,” “estimate,” “plan,” “intend,” “believe,” “anticipate,” “may,” “will,” “should,” “could,” “continue,” “project,” or similar statements or variations of such terms. Our forward-looking statements are based on a series of expectations, assumptions and projections about our company, are not guarantees of future results or performance, and involve substantial risks and uncertainty, including assumptions and projections concerning our cash inflows and outflows, operating cash flows, and current or future credit facilities, for all forward periods. All of our forward-looking statements are as of the date of this presentation only. The company can give no assurance that such expectations or forward-looking statements will prove to be correct. Actual results may differ materially. Our business and our forward-looking statements involve substantial known and unknown risks and uncertainties, including those discussed under “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our 2013 Annual Report on Form 10-K, filed with the SEC on March 27, 2014, our Quarterly Report on Form 10-Q filed with the SEC on August 14, 2014, and our other periodic filings with the SEC from time to time, as well as the following risks and uncertainties: (a) expectations regarding our ability to continue as a going concern; (b) our ability to maintain the required base amount of unrestricted cash, or otherwise trigger an event of default under the terms of our senior credit facility, as amended, which would result in a cash dominion event; (c) our failure to register our common stock under the Registration Rights Agreement, resulting in material penalties related to our Subordinated Secured Convertible Notes; (d) a sale or issuance of our common stock at a price less than the conversion price under the Subordinated Secured Convertible Notes agreement triggering an anti-dilution provision; (e) our ability to obtain financing or to generate sufficient cash flows to support operations; (f) our ability to identify and respond to new and changing fashion trends, customer preferences and other related factors; (g) the dislocation of customers that may occur as a result of strategic changes to marketing or merchandise selections; (h) failure to successfully execute marketing initiatives to drive core customers into our stores and to our website; (i) failure to successfully execute our growth strategy; (j) changes in consumer spending and general economic conditions; (k) changes in Federal and state tax policy on our customers; (l) changes in the competitive environment in our industry and the markets we serve, including increased competition from other retailers; (m) failure of our stores to achieve sales and operating levels consistent with our expectations; (n) failure to successfully execute our direct business segment initiatives; (o) our dependence on a strong brand image; (p) failure of our information technology systems to support our business; (q) failure to successfully integrate new information technology systems to support our business; (r) our dependence upon key executive management or our inability to hire or retain additional personnel; (s) changes in payments terms, including reduced credit limits and/or requirements to provide advance payments to our vendors; (t) disruptions in our supply chain and distribution facility; (u) our reliance upon independent third-party transportation providers for all of our product shipments; (v) hurricanes, natural disasters, unusually adverse weather conditions, boycotts and unanticipated events; (w) the seasonality of our business; (x) increases in the costs of fuel, or other energy, transportation or utilities costs as well as in the costs of raw materials, labor and employment; (y) the impact of governmental laws and regulations, including tax policy, and the outcomes of legal proceedings; (z) restrictions imposed by lease obligations on our current and future operations; (aa) our failure to maintain effective internal controls; and (bb) our inability to protect our trademarks or other intellectual property rights. Certain other factors which may impact our continuing operations, prospects, financial results and liquidity or which may cause actual results to differ from such forward-looking statements are discussed or included in the company’s periodic reports filed with the SEC and are available on our website at www.bodycentral.com under “Investor Relations.” You are urged to carefully consider all such factors. The company does not undertake or plan to update or revise any such forward-looking statements to reflect actual results, changes in plans, assumptions, estimates or projections, or other circumstances occurring after the date of this presentation, even if such results, changes or circumstances make it clear that any forward-looking information will not be realized. If there are any future public statements or disclosures by us which modify or impact any of the forward-looking statements contained in or accompanying this presentation, such statements or disclosures will be deemed to modify or supersede such statements in this presentation. 2

3 Business Overview Body Central is a fast fashion retailer in the midst of an operational restructuring. We are focused on building long-term value per share. In the near-term, this means we will be putting our efforts toward returning to positive free cash flow and create business processes that sustain and maximize this free cash flow. Long- term, we will expand our efforts toward investing our excess capital to maximize the growth of our value per share. We plan to accomplish this goal through the following strategic initiatives June 27, 2014; An investment provided the company with sufficient cash to support our turnaround efforts Re-focusing on our core customer Ongoing cost savings of at least $20 million have been identified, implemented and expect to be realized over the course of the next 18 months Increasing inventory turns to return to historic productivity Return to historic trade terms Hired a new CFO and appointed new Directors with aggressive focus on costs and the customer 3

4 Body Central Overview • Founded in 1972 as a Fast Fashion specialty apparel retailer of on-trend fashion at value prices • Multi-channel retailer with 275 stores located in 28 states, and e-commerce business (www.bodycentral.com) • Broad product offering, focused on head-to-toe outfitting, with a unique niche in sexy Nightlife at great prices We deliver new trend-driven merchandise daily to our stores and website, concentrating on the needs of the millennial customer While Nightlife is our best-at category, the strength of our cross-over product mix goes from day into evening, satisfying her lifestyle needs • Customers are value conscious, sexy, trend-driven young women with diverse cultural backgrounds, ranging from late teens to mid-thirties • With over 50% of our customer base African American and Hispanic, we believe our business is unique in terms of customer demographic, therefore offering a competitive advantage 4

5 2014 Capital Infusion and Restructuring Plans • Recapitalized, restructured and refocused on driving cash flow sustainability • June 27, 2014 investment injected $18mm via convertible note and preferred stock offering, timed with additional expense cuts intended to right-size cost structure quickly Notes carry a 7.5% interest rate, paid quarterly in PIK, with an option for payment in cash at a discounted rate of 6.75% Investment provided operating liquidity and with immediate changes in leadership and strategy; additionally, the Company intends significant shareholder friendly governance changes Expense cuts have been identified through the course of due diligence, implemented, and continued efforts to reduce expenses ongoing • Real Estate optimization policy will seek to close underperforming stores while maximizing performance of the overall portfolio 19 stores have been closed in 2014 due to underperformance or lease expirations/kick-out clauses that were exercised, with additional stores scheduled to close by year end based on upcoming lease expirations On an ongoing basis, the entire real estate portfolio will be reviewed annually for potential future closings as leases expire or kick-out clauses are triggered • Capital was contingent upon identification and implementation of expense cuts of at least $20 million. Ongoing expense reduction is a core focus. 5

6 Capital Structure 6 • Debt: $12mm of Asset-backed debt with Crystal Financial • The availability of this facility is driven and collateralized mostly by the value of our inventory base • Availability expands up to $17mm when the inventory collateral base allows New $18 million second lien convertible note appears on the June 28, 2014 balance sheet as receivable with an offsetting liability • Equity: 68mm shares outstanding an as-converted basis, including shares underlying, from the Convertible Notes

7 Cash Balance • We are focused on positioning the company to generate sustainable free cash flow Cash today (August 13, 2014): $14.2mm Assumptions for the remainder of 2014 • Gross margins negatively impacted by increased mark-downs in Q3 • Improved gross margins projected year- over-year in Q4 • Cost structure significantly reduced • No improvement in payables terms 2014 anticipated cash performance • Q3 seasonally burns cash as we build inventory • Q4 historically builds cash position during higher volume seasonal selling periods Opportunity to improve payable terms to market would increase cash position by $5 million to $8 million • We do not anticipate this happening until we demonstrate sustainable positive cash flow 7

8 How we lost our way 8 * August ‘13 fashion wall – one of many recent departures from our dominant historical category of Nightlife for multi-ethnic fashionable women (average age is 25). * We are now reset and focused on our core customer and best category, Nightlife. • Loss of focus on the core customer demographic and Nightlife product niche in the marketplace Assortment became too young, too junior, less edgy, and too inline with other competitors Nightlife was not distorted as a must-win category; overall assortment was too balanced between casual and Nightlife • Shift away from Fast Fashion to an inventory-heavy linear model Too much fashion was purchased in too much depth We believe Inventory mismanagement is the leading cause of failure in our industry Inventory turns dropped precipitously • Unnecessary spending on professional fees • Aspirational facility upgrades were overly aggressive based on current performance trend

9 Getting back on course • Six key areas that we believe will drive improved results Critical shift in inventory velocity strategy – going back to what worked for us from 2009 – 2011 $20mm+ of annualized expense cuts to align cost structure with current business environment, and ongoing focus on operational efficiency Strong focus on customer and Nightlife positioning in the marketplace Significant management changes, including new Board appointees with expertise in retail operations, supply chain, e-commerce, finance, investment management and public accounting Real Estate optimization program Merchandise purchased with peer and management review 9

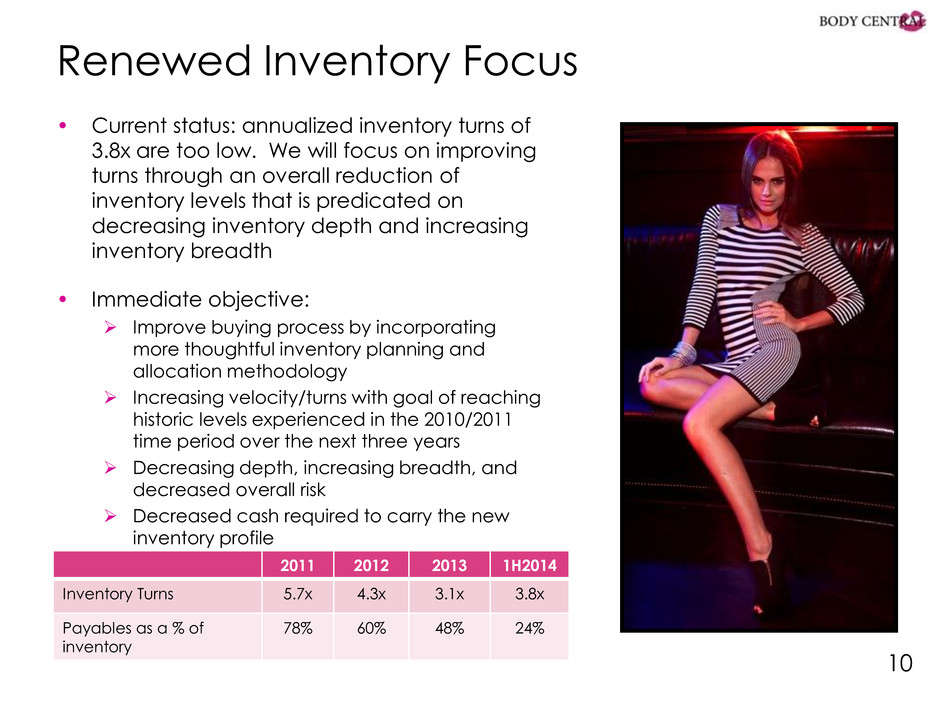

10 Renewed Inventory Focus • Current status: annualized inventory turns of 3.8x are too low. We will focus on improving turns through an overall reduction of inventory levels that is predicated on decreasing inventory depth and increasing inventory breadth • Immediate objective: Improve buying process by incorporating more thoughtful inventory planning and allocation methodology Increasing velocity/turns with goal of reaching historic levels experienced in the 2010/2011 time period over the next three years Decreasing depth, increasing breadth, and decreased overall risk Decreased cash required to carry the new inventory profile New CFO focused on driving inventory turns and improving working capital metrics New CFO expert in inventory management 10 2011 2012 2013 1H2014 Inventory Turns 5.7x 4.3x 3.1x 3.8x Payables as a % of inventory 78% 60% 48% 24%

11 Increased Turns and “One-and-Done” #2 Decreased inventory, risk, and cash outlay #3 Much less depth per SKU; sold out items will be replaced with similar items, but rarely reordered identically #4 TREASURE HUNT: customer gets sense of urgency to buy when she first sees it, and she visits more often #5 Fewer markdowns combined with lower initial price points will allow for greater regular priced sales and improved Gross Margins #6 Customer conditioned as credibility builds – she won’t see best fashion on the sale racks #1 Increased planned turns 11

12 Recent Expense Cuts • Current operating expenses are entirely too high • Objective: Returning expense structure to the levels experienced historically Through various cost saving initiatives, the company has identified at least $20 million in ongoing savings These initiatives include but are not limited to the following • Engaging Hilco in rent negotiations to optimize store footprint and lease structures with anticipated savings are expected to be realized beginning in 2015 • Reductions In Force 33% reduction in corporate staff Ongoing headcount reduction happening through attrition • Immediate elimination of at least $6.5 mm in annual professional fees • Shutting down unprofitable catalog business • Reviewing T&E, healthcare plans, and miscellaneous items • Holding ourselves accountable: CEO took 20% pay cut in May New CFO cash comp 25% below former CFO New Board forgoing comp for 2014 This is a cultural shift toward constant improvement 12 SG&A % of Sales 2011 $66.8mm 22.5% 2012 $74.7mm 24.0% 2013 $94.9mm 33.5% 1H14 $48.7 mm 41.9%

13 Focus on the customer 13 • We are the destination for a value conscious, sexy, trend-driven young woman of diverse cultural background, who ranges in age from late teens to mid-thirties • Our Nightlife niche and focus allows her to go from day-into-evening, with cross-over attire that meets the needs of our customer who has an active social agenda • Our multi-channel experience is ever-changing; with new merchandise received in-store and online daily to reflect the most current trends • We are focused on her entire outfit; visually exciting displays that start with our windows and continue throughout the store with signage, mannequins , and body forms • We keep her informed and up-to-date on the most current trends through our website, emails, text messaging, and social media channels

14 Revitalized Management • Executive Leadership CEO joined in Q1 2013; experienced merchant with 43 years of experience • Refocused on the company’s largest capital allocation decision: product • Oversees merchandising, marketing, design, and Product Development Former CFO was recruited back by the new Board during recent recapitalization • Was a key architect of the company’s success from 2007 through late 2011 • Tasked with cutting expenses, resetting the inventory strategy, and shoring up confidence with the vendors, factors, lenders, and investors • Board of Directors New leadership: new Board is very active and involved, with direct ownership of approximately 39% of the company (fully- diluted). 14

15 Real Estate Optimization Plan • Current Rationalization The majority of our stores are currently profitable Annually, we will continue to strategically review our entire portfolio for profitability and potential expansion and/or necessary closures Hilco consultants have been negotiating with our Landlords during the past few months and will continue to look at opportunities within our portfolio • Grow Strategically when we are ready We plan to open new stores in strategic markets once we stabilize our business and show improving trends Capex dedicated to store growth should be approximately $2.2-$3.0 mm per year, in order to open 15-20 stores at $150k each. 15

16 Store Opportunity • We see tremendous room for profitably once we stabilize and gain traction within the existing business, both within our footprint, and into the remaining half of the US that we don’t currently serve. 16

17 Priorities and Opportunities • Build cash and credit availability, thus ensuring control of our future • Build new e-commerce platform as a launching pad to attain 15% penetration of overall volume • In-store and online opportunity to round out our customers’ wardrobe with sexy lingerie through our exclusive LipstickLingerie label • Leverage SexyStretch as our part of our brand DNA, with body conscious product that differentiates us in the marketplace • Finish select software and systems upgrades and installations for distribution center and planning/allocation functions • Execute Real Estate Optimization plan for existing store base, as well as with future growth opportunities 17 Sexy Stretch and Lipstick Lingerie are two of our exclusive labels

18 Exchange Listing Plan • We are currently listed on the OTC Pink market • We intend to apply for listing on a National exchange in the coming months • We have had discussions with the NYSE MKT and NASDAQ exchanges about a potential listing 18

19 Proposed Governance Changes • Upcoming Special Meeting proposals include Reverse stock split 1:10 De-classify Board of Directors Eliminate super-majority voting requirement Allow 25% of the Board to call a Special Meeting Allow stockholder actions to be executed with 51% written consent • Focusing long term incentive compensation on performance that drives value We expect to implement a performance based long term incentive plan to further align the management goals with shareholders in the 2015 proxy As an example, the long term component of our one-time, performance stock grant to new CFO to vest • 25% after the free cash flow equivalent of $20mm EBITDA for trailing 12 months, and • 25% after the free cash flow equivalent of $40mm EBITDA for trailing 12 months • Installing an Employee Stock Purchase Plan to promote ownership at all levels of the organization 19

20 Summary • Balance sheet strengthened with capital infusion of $18mm • Clearly defined objective: driving cash flow sustainability • Clear focus on a customer who is a value conscious, sexy, trend-driven young woman with a diverse cultural background • Optimizing our merchandise buying process focusing on our best at category: Nightlife • Returning to high velocity inventory model used from ’09 – ’11 • Significant opportunity to re-launch e- commerce business • Healthy fleet of stores, with the majority profitable today; portfolio reviewed annually • Significant stakeholders now serving on the Board 20

Thank You

22 22 Appendix: Reconciliation of GAAP to Adjusted Earning for Q214 June 28, June 29, June 28, June 29, 2014 2013 2014 2013 Net (loss), as reported (21,017)$ (12,768)$ (30,270)$ (10,071)$ Impairment of long-lived assets 1,884 — 1,884 — Impairment of trade name, net of tax impact 2,909 — 2,909 — Impairment of goodwill — 10,358 — 10,358 Net (loss) income, as adjusted (16,224)$ (2,410)$ (25,477)$ 287$ Net (loss) income per common share, as reported: Basic (1.28)$ (0.78)$ (1.85)$ (0.62)$ Diluted (1.28)$ (0.78)$ (1.85)$ (0.62)$ Net (loss) income per common share, as adjusted: Basic (0.99)$ (0.15)$ (1.55)$ 0.02$ Diluted (0.99)$ (0.15)$ (1.55)$ 0.02$ Weighted-average common shares outstanding: Basic 16,404,276 16,342,419 16,386,972 16,293,042 Diluted 16,404,276 16,342,419 16,386,972 16,293,042 Thirteen Weeks Ended Twenty-six Weeks Ended (In thousands, except share data) (In thousands, except share data)