Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ASSEMBLY BIOSCIENCES, INC. | v386582_8k.htm |

Exhibit 99.1

Assembly Biosciences August 2014

This presentation contains forward - looking statements regarding future events. Forward - looking statements involve known and unknown risks that could cause actual results to differ materially from expected results. These risks and uncertainties include, among others: risks related to the costs, timing, regulatory review and results of our studies and clinical trials; our ability to obtain FDA and other regulatory approval of our product candidates; our anticipated capital expenditures, our estimates regarding our capital requirements, and our need for future capital; the unpredictability of the size of the markets for, and market acceptance of, any of our product candidates; our ability to sell any approved products and the price we are able to realize; our ability to obtain future funding on acceptable terms; our ability to retain and hire necessary employees and to staff our operations appropriately; our ability to compete in our industry and innovation by our competitors; our ability to stay abreast of and comply with new or modified laws and regulations that currently apply or become applicable to our business; and the risks set out in our filings with the SEC. 2 Forward - Looking Statements

Russell Ellison, MD – CEO, Chair – Pegasys and multiple other drugs on market Derek A. Small – Pres , COO – Founding CEO of multiple biotechs David Barrett – CFO – CFO; director at multiple biotechs Uri Lopatin , MD – CMO, VP R&D - Led HBV programs at leading pharma Lee Arnold, PhD – CSO – Discoverer of Tarceva ® and >7 other candidates while at Adam Zlotnick , PhD – SAB Chair (HBV) – Science founder, professor at 3 Assembly Biosciences – Overview • Core Protein Allosteric Modifiers ( CpAMs ) – 1 st focus, HBV • Targeted Delivery of Microbiome Therapeutics – 1 st focus, C. difficile • HBV : 1 st Gen Molecule expected in c linic by early 2016; 2 nd Gen following • CDAD : 1 st Gen Microbiome t herapeutic expected in clinic by early 2016; pipeline following Infectious Disease Focused Potential Curative Therapy for Hepatitis B and Clostridium difficile Two Proprietary Technology Platforms Pipeline Offers First - in - class and/or Best - in - class Product Opportunities Experienced Management and R&D Team

4 Why HBV?

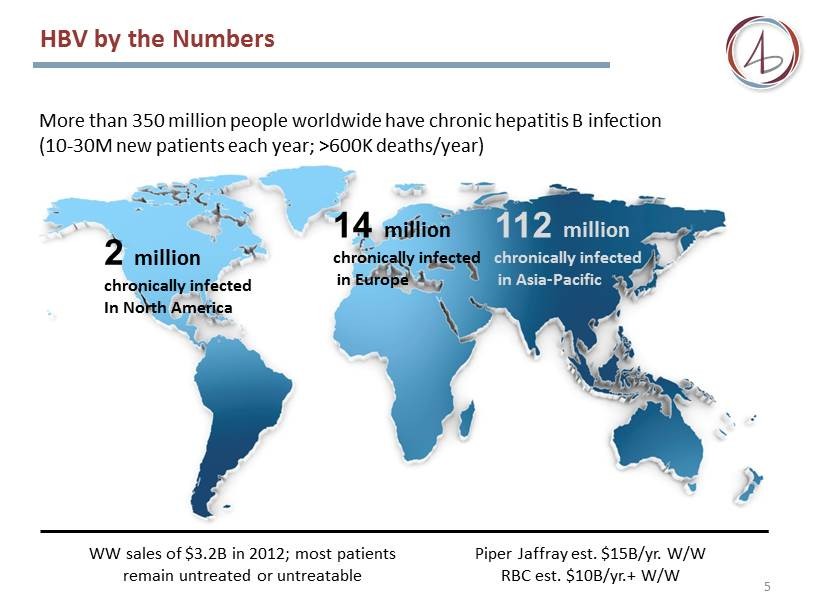

HBV by the Numbers Piper Jaffray est. $15B/yr. W/W RBC est. $10B/yr.+ W/W WW sales of $3.2B in 2012; most patients remain untreated or untreatable 2 million chronically infected In North America 14 million chronically infected in Europe 112 million chronically infected in Asia - Pacific More than 350 million people worldwide have chronic hepatitis B infection (10 - 30M new patients each year; >600K deaths/year) 5

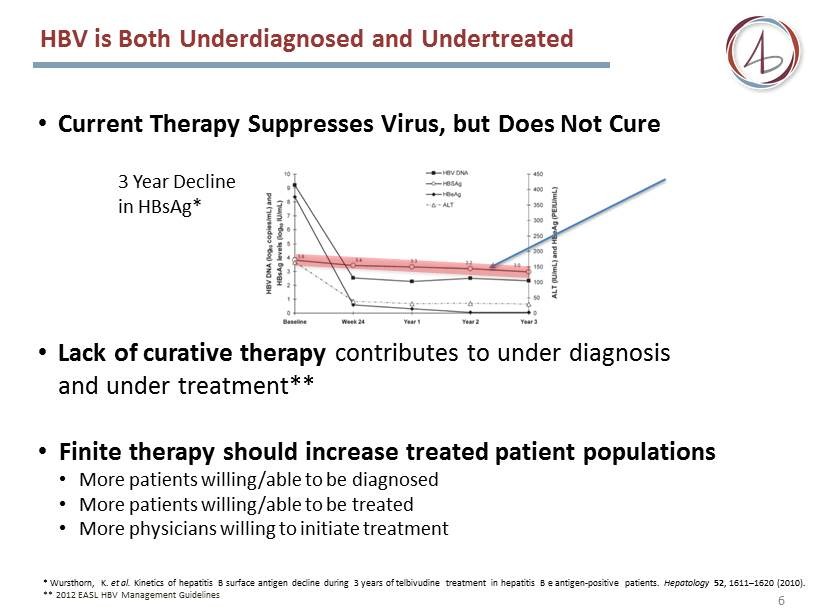

* Wursthorn , K. et al. Kinetics of hepatitis B surface antigen decline during 3 years of telbivudine treatment in hepatitis B e antigen - positive patie nts. Hepatology 52 , 1611 – 1620 ( 2010) . ** 2012 EASL HBV Management Guidelines • Current Therapy Suppresses Virus, but Does Not Cure • Lack of curative therapy contributes to under diagnosis and under treatment* * • Finite therapy should increase treated patient populations • More patients willing/able to be diagnosed • More patients willing/able to be treated • More physicians willing to initiate treatment HBV is Both Underdiagnosed and Undertreated 3 Year Decline in HBsAg* 6

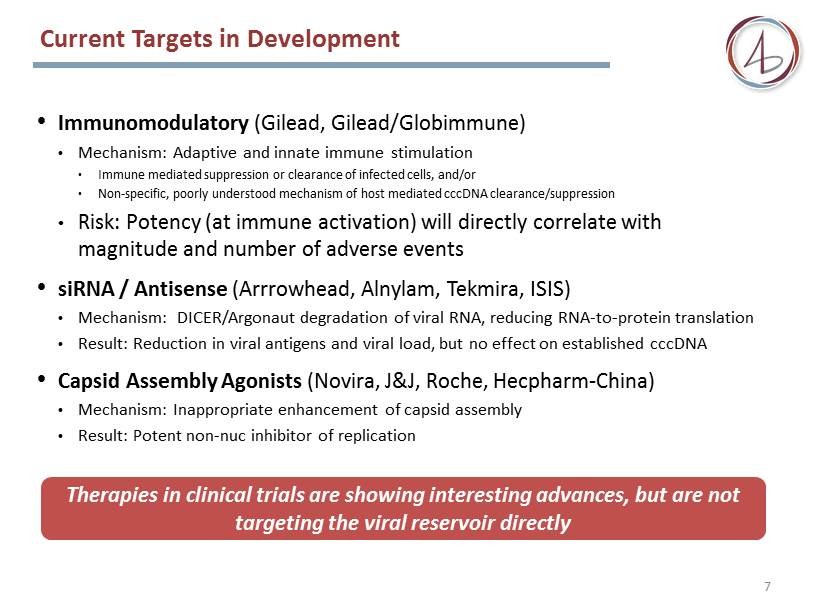

Current Targets in Development • Immunomodulatory (Gilead, Gilead/Globimmune) • Mechanism: Adaptive and innate immune stimulation • Immune mediated suppression or clearance of infected cells, and/or • N on - specific, poorly understood mechanism of host mediated cccDNA clearance/suppression • Risk: Potency (at immune activation) will directly correlate with magnitude and number of adverse events • siRNA / Antisense (Arrrowhead, Alnylam , Tekmira , ISIS) • Mechanism: DICER/Argonaut degradation of viral RNA, reducing RNA - to - protein translation • Result: Reduction in viral antigens and viral load, but no effect on established cccDNA • Capsid Assembly Agonists ( Novira , J&J, Roche, Hecpharm - China) • Mechanism: Inappropriate enhancement of capsid assembly • Result: Potent non - nuc inhibitor of replication 7 Therapies in clinical trials are showing interesting advances, but are not targeting the viral reservoir directly

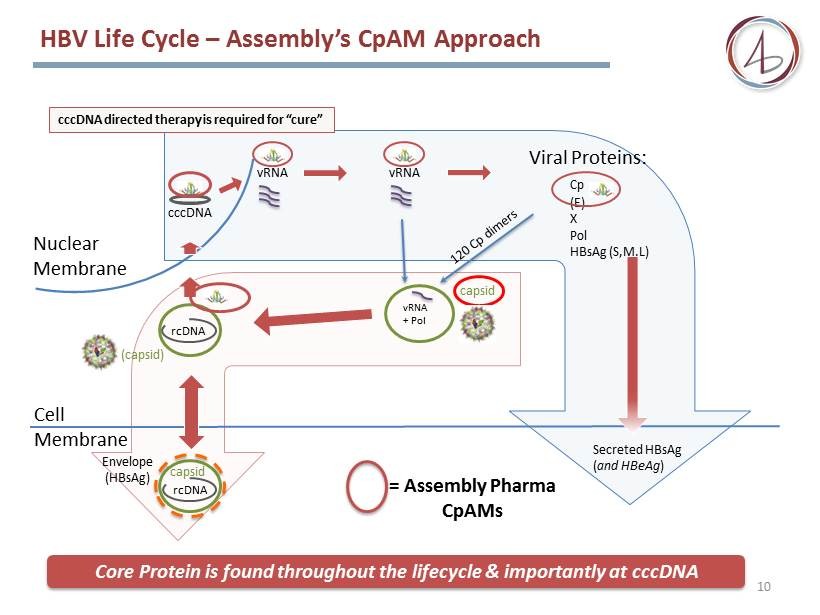

8 HBV Life Cycle & Current Approaches Current therapies target downstream of intra - nuclear viral reservoir cccDNA directed therapy is required for “cure” cccDNA rcDNA ( capsid) rcDNA capsid Envelope (HBsAg) vRNA vRNA Viral Proteins: Cp (E) X Pol HBsAg (S,M,L) vRNA + Pol capsid Secreted HBsAg ( and HBeAg ) Nuclear Membrane Cell Membrane Current RT inhibitors siRNA & Antisense Capsid Assembly (only) Immune Modulators Therapeutic Vaccines (indirect mechanisms)

Why Core Protein? 9

10 cccDNA directed therapy is required for “cure” = Assembly Pharma CpAMs cccDNA rcDNA ( capsid) rcDNA capsid Envelope (HBsAg) vRNA vRNA Viral Proteins: Cp (E) X Pol HBsAg (S,M,L) vRNA + Pol capsid Secreted HBsAg ( and HBeAg ) Nuclear Membrane Cell Membrane HBV Life Cycle – Assembly’s CpAM Approach Core Protein is found throughout the lifecycle & importantly at cccDNA

HBV core protein is pleiotropic - it has multiple functions in the HBV lifecycle free capsid Zlotnick, Tan, Selzer. (2013) Structure 21 , 6 - 8. 11 Deep understanding of core protein is a differentiating advantage for Assembly Core Protein – One Target, Many Functions

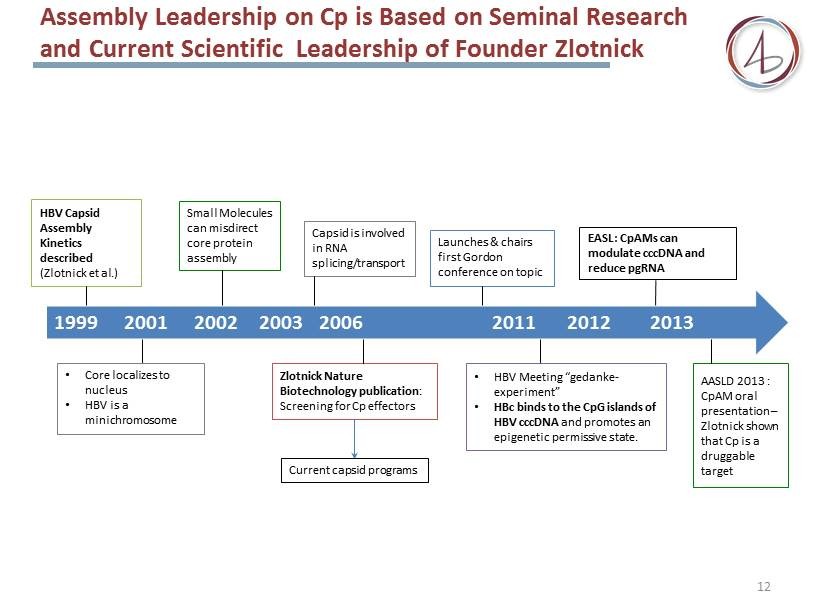

Assembly Leadership on Cp is Based on Seminal Research and Current Scientific Leadership of Founder Zlotnick 12 HBV Capsid Assembly Kinetics d escribed (Zlotnick et al.) • HBV Meeting “gedanke - experiment” • HBc binds to the CpG islands of HBV cccDNA and promotes an epigenetic permissive state. Zlotnick Nature Biotechnology publication : Screening for Cp effectors • Core localizes to nucleus • HBV is a minichromosome Capsid is involved in RNA splicing/transport Small Molecules can misdirect core protein assembly AASLD 2013 : CpAM oral presentation – Zlotnick shown that Cp is a druggable target Launches & chairs first Gordon conference on topic Current capsid programs EASL: CpAMs can modulate cccDNA and reduce pgRNA 1999 2001 2002 2003 2006 2011 2012 2013

Assembly’s CpAMs – Potential Key Advantages • Convenience : Oral • Single Agent or Combination Opportunity : • Potential to be combined with other classes of compounds • Immunology : • CpAMs are not dependent on immune response, but patients can expect the same benefits as immune modulating approaches if reducing viral antigen and pgRNA supports anti - HBV immunity • Efficacy : Assembly could target CpAMs to multiple aspects of viral lifecycle, resulting in: • Reducing viral load • Reducing viral pgRNA • Reducing viral a ntigens ( HBeAg & HBsAg ) • Safety: D irect anti - viral, modulator of a foreign protein 13

HBV Pipeline & Expected Upcoming Milestones 2014 Stage of Development Product Disease Area Lead ID IND Dev. Ph I Ph II Ph IIII CpAM Gen 1 HBV CpAM Gen 2 1H 2015 Initiate Phase I/ Ib Studies ( Aus /NZ) Select Gen 1 clinical c andidate Discovery Hits HBV Over Next ~18 Months Expected Upcoming Milestones Close Merger (July 14) 2 H Potential Analyst Day Gen 2 Hit - to - Lead 14 2016 1H 2 H 1H 2 H Initiate Phase II Studies Gen 2 Clinical Candidate Over Next ~18 Months

Intellectual Property Portfolio: HBV & CpAMs The patent applications fall broadly into two categories: 1. Platform patent applications • Multiple platform patent applications filed, with others in process • Patent applications cover novel mechanism of action, methods of treatment, novel assays, and others 2. Composition of matter patent applications • Several compound, structure, and composition of matter applications pending 15 » We are currently in the process of preparing multiple additional filings » Our patent portfolio is intended to cover significant geography in HBV

Microbiome Program: C. difficile 16

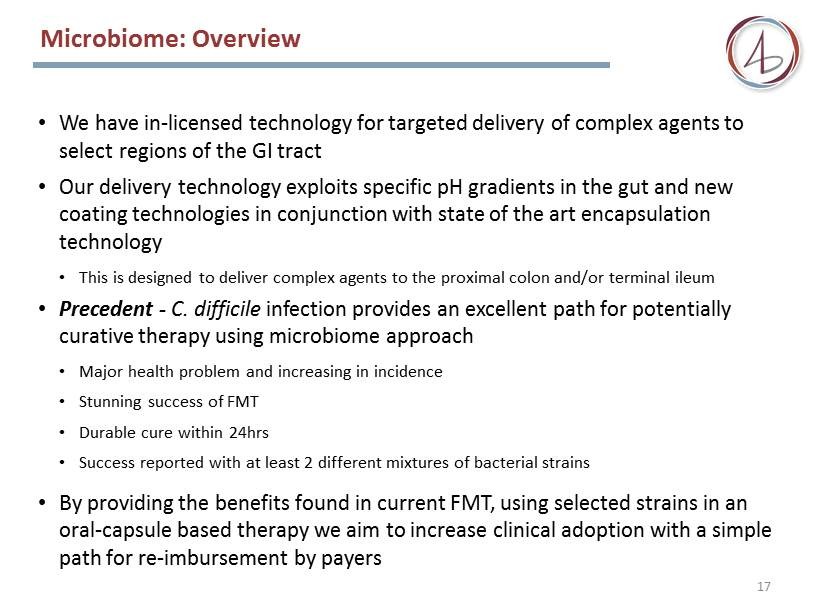

Microbiome: Overview • We have in - licensed technology for targeted delivery of complex agents to select regions of the GI tract • Our delivery technology exploits specific pH gradients in the gut and new coating technologies in conjunction with state of the art encapsulation technology • This is designed to deliver complex agents to the proximal colon and/or terminal ileum • Precedent - C. difficile infection provides an excellent path for potentially curative therapy using microbiome approach • Major health problem and increasing in incidence • Stunning success of FMT • Durable cure within 24hrs • Success reported with at least 2 different mixtures of bacterial strains • By providing the benefits found in current FMT, using selected strains in an oral - capsule based therapy we aim to increase clinical adoption with a simple path for re - imbursement by payers 17

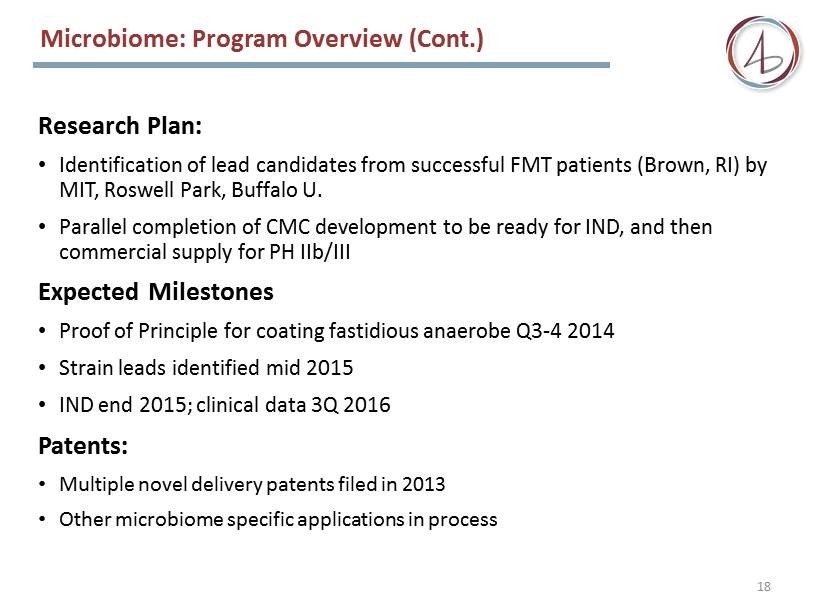

Research Plan: • Identification of lead candidates from successful FMT patients (Brown, RI) by MIT, Roswell Park, Buffalo U. • Parallel completion of CMC development to be ready for IND, and then commercial supply for PH IIb /III Expected Milestones • Proof of Principle for coating fastidious anaerobe Q3 - 4 2014 • Strain leads identified mid 2015 • IND end 2015; clinical data 3Q 2016 Patents: • Multiple novel delivery patents filed in 2013 • Other microbiome specific applications in process 18 Microbiome: Program Overview (Cont.)

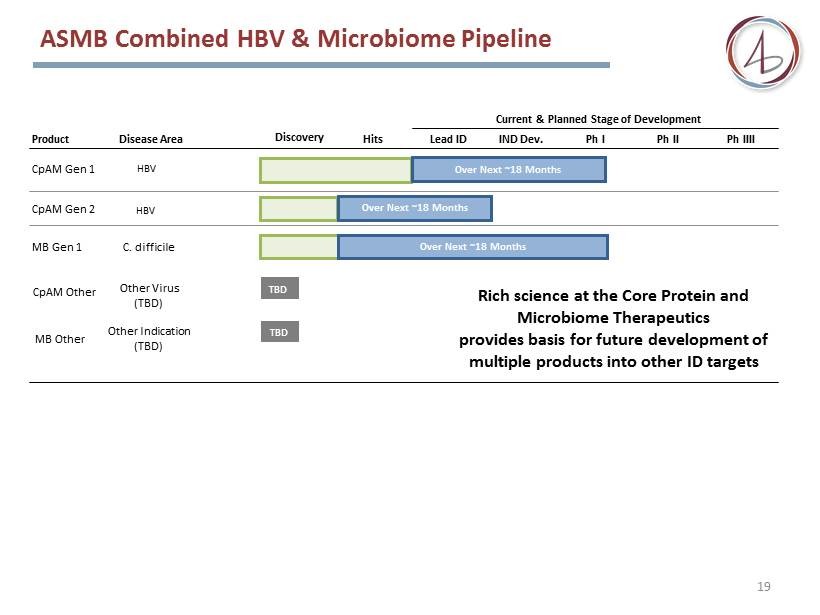

ASMB Combined HBV & Microbiome Pipeline TBD Current & Planned Stage of Development Product Disease Area Lead ID IND Dev. Ph I Ph II Ph IIII CpAM Gen 1 HBV CpAM Gen 2 MB Gen 1 C. difficile Hits CpAM Other Other Virus (TBD) Selecting lead Rich science at the Core Protein and Microbiome Therapeutics provides basis for future development of multiple products into other ID targets Discovery Hits HBV 19 TBD MB Other Other Indication (TBD) Over Next ~18 Months Over Next ~18 Months Over Next ~18 Months

20 Financial Summary • Nasdaq : ASMB • ~$20 mm on balance sheet (6/30/2014) • Cash runway enables multiple milestones into Q4 - 2015 under current development plan • Current S - 3 filing provides flexibility to opportunistically access the capital markets • Approximately 8.6 mm shares outstanding • Fully diluted 11.8 mm shares

21 Assembly Biosciences Infectious Disease Focused Potential Curative Therapy for Hepatitis B and Clostridium difficile Two Proprietary Technology Platforms Pipeline Offers First - in - class and Best - in - class Product Opportunities Experienced Management and R&D Team Cash Allows Achievement of Valuable M ilestones Flexibility to Opportunistically A ccess C apital M arkets