Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FLEETCOR TECHNOLOGIES INC | d773540d8k.htm |

| EX-99.1 - EX-99.1 - FLEETCOR TECHNOLOGIES INC | d773540dex991.htm |

Acquisition of Comdata

Investor Presentation

August 12, 2014

Exhibit 99.2 |

This presentation and accompanying remarks contain forward-looking statements

within the meaning of the federal securities laws. Some of these statements

include those regarding the transaction between FleetCor and Comdata,

FleetCor’s preliminary 2015 outlook, future financial and operating results,

additional financing, the expected closing of the transaction, benefits of

the transaction, future opportunities for the combined company, and any other statements about

FleetCor or Comdata management’s future expectations, beliefs, goals, plans or

prospects. Safe Harbor Provision

1

Statements that are not historical facts, including statements about FleetCor's beliefs, expectations

and future performance, are forward-looking statements. Forward-looking statements can

be identified by the use of words such as "anticipate," "intend,"

"believe," "estimate," "plan," "seek," "project" or "expect," "may," "will," "would," "could" or

"should," the negative of these terms or other comparable terminology. There are a number of

important factors that could cause actual results or events to differ materially from those

indicated by such forward-looking statements, including the outcome of any regulatory

review or proceedings that may be instituted in connection with the transaction; difficulties

in integrating Comdata or a failure to attain anticipated operating results or synergies, each of

which could affect the accretiveness of the acquisition, and the other factors described in

FleetCor’s periodic reports filed with the Securities and Exchange Commission. FleetCor

undertakes no obligation to update forward looking statements to reflect changed assumptions,

the occurrence of unanticipated events, or changes in future operating results, financial

condition or business over time. Readers are further advised to review the “Risk Factors” set forth in

FleetCor’s Annual Report on Form 10-K, which further detail and supplement the factors

described in this paragraph. |

Transaction Overview

2

Signed definitive agreement to acquire Comdata for approximately

$3,450M

Valuation: ~12x EBITDA, prior to consideration of 1) NOL, 2) positive working

capital, and 3) synergies

Consideration: $2.4B in cash and approximately 7.3M shares (~$950M of equity)

THL will receive a FLT board seat

Expected close: December 2014

Great brands, terrific technology, incredible people & expertise, quality

customers New Fuel Card Markets:

Adds 2 new fuel card markets to FLT portfolio

Virtual Payments Entry:

Unique opportunity to access the attractive virtual payments market

Synergies:

Meaningful synergies from combined operations

Scale:

Increases size and diversity

Highly accretive transaction

Pro forma leverage of 3.3x at year-end

Retains significant liquidity and capacity for future acquisitions

Transaction

Description

Rationale

Financial |

Comdata Overview

1969

Comdata

founded as a

payment services

and money

transfer company

2007

Ceridian acquired

by T.H. Lee &

Partners and

Fidelity National

Financial

1995

Comdata

acquired by

Ceridian

2013

Ceridian

completes spin-off

of Comdata from

its Human Capital

Management

business

2014

Comdata

acquired by

FleetCor

Enables $54B+ in payments volume in 48 countries

and 37 currencies

1B+ transactions annually

600M+ cards

20,000+ customers

History of Comdata

3

Business Overview

Key Stats

Headquarters:

Brentwood, TN

Founded:

1969

Employees:

~1,300

Lines of Business:

1.

Over the Road (“OTR”) Fuel Cards

The market leader in fleet trucking in North America, consists of

flagship fuel card and permitting/compliance services

2.

National Accounts Universal Fuel Cards

Serves large “local route fleets”

(i.e. Fortune 500 companies) with a

Universal MasterCard solution for fuel, purchasing, and travel &

entertainment

3.

Virtual Payments

Consists primarily of the fully-automated

-Payables program, a

virtual MasterCard payment program

4.

SVS –

Gift Cards

A global leader in pre-paid gift card processing and program

management that process over one billion transactions annually

e |

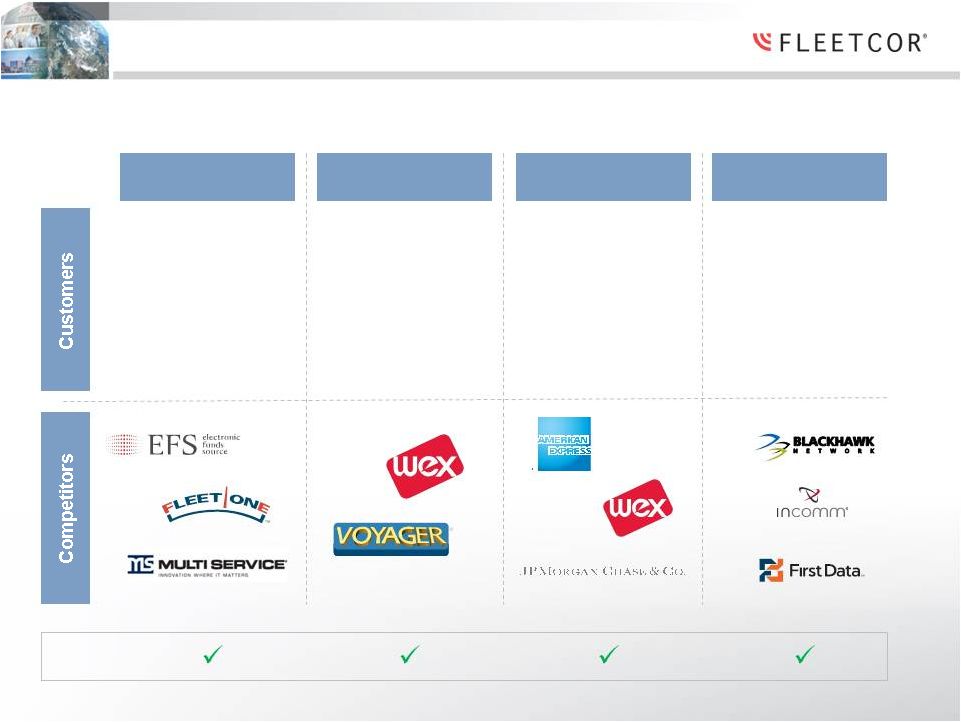

OTR

National

Accounts

Virtual Payments

SVS –

Gift Cards

New Category

for FLT

Comdata serves 4 adjacent end markets which provide new and interesting growth

opportunities for FleetCor

4

Over-the-road

trucking companies

Fortune 500 fleets

Fortune 500 and mid-

sized corporations

Large retailers

Where Comdata Operates |

Comdata Market Position

5

U.S. Visa & MasterCard Commercial

Card Issuers (2012)

Source: The Nilson Report, Issue 1022, July 2013 |

Financial Performance

2010 to 2013 Revenue CAGR of 7%

Corporate Payments represents

approximately ½

the overall

company

Corporate Payments revenue grew

at 15% CAGR from 2010 to 2013

6

Comdata Financial Performance

Revenue Split

MasterCard

OTR

MasterCard

OTR

Corporate

Payments

39%

Corporate

Payments

48%

Fleet

52%

Fleet

61%

2013A

Revenue

-

$581M

2010A

Revenue

-

$470M |

7

Strategic Rationale

Adds 2 complementary

markets to North American

Fleet business

–

OTR

–

National Accounts

Two New Fuel Card

Markets

Large and growing Virtual

Payments market

Virtual Payments

Entry

Significant increase in

revenue and absolute

earnings and diversity

Broader portfolio of

businesses

Scale |

Balance Sheet and Leverage Implications

Commentary

8

Pro forma year-end debt of $3.1B,

including $2.4B of new term debt

…

expect to securitize $0.2B by

year-end

Ample liquidity for continued M&A:

$400M undrawn revolver + ~$600M

annual

free

cash

flow

1

=

~$1B

NTM

capacity for acquisitions

Expect to de-lever to below 3.0x by

mid-2015

Cash

Debt

Leverage

$0.2

$0.2

$0.9

$3.1

1.4x

3.3x

FLT

PF FLT + CD

(1) Cash net income used as proxy for free cash flow.

PF Debt and Leverage at YE Close ($B) |