Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GAIN Capital Holdings, Inc. | q22014earningsrelease8-k.htm |

| EX-99.1 - PRESS RELEASE - GAIN Capital Holdings, Inc. | earningsreleaseq214.htm |

Q2 2014 Financial and Operating Results August 11, 2014

Special Note Regarding Forward-Looking Information In addition to historical information, this presentation contains "forward-looking" statements that reflect management's expectations for the future. The forward-looking statements contained in this presentation include, without limitation, statements relating to GAIN Capital's expectations regarding the opportunities and strengths of the combined company created by the combination of GAIN and GFT, anticipated cost and revenue synergies as well as expected growth in financial and operating metrics, the strategic rationale for the business combination, including expectations regarding product offerings, growth opportunities, value creation, and financial strength. A variety of important factors could cause results to differ materially from such statements. These factors include, but are not limited to, the actions of both current and potential new competitors, fluctuations in market trading volumes, financial market volatility, evolving industry regulations, including changes in regulation of futures companies, errors or malfunctions in our systems or technology, rapid changes in technology, effects of inflation, customer trading patterns, the success of our products and service offerings, our ability to continue to innovate and meet the demands of our customers for new or enhanced products, our ability to successfully integrate assets and companies we have acquired, including the successful integration of GFT, our ability to effectively compete in the OTC products and futures industries, changes in tax policy or accounting rules, fluctuations in foreign exchange rates and commodity prices, adverse changes or volatility in interest rates, as well as general economic, business, credit and financial market conditions, internationally or nationally, and our ability to continue paying a quarterly dividend in light of future financial performance and financing needs. The forward-looking statements included herein represent GAIN Capital's views as of the date of this presentation. GAIN Capital undertakes no obligation to revise or update publicly any forward-looking statement for any reason unless required by law. 2

Second Quarter and First Half 2014 Overview • Difficult trading conditions persist with currency volatility at levels not seen in over 10 years • Continued growth of commission-based businesses – more than doubling year-over-year • Successful execution of M&A strategy with the closing of four acquisitions and robust pipeline • Focus on overall expense management continues 3

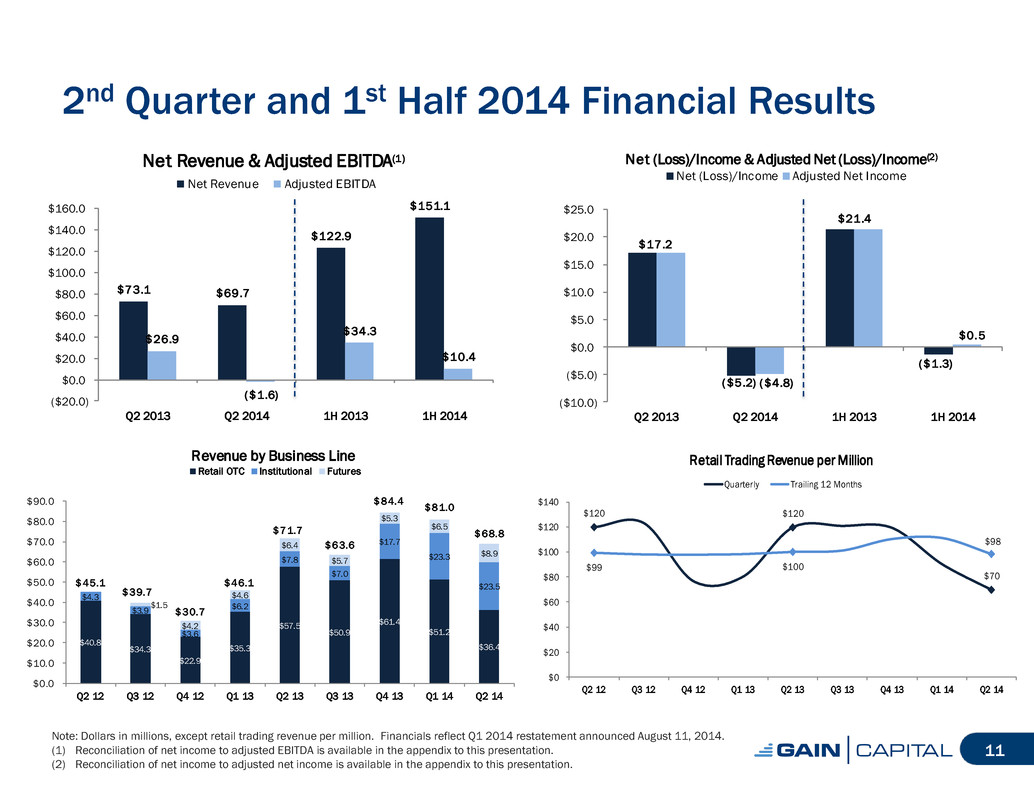

2nd Quarter 2014 Financial and Operating Results • Financial Results • Net revenue: $69.7 million • Adjusted EBITDA(1) loss: ($1.6) million • Net loss: ($5.2) million • EPS (Diluted): ($0.13) • Adjusted EPS (Diluted)(2): ($0.12) • Operating Metrics(3) • Retail volume: $522.2 billion (ADV: $8.0 billion) • Institutional volume: $1,348.7 billion (ADV: $20.7 billion) • GTX volume: $1,237.0 billion (ADV: $19.0 billion) • Futures contracts: 1.7 million • Funded accounts: 130,840 (1) Adjusted EBITDA is a non-GAAP financial measure that represents our earnings before interest, taxes, depreciation, amortization, restructuring, acquisition and integration expenses. A reconciliation of net income to adjusted EBITDA is available in the appendix to this presentation. (2) Adjusted EPS is a non-GAAP financial measure that represents net income per share excluding the impact of restructuring, acquisition and integration expenses. A reconciliation of GAAP EPS to adjusted EPS is available in the appendix to this presentation. (3) Definitions for all our operating metrics are available in the appendix to this presentation. 4

1st Half 2014 Financial and Operating Results • Financial Results • Net revenue: $151.1 million • Adjusted EBITDA(1): $10.4 million • Net loss: ($1.3) million • EPS (Diluted): ($0.04) • Adjusted EPS (Diluted)(2): $0.01 • Operating Metrics(3) • Retail volume: $1,094.5 billion (ADV: $8.6 billion) • Institutional volume: $2,702.2 billion (ADV: $21.1 billion) • GTX volume: $2,449.4 billion (ADV: $19.1 billion) • Futures contracts: 3.3 million • Client assets: $840 million Note: Financials reflect Q1 2014 restatement announced August 11, 2014. (1) Adjusted EBITDA is a non-GAAP financial measure that represents our earnings before interest, taxes, depreciation, amortization, restructuring, acquisition and integration expenses. A reconciliation of net income to adjusted EBITDA is available in the appendix to this presentation. (2) Adjusted EPS is a non-GAAP financial measure that represents net income per share excluding the impact of restructuring, acquisition and integration expenses. A reconciliation of GAAP EPS to adjusted EPS is available in the appendix to this presentation. (3) Definitions for all our operating metrics are available in the appendix to this presentation. 5

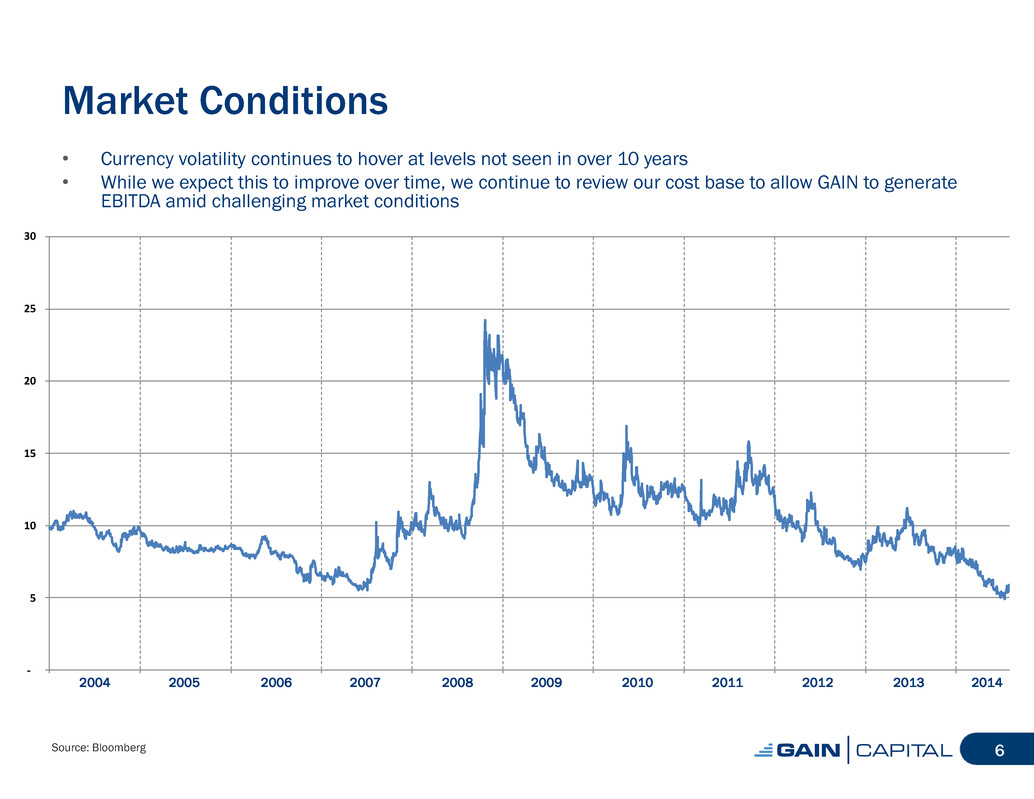

Market Conditions • Currency volatility continues to hover at levels not seen in over 10 years • While we expect this to improve over time, we continue to review our cost base to allow GAIN to generate EBITDA amid challenging market conditions Source: Bloomberg 6 2004 - 5 10 15 20 25 30 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Retail OTC • Growth in funded accounts continues with 37% year- over-year growth through June 30 • Strong client engagement • Q2 2014 average daily volume: $8.0 billion • Up 12% compared to Q2 2013 • Continuing to generate volume and new accounts from direct and indirect sales channels Note: Definitions for all our operating metrics are available in the appendix to this presentation. 7

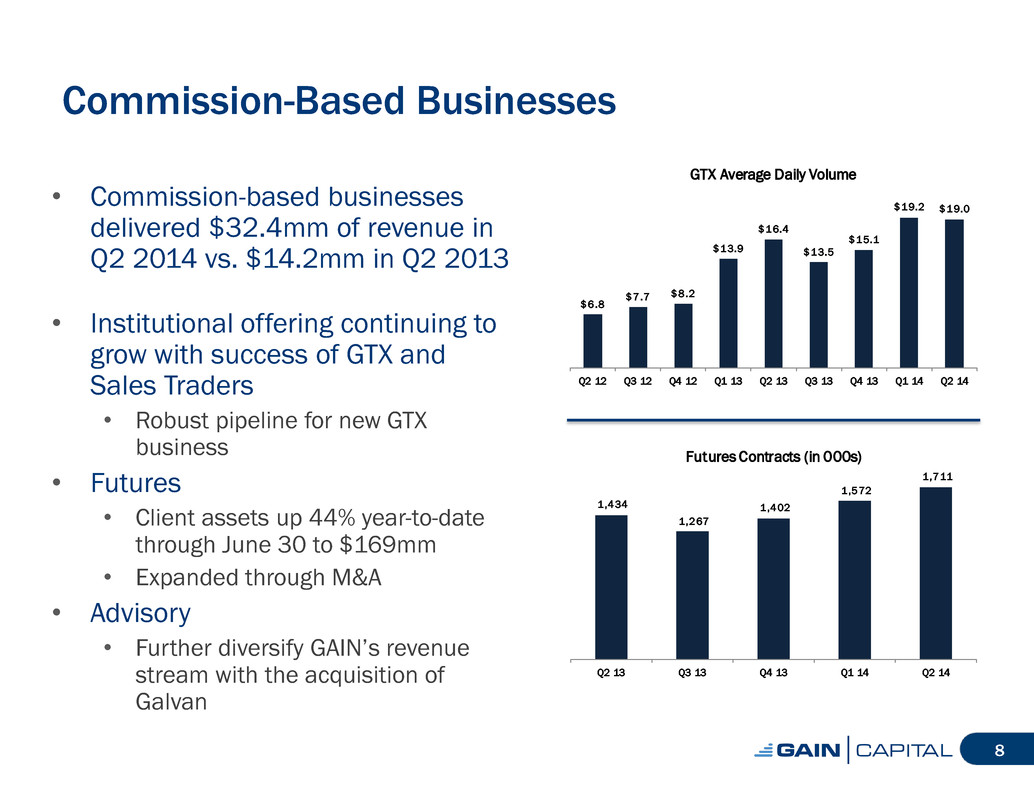

Commission-Based Businesses • Commission-based businesses delivered $32.4mm of revenue in Q2 2014 vs. $14.2mm in Q2 2013 • Institutional offering continuing to grow with success of GTX and Sales Traders • Robust pipeline for new GTX business • Futures • Client assets up 44% year-to-date through June 30 to $169mm • Expanded through M&A • Advisory • Further diversify GAIN’s revenue stream with the acquisition of Galvan 8 $6.8 $7.7 $8.2 $13.9 $16.4 $13.5 $15.1 $19.2 $19.0 Q2 12 Q3 12 Q4 12 Q1 13 Q2 13 Q3 13 Q4 13 Q1 14 Q2 14 GTX Average Daily Volume 1,434 1,267 1,402 1,572 1,711 Q2 13 Q3 13 Q4 13 Q1 14 Q2 14 Futures Contracts (in 000s)

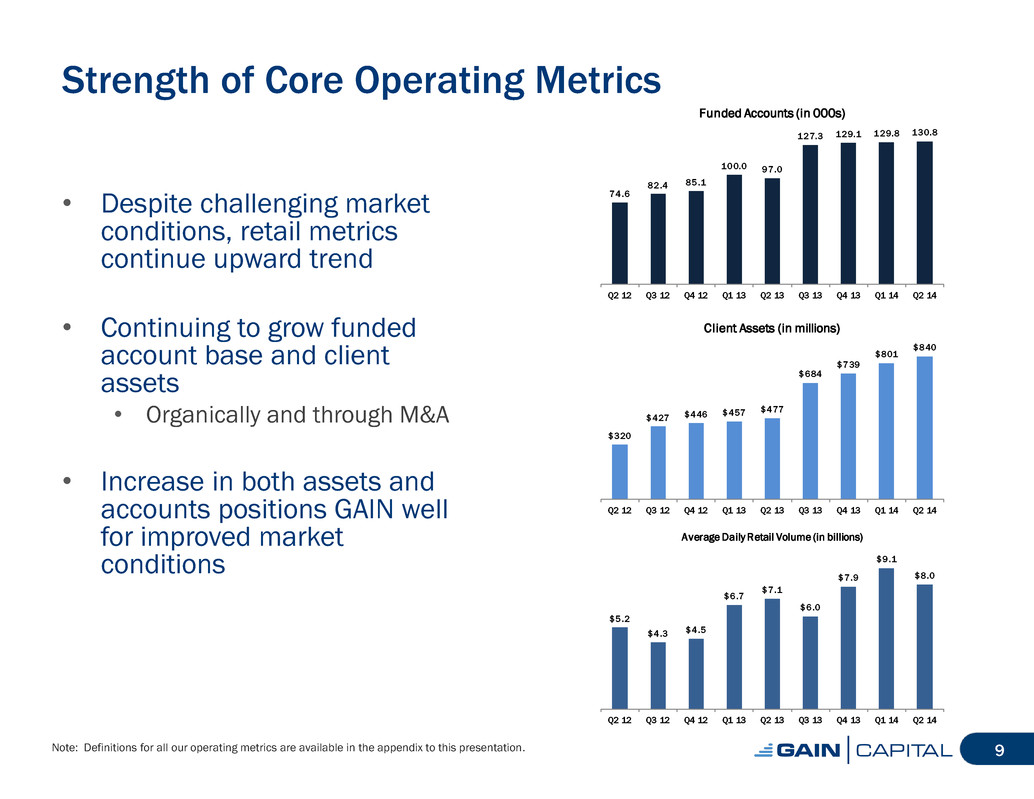

Strength of Core Operating Metrics • Despite challenging market conditions, retail metrics continue upward trend • Continuing to grow funded account base and client assets • Organically and through M&A • Increase in both assets and accounts positions GAIN well for improved market conditions Note: Definitions for all our operating metrics are available in the appendix to this presentation. 9 74.6 82.4 85.1 100.0 97.0 127.3 129.1 129.8 130.8 Q2 12 Q3 12 Q4 12 Q1 13 Q2 13 Q3 13 Q4 13 Q1 14 Q2 14 Funded Accounts (in 000s) $320 $427 $446 $457 $477 $684 $739 $801 $840 Q2 12 Q3 12 Q4 12 Q1 13 Q2 13 Q3 13 Q4 13 Q1 14 Q2 14 Client Assets (in millions) $5.2 $4.3 $4.5 $6.7 $7.1 $6.0 $7.9 $9.1 $8.0 Q2 12 Q3 12 Q4 12 Q1 13 Q2 13 Q3 13 Q4 13 Q1 14 Q2 14 Average Daily Retail Volume (in billions)

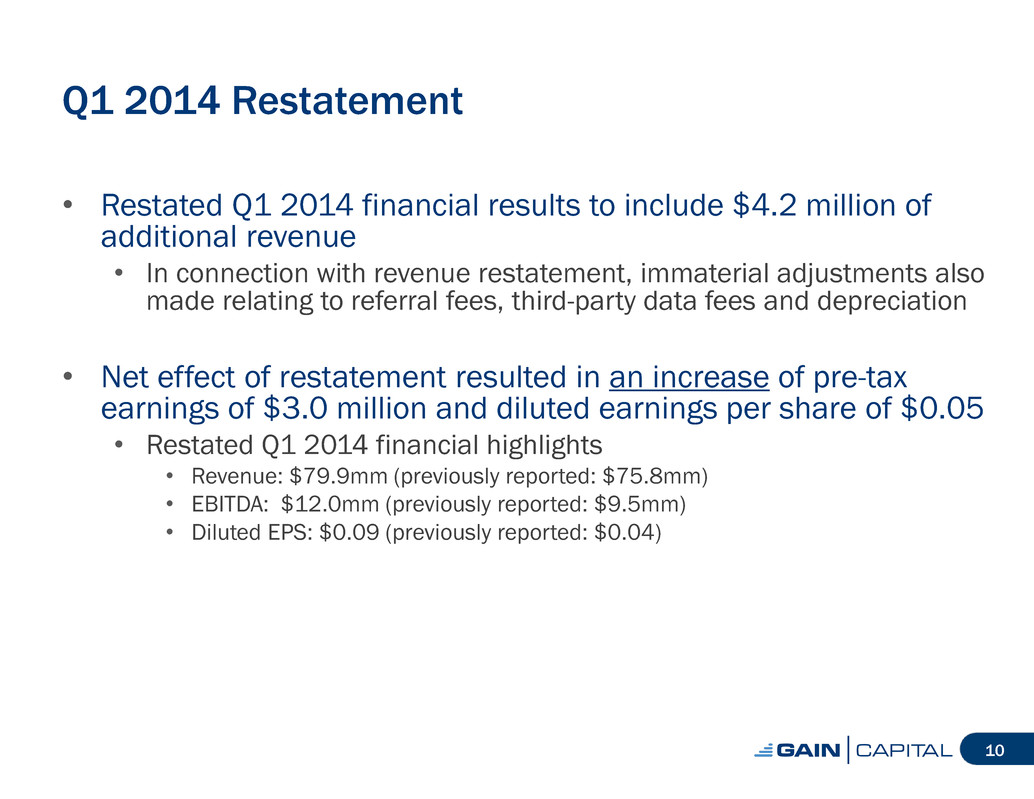

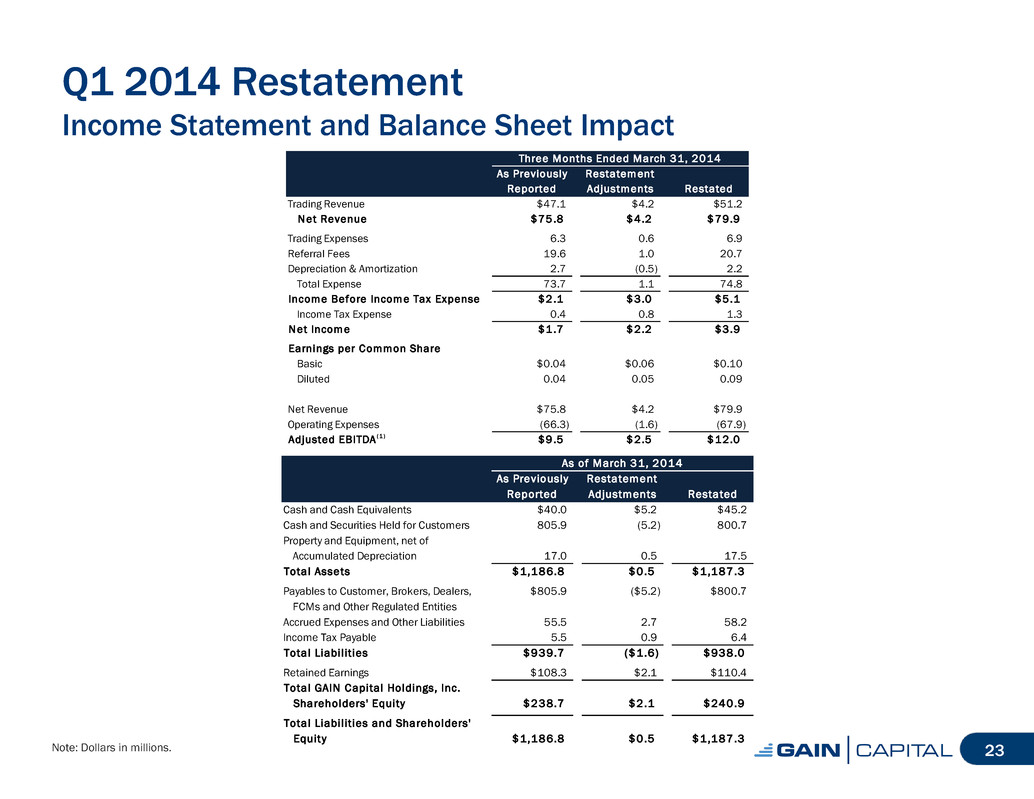

Q1 2014 Restatement • Restated Q1 2014 financial results to include $4.2 million of additional revenue • In connection with revenue restatement, immaterial adjustments also made relating to referral fees, third-party data fees and depreciation • Net effect of restatement resulted in an increase of pre-tax earnings of $3.0 million and diluted earnings per share of $0.05 • Restated Q1 2014 financial highlights • Revenue: $79.9mm (previously reported: $75.8mm) • EBITDA: $12.0mm (previously reported: $9.5mm) • Diluted EPS: $0.09 (previously reported: $0.04) 10

$17.2 ($5.2) $21.4 ($1.3) ($4.8) $0.5 ($10.0) ($5.0) $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 Q2 2013 Q2 2014 1H 2013 1H 2014 Net (Loss)/Income & Adjusted Net (Loss)/Income(2) Net (Loss)/Income Adjusted Net Income $73.1 $69.7 $122.9 $151.1 $26.9 ($1.6) $34.3 $10.4 ($20.0) $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 $160.0 Q2 2013 2 2014 1H 2013 1 2014 Net Revenue & Adjusted EBITDA(1) Net Revenue Adjusted EBITDA 2nd Quarter and 1st Half 2014 Financial Results Note: Dollars in millions, except retail trading revenue per million. Financials reflect Q1 2014 restatement announced August 11, 2014. (1) Reconciliation of net income to adjusted EBITDA is available in the appendix to this presentation. (2) Reconciliation of net income to adjusted net income is available in the appendix to this presentation. 11 $120 $120 $70 $99 $100 $98 $0 $20 $40 $60 $80 $100 $120 $140 Q2 12 Q3 12 Q4 12 Q1 13 Q2 13 Q3 13 Q4 13 Q1 14 Q2 14 Retail Trading Revenue per Million Quarterly Trailing 12 Months $40.8 $34.3 $22.9 $35.3 $57.5 $50.9 $61.4 $51.2 $36.4 $4.3 $3.9 $3.6 $6.2 $7.8 $7.0 $17.7 $23.3 $23.5 $1.5 $4.2 $4.6 $6.4 $5.7 $5.3 $6.5 $8.9 $45.1 $39.7 $30.7 $46.1 $71.7 $63.6 $84.4 $81.0 $68.8 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 $80.0 $90.0 Q2 12 Q3 12 Q4 12 Q1 13 Q 13 Q3 13 4 Q1 14 Q2 1 Revenue by Business Line Retail OTC Institutional Futures

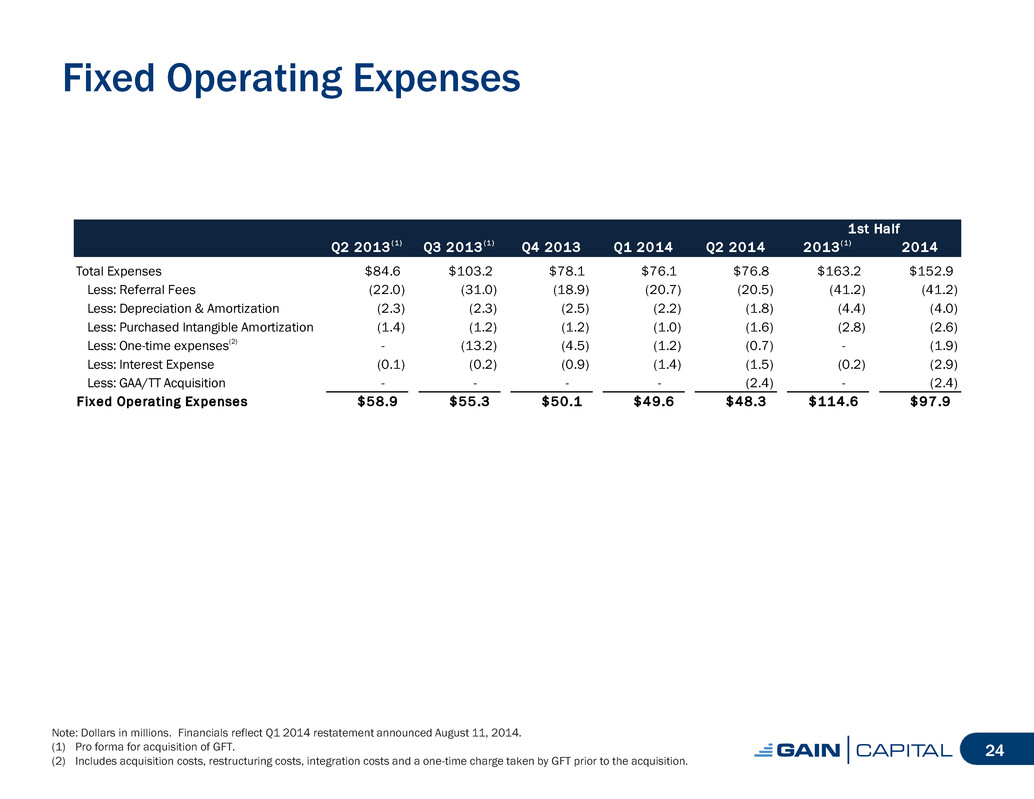

Fixed Operating Expenses Note: Dollars in millions. Fixed operating expenses calculated as total expenses less referral fees, depreciation & amortization, purchased intangible amortization, interest expense, acquisition costs, restructuring costs, integration costs and a one-time charge taken by GFT prior to the acquisition. Q2 2014 fixed operating expenses also exclude expenses related to Global Asset Advisors and Top Third Ag Marketing which closed in early March. (1) Pro forma for acquisition of GFT. (2) Reflects restatement announced August 11, 2014. 12 • Long-term focus on reducing fixed operating expenses • Q2 2014 fixed operating expenses down 18% compared to Q2 2013(1) • 1H 2014 fixed operating expenses down 15% compared to 1H 2013(1) • Continued realization of operating expense synergies from the acquisition of GFT • Expect $40mm annual run-rate savings by Q4 2014 • Taking additional expense reduction steps in Q3 $58.9 $55.3 $50.1 $49.6 $48.3 $114.6 $97.9 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 Q2 13 Q3 13 Q4 13 Q1 14 Q2 14 1H 13 1H 14 1 1 1 2 2

Return of Capital • Return of capital to shareholders • $0.05 per share quarterly dividend approved • Record date: September 12, 2014 • Payment date: September 19, 2014 • Share repurchase • Program remains in place and will continue to be opportunistic 13

YTD 2014 Acquisitions and Investments • Expansion of futures business – GAA / Top Third • Acquired 55% of both Global Asset Advisors (“GAA”) and Top Third Ag Marketing (“TT”) in April • GAA’s Daniels Trading strengthens direct futures business with higher margin, full service brokerage offering • TT provides new client base - agricultural hedgers • President of GAA appointed head of GAIN’s futures division • Expect to grow futures topline substantially and increase EBITDA margins • Acquisition of advisory business – Galvan Research • Galvan Research acquisition announced in April and closed in early July; provides CFD advisory and trade recommendations to retail clients • Complementary fee-based service meets growing demand for guidance-based solutions • High margin business / commission-based revenue source • Revenue of $5.9 million and EBITDA of $2.3 million for 1H 2014 • IP acquisition - GTX technology • Announced and closed transaction in mid-July • Acquired the intellectual property backbone of the GTX business’ ECN • Strengthens the Company’s ability to scale the institutional business for the long term • M&A pipeline remains robust with several transactions in various stages of negotiations 14

Closing Remarks • Strength in operating metrics to drive financial performance when market conditions improve • Diversification of revenue streams continues with larger percentage of top-line generated from commission-based businesses • M&A remains a key strategy for growth and we continue to explore a number of opportunities across various industries and products 15

16 Appendix

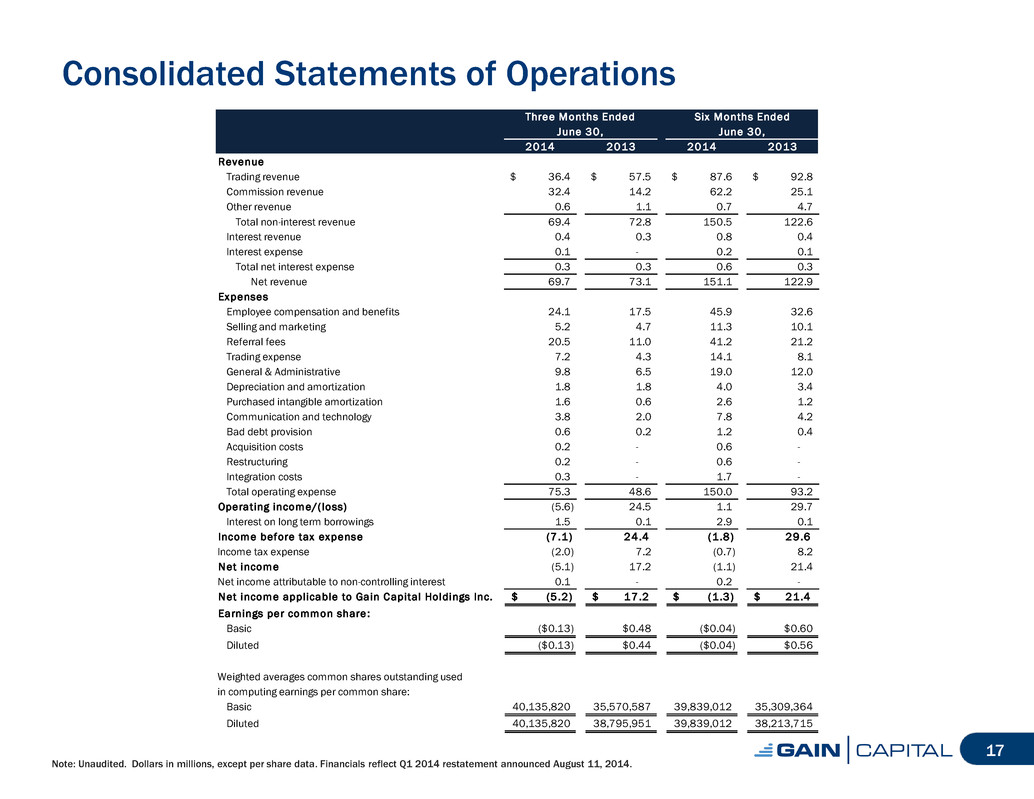

Consolidated Statements of Operations Note: Unaudited. Dollars in millions, except per share data. Financials reflect Q1 2014 restatement announced August 11, 2014. 17 Three Months Ended Six Months Ended June 30, June 30, 2014 2013 2014 2013 Revenue Trading revenue 36.4$ 57.5$ 87.6$ 92.8$ Commission revenue 32.4 14.2 62.2 25.1 Other revenue 0.6 1.1 0.7 4.7 Total non-interest revenue 69.4 72.8 150.5 122.6 Interest revenue 0.4 0.3 0.8 0.4 Interest expense 0.1 - 0.2 0.1 Total net interest expense 0.3 0.3 0.6 0.3 Net revenue 69.7 73.1 151.1 122.9 Expenses Employee compensation and benefits 24.1 17.5 45.9 32.6 Selling and marketing 5.2 4.7 11.3 10.1 Referral fees 20.5 11.0 41.2 21.2 Trading expense 7.2 4.3 14.1 8.1 General & Administrative 9.8 6.5 19.0 12.0 Depreciation and amortization 1.8 1.8 4.0 3.4 Purchased intangible amortization 1.6 0.6 2.6 1.2 Communication and technology 3.8 2.0 7.8 4.2 Bad debt provision 0.6 0.2 1.2 0.4 Acquisition costs 0.2 - 0.6 - Restructuring 0.2 - 0.6 - Integration costs 0.3 - 1.7 - Total operating expense 75.3 48.6 150.0 93.2 Operating income/(loss) (5.6) 24.5 1.1 29.7 Interest on long term borrowings 1.5 0.1 2.9 0.1 Income before tax expense (7.1) 24.4 (1 .8) 29.6 Income tax expense (2.0) 7.2 (0.7) 8.2 Net income (5.1) 17.2 (1.1) 21.4 Net income attributable to non-controlling interest 0.1 - 0.2 - Net income applicable to Gain Capital Holdings Inc. (5.2)$ 17.2$ (1 .3)$ 21.4$ Earnings per common share : Basic ($0.13) $0.48 ($0.04) $0.60 Diluted ($0.13) $0.44 ($0.04) $0.56 Weighted averages common shares outstanding used in computing earnings per common share: Basic 40,135,820 35,570,587 39,839,012 35,309,364 Diluted 40,135,820 38,795,951 39,839,012 38,213,715

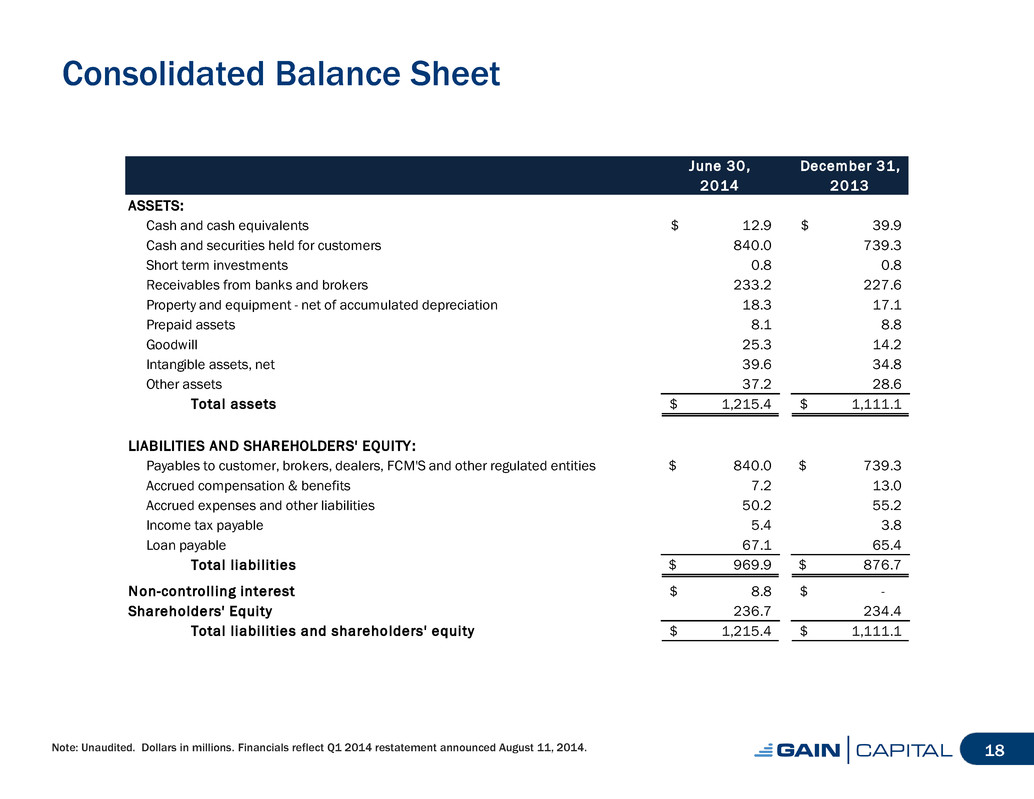

Consolidated Balance Sheet Note: Unaudited. Dollars in millions. Financials reflect Q1 2014 restatement announced August 11, 2014. 18 June 30, December 31, 2014 2013 ASSETS: Cash and cash equivalents 12.9$ 39.9$ Cash and securities held for customers 840.0 739.3 Short term investments 0.8 0.8 Receivables from banks and brokers 233.2 227.6 Property and equipment - net of accumulated depreciation 18.3 17.1 Prepaid assets 8.1 8.8 Goodwill 25.3 14.2 Intangible assets, net 39.6 34.8 Other assets 37.2 28.6 Total assets 1,215.4$ 1,111.1$ LIABILITIES AND SHAREHOLDERS' EQUITY: Payables to customer, brokers, dealers, FCM'S and other regulated entities 840.0$ 739.3$ Accrued compensation & benefits 7.2 13.0 Accrued expenses and other liabilities 50.2 55.2 Income tax payable 5.4 3.8 Loan payable 67.1 65.4 Total l iabilities 969.9$ 876.7$ Non-controlling interest 8.8$ -$ Shareholders' Equity 236.7 234.4 Total l iabilities and shareholders' equity 1,215.4$ 1,111.1$

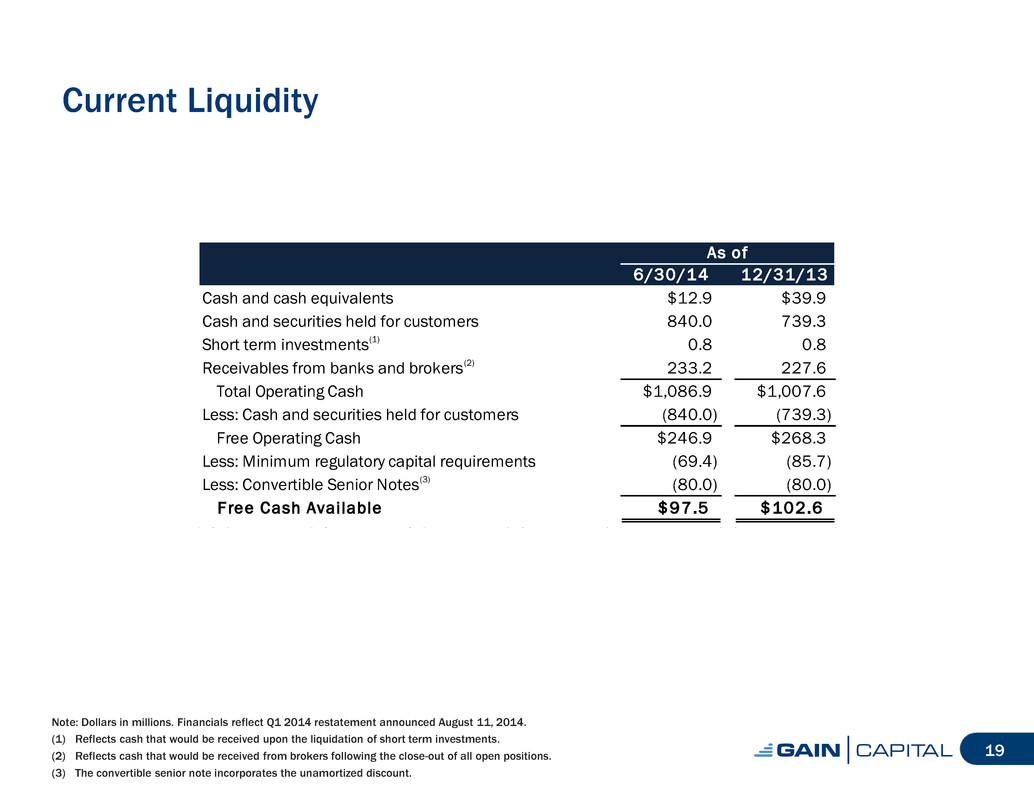

Current Liquidity Note: Dollars in millions. Financials reflect Q1 2014 restatement announced August 11, 2014. (1) Reflects cash that would be received upon the liquidation of short term investments. (2) Reflects cash that would be received from brokers following the close-out of all open positions. (3) The convertible senior note incorporates the unamortized discount. 19 As of 6/30/14 12/31/13 Cash and cash equivalents $12.9 $39.9 Cash and securities held for customers 840.0 739.3 Short term investments(1) 0.8 0.8 Receivables from banks and brokers(2) 233.2 227.6 Total Operating Cash $1,086.9 $1,007.6 Less: Cash and securities held for customers (840.0) (739.3) Free Operating Cash $246.9 $268.3 Less: Minimum regulatory capital requirements (69.4) (85.7) Less: Convertible Senior Notes(3) (80.0) (80.0) Free Cash Available $97.5 $102.6

2nd Quarter and 1st Half 2014 Financial Summary Note: Dollars in millions, except per share data. Financials reflect Q1 2014 restatement announced August 11, 2014. (1) See page 21 for a reconciliation of GAAP net income to adjusted EBITDA. (2) See page 22 for a reconciliation of GAAP EPS to adjusted EPS. (3) Adjusted EBITDA margin is calculated as adjusted EBITDA divided by net revenue. 20 3 Months Ended June 30, 1st Half '14 v '13 2014 2013 2014 2013 Q2 1st Half Net Revenue $69.7 $73.1 $151.1 $122.9 (5%) 23% Operating Expenses 71.3 46.2 140.7 88.6 54% 59% Adjusted EBITDA(1) ($1.6) $26.9 $10.4 $34.3 (106%) (70%) Net (Loss)/Income ($5.2) $17.2 ($1.3) $21.4 (130%) (106%) Adjusted EPS (Diluted)(2) ($0.12) $0.44 $0.01 $0.56 (127%) (98%) EPS (Diluted) ($0.13) $0.44 ($0.04) $0.56 (130%) (107%) Adjusted EBITDA Margin %(1)(3) (2%) 37% 7% 28% (39 pts) (21 pts) Net (Loss)/Income Margin % (7%) 24% (1%) 17% (31 pts) NM

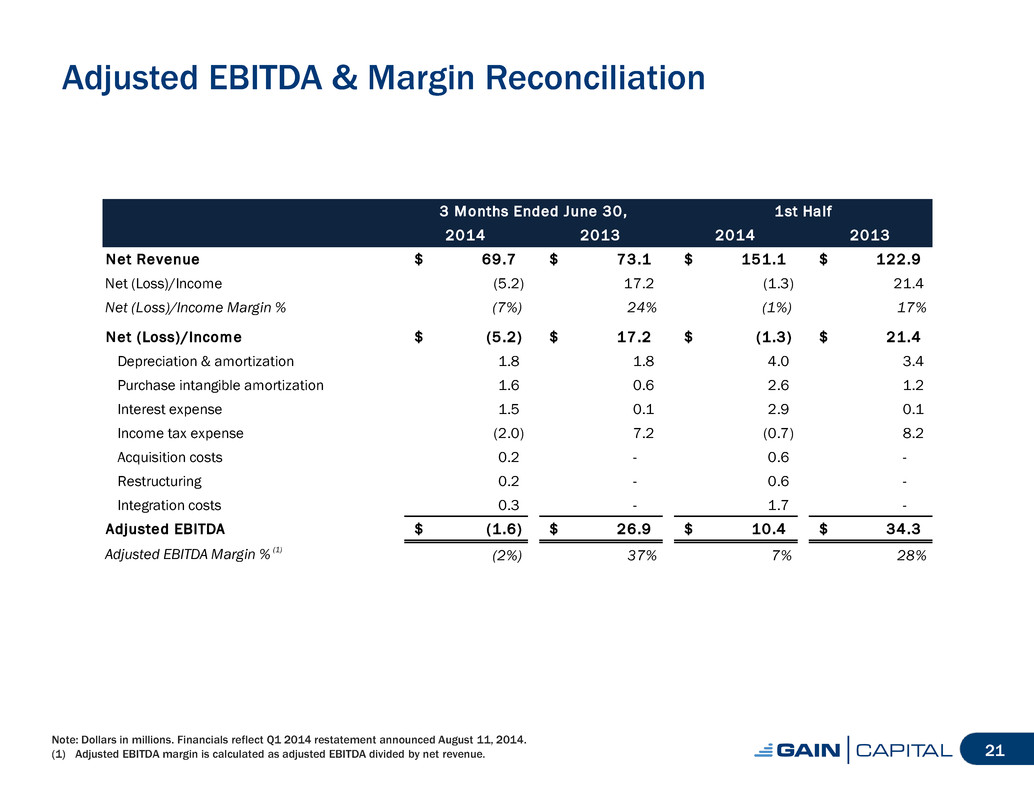

Adjusted EBITDA & Margin Reconciliation Note: Dollars in millions. Financials reflect Q1 2014 restatement announced August 11, 2014. (1) Adjusted EBITDA margin is calculated as adjusted EBITDA divided by net revenue. 21 3 Months Ended June 30, 1st Half 2014 2013 2014 2013 Net Revenue 69.7$ 73.1$ 151.1$ 122.9$ Net (Loss)/Income (5.2) 17.2 (1.3) 21.4 Net (Loss)/Income Margin % (7%) 24% (1%) 17% Net (Loss)/Income (5.2)$ 17.2$ (1 .3)$ 21.4$ Depreciation & amortization 1.8 1.8 4.0 3.4 Purchase intangible amortization 1.6 0.6 2.6 1.2 Interest expense 1.5 0.1 2.9 0.1 Income tax expense (2.0) 7.2 (0.7) 8.2 Acquisition costs 0.2 - 0.6 - Restructuring 0.2 - 0.6 - Integration costs 0.3 - 1.7 - Adjusted EBITDA (1.6)$ 26.9$ 10.4$ 34.3$ Adjusted EBITDA Margin % (1) (2%) 37% 7% 28%

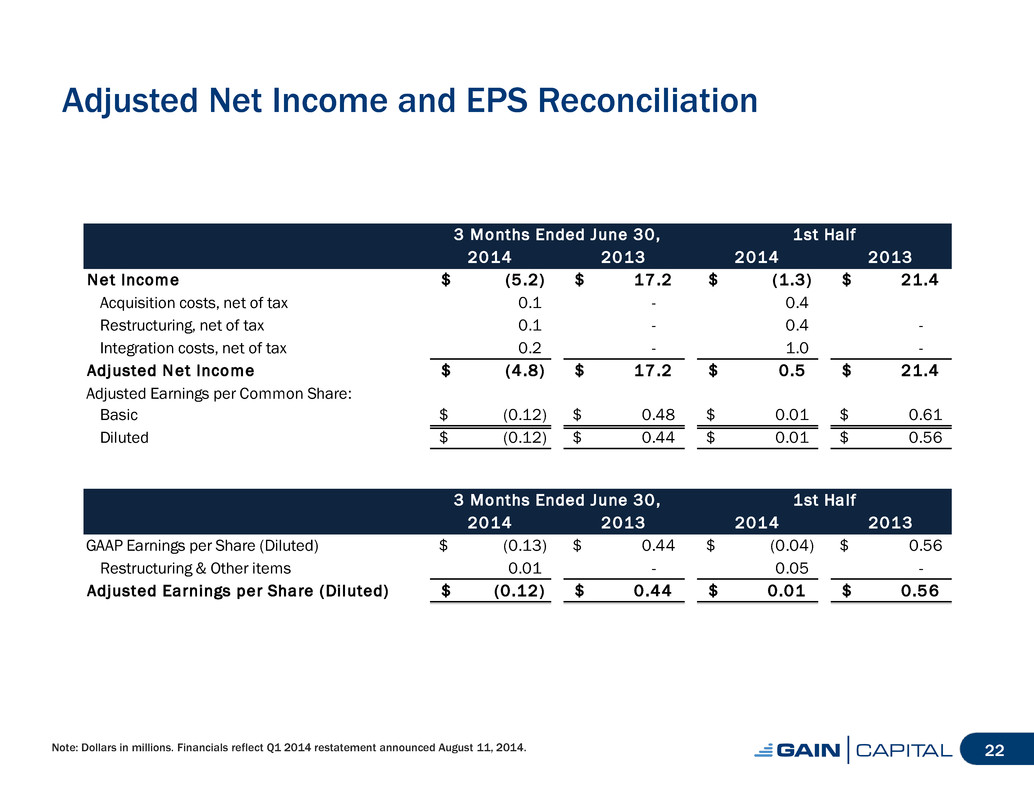

Adjusted Net Income and EPS Reconciliation Note: Dollars in millions. Financials reflect Q1 2014 restatement announced August 11, 2014. 22 3 Months Ended June 30, 1st Half 2014 2013 2014 2013 Net Income (5.2)$ 17.2$ (1 .3)$ 21.4$ Acquisition costs, net of tax 0.1 - 0.4 Restructuring, net of tax 0.1 - 0.4 - Integration costs, net of tax 0.2 - 1.0 - Adjusted Net Income (4.8)$ 17.2$ 0 .5$ 21.4$ Adjusted Earnings per Common Share: Basic (0.12)$ 0.48$ 0.01$ 0.61$ Diluted (0.12)$ 0.44$ 0.01$ 0.56$ 3 Months Ended June 30, 1st Half 2014 201 2014 2013 GAAP Earnings per Share (Diluted) (0.13)$ 0.44$ (0.04)$ 0.56$ Restructuring & Other items .01 - . 5 - Adjusted Earnings per Share (Diluted) (0.12)$ 0.44$ 0.01$ 0.56$

Q1 2014 Restatement Income Statement and Balance Sheet Impact Note: Dollars in millions. 23 Three Months Ended March 31, 2014 As Previously Restatement Reported Adjustments Restated Trading Revenue $47.1 $4.2 $51.2 Net Revenue $75.8 $4.2 $79.9 Trading Expenses 6.3 0.6 6.9 Referral Fees 19.6 1.0 20.7 Depreciation & Amortization 2.7 (0.5) 2.2 Total Expense 73.7 1.1 74.8 Income Before Income Tax Expense $2.1 $3.0 $5.1 Income Tax Expense 0.4 0.8 1.3 Net Income $1.7 $2.2 $3.9 Earnings per Common Share Basic $0.04 $0.06 $0.10 Diluted 0.04 0.05 0.09 Net Revenue $75.8 $4.2 $79.9 Operating Expenses (66.3) (1.6) (67.9) Adjusted EBITDA ( 1 ) $9.5 $2.5 $12.0 As of March 31, 2014 As Previously Restatement Reported Adjustments Restated Cash and Cash Equivalents $40.0 $5.2 $45.2 Cash and Securiti s Held for Customers 805.9 (5.2) 800.7 Property and Equipment, net of Accumulated Depreciation 17.0 0.5 17.5 Total Assets $1,186.8 $0.5 $1,187.3 Payabl s to Customer, Brokers, Dealers, $805.9 ($5.2) $8 0.7 FCMs and Other Regulated Entities Accru d Expenses and Other Liabilities 55.5 2.7 58.2 Income Tax Payable 5.5 0.9 6.4 Total Liabilities $939.7 ($1.6) 938.0 Retained Earnings $108.3 $2.1 $110.4 Total GAIN Capital Holdings, Inc. Shareholders' Equity $238.7 $2.1 $240.9 Total Liabilities and Shareholders' Equity $1,186.8 $0.5 $1,187.3

Fixed Operating Expenses Note: Dollars in millions. Financials reflect Q1 2014 restatement announced August 11, 2014. (1) Pro forma for acquisition of GFT. (2) Includes acquisition costs, restructuring costs, integration costs and a one-time charge taken by GFT prior to the acquisition. 24 1st Half Q2 2013 ( 1 ) Q3 2013 ( 1 ) Q4 2013 Q1 2014 Q2 2014 2013 ( 1 ) 2014 Total Expenses $84.6 $103.2 $78.1 $76.1 $76.8 $163.2 $152.9 Less: Referral Fees (22.0) (31.0) (18.9) (20.7) (20.5) (41.2) (41.2) Less: Depreciation & Amortization (2.3) (2.3) (2.5) (2.2) (1.8) (4.4) (4.0) Less: Purchased Intangible Amortization (1.4) (1.2) (1.2) (1.0) (1.6) (2.8) (2.6) Less: One-time expenses(2) - (13.2) (4.5) (1.2) (0.7) - (1.9) Less: Interest Expense (0.1) (0.2) (0.9) (1.4) (1.5) (0.2) (2.9) Less: GAA/TT Acquisition - - - - (2.4) - (2.4) F ixed Operating Expenses $58.9 $55.3 $50.1 $49.6 $48.3 $114.6 $97.9

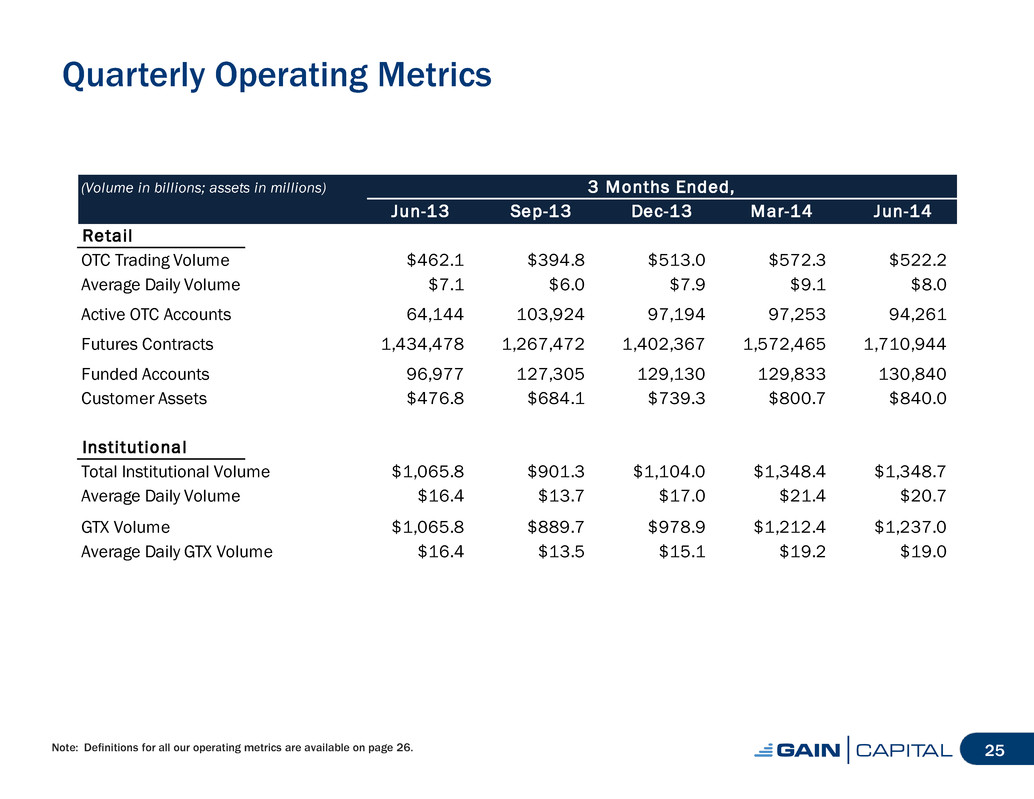

Quarterly Operating Metrics Note: Definitions for all our operating metrics are available on page 26. 25 (Volume in billions; assets in millions) 3 Months Ended, Jun-13 Sep-13 Dec-13 Mar-14 Jun-14 Retail OTC Trading Volume $462.1 $394.8 $513.0 $572.3 $522.2 Average Daily Volume $7.1 $6.0 $7.9 $9.1 $8.0 Active OTC Accounts 64,144 103,924 97,194 97,253 94,261 Futures Contracts 1,434,478 1,267,472 1,402,367 1,572,465 1,710,944 Funded Accounts 96,977 127,305 129,130 129,833 130,840 Customer Assets $476.8 $684.1 $739.3 $800.7 $840.0 Institutional Total Institutional Volume $1,065.8 $901.3 $1,104.0 $1,348.4 $1,348.7 Average Daily Volume $16.4 $13.7 $17.0 $21.4 $20.7 GTX Volume $1,065.8 $889.7 $978.9 $1,212.4 $1,237.0 Average Daily GTX Volume $16.4 $13.5 $15.1 $19.2 $19.0

Definition of Metrics • Funded Accounts • Retail accounts who maintain a cash balance • Active OTC Accounts • Retail accounts who executed a transaction during a given period • Trading Volume • Represents the U.S. dollar equivalent of notional amounts traded • Futures Contracts • Represents the total contracts transacted by customers of GAIN’s futures division • Customer Assets • Represents amounts due to clients, including customer deposits and unrealized gains or losses arising from open positions 26

Q2 2014 Financial and Operating Results August 11, 2014