Attached files

Exhibit 10.16

LEASE AGREEMENT

ONE EXETER PLAZA

699 BOYLSTON ST., BOSTON, MASSACHUSETTS

L E A S E

FROM

CPT ONE EXETER PLAZA, LLC, A DELAWARE

LIMITED LIABILITY COMPANY

TO

EPIRUS BIOPHARMACEUTICALS, INC.

DATE: MARCH 8, 2013

TABLE OF CONTENTS

| ARTICLE 1 BASIC LEASE PROVISIONS |

1 | |||

| ARTICLE 2 PREMISES |

4 | |||

| ARTICLE 3 LEASE TERM AND EXTENSION OPTIONS |

5 | |||

| ARTICLE 4 LANDLORD’S WORK |

6 | |||

| ARTICLE 5 USE OF PREMISES |

7 | |||

| ARTICLE 6 ANNUAL FIXED RENT |

8 | |||

| ARTICLE 7 TAXES AND OPERATING EXPENSES |

8 | |||

| ARTICLE 8 LANDLORD’S REPAIRS AND SERVICES |

13 | |||

| ARTICLE 9 TENANT’S REPAIRS |

16 | |||

| ARTICLE 10 ALTERATIONS |

17 | |||

| ARTICLE 11 ASSIGNMENT AND SUBLETTING |

18 | |||

| ARTICLE 12 LIABILITY OF LANDLORD AND TENANT |

23 | |||

| ARTICLE 13 INSURANCE |

24 | |||

| ARTICLE 14 FIRE OR CASUALTY AND TAKING |

27 | |||

| ARTICLE 15 DEFAULT |

28 | |||

| ARTICLE 16 ENVIRONMENTAL |

30 | |||

| ARTICLE 17 MISCELLANEOUS PROVISIONS |

32 |

LIST OF EXHIBITS. The following Exhibits are a part of this Lease and are incorporated herein by reference.

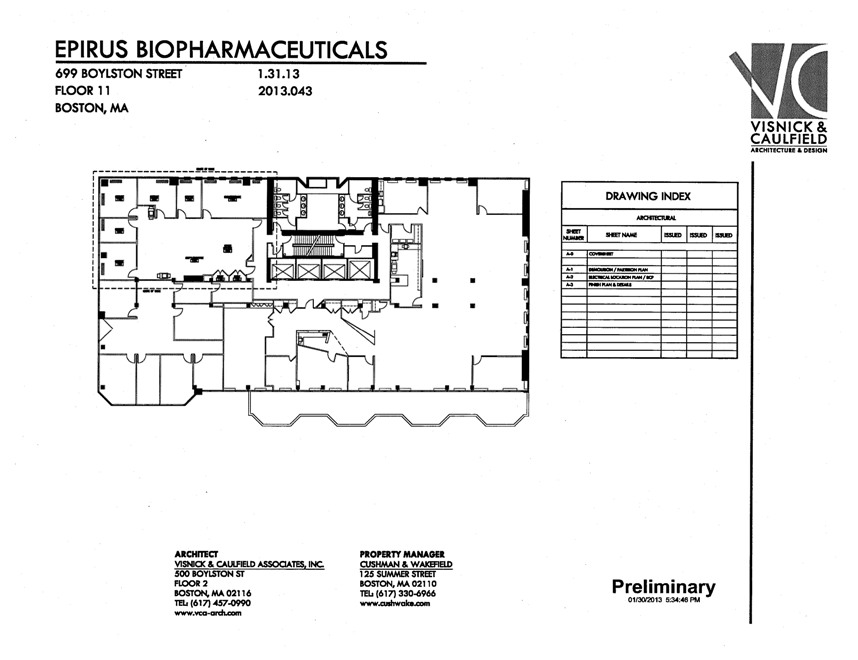

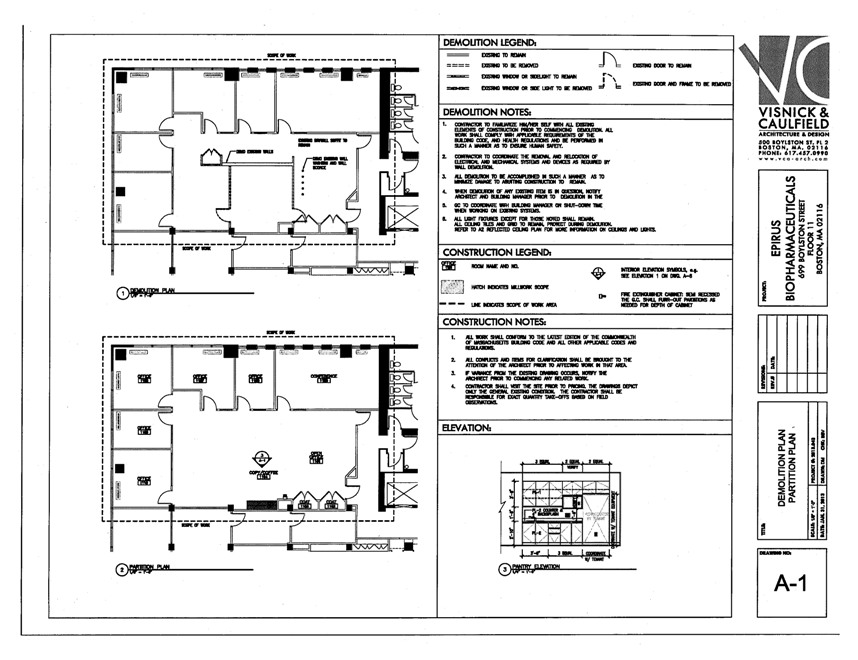

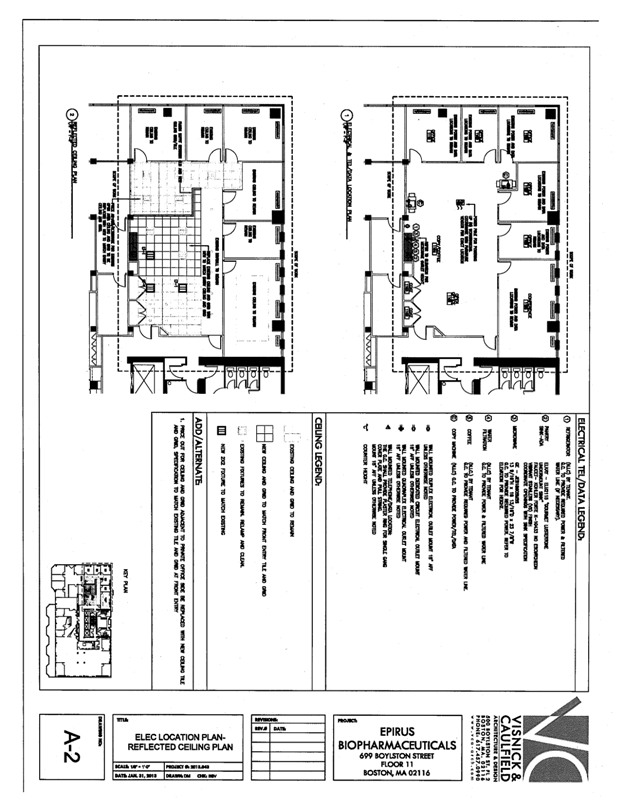

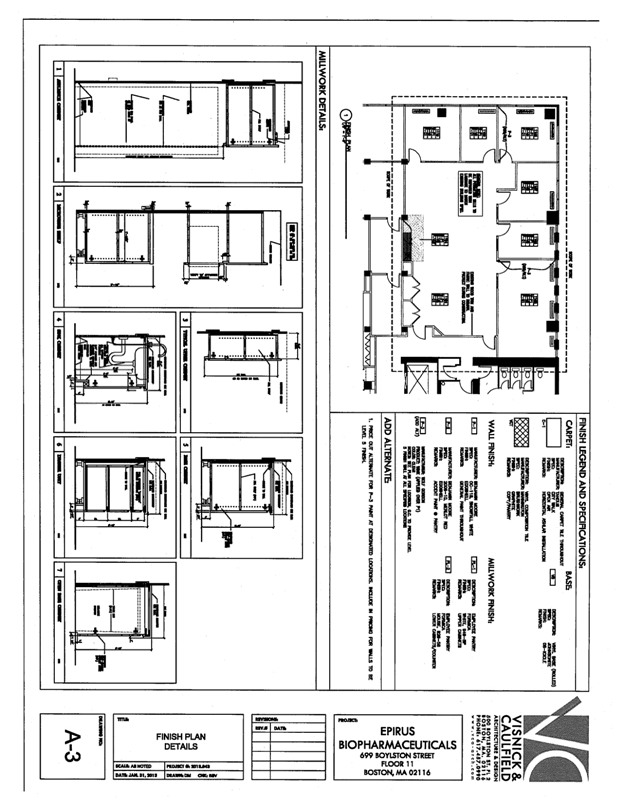

| Exhibit A |

Legal Description of the Land | |

| Exhibit B |

Floor Plan | |

| Exhibit C |

Workletter | |

| Schedule C-1 |

Landlord’s Work | |

| Schedule C-2 |

Plans | |

| Exhibit D |

List of Mortgagees | |

| Exhibit E |

Form of Commencement Date Agreement | |

| Exhibit F |

Contractor and Subcontractor Insurance Limit Requirements | |

| Exhibit G |

Service Contractor Insurance Limit Requirements | |

| Exhibit H |

Rules and Regulations | |

LEASE AGREEMENT

This LEASE is a Lease made as of this 8th day of March, 2013 (the “Effective Date”) between CPT ONE EXETER PLAZA, LLC, a Delaware limited liability company (hereinafter “Landlord”), and EPIRUS Biopharmaceuticals, Inc., a Delaware corporation (hereinafter “Tenant”).

Landlord and Tenant hereby agree with each other as follows:

ARTICLE 1

BASIC LEASE PROVISIONS

| 1.1 | BASIC DATA. The following terms shall have the following meanings: |

| LANDLORD: | CPT ONE EXETER PLAZA, LLC | |

| LANDLORD’S ADDRESS: | c/o AEW Capital Management, L.P. Two Seaport Lane World Trade Center East Boston, MA 02210 Attention: Asset Manager for CPT One Exeter Plaza LLC

Fax: (617) 261-9555 | |

| TENANT: | EPIRUS Biopharmaceuticals, Inc. | |

| TENANT’S ADDRESS: | Before Commencement Date:

800 Boylston Street 16th Floor Boston, MA 02199

After Commencement Date:

One Exeter Plaza 699 Boylston Street Boston, MA 02199 | |

| BUILDING: | One Exeter Plaza, 699 Boylston Street, Boston, Massachusetts | |

| LAND: | The Land on which the Building is located and which is described on Schedule A | |

1

| PREMISES: | As shown on Schedule B and known as Suite 1102 on the 11th floor of the Building. | |

| OFFICE SPACE OF BUILDING: | The aggregate area of rentable square feet contained in Floors 3 through Penthouse of the Building plus that portion of Floor 2 that is used for general office purposes. | |

| RENTABLE AREA OF THE PREMISES: | 3,000 rentable square feet. | |

| OFFICE RENTABLE AREA OF THE BUILDING: | 184,146 rentable square feet. | |

| TOTAL RENTABLE AREA OF THE BUILDING: | 207,076 rentable square feet. | |

| TERM: | Three (3) years and three (3) months, beginning on the Commencement Date and expiring on the Expiration Date. | |

| EFFECTIVE DATE: | The date of execution of this Lease. | |

| COMMENCEMENT DATE: | The Lease Commencement Date, as defined in the Work Letter, attached as Exhibit C hereto, anticipated to occur on March 8, 2013. | |

| RENT COMMENCEMENT DATE: | June 8, 2013 unless the Commencement Date is delayed as provided herein, in which case that date which is three (3) months after the Commencement Date. | |

| EXPIRATION DATE: | June 30, 2016, unless the Commencement Date is delayed as provided herein, in which case the Expiration Date shall be the last date of the month occurring three (3) years after the Rent Commencement Date. | |

| SECURITY DEPOSIT: | $53,000.00 | |

| BASE RENT: | ||

| Lease Year |

Annual Rent | Monthly Rent | ||||||

| Commencement Date – Rent Commencement Date |

N/A | $ | 0 | |||||

| Rent Commencement Date (est. June 1, 2013) – May 31, 2014 Lease Year 1 |

$ | 159,000.00 | $ | 13,250.00 | ||||

| June 1, 2014 – May 31, 2015 Lease Year 2 |

$ | 162,000.00 | $ | 13,500.00 | ||||

| June 1, 2015 – Expiration Date Lease Year 3 |

$ | 165,000.00 | $ | 13,750.00 | ||||

2

| TENANT’S PROPORTIONATE SHARE FOR OFFICE OPERATING EXPENSES: | 1.629% | |

| TENANT’S PROPORTIONATE SHARE FOR TAXES: | 1.449% | |

| BASE YEAR FOR COSTS OF OPERATIONS: | Calendar Year 2013 | |

| BASE YEAR FOR TAXES | Fiscal Year 2014 (i.e., July 1, 2013 through June 30, 2014) | |

| BROKER: | Landlord:

Cushman & Wakefield of MA, Inc.

Tenant:

Richards, Barry, Joyce & Partners | |

| ADA: | The Americans with Disabilities Act of 1990, as amended. | |

| ADDITIONAL RENT: | Any amounts that this Lease requires Tenant to pay in addition to Base Rent. | |

| COMMON AREAS: | As defined in Section 2.2. | |

| LEASE YEAR: | Any twelve (12) month period during the term of the Lease commencing as of the Rent Commencement Date (except if the Rent Commencement Date is not the first day of a calendar month, then the first Lease year shall be the period from the Rent Commencement Date to the first | |

3

| anniversary of the last day of the month in which the Rent Commencement Date occurs), or as of the day following the end of the previous Lease Year. That part of the Term subsequent to the Commencement Date but prior to the Rent Commencement Date is deemed to be part of the first Lease Year of the Term. | ||

| PROPERTY: | The Land and all improvements built on the Land, including without limitation the Building, walkways, driveways, fences, and landscaping. | |

| RENT: | The Base Rent and Additional Rent. | |

ARTICLE 2

PREMISES

| 2.1 | DEMISE AND LEASE OF PREMISES. Landlord hereby leases to Tenant, and Tenant hereby leases from Landlord, the Premises. The Premises shall not include any Common Areas. |

| 2.2 | COMMON AREAS AND LANDLORD’S RESERVED RIGHTS. |

(A) Tenant shall have the non-exclusive right to use in common with others, subject to the terms of this Lease, the following areas (“Common Areas”): (a) the common lobbies, corridors, stairways, elevators and mechanical, janitorial and electrical rooms of the Building, and the pipes, ducts, shafts, conduits, wires and appurtenant meters and equipment serving the Premises in common with others, (b) the loading areas serving the Building and the common walkways and driveways necessary for access to the Building, and (c) if the Premises include less than the entire rentable floor area of any floor, the common toilets, corridors and elevator lobby of such floor. Notwithstanding anything to the contrary herein contained, Landlord has no obligation to allow any particular telecommunication service provider to have access to the Building or to Tenant’s premises, but Landlord shall not be unreasonable in denying such access. If Landlord permits such access, Landlord may condition such access upon the payment to Landlord by the service provider of fees assessed by Landlord in its reasonable discretion.

(B) Landlord reserves the right, provided the same is done without unreasonable interference with Tenant’s use, to install, use, maintain, repair, replace and relocate pipes, ducts, conduits, wires and appurtenant fixtures, wherever located. Except in the case of emergencies or for normal cleaning or maintenance, Landlord agrees to use reasonable efforts to give Tenant reasonable advance notice of any of the foregoing which require work in the Premises.

4

(C) Landlord reserves all rights of ownership and use in all respects outside the Premises. Landlord shall have the right to change and rearrange the Common Areas, to change, relocate and eliminate facilities therein, to permit the use of or lease all or part thereof for exhibitions and displays and to sell, lease or dedicate all or part thereof to public use; and further to make changes in the Building and other structures and improvements on the Land, except the Premises; as long as Tenant at all times has reasonable access to the Building and Premises.

ARTICLE 3

LEASE TERM AND EXTENSION OPTIONS

| 3.1 | TERM. The Term of this Lease shall be the period specified in Section 1.1 hereof as the “Lease Term”, unless sooner terminated or extended as herein provided. |

| 3.2 | EXTENSION OPTIONS. |

(A) On the conditions that, both at the time of exercise of the option to extend and as of the commencement of the Extended Term in question: (i) there exists no Event of Default, (ii) this Lease is still in full force and effect, and (iii) Tenant, itself, a Permitted Tenant Successor, and/or Tenant Affiliates occupy one hundred percent (100%) of the Rentable Floor Area of the Premises, then Tenant shall have the right to extend the Term hereof from the original expiration date hereof for one (1) period of one (1) year. The option period is sometimes referred to as an “Extended Term.” Such extension shall be on all of the terms and conditions of this Lease, except that the Annual Fixed Rent shall be equal to the Fair Market Rental Value, as determined below, as of the commencement of the Extended Term in question, and Landlord has no obligation to provide any construction allowance or to perform any work to the Premises as a result of such extension.

(B) In order to exercise an option to extend the Term, Tenant shall give notice (“Tenant’s Extension Notice”) thereof to Landlord, not earlier than twelve (12) months nor later than nine (9) months prior to the expiration of the then-current Term of this Lease, whereupon Landlord shall tell Tenant the proposed Annual Fixed Rent for the applicable Extended Term (“Landlord’s Quotation”). Such Tenant’s Extension Notice shall be irrevocable. Landlord and Tenant shall attempt to agree on the Annual Fixed Rent for such Extended Term within thirty (30) days after Landlord’s Quotation (the “Negotiation Period”). If Landlord and Tenant have not so agreed and executed a written instrument evidencing such agreement within the Negotiation Period, then Landlord and Tenant shall each, within seven (7) days from the expiration of the Negotiation Period, designate an independent, licensed real estate broker, who shall have more than five (5) years’ experience as a real estate broker specializing in commercial leasing and who shall be familiar with the commercial real estate market in which the Building is located. Said brokers shall each determine the Fair Market Rent for the Premises within fifteen (15) days. If the lower of the two determinations is not less than ninety-five percent (95%) of

5

the higher of the two determinations, then the Fair Market Rent shall be the average of the two determinations. If the lower of the two determinations is less than ninety-five percent (95%) of the higher of the two determinations, then the two brokers shall render separate written reports of their determinations and within fifteen (15) days thereafter the two brokers shall appoint a third broker with like qualifications. Such third broker shall be furnished the written reports of the first two brokers. Within fifteen (15) days after the appointment of the third (3rd) broker, the third broker shall appraise the Fair Market Rent. The Fair Market Rent for purposes of this Section shall equal the average of the two closest determinations; provided, however, that (a) if any one determination is agreed upon by any two of the brokers, then the Fair Market Rent shall be such determination, and (b) if any one determination is equidistant from the other two determinations, then the Market Rent shall be such middle determination. The Annual Fixed Rent for the Extended Term in question shall be the Fair Market Rent as so determined. Landlord and Tenant shall each bear the cost of its broker and shall share equally the cost of the third broker. Among the factors to be considered in determining Fair Market Rent shall be the rental rates then being obtained for renewal leases for similar space in office buildings of similar quality, in similar locations, that are of comparable age to the Building and are leased to first-class private sector tenants. All determinations shall reflect market conditions expected to exist as of the date Annual Fixed Rent based on Fair Market Rent is to commence.

(C) Upon the timely giving of Tenant’s Extension Notice, the term of this Lease shall be automatically extended for the applicable Extended Term without the execution of any additional documents, and all references to the Lease Term or the Term of this Lease shall mean the Lease Term, as so extended, unless the context clearly otherwise requires. As soon as it is determined, Landlord and Tenant agree to enter into a document setting forth the Annual Fixed Rent for the applicable Extended Term. If Tenant shall not timely give Tenant’s Extension Notice, then Tenant’s extension option shall be void and of no further force and effect.

ARTICLE 4

LANDLORD’S WORK

| 4.1 | Tenant has inspected the Premises and agrees (a) to accept possession of the Premises in the condition existing on the Commencement Date “as is”, and (b) except as set forth below in this Article 4 or in the Workletter Agreement attached hereto as Exhibit C, Landlord has no obligation to perform any work, supply any materials, incur any expense or make any alterations or improvements to prepare the Premises for Tenant’s occupancy. Tenant’s occupancy of any part of the Premises shall be conclusive evidence, as against Tenant, that Landlord has substantially completed any work to be performed by Landlord under this Lease, Tenant has accepted possession of the Premises in its then current condition and at the time such possession was taken, the Premises and the Building were in a good and satisfactory condition as required by this Lease. |

6

ARTICLE 5

USE OF PREMISES

| 5.1 | USE. Tenant shall use the Premises solely for general office purposes and for no other use or purpose (the “Permitted Use”). Tenant shall not use the Premises: (i) for any unlawful purpose, (ii) for any auction sale, (iii) in any manner that will, to the extent applicable, cause the Building or any part thereof not to conform with Landlord’s sustainability practices and/or any then-applicable Green Building Standard (as defined below) regarding the Building or (iv) in any manner that will constitute waste, nuisance or unreasonable annoyance to Landlord or any other tenant of the Building. Tenant shall not knowingly generate, use, store, or dispose of any materials posing a health or environmental hazard in or about the Building. Tenant shall comply with and conform to all present and future laws, ordinances, regulations and orders of all applicable governmental or quasi-governmental authorities having jurisdiction over the Premises, including those concerning the use, occupancy and condition of the Premises and all machinery, equipment and furnishings therein. The party constructing the Tenant Work pursuant to Exhibit C hereto shall obtain any necessary certificate of occupancy for the Premises. As used herein, the term “Green Building Standard” shall refer to the standards and certifications utilized under a nationally recognized third party rating system for so-called “green” buildings (e.g. the U.S. Green Building Council’s Leadership in Energy and Environmental Design [LEED] rating system), it being acknowledged that as of the date hereof, the Building has not received any certification under any Green Building Standard. |

| 5.2 | OCCUPANCY TAXES. Tenant shall pay before delinquency any business, rent or other taxes or fees that are now or hereafter levied, assessed or imposed upon Tenant in connection with Tenant’s use or occupancy of the Premises, the conduct of Tenant’s business in the Premises or Tenant’s equipment, fixtures, furnishings, inventory or personal property. If any such tax or fee is enacted or altered so that such tax or fee is levied against Landlord or so that Landlord is responsible for collection or payment thereof, then Tenant shall pay to Landlord as Additional Rent the amount of such tax or fee. |

| 5.3 | SUSTAINABLE BUILDING OPERATIONS. |

(A) Tenant acknowledges that Landlord may elect to operate the Building in accordance with sustainable building practices as designated by Landlord. Tenant shall, in the performance of Tenant’s maintenance obligations hereunder, as well as in connection with any work undertaken by or on behalf of Tenant pursuant to this Lease, comply with the minimum standards of such sustainability practices, in addition to all applicable laws. The foregoing obligation shall also apply to any material purchased by or for Tenant in connection with such maintenance and/or work, as well as the disposal of waste by Tenant or anyone performing work on behalf of Tenant.

(B) Tenant shall use proven energy and carbon reduction measures, including energy efficient bulbs in task lighting; closing shades on the south side of the Building to avoid overheating the space when seasonally appropriate; turning off lights and equipment at the end of the work day (unless such items are required to be kept on for remote access); purchasing Energy Star qualified equipment, including but not limited to lighting, office equipment, commercial and residential kitchen equipment, vending and ice machines; and purchasing products certified by the EPA Water Sense program.

7

ARTICLE 6

ANNUAL FIXED RENT

| 6.1 | PAYMENT. Beginning on the Rent Commencement Date, Tenant shall pay the Annual Fixed Rent specified in Section 1.1. The Annual Fixed Rent shall be due and payable in equal monthly installments, without notice, demand, setoff or deduction (except as otherwise specifically provided herein), in advance on the first day of each month during each Lease Year. Concurrently with Tenant’s execution of this Lease, Tenant shall pay to Landlord an amount equal to one (1) monthly installment of the Annual Fixed Rent payable during the first Lease Year, which amount shall be credited toward the first full monthly installment of the Annual Fixed Rent payable under this Lease. If the Rent Commencement Date is not the first day of a month, then the Annual Fixed Rent from the Rent Commencement Date until the first day of the following month shall be prorated on a per diem basis, and Tenant shall pay such prorated installment of the Annual Fixed Rent on the Rent Commencement Date. |

| 6.2 | RENT COMMENCEMENT DATE. The Rent Commencement Date of the Lease shall be the date that is three (3) months following the Commencement Date and is estimated to be June 1, 2013. |

In the event the Rent Commencement Date, as determined pursuant to the foregoing is other than the first day of a calendar month, the expiration of the initial Term hereunder shall be extended to the close of the day on the last day of the calendar month in which the Term Expiration Date otherwise would fall.

Upon establishment of the Rent Commencement Date by Landlord, Landlord and Tenant shall execute, within ten (10) days of demand by either party, an agreement specifying the Commencement Date, Rent Commencement Date and the Expiration Date.

| 6.3 | METHOD OF PAYMENT. All sums payable by Tenant under this Lease shall be paid to Landlord by check drawn on a U.S. bank (subject to collection) or by wire transfer, at the address to which notices to Landlord are to be given or to such other party or such other address as Landlord may designate in writing. Landlord’s acceptance of rent after it shall have become due and payable shall not excuse a delay upon any subsequent occasion or constitute a waiver of any of Landlord’s rights. |

ARTICLE 7

TAXES AND OPERATING EXPENSES

| 7.1 | TAXES. |

(A) DEFINITIONS. With reference to the real estate taxes referred to in this Article VI, it is agreed that terms used herein are defined as follows:

“Tax Year” shall be any fiscal/tax period in respect of which Taxes are due and payable to the appropriate governmental taxing authority, any portion of which period occurs during the term of this Lease, the first such Tax Year being the one in which the Commencement Date occurs.

8

“Landlord’s Tax Expenses Allocable to the Premises” means the same proportion of Landlord’s Tax Expenses as Rentable Floor Area of Tenant’s Premises bears to the Total Rentable Floor Area of the Building.

“Landlord’s Tax Expenses” with respect to any Tax Year means the aggregate “real estate taxes” (hereinafter defined) with respect to that Tax Year, reduced by any net abatement receipts and taking into account any other tax benefit program which may be applicable to the Building and the Land with respect to that Tax Year.

“Real estate taxes” shall mean (1) all real estate taxes, including general and special assessments, if any, which are imposed upon Landlord in connection with its ownership of the Building or assessed against the Building and/or the Land, (2) any other present or future taxes or governmental charges that are imposed upon Landlord in connection with its ownership of the Building or assessed against the Building and/or the Land which are in the nature of or in substitution for real estate taxes, including any tax levied on or measured by the rents payable by tenants of the Building, (3) any assessments upon Landlord or the Building in connection with any operation to promote, police, clean or otherwise benefit the neighborhood in which the Building is situated, and (4) Landlord’s expenses (including reasonable attorneys’ and appraisers’ fees) incurred in reviewing, protesting or seeking a reduction of real estate taxes. Real estate taxes shall not include any (net) income taxes or any excess profits, excise, estate, succession, inheritance or transfer taxes. For the purposes of this Lease, real estate taxes shall include any payment in lieu of taxes.

“Base Taxes” means Landlord’s Tax Expenses (hereinbefore defined) for the fiscal tax year 2014 (i.e., the period beginning July 1, 2013 and ending June 30, 2014).

“Base Taxes Allocable to the Premises” means the same proportion of Base Taxes as the Rentable Floor Area of Tenant’s Premises bears to the Total Rentable Floor Area of the Building.

If during the Lease Term the Tax Year is changed by applicable law to less than a full 12-month period, the Base Taxes and Base Taxes Allocable to the Premises shall each be proportionately reduced.

(B) TENANT’S SHARE OF REAL ESTATE TAXES. If with respect to any full Tax Year or fraction of a Tax Year falling within the Lease Term, Landlord’s Tax Expenses

9

Allocable to the Premises for a full Tax Year exceed Base Taxes Allocable to the Premises or for any such fraction of a Tax Year exceed the corresponding fraction of Base Taxes Allocable to the Premises (such amount being hereinafter referred to as the “Tax Excess”), then Tenant shall pay to Landlord, as Additional Rent, the amount of such Tax Excess. Monthly payments by Tenant on account of any Tax Excess, as reasonably estimated by Landlord, shall be made at the time and in the fashion herein provided for the payment of Annual Fixed Rent. Following the end of each Tax Year, Landlord shall submit a statement showing (1) Tenant’s share of any Tax Excess actually incurred during the preceding Tax Year, and (2) the aggregate amount of Tenant’s estimated payments during such year. If such statement indicates that the aggregate amount of such estimated payments exceeds Tenant’s actual liability, then Tenant shall deduct the net overpayment from its next monthly rental payment (or, if the Lease Term has expired, Landlord shall promptly reimburse to Tenant the amount of the overpayment). If such statement indicates that Tenant’s actual liability exceeds the aggregate amount of such estimated payments, then Tenant shall pay the amount of such excess within thirty (30) days following its receipt of Landlord’s statement. Landlord’s and Tenant’s obligations to make the payments described in the foregoing sentences shall survive the expiration or termination of this Lease. The statement of Real Estate Taxes submitted by Landlord under this Section 6.1(B) shall become binding and conclusive if not contested by Tenant within ninety (90) days after it is rendered.

| 7.2 | OPERATING COSTS |

(A) DEFINITIONS.

“Operating Expenses Allocable to the Premises” means the same proportion of the Operating Expenses for the Building (as hereinafter defined) as Rentable Floor Area of the Premises bears to the Office Rentable Floor Area of the Building.

“Base Operating Expenses” means Operating Expenses for the Building for calendar year 2013 (that is the period beginning January 1, 2013 and ending December 31, 2013). Base Operating Expenses shall not include market-wide cost increases due to extraordinary circumstances, including but not limited to Landlord’s Force Majeure, boycotts, strikes, conservation surcharges, embargoes or shortages, none of which have occurred to Landlord’s knowledge as of the executed date hereof. Landlord agrees to provide notice to Tenant of such market wide cost increases as soon as practicable after the after the occurrence of the same.

“Base Operating Expenses Allocable to the Premises” means the same proportion of Base Operating Expenses as the Rentable Floor Area of Tenant’s Premises bears to the Office Rentable Floor Area of the Building.

“Operating Expenses for the Building” means all costs and expenses incurred by Landlord in the ownership and operation of the Building, including all of the following: (1) electricity, gas, water, sewer and other utility charges;

10

(2) premiums and other charges for insurance (including, but not limited to, property insurance, rent loss insurance and liability insurance which may include terrorism and mold coverage); (3) reasonable management fees incurred in the management of the Building; (4) all costs incurred in connection with service and maintenance contracts; (5) maintenance and repair expenses and supplies; (6) amortization (calculated over such reasonable period as Landlord may determine in accordance with generally accepted accounting principles, with interest at Landlord’s cost of funds or (if the capital improvement is not financed) at two (2) percentage points above the prime rate reported in The Wall Street Journal) for capital expenditures that are made by Landlord for the purpose of complying with legal or insurance requirements or that are intended to result in a net decrease in Operating Expenses for the Building; (7) reasonable legal fees (except as excluded below), administrative expenses, and accounting and other professional fees and expenses; (8) charges for security, janitorial, and cleaning services and supplies furnished to the Building; (9) to the extent applicable, insurance endorsements in order to repair, replace and re-commission the Building for re-certification pursuant to any Green Building Standard; (11) to the extent applicable, all costs of (i) maintaining, managing, reporting, commissioning, and recomissioning the Building or any part thereof that was designed and/or built to be sustainable and conform with any Green Building Standard, and (ii) all costs of applying, reporting and commissioning the Building or any part thereof to seek certification under any Green Building Standard; provided, however, the cost of such applying, reporting and commissioning of the Building or any part thereof to seek certification shall be a cost that is capitalized and thereafter amortized annually in accordance with generally accepted accounting principles; and (12) any other expense reasonably incurred by Landlord in maintaining, repairing or operating the Building. Operating Expenses for the Building shall not include: (A) interest and amortization of mortgages or any other encumbrances; (B) ground rent; (C) depreciation of the Building; (D) income or other taxes imposed or measured by the net income of Landlord from the operation of the Building; (E) costs of preparing, improving or altering tenant space for any new or renewal tenant; (F) leasing commissions and other marketing expenses; (G) legal fees incurred in disputes with tenants or in connection with the sale, financing or leasing of the Building; (H) costs of capital improvements other than those described in clauses (6) and (11) above; (I) expenses reimbursed to Landlord by way of warranties, insurance or condemnation proceeds, or any other source (other than “pass-through” provisions such as this Section 5.1); (J) amounts paid to any partner, shareholder, officer, or director of Landlord, for salary or other compensation; (K) reserves for repairs, maintenance, and replacements; (L) any amounts paid to any person, firm, or corporation related to or otherwise affiliated with Landlord or any general partner, officer or director of Landlord or any of

11

its general partners to the extent they exceed arms-length competitive prices paid in the greater Boston area for the services or goods provided; (M) costs of electricity outside normal business hours sold to tenants of the Building by Landlord or any other special service sold to other tenants; (N) costs relating to maintaining Landlord’s existence as a corporation, partnership or other entity, such as trustees’ fees, annual fees, corporate or partnership organization or administration expenses, deed recordation expenses, and legal and accounting fees (other than with respect to Building operations); (O) costs (including fines and penalties imposed) incurred by Landlord to remove any hazardous or toxic wastes, materials or substances from either the Building or Land; (P) Landlord’s general corporate overhead and general and administrative expenses; (Q) costs related to any building other than the Building, including any allocation of costs incurred on a shared basis, such as centralized accounting costs, unless the allocation is made on a reasonable and consistent basis that fairly reflects the share of any costs actually attributable to the Building; (R) acquisition costs for sculpture, paintings and other art objects; (S) rental costs and related expenses for leasing systems or equipment that would be considered a capital improvement or expenditure if purchased (unless such purchase would be covered under clause (6) above); (T) costs of selling, syndicating, financing, mortgaging or hypothecating any part of or interest in the Building; (U) costs of operation of the Building associated exclusively with restaurant or retail operations; and (V) electric expenses to the extent that electricity to the Premises is separately metered and paid by Tenant.

(B) GROSS UP PROVISION. Notwithstanding the foregoing, in determining the amount of Operating Expenses for the Building for any calendar year or portion thereof falling within the Lease Term, if less than one hundred percent (100%) of the Rentable Area of the Building shall have been occupied by tenants at any time during the period in question, then those elements of Operating Expenses which vary based upon occupancy for such period shall be adjusted to equal the amount such elements of Operating Expenses would have been for such period had occupancy been one hundred percent (100%) throughout such period.

(C) TENANT’S PAYMENTS ON ACCOUNT OF OPERATING EXPENSES.

If with respect to any calendar year falling within the Lease term, or fraction of a calendar year falling within the Lease Term at the beginning or end thereof, the Operating Expenses Allocable to the Premises (as defined above) for a full calendar year exceed Base Operating Expenses Allocable to the Premises (as defined above) or for any such fraction of a calendar year exceed the corresponding fraction of Base Operating Expenses Allocable to the Premises (as defined above) (either such amounts being hereinafter referred to as the “Operating Cost Excess”), then commencing on the Rent Commencement Date and continuing thereafter throughout the term of the Lease, Tenant shall pay to Landlord, as Additional Rent, on or

12

before the thirtieth (30th) day following receipt by Tenant of the statement referred to below in subpart (ii), the amount of such Operating Cost Excess.

Estimated payments by Tenant on account of Tenant’s responsibility for any Operating Cost Excess shall be made monthly at the time and in the fashion herein provided for the payment of Annual Fixed Rent. The amount so to be paid shall be an amount from time to time reasonably estimated by Landlord. Following the end of each calendar year, Landlord shall submit a statement showing (1) Tenant’s responsibility for any Operating Cost Excess actually incurred during the preceding calendar year, and (2) the aggregate amount of Tenant’s estimated payments during such year. If such statement indicates that the aggregate amount of such estimated payments exceeds Tenant’s actual liability, then Tenant shall deduct the net overpayment from its next monthly rental payment (or, if the Lease Term has expired, Landlord shall promptly reimburse to Tenant the amount of the overpayment). If such statement indicates that Tenant’s actual liability exceeds the aggregate amount of such estimated payments, then Tenant shall pay the amount of such excess within thirty (30) days following its receipt of Landlord’s statement. Landlord’s and Tenant’s obligations to make the payments described in the foregoing sentences shall survive the expiration or termination of this Lease. The statement of Operating Expenses submitted by Landlord under this Section 7.3(C) shall become binding and conclusive if not contested by Tenant within ninety (90) days after it is rendered.

ARTICLE 8

LANDLORD’S REPAIRS AND SERVICES

| 8.1 | REPAIRS. Landlord shall deliver the Premises to Tenant with the following building systems in good working order: mechanical, electrical, plumbing, sanitary, sprinkler, heating, ventilation and air conditioning, security, life-safety, elevator and other service systems or facilities of the Building up to the point of connection of localized distribution to the Premises (excluding, however, any supplemental HVAC systems installed by the Tenant). Except for (a) normal and reasonable wear and use and (b) damage caused by fire or casualty and by eminent domain (which shall be governed by the respective provisions of Sections 14.1 and 14.3 hereof), Landlord shall keep and maintain, or cause to be kept and maintained, in good order, condition and repair the following portions of the Building: the heating, ventilation and air conditioning system, the structural portions of the roof, the exterior and load bearing walls, the foundation, the structural columns and floor slabs and other structural elements of the Building, and the Common Areas. Notwithstanding the foregoing, Tenant shall pay to Landlord the cost of (x) any and all such repairs which may be required as a result of repairs, alterations, or installations made by Tenant or any subtenant, assignee, licensee or concessionaire of Tenant or any agent, servant, employee or contractor of any of them (each, a “Tenant Party”) or (y) any loss, destruction or damage to the extent caused by the omission or negligence of Tenant, or any Tenant Party. |

13

| 8.2 | WAIVER OF SUBROGATION APPLICABLE. The provisions of this Article 8 shall be subject to the waiver of subrogation contained in Article 13. |

| 8.3 | SERVICES. Landlord will provide: air-conditioning and heating during the seasons in which they are required; electricity; water; elevator service; exterior window-cleaning service; and janitorial service. The normal hours of operation of the Building will be 8 a.m. to 6 p.m. on Monday through Friday (except Federal holidays) and 9 a.m. to 1 p.m. on Saturday (except Federal holidays) and such additional hours, if any, as Landlord from time to time reasonably determines. Electricity, water, and elevator service will be available at all times. If Tenant requires air-conditioning or heat beyond the normal hours of operation, then Landlord will furnish the same, provided Tenant gives Landlord notice of such requirement by noon of the prior business day. Tenant shall pay for such extra service at Landlord’s then-current rate for such extra service. The initial charge for after-hours HVAC service is One Hundred Dollars ($100.00) per hour, which charge is subject to periodic adjustment by Landlord (provided that such charge does not exceed the cost charged to other tenants in the Building). Tenant shall have access to the Premises twenty-four (24) hours per day every day of the year. Except as otherwise specified herein, Landlord shall not be required to furnish services and utilities during hours other than the normal hours of operation of the Building. |

The parties agree to comply with all mandatory energy or water conservation controls and requirements applicable to office buildings that are imposed or instituted by the Federal, state or local governments, or are required pursuant to Section 5.3(B) hereof, including without limitation, controls on the permitted range of temperature settings in office buildings and requirements necessitating curtailment of the volume of energy or water consumption or the hours of operation of the Building. Any terms or conditions of this Lease that conflict or interfere with compliance with such controls or requirements shall be suspended for the duration of such controls or requirements. It is further agreed that compliance with such controls or requirements shall not be considered an eviction, actual or constructive, of the Tenant from the Premises and shall not entitle Tenant to terminate this Lease or to an abatement of any rent payable hereunder. Landlord shall not have any liability to Tenant whatsoever as a result of Landlord’s failure or inability to furnish any of the utilities or services to be furnished by Landlord hereunder, nor shall such failure or inability be considered an eviction, actual or constructive, of Tenant from the Premises. Should any of the Building equipment or machinery break down, or for any cause or reason cease to function properly, Landlord shall use all reasonable efforts to repair the same promptly, but Tenant shall have no claim for abatement of rental or for any damages on account of any interruptions in service occasioned thereby or resulting therefrom; provided, however, that if such failure (i) is within Landlord’s reasonable control to remedy, (ii) is continuous for five (5) business days, and (iii) renders the Premises or material portion thereof untenantable, then rent shall abate from the sixth (6th) business day of such failure until the Premises are tenantable again.

| 8.4 | ELECTRICITY. |

(A) If Tenant requires electric current for use in the Premises in excess of the amount required for general business office use and if in Landlord’s reasonable judgment,

14

(i) Landlord’s facilities are inadequate for such excess requirements or (ii) such excess use shall result in an additional burden on the Building air conditioning system and additional cost to Landlord on account thereof then, as the case may be, (x) Landlord, at Tenant’s sole cost and expense, will furnish and install such additional wire, conduits, feeders, switchboards and equipment as may be required to supply such additional requirements of Tenant, provided that the same shall be permitted by law and applicable insurance requirements and shall not cause damage to the Building or the Premises or cause or create a dangerous or hazardous condition, or (y) Tenant shall reimburse Landlord for such additional cost, as aforesaid.

(B) Tenant agrees that it will not make any material alteration or addition to the electrical equipment in the Premises without the prior written consent of Landlord, which consent will not be unreasonably withheld.

(C) Landlord will furnish electricity to the Premises through presently installed electrical facilities for Tenant’s reasonable use for lighting, electrical appliances and equipment. Tenant shall pay, as Additional Rent, the sum of $4,500.00 per year ($1.50/rentable square foot/year) in equal monthly installments with Base Rent. Said Additional Rent shall be subject to proportionate increase(s), from time to time and at any time throughout the Term, to the extent that the rate charged to Landlord by the utility company providing electricity to the Building is increased. Tenant agrees that, at Landlord’s sole option, an electrical consultant, selected by Landlord, may make periodic surveys of the electrical equipment in the Premises. In the event such survey(s) indicate that Tenant’s use of electricity is greater than $1.50 per rentable square foot, the electricity charge shall be adjusted accordingly. In the event that the Premises is separately metered for electrical usage, Tenant shall pay all applicable utility charges directly to the provider of such utility. Landlord reserves the right to change electricity providers at any time, and to purchase green or renewable energy, provided that such change will not materially adversely affect Tenant.

| 8.5 | NO LIABILITY. |

(A) Landlord shall not be liable to Tenant for any compensation or reduction of rent by reason of inconvenience or annoyance or for loss of business arising from the necessity of Landlord or its agents entering the Premises in accordance herewith for any purposes in this Lease authorized, or for repairing the Premises or any portion of the Building however the necessity may occur. In case Landlord is prevented or delayed from making any repairs, or furnishing any services or performing any other obligation hereunder, by reason of any cause reasonably beyond Landlord’s control, or for any cause due to any act or neglect of Tenant or any Tenant Party, Landlord shall not be liable to Tenant therefor, and except as expressly otherwise provided in this Lease, Tenant shall not be entitled to any abatement or reduction of rent by reason thereof, nor shall the same give rise to a claim in Tenant’s favor that such failure constitutes actual or constructive, total or partial, eviction from the Premises.

(B) Landlord reserves the right to stop any service or utility system, in case of accident or emergency, or until necessary repairs have been completed. Landlord shall

15

exercise reasonable diligence to restore such service or utility. Except in case of emergency, Landlord will give Tenant reasonable advance notice of any contemplated stoppage and will use reasonable efforts to avoid unnecessary inconvenience to Tenant by reason of such stoppage.

| 8.6 | RECYCLING AND WASTE MANAGEMENT. Tenant covenants and agrees, at its sole cost and expense: (a) to comply with all present and future laws, orders and regulations of Federal, state or local government authorities regarding the collection, sorting, separation, and recycling of garbage, trash, rubbish and other refuse (collectively, “Trash”); (b) to comply with Landlord’s recycling policy as part of any sustainability practices employed by Landlord; (c) to sort and separate its Trash and recycling into such categories as are provided by law and/or Landlord’s sustainability practices; (d) that each separately sorted category of Trash and recycling shall be placed in separate receptacles, to the extent directed by Landlord, (e) that Landlord reserves the right to refuse to collect or accept from Tenant any Trash and recycling that is not separated and sorted, as required by law and/or by Landlord, and to require Tenant to arrange for such collection at Tenant’s sole cost and expense, utilizing a contractor satisfactory to Landlord; and (f) that Tenant shall pay all costs, expenses, fines, penalties or damages that may be imposed on Landlord or Tenant by reason of Tenant’s failure to comply with the provisions of this Section. |

ARTICLE 9

TENANT’S REPAIRS

| 9.1 | TENANT’S REPAIRS AND MAINTENANCE. Tenant covenants and agrees that, from and after the date that possession of the Premises is delivered to Tenant and until the end of the Lease Term, Tenant will keep neat and clean and maintain in good order, condition and repair the Premises and every part thereof, excepting only for those repairs for which Landlord is responsible under the terms of Article 8 of this Lease and damage by fire or casualty and as a consequence of the exercise of the power of eminent domain. Tenant shall not permit or commit any waste, and Tenant shall be responsible for the cost of repairs which may be made necessary by reason of damages to common areas in the Building or the Land by Tenant, Tenant’s agents, employees, contractors, sublessees, licensees, concessionaires or invitees. Tenant shall maintain all its equipment, furniture and furnishings in good order and repair. |

If repairs are required to be made by Tenant pursuant to the terms hereof, Landlord may demand that Tenant make the same forthwith, and if Tenant refuses or neglects to commence such repairs and complete the same with reasonable dispatch after such demand, Landlord may (but shall not be required to) make or cause such repairs to be made and shall not be responsible to Tenant for any loss or damage that may accrue to Tenant’s stock or business by reason thereof. If Landlord makes or causes such repairs to be made, Tenant agrees that Tenant will forthwith on demand, pay to Landlord the cost thereof together with interest thereon at the rate specified in Section 15.5, and if Tenant shall default in such payment, Landlord shall have the remedies provided for non-payment of rent or other charges payable hereunder.

16

ARTICLE 10

ALTERATIONS

| 10.1 | ORIGINAL ALTERATIONS. The original improvement of the Premises shall be accomplished in accordance with Exhibit C. Landlord is under no obligation to make any structural or other alterations, additions, improvements or other changes (collectively “Alterations”) in or to the Premises except as set forth in Exhibit C. |

| 10.2 | RIGHT TO MAKE FUTURE ALTERATIONS. Tenant shall not make or permit any Tenant Party to make any Alterations in or to the Premises without Landlord’s prior written consent. However, Landlord’s consent shall not be required with respect to any interior cosmetic or decorative Alteration (such as the installation of paint, carpeting or wallcoverings) costing less than $10,000, provided the same are in accordance with the requirements of this Section 10.2. Landlord’s consent shall not be unreasonably withheld, conditioned or delayed with respect to any proposed Alteration that (i) does not affect the structure of the Building, (ii) does not affect the functioning of the Building’s mechanical, electrical, plumbing or HVAC systems, (iii) does not negatively impact the Building’s then current or planned “green” rating under any Green Building Standard, and (iv) is not readily visible from the exterior of the Premises. Any Alteration made by Tenant shall be made in a good and workmanlike manner by an experienced, reputable contractor reasonably approved by Landlord, in accordance with plans and specifications approved in writing by Landlord (which approval will not be unreasonably withheld, conditioned or delayed), in accordance with the requirements of this Section 10.2, and in accordance with all applicable legal requirements and requirements of any insurance company insuring the Building. If any mechanic’s or materialman’s lien (or a petition to establish such lien) is filed in connection with any Alteration for which Tenant is responsible, then such lien (or petition) shall be discharged by Tenant at Tenant’s expense within ten (10) days thereafter by the payment thereof or the filing of a bond acceptable to Landlord. If Tenant shall fail to discharge any such mechanic’s or materialman’s lien, Landlord may, at its option, discharge such lien and treat the cost thereof (including reasonable attorneys’ fees incurred in connection therewith) as Additional Rent payable with the next monthly installment of Annual Fixed Rent falling due. Landlord’s consent to the making of any Alteration shall not be deemed to constitute Landlord’s consent to subject its interest in the Premises, the Building or the Land to any mechanic’s or materialman’s lien which may be filed in connection therewith. Any and all Alterations will be performed in accordance with Landlord’s sustainability practices, including any third-party rating system concerning the environmental compliance of the Building and/or the Premises, as the same may change from time to time. |

| 10.3 | REMOVAL. All Alterations to the Premises shall remain upon and be surrendered with the Premises as a part thereof at the expiration or earlier termination of the Lease Term. However, (i) if Tenant is not then in default under this Lease, Tenant shall have the right to remove, prior to the expiration or earlier termination of the Lease Term, all movable furniture, furnishings and equipment installed in the Premises at Tenant’s expense, and (ii) Tenant shall be required to remove all Alterations to the Premises or the Building which Landlord designates in writing for removal, other than those set forth on Exhibit C. |

17

| Landlord shall have the right to repair at Tenant’s expense all damage and injury to the Premises or the Building caused by such removal or to require Tenant to do the same. If any such Alterations, furniture, furnishing or equipment is not removed by Tenant prior to the expiration or earlier termination of the Lease Term, then the same shall become Landlord’s property and shall be surrendered with the Premises as a part thereof; provided, however, that Landlord shall have the right to remove from the Premises at Tenant’s expense such furniture, furnishing or equipment and any Alteration other than those set forth on Exhibit C which Landlord designates in writing for removal. Notwithstanding the foregoing, Tenant, upon submitting its request to make any Alteration, shall have the right to request therein that Landlord specify whether and to what extent Landlord will require Tenant to remove the Alterations in question at the end of the Term. If Tenant submits its request for such information in accordance with the foregoing provision and Landlord consents to the Alterations requested, Landlord shall, together with its consent, specify in writing whether and to what extent it will require Tenant to remove the Alterations in question at the end of the Term, and if Landlord fails to specify, Tenant shall have no further obligation to remove the Alterations which were subject of Tenant’s request. |

| 10.4 | HEAVY EQUIPMENT. Landlord shall have the right to prescribe the weight and position of safes and other heavy equipment and fixtures, which, if considered necessary by the Landlord, shall be installed in such manner as Landlord directs in order to distribute their weight adequately. Any damage to the Premises or the Building caused by moving the property of Tenant into or out of the Premises shall be repaired at Tenant’s cost. |

| 10.5 | SUPPLEMENTAL COOLING. Consistent with the provisions of this Article 10, Tenant may install in the Premises supplemental cooling units. Additionally, Tenant may access the central coolant water loop, the use of which will be billed to Tenant on a regular basis. |

| 10.6 | INCREASE IN TAXES. Tenant shall pay one hundred percent (100%) of any increase in real estate taxes on the Building which shall, at any time after the Commencement Date, result from alterations, additions or improvements to the Premises made by Tenant, if the taxing authority specifically determines such increase results from such alterations, additions or improvements made by Tenant. |

ARTICLE 11

ASSIGNMENT AND SUBLETTING

| 11.1 | RESTRICTIONS ON TRANSFER. Tenant shall not assign or transfer this Lease or any of Tenant’s rights or obligations hereunder, or sublet or permit anyone to occupy the Premises or any part thereof, without Landlord’s prior written consent. Subject to the provisions of Sections 11.2 through 11.7 below, Landlord’s consent shall not be unreasonably withheld, conditioned or delayed, provided the proposed assignee or subtenant (i) is compatible with the quality and stature of the Building and its tenants, (ii) will use the Premises only for the Permitted Use, and will not, in Landlord’s reasonable opinion, cause the Building or any part thereof not to conform to the environmental and |

18

| green building clauses in this Lease, and (iii) in the reasonable judgment of Landlord, has the financial capability to undertake and perform its obligations under this Lease or under the sublease. No assignment or transfer of this Lease may be effected by operation of law or otherwise without Landlord’s prior written consent, which may not be unreasonably withheld, conditioned or delayed. Landlord’s acceptance or collection of rent from any assignee, subtenant or occupant shall not be construed as a consent to or acceptance of such assignee, subtenant or occupant as a tenant. Landlord’s consent to any assignment, subletting or occupancy, or Landlord’s acceptance or collection of rent from any assignee, subtenant or occupant, shall not be construed (i) as a waiver or release of Tenant from liability for the performance of any obligation to be performed under this Lease by Tenant, or (ii) as relieving Tenant or any assignee, subtenant or occupant from the obligation of obtaining Landlord’s prior written consent to any subsequent assignment, subletting or occupancy. Tenant hereby collaterally assigns to Landlord any rent due from any assignee, subtenant or occupant of Tenant as security for Tenant’s performance of its obligations pursuant to this Lease. Tenant authorizes each such assignee, subtenant or occupant to pay such rent directly to Landlord if such assignee, subtenant or occupant receives written notice from Landlord stating that an Event of Default exists under this Lease and specifying that such rent shall be paid directly to Landlord. Any such payments made by any assignee, subtenant or occupant shall be credited against the monthly amounts owed by Tenant under this Lease. Each sublease shall provide that, at Landlord’s election, the subtenant agrees to attorn to Landlord or enter into a direct lease with Landlord on the same terms as the sublease in the event this Lease is terminated by reason of an Event of Default by Tenant. Tenant shall not mortgage this Lease without Landlord’s consent, which consent may be granted or withheld in Landlord’s sole discretion. All restrictions and obligations imposed pursuant to this Lease on Tenant shall be deemed to extend to any subtenant, assignee or occupant of Tenant, and Tenant shall cause such persons to comply with all such restrictions and obligations. |

If Tenant is a partnership, then any dissolution of Tenant or a withdrawal or change, whether voluntary, involuntary or by operation of law, of partners owning a controlling interest in Tenant shall be deemed a voluntary assignment of this Lease. If Tenant is a corporation, then any dissolution, merger, consolidation or other reorganization of Tenant, or any sale or transfer of a controlling interest in the capital stock of Tenant, shall be deemed a voluntary assignment of this Lease.

| 11.2 | EXCEPTIONS. Notwithstanding the foregoing provisions of Section 11.1, Tenant shall have the right to assign this Lease or to sublet the Premises (in whole or in part) to any Tenant Affiliate (meaning thereby any controlling entity of Tenant or any entity controlled by Tenant or any entity under common control with Tenant) or to any corporation, limited liability partnership or limited liability company into which Tenant may be converted or with which it may merge, or to any entity purchasing all or substantially all of Tenant’s stock or assets (each, a “Permitted Tenant Successor”), provided that in the case of a Permitted Tenant Successor, the entity to which this Lease is so assigned or which so sublets the Premises has a net worth which is the same or better than the Tenant as of the date of this Lease. If any Tenant Affiliate to which this Lease is assigned or the Premises sublet (in whole or in part) shall cease to be such a |

19

| Tenant Affiliate, and if such cessation was contemplated at the time of the assignment or subletting, such cessation shall be considered an assignment or subletting requiring Landlord’s consent. Notwithstanding anything contained herein to the contrary, Tenant shall not require the consent of Landlord hereunder as a result of any infusion of additional equity capital in Tenant or an initial public offering of equity securities of Tenant. |

| 11.3 | LANDLORD’S TERMINATION RIGHT. Subject to the exceptions set forth in Section 11.2 above, in the event Tenant desires to assign this Lease or to sublet the whole or any part of the Premises, Tenant shall give Landlord a Recapture Offer. |

For the purposes hereof a “Recapture Offer” shall be defined as a notice from Tenant to Landlord which:

States that Tenant desires to sublet the Premises, or a portion thereof, or to assign its interest in this Lease.

Identifies the affected portion of the Premises (“Recapture Premises”).

Identifies the rental rate of the proposed subletting or assignment.

Offers to Landlord to terminate the Lease in respect of the Recapture Premises (in the case of a proposed assignment of Tenant’s interest in the Lease or a subletting for the remainder of the Term of the Lease) or to suspend the Lease Term in respect of the Recapture Period (meaning that the Lease Term in respect of the Recapture Premises shall be terminated during the Recapture Period, and Tenant’s rental obligations shall be proportionately reduced, and at the expiration of the Recapture Period the Recapture Premises will be returned to Tenant under the terms of the Lease), in either case as of a specified date (the “Release Date”).

Landlord shall have forty-five (45) days (the “Acceptance Period”) from Landlord’s receipt of the Recapture Offer to accept it, in which case all obligations of Tenant to Landlord under the Lease with respect to the Recapture Premises for the Recapture Period shall cease and terminate and, if applicable, Landlord shall be obligated to physically separate the Recapture Premises from the remainder of the Premises at its expense. In the event that Landlord shall not exercise its termination or suspension rights as aforesaid, or shall fail to give any timely notice pursuant to this Section, the provisions of Sections 11.4-11.7 shall be applicable. This Section 11.3 shall not be applicable to an assignment or sublease pursuant to Section 11.2.

| 11.4 | CONSENT OF LANDLORD. In the event that Landlord shall not have exercised the termination or suspension right as set forth in Section 11.3, then for a period of one hundred twenty (120) days after the earlier of (i) the receipt of Landlord’s notice stating that Landlord does not elect the termination or suspension right, or (ii) the expiration of the Acceptance Period, Tenant shall have the right to assign this Lease or sublet the portion of the Premises designated in the Recapture Offer, provided that, in each instance, |

20

| Tenant first obtains the prior written consent of Landlord, which consent shall not be unreasonably withheld or delayed. Without limiting the foregoing, Landlord shall not be deemed to be unreasonably withholding its consent to such a proposed assignment or subleasing if: |

the proposed assignee or subtenant is a tenant in the Building or is (or within the previous sixty (60) days has been) in active negotiation with Landlord for premises in the Building or is not of a character consistent with the operation of a first class office building (by way of example Landlord shall not be deemed to be unreasonably withholding its consent to an assignment or subleasing to any governmental or quasi-governmental agency), or

the proposed assignee or subtenant is not of good character and reputation, or

the proposed assignee or subtenant does not possess adequate financial capability to perform the Tenant obligations as and when due or required, or

the assignee or subtenant proposes to use the Premises (or part thereof) for a purpose other than the Permitted Use, or

the character of the business to be conducted or the proposed use of the Premises by the proposed subtenant or assignee shall (i) be likely to increase Operating Expenses for the Building beyond that which Landlord now incurs for use by Tenant; (ii) be likely to increase the burden on elevators or other Building systems or equipment over the burden prior to such proposed subletting or assignment; or (iii) violate or be likely to violate any provisions or restrictions contained herein relating to the use or occupancy of the Premises, or

there shall be existing an Event of Default.

This Section 11.4 shall not be applicable to an assignment or sublease pursuant to Section 11.2.

| 11.5 | TENANT’S NOTICE. Tenant shall give Landlord notice of any proposed sublease or assignment (“Proposed Transfer Notice”), and said notice shall specify the provisions of the proposed assignment or subletting, including (a) the name and address of the proposed assignee or subtenant, (b) in the case of a proposed assignment or subletting subject to the provisions of Section 11.4, the information necessary for Landlord to make the determinations set forth in such Section, (c) all of the terms and provisions upon which the proposed assignment or subletting is to be made, and (d) in the case of a proposed assignment or subletting pursuant to Section 11.2 above, such information as may be reasonably required by Landlord to determine that such proposed assignment or subletting complies with the requirements of Section 11.2. |

21

If Landlord shall consent to the proposed assignment or subletting, then Tenant may thereafter sublease the whole or any part of the Premises or assign pursuant to the Proposed Transfer Notice; provided, however, that if such assignment or sublease shall not be executed and delivered to Landlord within ninety (90) days after the date of Landlord’s consent, the consent shall be deemed null and void and the provisions of Section 11.3 shall again be applicable.

| 11.6 | PROFIT ON SUBLEASING OR ASSIGNMENT. If any sublease, assignment or other transfer (whether by operation of law or otherwise) provides that the subtenant, assignee or other transferee is to pay any amount in excess of the sum of (i) the rent and other charges due under this Lease and (ii) the reasonable out-of-pocket costs incurred by Tenant in connection with the assignment or sublease transaction (which costs shall be amortized on a straight-line basis over the term of the assignment or sublease), then whether such excess is in the form of an increased monthly or annual rental, a lump sum payment, payment at an above-market rate for the sale, transfer or lease of Tenant’s fixtures, leasehold improvements, furniture and other personal property, or any other form (and if the subleased or assigned space does not constitute the entire Premises, the existence of such excess shall be determined on a pro rata basis), Tenant shall pay fifty percent (50%) of any such excess to Landlord as Additional Rent no later than ten (10) days after Tenant’s receipt thereof. Upon at least thirty (30) days’ prior notice to Tenant, Landlord shall have the right to inspect and audit Tenant’s books and records relating to any sublease, assignment or other transfer. Any instrument of sublease, assignment or other transfer shall be subject to Landlord’s reasonable approval. |

| 11.7 | ADDITIONAL CONDITIONS. |

(A) No assignment or subletting under this Article 11 shall be valid unless both Tenant and the assignee or sublessee agree directly with Landlord to be bound by all the obligations of the Tenant hereunder (including, without limitation, the obligation to pay the Annual Fixed Rent and Additional Rent and to comply with the provisions of this Article 11). Such agreement shall be in form reasonably satisfactory to Landlord. No such assignment or subletting shall relieve the Tenant named herein of any of its obligations under this Lease. The provisions hereof shall not constitute a recognition of the assignment or the assignee thereunder or the sublease or the subtenant thereunder, as the case may be, and at Landlord’s option, upon the termination of the Lease, the assignment or sublease shall be terminated.

(B) Tenant shall promptly reimburse Landlord for the reasonable expenses (including reasonable attorneys’ fees) incurred by Landlord in connection with Tenant’s request for Landlord to give its consent to any assignment, subletting or occupancy.

(C) No assignment or subletting under any of the provisions of Sections 11.2 or 11.4 shall in any way be construed to relieve Tenant from obtaining the express consent in writing of Landlord to any further assignment or subletting.

22

ARTICLE 12

LIABILITY OF LANDLORD AND TENANT

| 12.1 | LANDLORD LIABILITY. Except in the case of the gross negligence or willful misconduct of Landlord, Landlord shall not be liable to Tenant for any damage, injury, loss or claim (including claims for the interruption of or loss to business) based on or arising out of any of the following: repair to any portion of the Premises or the Building; interruption in the use of the Premises or any equipment therein; any accident or damage resulting from any use or operation (by Landlord, Tenant or any other person or entity) of elevators or heating, cooling, electrical, sewerage or plumbing equipment or apparatus; termination of this Lease by reason of damage to the Premises or the Building; fire, robbery, theft, vandalism, mysterious disappearance or any other casualty; actions of any other tenant of the Building or of any other person or entity; failure or inability of Landlord to furnish any utility or service specified in this Lease; and leakage in any part of the Premises or the Building, or from water, rain, ice or snow that may leak into, or flow from, any part of the Premises or the Building, or from drains, pipes or plumbing fixtures in the Premises or the Building. Any property stored or placed by Tenant or Tenant Parties in or about the Premises or the Building shall be at the sole risk of Tenant, and Landlord shall not in any manner be held responsible therefor. Notwithstanding the foregoing provisions of this Section or any other Section of this Lease, Landlord shall not be released from liability to Tenant for any damage caused by Landlord’s willful misconduct or gross negligence. However, in no event shall Landlord ever be liable for any indirect or consequential damages or loss of profits or the like. |

| 12.2 | INDEMNITIES. |

(A) Without limiting any other provisions hereof, but subject to the waiver of subrogation contained in Section 13.3 hereof. Tenant agrees to defend, protect, indemnify and save Landlord and its partners, affiliates, officers, agents, servants and employees and Landlord’s management, leasing and redevelopment agents from and against all liability to third parties arising out of the use of the Premises or the acts or omissions of Tenant or its servants, agents, employees, contractors, suppliers, workers or invitees. To the extent not prohibited by law and subject to the waiver of subrogation contained in Section 13.3, Landlord and its partners, affiliates, officers, agents, servants and employees shall not be liable for any damage either to person, property or business resulting from the loss of the use thereof sustained by Tenant or by other persons due to the Building or any part thereof or any appurtenances thereto becoming out of repair, or due to the happening of any accident or event in or about the Building, including the Premises, or due to any act or neglect of any tenant or occupant of the Building or of any other person, unless caused by the negligence or willful misconduct of Landlord or its agents, employees or contractors. This provision shall apply particularly, but not exclusively, to damage caused by gas, electricity, snow, ice, frost, steam, sewage, sewer gas or odors, fire, water or by the bursting or leaking of pipes, faucets, sprinklers, plumbing fixtures and windows, and except as provided above, shall apply without distinction as to the person whose act or neglect was responsible for the damage and shall apply whether the damage was due to any of the causes specifically enumerated above or to some other cause of an entirely different kind. Tenant further agrees that all personal property upon the Premises, or upon loading docks, recovering and holding areas, or freight elevators of the Building, shall be at the risk of Tenant only, and that Landlord shall not be liable for any loss or damage thereto or theft thereof.

23

(B) Landlord shall indemnify and hold Tenant, its officers, employees and agents harmless from and against all costs, damages, claims, liabilities and expenses (including reasonable attorneys’ fees) suffered by or claimed against Tenant, directly or indirectly, based on or arising out of any negligent or wrongful act or omission of Landlord or its agents or employees. In the event Tenant shall, without fault on its part, be made a party to any litigation commenced by or against Landlord (other than a suit commenced by one party to this Lease against the other), then Landlord shall protect and hold them harmless, and shall pay all costs, expenses and reasonable attorneys’ fees incurred or paid by Tenant in connection with such litigation.

| 12.3 | SUCCESSOR LANDLORD. If any landlord hereunder transfers the Building or such landlord’s interest therein, then such landlord shall not be liable for any obligation or liability based on or arising out of any event or condition occurring on or after the date of such transfer. |

| 12.4 | NO OFFSET. Tenant shall not have the right to offset or deduct the amount allegedly owed to Tenant pursuant to any claim against Landlord from any rent or other sum payable to Landlord, Tenant hereby acknowledges that the covenant to pay Rent is independent of all other covenants of this Lease. Tenant’s sole remedy for recovering upon such claim shall be to institute an independent action against Landlord. |

| 12.5 | NO PERSONAL LIABILITY. If Tenant is awarded a money judgment against Landlord, then recourse for satisfaction of such judgment shall be limited to execution against Landlord’s estate and interest in the Building and the Land. No other asset of Landlord, any partner of Landlord or any other person or entity shall be available to satisfy, or be subject to, such judgment, nor shall any such partner, person or entity be held to have personal liability for satisfaction of any claim or judgment against Landlord or any partner of Landlord. |

ARTICLE 13

INSURANCE

| 13.1 | TENANT’S INSURANCE COVERAGE. Tenant shall purchase and maintain insurance during the entire Term of the Lease, and for so long thereafter as Tenant shall occupy any portion of the Premises, for the benefit of the Tenant and Landlord (as their interest may appear) with terms and coverages reasonably satisfactory to Landlord, and with insurers having a minimum A.M. Best rating of A-/VII, and with such increases in limits as Landlord may from time to time reasonably request, but initially Tenant shall maintain the following coverages in the following amounts: |

Commercial General Liability insurance, in occurrence form, covering bodily injury or death to persons and damage to or destruction of property, and including contractual liability coverage for Tenant’s indemnity obligations required by this Lease to afford protection of not less than $2,000,000 per occurrence and $5,000,000 combined single limit in the aggregate for any one accident;

24

Workers’ Compensation insurance as required by all state and/or federal laws;

Business Interruption insurance;

“all-risk” property insurance on a “replacement cost” basis with an agreed value endorsement covering all Tenant’s personal property and all improvements and betterments to the Premises performed at Tenant’s expense; and

coverage on behalf of Landlord against rental loss in an amount equal to the Base Rent then payable for the upcoming period of not less than twelve months.

Tenant shall, prior to the commencement of the Lease Term and on each anniversary of the Commencement Date and/or renewal date thereof, furnish to Landlord certificate(s) evidencing such coverage, which certificate(s) shall state that such insurance coverage may not be changed or canceled without at least thirty (30) days prior written notice to Landlord and Tenant. The insurance maintained by Tenant shall be deemed to be primary insurance and any insurance maintained by Landlord shall be deemed secondary thereto.

| 13.2 | AVOID ACTION INCREASING RATES. Tenant shall comply with all applicable laws and ordinances, all orders and decrees of court and all requirements of other governmental authorities, and shall not, directly or indirectly, make any use of the Premise which may thereby be prohibited or be dangerous to person or property or which may jeopardize any insurance coverage or may increase the cost of insurance or require additional insurance coverage. If Tenant fails to comply with the provisions of this Section 13.2 and: (i) any insurance coverage is jeopardized and Tenant fails to correct such dangerous or prohibited use following notice within the applicable cure period set forth within the Lease hereof; or (ii) insurance premiums are increased and Tenant fails, following notice, to cease such use within the applicable cure period set forth within the Lease, then in each event such failure shall constitute an Event of Default by Tenant hereunder and Landlord shall have all of its remedies as set forth in the Lease. |

| 13.3 | WAIVER OF SUBROGATION. Landlord and Tenant each hereby waive any and every claim for recovery from the other for any and all loss of or damage to the Building or Premises or to the contents thereof, which loss or damage is covered by valid and collectible property insurance policies. Landlord waives any and every claim against Tenant for any and all loss of or damage to the Building or the Premises or contents thereof, which would have been covered had the insurance policies required to be maintained by Landlord by this Lease been in force, to the extent that such loss or damage would have been recoverable under such insurance policies. Tenant waives any and every claim against Landlord for any and all loss of, or damage to, the Building or Premises or the contents thereof which would have been covered had tenant maintained the insurance policies required to be maintained by tenant under this Lease been in force, to the extent that such loss or damage would have been recoverable under such insurance policies. Inasmuch as this mutual waiver will preclude the assignment of any such claim by subrogation (or otherwise) to an insurance company (or any other person), Landlord |

25

| and Tenant each agree to give to each insurance company which has issued, or in the future may issue, to it policies of property insurance, written notice of the terms of this mutual waiver, and to have said insurance policies properly endorsed, if necessary, to prevent the invalidation of said insurance coverage by reason of said waiver. |

| 13.4 | LANDLORD’S INSURANCE. Landlord shall maintain (a) a policy of commercial general liability insurance, with a broad form comprehensive liability endorsement, on an occurrence basis, in an amount not less than $5,000,000 combined single limit per location, and (b) a policy of insurance against all direct risk of physical loss to the Building in an amount not less than eighty percent (80%) of the full replacement value of the Building above foundation walls. All insurance required to be maintained by Landlord pursuant to this Lease shall be maintained with responsible companies qualified to do business, and in good standing, in Massachusetts and which have a rating of at least “A-” and are within a financial size category of not less than “Class VIII” in the most current Best’s Key Rating Guide (or another rating reasonably selected by Landlord if such Guide is no longer published). |

| 13.5 | CONTRACTOR’S AND SUBCONTRACTOR’S INSURANCE. Tenant will require that all parties performing work on or with respect to the Property, including, without limitation, contractors, subcontractors and service vendors, maintain insurance coverage at such parties’ expense, in the following minimum amounts: |

Workers’ Compensation - Statutory amount.

Employer’s Liability - $500,000 each accident; $500,000 disease-policy limit; $500,000 disease - each employee.

Automobile Liability - $1,000,000 covering losses due to the insurer’s liability for bodily injury or property damage.

Medical Expenses - $5,000 per person per accident.

Uninsured/Underinsured Motorists’ Coverage - $1,000,000.

Commercial General Liability: Bodily injury and property damage – Per Exhibit F (construction contractors) or per Exhibit G (service contractors).

Excess Liability Coverage – Per Exhibit F (construction contractors) or per Exhibit G (service contractors) or such greater amount as is needed for the specific job.

Transit Coverage - As needed for the specific job.

The minimum A.M. Best’s rating of each insurer is A-/VII. Tenant must obtain Landlord’s written permission to waive any of the above requirements. Higher amounts may be required by Landlord if the work to be performed is deemed by Landlord to be hazardous. Tenant will obtain and keep on file a certificate of insurance which shows

26

that each such party is so insured. Landlord will be named as an additional insured with respect to Contractors’ and Subcontractors’ Auto Liability, Commercial General Liability and Excess Liability policies. Landlord must obtain indemnification and hold harmless provisions in favor of Landlord, Property Manager and Tenant.

ARTICLE 14

FIRE OR CASUALTY AND TAKING