Attached files

| file | filename |

|---|---|

| 8-K - 8K CDI 8-11-2014 - Cal Dive International, Inc. | form8k.htm |

| EX-99.1 - PRESS RELEASE 2Q FISCAL 2014 - Cal Dive International, Inc. | exhibit99_1.htm |

Exhibit 99.2

Cal Dive International 2nd Quarter 2014 Earnings Conference Call

Cautionary Statement This presentation and related commentary may include “forward-looking” statements that are generally identifiable through the use of words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “project” and similar expressions and include any statements that are made regarding earnings expectations. The forward-looking statements speak only as of the date of this presentation, and the Company undertakes no obligation to update or revise such statements to reflect new information or events as they occur. These statements are based on a number of assumptions, risks and uncertainties, many of which are beyond the control of the Company. Investors are cautioned that any such statements are not guarantees of future performance and that actual future results may differ materially due to a variety of factors, including the Company’s significant indebtedness and constraints on the Company’s liquidity, current economic and financial market conditions, changes in commodity prices for natural gas and oil, and in the level of offshore exploration, development and production activity in the oil and natural gas industry, the Company’s inability to obtain contracts with favorable pricing terms if there is a downturn in its business cycle, intense competition and pricing pressure in the Company’s industry, the risks of cost overruns on fixed price contracts, the uncertainties inherent in competitive bidding for work, the operational risks inherent in the Company’s business, risks associated with the Company’s increasing presence internationally, and other risks detailed in the Company’s most recently filed Annual Report on Form 10-K. *

Presentation Outline * Summary of 2Q 2014 Backlog Discussion of Financial Results Non-GAAP Reconciliations Q & A

Summary of 2Q 2014 * Pemex projectsUnseasonably adverse weather during latter half of quarterCost overruns on two projects; one is complete and the other expected to be completed in 3Q’14Remaining two contracts temporarily suspended by Pemex due to other contractor delays; expected completion 4Q’14U.S. Gulf of Mexico – delayed start to summer work seasonUnseasonably adverse weather during latter half of quarterCustomer delays in start of certain projectsSteady activity in Southeast Asia and AustraliaMexico contractor bankruptcy – $9.5 million reserveSale of U.S. Gulf of Mexico surface diving vessels effective May 31, 2014Successful completion of first project in North Sea

Backlog * ($ millions) 230 $54(1) (1) Backlog related to Macondo work.

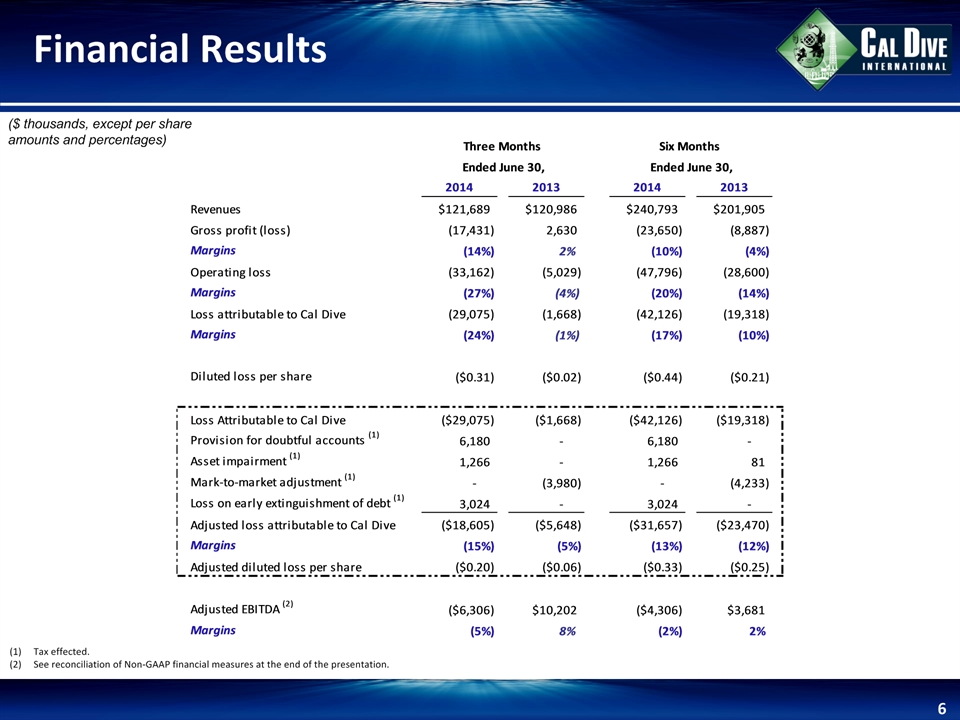

Financial Results * Tax effected.See reconciliation of Non-GAAP financial measures at the end of the presentation. ($ thousands, except per share amounts and percentages)

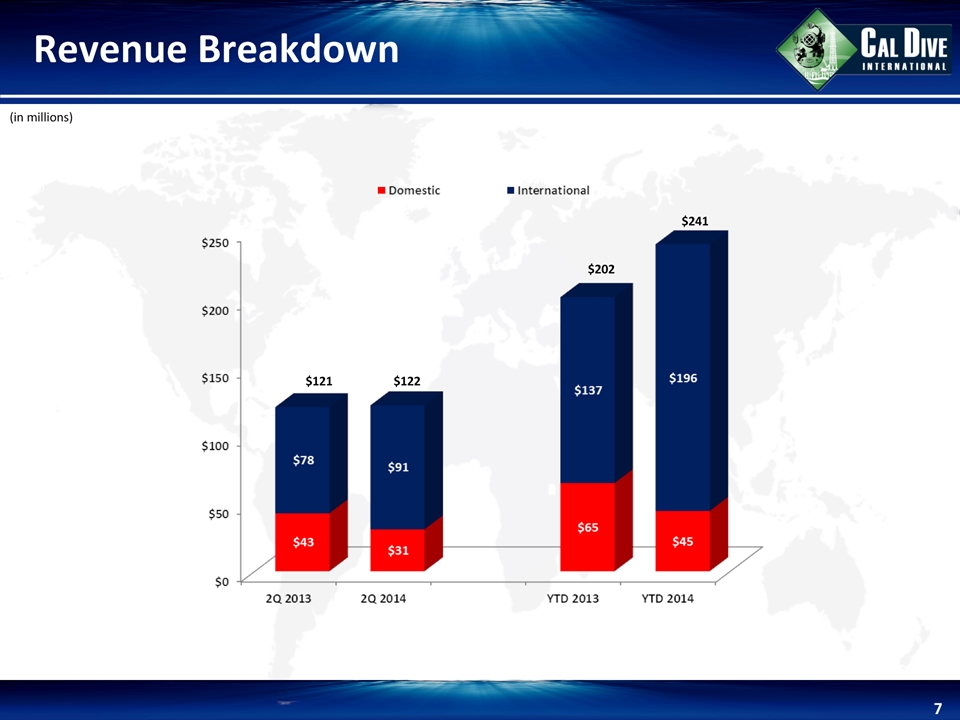

Revenue Breakdown * {55%} {45%} {47%} {53%} {55%} {49%} {27%} {12%} {88%} {73%} $241 $202 $121 $122 (in millions)

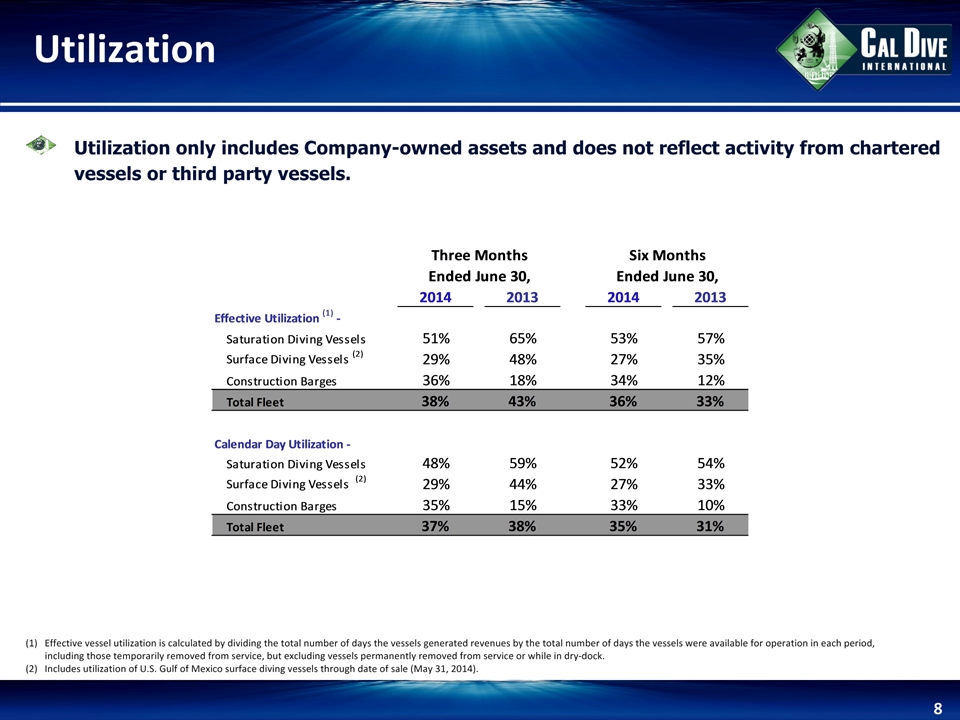

Utilization * (1) Effective vessel utilization is calculated by dividing the total number of days the vessels generated revenues by the total number of days the vessels were available for operation in each period, including those temporarily removed from service, but excluding vessels permanently removed from service or while in dry-dock.(2) Includes utilization of U.S. Gulf of Mexico surface diving vessels through date of sale (May 31, 2014). Utilization only includes Company-owned assets and does not reflect activity from chartered vessels or third party vessels.

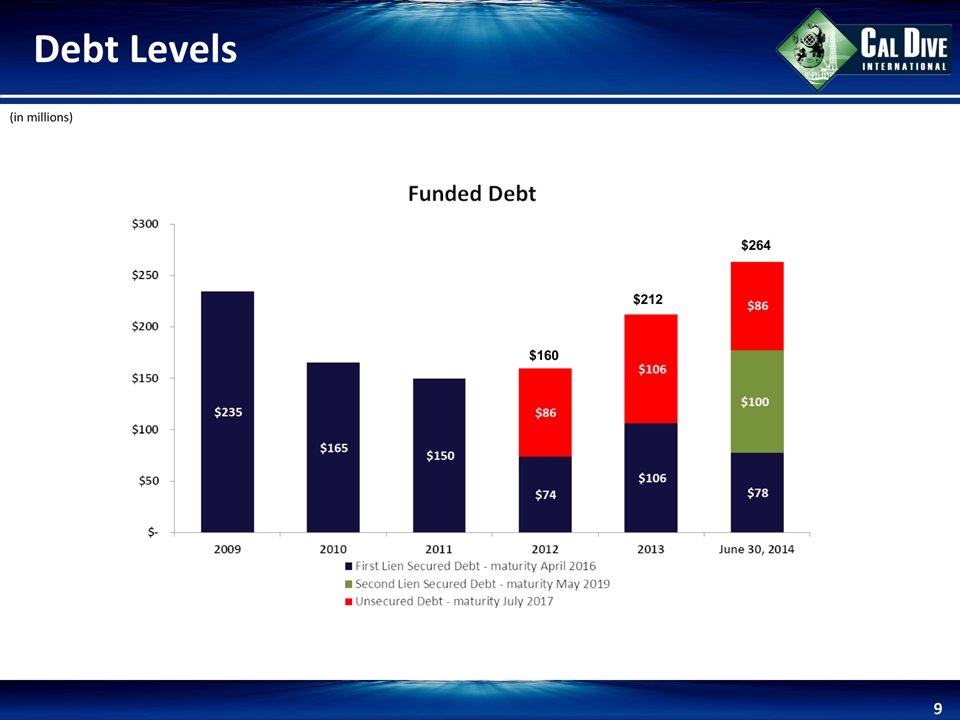

Debt Levels * (in millions) $264 $160 $212

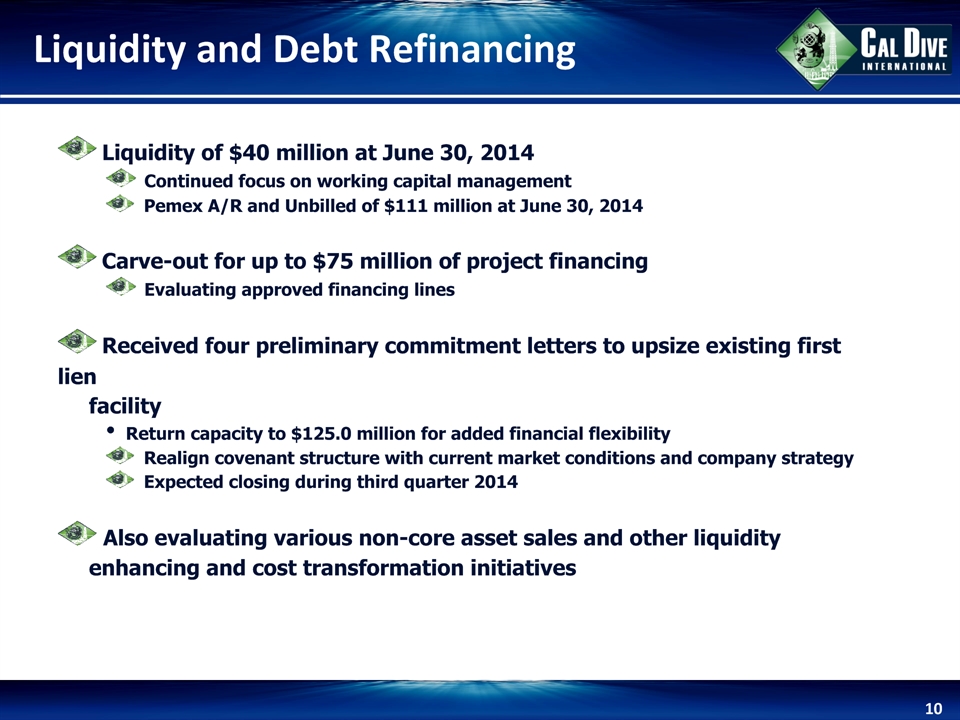

Liquidity and Debt Refinancing * Liquidity of $40 million at June 30, 2014 Continued focus on working capital management Pemex A/R and Unbilled of $111 million at June 30, 2014 Carve-out for up to $75 million of project financing Evaluating approved financing lines Received four preliminary commitment letters to upsize existing first lien facility Return capacity to $125.0 million for added financial flexibility Realign covenant structure with current market conditions and company strategy Expected closing during third quarter 2014 Also evaluating various non-core asset sales and other liquidity enhancing and cost transformation initiatives

Non-GAAP Reconciliations *

EBITDA Reconciliations * (all amounts in thousands)