Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Post Holdings, Inc. | form8k1_080814.htm |

Post Holdings, Inc. Investor Presentation August 2014

Post Holdings, Inc. 2 Certain matters discussed in this presentation and on the conference call held August 8, 2014 are forward-looking statements, including management’s revised outlook for fiscal 2014 and the assumptions thereunder; the expectation that certain supply chain and packaging projects in fiscal 2015 will generate approximately $10 million in cost savings; the expected timing of and cost savings related to the closure of the Modesto, California facility; our expectation of significant operational improvements at Dymatize in fiscal 2015; and management’s expectations that Michael Foods will generate approximately $75 to $80 million in Adjusted EBITDA. Such statements involve certain risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Potential risks and uncertainties include our ability to successfully complete the PowerBar and Musashi and American Blanching acquisition; our high leverage and substantial debt, including covenants that restrict the operation of its business; our ability to service outstanding debt or obtain additional financing, including unsecured debt; our ability to continue to compete in its product markets and its ability to retain market position; our ability to identify and complete acquisitions, manage growth and integrate acquisitions; changes in our cost structure, management, financing and business operations; significant increases in the costs of certain commodities, packaging or energy used to manufacture products; significant volatility in raw material costs, including eggs, potatoes, cheese and other dairy products; our ability to recognize the expected benefits of the closing of the Modesto, California manufacturing facility; our ability to maintain competitive pricing, successfully introduce new products or successfully manage costs; our ability to successfully implement business strategies to reduce costs; impairment in the carrying value of goodwill or other intangibles; the loss or bankruptcy of a significant customer; allegations that products cause injury or illness, product recalls and product liability claims and other litigation; our ability to anticipate changes in consumer preferences and trends; changes in economic conditions and consumer demand for our products; disruptions in the U.S. and global capital and credit markets; labor strikes, work stoppages or unionization efforts by employees; legal and regulatory factors, including changes in food safety, advertising and labeling laws and regulations and laws and regulations governing animal feeding operations; our ability to comply with increased regulatory scrutiny related to certain of its products and/or international sales; the ultimate impact litigation may have on us, including the lawsuit Michael Foods is subject to alleging violations of federal and state antitrust laws; disruptions or inefficiencies in supply chain; our reliance on third party manufacturers for certain of its products; fluctuations in foreign currency exchange rates; consolidations among the retail grocery and foodservice industries; change in estimates in critical accounting judgments and changes to or new laws and regulations affecting our business; losses or increased funding and expenses related to qualified pension plans; loss of key employees; our ability to protect its intellectual property; changes in weather conditions, natural disasters and other events beyond our control; our ability to successfully operate international operations in compliance with applicable regulations; our ability to operate effectively as a stand-alone, publicly traded company; our ability to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, including with respect to acquired companies; business disruptions caused by information technology failures; and other risks described in the Company’s filings with the Securities and Exchange Commission. These forward-looking statements represent the Company’s judgment as of the date of this presentation. The Company disclaims, however, any intent or obligation to update these forward-looking statements. Forward-Looking Statements

Post Holdings, Inc. 3 Non-GAAP Financial Measures While the Company reports financial results in accordance with accounting principles generally accepted in the U.S., this presentation includes the non-GAAP measure Adjusted EBITDA for Post and Michael Foods which is not in accordance with or a substitute for GAAP measures. Post considers Adjusted EBITDA an important supplemental measure of performance and ability to service debt. Adjusted EBITDA is often used to assess performance because it allows comparison of operating performance on a consistent basis across periods by removing the effects of various items. Adjusted EBITDA has various limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of results as reported under GAAP. For a reconciliation of Adjusted EBITDA to the comparable GAAP measure, see the reconciliation tables provided in the Appendix. Certain of the Non-GAAP financial measures included herein present prospective financial information. The Company has not provided a quantitative reconciliation between such financial measures to the most comparable financial measure or measures calculated and presented in accordance with GAAP because it is not reasonably practicable to produce such reconciliation for this prospective financial information. Prospective Financial Information The prospective financial information provided in this presentation regarding Post’s and Michael Foods’ future performance represents Post management’s estimates as of the date of this presentation only. This information, which has not been audited, consists entirely of forward-looking statements, has been prepared by Post management and is qualified by, and subject to, certain assumptions, risks and uncertainties that may cause actual results to differ materially from what is presented herein. Prospective financial information is necessarily speculative in nature, and it can be expected that some or all of the assumptions of the information will not materialize or will vary significantly from actual results. Accordingly, the prospective financial information provided in this presentation is only an estimate of what Post management believes is realizable as of the date of this presentation. It should also be recognized that the reliability of any forecasted financial data diminishes the farther in the future the data is forecast. In light of the foregoing, the information should be viewed in context and undue reliance should not be placed upon it. Additional Information

Post Holdings, Inc. Contents 3Q’14 Adjusted EBITDA Impact Post Foods Commentary Dymatize Commentary Revised Fiscal 2014 Adjusted EBITDA Outlook 4

Post Holdings, Inc. 3Q’14 Adjusted EBITDA Impact ($ in mm) 3Q’14 Impact Post Foods $ (11.8) Dymatize (5.0) Total $ (16.8) ($ in mm) Adjusted EBITDA Actual 1H’14(1) $ 119.4 2H’14 Prior Outlook(2) $ 180-200 Post 3Q’14 Forecast(3) 90 Post 4Q’14 Forecast(3) 100 3Q’14 Actual(4) $ 73.2 3Q’14 Impact $ (16.8) (1) As issued in Post’s Second Quarter Earnings Release on May 8, 2014; excludes Michael Foods. For a reconciliation of Adjusted EBITDA to the comparable GAAP measure, see the reconciliation tables provided in the Appendix. (2) As issued in Post’s Second Quarter Earnings Release on May 8, 2014; excludes Michael Foods. A quantitative reconciliation between this non-GAAP financial measure to the most directly comparable GAAP measure is not provided. It is not reasonably practicable to produce such a reconciliation for this prospective financial information. (3) Post management forecast for Adjusted EBITDA as of May 8, 2014. (4) As issued in Post’s Third Quarter Earnings Release on August 7, 2014; excludes Michael Foods. For a reconciliation of Adjusted EBITDA to the comparable GAAP measure, see the reconciliation tables provided in the Appendix. 5 Post management expected total 2H’14 Adjusted EBITDA of $180- $200mm Based on sequential improvement, Post management forecasted Adjusted EBITDA for 3Q’14 to be $90mm and 4Q’14 to be $100mm(3) 3Q’14 reported Adjusted EBITDA of $73.2mm fell short of Post management expectations by ~$16.8mm Main contributors to the shortfall were Post Foods and Dymatize

Post Holdings, Inc. Item 3Q’14 Expectation Compared to 1H’14 3Q’14 Result Compared to 1H’14 Variance to Forecast ($mm) Pricing • Average net pricing lift of ~3.8% • Improvement in trade efficiencies • Inventory liquidation levels moderate • Average net pricing lift of ~0.8% • Trade efficiencies remain challenged • Inventory liquidation levels remain high $ ~(7.0) Cost of Goods Sold per Pound • Decline of ~4.4% • Lower commodity expenses (primarily grains) • Decline of ~2.0% • $2mm higher than anticipated freight expenses ~(3.3) Volume • Lift of ~0.5% at Post Foods • RTE cereal category volume rate of decline stabilizes at 1H’14 decline of 3.4%(1) • Decline of ~0.8% • RTE cereal category volume rate of decline accelerates to 5.1%(2) ~(1.5) Total $ ~(11.8) Post Foods Commentary Tactical and Strategic Plans Modesto, California plant closure on track for closure in Sept. 2014 with savings of ~$14mm in FY’15 Supply chain and packaging projects in FY’15 will generate ~$10mm of cost savings 6 (1) Ready-to-eat cereal category; ACNieslen xAOC, 26 weeks ended 3/29/14. (2) Ready-to-eat cereal category; ACNielsen xAOC, 13 weeks ended 6/28/14.

Post Holdings, Inc. Dymatize Commentary Dymatize domestic brand is strong Problems in manufacturing and supply chain (as previously discussed) are bottlenecking shipments internationally Supply chain disruption issues have cost an incremental ~$5.0mm in 3Q’14 ̶ Costs are running higher by ~$2.5mm ̶ Foregone profit on missed shipments are ~$2.5mm Dymatize Brand by Region/Type Sales Growth Rate(1) Domestic +16% International (26%) Co-Manufactured +16% (1) Sales growth rate is the comparison of the net sales for the Dymatize brand for the three months ended June 30, 2014 to the net sales the same three-month basis in 2013, including net sales for the periods of time Post owned Dymatize and the respective periods of time Post did not own Dymatize. Operations problems masking strength of brand 7

Post Holdings, Inc. Dymatize Operational Problems and Fixes Investing to build a strong organization capable of supporting future growth Capital Basic growth investments not completed Investing ~$15mm in capital expenditures from FY’14 through FY’16 to address manufacturing facility improvements People Processes and Controls Operations, regulatory and quality departments lacked qualified personnel; significant under staffing Manufacturing best practices not observed Strengthening management team; hiring to fill under staffed areas Implementing best practices with assistance from Post Holdings Centers of Excellence Outlook Long-term outlook remains positive Significant improvements expected in FY’15 8

Post Holdings, Inc. Post management expects fiscal 2014 Adjusted EBITDA to be between $260-$270 million(1) The fiscal 2014 Adjusted EBITDA outlook reflects the following: − Include the partial year expected results of Dakota Growers Pasta Company (acquired January 1, 2014), as well as Golden Boy Foods and Dymatize Enterprises (both acquired on February 1, 2014) − Exclude any contribution from Michael Foods (acquired on June 2, 2014) − Exclude any contribution from the pending acquisitions of the PowerBar and Musashi brands and American Blanching Company Post management expects fiscal 2014 Adjusted EBITDA for Michael Foods (a nearly four-month contribution period) to be between $75 and $80 million(1) Fiscal 2014 Adjusted EBITDA Outlook Update (1) As issued in Post’s Third Quarter Earnings Release on August 7, 2014. A quantitative reconciliation between this non-GAAP financial measure to the most directly comparable GAAP measure is not provided. It is not reasonably practicable to produce such a reconciliation for this prospective financial information. 9

Appendix 10

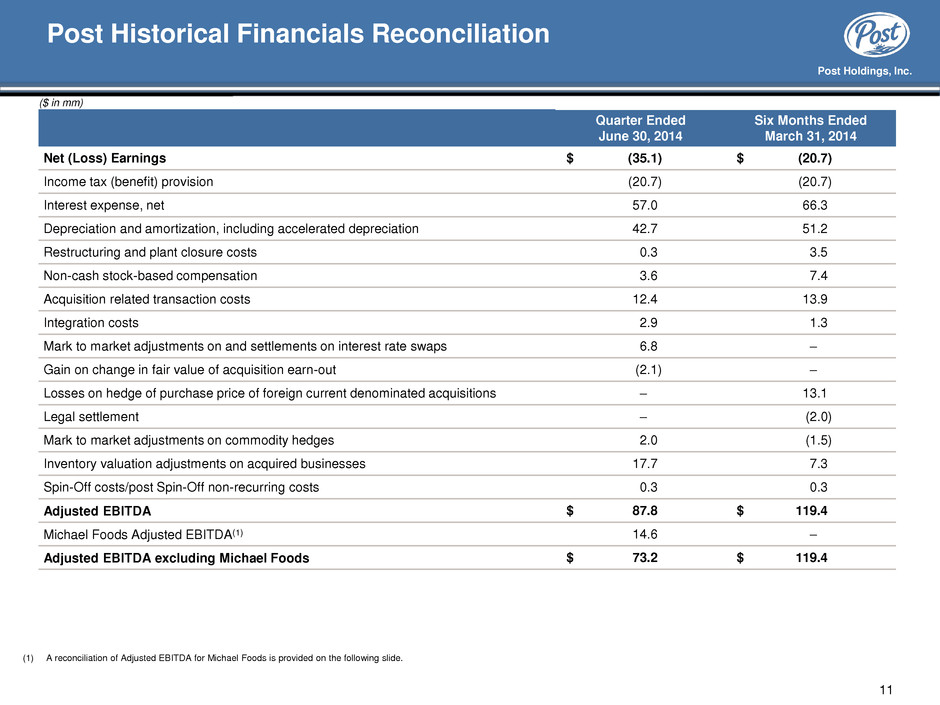

Post Holdings, Inc. Quarter Ended June 30, 2014 Six Months Ended March 31, 2014 Net (Loss) Earnings $ (35.1) $ (20.7) Income tax (benefit) provision (20.7) (20.7) Interest expense, net 57.0 66.3 Depreciation and amortization, including accelerated depreciation 42.7 51.2 Restructuring and plant closure costs 0.3 3.5 Non-cash stock-based compensation 3.6 7.4 Acquisition related transaction costs 12.4 13.9 Integration costs 2.9 1.3 Mark to market adjustments on and settlements on interest rate swaps 6.8 – Gain on change in fair value of acquisition earn-out (2.1) – Losses on hedge of purchase price of foreign current denominated acquisitions – 13.1 Legal settlement – (2.0) Mark to market adjustments on commodity hedges 2.0 (1.5) Inventory valuation adjustments on acquired businesses 17.7 7.3 Spin-Off costs/post Spin-Off non-recurring costs 0.3 0.3 Adjusted EBITDA $ 87.8 $ 119.4 Michael Foods Adjusted EBITDA(1) 14.6 – Adjusted EBITDA excluding Michael Foods $ 73.2 $ 119.4 11 ($ in mm) Post Historical Financials Reconciliation (1) A reconciliation of Adjusted EBITDA for Michael Foods is provided on the following slide.

Post Holdings, Inc. 12 Quarter Ended June 30, 2014 Post Foods Michael Foods Active Nutrition Private Brands Attune Foods Corporate/ Other Total Segment Profit (Loss) $ 48.2 $ (12.5) $ (2.5) $ 5.9 $ 2.0 $ – $ 41.1 General corporate expenses and other – – – – – (30.8) (30.8) Accelerated depreciation on plant closure – – – – – (2.1) (2.1) Restructuring expense – – – – – (0.2) (0.2) Operating Profit 48.2 (12.5) (2.5) 5.9 2.0 (33.1) 8.0 Depreciation and amortization, including accelerated depreciation 13.0 10.2 5.5 8.5 1.8 3.7 42.7 Restructuring and plant closure costs – – – – – 0.3 0.3 Non-cash stock-based compensation – – – – – 3.6 3.6 Acquisition related transaction costs – – 0.1 – – 12.3 12.4 Integration costs – – – – – 2.9 2.9 Gain on change in fair value of acquisition earn-out – – – – – (2.1) (2.1) Mark to market adjustments on commodity hedges – 1.1 – – – 0.9 2.0 Inventory valuation adjustments on acquired businesses – 15.8 1.9 – – – 17.7 Spin-Off costs/post Spin-Off non-recurring costs – – – – – 0.3 0.3 Adjusted EBITDA $ 61.2 $ 14.6 $ 5.0 $ 14.4 $ 3.8 $ (11.2) $ 87.8 Post Historical Financials Reconciliation ($ in mm)

13 Post Holdings, Inc.