Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CAREFUSION Corp | form8-kitem202707901_fy14q4.htm |

| EX-99.1 - NEWS RELEASE - CAREFUSION Corp | ex991fy14q4.htm |

Fiscal 2015 Financial Guidance August 7, 2014 © 2014 CareFusion Corporation or one of its subsidiaries. All rights reserved. Exhibit 99.2

Forward-Looking Statements and Use of Non-GAAP Financial Measures “Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995: This presentation contains our fiscal 2015 financial guidance and long-term outlook, which are forward-looking statements addressing expectations, prospects, estimates and other matters that are dependent upon future events or developments. The matters discussed in these forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those projected, anticipated or implied. The most significant of these uncertainties are described in CareFusion’s Form 10-K, Form 10-Q and Form 8-K reports (including all amendments to those reports) and exhibits to those reports, and include (but are not limited to) the following: we may be unable to effectively enhance our existing products or introduce and market new products or may fail to keep pace with advances in technology; we are subject to complex and costly regulation; cost containment efforts of our customers, purchasing groups, third-party payers and governmental organizations could adversely affect our sales and profitability; challenging economic conditions have and may continue to adversely affect our business, results of operations and financial condition; we may be unable to realize any benefit from our cost reduction and restructuring efforts and our profitability may be hurt or our business otherwise might be adversely affected; we may be unable to protect our intellectual property rights or may infringe on the intellectual property rights of others; defects or failures associated with our products and/or our quality system could lead to the filing of adverse event reports, product recalls or safety alerts with associated negative publicity and could subject us to regulatory actions; and we are currently operating under an amended consent decree with the FDA and our failure to comply with the requirements of the amended consent decree may have an adverse effect on our business. This presentation reflects management’s views as of August 7, 2014. Except to the limited extent required by applicable law, CareFusion undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Non-GAAP Financial Measures: The fiscal 2015 financial guidance and long-term outlook contained in this presentation include non-GAAP financial measures that exclude certain amounts, as follows: “adjusted operating margin,” which excludes amortization of acquired intangibles, nonrecurring restructuring and acquisition integration charges, and inventory valuation step-up charges from acquisitions; “adjusted diluted earnings per share from continuing operations” and “adjusted effective tax rate,” which exclude amortization of acquired intangibles, nonrecurring restructuring and acquisition integration charges, inventory valuation step-up charges from acquisitions, and nonrecurring tax items; and “free cash flow,” which reflects cash provided by operating activities, excluding expenses associated with capital expenditures. The Company’s management uses non-GAAP financial measures to evaluate the Company’s performance and provides them to investors as a supplement to the Company’s reported results, as they believe this information provides additional insight into the Company’s operating performance by disregarding certain non- recurring items. A reconciliation of GAAP to non-GAAP financial measures for our fiscal 2014 financial results can be found in the Company’s Q4FY14 earnings release, which was furnished to the SEC on Form 8-K on August 7, 2014 and is posted on CareFusion’s website at www.carefusion.com under the Investors tab. The Form 8-K also includes a discussion of the reasons why management believes that the presentation of non-GAAP financial measures provides useful information to investors regarding the company’s financial condition and results of operations. 2 © 2014 CareFusion Corporation or one of its subsidiaries. All rights reserved.

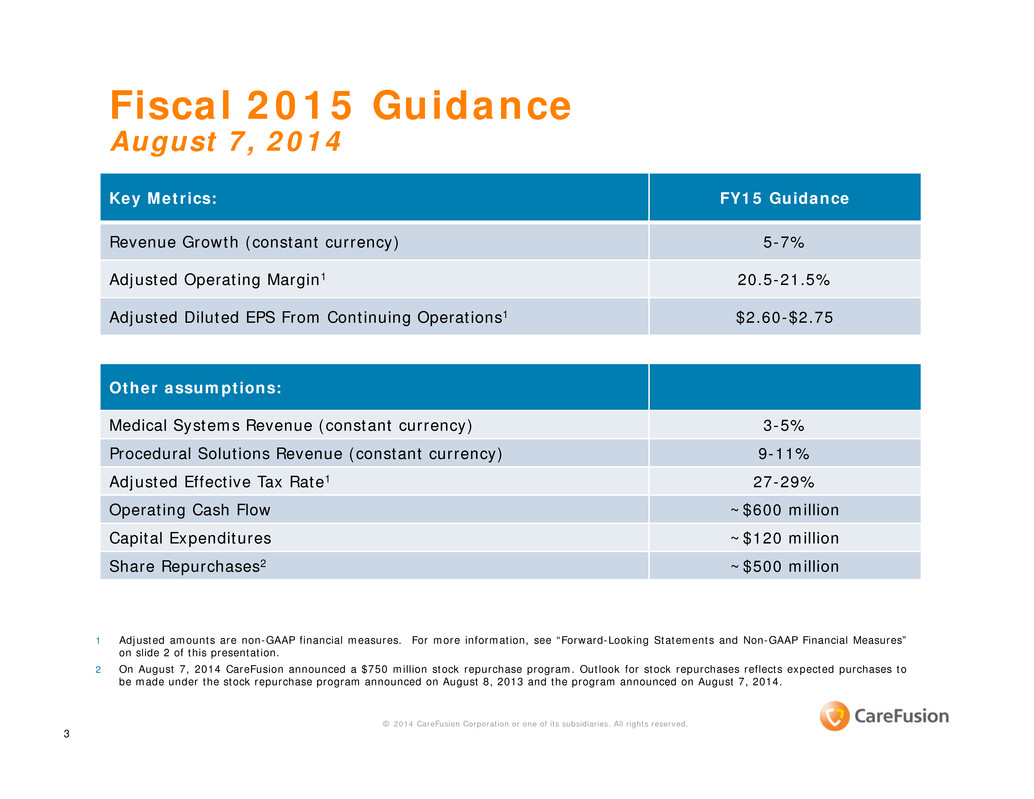

3 Fiscal 2015 Guidance August 7, 2014 Key Metrics: FY15 Guidance Revenue Growth (constant currency) 5-7% Adjusted Operating Margin1 20.5-21.5% Adjusted Diluted EPS From Continuing Operations1 $2.60-$2.75 Other assumptions: Medical Systems Revenue (constant currency) 3-5% Procedural Solutions Revenue (constant currency) 9-11% Adjusted Effective Tax Rate1 27-29% Operating Cash Flow ~$600 million Capital Expenditures ~$120 million Share Repurchases2 ~$500 million © 2014 CareFusion Corporation or one of its subsidiaries. All rights reserved. 1 Adjusted amounts are non-GAAP financial measures. For more information, see “Forward-Looking Statements and Non-GAAP Financial Measures” on slide 2 of this presentation. 2 On August 7, 2014 CareFusion announced a $750 million stock repurchase program. Outlook for stock repurchases reflects expected purchases to be made under the stock repurchase program announced on August 8, 2013 and the program announced on August 7, 2014.

Revenue growth in mid single- digits Base market growth Continued share gain and global expansion 2014 Adjusted Diluted EPS1 2017 Adjusted Diluted EPS1 Operational efficiencies and product mix $2.36 >50% FCF for stock buybacks and “tuck-in” M&A2,3 10-12% CAGR Capital deployment © 2014 CareFusion Corporation or one of its subsidiaries. All rights reserved. 4 1 Adjusted amounts are non-GAAP financial measures. For more information, see “Forward-Looking Statements and Non-GAAP Financial Measures” on slide 2 of this presentation. 2 FCF or Free Cash Flow is a non-GAAP financial measure that presents the Company’s cash provided by operating activities, excluding expenses associated with capital expenditures. 3 Long-term outlook for FY15-FY17 includes the impact of capital deployment for stock repurchases and “tuck-in” merger and acquisition transactions. In the event of a large transformative merger and acquisition transaction, this long-term outlook will be updated accordingly. Long-term goals FY15-FY17 Adjusted operating margins of 23%+ in 20171 Adjusted diluted EPS CAGR of 10-12%1