Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - New York REIT Liquidating LLC | v385861_8k.htm |

0 February 2014 Investor Presentation August 2014

1 Forward Looking Statements Certain statements included in this presentation are forward - looking statements . Those statements include statements regarding the intent, belief or current expectations of New York REIT, Inc . (the "Company," "we," "our" or "us") and members of our management team , as well as the assumptions on which such statements are based, and generally are identified by the use of words such as "may," " will", " seeks," "anticipates," "believes," "estimates," "expects," " plans," "intends," "should" or similar expressions . Actual results may differ materially from those contemplated by such forward - looking statements . Further, forward - looking statements speak only as of the date they are made, and we undertake no obligation to update or revise forward - looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law .

2 The following are some of the risks and uncertainties, although not all risks and uncertainties, that could cause our actual results to differ materially from those presented in our forward - looking statements : • All of our executive officers are also officers, managers and/or holders of a direct or indirect interest in our Advisor and other American Realty Capital - affiliated entities ; as a result, our executive officers, our Advisor and its affiliates face conflicts of interest, including significant conflicts created by our Advisor’s compensation arrangements with us and other investor entities advised by American Realty Capital affiliates, and conflicts in allocating time among these entities and us, which could negatively impact our operating results ; • Because investment opportunities that are suitable for us may also be suitable for other American Realty Capital - advised programs or investors, our Advisor and its affiliates face conflicts of interest relating to the purchase of properties and other investments and such conflicts may not be resolved in our favor, meaning that we could invest in less attractive assets, which could reduce the investment return to our stockholders ; • We depend on tenants for our revenue, and, accordingly, our revenue is dependent upon the success and economic viability of our tenants ; • We may not be able to achieve our rental rate incentives and our expenses could be greater, which may impact our results of operations ; • Increases in interest rates could increase the amount of our debt payments and limit our ability to pay distributions ; • We may not generate cash flows sufficient to pay our distributions to stockholders, as such, we may be forced to borrow at higher rates or depend on our Advisor or our Property Manager, New York Recovery Properties, LLC, to waive reimbursement of certain expenses and fees to fund our operations ; • We may be unable to pay or maintain cash distributions or increase distributions over time ; • We are obligated to pay fees, which may be substantial, to our Advisor and its affiliates, including fees payable upon the sale of properties ; • We are subject to risks associated with the significant dislocations and liquidity disruptions that recently existed or occurred in the credit markets of the United States ; • We may fail to continue to qualify to be treated as a real estate investment trust for U . S . federal income tax purposes (“REIT”) ; • Our properties may be adversely affected by economic cycles and risks inherent to the New York metropolitan statistical area (“MSA”), especially New York City ; and • Changes in general economic, business and political conditions, including the possibility of intensified international hostilities, acts of terrorism, and changes in conditions of United States or international lending, capital and financing markets . Forward - Looking Statements (cont’d)

3 Introduction » New York REIT, Inc. (“NYRT”) is a publicly traded real estate investment trust listed on the New York Stock Exchange • Enterprise value of approximately $2.7 billion (1 ) » Focused on New York City commercial real estate • 100% of portfolio located in New York City • Over 90% office/retail » Solid balance sheet • ~33% combined debt/enterprise value (1) • Nominal near term debt maturities » Strong growth prospects • Targeting over 15% growth in same store run rate cash NOI • Proven acquisition capabilities (1) Based on June 30, 2014 closing price of $ 11.06 per share, and June 30, 2014 debt balances and share count

4 Total SF (mm) 3 27 8 71 41 Manhattan Real Estate Exposure (% SF) “Pure Play” on New York City 96% 80% NYRT’s portfolio has the highest concentration of Manhattan - based real estate of all public REITs 78% 37% 20% Source: SNL Financial and company filings for Q2 2014. Note: Reflects company metrics for Q2 2014. All metrics for NYRT shown represent the company’s proportionate ownership, including proportionate ownership of unconsolidated joint ventures. All other companies based on reported square footage. Amounts also inc lude properties under development. Excludes acquisitions after 6/30/2014.

5 Strong Value Proposition Compared to Public Peers (as of 6/30/14) Sources : Company filings, FactSet , and SNL Financial as of 6 /30/2014. Note: Reflects company metrics for Q2 2014. (1) Includes pro rata share of unconsolidated JV debt and JV share of consolidated debt. (2) Enterprise value = equity value + net debt + preferred equity. Net debt = combined debt - cash. (3) Based on estimated 2015 FFO per share of $0.65 and AFFO per share of $0.54 (midpoint of our guidance). (4) Portfolio metrics exclude purchase of the properties at 112 West 34 th Street and 1400 Broadway which occurred after 6/30/2014. New York REIT (with Twitter Building) SL Green Realty Corp Empire State Realty Trust Boston Properties, Inc. Vornado Realty Trust Ticker: NYRT SLG ESRT (4) BXP VNO SF (mm) 3.4 27.5 8.4 40.7 71.4 Manhattan Real Estate Exposure (by SF) 96% 80% 78% 20% 37% Occupancy 94% 92% 89% 93% 97% Total Equity Value (billions) $1.8 $10.8 $4.4 $20.3 $21.3 Combined Debt (billions) (1) $1.2 $9.4 $1.6 $9.9 $14.6 Enterprise Value (billions) (2) $ 3.1 $20.0 $6.0 $29.3 $35.6 (Net Debt + Pref.) / Enterprise Value (2) 41% 46% 26% 31% 40% (Net Debt + Pref.) / EBITDA 8.8x 9.6x 5.9x 6.3x 8.0x Dividend Yield 4.2% 1.8% 2.1% 2.2% 2.7% 2015E FFO Payout Ratio 71% 32% 40% 45% 57% 2015E AFFO Payout Ratio 85% 44% 69% 61% 81% 2015E FFO Multiple 17.0x 17.5x 19.8x 20.8x 20.7x 2015E AFFO Multiple 20.5x 23.8x 33.7x 27.7x 29.6x Price (as of 6/30/2014) $11.06 $109.41 $16.50 $118.18 $106.73 Implied Price at Average Peer FFO Multiple of 20.0x $13.00 Implied Price at Average Peer AFFO Multiple of 29.0x $15.66 (3) (3) (3) (3) (3) (3)

6 Internal Growth Potential » Three of our 23 properties are not yet stabilized » Targeting over 15% growth in same store run rate cash NOI o Key drivers: • Elimination of free rent at 50 Varick Street • Ramp - up of the newly opened Viceroy Hotel • Lease - up of 138,000 square feet at Worldwide Plaza » Expect 4 - 5% long - term growth in same store cash NOI once portfolio is stabilized o In - place portfolio rents are 10 - 15 % below market o Average remaining lease term of approximately 10 years

7 External Growth Opportunity » Proven acquisition capabilities: • Acquired over $2 billion of Manhattan real estate • Under contract to buy Twitter’s Manhattan headquarters location for $335 million (“Twitter Building”) » Fixed price option to acquire remaining interest in Worldwide Plaza at $669 per SF on January 1, 2017: • Believe option price represents a substantial discount to estimated FMV of the asset • Represents a 33% increase in square footage from current portfolio » Conservative balance sheet metrics provide ample liquidity for growth • 33% (1) combined debt to enterprise value 1.) Based on 6/30/14 Closing Price of $ 11.06, and 6/30/14 Share Count and Combined Debt Balances (1) Based on June 30, 2014 closing price of $ 11.06 per share, and June 30, 2014 debt balances and share count

8 96% 4% 0.3 % Manhattan Brooklyn Queens Borough by S quare Feet NYRT is: » 100% New York City » 96% Manhattan Portfolio Mix by Geography

9 82% 8% 4% 4% 2% NYRT is: » 90% Office & Retail Portfolio Mix by Property Type Property Use by Square Feet Office Retail (1 ) Parking Hotel Other (2) (1) Includes retail at office buildings (2) Multifamily and storage ( 3) Calculations exclude revenue from hotel Property Use by Cash Rent (3) Office Retail (1) Parking 84% 15% 1% 0.3% Multifamily

10 Major Assets (1) Currently under contract (2) Red Bull building occupancy went up to 92% after June 30, 2014 Top 5 properties account for more than 70% of portfolio cash NOI Property Square Footage Occupancy (as of 6/30/14) Average Remaining Lease Term Borough Worldwide Plaza 1,005,178 93% 12.8 Manhattan 1440 Broadway 755,679 89% 5.6 Manhattan Twitter Building (1) 282,143 99% 12.7 Manhattan 333 West 34th Street 346,728 100% 10.2 Manhattan Red Bull Building (2) 165,670 84% 9.3 Manhattan Total 2,555,398 93% 10.1

11 218 West 18 th Street 50 Varick Street 256 West 38 th Street 306 East 61 st Street 229 West 36 th Street 1440 Broadway Worldwide Plaza 333 West 34 th Street Manhattan Office Portfolio Snapshot

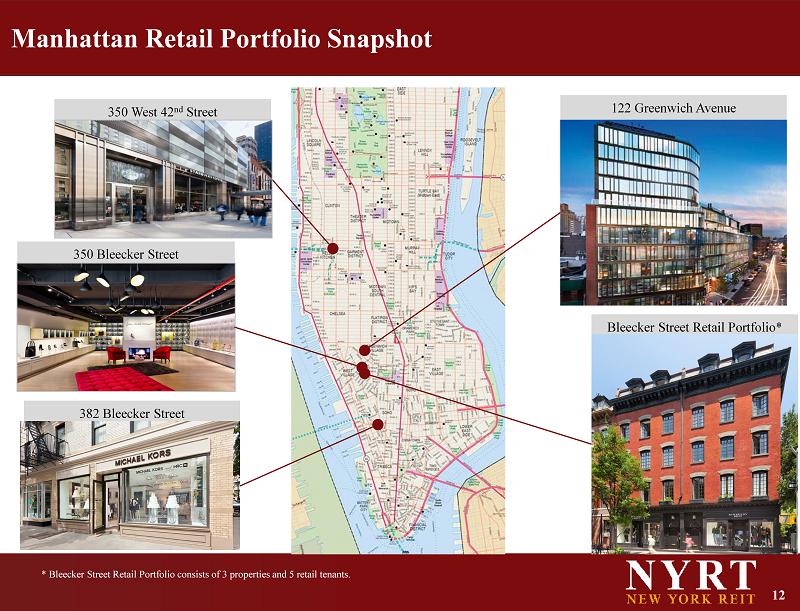

12 350 Bleecker Street 350 West 42 nd Street 382 Bleecker Street 122 Greenwich Avenue Bleecker Street Retail Portfolio* Manhattan Retail Portfolio Snapshot * Bleecker Street Retail Portfolio consists of 3 properties and 5 retail tenants .

13 1.0% 8.0% 3.9% 4.0% 1.8% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 2014 2015 2016 2017 2018 Note: As of June 30, 2014. Excludes Hotel and Multifamily properties. (1) 171,000 SF is attributed to Primedia at 1440 Broadway (~6.1%) Well - Staggered Lease Maturity Schedule Weighted Average Remaining Lease Term of 10 years Only 20% expiring over the next five years (1)

14 Low Recurring Cap Ex Note: Excludes properties without recurring capital expenditures in 2014 and 2015. (1) Recurring Cap Ex represents capital expenditures, tenant improvements and leasing commissions needed to maintain existing inc ome . It excludes first generation lease up. 2014 Total 2015 Total Interior Design Building $ 158 $ 157 163 Washington Avenue 94 97 256 West 38th Street 1,570 151 229 West 36th Street 37 11 218 West 18th Street 10 118 333 W 34th Street 55 0 Worldwide Plaza 28 1,271 Viceroy Hotel 813 1,250 1440 Broadway 3,150 3,546 Other Properties 0 0 Total $ 5,915 $ 6,601 % of Cash NOI 5 % 5 % Recurring Cap Ex by Property (1) ($ Amounts In Thousands) Acquisition Strategy Intentionally Targeted Buildings in Good Physical Condition

15 Financial Highlights x Conservative Capital Structure ▪ Q2 2014 Combined Enterprise Value is only 33% ▪ Combined interest coverage of 3.6x ▪ Favorable debt metrics provide ample liquidity for growth x Manageable Debt Maturity Schedule ▪ No major debt maturities until 2018 x Attractive Tax Efficient Dividend ▪ $0.46 per share annual dividend distributed monthly ▪ 4.2% annual dividend yield (1) ▪ 93% of dividend was a return of capital in 2013 (1) Based on June 30, 2014 closing price of $ 11.06 per share

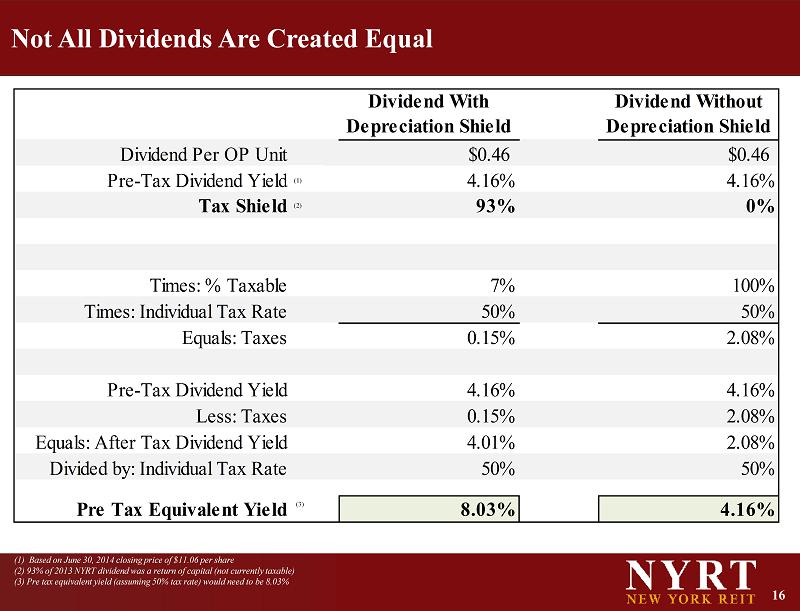

16 Not All Dividends Are Created Equal (1 ) Based on June 30, 2014 closing price of $11.06 per share (2) 93% of 2013 NYRT dividend was a return of capital (not currently taxable) (3) Pre tax equivalent yield (assuming 50% tax rate) would need to be 8.03% Dividend With Depreciation Shield Dividend Without Depreciation Shield Dividend Per OP Unit $0.46 $0.46 Pre-Tax Dividend Yield 4.16% 4.16% Tax Shield 93% 0% Times: % Taxable 7% 100% Times: Individual Tax Rate 50% 50% Equals: Taxes 0.15% 2.08% Pre-Tax Dividend Yield 4.16% 4.16% Less: Taxes 0.15% 2.08% Equals: After Tax Dividend Yield 4.01% 2.08% Divided by: Individual Tax Rate 50% 50% Pre Tax Equivalent Yield 8.03% 4.16% 3 . 1. 2 . (1) (2) (3)

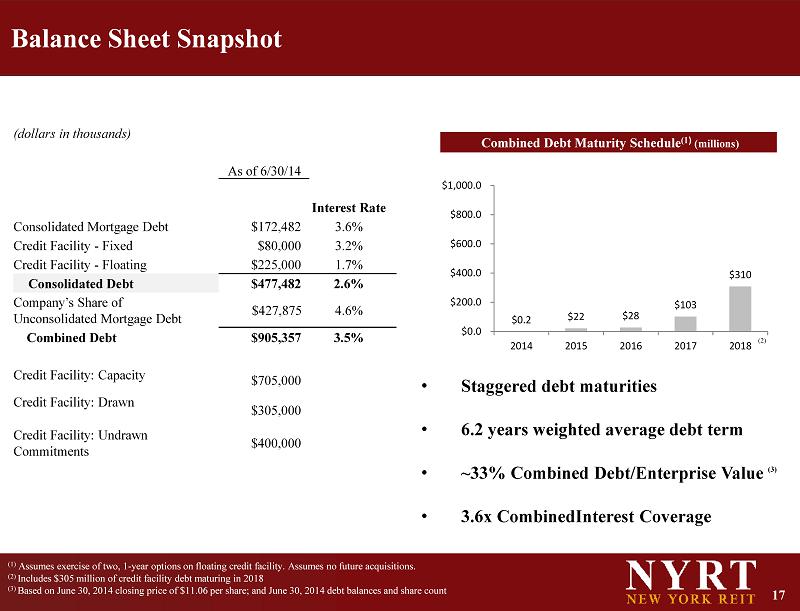

17 Balance Sheet Snapshot (1) Assumes exercise of two, 1 - year options on floating credit facility. Assumes no future acquisitions. ( 2 ) Includes $305 million of credit facility debt maturing in 2018 (3) Based on June 30, 2014 closing price of $11.06 per share; and June 30, 2014 debt balances and share count (dollars in thousands ) As of 6/30/14 Interest Rate Consolidated Mortgage Debt $172,482 3.6% Credit Facility - Fixed $80,000 3.2% Credit Facility - Floating $225,000 1.7% Consolidated Debt $477,482 2.6% Company’s Share of Unconsolidated Mortgage Debt $427,875 4.6% Combined Debt $905,357 3.5% Credit Facility: Capacity $705,000 Credit Facility: Drawn $305,000 Credit Facility: Undrawn Commitments $400,000 Combined Debt Maturity Schedule (1 ) (millions) • Staggered debt maturities • 6.2 years weighted average debt term • ~33% Combined Debt/Enterprise Value (3) • 3.6x CombinedInterest Coverage $0.2 $22 $28 $103 $310 $0.0 $200.0 $400.0 $600.0 $800.0 $1,000.0 2014 2015 2016 2017 2018 (2)

18 $0.2 $22 $28 $103 $649 $0.0 $200.0 $400.0 $600.0 $800.0 $1,000.0 2014 2015 2016 2017 2018 Balance Sheet Snapshot (with Twitter Building) (1) Assumes Twitter Building is funded using a mix of floating rate debt financing at 2.05% and fixed rate debt at 3.40% to achieve company floating rate mix of 30 % (2) Assumes exercise of two, 1 - year options on floating credit facility. (3) Includes $644 million of credit facility debt maturing in 2018 (4) Based on June 30, 2014 closing price of $11.06 per share; and June 30, 2014 debt balances and share count (dollars in thousands ) As of 6/30/14 (with Twitter Building ) (1) Interest Rate Consolidated Mortgage Debt $172,482 3.6% Credit Facility - Fixed $271,949 3.3% Credit Facility - Floating $372,107 1.8% Consolidated Debt $816,538 2.7% Company’s Share of Unconsolidated Mortgage Debt $427,875 4.6% Combined Debt $1,244,413 3.3% Credit Facility: Capacity $705,000 Credit Facility: Drawn $644,056 Credit Facility: Undrawn Commitments $60,944 Combined Debt Maturity Schedule (2 ) (millions) • Staggered debt maturities • 5.6 years weighted average debt term • ~41% Combined Debt/Enterprise Value (4) • 3.2x Combined Interest Coverage (3)

19 Debt Strategy » Strong balance sheet consistent with investment grade metrics • Target combined debt/enterprise value less than 50% • Maintain interest coverage in excess of 2.5 times • Target 40% - 60% unencumbered assets as a percentage of total assets • Target less than 35% floating rate debt • Maintain well - staggered debt maturities

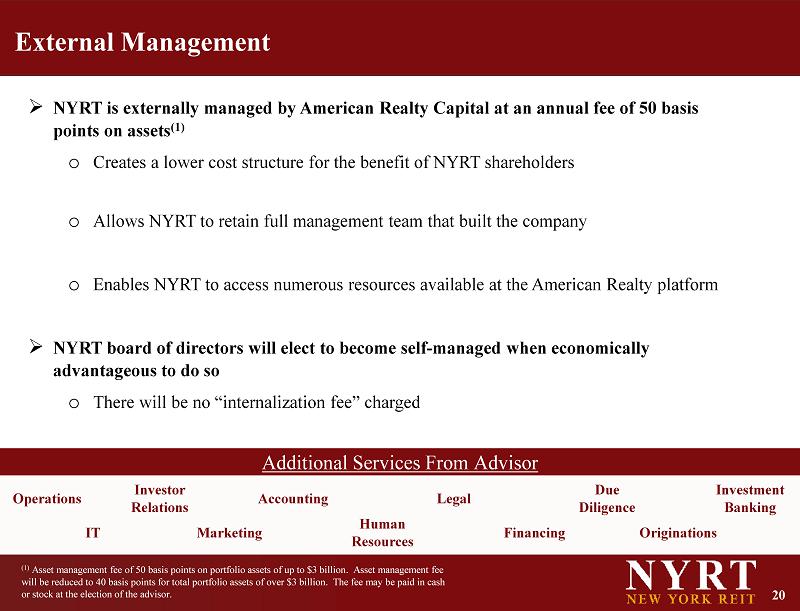

20 External Management CBD office peers » NYRT is externally managed by American Realty Capital at an annual fee of 50 basis points on assets (1) o Creates a lower cost structure for the benefit of NYRT shareholders o Allows NYRT to retain full management team that built the company o Enables NYRT to access numerous resources available at the American Realty platform » NYRT board of directors will elect to become self - managed when economically advantageous to do so o There will be no “internalization fee” charged (1) Asset management fee of 50 basis points on portfolio assets of up to $3 billion. Asset management fee will be reduced to 40 basis points for total portfolio assets of over $3 billion. The fee may be paid in cash or stock at the election of the advisor. Additional Services From Advisor Operations IT Marketing Accounting Legal Human Resources Originations Due Diligence Investment Banking Investor Relations Financing

21 Michael Ead Assistant General Counsel William Stanley Independent Director Michael Happel President Judi Stillman Controller Greg Sullivan CFO & COO Robert Burns Independent Director Scott Bowman Independent Director Zachary Pomerantz V.P. Asset Management Patrick O’Malley Acquisition Director Nicholas S. Schorsch CEO & Chairman William Kahane Director Experienced NYRT Management Team and Board of Directors Same High - Quality Team That Built This Company

22 Michael A. Happel, President Mr . Happel has over 25 years of experience investing in real estate including acquisitions of office, retail, multifamily, industrial, and hotel properties as well as acquisitions of real estate companies and real estate debt . From 1988 - 2002 , he worked at Morgan Stanley & Co . , specializing in real estate and becoming co - head of acquisitions for the Morgan Stanley Real Estate Funds, or MSREF, in 1994 . While at MSREF, he was involved in acquiring over $ 10 billion of real estate and related assets in MSREF I and MSREF II . As stated in a report prepared by Wurts & Associates for the Fresno County Employees’ Retirement Association for the period ending September 30 , 2008 , both MSREF I and MSREF II generated approximately a 48 % gross IRR for investors and MSREF II generated approximately a 27 % gross IRR for investors . Mr . Happel later joined Westbrook Partners, a real estate private equity firm with over $ 5 billion of real estate assets . In 2004 , he joined Atticus Capital, a multi - billion dollar hedge fund, as the head of real estate with responsibility for investing primarily in REITs and other publicly traded real estate securities . Gregory W. Sullivan, Chief Financial Officer Mr . Sullivan was Chief Financial Officer, Executive Vice President and Treasurer of STAG Capital Partners prior to joining ARC . Mr . Sullivan served on the Board of Managers of STAG Capital Partners, LLC and STAG Capital Partners III, LLC from 2004 to 2011 . He served as Executive Vice President for Corporate Development for New England Development LLC (NED) from 2002 to 2011 , where his role was to expand and diversify NED's real estate and non - real estate private equity activities . Prior to joining NED in 2002 , Mr . Sullivan was Executive Vice President and Chief Financial Officer of Trizec Hahn Corporation from 1994 to 2001 , a publicly traded real estate company headquartered in Toronto . From 1987 to 1994 , Mr . Sullivan served in various capacities at AEW Capital Management in Boston including overseeing investments for the company's real estate opportunity fund and heading the capital markets group . In addition, from 1982 to 1987 , he served as a senior finance officer at M/A - COM, Inc . , a Boston based telecommunications company and, from 1980 to 1982 , he served as an investment banker at Smith Barney in New York . Mr . Sullivan received his Bachelor of Sciences degree from the University of Vermont and his Master of Business Administration degree from The Wharton School of the University of Pennsylvania . Senior Management Team

23 Case Studies

24 • In December 2013, NYRT completed its off - market acquisition of 1440 Broadway, an 89% occupied institutional - quality office building on the corner of Broadway and 40 th Street • Investment grade tenants account for approximately 40% of existing rent including: Macy’s (S&P: BBB), Mizuho (S&P: A+), Citibank (S&P: A), Western Union (S&P: BBB +) and FedEx (S&P: BBB ) • Value creation opportunity in 2015 when the existing below - market retail leases expire • Potential to create “big box” retail concept by using the second floor, basement, and part of the existing lobby to create approximately 45,000 square feet of available retail space • NYRT has significant upside with various configurations at a time when Times Square retail continues to get better and move south down Broadway • Ideally positioned in the Times Square South submarket, just two blocks south of the “Times Square Bowtie”, currently one of the fastest growing, most expensive retail stretches in the world • Asset is in excellent condition and is LEED Gold Certified. Prior ownership spent ~$36 million on base building improvements sin ce 2000, including over $15 million in lobby renovations Case Study: 1440 Broadway

25 • In October 2013, NYRT completed an off - market acquisition of a 48.9% equity interest in One Worldwide Plaza at a discount to replacement cost • The Trophy New York office building is currently 93% occupied » 84 % is leased to two high - quality tenants: Nomura Holdings (Moody's: Baa3, S&P: BBB+) and Cravath , Swaine & Moore » Long term leases in place with Nomura Holdings expiring in September 2033, and Cravath , Swaine & Moore expiring in August 2024 • Embedded growth through contractual option to purchase the remaining 51.1% in three years at a fixed price, valuing the whole bu ilding at $1.375 billion ($669 per SF). Total building is over 2 million square feet. • Value creation opportunity from both vacant space lease up and contractual rent increases in existing leases • NYRT currently sweeps disproportionate cash flow through its 7 % preferred return • Built in 1987 and LEED Gold certified, the asset is in excellent physical condition thus requiring minimal future capital Case Study: One Worldwide Plaza

26 • In March 2013, NYRT completed its acquisition of the fee simple interest in 218 West 18 th Street, a 165,670 square foot office building located on West 18 th Street between 7 th and 8 th Avenues • The 84% occupied, institutional - quality office building was acquired off market at a price well below replacement cost • Located just three blocks from the 'Google Building' at 111 Eighth Avenue, the property sits in the heart of "Silicon Alley" in the Chelsea submarket of Midtown South, Manhattan • Value creation opportunity through vacant lease up of 27,008 square feet in Midtown South, the most supply constrained submarket in Manhattan. • The building attracts a mix of tenants in the creative and technology sectors including credit tenants Red Bull and Yammer (recently purchased by Microsoft) Case Study: 218 West 18 th Street

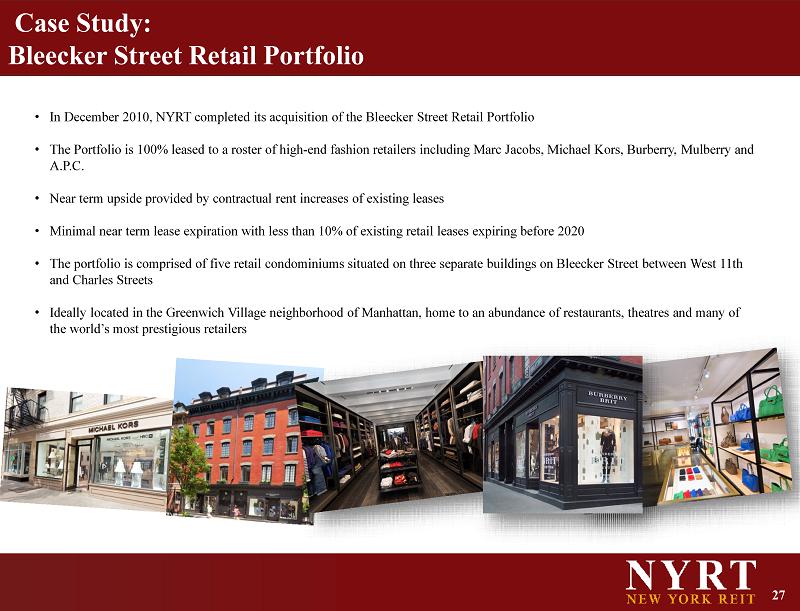

27 • In December 2010, NYRT completed its acquisition of the Bleecker Street Retail Portfolio • The Portfolio is 100% leased to a roster of high - end fashion retailers including Marc Jacobs, Michael Kors , Burberry, Mulberry and A.P.C . • Near term upside provided by contractual rent increases of existing leases • Minimal near term lease expiration with less than 10% of existing retail leases expiring before 2020 • The portfolio is comprised of five retail condominiums situated on three separate buildings on Bleecker Street between West 11th and Charles Streets • Ideally located in the Greenwich Village neighborhood of Manhattan, home to an abundance of restaurants, theatres and many of the world’s most prestigious retailers Case Study: Bleecker Street Retail Portfolio

28 Appendix – Market Data

29 $34.9 $37.4 $40.8 $44.3 $47.4 $48.4 $47.1 $51.1 $57.3 $62.2 $65.8 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013E Increasing Retail Sales (in billions) 23.3 23.6 25.8 27.3 29.0 30.1 2008 2009 2010 2011 2012 2013E New York City’s economy has continued to grow despite broader economic challenges since 2008 Expanding Tourism (millions of people per year) Growth in Hotel Room Night Sales (millions of nights sold) Job Creation (in thousands) Source: Cushman & Wakefield, Bureau of Labor Statistics, and NYC Office of management and Budget Positive New York City Economic Trends (2.7) 84.9 74.8 90.8 19.2 (26.1) (111.5) 23.2 36.2 36.6 81.5 109.0 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 YTD 37.8 39.9 42.7 43.8 46.0 47.1 48.6 48.8 50.9 52.7 54.3 55.0 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014E

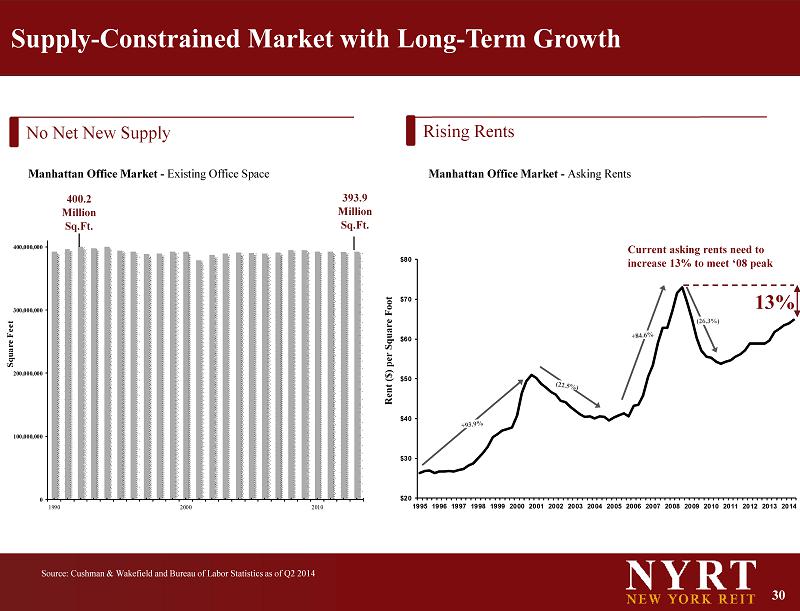

30 0 100,000,000 200,000,000 300,000,000 400,000,000 1990 2000 2010 Square Feet Manhattan Office Market - Asking Rents Rent ($) per Square Foot Rising Rents Supply - Constrained Market with Long - Term Growth Source: Cushman & Wakefield and Bureau of Labor Statistics as of Q2 2014 Manhattan Office Market - Existing Office Space 400.2 Million Sq.Ft . No Net New Supply 393.9 Million Sq.Ft . $20 $30 $40 $50 $60 $70 $80 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 ( 26.3%) 13% Current asking rents need to increase 13% to meet ‘08 peak

31 # City Rent (US$/SF) 1 London – Central (West End), U.K. $277.21 2 Hong Kong (Central), Hong Kong 241.92 3 Beijing (Finance Street), China 194.01 4 Beijing (CBD) , China 187.00 5 Moscow, Russian Federation 165.05 6 Hong Kong (West Kowloon), Hong Kong 160.83 7 London – Central (City), U.K. 153.66 8 New Delhi (Connaught Place – CBD), India 153.56 9 Tokyo ( Marunouchi Otemachi ), Japan 145.73 10 Paris, France 124.32 11 New York (Midtown Manhattan), U.S. 120.65 12 Shanghai ( Pudong ), China 117.65 13 Rio de Janeiro, Brazil 110.29 14 Shanghai ( Puxi ), China 109.97 15 San Francisco (Downtown), U.S. 108.00 Source: CB Richard Ellis Global Research and Consulting as of Q1 2014 New York Midtown Office Rents are 11 th Highest in the World # City Rent (US$/SF) 16 Mumbai ( Bandra Kurla Complex), India $106.56 17 Sydney, Australia 106.32 18 Singapore, Singapore 104.95 19 Geneva, Switzerland 104.13 20 Seoul (CBD), South Korea 101.70 21 Sao Paulo, Brazil 99.89 22 Boston (Downtown), U.S. 93.75 23 Dubai, United Arab Emirates 92.56 24 Seoul ( Yeouido ), South Korea 91.92 25 Zurich, Switzerland 90.98 26 Washington, D.C. (Downtown), U.S. 85.67 27 Perth, Australia 84.20 28 Istanbul, Turkey 84.11 29 New York (Downtown Manhattan), U.S. 82.55 30 Los Angeles (Suburban), U.S. 82.49

32 Appendix – Additional Information

33 NYRT 2Q Metrics 2Q Operating Results Cash NOI $26.3 Core FFO $19.9 per share $.12 AFFO $18.2 per share $.11 Dividend Yield 4.2% Pro Forma (1) Q2 Payout Ratio Core FFO 98% AFFO 108% Leverage Information Combined Debt to Enterprise Value (2)(3) 33% Weighted Average Interest Rate 3.54% Weighted Average Term 6.2 years Interest Coverage 3.6x As of 6/30/14 ($ in Millions except share and per share information) (1) Based on revised annual dividend of $.46 (2) Based on June 30, 2014 closing price of $11.06 per share; and June 30, 2014 debt balances and share count (3) Combined metrics include pro - rata share of unconsolidated debt Equity Information Equity Market Capitalization (2) $1.8 billion Combined Pro Forma Enterprise Value (2)(3) $2.7 billion

New York REIT Portfolio Overview Property/Portfolio Acquisition Date Neighborhood Borough Property Type Number of Properties Square Feet Occupancy All Acquisitions 1 Interior Design Building 6/22/2010 Midtown East Manhattan Office 1 81,082 100.0% 2 Bleecker Street Retail 12/1/2010 Greenwich Village Manhattan Retail 3 9,724 100.0% 3 Foot Locker 4/18/2011 Bensonhurst Brooklyn Retail 1 6,118 100.0% 4 Centurion Parking Garage 6/1/2011 Midtown West Manhattan Parking 1 12,856 100.0% 5 Duane Reade 10/5/2011 Howard Beach Queens Retail 1 9,767 100.0% 6 Washington Street Retail 11/3/2011 Tribeca Manhattan Retail 1 9,001 57.4% 7 One Jackson Square Retail 11/18/2011 Greenwich Village Manhattan Retail 1 8,392 100.0% 8 42nd Street 3/16/2012 Times Square Manhattan Retail 1 42,774 100.0% 9 1100 Kings Highway 5/4/2012 Midwood Brooklyn Retail 1 61,318 100.0% 10 163 Washington Avenue 9/7/2012 Clinton Hill Brooklyn Multifamily 1 41,613 91.1% 11 1623 Kings Highway 10/9/2012 Midwood Brooklyn Retail 1 19,960 100.0% 12 256 West 38th Street 12/26/2012 Garment District Manhattan Office 1 118,122 94.2% 13 229 West 36th Street 12/27/2012 Garment District Manhattan Office 1 148,894 100.0% 14 350 Bleecker Street 12/31/2012 Greenwich Village Manhattan Retail 1 14,511 100.0% 15 218 West 18th Street 3/27/2013 Chelsea Manhattan Office 1 165,670 83.7% 16 50 Varick Street 7/5/2013 Tribeca Manhattan Office 1 158,573 100.0% 17 333 West 34th Street 8/9/2013 Midtown West Manhattan Office 1 346,728 100.0% 18 One Worldwide Plaza 10/31/2013 Midtown West Manhattan Office 1 1,005,178 93.0% 19 120 West 57th Street (Viceroy) 11/18/2013 Midtown Manhattan Hotel 1 128,612 n/a 20 1440 Broadway 12/23/2013 Times Square South Manhattan Office 1 755,679 89.3% Sub-total 3,144,572 93.6% 21 123 William Street (Pref Equity) 10/2/2013 Financial District Manhattan Other 1 512,637 n/a Sub-total Preferred Equity 512,637 Total 23 3,657,209 93.6% (1) Occupancy on Washington Street Retail excludes garage (2) Reflects 48.9% of asset, NOI, etc.

New York REIT Debt Summary Current Loan Balance (June 30, 2014) Loan Closing Date Maturity Date Interest Rate Effective Interest Rate Amortization Debt Maturity Year 1 Interior Design Building 20,392,000$ 11/15/2011 12/1/2021 4.38% 4.38% P&I, 30 Yr 2021 2 Bleecker Street Retail 21,300,000$ 12/1/2010 12/6/2015 4.29% 4.34% Interest Only 2015 3 Foot Locker 3,250,000$ 4/18/2011 6/6/2016 4.51% 4.57% Interest Only 2016 4 Centurion Parking Garage 3,000,000$ 6/1/2011 7/6/2016 4.39% 4.45% Interest Only 2016 5 Duane Reade 8,400,000$ 10/5/2011 11/1/2016 3.55% 3.60% Interest Only 2016 6 Washington Street Retail 4,787,000$ 11/3/2011 12/1/2021 4.38% 4.38% P&I, 30 Yr 2021 7 One Jackson Square Retail 13,000,000$ 11/18/2011 12/1/2016 3.40% 3.45% Interest Only 2016 8 42nd Street 11,365,000$ 8/29/2012 8/29/2017 3.38% 3.42% Interest Only 2017 9 1100 Kings Highway 20,200,000$ 7/12/2012 8/1/2017 3.33% 3.38% Interest Only 2017 10 1623 Kings Highway 7,288,000$ 10/9/2012 11/1/2017 3.30% 3.34% Interest Only 2017 11 256 West 38th Street 24,500,000$ 12/26/2012 12/26/2017 3.08% 3.12% Interest Only 2017 12 229 West 36th Street 35,000,000$ 12/27/2012 12/27/2017 2.83% 2.87% Interest Only 2017 Consolidated First Mortgage Sub-total 172,482,000$ 3.52% 3.56% 13 Worldwide Plaza (Unconsolidated) 427,875,000$ 2/25/2013 3/6/2023 4.52% 4.58% Interest Only 2023 14 163 Washington Avenue None None None None None None None 15 350 Bleecker Street None None None None None None None 16 218 West 18th Street None None None None None None None 17 50 Varick Street None None None None None None None 18 333 West 34th Street None None None None None None None 22 120 West 57th Street (Viceroy) None None None None None None None 19 1440 Broadway None None None None None None None 20 Line of Credit - Fixed 80,000,000$ 8/20/2013 8/20/2018 3.18% 3.22% Interest Only 2018 21 Line of Credit - Floating 225,000,000$ 8/20/2013 8/20/2018 1.65% 1.67% Interest Only 2018 Unencumbered Sub-total 305,000,000$ 2.05% 2.08% 23 123 William Street (Pref Equity) None None None None None None None Other Assets Sub-total N/A N/A N/A TOTAL (Consolidated) 477,482,000$ 2.58% 2.61% TOTAL (Combined) 905,357,000$ 3.50% 3.54% 1.) Shows 48.9% of debt on Worldwide Plaza 2.) Expires in August, 2016 with two, 1 year renewal options

34 About the Data Funds from operations (FFO) Pursuant to the revised definition of funds from operations adopted by the Board of Governors of the National Association of Rea l Estate Investment Trusts (“NAREIT”), we calculate funds from operations (FFO); a non - GAAP financial measure; by adjusting net income (loss) attributable stockholders (c omputed in accordance with GAAP, including non - recurring items) for gains (or losses) from sales of properties, impairment losses on depreciable real estate of c onsolidated real estate, impairment losses on investments in unconsolidated joint ventures driven by a measurable decrease in the fair value of depreciable real estate hel d b y the unconsolidated joint ventures, real estate related depreciation and amortization, and after adjustment for unconsolidated partnerships and joint ventures. FFO is a non - GAA P financial measure. The use of FFO, combined with the required primary GAAP presentations, has been fundamentally beneficial in improving the understanding of op era ting results of REITs among the investing public and making comparisons of REIT operating results more meaningful. Management generally considers FFO to be a us eful measure for reviewing our comparative operating and financial performance because, by excluding gains and losses related to asset sales (land and prope rty ), impairment losses and real estate asset depreciation and amortization (which can vary among owners of identical assets in similar condition based on historical cost acc ounting and useful life estimates), FFO can help one compare the operating performance of a company’s real estate between periods or as compared to different companies. Our computation of FFO may not be comparable to FFO reported by other REITs or real estate companies that do not define the term in accordance with the current NA REIT definition or that interpret the current NAREIT definition differently. FFO should not be considered as an alternative to net income attributable to stockhol der s (determined in accordance with GAAP) as an indication of our performance. FFO does not represent cash generated from operating activities determined in accordance w ith GAAP, and is not a measure of liquidity or an indicator of our ability to make cash distributions. We believe that to further understand our performance, FFO should be com pared with our reported net income attributable to stockholders and considered in addition to cash flows determined in accordance with GAAP, as presented in our co nsolidated financial statements. Adjusted funds from operations (AFFO) AFFO; a non - GAAP financial measure; is core FFO excluding certain income or expense items that we consider more reflective of in vesting activities, other non - cash income and expense items and the income and expense effects of other activities that are not a fundamental attribute of our b usi ness plan. These items include unrealized gains and losses, which may not ultimately be realized, such as gains or losses on derivative instruments, gains or losses on co ntingent valuation rights, gains and losses on investments and early extinguishment of debt. In addition, by excluding non - cash income and expense items such as amortization o f above and below market leases, amortization of deferred financing costs, straight - line rent and non - cash equity compensation from AFFO we believe we provide us eful information regarding income and expense items which have no cash impact and do not provide liquidity to the company or require capital resources of the compa ny. We exclude distributions related to Class B units and certain interest expenses related to securities that are convertible to common stock as the shares are assumed to ha ve converted to common stock in our calculation of weighted average common shares - fully diluted. Furthermore we include certain cash inflow and outflows that are r eflective of operating activities including preferred returns on joint ventures, second generation tenant improvement and leasing commissions (included in the period in whi ch the lease commences) and recurring capital expenditures. Although our AFFO may not be comparable to that of other REITs and real estate companies, we believe it provides a meaningful in dicator of our ability to fund cash needs and to make cash distributions to stockholders. In addition, we believe that to further understand our liquidity, AFFO should be compared with our cash flows determined in accordance with GAAP, as presented in our consolidated financial statements. AFFO does not represent cash generated from oper ati ng activities determined in accordance with GAAP, and AFFO should not be considered as an alternative to net income (determined in accordance with GAAP) as an indic ati on of our performance, as an alternative to net cash flows from operating activities (determined in accordance with GAAP), or as a measure of our liquidit y.

35 About the Data Earnings before interest, taxes, depreciation and amortization (EBITDA) EBITDA; a non - GAAP financial measure; is defined as net income in accordance with GAAP before interest, taxes, depreciation and amortization. We believe EBITDA is an appropriate measure of our ability to incur and service debt. EBITDA should not be considered as an alternative to cash flows fr om operating activities, as a measure of our liquidity or as an alternative to net income as an indicator of our operating activities. Other REITs may calculate EBITDA di ffe rently and our calculation should not be compared to that of other REITs. EBITDA is adjusted to include our pro - rata share of EBITDA from unconsolidated joint ventures. Net operating income (NOI) Net operating income (NOI) is a non - GAAP financial measure equal to net income attributable to stockholders, the most directly c omparable GAAP financial measure, less discontinued operations, plus corporate general and administrative expense, acquisition and transaction costs, depreciation a nd amortization and interest expense, income from unconsolidated joint ventures, interest and other income and gains from investments in securities. NOI is adjusted to in clu de our pro - rata share of NOI from unconsolidated joint ventures. We use NOI internally as a performance measure and believe NOI provides useful information to in vestors regarding our financial condition and results of operations because it reflects only those income and expense items that are incurred at the property level. Th ere fore, we believe NOI is a useful measure for evaluating the operating performance of our real estate assets and to make decisions about resource allocations. Further, we bel ieve NOI is useful to investors as a performance measure because, when compared across periods, NOI reflects the impact on operations from trends in occupancy rat es, rental rates, operating costs acquisition activity on an unleveraged basis, providing perspective not immediately apparent from net income. NOI excludes certain compon ent s from net income in order to provide results that are more closely related to a property's results of operations. For example, interest expense is not necessarily li nked to the operating performance of a real estate asset and is often incurred at the corporate level as opposed to the property level. In addition, depreciation and amortizati on, because of historical cost accounting and useful life estimates, may distort operating performance at the property level. NOI presented by us may not be comparable to NOI rep ort ed by other REITs that define NOI differently. We believe that in order to facilitate a clear understanding of our operating results, NOI should be examined in co njunction with net income as presented in our consolidated financial statements. NOI should not be considered as an alternative to net income as an indication of our perfo rma nce or to cash flows as a measure of our liquidity or ability to make distributions. Cash net operating income (Cash NOI) NOI, presented on a cash basis, which is equal to NOI after eliminating the effects of straight - lining of rent and fair value le ase revenue.