Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NORTHSTAR REALTY FINANCE CORP. | t1401485_8k.htm |

| EX-10.1 - EXHIBIT 10.1 - NORTHSTAR REALTY FINANCE CORP. | t1401485_10-1.htm |

| EX-99.2 - EXHIBIT 99.2 - NORTHSTAR REALTY FINANCE CORP. | t1401485_99-2.htm |

| EX-2.1 - EXHIBIT 2.1 - NORTHSTAR REALTY FINANCE CORP. | t1401485_ex2-1.htm |

Exhibit 99.1

NorthStar Realty

to Acquire

Griffin-American Healthcare REIT II for $4 billion

August 2014

399 Park Avenue, 18th Floor, New York, NY 10022 | 212.547.2600 | NRFC.com

Safe Harbor Certain items in this presentation may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, , which can be identified by words like “may,” “should,” “potential,” “expect,” “anticipate,” “estimate,” “believe,” “could,” “project,” predict,” “continue,” “will,” “would,” “seek,” “future,” “intends” and similar expressions. These include statements about future results, projected yields, rates of return and performance, projected cash available for distribution, projected cash from any single source of investment or fee stream, projected expenses, expected and weighted average return on equity, market and industry trends, investment opportunities, business conditions and other matters, including, among other things: the ability to consummate NorthStar Realty Finance Corp.’s (the “Company”) proposed merger with Griffin-American Healthcare REIT II, Inc. (“Griffin”) on the terms proposed or at all. These statements are based on management’s current expectations and beliefs and are subject to a number of trends and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements; the Company can give no assurance that its expectations will be attained. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions underlying any forward-looking statements will not materialize or will vary significantly from actual results. Variations of assumptions and results may be material. The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the definitive merger agreement; (2) the inability to complete the merger or failure to satisfy other conditions to completion of the merger; (3) the inability to complete the merger within the expected time period or at all, including due to the failure to obtain the Griffin stockholder approval, the Company stockholder approval or the failure to satisfy other conditions to completion of the merger, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the merger; (4) risks related to disruption of management’s attention from the ongoing business operations due to the proposed merger; (5) the effect of the announcement of the proposed mergers on the Company’s or Griffin’s relationships with their respective customers, tenants, lenders, operating results and businesses generally; (6) the scalability of our investment platform, in particular, the healthcare real estate portfolio; (7) the size and timing of offerings or capital raises; (8) the performance of Griffin’s portfolio and the Company’s healthcare real estate portfolio generally; (9) the ability to execute upon, and realize any benefits from, potential value creation opportunities through strategic transactions and tenant relationships in the future or at all; (10) the stability of long-term cash flow streams; (11) the ability to achieve EBITDAR coverage, dividend yields and implied cap rates similar to other diversified healthcare REITs or at all; (12) the ability to achieve multiple expansion; (13) the ability to enhance dividend safety and growth potential; (14) the projected net operating income of the Company’s portfolio and Griffin’s portfolio, including the ability to achieve the growth, obtain the lease payments and step ups in contractual lease payments, and maintain dividend payments, at current or anticipated levels, or at all; (15) the ability to opportunistically participate in commercial real estate refinancings; (16) the ability to realize upon attractive investment opportunities; (17) the Company’s future cash available for distribution; and (18) the projected returns on, and cash earned from, investments, including investments funded by drawings from our credit facility and securities offerings. Additional factors that could cause actual results to differ materially from those in the forward-looking statements are specified in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013, and its other filings with the Securities and Exchange Commission and Griffin’s Annual Report on Form 10-K for the year ended December 31, 2013, and its other filings with the SEC. Such forward-looking statements speak only as of the date of this presentation. The Company expressly disclaims any obligation to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in its expectations with regard thereto or change in events, conditions or circumstances on which any statement is based. Unless otherwise stated, historical financial information and per share & other data is as of March 31, 2014. This presentation is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities of the Company. The footnotes herein contain important information that is material to an understanding of this presentation and you should readthis presentation only with and in context of the footnotes.

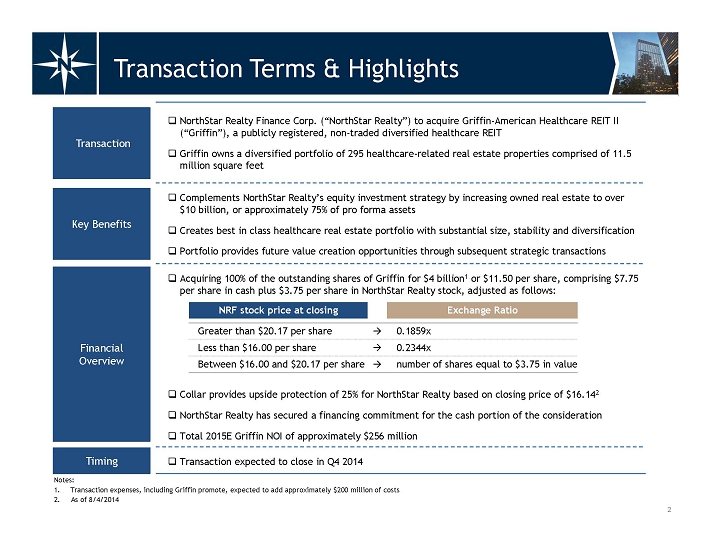

NorthStar Realty Finance Corp. (“NorthStar Realty”) to acquire Griffin-American Healthcare REIT II (“Griffin”), a publicly registered, non-traded diversified healthcare REIT. Griffin owns a diversified portfolio of 295 healthcare-related real estate properties comprised of 11.5 million square feet. Complements NorthStar Realty’s equity investment strategy by increasing owned real estate to over $10 billion, or approximately 75% of pro forma assets. Creates best in class healthcare real estate portfolio with substantial size, stability and diversification. Portfolio provides future value creation opportunities through subsequent strategic transactions. Acquiring Griffin for $4 billion1, including approximately $600 million of debt. $11.50 per Griffin share2, comprising $7.75 per share in cash plus $3.75 per share in NorthStar Realty stock, adjusted as follows:Greater than $20.17 per share • 0.1859x Less than $16.00 per share • 0.2344x Between $16.00 and $20.17 per share • number of shares equal to $3.75 in value . Collar provides upside protection of 25% for NorthStar Realty based on closing price of $16.143. NorthStar Realty has secured a financing commitment for the cash portion of the consideration. Total 2015E Griffin NOI of approximately $256 million. Transaction expected to close in Q4 2014Notes: 1. Transaction expenses, including Griffin promote, expected to add approximately $200 million of costs2. Based on 293.7 million Griffin shares outstanding3. As of 8/4/2014

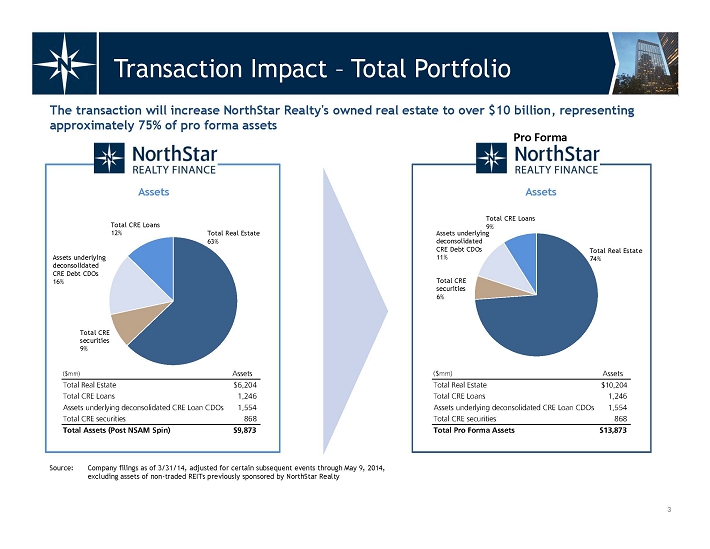

Transaction Impact – Total Portfolio The transaction will increase NorthStar Realty's owned real estate to over $10 billion, representing approximately 75% of pro forma assets NorthStar Reality Finance Assets Source: Company filings as of 3/31/14, adjusted for certain subsequent events through May 9, 2014, excluding assets of non-traded REITs previously sponsored by NorthStar Realty Total CRE securities 9% Assets underlying deconsolidated CRE Debt CDOs 16% Total CRE Loans 12% Total Real Estate 63% Pro Forma NorthStar Realty Finance Assets Total CRE securities 6% Assets underlying deconsolidated CRE Debt CDOs 11% Total CRE Loans 9% ($mm) Assets ($mm) Assets Total Real Estate $6,204 Total Real Estate $10,204 Total CRE Loans 1,246 Total CRE Loans 1,246 Assets underlying deconsolidated CRE Loan CDOs 1,554 Assets underlying deconsolidated CRE Loan CDOs 1,554 Total CRE securities 868 Total CRE securities 868 Total Assets (Post NSAM Spin) $9,873 Total Real Estate 74%

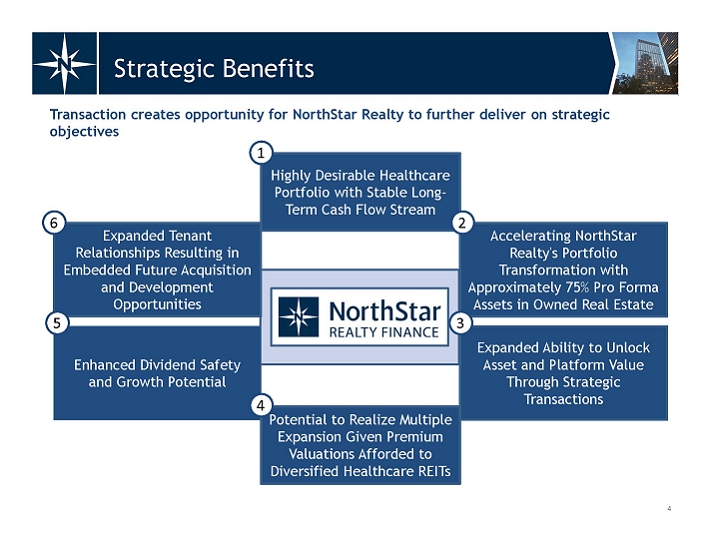

Strategic Benefits Transaction creates opportunity for NorthStar Realty to further deliver on strategic objectives 1 Highly Desirable Healthcare Portfolio with Stable Long- Term Cash Flow Stream 2 Accelerating NorthStar Realty's Portfolio Transformation with Approximately 75% Pro Forma Assets in Owned Real Estate 3 Expanded Ability to Unlock Asset and Platform Value Through Strategic Transactions 4 Potential to Realize Multiple Expansion Given Premium Valuations Afforded to Diversified Healthcare REITs 5 Enhanced Dividend Safety and Growth Potential 6 Expanded Tenant Relationships Resulting in Embedded Future Acquisition and Development Opportunities

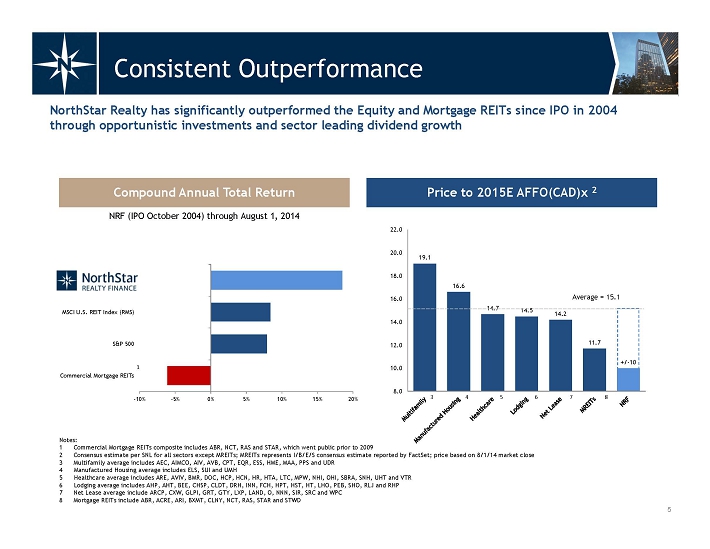

Consistent Outperformance NorthStar Realty has significantly outperformed the Equity and Mortgage REITs since IPO in 2004 through opportunistic investments and sector leading dividend growth Notes: 1 Commercial Mortgage REITs composite includes ABR, NCT, RAS and STAR, which went public prior to 2009 2 Consensus estimate per SNL for all sectors except MREITs; MREITs represents I/B/E/S consensus estimate reported by FactSet; price based on 8/1/14 market close 3 Multifamily average includes AEC, AIMCO, AIV, AVB, CPT, EQR, ESS, HME, MAA, PPS and UDR 4 Manufactured Housing average includes ELS, SUI and UMH 5 Healthcare average includes ARE, AVIV, BMR, DOC, HCP, HCN, HR, HTA, LTC, MPW, NHI, OHI, SBRA, SNH, UHT and VTR 6 Lodging average includes AHP, AHT, BEE, CHSP, CLDT, DRH, INN, FCH, HPT, HST, HT, LHO, PEB, SHO, RLJ and RHP 7 Net Lease average include ARCP, CXW, GLPI, GRT, GTY, LXP, LAND, O, NNN, SIR, SRC and WPC 8 Mortgage REITs include ABR, ACRE, ARI, BXMT, CLNY, NCT, RAS, STAR and STWD

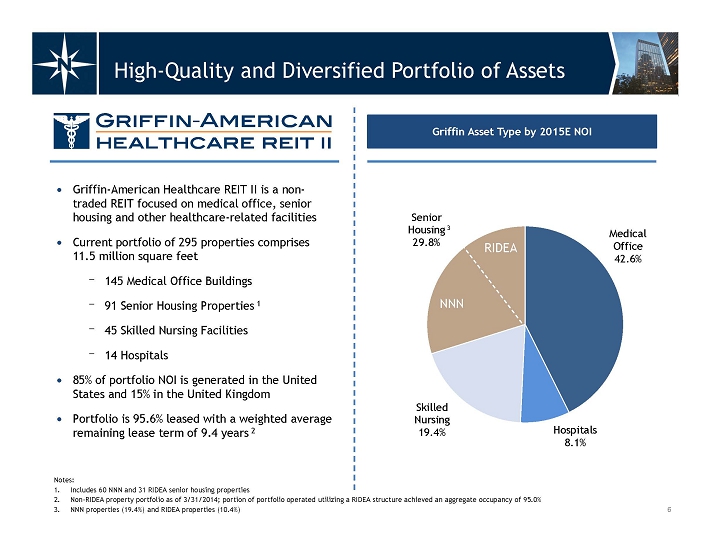

High-Quality and Diversified Portfolio of Assets Griffin-American Healthcare REIT II

Griffin-American Healthcare REIT II is a non- traded REIT focused on medical office, senior housing and other healthcare-related facilities

• Current portfolio of 295 properties comprises

11.5 million square feet

⁻ 145 Medical Office Buildings

⁻ 91 Senior Housing Properties 1

⁻ 45 Skilled Nursing Facilities

⁻ 14 Hospitals

• 85% of portfolio NOI is generated in the United

States and 15% in the United Kingdom

Portfolio is 95.6% leased with a weighted average remaining lease term of 9.4 years 2

Griffin Asset Type by 2015E NOI

Senior Housing 3 Medical

29.8% Office

42.6%

Skilled

Nursing

19.4% Hospitals

8.1%

Notes:

1. Includes 60 NNN and 31 RIDEA senior housing properties

2. Non-RIDEA property portfolio as of 3/31/2014; portion of portfolio operated utilizing a RIDEA structure achieved an aggregate occupancy of 95.0%

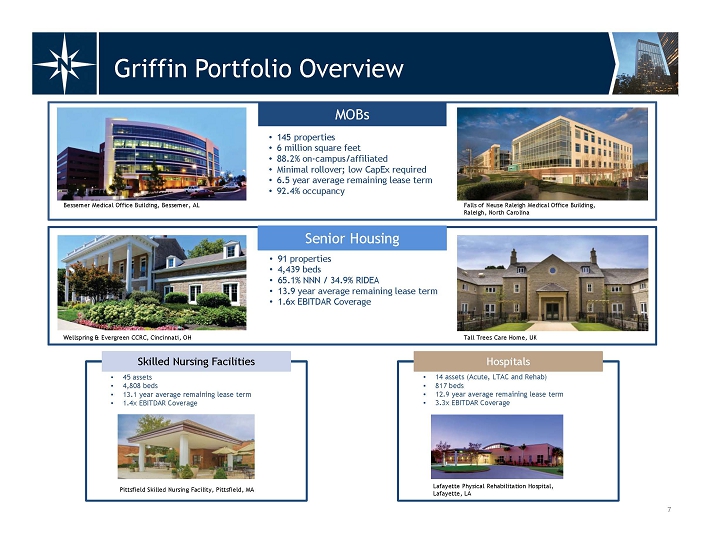

Griffin Portfolio Overview MOBs o 145 properties o 6 million square feet o 88.2% on-campus/affiliated o Minimal rollover; low CapEx required o 6.5 year average remaining lease term o 92.4% occupancy Senior Housing o 91 properties o 4,439 beds o 65.1% NNN / 34.9% RIDEA o 13.9 year average remaining lease term o 1.6x EBITDAR Coverage Skilled Nursing Facilities o 45 assets o 4,808 beds o 13.1 year average remaining lease term o 1.4x EBITDAR Coverage Hospitals o 14 assets (Acute, LTAC and Rehab) o 817 beds o 12.9 year average remaining lease term o 3.3x EBITDAR Coverage

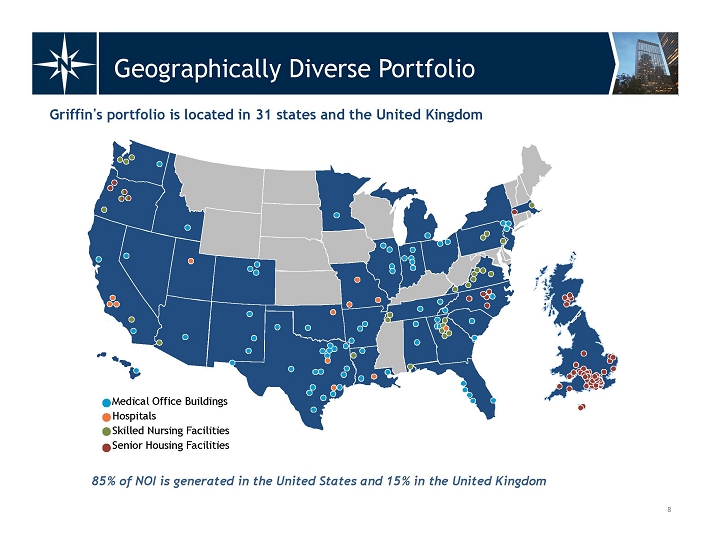

Geographically Diverse Portfolio Griffin's portfolio is located in 31 states and the United Kingdom 85% of NOI is generated in the United States and 15% in the United Kingdom

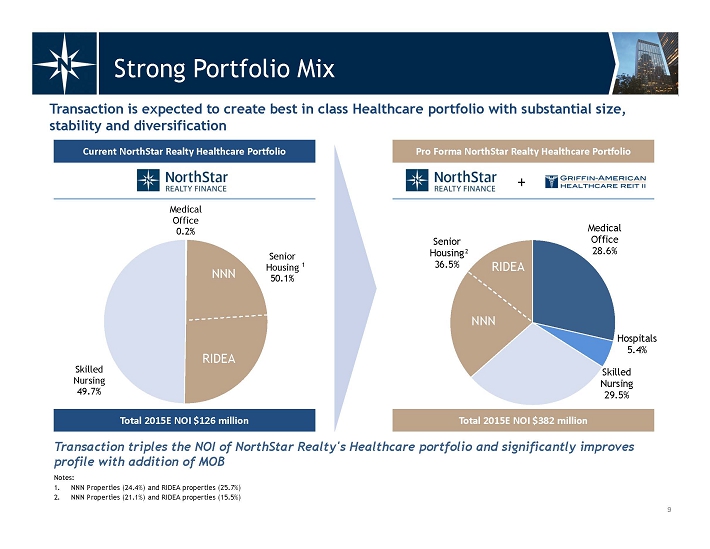

Strong Portfolio Mix Transaction is expected to create best in class Healthcare portfolio with substantial size, stability and diversification Current NorthStar Realty Healthcare Portfolio Skilled Nursing 49.7% Medical Office 0.2% Senior Housing 1 50.1% Total 2015E NOI $126 million Pro Forma NorthStar Realty Healthcare Portfolio Senior Housing 2 36.5% Medical Office 28.6% Hospitals 5.4% Skilled Nursing 29.5% Total 2015E NOI $382 million Transaction triples the NOI of NorthStar Realty's Healthcare portfolio and significantly improves profile with addition of MOB Notes: 1. NNN Properties (24.4%) and RIDEA properties (25.7%) 2. NNN Properties (21.1%) and RIDEA properties (15.5%)

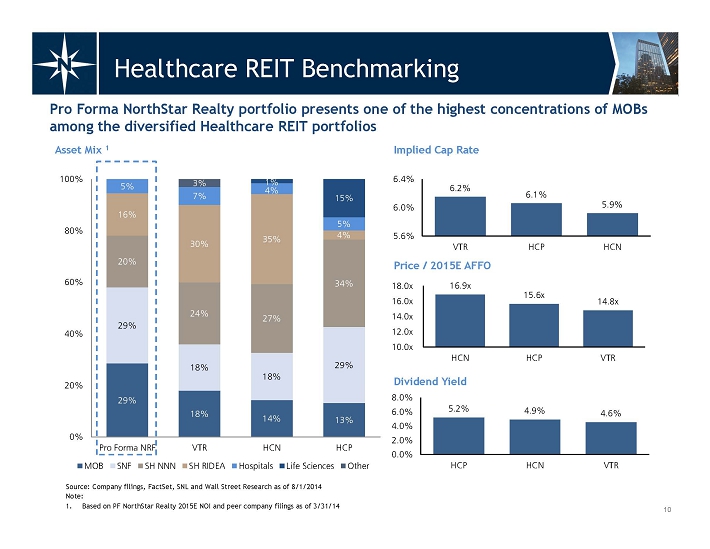

Healthcare REIT Benchmarking Pro Forma NorthStar Realty portfolio presents one of the highest concentrations of MOBs among the diversified Healthcare REIT portfolios Source: Company filings, FactSet, SNL and Wall Street Research as of 8/1/2014 Note 1. Based on PF NorthStar Realty 2015E NOI and peer company filings as of 3/31/14

NorthStar Realty Finance 399 Park Avenue, 18th Floor, New York, NY 10022 I 212.547.2600 I NRFC.com