Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MATERION Corp | mtrn-20140804x8kinvestorpr.htm |

Investor Presentation July 2014 Exhibit 99.1

These slides contain (and the accompanying oral discussion will contain) “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve known and unknown risks, uncertainties and other factors that could cause the actual results of the Company to differ materially from the results expressed or implied by these statements, including health issues, litigation and regulation relating to our business, our ability to achieve and/or maintain profitability, significant cyclical fluctuations in our customers’ businesses, competitive substitutes for our products, risks associated with our international operations, including foreign currency rate fluctuations, energy costs and the availability and prices of raw materials, and other factors disclosed in periodic reports filed with the Securities and Exchange Commission. Consequently these forward-looking statements should be regarded as the Company’s current plans, estimates and beliefs. The Company does not undertake and specifically declines any obligation to publicly release the results of any revisions to these forward-looking statements that may be made to reflect any future events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. These slides include certain non-GAAP financial measures as defined by the rules and regulations of the Securities and Exchange Commission. A reconciliation of those measures to the most directly comparable GAAP equivalent is provided in the Appendix to this presentation as well as a glossary of non-GAAP definitions. Forward-looking Statements 2

Materion: Who We Are We are a global leader in advanced material solutions and services that enable our customers to excel in their markets while making a material difference in improving our world. 3

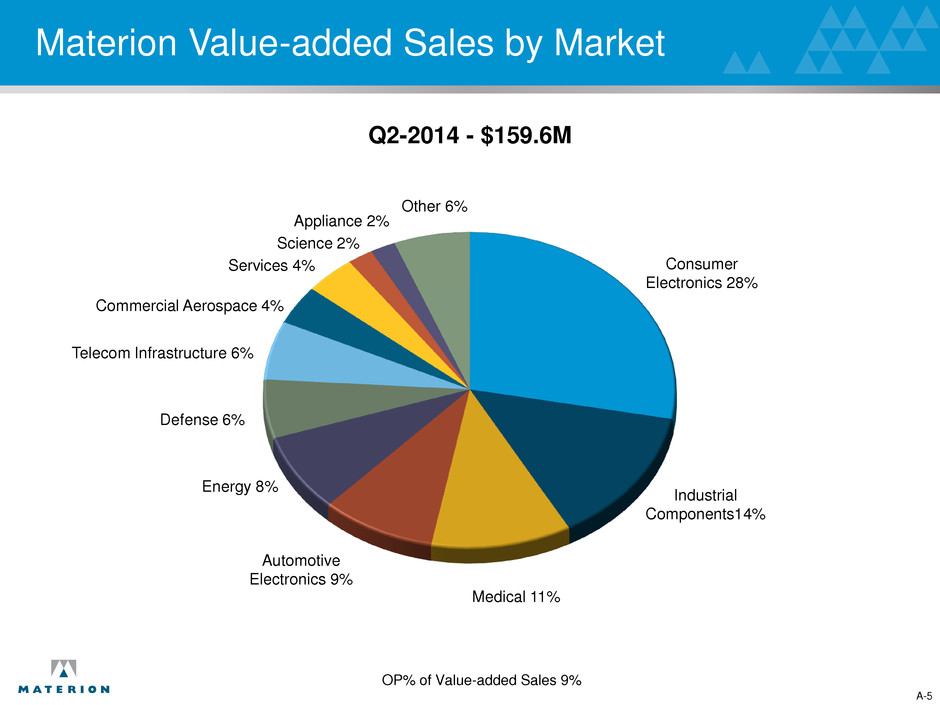

W H A T W E D O Materion: Mission Critical Advanced Materials Consumer Electronics 28% Industrial Components 14% Medical 11% Automotive Electronics 9% Energy 8% Defense 6% Telecom infrastructure 6% Commercial Aerospace 4% A Balanced Portfolio 4 Performance Metals & Composites Advanced Materials Precision Coatings

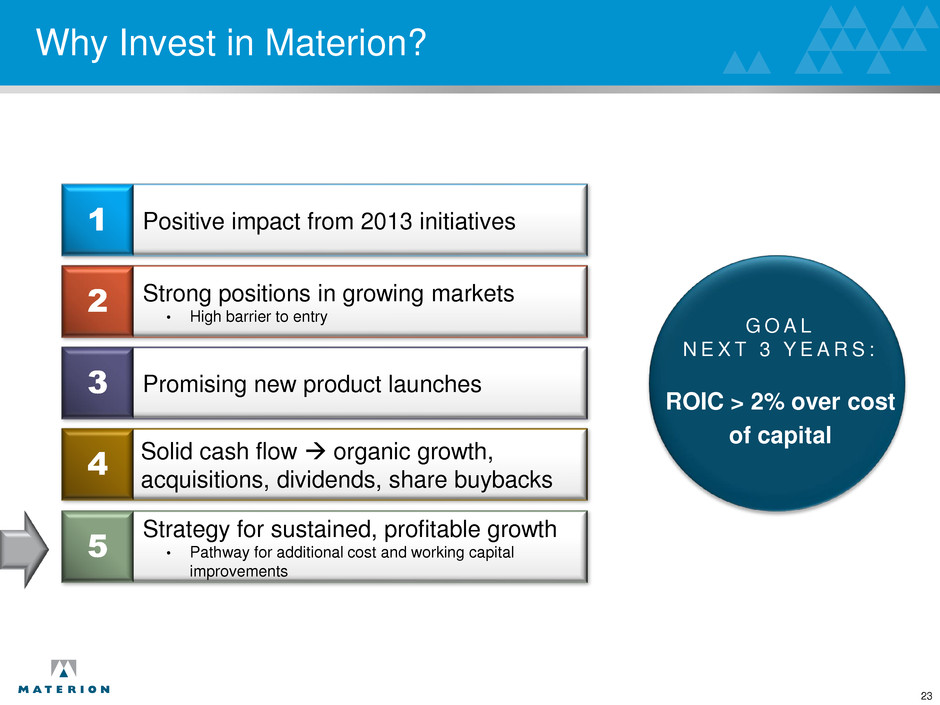

Why Invest in Materion? G O A L N E X T 3 Y E A R S : Sustained growth >15% EPS CAGR Positive impact from 2013 initiatives 1 Strategy for sustained, profitable growth • Pathway for additional cost and working capital improvements 5 Strong positions in growing markets • High barrier to entry 2 Promising new product launches 3 4 Solid cash flow organic growth, acquisitions, dividends, share buybacks 5

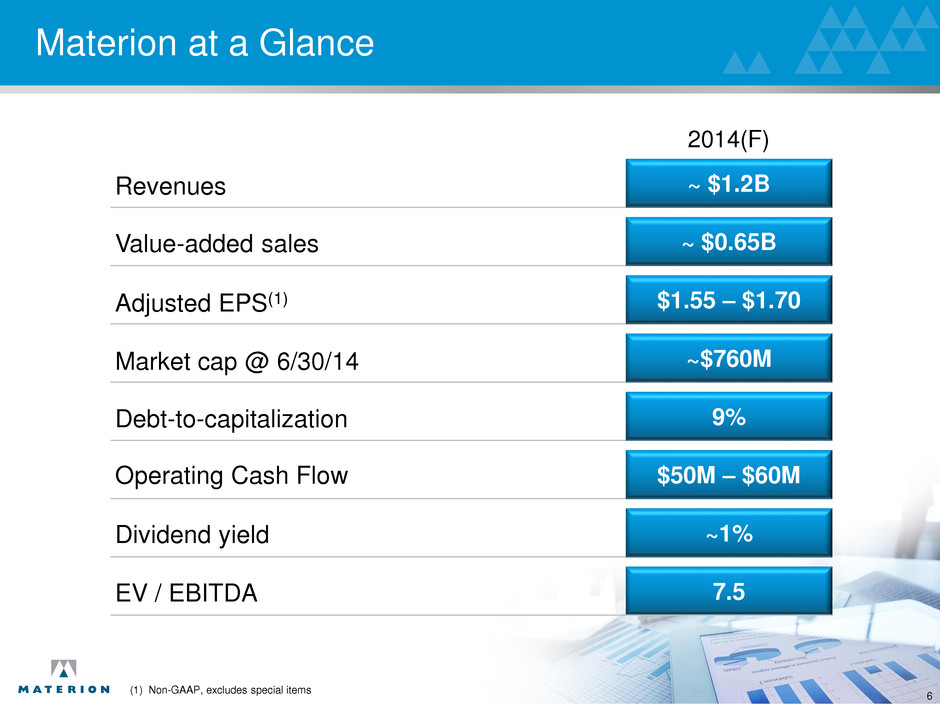

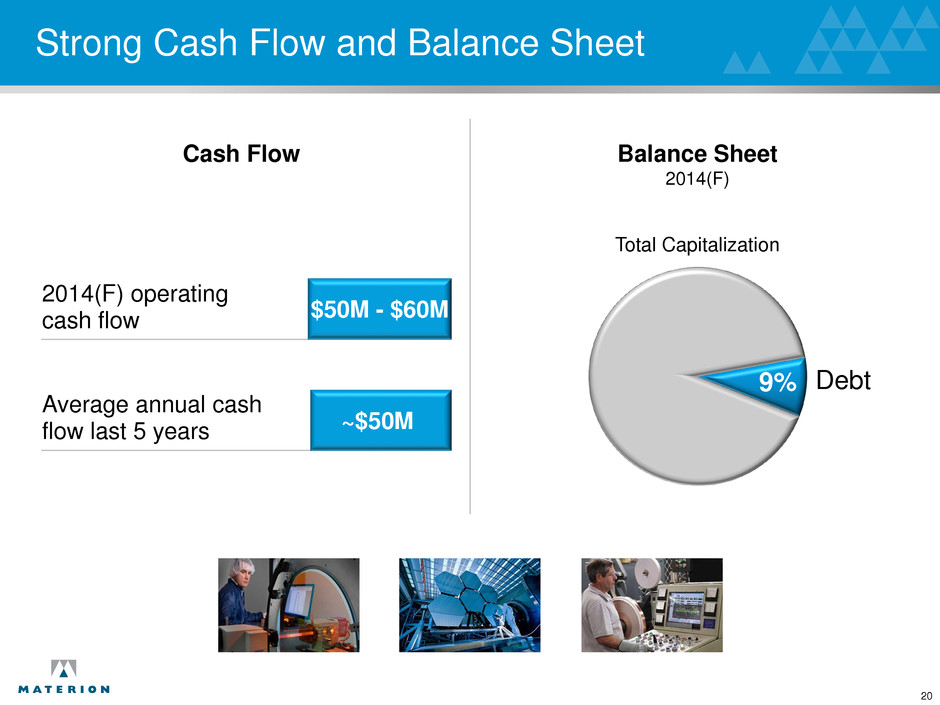

Materion at a Glance 6 Adjusted EPS(1) $1.55 – $1.70 Market cap @ 6/30/14 ~$760M Debt-to-capitalization 9% Operating Cash Flow $50M – $60M Dividend yield ~1% Revenues ~ $1.2B Value-added sales ~ $0.65B 2014(F) 7.5 EV / EBITDA (1) Non-GAAP, excludes special items

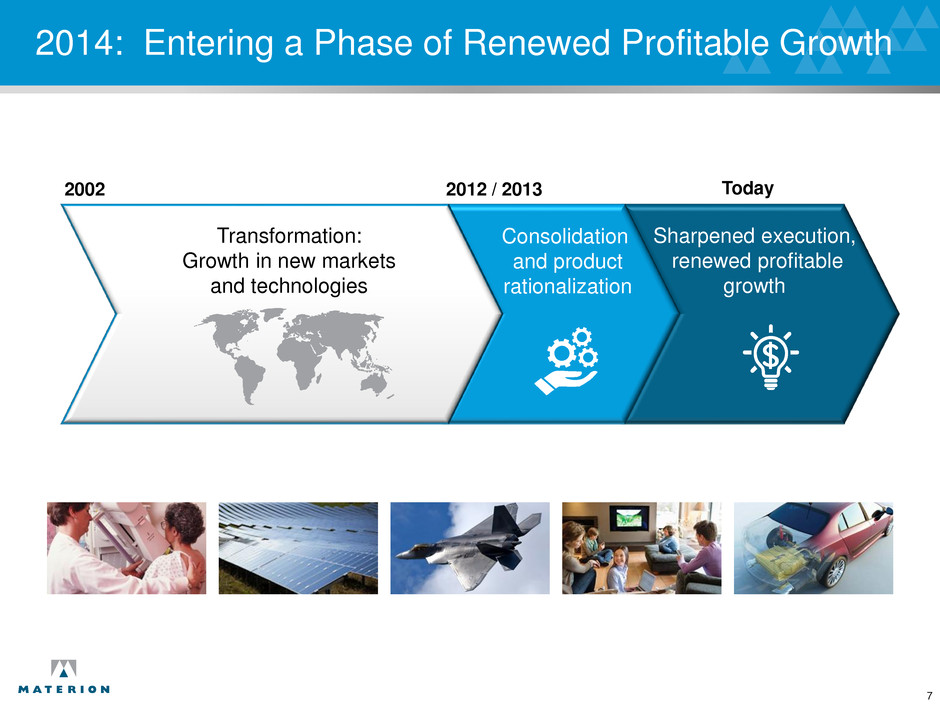

2014: Entering a Phase of Renewed Profitable Growth Consolidation and product rationalization Sharpened execution, renewed profitable growth 2002 2012 / 2013 Today Transformation: Growth in new markets and technologies 7

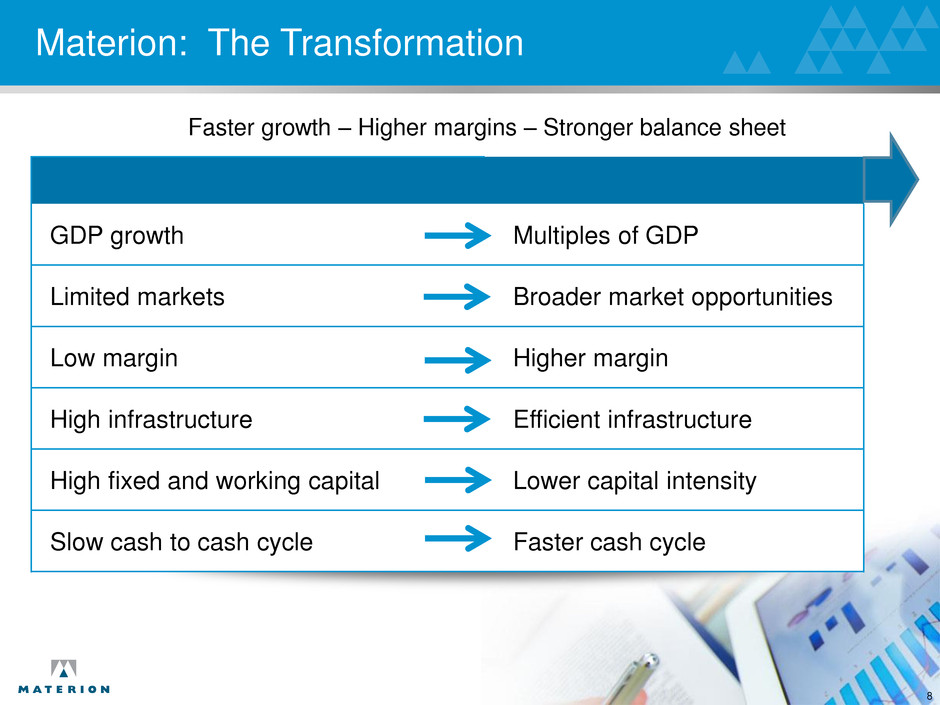

Materion: The Transformation GDP growth Multiples of GDP Limited markets Broader market opportunities Low margin Higher margin High infrastructure Efficient infrastructure High fixed and working capital Lower capital intensity Slow cash to cash cycle Faster cash cycle Faster growth – Higher margins – Stronger balance sheet 8

A C T I O N S I N 2 0 1 2 a n d 2 0 1 3 A Solid Foundation for the Future Consolidations and product rationalizations • Closed three facilities • Consolidated four precious metals facilities into two • Eliminated low margin product lines • Realigned segment headquarters structure • Consolidated three precision optics operations into two Completed new plant • New beryllium plant operating – end of start-up costs Adds over $0.30 to EPS in 2014 9

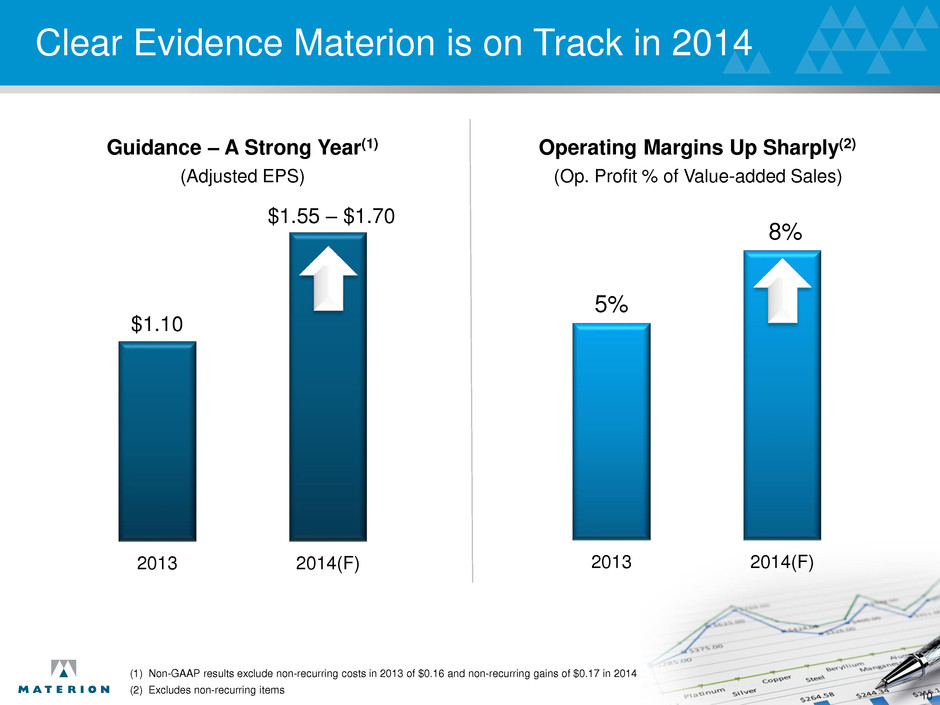

$1.10 2013 2014(F) $1.55 – $1.70 Clear Evidence Materion is on Track in 2014 Guidance – A Strong Year(1) Operating Margins Up Sharply(2) (Adjusted EPS) (Op. Profit % of Value-added Sales) 5% 8% 2013 2014(F) 10 (1) Non-GAAP results exclude non-recurring costs in 2013 of $0.16 and non-recurring gains of $0.17 in 2014 (2) Excludes non-recurring items

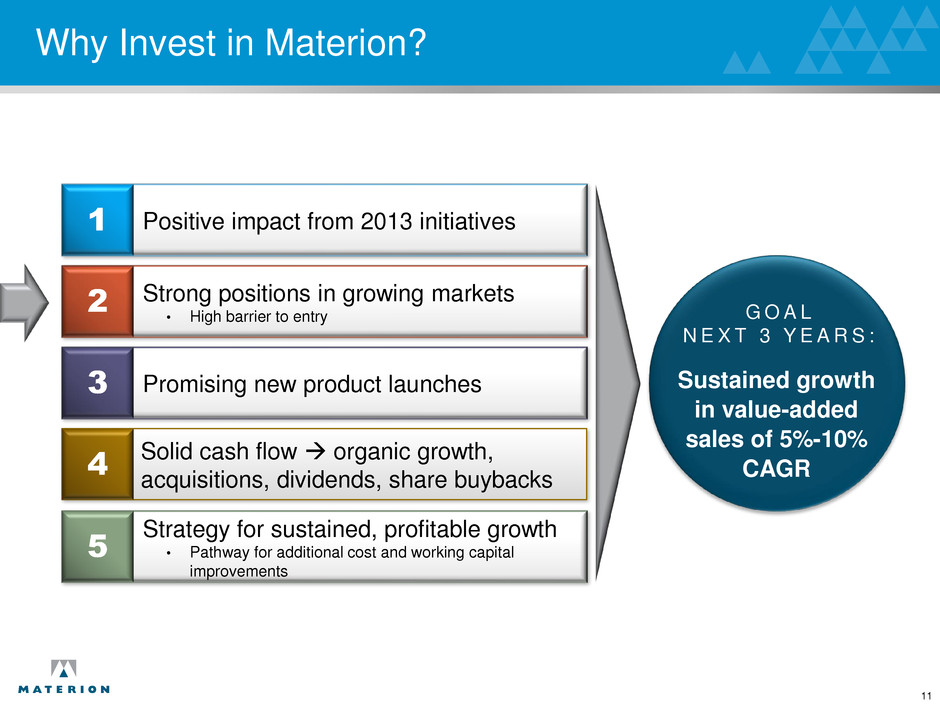

Why Invest in Materion? Positive impact from 2013 initiatives 1 Strategy for sustained, profitable growth • Pathway for additional cost and working capital improvements 5 Strong positions in growing markets • High barrier to entry 2 Promising new product launches 3 4 G O A L N E X T 3 Y E A R S : Sustained growth in value-added sales of 5%-10% CAGR Solid cash flow organic growth, acquisitions, dividends, share buybacks 11

Secular Market Trends Play to our Strengths Key Trends • Miniaturization of electronics • Additional electronic instruments for autos, aircraft • Advancements in lighting (LED) • Expanding high performance optical device opportunities • Innovation in medical diagnostics • Extraction of oil and gas from previously inaccessible locations • New aircraft builds and retrofits Characteristics of our Materials Conductivity Corrosion resistance Weight savings (lighter) Wavelength Management Heat resistance Lubricity Reliability Durability Miniaturization Strength 12

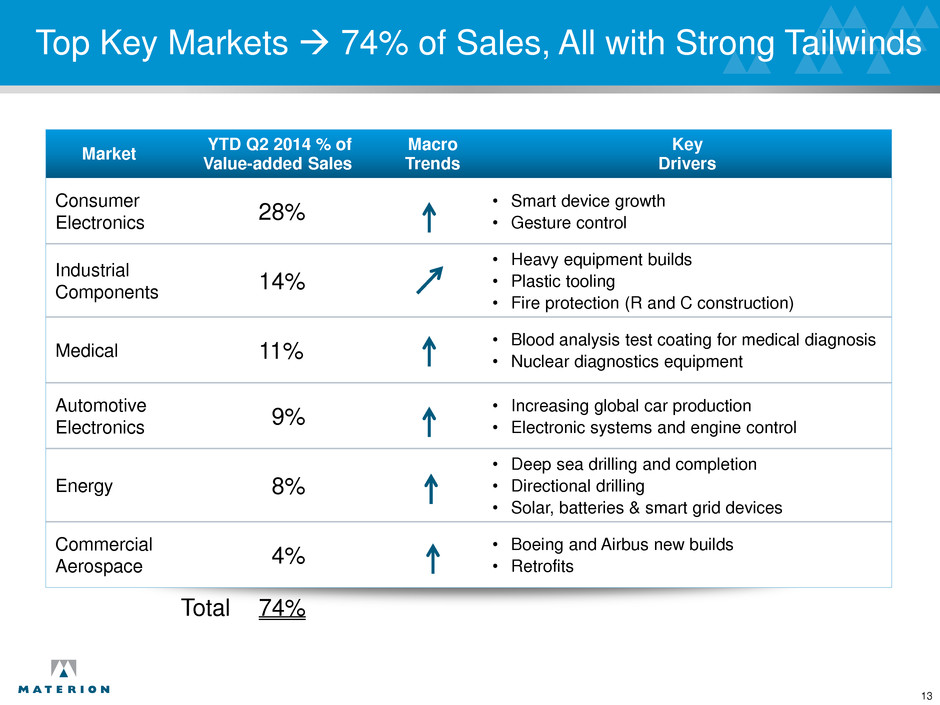

Top Key Markets 74% of Sales, All with Strong Tailwinds Market YTD Q2 2014 % of Value-added Sales Macro Trends Key Drivers Consumer Electronics 28% • Smart device growth • Gesture control Industrial Components 14% • Heavy equipment builds • Plastic tooling • Fire protection (R and C construction) Medical 11% • Blood analysis test coating for medical diagnosis • Nuclear diagnostics equipment Automotive Electronics 9% • Increasing global car production • Electronic systems and engine control Energy 8% • Deep sea drilling and completion • Directional drilling • Solar, batteries & smart grid devices Commercial Aerospace 4% • Boeing and Airbus new builds • Retrofits Total 74% 13

Well-positioned with Leading Global Positions Product Percent of Value-added Sales (2013) Expected Annual Growth Next 3-5 Years Leading supplier of beryllium- containing products ~42% Leading supplier of gold for semi- conductor fabrication ~20% Leading supplier of high-end optical coatings ~11% Only supplier of unique copper- nickel-tin materials, ToughMet® ~8% Leading supplier of specialty coating test strips for medical diagnosis ~6% Double digit growth Single digit growth Key Differentiated Products 14

A C L O S E R L O O K Evolving Potential from Beryllium Supply Shortage Materion – leading position in beryllium market • Only global integrated producer – over 75 years of proven reserves in Utah – supplies over 60% of world needs • Over 40% of company sales include beryllium in some form Signs of shortage ahead • U.S. government stockpile down 50% since 2009 • Global sources depleting – no future congressional authorizations for stockpile sales • Materion positioned to support world demand • Significant incremental profit potential 15

Why Invest in Materion? G O A L N E X T 3 Y E A R S : New Product Sales >10% Annually Positive impact from 2013 initiatives 1 Strategy for sustained, profitable growth • Pathway for additional cost and working capital improvements 5 Strong positions in growing markets • High barrier to entry 2 Promising new product launches 3 4 Solid cash flow organic growth, acquisitions, dividends, share buybacks 16

Wide Range of Strategic Investments… New Wafer Coating Facility New Optics Facility Increased Capacity LED Phosphor ToughMet® Capacity Expansion Expanded Beryllium Hydroxide Capacity Singapore Expansion 17

… Driving Record Number of New Product Launches Examples of New Products Sales Growth New products last 3 years ~$50M of 2013 sales – up 60% vs. 2012 New products Existing products Gesture Controls LED Phosphorous ToughMet® Oil & Gas Bulk Metallic Glass (Liquidmetal) 50% 50% Wafer Level Processing Dovetail Connectors 18

Why Invest in Materion? G O A L N E X T 3 Y E A R S : Operating cash flow >$50 million Positive impact from 2013 initiatives 1 Strategy for sustained, profitable growth • Pathway for additional cost and working capital improvements 5 Strong positions in growing markets • High barrier to entry 2 Promising new product launches 3 4 Solid cash flow organic growth, acquisitions, dividends, share buybacks 19

Strong Cash Flow and Balance Sheet Cash Flow Balance Sheet 2014(F) 2014(F) operating cash flow Average annual cash flow last 5 years $50M - $60M ~$50M Total Capitalization Debt 9% 20

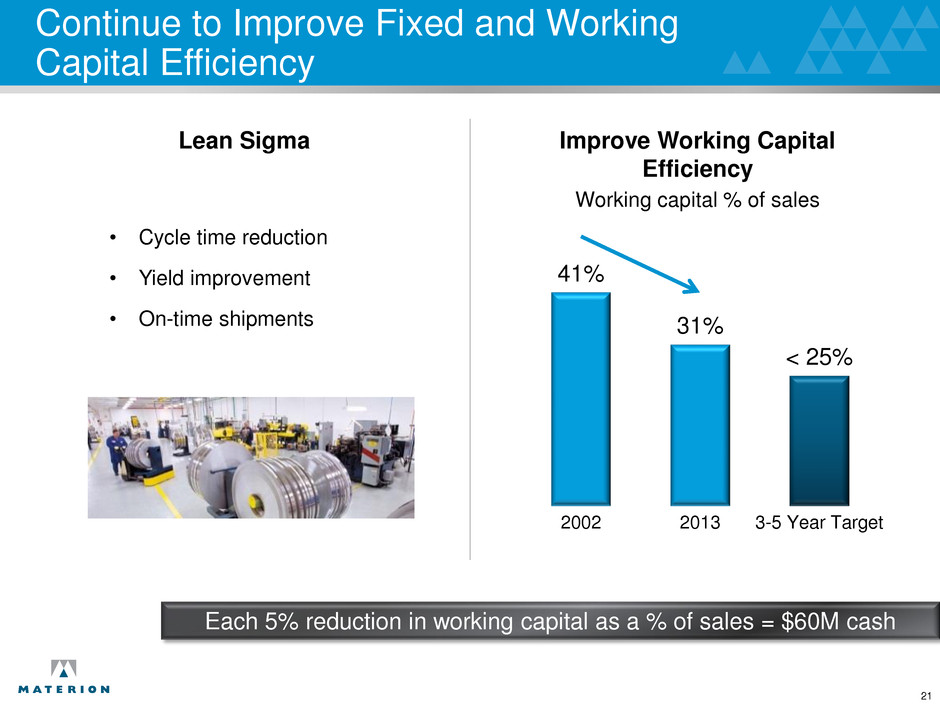

Continue to Improve Fixed and Working Capital Efficiency Lean Sigma • Cycle time reduction • Yield improvement • On-time shipments Improve Working Capital Efficiency Working capital % of sales 41% 31% < 25% 2002 2013 3-5 Year Target Each 5% reduction in working capital as a % of sales = $60M cash 21

Disciplined Capital Deployment Going Forward Return Cash to Shareholders • Share repurchase - $50M authorization • Dividends – increased 6% in 2014 Capex Below Depreciation • Invest in facilities • Invest in new products Growth • Organic • Selective tuck-in acquisitions 22 35% Debt & Shareholder 65% Growth

Why Invest in Materion? G O A L N E X T 3 Y E A R S : ROIC > 2% over cost of capital Positive impact from 2013 initiatives 1 Strategy for sustained, profitable growth • Pathway for additional cost and working capital improvements 5 Strong positions in growing markets • High barrier to entry 2 Promising new product launches 3 4 Solid cash flow organic growth, acquisitions, dividends, share buybacks 23

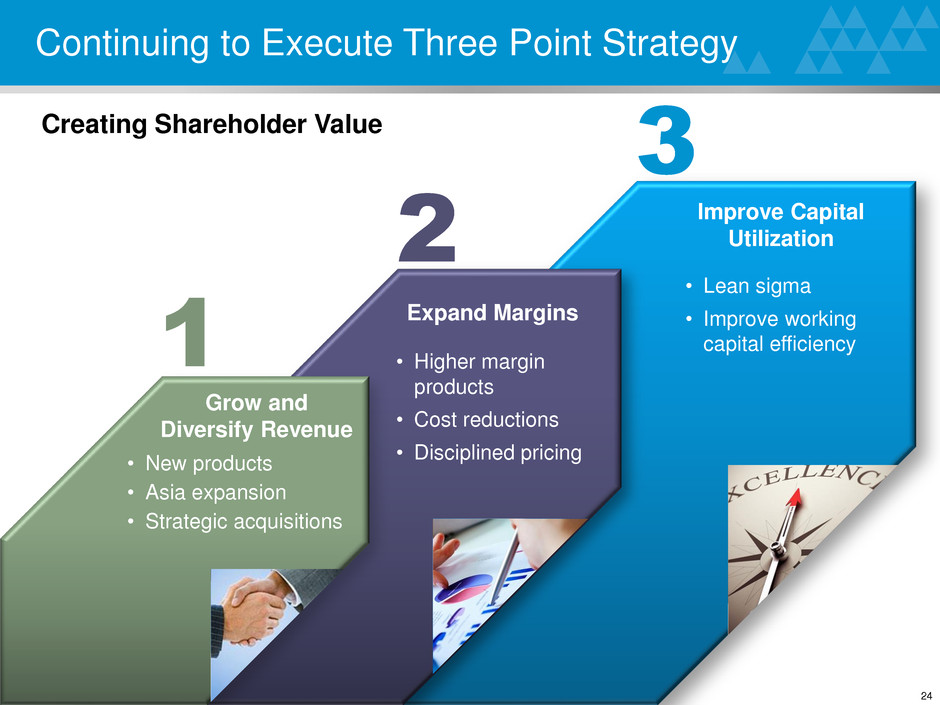

Continuing to Execute Three Point Strategy Grow and Diversify Revenue Expand Margins Improve Capital Utilization • New products • Asia expansion • Strategic acquisitions • Higher margin products • Cost reductions • Disciplined pricing • Lean sigma • Improve working capital efficiency 1 2 3 Creating Shareholder Value 24

Financial Goals Next 3 – 5 Years 2013 Next 3–5 years Value-added sales growth (1%) 5% –10% annually Value-added sales $609M $750M - $981M Margins (OP % VA)(1) 5% 9% –12% ROIC 5% >2% over cost of capital Operating Cash Flow $76M >$50M Working capital % sales 31% <25% Debt-to-capitalization 13% <30% Acquisition Investment N/A $50M – $100M annually EPS(2) $1.10 >$3.00 25 (1) Excludes non-recurring items (2) Non-GAAP, excludes special items

2014 Key Milestones Targets Value-added sales growth >6% Expanding operating margins 200 bps Beryllium plant at production >15,000 lbs./qtr. Operating Cash Flow >$50M Benefit from facility consolidations >$0.30 EPS 26

Appendix

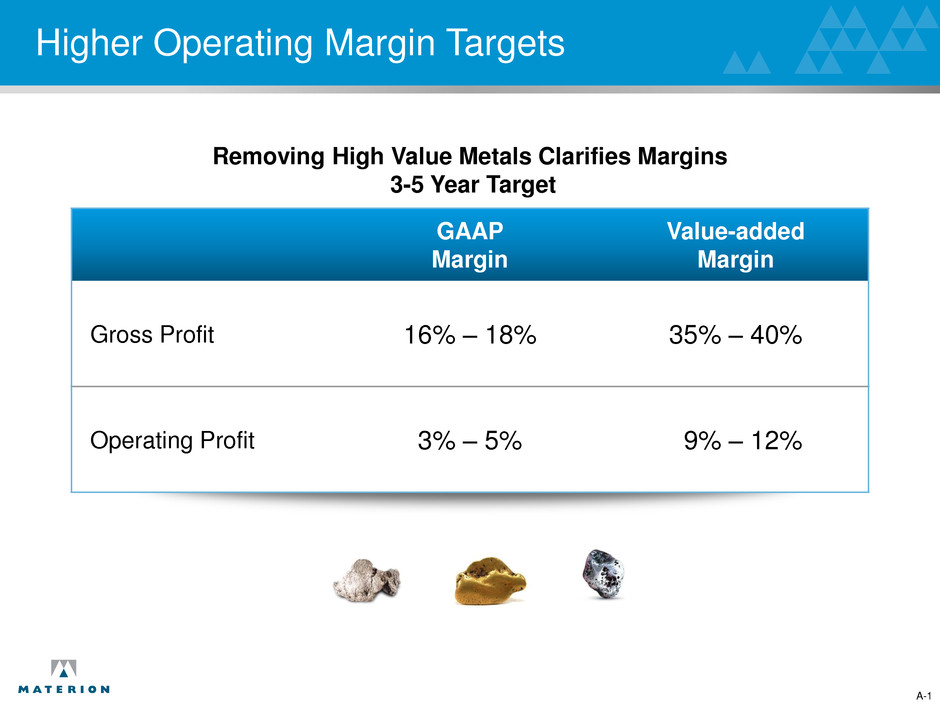

Higher Operating Margin Targets A-1 GAAP Margin Value-added Margin Gross Profit 16% – 18% 35% – 40% Operating Profit 3% – 5% 9% – 12% Removing High Value Metals Clarifies Margins 3-5 Year Target

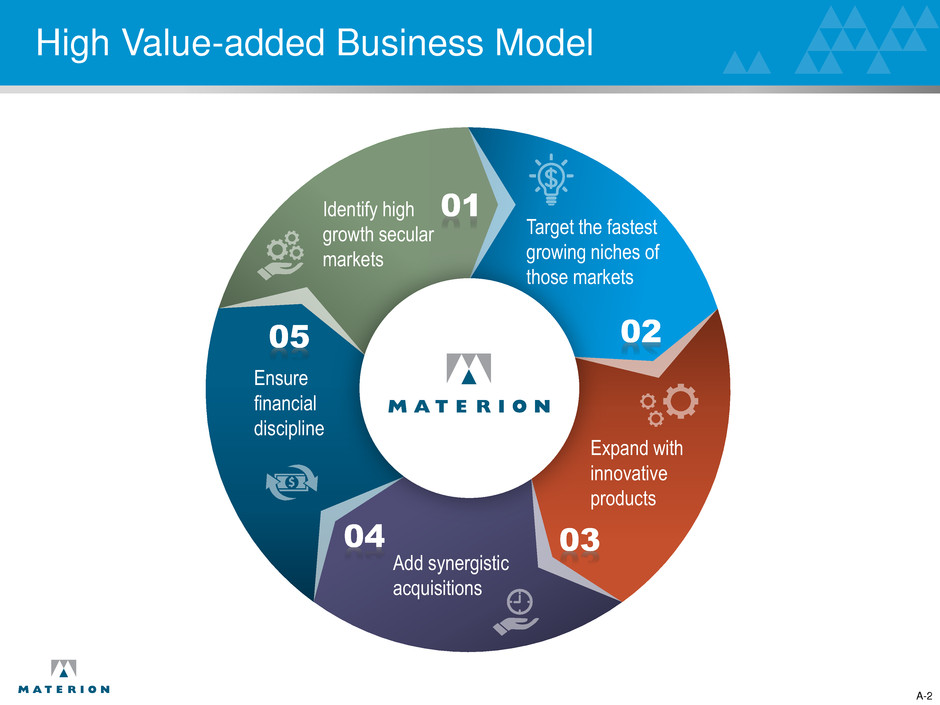

High Value-added Business Model A-2 Identify high growth secular markets Target the fastest growing niches of those markets Expand with innovative products Add synergistic acquisitions Ensure financial discipline 01 02 03 04 05

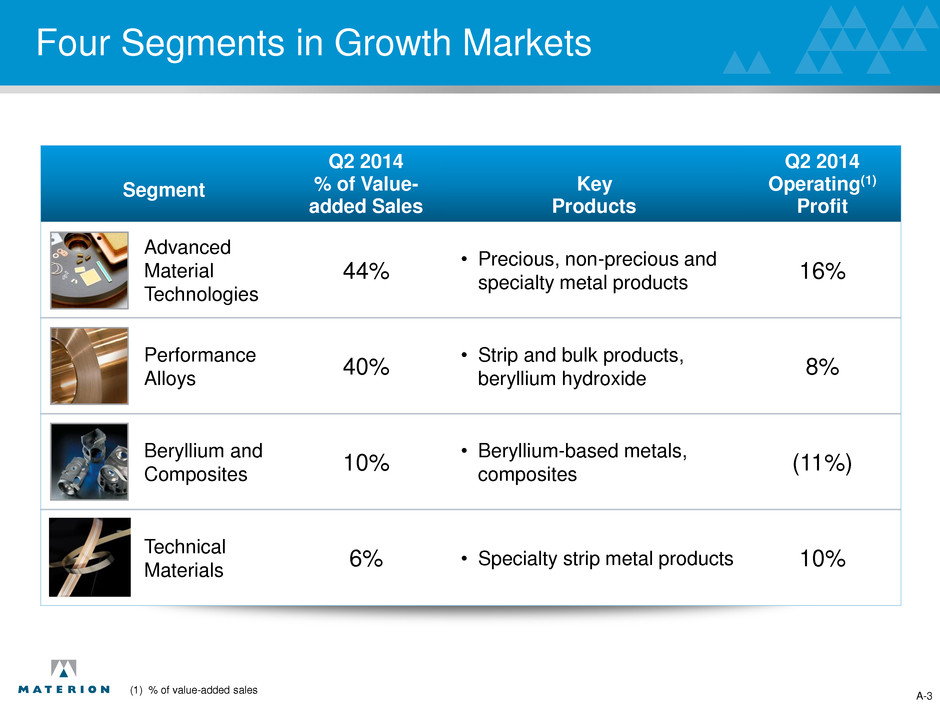

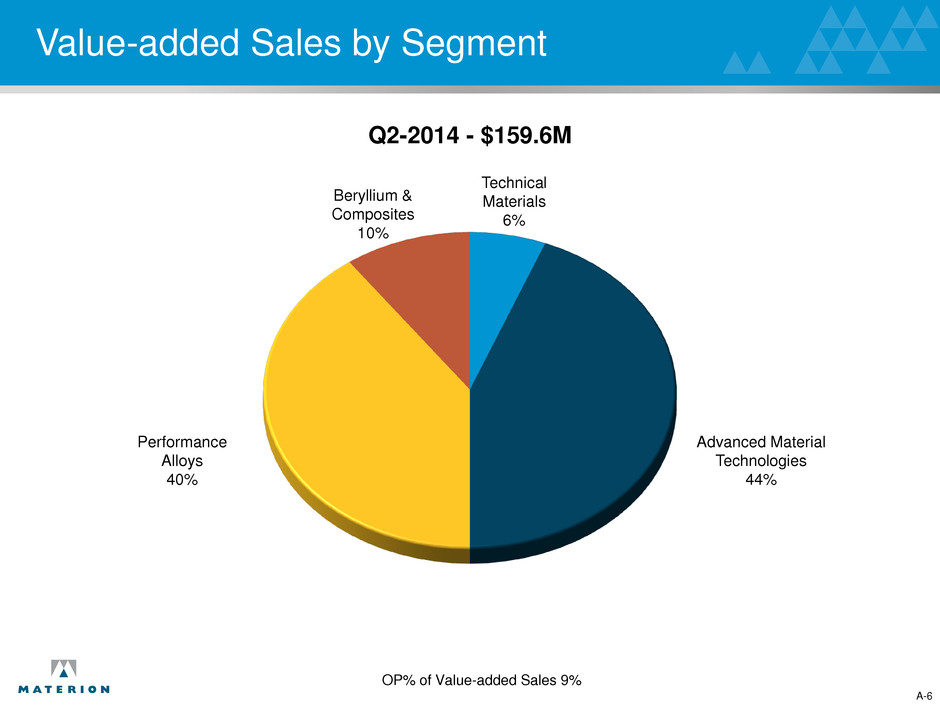

Four Segments in Growth Markets A-3 (1) % of value-added sales Segment Q2 2014 % of Value- added Sales Key Products Q2 2014 Operating(1) Profit Advanced Material Technologies 44% • Precious, non-precious and specialty metal products 16% Performance Alloys 40% • Strip and bulk products, beryllium hydroxide 8% Beryllium and Composites 10% • Beryllium-based metals, composites (11%) Technical Materials 6% • Specialty strip metal products 10%

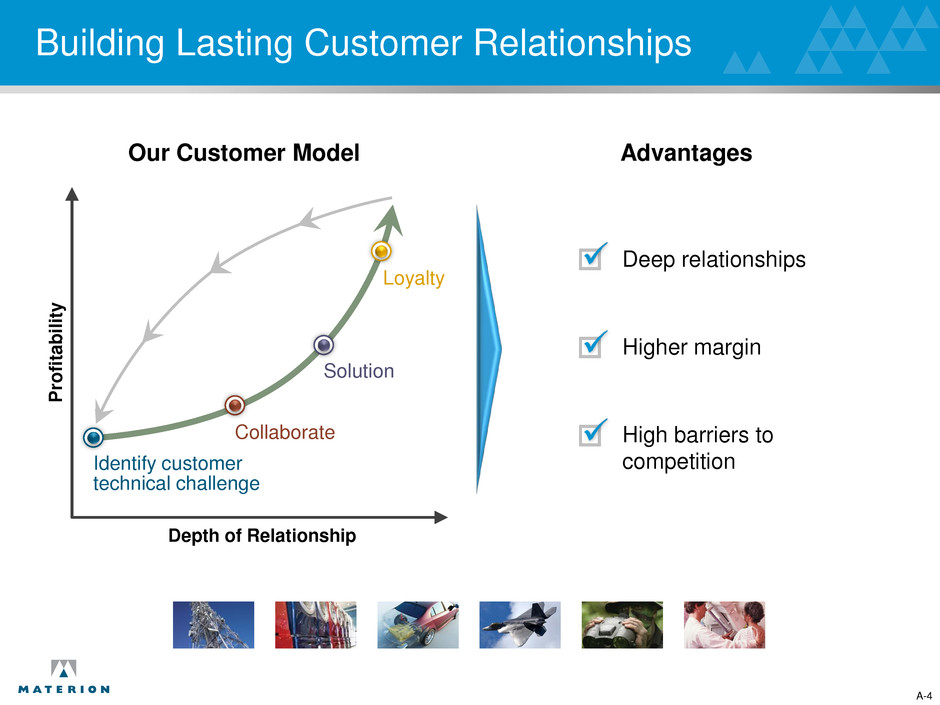

Building Lasting Customer Relationships Deep relationships Higher margin High barriers to competition Our Customer Model Advantages Identify customer technical challenge Solution Collaborate Loyalty Depth of Relationship P ro fi ta b il it y A-4

Materion Value-added Sales by Market A-5 Q2-2014 - $159.6M OP% of Value-added Sales 9% Telecom Infrastructure 6% Defense 6% Energy 8% Medical 11% Commercial Aerospace 4% Services 4% Science 2% Appliance 2% Other 6% Automotive Electronics 9% Industrial Components14% Consumer Electronics 28%

Value-added Sales by Segment A-6 Q2-2014 - $159.6M OP% of Value-added Sales 9% Beryllium & Composites 10% Performance Alloys 40% Advanced Material Technologies 44% Technical Materials 6%

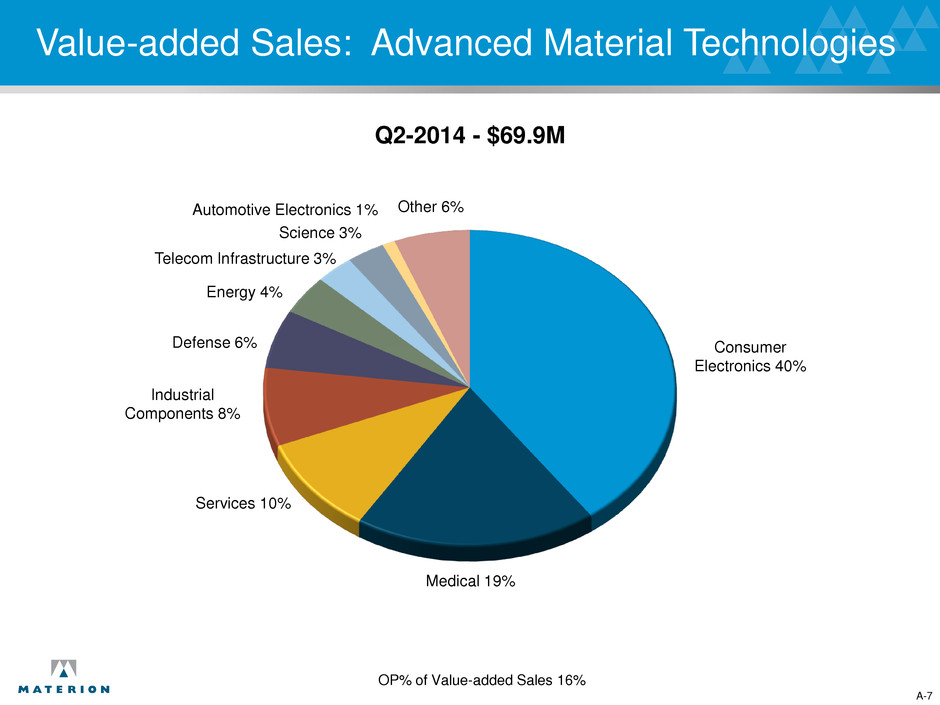

Value-added Sales: Advanced Material Technologies A-7 Telecom Infrastructure 3% Defense 6% Energy 4% Medical 19% Other 6% Science 3% Industrial Components 8% Consumer Electronics 40% Services 10% Q2-2014 - $69.9M OP% of Value-added Sales 16% Automotive Electronics 1%

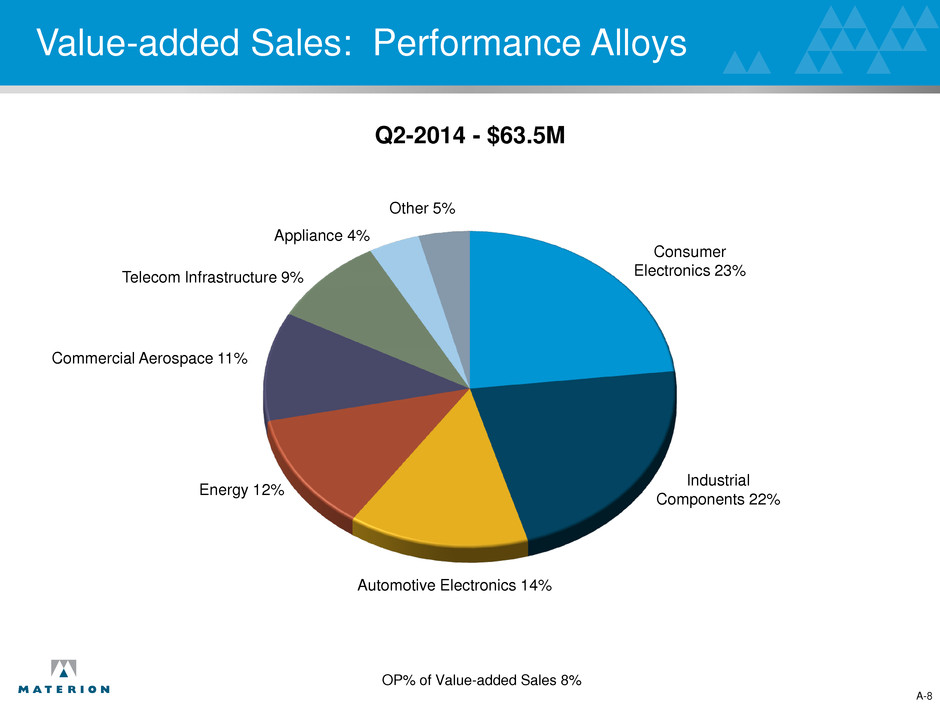

Value-added Sales: Performance Alloys A-8 Telecom Infrastructure 9% Energy 12% Commercial Aerospace 11% Other 5% Appliance 4% Industrial Components 22% Consumer Electronics 23% Automotive Electronics 14% Q2-2014 - $63.5M OP% of Value-added Sales 8%

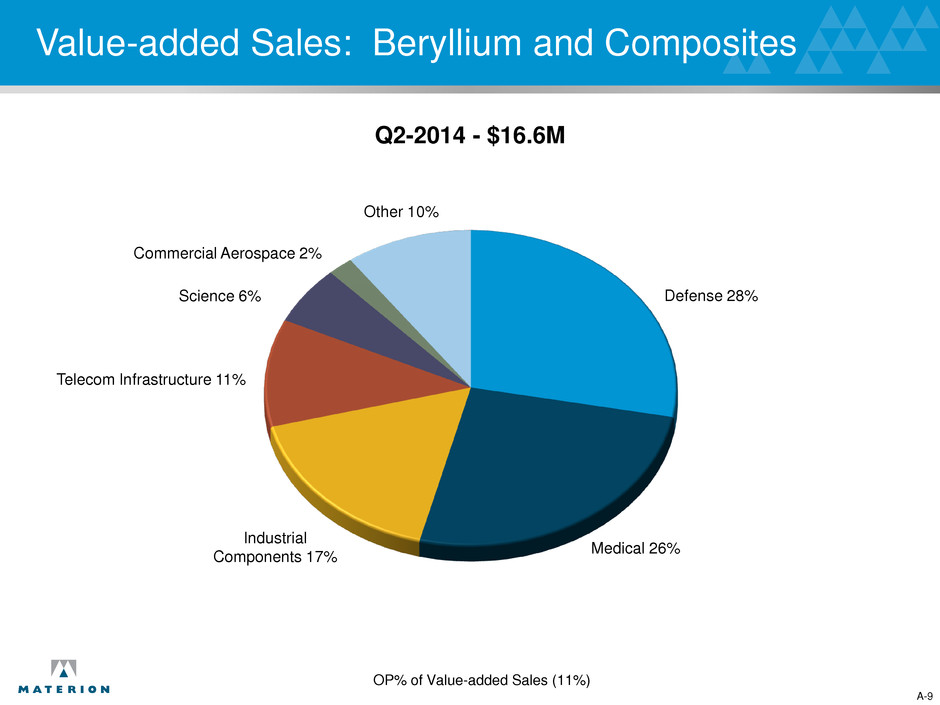

Value-added Sales: Beryllium and Composites A-9 Commercial Aerospace 2% Other 10% Defense 28% Medical 26% Science 6% Industrial Components 17% Q2-2014 - $16.6M OP% of Value-added Sales (11%) Telecom Infrastructure 11%

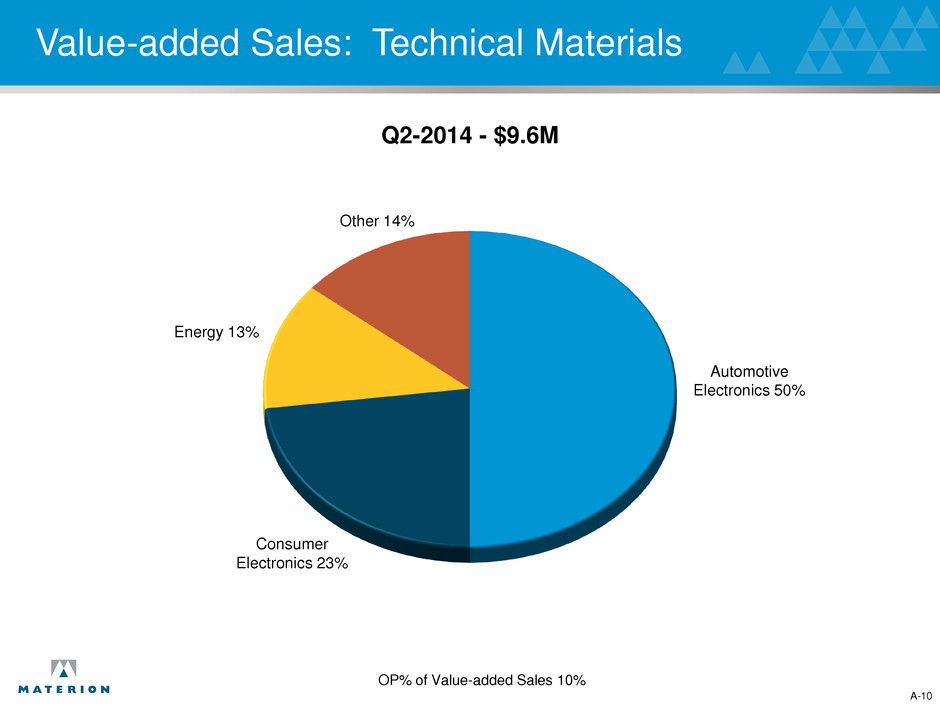

Value-added Sales: Technical Materials A-10 Other 14% Automotive Electronics 50% Consumer Electronics 23% Energy 13% Q2-2014 - $9.6M OP% of Value-added Sales 10%

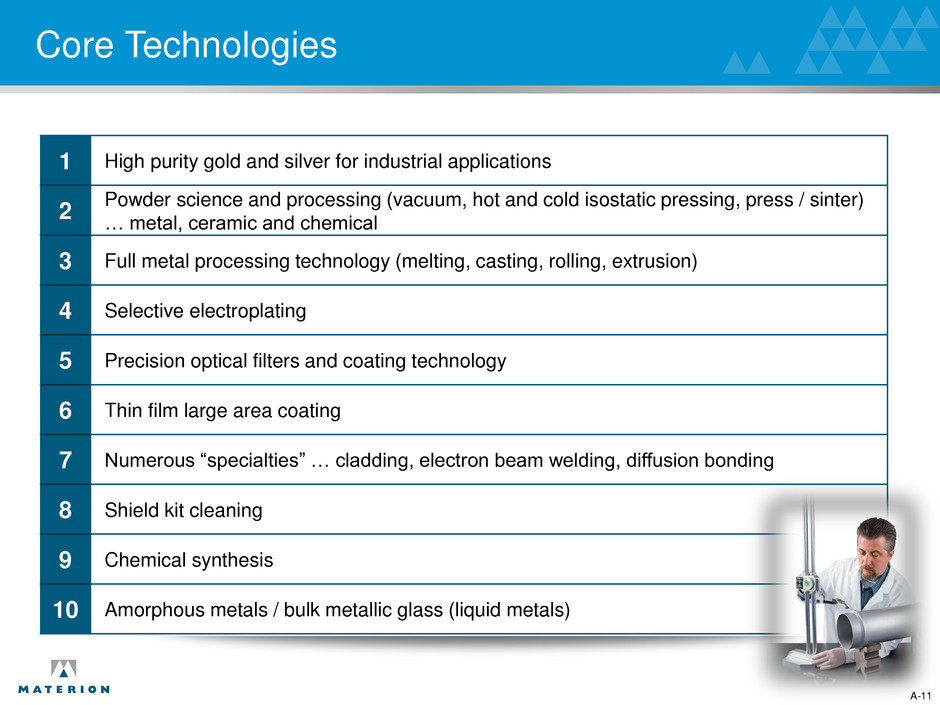

Core Technologies A-11 1 High purity gold and silver for industrial applications 2 Powder science and processing (vacuum, hot and cold isostatic pressing, press / sinter) … metal, ceramic and chemical 3 Full metal processing technology (melting, casting, rolling, extrusion) 4 Selective electroplating 5 Precision optical filters and coating technology 6 Thin film large area coating 7 Numerous “specialties” … cladding, electron beam welding, diffusion bonding 8 Shield kit cleaning 9 Chemical synthesis 10 Amorphous metals / bulk metallic glass (liquid metals)

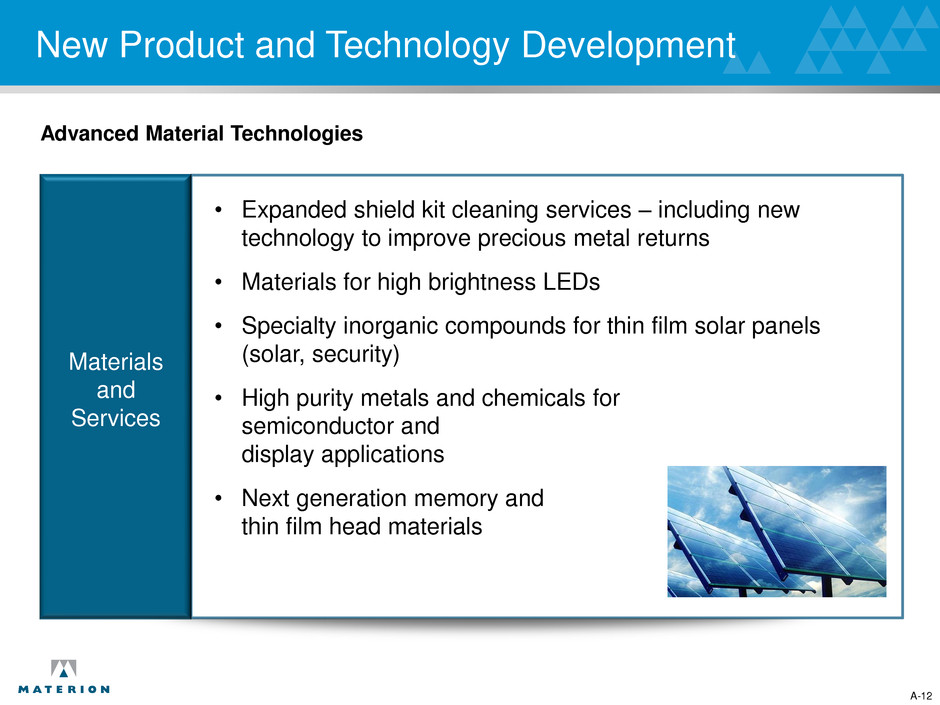

New Product and Technology Development • Expanded shield kit cleaning services – including new technology to improve precious metal returns • Materials for high brightness LEDs • Specialty inorganic compounds for thin film solar panels (solar, security) • High purity metals and chemicals for semiconductor and display applications • Next generation memory and thin film head materials A-12 Materials and Services Advanced Material Technologies

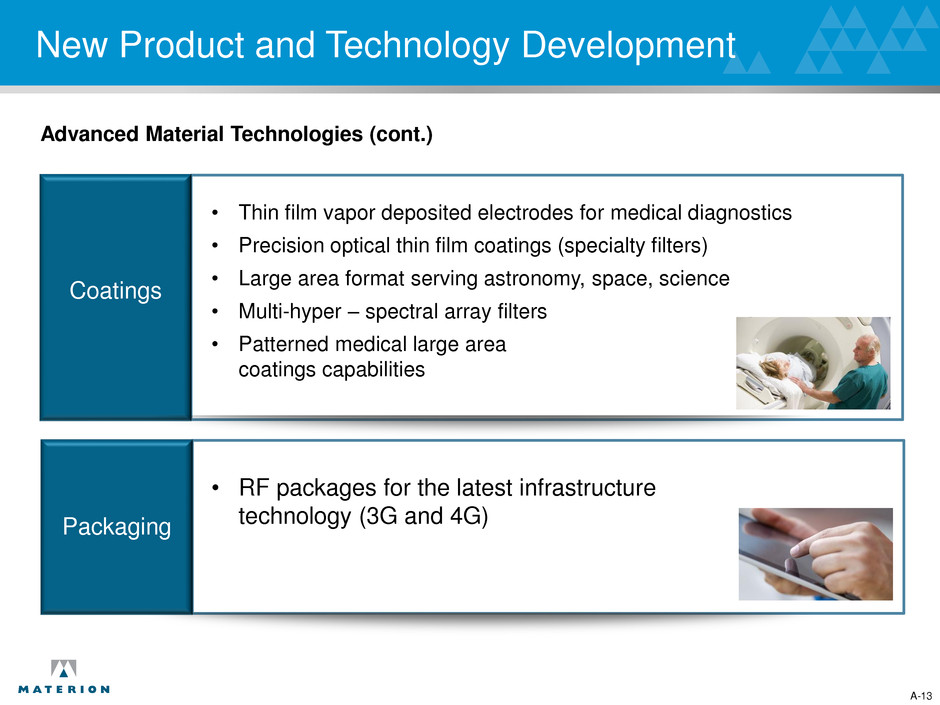

New Product and Technology Development • Thin film vapor deposited electrodes for medical diagnostics • Precision optical thin film coatings (specialty filters) • Large area format serving astronomy, space, science • Multi-hyper – spectral array filters • Patterned medical large area coatings capabilities A-13 Coatings Advanced Material Technologies (cont.) Packaging • RF packages for the latest infrastructure technology (3G and 4G)

New Product and Technology Development A-14 • ToughMet® alloy “strip” for high volume bearing applications • BrushForm 158 “strip” for cell phone camera suspension applications • ToughMet® alloy “wire” for next generation cell phone camera suspension applications • ToughMet® alloy “bulk” with enhanced impact toughness • ToughMet® “alloy “sheet” for vehicle gearboxes • “Next generation” alloy for oil & gas • Nearer net shape fabrication (hot isostatic pressing) • Truextent™ speaker diaphragms • Investment casting • Amorphous metals / bulk metallic glass • SupremEX™ aluminum metal matrix composites • Improved foils for x-ray windows • Durox® alumina ceramics • Hybrid & electric vehicle battery components • Power electronics • Smart grid meters Beryllium and Composites Performance Alloys Technical Materials Advanced Material Technologies (cont.)

I/O Connector Contacts Battery Contacts Internal Antenna Contacts Grounding Clips and Audio Jacks Micro Mezzanine Connectors for LCD Screen Internal Electronics and LED • Thin film materials – power amplifiers, LED, SAW and BAW devices, filters, and ICs • Hermetic solutions for SAW • Refining / recycling • Precision parts cleaning Other Smart Phone Applications: • Circuit board and IC inspection • RoHS compliance assurance • Cellular infrastructure with high power RF packaging Internal Electronics • Precursor materials for GaAs wafer production Applications: Smart Phones Voice Coil Motor (auto focus lens stabilizer) A-15

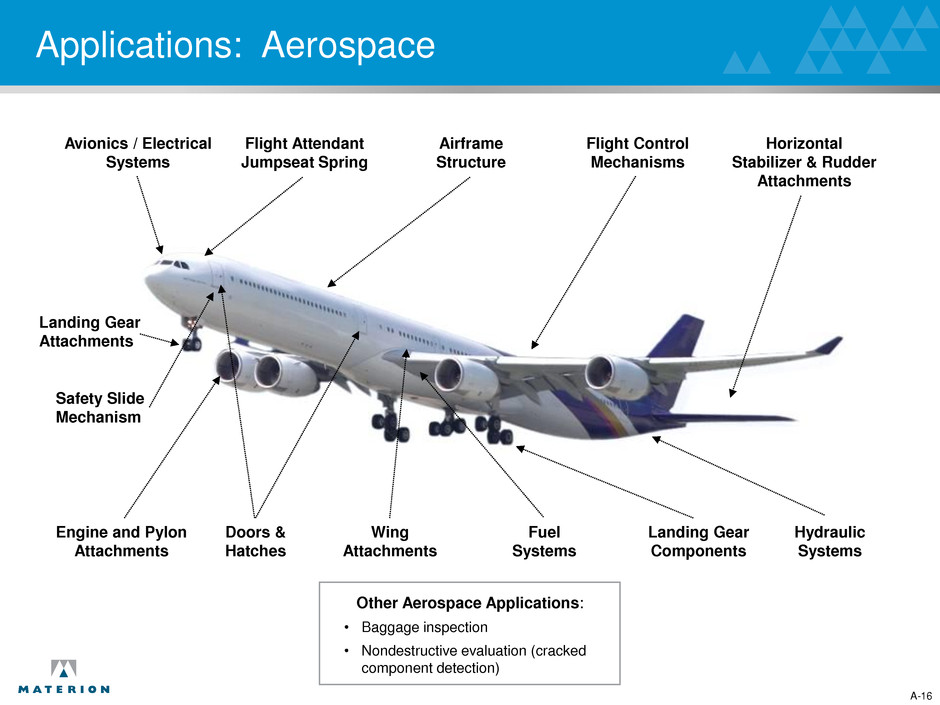

Avionics / Electrical Systems Airframe Structure Landing Gear Attachments Flight Control Mechanisms Horizontal Stabilizer & Rudder Attachments Hydraulic Systems Fuel Systems Wing Attachments Doors & Hatches Landing Gear Components Flight Attendant Jumpseat Spring Safety Slide Mechanism Other Aerospace Applications: • Baggage inspection • Nondestructive evaluation (cracked component detection) Applications: Aerospace A-16 Engine and Pylon Attachments

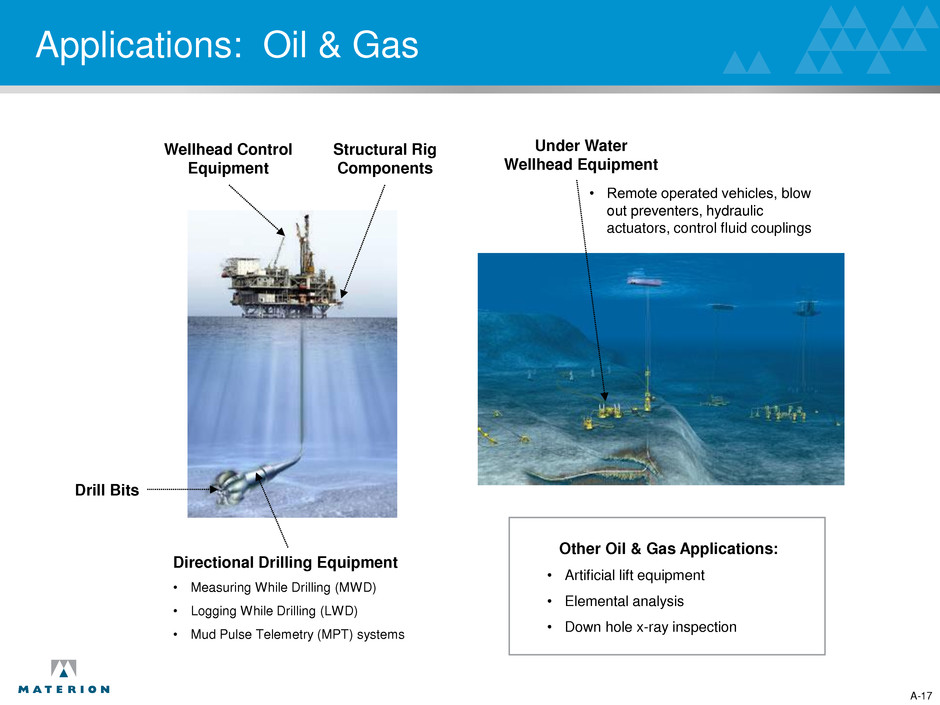

Under Water Wellhead Equipment Directional Drilling Equipment • Measuring While Drilling (MWD) • Logging While Drilling (LWD) • Mud Pulse Telemetry (MPT) systems Drill Bits Structural Rig Components Wellhead Control Equipment Other Oil & Gas Applications: • Artificial lift equipment • Elemental analysis • Down hole x-ray inspection • Remote operated vehicles, blow out preventers, hydraulic actuators, control fluid couplings Applications: Oil & Gas A-17

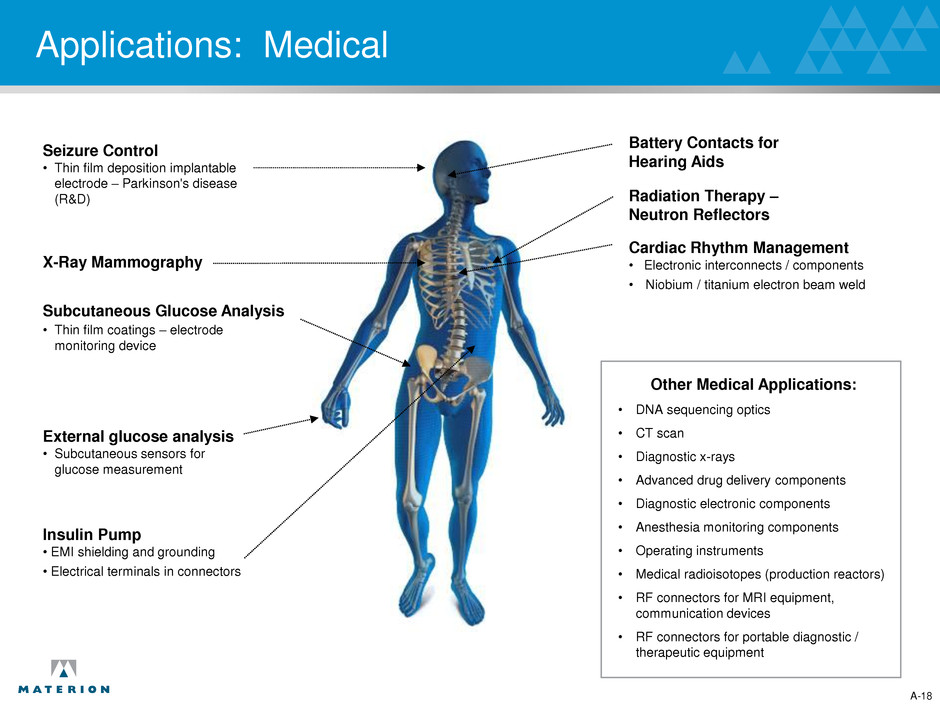

Cardiac Rhythm Management • Electronic interconnects / components • Niobium / titanium electron beam weld Insulin Pump • EMI shielding and grounding • Electrical terminals in connectors Seizure Control • Thin film deposition implantable electrode – Parkinson's disease (R&D) External glucose analysis • Subcutaneous sensors for glucose measurement Subcutaneous Glucose Analysis • Thin film coatings – electrode monitoring device Radiation Therapy – Neutron Reflectors X-Ray Mammography Other Medical Applications: • DNA sequencing optics • CT scan • Diagnostic x-rays • Advanced drug delivery components • Diagnostic electronic components • Anesthesia monitoring components • Operating instruments • Medical radioisotopes (production reactors) • RF connectors for MRI equipment, communication devices • RF connectors for portable diagnostic / therapeutic equipment Applications: Medical Battery Contacts for Hearing Aids A-18

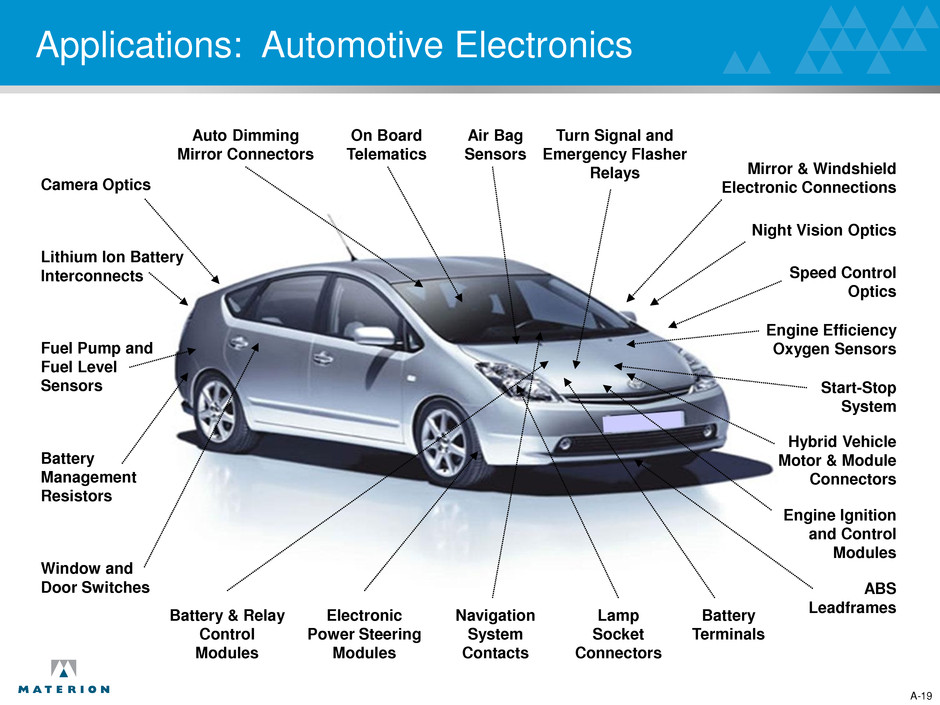

Lithium Ion Battery Interconnects Battery Management Resistors Electronic Power Steering Modules ABS Leadframes Engine Efficiency Oxygen Sensors Mirror & Windshield Electronic Connections Air Bag Sensors Lamp Socket Connectors Auto Dimming Mirror Connectors Hybrid Vehicle Motor & Module Connectors Window and Door Switches Fuel Pump and Fuel Level Sensors Battery Terminals Engine Ignition and Control Modules Battery & Relay Control Modules Turn Signal and Emergency Flasher Relays On Board Telematics Applications: Automotive Electronics Night Vision Optics Speed Control Optics Camera Optics Navigation System Contacts Start-Stop System A-19

Applications: Defense • Infrared Sensors for fighter jet and UAV optical targeting • Electronic packaging for defense avionics, radar and electronic countermeasure systems • Structural and electronic components for satellites • X-ray windows in security imaging systems • Laser protection optical coatings • Night vision system optics A-20

Applications: Telecommunications Infrastructure Base Stations • Coaxial connectors • High power amplifiers Local Area Networks • Shielding • Modular jacks • PCB sockets • Processor sockets Other Telecommunications Infrastructure Applications • Undersea repeater housings A-21

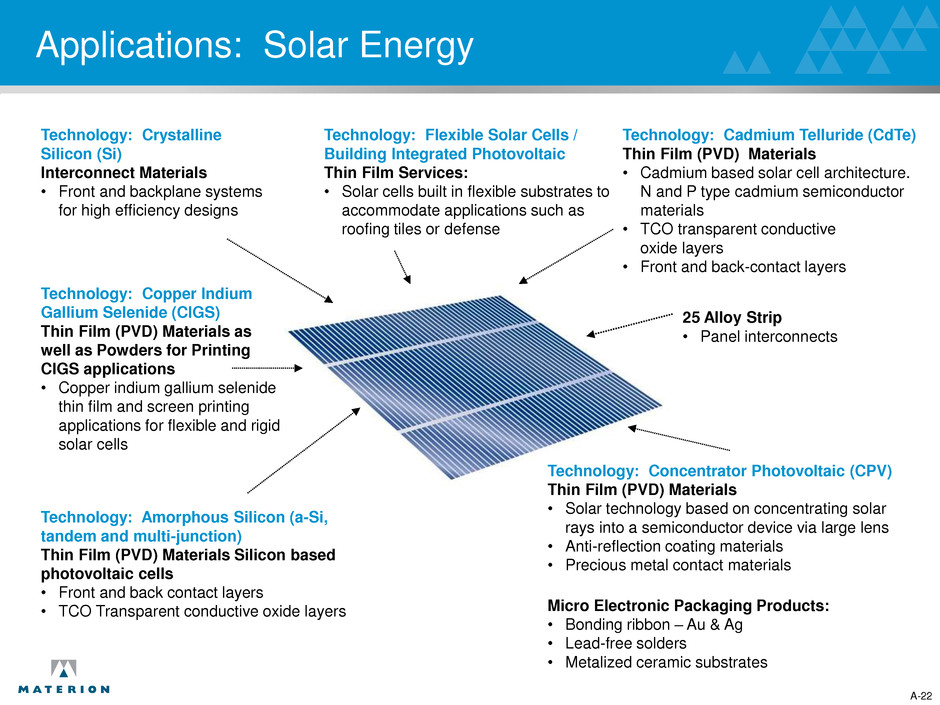

Technology: Amorphous Silicon (a-Si, tandem and multi-junction) Thin Film (PVD) Materials Silicon based photovoltaic cells • Front and back contact layers • TCO Transparent conductive oxide layers Technology: Cadmium Telluride (CdTe) Thin Film (PVD) Materials • Cadmium based solar cell architecture. N and P type cadmium semiconductor materials • TCO transparent conductive oxide layers • Front and back-contact layers Technology: Concentrator Photovoltaic (CPV) Thin Film (PVD) Materials • Solar technology based on concentrating solar rays into a semiconductor device via large lens • Anti-reflection coating materials • Precious metal contact materials Micro Electronic Packaging Products: • Bonding ribbon – Au & Ag • Lead-free solders • Metalized ceramic substrates Technology: Flexible Solar Cells / Building Integrated Photovoltaic Thin Film Services: • Solar cells built in flexible substrates to accommodate applications such as roofing tiles or defense Technology: Crystalline Silicon (Si) Interconnect Materials • Front and backplane systems for high efficiency designs Applications: Solar Energy A-22 Technology: Copper Indium Gallium Selenide (CIGS) Thin Film (PVD) Materials as well as Powders for Printing CIGS applications • Copper indium gallium selenide thin film and screen printing applications for flexible and rigid solar cells 25 Alloy Strip • Panel interconnects

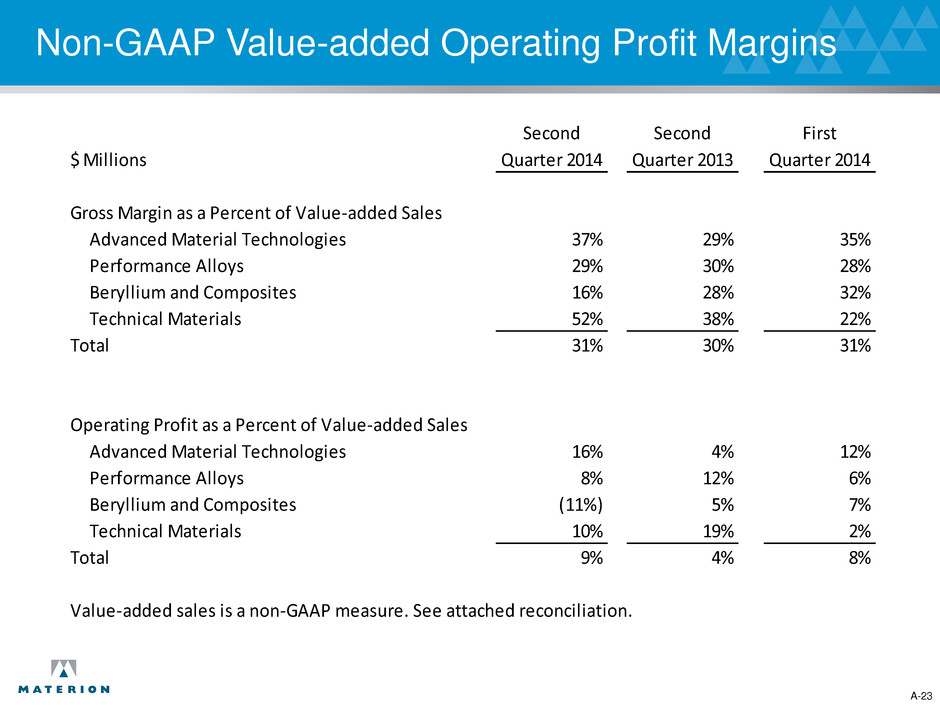

Non-GAAP Value-added Operating Profit Margins A-23 Second Second First $ Millions Quarter 2014 Quarter 2013 Quarter 2014 Gross Margin as a Percent of Value-added Sales Advanced Material Technologies 37% 29% 35% Performance Alloys 29% 30% 28% Beryllium and Composites 16% 28% 32% Technical Materials 52% 38% 22% Total 31% 30% 31% Operating Profit as a Percent of Value-added Sales Advanced Material Technologies 16% 4% 12% Performance Alloys 8% 12% 6% Beryllium and Composites (11%) 5% 7% T chnical Materials 10% 19% 2% Total 9% 4% 8% Value-added sales is a non-GAAP measure. See attached reconciliation.

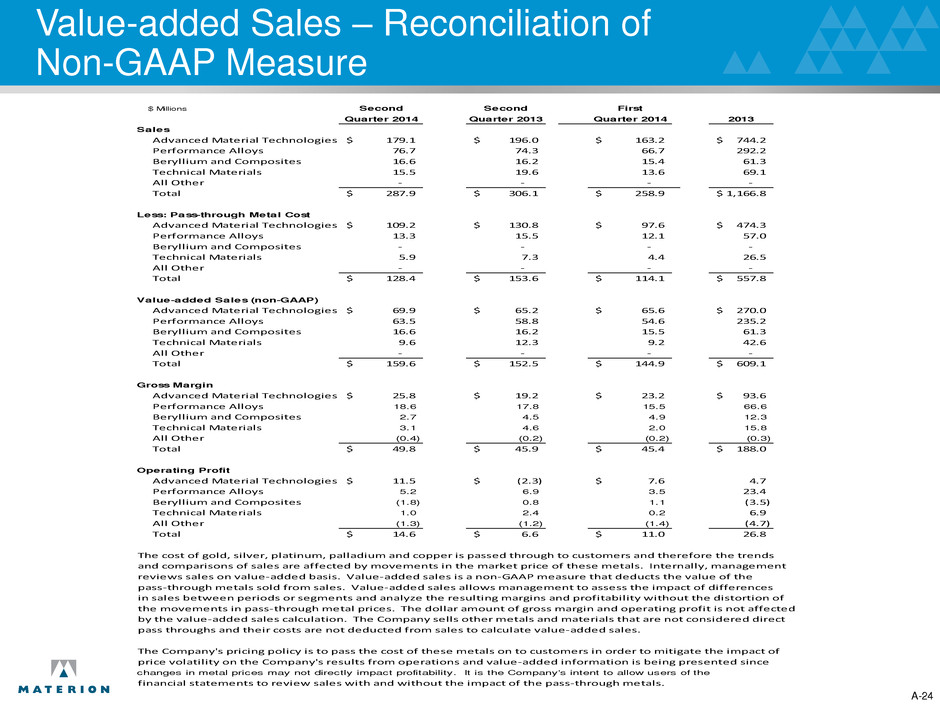

Value-added Sales – Reconciliation of Non-GAAP Measure A-24 $ Millions Second Second First Quarter 2014 Quarter 2013 Quarter 2014 2013 Sales Advanced Material Technologies 179.1$ 196.0$ 163.2$ 744.2$ Performance Alloys 76.7 74.3 66.7 292.2 Beryllium and Composites 16.6 16.2 15.4 61.3 Technical Materials 15.5 19.6 13.6 69.1 All Other - - - - Total 287.9$ 306.1$ 258.9$ 1,166.8$ Less: Pass-through Metal Cost Advanced Material Technologies 109.2$ 130.8$ 97.6$ 474.3$ Performance Alloys 13.3 15.5 12.1 57.0 Beryllium and Composites - - - - Technical Materials 5.9 7.3 4.4 26.5 All Other - - - - Total 128.4$ 153.6$ 114.1$ 557.8$ Value-added Sales (non-GAAP) Advanced Material Technologies 69.9$ 65.2$ 65.6$ 270.0$ Performance Alloys 63.5 58.8 54.6 235.2 Beryllium and Composites 16.6 16.2 15.5 61.3 Technical Materials 9.6 12.3 9.2 42.6 All Other - - - - Total 159.6$ 152.5$ 144.9$ 609.1$ Gross Margin Advanced Material Technologies 25.8$ 19.2$ 23.2$ 93.6$ Performance Alloys 18.6 17.8 15.5 66.6 Beryllium and Composites 2.7 4.5 4.9 12.3 Technical Materials 3.1 4.6 2.0 15.8 All Other (0.4) (0.2) (0.2) (0.3) Total 49.8$ 45.9$ 45.4$ 188.0$ Operating Profit Advanced Material Technologies 11.5$ (2.3)$ 7.6$ 4.7 Performance Alloys 5.2 6.9 3.5 23.4 Beryllium and Composites (1.8) 0.8 1.1 (3.5) Technical Materials 1.0 2.4 0.2 6.9 All Other (1.3) (1.2) (1.4) (4.7) Total 14.6$ 6.6$ 11.0$ 26.8 The cost of gold, silver, platinum, palladium and copper is passed through to customers and therefore the trends and comparisons of sales are affected by movements in the market price of these metals. Internally, management reviews sales on value-added basis. Value-added sales is a non-GAAP measure that deducts the value of the pass-through metals sold from sales. Value-added sales allows management to assess the impact of differences in sales between periods or segments and analyze the resulting margins and profitability without the distortion of the movements in pass-through metal prices. The dollar amount of gross margin and operating profit is not affected by the value-added sales calculation. The Company sells other metals and materials that are not considered direct pass thr ughs and their costs are not deducted from sales to calculate value-added sales. The Company's pricing policy is to pass the cost of these metals on to customers in order to mitigate the impact of price volatility on the Company's results from operations and value-added information is being presented since changes in metal prices may not directly impact profitability. It is the Company's intent to allow users of the financial statements to review sales with and without the impact of the pass-through metals.

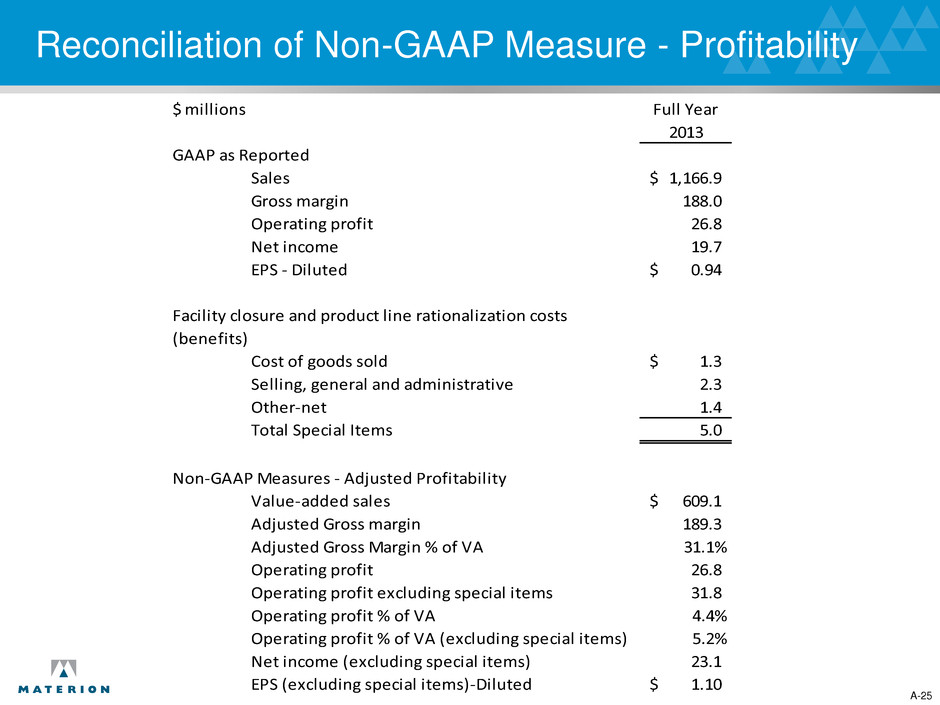

Reconciliation of Non-GAAP Measure - Profitability A-25 $ millions Full Year 2013 GAAP as Reported Sales 1,166.9$ Gross margin 188.0 Operating profit 26.8 Net income 19.7 EPS - Diluted 0.94$ Facility closure and product line rationalization costs (benefits) Cost of goods sold 1.3$ Selling, general and administrative 2.3 Other-net 1.4 Total Special Items 5.0 Non-GAAP Measures - Adjusted Profitability Value-added sales 609.1$ Adjusted Gross margin 189.3 Adjusted Gross Margin % of VA 31.1% Operating profit 26.8 Operating profit excluding special items 31.8 Operating profit % of VA 4.4% Operating profit % of VA (excluding special items) 5.2% Net income (excluding special items) 23.1 EPS (excluding special items)-Diluted 1.10$

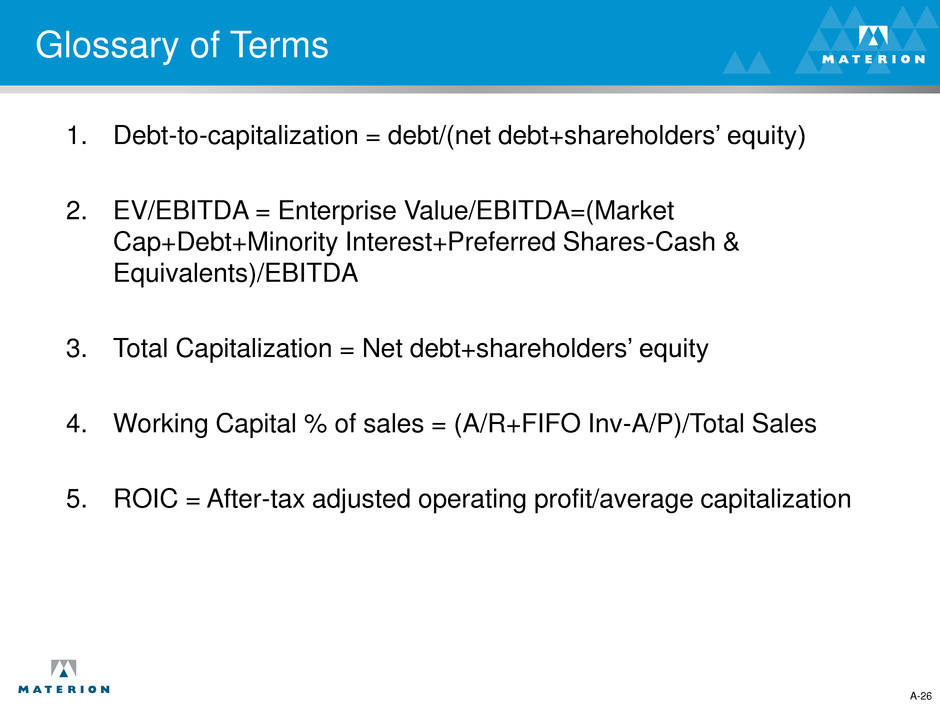

Glossary of Terms 1. Debt-to-capitalization = debt/(net debt+shareholders’ equity) 2. EV/EBITDA = Enterprise Value/EBITDA=(Market Cap+Debt+Minority Interest+Preferred Shares-Cash & Equivalents)/EBITDA 3. Total Capitalization = Net debt+shareholders’ equity 4. Working Capital % of sales = (A/R+FIFO Inv-A/P)/Total Sales 5. ROIC = After-tax adjusted operating profit/average capitalization A-26