Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FTI CONSULTING, INC | d769161d8k.htm |

| Exhibit 99.1

|

FTI Consulting, Inc.

Second Quarter 2014 Earnings Presentation

Exhibit 99.1

|

|

Cautionary Note About Forward-Looking Statements

This presentation includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which involve uncertainties and risks. Forward-looking statements include statements concerning our plans, objectives, goals, strategies, future events, future revenues, future results and performance, expectations, plans or intentions relating to acquisitions and other matters, business trends and other information that is not historical, including statements regarding estimates of our 2014 financial results, our medium-term growth targets or other future financial results. When used in this press release, words such as “anticipates,” “aspirational,” “estimates,” “expects,” “goals,” “intends,” “believes,” “forecasts,” “targets,” “objectives” and variations of such words or similar expressions are intended to identify forward-looking statements. All forward-looking statements, including, without limitation, estimates of our 2014 financial results, our medium-term growth targets or other future financial results, are based upon our expectations at the time we make them and various assumptions. Our medium term growth targets do not represent forecasted future results or financial guidance; rather, they reflect our medium-term growth objectives, developed on the basis of a comprehensive review of our businesses and reflecting our plans for the future. Our expectations, beliefs, projections and growth targets are expressed in good faith, and we believe there is a reasonable basis for them. However, there can be no assurance that management’s expectations, beliefs, estimates or growth targets will be achieved, and the Company’s actual results may differ materially from our expectations, beliefs, estimates and growth targets. The Company has experienced fluctuating revenues, operating income and cash flow in prior periods and expects that this will occur from time to time in the future. Other factors that could cause such differences include declines in demand for, or changes in, the mix of services and products that we offer, the mix of the geographic locations where our clients are located or where services are performed, adverse financial, real estate or other market and general economic conditions, which could impact each of our segments differently, the pace and timing of the consummation and integration of past and future acquisitions, the Company’s ability to realize cost savings and efficiencies, competitive and general economic conditions, retention of staff and clients and other risks described under the heading “Item 1A Risk Factors” in the Company’s most recent Form 10-K filed with the SEC and in the Company’s other filings with the SEC, including the risks set forth under “Risks Related to Our Reportable Segments” and “Risks Related to Our Operations”. We are under no duty to update any of the forward looking statements to conform such statements to actual results or events and do not intend to do so.

2

|

|

FTI Consulting Announces Election of Executive Officers: David M. Johnson, Holly Paul, Paul Linton and Adam S. Bendell

Effective August 25, 2014,

David M. Johnson will serve as the Company’s Chief Financial Officer and will be based out of the Company’s executive headquarters in Washington, D.C. Mr. Johnson will be responsible for all finance functions and work with the firm’s Executive Committee to develop and execute acquisition and other growth strategies.

Effective August 25, 2014, Holly Paul will become the Company’s Chief Human Resources Officer and will be based out of the Company’s executive headquarters in Washington, D.C. Ms. Paul will be responsible for attracting, engaging, hiring, developing and retaining leading professionals.

Effective August 25, 2014, Paul Linton will become the Company’s Chief Strategy and Transformation Officer and will be based out of the Company’s executive headquarters in Washington, D.C. Mr. Linton will focus on supporting FTI Consulting’s business segments as they develop and drive their near-term and medium-term agendas.

Effective August 25, 2014,

Adam S. Bendell who has been serving as the Company’s Senior Vice President of Strategic Development, will move into a new role as the Company’s first-ever Chief Innovation Officer and will be based out of the firm’s San Francisco office. Mr. Bendell will guide the commercialization of new products and services adjacent to FTI Consulting’s existing businesses.

3

|

|

Second Quarter 2014 Key Messages

Second quarter results are in line with the expectations provided at June investor day

Elected four executive officers, David M. Johnson as Chief Financial Officer; Holly Paul as Chief Human Resources Officer;

Paul Linton as Chief Strategy and Transformation Officer; and Adam S. Bendell as Chief Innovation Officer, effective August 25, 2014

Organic revenue growth of 8.7% year-over-year, driven by year-over-year revenue growth across all business segments

Strong demand for Forensic and Litigation Consulting and Technology services, revenues increasing 13.3% and 18.6% compared to the same period in the prior year

Economic Consulting revenues improving from the slow start in first quarter of 2014, up 9.7% sequentially

Sequential uptick in M&A activity, particularly in Economic Consulting and Strategic Communications

Bankruptcy and restructuring demand environment remains soft in North America and continues to weaken globally

4

|

|

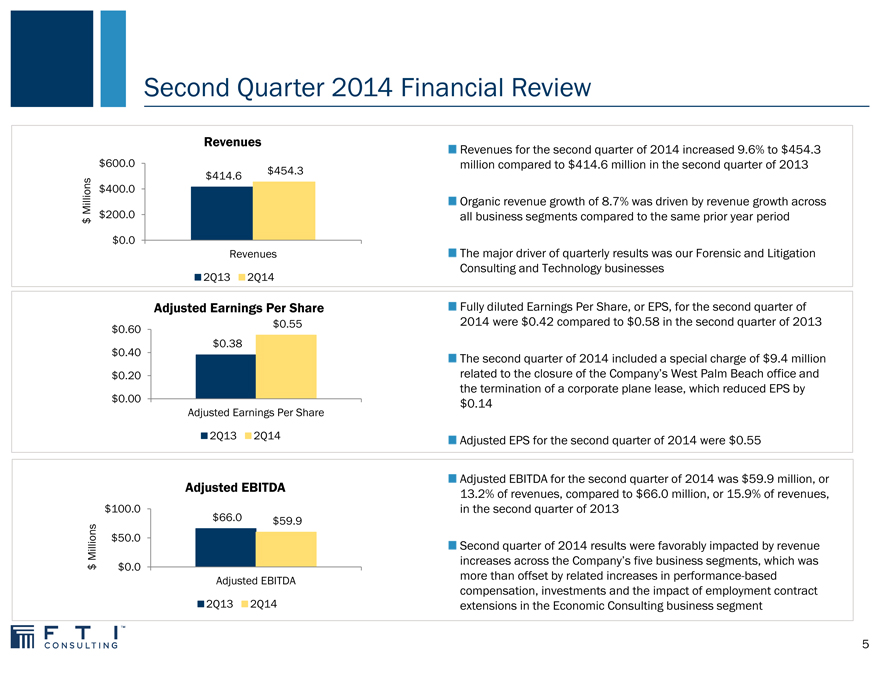

Second Quarter 2014 Financial Review

Revenues

$600.0

$414.6 $454.3

Millions $400.0

$200.0

$

$0.0

Revenues

2Q13 2Q14

Adjusted Earnings Per Share

$ 0.60 $ 0.55

$ 0.38

$ 0.40

$ 0.20

$ 0.00

Adjusted Earnings Per Share

2Q13 2Q14

Adjusted EBITDA

$100.0

$66.0 $59.9

Millions $50.0

$ $0.0

Adjusted EBITDA

2Q13 2Q14

Revenues for the second quarter of 2014 increased 9.6% to $454.3 million compared to $414.6 million in the second quarter of 2013

Organic revenue growth of 8.7% was driven by revenue growth across all business segments compared to the same prior year period

The major driver of quarterly results was our Forensic and Litigation Consulting and Technology businesses

Fully diluted Earnings Per Share, or EPS, for the second quarter of 2014 were $0.42 compared to $0.58 in the second quarter of 2013

The second quarter of 2014 included a special charge of $9.4 million related to the closure of the Company’s West Palm Beach office and the termination of a corporate plane lease, which reduced EPS by

$0.14

Adjusted EPS for the second quarter of 2014 were $0.55

Adjusted EBITDA for the second quarter of 2014 was $59.9 million, or

13.2% of revenues, compared to $66.0 million, or 15.9% of revenues, in the second quarter of 2013

Second quarter of 2014 results were favorably impacted by revenue increases across the Company’s five business segments, which was more than offset by related increases in performance-based compensation, investments and the impact of employment contract extensions in the Economic Consulting business segment

5

|

|

Second Quarter 2014 Segment Results

|

|

Balanced and Diversified Portfolio

Corporate Finance/Restructuring

Bankruptcy Support Services Performance Improvement Interim Management Private Equity Advisory

Investment Banking Restructuring/Turnaround Services Litigation Support Transaction Advisory Services Office of the CFO Valuation & Financial Advisory Services

Forensic and Litigation Consulting

Business Insurance Claims Global Risk & Investigations Practice Compliance, Monitoring & Receivership Government Contracts Construction & Environmental Solutions Health Solutions Dispute Advisory Services Insurance Financial & Enterprise Data Analytics Intellectual Property Financial Services Trial Services Forensic Accounting & Advisory Services

Economic Consulting

Antitrust & Competition Economics Labor & Employment Business Valuation Public Policy Intellectual Property Regulated Industries

International Arbitration Securities Litigation & Risk Management

Technology

Computer Forensics & Investigations Discovery Consulting E-discovery Software & Services

Strategic Communications

Corporate Communications Litigation Communications Creative Engagement & Digital M&A Communications Communications Public Affairs Crisis Communications Restructuring & Financial Issues Employee Engagement & Change Shareholder Activism & Proxy Advisory Communications Strategy Consulting & Research Financial Communications

Second Quarter 2014 Segment Revenues

12% Corporate Finance/Restructuring

23%

13% Forensic and Litigation Consulting

Economic Consulting

26% 26% Technology

Strategic Communications

Second Quarter 2014 Geographic Revenues

United States

International

29%

71%

7

|

|

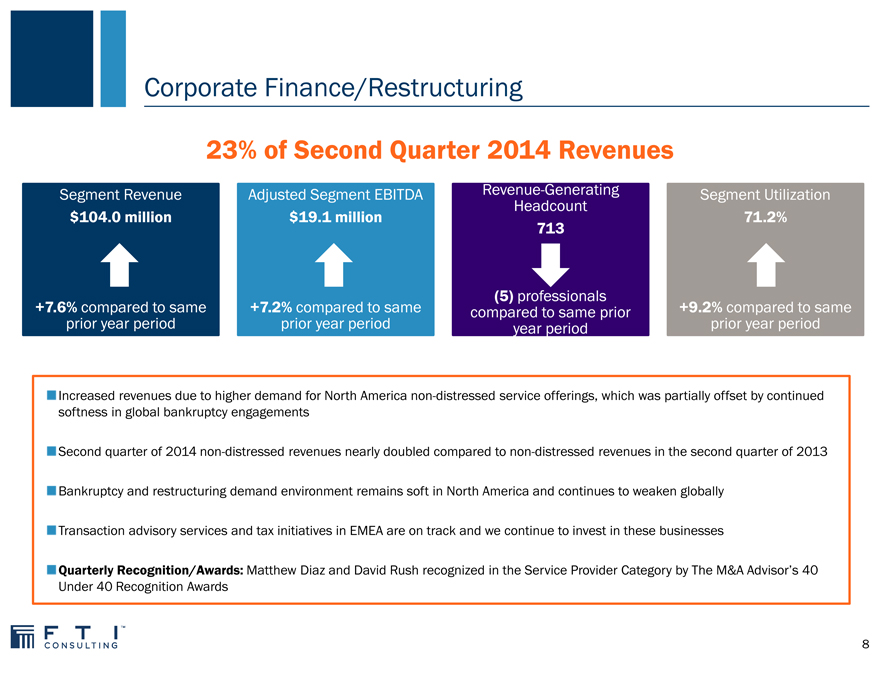

Corporate Finance/Restructuring

23% of Second Quarter 2014 Revenues

Segment Revenue Adjusted Segment EBITDA Revenue-Generating Segment Utilization Headcount $104.0 million $19.1 million 71.2% 713

(5) professionals

+7.6% compared to same +7.2% compared to same compared to same prior +9.2% compared to same prior year period prior year period year period prior year period

Increased revenues due to higher demand for North America non-distressed service offerings, which was partially offset by continued softness in global bankruptcy engagements

Second quarter of 2014 non-distressed revenues nearly doubled compared to non-distressed revenues in the second quarter of 2013 Bankruptcy and restructuring demand environment remains soft in North America and continues to weaken globally Transaction advisory services and tax initiatives in EMEA are on track and we continue to invest in these businesses

Quarterly Recognition/Awards: Matthew Diaz and David Rush recognized in the Service Provider Category by The M&A Advisor’s 40 Under 40 Recognition Awards

8

|

|

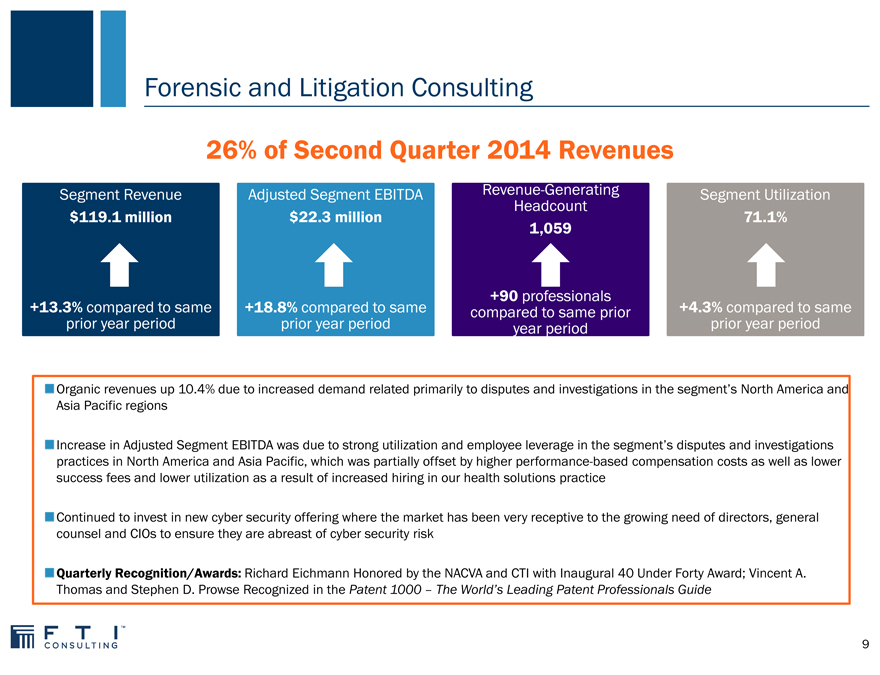

Forensic and Litigation Consulting

26% of Second Quarter 2014 Revenues

Segment Revenue Adjusted Segment EBITDA Revenue-Generating Segment Utilization Headcount $119.1 million $22.3 million 71.1% 1,059

+90 professionals

+13.3% compared to same +18.8% compared to same compared to same prior +4.3% compared to same prior year period prior year period year period prior year period

Organic revenues up 10.4% due to increased demand related primarily to disputes and investigations in the segment’s North America and Asia Pacific regions

Increase in Adjusted Segment EBITDA was due to strong utilization and employee leverage in the segment’s disputes and investigations practices in North America and Asia Pacific, which was partially offset by higher performance-based compensation costs as well as lower success fees and lower utilization as a result of increased hiring in our health solutions practice

Continued to invest in new cyber security offering where the market has been very receptive to the growing need of directors, general counsel and CIOs to ensure they are abreast of cyber security risk

Quarterly Recognition/Awards: Richard Eichmann Honored by the NACVA and CTI with Inaugural 40 Under Forty Award; Vincent A.

Thomas and Stephen D. Prowse Recognized in the Patent 1000 – The World’s Leading Patent Professionals Guide

9

|

|

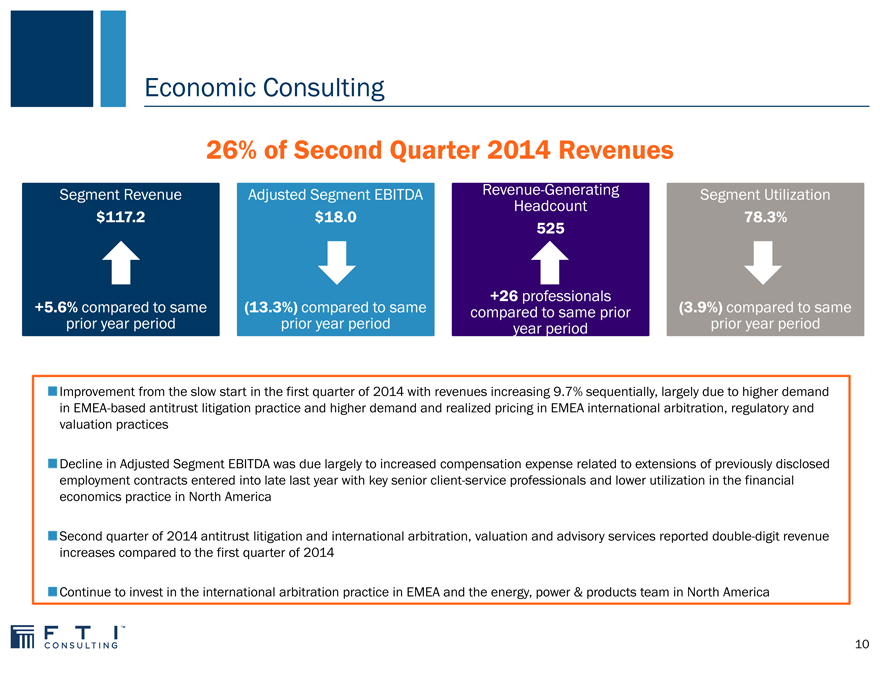

Economic Consulting

26% of Second Quarter 2014 Revenues

Segment Revenue Adjusted Segment EBITDA Revenue-Generating Segment Utilization

Headcount

$117.2 $18.0 78.3%

525

+26 professionals

+5.6% compared to same (13.3%) compared to same compared to same prior (3.9%) compared to same

prior year period prior year period year period prior year period

Improvement from the slow start in the first quarter of 2014 with revenues increasing 9.7% sequentially, largely due to higher demand in EMEA-based antitrust litigation practice and higher demand and realized pricing in EMEA international arbitration, regulatory and valuation practices

Decline in Adjusted Segment EBITDA was due largely to increased compensation expense related to extensions of previously disclosed employment contracts entered into late last year with key senior client-service professionals and lower utilization in the financial economics practice in North America

Second quarter of 2014 antitrust litigation and international arbitration, valuation and advisory services reported double-digit revenue increases compared to the first quarter of 2014

Continue to invest in the international arbitration practice in EMEA and the energy, power & products team in North America

10

|

|

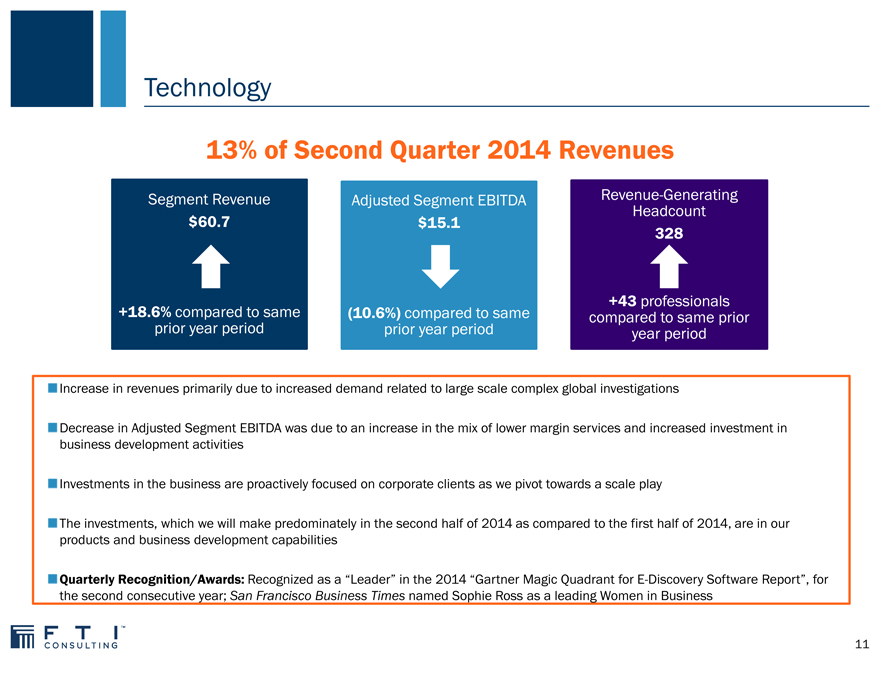

Technology

13% of Second Quarter 2014 Revenues

Segment Revenue Adjusted Segment EBITDA Revenue-Generating Headcount

$60.7 $15.1

328

+43 professionals +18.6% compared to same (10.6%) compared to same compared to same prior prior year period prior year period year period

Increase in revenues primarily due to increased demand related to large scale complex global investigations

Decrease in Adjusted Segment EBITDA was due to an increase in the mix of lower margin services and increased investment in business development activities

Investments in the business are proactively focused on corporate clients as we pivot towards a scale play

The investments, which we will make predominately in the second half of 2014 as compared to the first half of 2014, are in our products and business development capabilities

Quarterly Recognition/Awards: Recognized as a “Leader” in the 2014 “Gartner Magic Quadrant for E-Discovery Software Report”, for the second consecutive year; San Francisco Business Times named Sophie Ross as a leading Women in Business

11

|

|

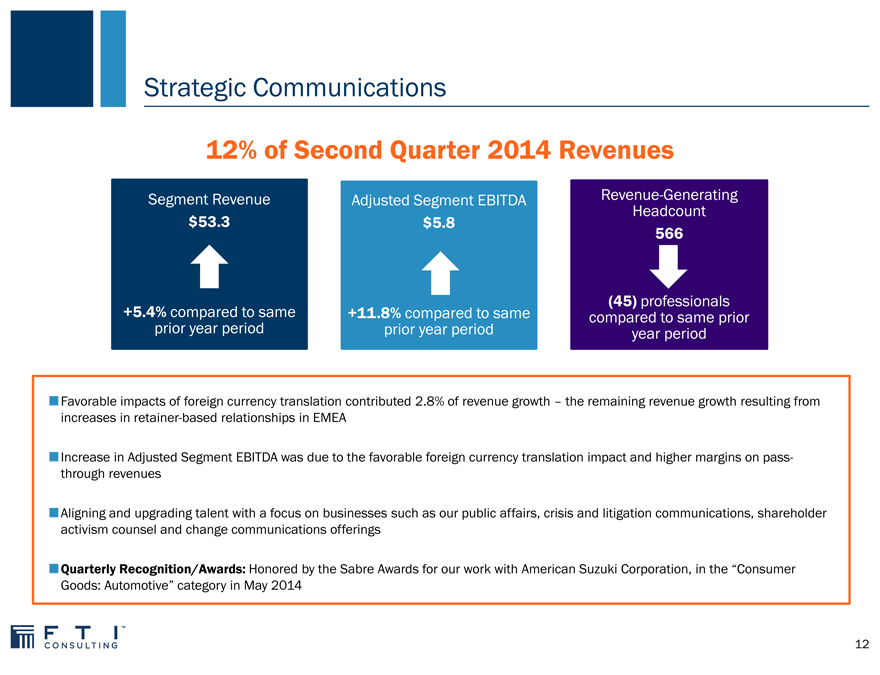

Strategic Communications

12% of Second Quarter 2014 Revenues

Segment Revenue Adjusted Segment EBITDA Revenue-Generating Headcount $53.3 $5.8 566

(45) professionals +5.4% compared to same +11.8% compared to same compared to same prior prior year period prior year period year period

Favorable impacts of foreign currency translation contributed 2.8% of revenue growth – the remaining revenue growth resulting from increases in retainer-based relationships in EMEA

Increase in Adjusted Segment EBITDA was due to the favorable foreign currency translation impact and higher margins on pass-through revenues

Aligning and upgrading talent with a focus on businesses such as our public affairs, crisis and litigation communications, shareholder activism counsel and change communications offerings

Quarterly Recognition/Awards: Honored by the Sabre Awards for our work with American Suzuki Corporation, in the “Consumer Goods: Automotive” category in May 2014

12

|

|

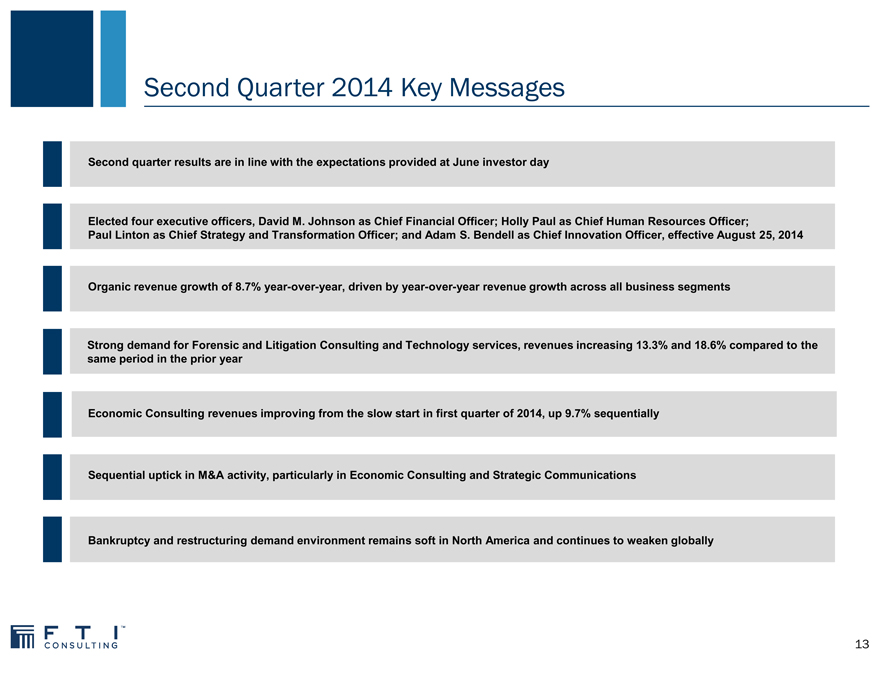

Second Quarter 2014 Key Messages

Second quarter results are in line with the expectations provided at June investor day

Elected four executive officers, David M. Johnson as Chief Financial Officer; Holly Paul as Chief Human Resources Officer;

Paul Linton as Chief Strategy and Transformation Officer; and Adam S. Bendell as Chief Innovation Officer, effective August 25, 2014

Organic revenue growth of 8.7% year-over-year, driven by year-over-year revenue growth across all business segments

Strong demand for Forensic and Litigation Consulting and Technology services, revenues increasing 13.3% and 18.6% compared to the same period in the prior year

Economic Consulting revenues improving from the slow start in first quarter of 2014, up 9.7% sequentially

Sequential uptick in M&A activity, particularly in Economic Consulting and Strategic Communications

Bankruptcy and restructuring demand environment remains soft in North America and continues to weaken globally

13

|

|

Second Quarter 2014 Financial Tables

|

|

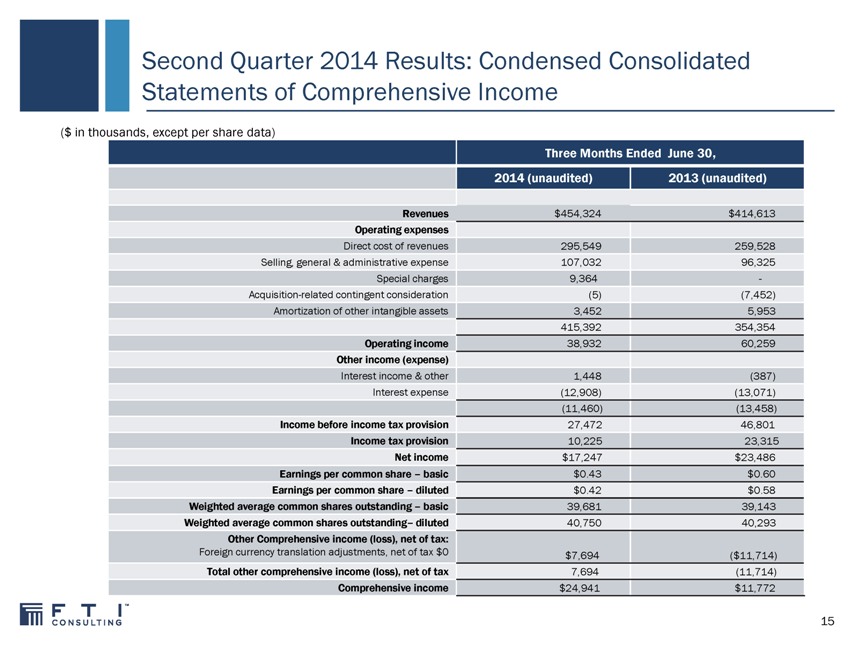

Second Quarter 2014 Results: Condensed Consolidated Statements of Comprehensive Income

($ in thousands, except per share data)

Three Months Ended June 30,

2014 (unaudited) 2013 (unaudited)

Revenues $454,324 $414,613

Operating expenses

Direct cost of revenues 295,549 259,528

Selling, general & administrative expense 107,032 96,325

Special charges 9,364 -

Acquisition-related contingent consideration (5) (7,452)

Amortization of other intangible assets 3,452 5,953

415,392 354,354

Operating income 38,932 60,259

Other income (expense)

Interest income & other 1,448 (387)

Interest expense (12,908) (13,071)

(11,460) (13,458)

Income before income tax provision 27,472 46,801

Income tax provision 10,225 23,315

Net income $17,247 $23,486

Earnings per common share – basic $0.43 $0.60

Earnings per common share – diluted $0.42 $0.58

Weighted average common shares outstanding – basic 39,143

39,681

Weighted average common shares outstanding– diluted 40,293

40,750

Other Comprehensive income (loss), net of tax:

Foreign currency translation adjustments, net of tax $0 $7,694 ($11,714)

Total other comprehensive income (loss), net of tax 7,694 (11,714)

Comprehensive income $24,941 $11,772

15

|

|

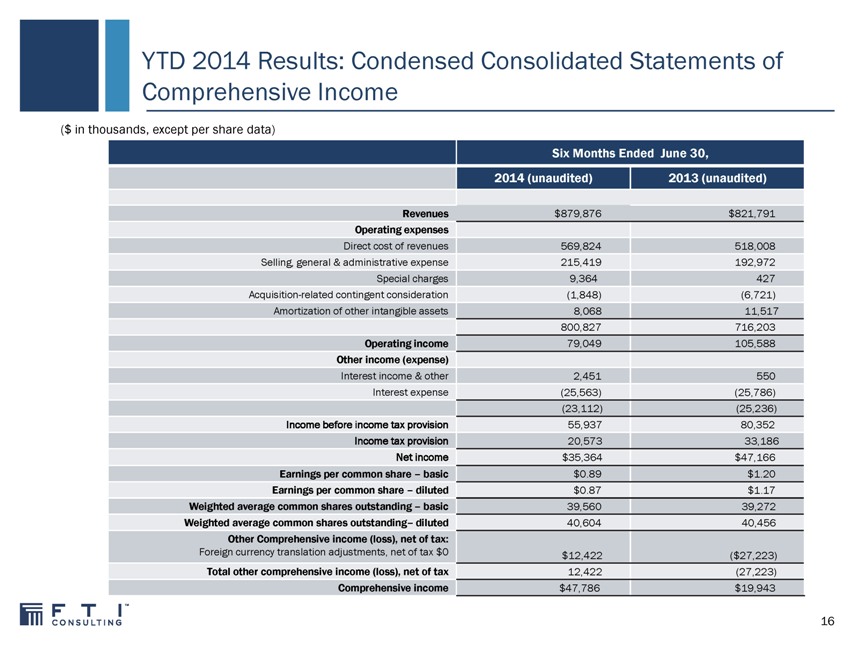

YTD 2014 Results: Condensed Consolidated Statements of Comprehensive Income

($ in thousands, except per share data)

Six Months Ended June 30,

2014 (unaudited) 2013 (unaudited)

Revenues $879,876 $821,791

Operating expenses

Direct cost of revenues 569,824 518,008

Selling, general & administrative expense 215,419 192,972

Special charges 9,364 427

Acquisition-related contingent consideration (1,848) (6,721)

Amortization of other intangible assets 8,068 11,517

800,827 716,203

Operating income 79,049 105,588

Other income (expense)

Interest income & other 2,451 550

Interest expense (25,563) (25,786)

(23,112) (25,236)

Income before income tax provision 55,937 80,352

Income tax provision 20,573 33,186

Net income $35,364 $47,166

Earnings per common share – basic $0.89 $1.20

Earnings per common share – diluted $0.87 $1.17

Weighted average common shares outstanding – basic 39,272

39,560

Weighted average common shares outstanding– diluted 40,456

40,604

Other Comprehensive income (loss), net of tax:

Foreign currency translation adjustments, net of tax $0 $12,422 ($27,223)

Total other comprehensive income (loss), net of tax 12,422 (27,223)

Comprehensive income $47,786 $19,943

16

|

|

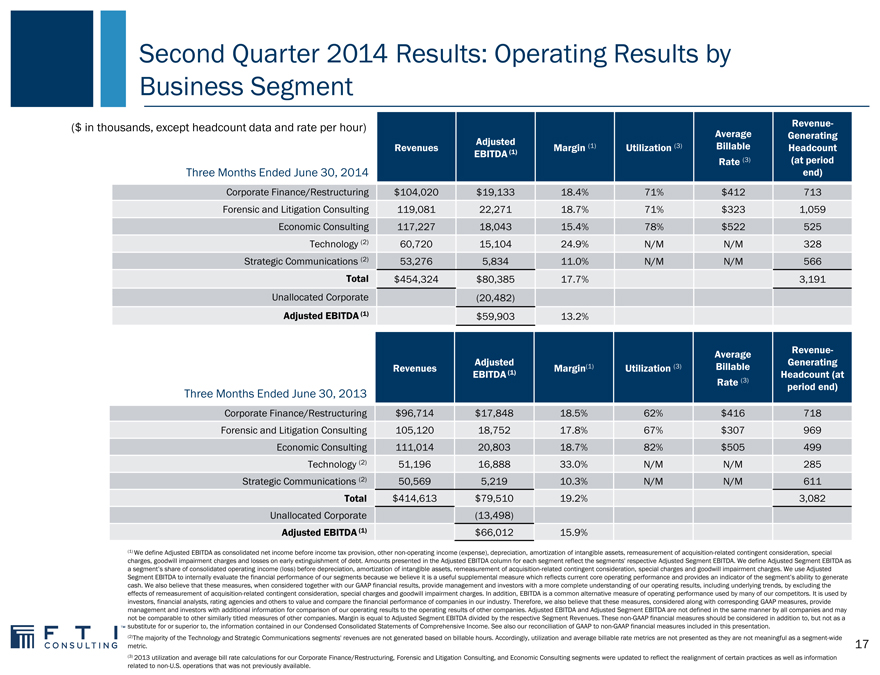

Second Quarter 2014 Results: Operating Results by Business Segment

($ in thousands, except headcount data and rate per hour) Revenue-

Adjusted Average Generating

Revenues Margin (1) Utilization (3) Billable Headcount

EBITDA (1) Rate (3) (at period

Three Months Ended June 30, 2014 end)

Corporate Finance/Restructuring $104,020 $19,133 18.4% 71% $412 713

Forensic and Litigation Consulting 119,081 22,271 18.7% 71% $323 1,059

Economic Consulting 117,227 18,043 15.4% 78% $522 525

Technology (2) 60,720 15,104 24.9% N/M N/M 328

Strategic Communications (2) 53,276 5,834 11.0% N/M N/M 566

Total $454,324 $80,385 17.7% 3,191

Unallocated Corporate (20,482)

Adjusted EBITDA (1) $59,903 13.2%

Average Revenue-

Revenues Adjusted Margin(1) Utilization (3) Billable Generating

EBITDA (1) Headcount (at

Rate (3) period end)

Three Months Ended June 30, 2013

Corporate Finance/Restructuring $96,714 $17,848 18.5% 62% $416 718

Forensic and Litigation Consulting 105,120 18,752 17.8% 67% $307 969

Economic Consulting 111,014 20,803 18.7% 82% $505 499

Technology (2) 51,196 16,888 33.0% N/M N/M 285

Strategic Communications (2) 50,569 5,219 10.3% N/M N/M 611

Total $414,613 $79,510 19.2% 3,082

Unallocated Corporate (13,498)

Adjusted EBITDA (1) $66,012 15.9%

(1) We define Adjusted EBITDA as consolidated net income before income tax provision, other non-operating income (expense), depreciation, amortization of intangible assets, remeasurement of acquisition-related contingent consideration, special

charges, goodwill impairment charges and losses on early extinguishment of debt. Amounts presented in the Adjusted EBITDA column for each segment reflect the segments’ respective Adjusted Segment EBITDA. We define Adjusted Segment EBITDA as

a segment’s share of consolidated operating income (loss) before depreciation, amortization of intangible assets, remeasurement of acquisition-related contingent consideration, special charges and goodwill impairment charges. We use Adjusted

Segment EBITDA to internally evaluate the financial performance of our segments because we believe it is a useful supplemental measure which reflects current core operating performance and provides an indicator of the segment’s ability to generate

cash. We also believe that these measures, when considered together with our GAAP financial results, provide management and investors with a more complete understanding of our operating results, including underlying trends, by excluding the

effects of remeasurement of acquisition-related contingent consideration, special charges and goodwill impairment charges. In addition, EBITDA is a common alternative measure of operating performance used by many of our competitors. It is used by

investors, financial analysts, rating agencies and others to value and compare the financial performance of companies in our industry. Therefore, we also believe that these measures, considered along with corresponding GAAP measures, provide

management and investors with additional information for comparison of our operating results to the operating results of other companies. Adjusted EBITDA and Adjusted Segment EBITDA are not defined in the same manner by all companies and may

not be comparable to other similarly titled measures of other companies. Margin is equal to Adjusted Segment EBITDA divided by the respective Segment Revenues. These non-GAAP financial measures should be considered in addition to, but not as a

substitute for or superior to, the information contained in our Condensed Consolidated Statements of Comprehensive Income. See also our reconciliation of GAAP to non-GAAP financial measures included in this presentation.

(2)The majority of the Technology and Strategic Communications segments’ revenues are not generated based on billable hours. Accordingly, utilization and average billable rate metrics are not presented as they are not meaningful as a segment-wide

metric.

(3) 2013 utilization and average bill rate calculations for our Corporate Finance/Restructuring, Forensic and Litigation Consulting, and Economic Consulting segments were updated to reflect the realignment of certain practices as well as information

related to non-U.S. operations that was not previously available.

17

|

|

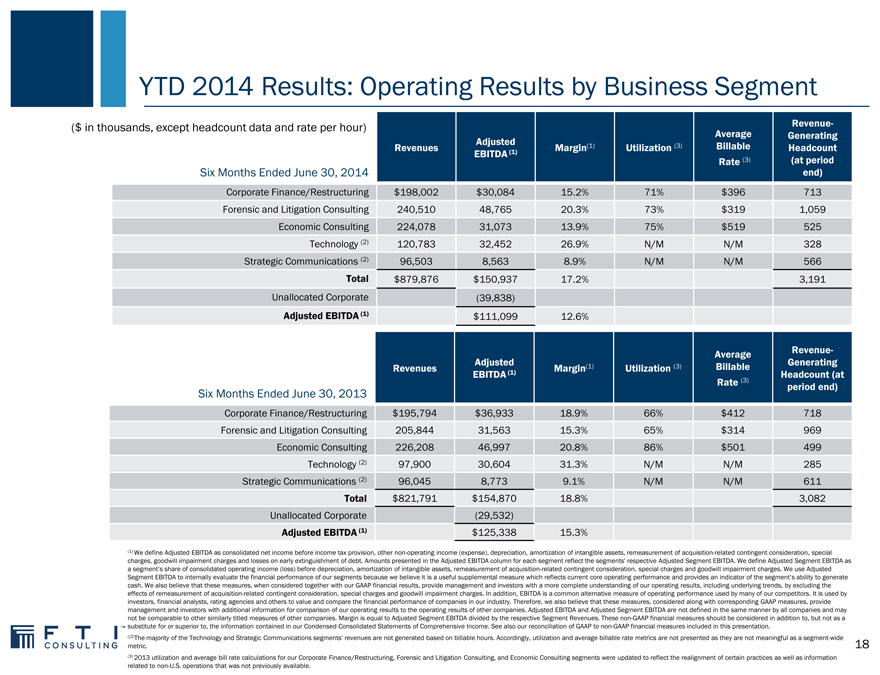

YTD 2014 Results: Operating Results by Business Segment

($ in thousands, except headcount data and rate per hour)

Revenue-

Adjusted

Average

Generating

Revenues

Margin(1)

Utilization (3)

Billable

Headcount

EBITDA (1)

Rate (3)

(at period

Six Months Ended June 30, 2014

end)

Corporate Finance/Restructuring

$198,002

$30,084

15.2%

71%

$396

713

Forensic and Litigation Consulting

240,510

48,765

20.3%

73%

$319

1,059

Economic Consulting

224,078

31,073

13.9%

75%

$519

525

Technology (2)

120,783

32,452

26.9%

N/M

N/M

328

Strategic Communications (2)

96,503

8,563

8.9%

N/M

N/M

566

Total

$879,876

$150,937

17.2%

3,191

Unallocated Corporate

(39,838)

Adjusted EBITDA (1)

$111,099

12.6%

Average

Revenue-

Revenues

Adjusted

Margin(1)

Utilization (3)

Billable

Generating

EBITDA (1)

Headcount (at

Rate (3)

period end)

Six Months Ended June 30, 2013

Corporate Finance/Restructuring

$195,794

$36,933

18.9%

66%

$412

718

Forensic and Litigation Consulting

205,844

31,563

15.3%

65%

$314

969

Economic Consulting

226,208

46,997

20.8%

86%

$501

499

Technology (2)

97,900

30,604

31.3%

N/M

N/M

285

Strategic Communications (2)

96,045

8,773

9.1%

N/M

N/M

611

Total

$821,791

$154,870

18.8%

3,082

Unallocated Corporate

(29,532)

Adjusted EBITDA (1)

$125,338

15.3%

(1) We define Adjusted EBITDA as consolidated net income before income tax provision, other non-operating income (expense), depreciation, amortization of intangible assets, remeasurement of acquisition-related contingent consideration, special

charges, goodwill impairment charges and losses on early extinguishment of debt. Amounts presented in the Adjusted EBITDA column for each segment reflect the segments’ respective Adjusted Segment EBITDA. We define Adjusted Segment EBITDA as

a segment’s share of consolidated operating income (loss) before depreciation, amortization of intangible assets, remeasurement of acquisition-related contingent consideration, special charges and goodwill impairment charges. We use Adjusted

Segment EBITDA to internally evaluate the financial performance of our segments because we believe it is a useful supplemental measure which reflects current core operating performance and provides an indicator of the segment’s ability to generate

cash. We also believe that these measures, when considered together with our GAAP financial results, provide management and investors with a more complete understanding of our operating results, including underlying trends, by excluding the

effects of remeasurement of acquisition-related contingent consideration, special charges and goodwill impairment charges. In addition, EBITDA is a common alternative measure of operating performance used by many of our competitors. It is used by

investors, financial analysts, rating agencies and others to value and compare the financial performance of companies in our industry. Therefore, we also believe that these measures, considered along with corresponding GAAP measures, provide

management and investors with additional information for comparison of our operating results to the operating results of other companies. Adjusted EBITDA and Adjusted Segment EBITDA are not defined in the same manner by all companies and may

not be comparable to other similarly titled measures of other companies. Margin is equal to Adjusted Segment EBITDA divided by the respective Segment Revenues. These non-GAAP financial measures should be considered in addition to, but not as a

substitute for or superior to, the information contained in our Condensed Consolidated Statements of Comprehensive Income. See also our reconciliation of GAAP to non-GAAP financial measures included in this presentation.

((2)The majority of the Technology and Strategic Communications segments’ revenues are not generated based on billable hours. Accordingly, utilization and average billable rate metrics are not presented as they are not meaningful as a segment-wide

metric.

(3) 2013 utilization and average bill rate calculations for our Corporate Finance/Restructuring, Forensic and Litigation Consulting, and Economic Consulting segments were updated to reflect the realignment of certain practices as well as information

related to non-U.S. operations that was not previously available.

18

|

|

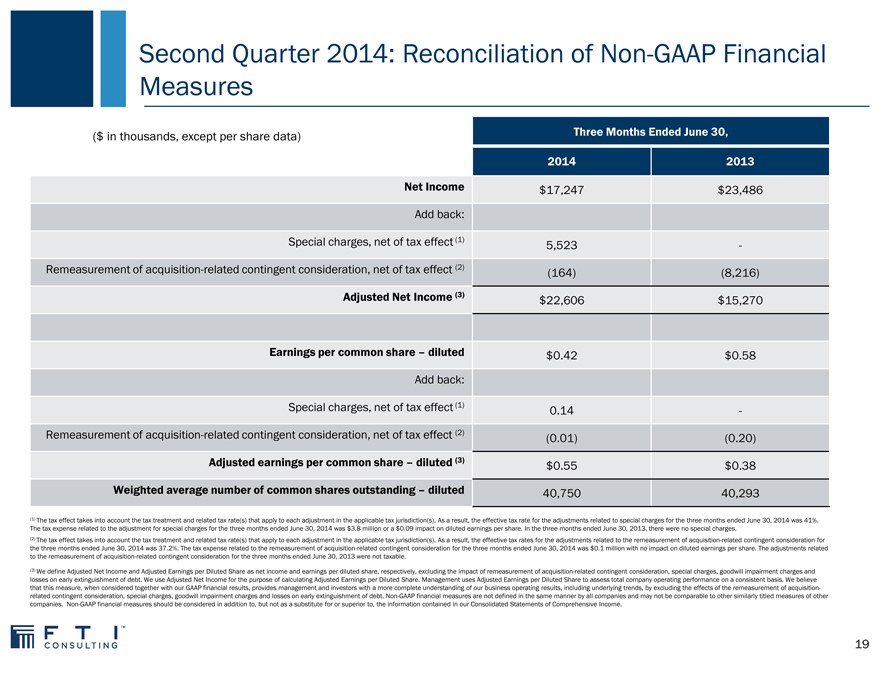

Second Quarter 2014: Reconciliation of Non-GAAP Financial Measures

($ in thousands, except per share data)

Three Months Ended June 30,

2014

2013

Net Income

$17,247

$23,486

Add back:

Special charges, net of tax effect (1)

5,523

-

Remeasurement of acquisition-related contingent consideration, net of tax effect (2)

(164)

(8,216)

Adjusted Net Income (3)

$22,606

$15,270

Earnings per common share – diluted

$0.42

$0.58

Add back:

Special charges, net of tax effect (1)

0.14

-

Remeasurement of acquisition-related contingent consideration, net of tax effect (2)

(0.01)

(0.20)

Adjusted earnings per common share – diluted (3)

$0.55

$0.38

Weighted average number of common shares outstanding – diluted

40,750

40,293

(1) The tax effect takes into account the tax treatment and related tax rate(s) that apply to each adjustment in the applicable tax jurisdiction(s). As a result, the effective tax rate for the adjustments related to special charges for the three months ended June 30, 2014 was 41%.

The tax expense related to the adjustment for special charges for the three months ended June 30, 2014 was $3.8 million or a $0.09 impact on diluted earnings per share. In the three months ended June 30, 2013, there were no special charges.

(2) The tax effect takes into account the tax treatment and related tax rate(s) that apply to each adjustment in the applicable tax jurisdiction(s). As a result, the effective tax rates for the adjustments related to the remeasurement of acquisition-related contingent consideration for

the three months ended June 30, 2014 was 37.2%. The tax expense related to the remeasurement of acquisition-related contingent consideration for the three months ended June 30, 2014 was $0.1 million with no impact on diluted earnings per share. The adjustments related

to the remeasurement of acquisition-related contingent consideration for the three months ended June 30, 2013 were not taxable.

(3) We define Adjusted Net Income and Adjusted Earnings per Diluted Share as net income and earnings per diluted share, respectively, excluding the impact of remeasurement of acquisition-related contingent consideration, special charges, goodwill impairment charges and

losses on early extinguishment of debt. We use Adjusted Net Income for the purpose of calculating Adjusted Earnings per Diluted Share. Management uses Adjusted Earnings per Diluted Share to assess total company operating performance on a consistent basis. We believe

that this measure, when considered together with our GAAP financial results, provides management and investors with a more complete understanding of our business operating results, including underlying trends, by excluding the effects of the remeasurement of acquisition-

related contingent consideration, special charges, goodwill impairment charges and losses on early extinguishment of debt. Non-GAAP financial measures are not defined in the same manner by all companies and may not be comparable to other similarly titled measures of other

companies. Non-GAAP financial measures should be considered in addition to, but not as a substitute for or superior to, the information contained in our Consolidated Statements of Comprehensive Income.

19

|

|

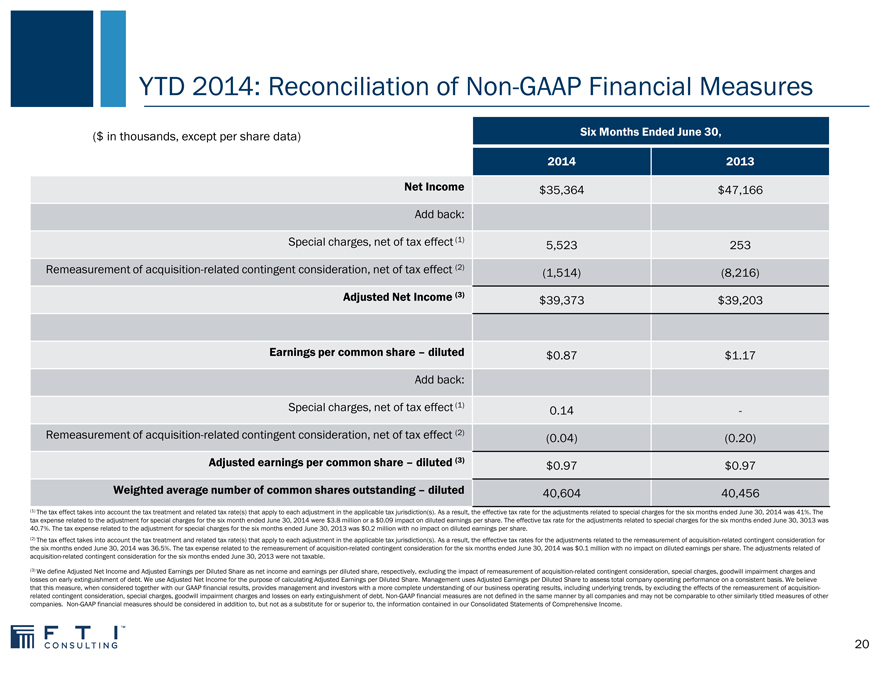

YTD 2014: Reconciliation of Non-GAAP Financial Measures

($ in thousands, except per share data)

Six Months Ended June 30,

2014

2013

Net Income

$35,364

$47,166

Add back:

Special charges, net of tax effect (1)

5,523

253

Remeasurement of acquisition-related contingent consideration, net of tax effect (2)

(1,514)

(8,216)

Adjusted Net Income (3)

$39,373

$39,203

Earnings per common share – diluted

$0.87

$1.17

Add back:

Special charges, net of tax effect (1)

0.14

-

Remeasurement of acquisition-related contingent consideration, net of tax effect (2)

(0.04)

(0.20)

Adjusted earnings per common share – diluted (3)

$0.97

$0.97

Weighted average number of common shares outstanding – diluted

40,604

40,456

(1) The tax effect takes into account the tax treatment and related tax rate(s) that apply to each adjustment in the applicable tax jurisdiction(s). As a result, the effective tax rate for the adjustments related to special charges for the six months ended June 30, 2014 was 41%. The

tax expense related to the adjustment for special charges for the six month ended June 30, 2014 were $3.8 million or a $0.09 impact on diluted earnings per share. The effective tax rate for the adjustments related to special charges for the six months ended June 30, 3013 was

40.7%. The tax expense related to the adjustment for special charges for the six months ended June 30, 2013 was $0.2 million with no impact on diluted earnings per share.

(2) The tax effect takes into account the tax treatment and related tax rate(s) that apply to each adjustment in the applicable tax jurisdiction(s). As a result, the effective tax rates for the adjustments related to the remeasurement of acquisition-related contingent consideration for

the six months ended June 30, 2014 was 36.5%. The tax expense related to the remeasurement of acquisition-related contingent consideration for the six months ended June 30, 2014 was $0.1 million with no impact on diluted earnings per share. The adjustments related of

acquisition-related contingent consideration for the six months ended June 30, 2013 were not taxable.

(3) We define Adjusted Net Income and Adjusted Earnings per Diluted Share as net income and earnings per diluted share, respectively, excluding the impact of remeasurement of acquisition-related contingent consideration, special charges, goodwill impairment charges and

losses on early extinguishment of debt. We use Adjusted Net Income for the purpose of calculating Adjusted Earnings per Diluted Share. Management uses Adjusted Earnings per Diluted Share to assess total company operating performance on a consistent basis. We believe

that this measure, when considered together with our GAAP financial results, provides management and investors with a more complete understanding of our business operating results, including underlying trends, by excluding the effects of the remeasurement of acquisition-

related contingent consideration, special charges, goodwill impairment charges and losses on early extinguishment of debt. Non-GAAP financial measures are not defined in the same manner by all companies and may not be comparable to other similarly titled measures of other

companies. Non-GAAP financial measures should be considered in addition to, but not as a substitute for or superior to, the information contained in our Consolidated Statements of Comprehensive Income.

20

|

|

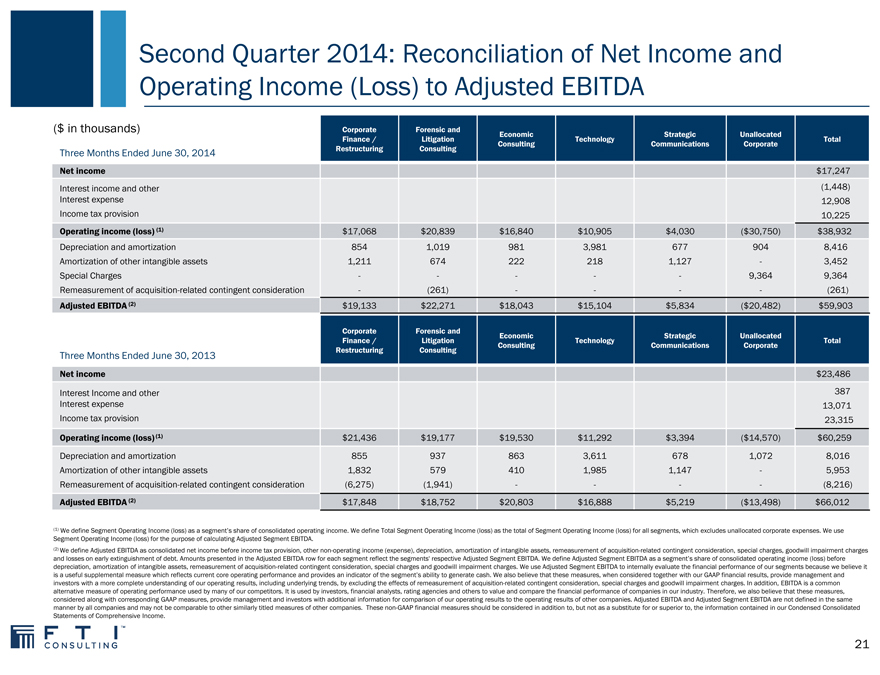

Second Quarter 2014: Reconciliation of Net Income and Operating Income (Loss) to Adjusted EBITDA

($ in thousands) Corporate Forensic and Economic Strategic Unallocated

Finance / Litigation Technology Total

Consulting Communications Corporate

Three Months Ended June 30, 2014 Restructuring Consulting

Net income $17,247

Interest income and other (1,448)

Interest expense 12,908

Income tax provision 10,225

Operating income (loss) (1) $17,068 $20,839 $16,840 $10,905 $4,030 ($30,750) $38,932

Depreciation and amortization 854 1,019 981 3,981 677 904 8,416

Amortization of other intangible assets 1,211 674 222 218 1,127 — 3,452

Special Charges ----- 9,364 9,364

Remeasurement of acquisition-related contingent consideration - (261) ---- (261)

Adjusted EBITDA (2) $19,133 $22,271 $18,043 $15,104 $5,834 ($20,482) $59,903

Corporate Forensic and Economic Strategic Unallocated

Finance / Litigation Technology Total

Consulting Communications Corporate

Three Months Ended June 30, 2013 Restructuring Consulting

Net income $23,486

Interest Income and other 387

Interest expense 13,071

Income tax provision 23,315

Operating income (loss) (1) $21,436 $19,177 $19,530 $11,292 $3,394 ($14,570) $60,259

Depreciation and amortization 855 937 863 3,611 678 1,072 8,016

Amortization of other intangible assets 1,832 579 410 1,985 1,147 - 5,953

Remeasurement of acquisition-related contingent consideration (6,275) (1,941) ---- (8,216)

Adjusted EBITDA (2) $17,848 $18,752 $20,803 $16,888 $5,219 ($13,498) $66,012

(1) We define Segment Operating Income (loss) as a segment’s share of consolidated operating income. We define Total Segment Operating Income (loss) as the total of Segment Operating Income (loss) for all segments, which excludes unallocated corporate expenses. We use

Segment Operating Income (loss) for the purpose of calculating Adjusted Segment EBITDA.

(2) We define Adjusted EBITDA as consolidated net income before income tax provision, other non-operating income (expense), depreciation, amortization of intangible assets, remeasurement of acquisition-related contingent consideration, special charges, goodwill impairment charges

and losses on early extinguishment of debt. Amounts presented in the Adjusted EBITDA row for each segment reflect the segments’ respective Adjusted Segment EBITDA. We define Adjusted Segment EBITDA as a segment’s share of consolidated operating income (loss) before

depreciation, amortization of intangible assets, remeasurement of acquisition-related contingent consideration, special charges and goodwill impairment charges. We use Adjusted Segment EBITDA to internally evaluate the financial performance of our segments because we believe it

is a useful supplemental measure which reflects current core operating performance and provides an indicator of the segment’s ability to generate cash. We also believe that these measures, when considered together with our GAAP financial results, provide management and

investors with a more complete understanding of our operating results, including underlying trends, by excluding the effects of remeasurement of acquisition-related contingent consideration, special charges and goodwill impairment charges. In addition, EBITDA is a common

alternative measure of operating performance used by many of our competitors. It is used by investors, financial analysts, rating agencies and others to value and compare the financial performance of companies in our industry. Therefore, we also believe that these measures,

considered along with corresponding GAAP measures, provide management and investors with additional information for comparison of our operating results to the operating results of other companies. Adjusted EBITDA and Adjusted Segment EBITDA are not defined in the same

manner by all companies and may not be comparable to other similarly titled measures of other companies. These non-GAAP financial measures should be considered in addition to, but not as a substitute for or superior to, the information contained in our Condensed Consolidated

Statements of Comprehensive Income.

21

|

|

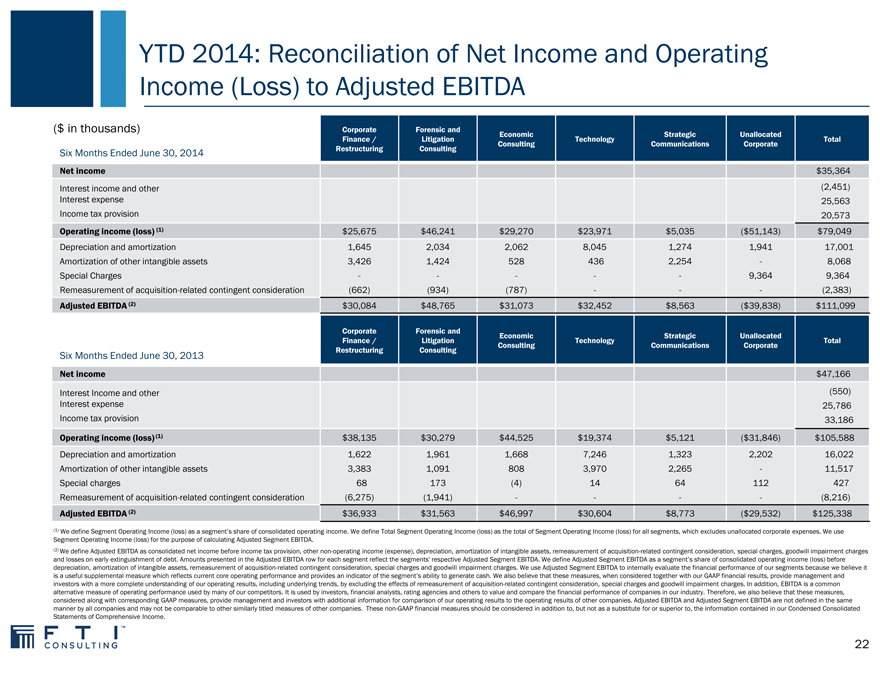

YTD 2014: Reconciliation of Net Income and Operating Income (Loss) to Adjusted EBITDA

($ in thousands) Corporate Forensic and Economic Strategic Unallocated

Finance / Litigation Technology Total

Consulting Communications Corporate

Six Months Ended June 30, 2014 Restructuring Consulting

Net income $35,364

Interest income and other (2,451)

Interest expense 25,563

Income tax provision 20,573

Operating income (loss) (1) $25,675 $46,241 $29,270 $23,971 $5,035 ($51,143) $79,049

Depreciation and amortization 1,645 2,034 2,062 8,045 1,274 1,941 17,001

Amortization of other intangible assets 3,426 1,424 528 436 2,254 - 8,068

Special Charges ----- 9,364 9,364

Remeasurement of acquisition-related contingent consideration (662) (934) (787) --- (2,383)

Adjusted EBITDA (2) $30,084 $48,765 $31,073 $32,452 $8,563 ($39,838) $111,099

Corporate Forensic and Economic Strategic Unallocated

Finance / Litigation Technology Total

Consulting Communications Corporate

Six Months Ended June 30, 2013 Restructuring Consulting

Net income $47,166

Interest Income and other (550)

Interest expense 25,786

Income tax provision 33,186

Operating income (loss) (1) $38,135 $30,279 $44,525 $19,374 $5,121 ($31,846) $105,588

Depreciation and amortization 1,622 1,961 1,668 7,246 1,323 2,202 16,022

Amortization of other intangible assets 3,383 1,091 808 3,970 2,265 - 11,517

Special charges 68 173 (4) 14 64 112 427

Remeasurement of acquisition-related contingent consideration (6,275) (1,941) ---- (8,216)

Adjusted EBITDA (2) $36,933 $31,563 $46,997 $30,604 $8,773 ($29,532) $125,338

(1) We define Segment Operating Income (loss) as a segment’s share of consolidated operating income. We define Total Segment Operating Income (loss) as the total of Segment Operating Income (loss) for all segments, which excludes unallocated corporate expenses. We use

Segment Operating Income (loss) for the purpose of calculating Adjusted Segment EBITDA.

(2) We define Adjusted EBITDA as consolidated net income before income tax provision, other non-operating income (expense), depreciation, amortization of intangible assets, remeasurement of acquisition-related contingent consideration, special charges, goodwill impairment charges

and losses on early extinguishment of debt. Amounts presented in the Adjusted EBITDA row for each segment reflect the segments’ respective Adjusted Segment EBITDA. We define Adjusted Segment EBITDA as a segment’s share of consolidated operating income (loss) before

depreciation, amortization of intangible assets, remeasurement of acquisition-related contingent consideration, special charges and goodwill impairment charges. We use Adjusted Segment EBITDA to internally evaluate the financial performance of our segments because we believe it

is a useful supplemental measure which reflects current core operating performance and provides an indicator of the segment’s ability to generate cash. We also believe that these measures, when considered together with our GAAP financial results, provide management and

investors with a more complete understanding of our operating results, including underlying trends, by excluding the effects of remeasurement of acquisition-related contingent consideration, special charges and goodwill impairment charges. In addition, EBITDA is a common

alternative measure of operating performance used by many of our competitors. It is used by investors, financial analysts, rating agencies and others to value and compare the financial performance of companies in our industry. Therefore, we also believe that these measures,

considered along with corresponding GAAP measures, provide management and investors with additional information for comparison of our operating results to the operating results of other companies. Adjusted EBITDA and Adjusted Segment EBITDA are not defined in the same

manner by all companies and may not be comparable to other similarly titled measures of other companies. These non-GAAP financial measures should be considered in addition to, but not as a substitute for or superior to, the information contained in our Condensed Consolidated

Statements of Comprehensive Income.

22

|

|

Critical Thinking at the Critical Time ™