Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TELEFLEX INC | d764805d8k.htm |

TELEFLEX INCORPORATED

SECOND QUARTER 2014

EARNINGS CONFERENCE CALL

1

Exhibit 99.1 |

Conference Call Logistics

The release, accompanying slides, and replay webcast are available online at

www.teleflex.com (click on “Investors”)

Telephone replay available by dialing 888-286-8010 or for international

calls, 617- 801-6888, pass code number 18970797

2 |

Introductions

Benson Smith

Chairman, President and CEO

Thomas Powell

Executive Vice President and CFO

Jake Elguicze

Treasurer and Vice President of Investor Relations

3 |

Forward-Looking Statements/Non-GAAP Financial Measures

This presentation and our discussion contain forward-looking information and

statements including, but not limited to, forecasted

2014

constant

currency

revenue

growth,

adjusted

gross

margins,

adjusted

operating

margins

excluding

intangible

amortization expense and adjusted earnings per share; and other matters which

inherently involve risks and uncertainties which could cause actual results to

differ from those projected or implied in the forward–looking statements. These risks and

uncertainties are addressed in our SEC filings, including our most recent Form

10-K. This presentation includes the following non-GAAP financial

measures: Reconciliation of these non-GAAP financial measures to the most

comparable GAAP measures is contained within this presentation.

Unless otherwise noted, the following slides reflect continuing operations.

4

•

Adjusted diluted earnings per share. This measure excludes, depending on the

period presented (i) the effect of charges associated with our restructuring

programs, as well as goodwill and other asset impairment charges; (ii) losses and other

charges related to acquisition and integration costs, the reversal of liabilities

related to certain contingent consideration arrangements, the establishment

of a litigation reserve and a litigation verdict against the Company with respect to a non-

operating

joint

venture;

(iii)

amortization

of

the

debt

discount

on

the

Company’s

convertible

notes;

(iv)

intangible

amortization expense; and (v) tax benefits resulting from the resolution of, or

expiration of the statute of limitations with respect

to,

prior

years’

tax

matters.

In

addition,

the

calculation

of

diluted

shares

within

adjusted

earnings

per

share

gives

effect to the anti-dilutive impact of the Company’s convertible note hedge

agreements, which reduce the potential economic dilution that otherwise would

occur upon conversion of the Company’s senior subordinated convertible notes

(under GAAP, the anti-dilutive impact of the convertible note hedge agreements

is not reflected in diluted shares). •

Constant currency revenue growth. This measure excludes the impact of

translating the results of international subsidiaries

at

different

currency

exchange

rates

from

period

to

period.

•

Adjusted gross margin. This measure excludes the impact of certain losses and

other charges, primarily related to acquisition and integration costs.

•

Adjusted operating margin excluding intangible amortization expense. This

measure excludes (i) the impact of restructuring and other impairment

charges, (ii) losses and other charges primarily related to the reversal of contingent

consideration liabilities and acquisition and integration costs and (iii) the impact

of intangible amortization expense. •

Adjusted tax rate. This measure is the percentage of the Company’s

adjusted taxes on income from continuing operations to

its

adjusted

income

from

continuing

operations

before

taxes.

Adjusted

taxes

on

income

from

continuing

operations

excludes, depending on the period presented, the impact of tax benefits or costs

associated with (i) restructuring and impairment charges, (ii) amortization

of the debt discount on the Company’s convertible notes, (iii) intangible amortization

expense,

(iv)

the

resolution

of,

or

expiration

of

statutes

of

limitations

with

respect

to,

various

prior

years’

tax

matters

and

(v) losses and other charges related to related to acquisition and integration costs

and the reversal of liabilities related to certain contingent consideration

arrangements. |

SECOND

QUARTER

2014

HIGHLIGHTS

5 |

Second

Quarter Highlights Second quarter constant currency revenue growth and adjusted

earnings per share achievement exceeded our expectations

Revenue of $468.1 million, up 11.4% vs. prior year period on an as-

reported basis; up 10.1% vs. prior year period on a constant currency

basis

Adjusted EPS of $1.51, up 18.9% vs. prior year

6 |

Second

Quarter Highlights Improvement in the average selling prices of products

contributes 193 bps of top-line growth in Q2’14 compared to

Q2’13 102 bps improvement in sales of existing products in Q2’14

compared to Q2’13 resulting from modest improvement in end-market

utilization New product introductions contribute 73 bps of top-line

growth in Q2’14 compared to Q2’13

Continue to expand GPO & IDN relationships

•

14 renewed agreements (9 GPO; 5 IDN)

7 |

Second

Quarter Highlights Vidacare contributes 5.1% to Teleflex’s constant

currency revenue growth •

Q2’14 revenue of $21.3 million, ahead of initial internal expectations

•

Q2’14 revenue up ~ 30% versus Q2’13 on an as-reported basis

•

Integration activities on schedule

•

Continue to invest in additional clinical training and cadaver lab

workshops to drive future sustainable revenue growth

8 |

ARROW-Clark™

VectorFlow™

Chronic Hemodialysis Catheter

Second Quarter Highlights

9

Received FDA 510(k) clearance to market the

ARROW-Clark ™

VectorFlow ™

Chronic

Hemodialysis Catheter.

PRODUCT UPDATE

ARROW-Clark ™

VectorFlow ™

Chronic

Hemodialysis Catheter features a

symmetrical tip design that allows ease of

placement and sustained high flows with

minimal recirculation. The ARROW-Clark ™

VectorFlow ™

Catheter is the only catheter

with an innovative tip designed to produce a

helical, three-dimensional transition of blood

entering and leaving the catheter.

PRODUCT DESCRIPTION |

LMA

SureSeal™ PreCurved

LMA SureSeal™

PreCurved was developed

from the assets acquired from Ultimate

Medical and benefits the LMA™

portfolio by

giving customers the option of a first

generation, fixed curve device for ease of

insertion, with a silicone cuff for improved

patient comfort.

PRODUCT DESCRIPTION

Second Quarter Highlights

PRODUCT UPDATE

10

Announced the European launch of the CE

Marked LMA SureSeal™

PreCurved. |

ARROW®

GPSCath®

Balloon Dilatation Catheters

Second Quarter Highlights

11

Received FDA 510(k) clearance to market the

ARROW®

GPSCath®

Balloon Dilatation

Catheters designed for use with .014”

guide

wires and in 150 cm length.

PRODUCT UPDATE

ARROW®

GPSCath®

Balloon Dilatation

Catheters combine angioplasty and targeted

injection in one device for use in below the

knee peripheral angioplasty procedures.

Enables clinicians to inject selected fluids,

such as contrast media, while maintaining

guide wire position.

PRODUCT DESCRIPTION |

Mayo

Healthcare Pty Ltd. •

Contributed 2.24% to Teleflex’s constant currency revenue growth in Q2;

mixture of additional volume and improved pricing

•

Integration activities on schedule

Second Quarter Highlights

12 |

SECOND QUARTER 2014 FINANCIAL REVIEW

13 |

Financial Results

Revenue of $468.1 million

•

Up 11.4% vs. prior year period on an as-reported basis

•

Up 10.1% vs. prior year period on a constant currency basis

Adjusted gross margin of 52.3%

•

Up 254 bps vs. prior year period

Adjusted operating margin excluding intangible amortization expense of 21.0%,

up 109 bps vs. prior year period

Adjusted tax rate of 22.3%, down 370 bps versus prior year period

Adjusted EPS of $1.51, up 18.9% vs. prior year period

14 |

Financial Results

15

•

Up 114% vs. prior year period

•

Repatriated $230 million of foreign cash; used repatriated cash to partially fund a

$235 million repayment of borrowings under revolving credit facility

•

Issued

$250

million

of

5.25%

senior

unsecured

notes

due

in

2024;

used

proceeds

to partially fund a $245 million repayment of borrowings under revolving credit

facility

Cash flow from operations for the first six months of 2014 of $120.2 million

Improved Balance Sheet

Announced manufacturing footprint rationalization plan to improve the

Company’s cost structure |

SECOND QUARTER 2014 SEGMENT REVENUE REVIEW

16 |

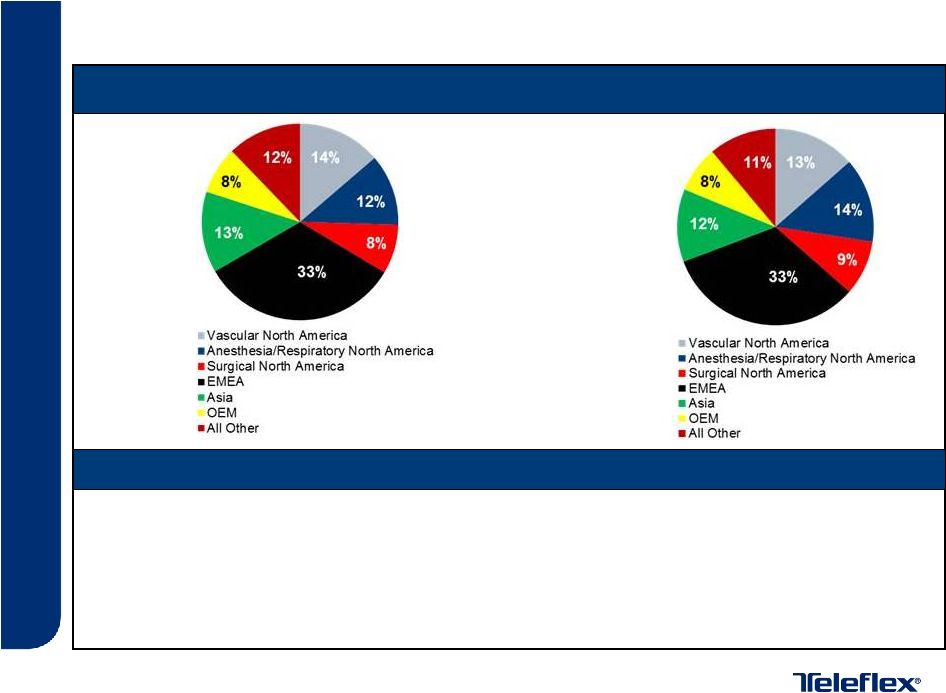

Segment Revenue Review

Q2’14

Q2’13

Vascular N.A: $64.2 million, up 13.5%

Anesthesia/Respiratory N.A: $55.0 million, down 5.7%

Surgical N.A: $38.0 million, up 1.3%

EMEA: $154.7 million, up 7.3%

Asia: $62.5 million, up 25.2%

OEM: $36.6 million, up 13.1%

All Other: $57.1 million, up 23.0%

Note:

Increases and decreases in revenue referred to above are as compared to results

for the second quarter of 2013. 17

Constant Currency Revenue Commentary |

2014 FINANCIAL OUTLOOK

18 |

2014

Financial Outlook 19

2014 guidance ranges reaffirmed:

2014 adjusted earnings per share guidance range increased:

•

Constant currency revenue growth of 7% to 9%

•

Adjusted gross margin of 52.0% to 52.5%

•

Adjusted operating margin excluding intangible amortization

expense of 20% to 21%

•

2014 guidance range for adjusted diluted earnings per share

increased from $5.35 to $5.55 to $5.45 to $5.60 |

QUESTION & ANSWER

20 |

APPENDICES

21 |

Appendix A –

Reconciliation of Segment Constant Currency Revenue Growth

Dollars in Millions

22

June 29, 2014

June 30, 2013

Constant Currency

Currency

Total

Vascular

North

America

64.2

$

56.8

$

13.5%

(0.4%)

13.1%

Anesthesia/Respiratory

North

America

55.0

58.5

(5.7%)

(0.2%)

(5.9%)

Surgical

North

America

38.0

37.8

1.3%

(0.7%)

0.6%

EMEA

154.7

137.8

7.3%

4.9%

12.2%

Asia

62.5

50.4

25.2%

(1.1%)

24.1%

OEM

36.6

32.1

13.1%

0.9%

14.0%

All Other

57.1

46.7

23.0%

(0.7%)

22.3%

Net

Revenues

468.1

$

420.1

$

10.1%

1.3%

11.4%

Three Months Ended

% Increase / (Decrease) |

Appendix B –

Reconciliation of Revenue Growth

Dollars in Millions

23

Year-over-

year growth

Three Months Ended June 30, 2013 Revenue As-Reported

$420.1

Foreign Currency

5.5

1.32%

Vidacare

21.3

5.07%

Mayo

9.4

2.24%

All other

11.8

2.80%

Three Months Ended June 29, 2014 Revenue As-Reported

$468.1

11.4% |

24

Appendix C –

Reconciliation of Teleflex Gross Profit and Margin

June 29, 2014

June 30, 2013

Teleflex gross profit as-reported

244,088

$

209,490

$

Teleflex gross margin

as-reported 52.1%

49.9%

Losses and other charges (A)

880

(319)

Adjusted Teleflex gross profit

244,968

$

209,171

$

Adjusted Teleflex gross

margin 52.3%

49.8%

Teleflex revenue as-reported

468,105

$

420,059

$

$ thousands

Three Months Ended

A:

In

2014

losses

and

other

charges

primarily

relate

to

facility

consolidation

costs.

In

2013,

losses

and

other

charges

primarily

relate

to

acquisition

and

integration

costs. |

25

Appendix D –

Reconciliation of Teleflex Operating Profit and Margin

June 29, 2014

June 30, 2013

Teleflex income from continuing operations before interest and taxes

74,752

$

63,751

$

Teleflex income from continuing operations before interest and taxes margin

16.0%

15.2%

Restructuring and other impairment charges

7,623

12,962

Losses and other charges (A)

(178)

(5,195)

Adjusted Teleflex income from continuing operations before interest and taxes

82,197

$

71,518

$

Adjusted Teleflex income from continuing operations before interest and taxes

margin

17.6%

17.0%

Intangible amortization expense

16,083

12,113

Adjusted Teleflex income from continuing operations before interest, taxes and

intangible amortization expense

98,280

$

83,631

$

Adjusted Teleflex income from continuing operations before interest, taxes and

intangible amortization expense margin

21.0%

19.9%

Teleflex revenue as-reported

468,105

$

420,059

$

$ thousands

Three Months Ended

A:

In 2014, losses and other charges primarily relate to the reversal of contingent

consideration liabilities; acquisition and integration costs; and charges

related to facility consolidations. In 2013, losses and other charges primarily relate to the reversal of contingent

consideration liabilities; and acquisition and integration costs.

|

Appendix E –

EPS Reconciliation from Continuing Operations

Quarter Ended –

June 29, 2014

Dollars in millions, except per share data

26

Cost of

goods

sold

Research and

development

expenses

Restructuring

and other

impairment

charges

Interest

expense,

net

Income

taxes

Net income (loss)

attributable to common

shareholders from

continuing operations

GAAP Basis

$224.0

$14.9

$7.6

$15.9

$10.0

$48.4

$1.04

46,392

Adjustments

Restructuring and

other impairment

charges

Losses and other

charges (A)

Amortization of

debt discount on

convertible notes

Intangible

amortization

expense

—

—

—

—

4.4

11.7

$0.25

—

Tax adjustment (B)

—

—

—

—

—

—

$0.00

—

Shares due to

Teleflex under

note hedge (C)

Adjusted basis

$223.1

$14.8

—

$12.9

$19.0

$65.9

$1.51

43,678

(A) In 2014, losses and other charges include approximately ($4.4) million, net of tax, or

($0.09) per share, related to the reversal of contingent consideration liabilities; and

approximately $4.2 million, net of tax, or $0.09 per share, related to acquisition and integration costs, and charges related to facility consolidation.

(B) The tax adjustment represents a net benefit resulting from the resolution of, or the

expiration of statute of limitations with respect to various prior years’ U.S. federal,

state and foreign tax matters. (C) Adjusted diluted shares are calculated by giving effect

to the anti-dilutive impact of the Company’s convertible note hedge agreements, which reduce the

potential economic dilution that otherwise would occur upon conversion of our senior subordinated

convertible notes. Under GAAP, the anti-dilutive impact of the convertible note hedge

agreements is not reflected in diluted shares. $0.09

(2,714)

$131.9

—

16.1

—

—

—

—

—

—

—

—

$0.00

—

—

—

—

—

3.0

1.1

1.9

$0.04

4.2

$0.09

—

0.9

(1.1)

0.1

—

—

—

(0.2)

—

—

—

7.6

—

3.5

Diluted

earnings per

share available

to common

shareholders

Shares used

in calculation

of GAAP and

adjusted

earnings per

share

$146.8

Selling, general and

administrative

expenses |

Appendix F –

EPS Reconciliation from Continuing Operations

Quarter Ended –

June 30, 2013

Dollars in millions, except per share data

27

Selling, general and

administrative

expenses

Research and

development

expenses

Restructuring

and other

impairment

charges

Interest

expense,

net

Income

taxes

Net income (loss)

attributable to common

shareholders from

continuing operations

GAAP Basis

$116.3

$16.5

$13.0

$14.3

$6.1

$43.2

$0.99

43,429

Adjustments

Restructuring and

other impairment

charges

Losses and other

charges (A)

(4.9)

—

—

—

0.8

(6.0)

($0.13)

—

Amortization of

debt discount on

convertible notes

Intangible

amortization

expense

12.1

—

—

—

4.2

7.9

$0.18

—

Tax adjustment (B)

Shares due to

Teleflex under note

hedge (C)

Adjusted basis

$109.0

$16.5

—

$11.5

$18.7

$53.2

$1.27

41,915

$0.04

(1,514)

$210.9

4.7

(4.7)

($0.11)

—

—

—

—

—

—

—

1.0

1.8

—

—

—

—

—

—

—

—

—

—

—

—

2.8

$0.04

—

2.0

11.0

$0.25

—

(0.3)

$210.6

—

—

—

13.0

(A) In 2013, losses and other charges include approximately ($7.1) million, net of tax, or ($0.16) per

share, related to the reversal of contingent consideration liabilities; approximately $1.5

million, net of tax, or $0.04 per share, related to acquisition and integration costs; and approximately ($0.4) million, net of tax, or

($0.01) per share, related to a reserve reversal associated with a previously announced stock keeping

unit (“SKU”) rationalization charge. (B) The tax adjustment represents a net

benefit resulting from the resolution of, or the expiration of statute of limitations with respect to various prior years’ U.S.

federal, state and foreign tax matters.

(C) Adjusted diluted shares are calculated by giving effect to the anti-dilutive impact of

the Company’s convertible note hedge agreements, which reduce the potential economic

dilution that otherwise would occur upon conversion of our senior subordinated convertible notes. Under GAAP, the anti-dilutive impact of the

convertible note hedge agreements is not reflected in diluted shares.

Cost of

goods

sold

Diluted

earnings per

share available

to common

shareholders

Shares used

in calculation

of GAAP and

adjusted

earnings per

share |

28

Appendix G –

Reconciliation of Teleflex Tax Rate

Dollars in Thousands

Three Months Ended June 29, 2014

Income from

continuing

operations

before taxes

Taxes on

income from

continuing

operations

Tax rate

GAAP basis

$58,836

$10,006

17.0%

Restructuring and impairment charges

7,623

3,467

Losses and other charges (A)

(178)

5

Amortization of debt discount on convertible notes

3,012

1,100

Intangible amortization expense

16,083

4,410

Tax adjustment (B)

0

46

Adjusted basis

$85,376

$19,034

22.3%

Three Months Ended June 30, 2013

GAAP basis

$49,483

$6,082

12.3%

Restructuring and impairment charges

12,962

1,990

Losses and other charges (A)

(5,195)

810

Amortization of debt discount on convertible notes

2,790

1,019

Intangible amortization expense

12,113

4,186

Tax adjustment (B)

0

4,660

Adjusted basis

$72,153

$18,747

26.0%

(A) In 2014, losses and other charges primarily relate to the reversal of contingent

consideration liabilities, acquisition and integration costs, and charges related to facility

consolidations. In 2013, losses and other charges primarily relate to the reversal of

contingent consideration liabilities and acquisition and integration costs. (B) The tax

adjustment represents a net benefit resulting from the resolution of, or the expiration of statute of limitations

with respect to various prior years’ U.S. federal, state and foreign tax matters.

|

Appendix H –

Reconciliation of 2014 Constant Currency Revenue Growth Guidance

29

Low

High

Forecasted GAAP Revenue Growth

7.0%

9.0%

Estimated impact of foreign currency fluctuations

Forecasted Constant Currency Revenue Growth

7.0%

9.0% |

Appendix I –

Reconciliation of 2014 Gross Margin Guidance

30

Note:

In

2014,

losses

and

other

charges

relate

to

expenses

associated

with

the

Restructuring

Plan

approved

by

the

Board

of

Directors

on

April

28,

2014.

Low

High

GAAP Gross Margin

51.35%

51.80%

Losses and other charges

0.65%

0.70%

Adjusted Gross Margin

52.00%

52.50% |

Appendix J –

Reconciliation of 2014 Operating Margin Guidance

31

Note:

In 2014, losses and other charges include expenses associated with the Restructuring

Plan approved by the Board of Directors on April 28, 2014, acquisition costs

and the reversal of contingent consideration liabilities. Low

High

GAAP Operating Margin

15.8%

16.7%

Losses and other charges

0.7%

0.8%

Adjusted Operating Margin

16.5%

17.5%

Intangible amortization expense

3.5%

3.5%

Adjusted Operating Margin Excluding Intangible Amortization Expense

20.0%

21.0% |

Appendix K –

Reconciliation of 2014 Adjusted Earnings per Share Guidance

32

Low

High

Forecasted diluted earnings per share attributable to

common shareholders

$3.50

$3.60

Restructuring, impairment charges, and special items,

net of tax

$0.85

$0.90

Intangible amortization expense, net of tax

$0.93

$0.93

Amortization of debt discount on convertible notes,

net of tax

$0.17

$0.17

Forecasted adjusted diluted earnings per share

$5.45

$5.60 |