Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SOUTHERN COPPER CORP/ | a14-18030_18k.htm |

Exhibit 99.1

|

|

Investor Relations:

Raul Jacob (602) 264-1375 southerncopper@southernperu.com.pe www.southerncoppercorp.com

|

July 28, 2014 - Southern Copper Corporation (NYSE and BVL: SCCO)

· Second quarter 2014 (“2Q14”) net sales were $1,487.4 million, 9.8% higher than 1Q14 net sales of $1,354.4 million, mainly due to higher sales volume of copper (+7.1%), molybdenum (+5.7%) and silver (+15.6%) and higher prices of molybdenum (+35.4%) and zinc (+2.2%) partially offset by lower copper (-3.4%) and silver prices (-4.1%).

|

|

|

|

|

|

|

|

· EBITDA1 in 2Q14 was $707.6 million, 5.7% higher than the $669.2 million in 1Q14. However, the margin decreased from 49.4% to 47.6% mainly due to an increase in cost of sales due to fuel, spare parts, tires and reagent costs.

|

· Net income in 2Q14 was $337.3 million (22.7% of net sales), 4.3% higher than net income of $323.4 million (23.9% of sales) in the 1Q14. Net Income in the first six months of 2014 (“6M14”) was $660.6 million.

· Copper mine production increased by 2,183 tons or 1.3% in 2Q14 compared with 1Q14, due to initial production from our new Buenavista SXEW III plant which started commercial production in the second quarter, higher production at La Caridad mine due to higher recoveries and at the Toquepala mine due to higher ore grades and recoveries. Molybdenum production increased by 4.6% in 2Q14 compared with 1Q14. The 257 ton increase in molybdenum production was mainly result of the production at the new Buenavista’s molybdenum plant (+202 tons).

· Operating cash costii per pound of copper net of by-product credits was $0.92 in 2Q14, a decrease of 10.0% compared to $1.02 in 1Q14 mainly due to higher molybdenum sales volume and prices. Operating cash cost per pound of copper before by-product credits was $1.98 in 2Q14.

· Capital expenditures were $375.6 million for 2Q14, 16% higher than 1Q14, and represented 111.4% of net income. We continue moving forward with our capital expansion program, which will increase copper production capacity by approximately 87% from 630,000 tons last year to 1,175,000 tons by 2017. As of 1H14, capital expenditures are $699 million, which in addition to the committed amounts represent 60% of the 2014 budget of $2,188 million.

· Dividends: On July 24 2014, the Board of Directors authorized a dividend of $0.12 per share payable on August 28, 2014, to shareholders of record at the close of business on August 15, 2014.

|

|

|

|

|

|

|

|

|

SECOND QUARTER AND SIX MONTHS 2014 RESULTS |

|

SOUTHERN COPPER |

|

|

|

|

|

|

· Our Caterpillar trucks were awarded the availability world record. In April 2014, our Peruvian operations were recognized by Caterpillar International for its best practices operating these 400 ton large-capacity trucks by our personnel at the Toquepala and Cuajone mines.

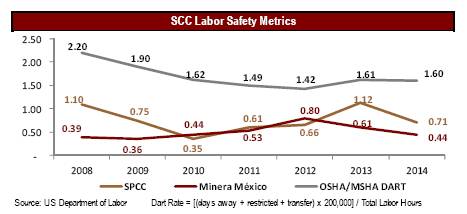

· Open Pit Operations Labor Safety. Southern Copper labor safety metrics at 1H14 have been over 60% better than the US Department of Labor OSHA/MSHA Dart Rate benchmark for mining operations.

Commenting on the Company’s results, Mr. German Larrea, Chairman of the Board, said “In the first six months of this year we are seeing, with satisfaction, the initial benefits of Southern Copper’s program to increase shareholder’s value through higher production and cost efficiencies. Our operations have increased copper production by 10.6% year to date while reducing cash cost per pound before by-product credits by 2 cents. This positive result has been reinforced by higher molybdenum production and price, reducing our cash cost with by-product credits to $0.92 per pound, or 10% lower in this past quarter.

At the current price environment, we expect to improve Southern Copper results during the second half of 2014 as the low cost, 120,000 ton capacity, SXEW III copper plant in Buenavista will reach full capacity during the third quarter. For 2015, our new Buenavista concentrator will add 188,000 tons of copper and 2,600 tons of molybdenum of additional capacity which will further improve Southern Copper’s profitability and return.”

|

|

Second Quarter |

First Six Months | |||||||||||||||

|

2014 |

2013 |

Variance |

2014 |

2013 |

Variance | ||||||||||||

|

$ |

% |

$ |

% |

| |||||||||||||

|

(in millions except per share amount and %s) | |||||||||||||||||

|

Sales |

|

$1,487.4 |

|

$1,410.2 |

|

$77.2 |

|

5.5% |

|

$2,841.8 |

|

$3,033.2 |

|

$(191.4) |

|

(6.3)% |

|

|

Cost of sales |

|

726.6 |

|

711.2 |

|

15.4 |

|

2.2% |

|

1,368.5 |

|

1,434.0 |

|

(65.5) |

|

(4.6)% |

|

|

Operating income |

|

597.2 |

|

566.4 |

|

30.8 |

|

5.4% |

|

1,160.2 |

|

1,340.3 |

|

(180.1) |

|

(13.4)% |

|

|

EBITDA1 |

|

707.6 |

|

676.8 |

|

30.8 |

|

4.6% |

|

1,376.7 |

|

1,542.2 |

|

(165.5) |

|

(10.7)% |

|

|

EBITDA margin |

|

47.6% |

|

48.0% |

|

(0.4)% |

|

0.8pp |

|

48.4% |

|

50.8 |

% |

(2.4)% |

|

4.7pp |

|

|

Net income |

|

$337.3 |

|

$372.7 |

|

$(35.4) |

|

(9.5)% |

|

$660.6 |

|

$868.1 |

|

$(207.5) |

|

(23.9)% |

|

|

Net income margin |

|

22.7% |

|

26.4% |

|

(3.8)% |

|

(14.2)pp |

|

23.2% |

|

28.6 |

% |

(5.4)% |

|

(18.8)pp |

|

|

Income per share |

|

$0.40 |

|

$0.44 |

|

$(0.04) |

|

(8.3)% |

|

$0.79 |

|

$1.03 |

|

$(0.23) |

|

(22.8)% |

|

|

Capital expenditures |

|

$375.6 |

|

$385.5 |

|

$(9.9) |

|

(2.6)% |

|

$699.4 |

|

$702.3 |

|

$(2.9) |

|

(0.4)% |

|

|

Exploration |

|

$22.1 |

|

$11.6 |

|

$10.5 |

|

90.5% |

|

$36.7 |

|

$22.0 |

|

$14.7 |

|

66.8% |

|

1 http://www.southerncoppercorp.com/ENG/invrel/Pages/PGEbitda.aspx

|

2Q14 |

www.southerncoppercorp.com |

|

|

|

|

|

|

|

|

|

SECOND QUARTER AND SIX MONTHS 2014 RESULTS |

|

SOUTHERN COPPER |

|

|

|

|

|

|

Capital Expenditures

The current status of our major capital expenditure projects is the following:

Mexican Projects

Buenavista Projects. - We continue developing our $3.4 billion investment program at this unit which is expected to increase its copper production capacity by approximately 175% as well as our molybdenum production.

The new Copper Molybdenum Concentrator has an annual production capacity of 188,000 tons of copper and 2,600 tons of molybdenum. The project will additionally produce 2.3 million ounces of silver and 21,000 ounces of gold per year. The project has an 80.7% progress with an investment of $772.2 million out of the approved capital budget of $1,383.6 million. The project is expected to be completed in the first half of 2015. All major equipment is on site and 72.5% has been installed.

To date we have received sixty-one 400-tons capacity trucks, 7 shovels and 8 drills required for the mine expansion; with an investment of $510.8 million.

The first copper cathode in our SXEW III plant was produced last June. The first of three Solvent Extraction trains started operations, as well as 50% of our Electro Winning Plant. Full capacity is expected to be reached by the end of 3Q14, with an annual production of 120,000 tons per year. The capital budget for this project is $444.0 million of which 99% has been invested.

Crushing, conveying and spreading system for leachable ore (Quebalix IV). This project will increase production by improving SXEW copper recovery, reducing processing time and hauling costs. It has a crushing and conveying capacity of 80 million tons per year and is expected to be completed in the fourth quarter of 2015. The project has a 37.6% progress with an investment of $70.2 million out of the approved capital budget of $340 million. The Mobile Stacking Conveyor and the Overland Conveyor contracts have been assigned.

The remaining projects to complete the $3.4 billion budgeted program include important investments in infrastructure (power lines and substations, water supply, tailings dam, mine equipment shops, internal roads, etc.).

Peruvian Projects

Toquepala Projects. - Through June 30, 2014, we have invested a total $309.8 million on Toquepala projects. On July 1, 2014 we received the comments from the authorities and stakeholders related the EIA of the Toquepala concentrator expansion, which we expect to answer during the third quarter of 2014. We expect to receive the EIA approval by year end and continue developing this project. The Toquepala concentrator expansion will increase annual production capacity by 100,000 tons of copper and 3,100 tons of molybdenum.

Cuajone Projects. - Through June 30, 2014, we have invested $38.3 million of a budget of $45 million on the HPGR project, which will produce a more finely crushed material. This project continues in the ramping up stage and we expect to reach full capacity during the third quarter of 2014. The project will generate cost savings, improve copper recovery and reduce power consumption in the crushing process. Through June 2014, the implementation of the HPGR project and the variable cut-off ore grade project, implemented in 2013, has produced incremental production of approximately 13,000 tons of copper. When fully operational, we expect an annual increment in copper production of 22,000 tons.

The project to improve slope stability at the south area of the Cuajone mine, will remove approximately 148 million tons of waste material over a three-year period. This project will improve mine design without reducing current

|

2Q14 |

www.southerncoppercorp.com |

|

|

|

|

|

|

|

|

|

SECOND QUARTER AND SIX MONTHS 2014 RESULTS |

|

SOUTHERN COPPER |

|

|

|

|

|

|

production level. The mine equipment acquired includes one shovel, five 400-tons capacity trucks, one drill and auxiliary equipment which will be reallocated to our mine operations once the project is finished. Besides preparing the mine for the future, this investment will avoid a reduction in average ore grade. At June 30, 2014, we have invested $62.0 million of a total budget of $65.1 million.

Regarding the Tia Maria project, we have responded to the comments raised by the governmental authorities and stakeholders and are waiting for the final approval of our Environmental Impact Assessment during the 3Q14. Once received, we will be able to move forward with this important project.

This project will represent an investment of approximately $1.4 billion and will produce 120,000 tons of copper cathodes using state of the art technology which would be compliant with the highest international environmental and sustainable development standards. The project is currently expected to generate 3,500 jobs during the construction phase. When in operation, Tia Maria would directly employ 600 workers and indirectly another 2,000. Through its expected twenty-years of life, the project related services would create significant business opportunities in the Arequipa region.

In addition, the Company intends to implement social responsibility programs in the Arequipa region similar to those established in the communities near its other operations in Peru.

Conference Call

The Company’s second quarter and first six months earnings conference call will be held on Wednesday, July 30, 2014, beginning at 12:00 P.M. – EST (11:00 A.M. Lima and Mexico City time).

To participate:

|

Dial-in number: |

888-771-4371 in the U.S. |

|

|

847-585-4405 outside the U.S. |

|

|

Victor Pedraglio, SCC Financial Planning Manager |

|

Conference ID: |

37792663 and “Southern Copper Corporation Second Quarter and Six Months 2014 Earnings Results” |

|

2Q14 |

www.southerncoppercorp.com |

|

|

|

|

|

|

|

|

|

SECOND QUARTER AND SIX MONTHS 2014 RESULTS |

|

SOUTHERN COPPER |

|

|

|

|

|

|

Average Metal Prices

|

|

|

LME |

|

COMEX |

|

Molybdenum |

|

Zinc |

|

Silver |

|

Gold |

|

|

1Q 2014 |

|

3.19 |

|

3.24 |

|

9.93 |

|

0.92 |

|

20.46 |

|

1,293.95 |

|

|

2Q 2014 |

|

3.08 |

|

3.10 |

|

13.45 |

|

0.94 |

|

19.62 |

|

1,288.54 |

|

|

6M 2014 |

|

3.14 |

|

3.17 |

|

11.69 |

|

0.93 |

|

20.04 |

|

1,291.25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1Q 2013 |

|

3.60 |

|

3.60 |

|

11.28 |

|

0.92 |

|

30.03 |

|

1,630.47 |

|

|

2Q 2013 |

|

3.24 |

|

3.25 |

|

10.80 |

|

0.83 |

|

23.10 |

|

1,413.65 |

|

|

3Q 2013 |

|

3.21 |

|

3.23 |

|

9.36 |

|

0.84 |

|

21.39 |

|

1,327.54 |

|

|

4Q 2013 |

|

3.24 |

|

3.28 |

|

9.60 |

|

0.87 |

|

20.77 |

|

1,272.47 |

|

|

6M 2013 |

|

3.42 |

|

3.43 |

|

11.04 |

|

0.88 |

|

26.56 |

|

1,522.06 |

|

|

Average 2013 |

|

3.32 |

|

3.34 |

|

10.26 |

|

0.87 |

|

23.82 |

|

1,411.03 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Variance: 2Q14 vs. 2Q13 |

|

(4.9)% |

|

(4.6)% |

|

24.5% |

|

13.3% |

|

(15.1)% |

|

(8.9)% |

|

|

Variance: 2Q14 vs. 1Q14 |

|

(3.4)% |

|

(4.3)% |

|

35.4% |

|

2.2% |

|

(4.1)% |

|

(0.4)% |

|

|

Variance: 6M14 vs. 6M13 |

|

(8.2)% |

|

(7.6)% |

|

5.9% |

|

5.7% |

|

(24.5)% |

|

(15.2)% |

|

Source: Silver – COMEX; Gold and Zinc – LME; Molybdenum – Metals Week Dealer Oxide

Production and Sales

|

|

|

Three Months Ended |

|

Six Months Ended |

| ||||||||

|

|

|

2014 |

|

2013 |

|

% |

|

2014 |

|

2013 |

|

% |

|

|

Copper (tons) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mined |

|

165,351 |

|

147,479 |

|

12.1% |

|

328,519 |

|

296,964 |

|

10.6% |

|

|

3rd party concentrate |

|

18 |

|

10,113 |

|

(99.8%) |

|

2,246 |

|

12,594 |

|

(82.2%) |

|

|

Total production |

|

165,369 |

|

157,592 |

|

4.9% |

|

330,765 |

|

309,558 |

|

6.9% |

|

|

Smelted |

|

151,130 |

|

145,707 |

|

3.7% |

|

289,400 |

|

282,689 |

|

2.4% |

|

|

Refined and Rod |

|

189,659 |

|

181,772 |

|

4.3% |

|

71,731 |

|

65,043 |

|

10.3% |

|

|

Sales |

|

160,382 |

|

149,970 |

|

6.9% |

|

310,091 |

|

306,277 |

|

1.2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Molybdenum (tons) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mined |

|

5,821 |

|

4,492 |

|

29.6% |

|

11,386 |

|

9,302 |

|

22.4% |

|

|

Sales |

|

5,828 |

|

4,500 |

|

29.5% |

|

11,342 |

|

9,375 |

|

21.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Zinc (tons) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mined |

|

16,498 |

|

27,055 |

|

(39.0%) |

|

37,316 |

|

50,512 |

|

(26.1%) |

|

|

Refined |

|

23,709 |

|

25,183 |

|

(5.9%) |

|

48,464 |

|

49,583 |

|

(2.3%) |

|

|

Sales |

|

23,540 |

|

25,351 |

|

(7.1%) |

|

47,898 |

|

48,807 |

|

(1.9%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Silver (000sounces) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mined |

|

3,212 |

|

3,369 |

|

(4.7%) |

|

6,632 |

|

6,519 |

|

1.7% |

|

|

Refined |

|

3,399 |

|

4,269 |

|

(20.4%) |

|

6,180 |

|

8,421 |

|

(26.6%) |

|

|

Sales |

|

3,647 |

|

4,353 |

|

(16.2%) |

|

6,802 |

|

8,677 |

|

(21.6%) |

|

|

2Q14 |

www.southerncoppercorp.com |

|

|

|

|

|

|

|

|

|

SECOND QUARTER AND SIX MONTHS 2014 RESULTS |

|

SOUTHERN COPPER |

|

|

|

|

|

|

Southern Copper Corporation

CONDENSED CONSOLIDATED STATEMENT OF EARNINGS

(Unaudited)

|

|

|

Three Months Ended |

|

Six Months Ended |

| ||||||||||||

|

|

|

2014 |

|

2013 |

|

VAR % |

|

2014 |

|

2013 |

|

VAR % |

| ||||

|

|

|

(in millions, except per share amount) |

| ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Net sales: |

|

$1,487.4 |

|

$1,410.2 |

|

5.5% |

|

$2,841.8 |

|

$3,033.2 |

|

(6.3)% |

| ||||

|

Operating cost and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Cost of sales (exclusive of depreciation, amortization, and depletion shown separately below) |

|

726.6 |

|

711.2 |

|

2.2% |

|

1,368.5 |

|

1,434.0 |

|

(4.6)% |

| ||||

|

Selling, general and administrative |

|

25.4 |

|

27.5 |

|

(7.6)% |

|

49.9 |

|

52.8 |

|

(5.5)% |

| ||||

|

Depreciation, amortization and depletion |

|

116.1 |

|

93.5 |

|

24.2% |

|

226.5 |

|

184.1 |

|

23.0% |

| ||||

|

Exploration |

|

22.1 |

|

11.6 |

|

90.5% |

|

36.7 |

|

22.0 |

|

66.8% |

| ||||

|

Total operating costs and expenses |

|

890.2 |

|

843.8 |

|

5.5% |

|

1,681.6 |

|

1,692.9 |

|

(0.7)% |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Operating income |

|

597.2 |

|

566.4 |

|

5.4% |

|

1,160.2 |

|

1,340.3 |

|

(13.4)% |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Interest expense, net of capitalized interest |

|

(36.9) |

|

(50.8) |

|

(27.4)% |

|

(77.5) |

|

(103.8 |

) |

(25.3)% |

| ||||

|

Other income (expense) |

|

(5.7) |

|

16.9 |

|

(133.7)% |

|

(10.0) |

|

17.8 |

|

(156.2)% |

| ||||

|

Interest income |

|

3.7 |

|

4.3 |

|

(14.0)% |

|

8.2 |

|

10.3 |

|

(20.4)% |

| ||||

|

Income before income tax |

|

558.3 |

|

536.8 |

|

4.0% |

|

1,080.9 |

|

1,264.6 |

|

(14.5)% |

| ||||

|

Income taxes |

|

225.8 |

|

167.8 |

|

34.6% |

|

429.9 |

|

406.8 |

|

5.7% |

| ||||

|

Net income before equity earnings of affiliate |

|

332.5 |

|

369.0 |

|

(9.9)% |

|

651.0 |

|

857.8 |

|

(24.1)% |

| ||||

|

Equity earnings of affiliate |

|

5.9 |

|

5.1 |

|

15.7% |

|

11.9 |

|

13.3 |

|

(10.5)% |

| ||||

|

Net Income |

|

338.4 |

|

374.1 |

|

(9.5)% |

|

662.9 |

|

871.1 |

|

(23.9)% |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Less: Net income attributable to non-controlling interest |

|

1.1 |

|

1.4 |

|

(21.4)% |

|

2.3 |

|

3.0 |

|

(23.3)% |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Net Income attributable to SCC |

|

$337.3 |

|

$372.7 |

|

(9.5)% |

|

$660.6 |

|

$868.1 |

|

(23.9)% |

| ||||

|

Per common share amounts: |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Net income attributable to SCC common shareholders – basic and diluted |

|

$0.40 |

|

$0.44 |

|

(8.3)% |

|

$0.79 |

|

$1.03 |

|

(22.8)% |

| ||||

|

Dividends paid |

|

$0.10 |

|

$0.20 |

|

(50.0)% |

|

$0.22 |

|

$0.44 |

|

(50.0)% |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Weighted average shares outstanding (Basic and diluted) |

|

|

833.4 |

|

|

845.0 |

|

|

|

|

833.6 |

|

|

845.3 |

|

|

|

|

2Q14 |

www.southerncoppercorp.com |

|

|

|

|

|

|

|

|

|

SECOND QUARTER AND SIX MONTHS 2014 RESULTS |

|

SOUTHERN COPPER |

|

|

|

|

|

|

Southern Copper Corporation

CONDENSED CONSOLIDATED BALANCE SHEET

(Unaudited)

|

|

June 30, |

December 31, |

June 30, |

| |||

|

|

2014 |

2013 |

2013 |

| |||

|

|

|

(in millions) |

|

| |||

|

ASSETS |

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$1,335.4 |

|

$1,672.7 |

|

$1,939.7 |

|

|

Short-term investments |

|

289.9 |

|

208.3 |

|

392.9 |

|

|

Accounts receivable |

|

649.2 |

|

597.8 |

|

571.0 |

|

|

Inventories |

|

754.6 |

|

693.9 |

|

699.0 |

|

|

Other current assets |

|

283.6 |

|

243.3 |

|

288.4 |

|

|

Total current assets |

|

3,312.7 |

|

3,416.0 |

|

3,891.0 |

|

|

|

|

|

|

|

|

|

|

|

Property, net |

|

6,933.7 |

|

6,476.2 |

|

5,636.4 |

|

|

Related parties receivable |

|

161.2 |

|

161.2 |

|

170.7 |

|

|

Leachable material, net |

|

495.2 |

|

395.2 |

|

310.1 |

|

|

Intangible assets, net |

|

110.5 |

|

110.2 |

|

108.4 |

|

|

Deferred income tax |

|

213.8 |

|

180.7 |

|

26.7 |

|

|

Other assets |

|

280.8 |

|

256.5 |

|

296.0 |

|

|

Total assets |

|

$11,507.9 |

|

$10,996.0 |

|

$10,439.3 |

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Current portion of long-term debt |

|

$200.0 |

|

$ - |

|

$ 5.0 |

|

|

Accounts payable |

|

565.0 |

|

500.7 |

|

447.4 |

|

|

Income taxes |

|

35.7 |

|

- |

|

- |

|

|

Accrued workers’ participation |

|

120.8 |

|

192.4 |

|

103.8 |

|

|

Other accrued liabilities |

|

104.1 |

|

90.5 |

|

102.7 |

|

|

Total current liabilities |

|

1,025.6 |

|

783.6 |

|

658.9 |

|

|

|

|

|

|

|

|

|

|

|

Long-term debt |

|

4,005.5 |

|

4,204.9 |

|

4,204.4 |

|

|

Deferred income taxes |

|

271.7 |

|

244.9 |

|

156.5 |

|

|

Other liabilities |

|

76.7 |

|

76.0 |

|

67.3 |

|

|

Asset retirement obligation |

|

151.5 |

|

124.8 |

|

127.7 |

|

|

Total non-current liabilities |

|

4,505.4 |

|

4,650.6 |

|

4,555.9 |

|

|

|

|

|

|

|

|

|

|

|

EQUITY |

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

|

Common stock |

|

3,359.4 |

|

3,349.2 |

|

3,342.2 |

|

|

Treasury stock |

|

(1,290.7) |

|

(1,216.6) |

|

(994.0) |

|

|

Accumulated comprehensive income |

|

3,878.2 |

|

3,401.0 |

|

2,850.3 |

|

|

Total stockholders’ equity |

|

5,946.9 |

|

5,533.6 |

|

5,198.5 |

|

|

Non-controlling interest |

|

30.0 |

|

28.2 |

|

26.0 |

|

|

Total equity |

|

5,976.9 |

|

5,561.8 |

|

5,224.5 |

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities and equity |

|

$11,507.9 |

|

$10,996.0 |

|

$10,439.3 |

|

As of June 30, 2014, December 31, 2013 and June 30, 2013 there were 833.0 million, 835.3 million and 843.4 million shares outstanding, respectively.

|

2Q14 |

www.southerncoppercorp.com |

|

|

|

|

|

|

|

|

|

SECOND QUARTER AND SIX MONTHS 2014 RESULTS |

|

SOUTHERN COPPER |

|

|

|

|

|

|

Southern Copper Corporation

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOW

(Unaudited)

|

|

Three months ended |

Six months ended | |||||||

|

|

2014 |

2013 |

2014 |

2013 | |||||

|

|

(in millions) |

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

Net income |

|

$338.4 |

|

$374.1 |

|

$663.0 |

|

$871.1 |

|

|

Depreciation, amortization and depletion |

|

116.1 |

|

93.5 |

|

226.5 |

|

184.1 |

|

|

Deferred income tax |

|

27.5 |

|

16.4 |

|

(56.8) |

|

10.7 |

|

|

Cash used for operating assets and liabilities |

|

(129.5) |

|

(181.4) |

|

(136.4) |

|

(174.6) |

|

|

Other, net |

|

(3.8) |

|

(0.2) |

|

(12.8) |

|

5.6 |

|

|

Net cash provided from operating activities |

|

348.7 |

|

302.4 |

|

683.5 |

|

896.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

INVESTING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

(375.6) |

|

(385.5) |

|

(699.4) |

|

(702.3) |

|

|

Sale (purchase) of short-term investment, net |

|

(16.9) |

|

(188.4) |

|

(81.6) |

|

(258.6) |

|

|

Other, net |

|

4.6 |

|

3.5 |

|

4.9 |

|

14.3 |

|

|

Net cash used for investing activities |

|

(387.9) |

|

(570.4) |

|

(776.1) |

|

(946.6) |

|

|

|

|

|

|

|

|

|

|

|

|

|

FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

Debt repaid |

|

- |

|

(5.0) |

|

- |

|

(5.0) |

|

|

Dividends paid |

|

(83.3) |

|

(169.1) |

|

(183.4) |

|

(372.0) |

|

|

Distributions to non-controlling interest |

|

(0.2) |

|

(0.3) |

|

(0.5) |

|

(0.9) |

|

|

SCC common shares buyback |

|

(13.0) |

|

(64.6) |

|

(65.5) |

|

(64.6) |

|

|

Other |

|

0.5 |

|

0.5 |

|

0.8 |

|

0.8 |

|

|

Net cash used for financing activities |

|

(96.0) |

|

(238.5) |

|

(248.6) |

|

(441.7) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash |

|

(2.5) |

|

(16.2) |

|

3.8 |

|

(28.4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase (decrease) in cash and cash equivalents |

|

$(137.7) |

|

$(522.7) |

|

$(337.4) |

|

$(519.8) |

|

|

2Q14 |

www.southerncoppercorp.com |

|

|

|

|

|

|

|

|

|

SECOND QUARTER AND SIX MONTHS 2014 RESULTS |

|

SOUTHERN COPPER |

|

|

|

|

|

|

Company Profile

Southern Copper Corporation (SCC) is one of the largest integrated copper producers in the world and we believe we currently have the largest copper reserves in the industry. The Company is a NYSE and Lima Stock Exchange listed company that is 82.5% owned by Grupo Mexico, a Mexican company listed on the Mexican stock exchange. The remaining 17.5% ownership interest is held by the international investment community. The Company operates mining units and metallurgical facilities in Mexico and Peru and conducts exploration activities in Argentina, Chile, Ecuador, Mexico and Peru.

SCC Corporate Address

USA

1440 E Missouri Ave, Suite 160

Phoenix, AZ 85014, U. S. A.

Phone: (602) 264-1375

Fax: (602) 264-1397

Mexico

Campos Eliseos N° 400

Colonia Lomas de Chapultepec

Delegacion Miguel Hidalgo

C.P. 11000 - MEXICO

Phone: (5255) 1103-5000

Fax: (5255) 1103-5567

Peru

Av. Caminos del Inca 171

Urb. Chacarilla del Estanque

Santiago de Surco

Lima 33 – PERU

Phone: (511) 512-0440

Fax: (511) 512-0492

###

This news release contains forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. In addition to the risks and uncertainties noted in this news release, there are certain factors that could cause results to differ materially from those anticipated by some of the statements made. These factors include those listed in the Company’s most recently filed quarterly reports on Form 10-Q and annual report on Form 10-K. The Company expressly disclaims any obligation to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company’s expectations with regard thereto or any change in events, conditions or circumstances on which any statement is based.

i. EBITDA is a common non-GAAP measure useful for our management as an indicator of Company’s ability to produce income from its operations. See reconciliation of EBITDA to GAAP net earnings on our website http://www.southerncoppercorp.com/ENG/invrel/Pages/PGEbitda.aspx.

ii. Operating cash cost is a non-GAAP measure useful as a management tool to track our performance and better allocate our resources. It is also useful to readers of the financial statements for analysis and comparability purposes. See reconciliation of operating cash cost to GAAP cost of sales on our website http://www.southerncoppercorp.com/ENG/invrel/Pages/PGEbitda.aspx.

|

2Q14 |

www.southerncoppercorp.com |