Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - SOUTHERN COPPER CORP/ | a2231031zex-32_2.htm |

| EX-32.1 - EX-32.1 - SOUTHERN COPPER CORP/ | a2231031zex-32_1.htm |

| EX-31.2 - EX-31.2 - SOUTHERN COPPER CORP/ | a2231031zex-31_2.htm |

| EX-31.1 - EX-31.1 - SOUTHERN COPPER CORP/ | a2231031zex-31_1.htm |

| EX-23.1 - EX-23.1 - SOUTHERN COPPER CORP/ | a2231031zex-23_1.htm |

| EX-21.1 - EX-21.1 - SOUTHERN COPPER CORP/ | a2231031zex-21_1.htm |

| EX-12.1 - EX-12.1 - SOUTHERN COPPER CORP/ | a2231031zex-12_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

FINANCIAL STATEMENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended: December 31, 2016 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission File Number: 1-14066

SOUTHERN COPPER CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

13-3849074 (I.R.S. Employer Identification No.) |

|

1440 East Missouri Avenue Suite 160 Phoenix, AZ (Address of principal executive offices) |

85014 (Zip code) |

Registrant's telephone number, including area code: (602) 264-1375

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Name of each exchange on which registered: | |

|---|---|---|

| Common stock, par value $0.01 per share | New York Stock Exchange Lima Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

At February 15, 2017, there were of record 773,016,469 shares of common stock, par value $0.01 per share, outstanding.

The aggregate market value of the shares of common stock (based upon the closing price at June 30, 2016 as reported on the New York Stock Exchange—Composite Transactions) of Southern Copper Corporation held by non-affiliates was approximately $2,332.2 million.

PORTIONS OF THE FOLLOWING DOCUMENTS ARE INCORPORATED BY REFERENCE:

| Part III: | Proxy statement for 2017 Annual Meeting of Stockholders | |

Part IV: |

Exhibit Index is on Page 152 through 154 |

Southern Copper Corporation ("SCC")

2

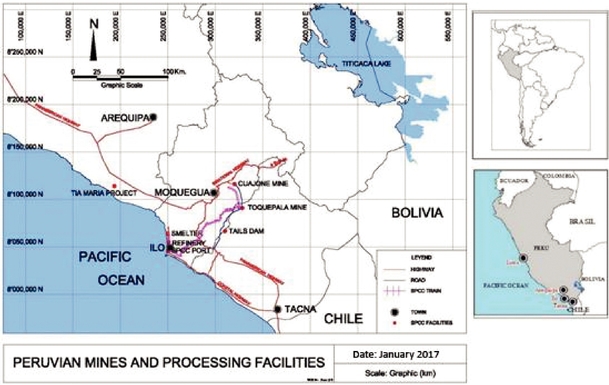

Southern Copper Corporation ("SCC", "Southern Copper" or the "Company") is one of the largest integrated copper producers in the world. Our major production includes copper, molybdenum, zinc and silver. All of our mining, smelting and refining facilities are located in Peru and Mexico and we conduct exploration activities in those countries and in Argentina, Chile and Ecuador. See Item 2 "Properties—Review of Operations" for maps of our principal mines, smelting facilities and refineries. Our operations make us one of the largest mining companies in Peru and Mexico. We believe we have the largest copper reserves in the world. We were incorporated in Delaware in 1952 and have conducted copper mining operations since 1960. Since 1996, our common stock has been listed on both the New York and Lima Stock Exchanges.

Our Peruvian copper operations involve mining, milling and flotation of copper ore to produce copper concentrates and molybdenum concentrates; the smelting of copper concentrates to produce blister and anode copper; and the refining of anode copper to produce copper cathodes. As part of this production process, we also produce significant amounts of molybdenum concentrate and sulfuric acid. Our precious metals plant at the Ilo refinery produces refined silver, gold, and other materials. Additionally, we produce refined copper using solvent extraction/electrowinning technology ("SX-EW"). We operate the Toquepala and Cuajone open-pit mines high in the Andes Mountains, approximately 860 kilometers southeast of the city of Lima, Peru. We also operate a smelter and refinery west of the Toquepala and Cuajone mines in the coastal city of Ilo, Peru.

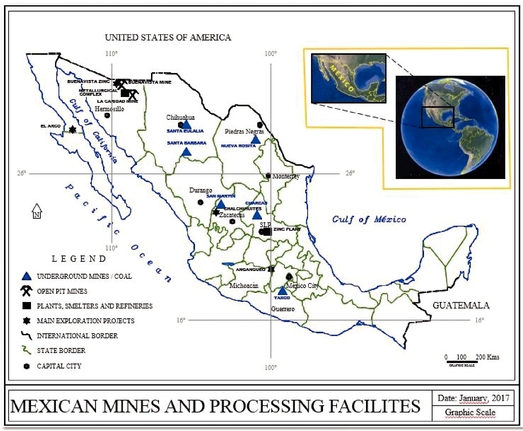

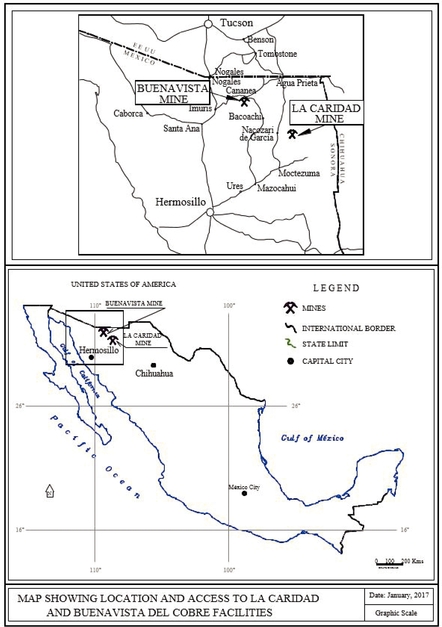

Our Mexican operations are conducted through our subsidiary, Minera Mexico S.A. de C.V. ("Minera Mexico"), which we acquired in 2005. Minera Mexico engages primarily in the mining and processing of copper, molybdenum, zinc, silver, gold and lead. Minera Mexico operates through subsidiaries that are grouped into three separate units. Mexicana de Cobre S.A. de C.V. (together with its subsidiaries, the "La Caridad" unit) operates La Caridad, an open-pit copper mine, a copper ore concentrator, a SX-EW plant, a smelter, refinery and a rod plant. The La Caridad refinery has a precious metals plant which produces refined silver, gold and other materials. Operadora de Minas e Instalaciones Mineras S.A de C.V. (the "Buenavista unit") operates Buenavista, an open-pit copper mine, which is located at the site of one of the world's largest copper ore deposits, two copper concentrators and three SX-EW plants. Industrial Minera Mexico, S.A. de C.V. (together with its subsidiaries, the "IMMSA unit") operates five underground mines that produce zinc, lead, copper, silver and gold, a coal mine and a zinc refinery.

We utilize modern, state of the art mining and processing methods, including global positioning systems and computerized mining processes. Our operations have a high level of vertical integration that allows us to manage the entire production process, from the mining of the ore to the production of refined copper rod and other products and most related transport and logistics functions, using our own facilities, employees and equipment.

The sales prices for our products are largely determined by market forces out of our control. Our management, therefore, focuses on cost control and production enhancement to remain profitable. We endeavor to achieve these goals through capital spending programs, exploration efforts and cost reduction programs. Our focus is to remain profitable during periods of low copper prices and on maximizing results in periods of high copper prices. For additional information on the sale prices of the metals we produce, please see "Metal Prices" in this Item 1.

3

Currency Information:

Unless stated otherwise, all our financial information is presented in U.S. dollars and any reference herein to "U.S. dollars", "dollars", or "$" are to U.S. dollars; references to "sol", "soles" or "S/", are to Peruvian soles; and references to "peso", "pesos", or "Ps.", are to Mexican pesos.

Unit Information:

Unless otherwise noted, all tonnages are in metric tons. To convert to short tons, multiply by 1.102. All ounces are troy ounces. All distances are in kilometers. To convert to miles, multiply by 0.621. To convert hectares to acres, multiply by 2.47.

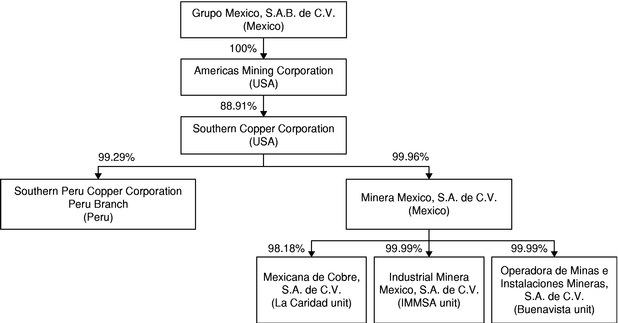

ORGANIZATIONAL STRUCTURE

The following chart describes our organizational structure, starting with our controlling stockholders, as of December 31, 2016. For clarity of presentation, the chart identifies only our main subsidiaries and eliminates intermediate holding companies.

We are a majority-owned, indirect subsidiary of Grupo Mexico S.A.B. de C.V. ("Grupo Mexico"). At December 31, 2016, Grupo Mexico through its wholly-owned subsidiary Americas Mining Corporation ("AMC") owned 88.9% of our capital stock. Grupo Mexico's principal business is to act as a holding company for the shares of other corporations engaged in the mining, processing, purchase and sale of minerals and other products and railway and other related services.

We conduct our operations in Peru through a registered branch (the "SPCC Peru Branch", "Branch" or "Peruvian Branch"). The SPCC Peru Branch comprises substantially all of our assets and liabilities associated with our copper operations in Peru. The SPCC Peru Branch is not a corporation separate from us and, therefore, obligations of SPCC Peru Branch are direct obligations of SCC and vice-versa. It is, however, an establishment, registered pursuant to Peruvian law, through which we hold assets, incur liabilities and conduct operations in Peru. Although it has neither its own capital nor liability separate from us, it is deemed to have equity capital for purposes of determining the economic interests of holders of our investment shares (See Note 14 "Stockholders´ Equity" of our consolidated financial statements).

4

In April 2005, we acquired Minera Mexico, from Americas Mining Corporation ("AMC"), a subsidiary of Grupo Mexico, our controlling stockholder. Minera Mexico is a holding company and all of its operations are conducted through subsidiaries that are grouped into three units: (i) the La Caridad unit (ii) the Buenavista unit and (iii) the IMMSA unit. We own 99.96% of Minera Mexico.

In 2008, our Board of Directors ("BOD") authorized a $500 million share repurchase program that has since been increased by the BOD and is currently authorized to $3 billion. Pursuant to this program, through December 31, 2016 we have purchased 119.5 million shares of our common stock at a cost of $2,918.4 million. These shares are available for general corporate purposes. We may purchase additional shares from time to time, based on market conditions and other factors. This repurchase program has no expiration date and may be modified or discontinued at any time.

REPUBLIC OF PERU AND MEXICO

Our revenues are derived primarily from our operations in Peru and Mexico. Risks related to our operations in both countries include those associated with economic and political conditions, the effects of currency fluctuations and inflation, the effects of government regulations and the geographic concentration of our operations.

AVAILABLE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the U.S. Securities and Exchange Commission ("SEC"). You may read and copy any document we file at the SEC's Public Reference Room at 100 F Street NE, Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for information on the Public Reference Room. The SEC maintains a website that contains annual, quarterly and current reports, proxy statements and other information that issuers (including Southern Copper Corporation) file electronically with the SEC. The SEC's website is www.sec.gov.

Our website is www.southerncoppercorp.com. Beginning with the Form 8-K dated March 14, 2003, we have made available on this website our annual, quarterly and current reports, as soon as reasonably practical after we electronically file such material with, or furnish it to, the SEC. Our website also includes the Company's Corporate Governance guidelines and the charters of our principal Board Committees. However, the information found on our website is not part of this or any other report.

CAUTIONARY STATEMENT

Forward-looking statements in this report and in other Company statements include information regarding expected commencement dates of mining or metal production operations, projected quantities of future metal production, anticipated production rates, operating efficiencies, costs and expenditures, including taxes, as well as projected demand or supply for the Company's products. Actual results could differ materially depending upon certain factors, including the risks and uncertainties relating to general U.S. and international economic and political conditions, the cyclical and volatile prices of copper, other commodities and supplies, including fuel and electricity, the availability of materials, insurance coverage, equipment, required permits or approvals and financing, the occurrence of unusual weather or operating conditions, lower than expected ore grades, water and geological problems, the failure of equipment or processes to operate in accordance with specifications, failure to obtain financial assurance to meet closure and remediation obligations, labor relations, litigation and environmental risks, as well as political and economic risk associated with foreign operations. Results of operations are directly affected by metal prices on commodity exchanges, which can be volatile.

5

Additional business information follows:

COPPER BUSINESS

Copper is an important component in the world's infrastructure. It is the third most widely used metal, after to iron and aluminum. Copper has unique chemical and physical properties, including high ductility, malleability, thermal and electrical conductivity, and resistance to corrosion that has made it a superior material for use in electrical and electronic products, including power transmission and generation, which accounts for about three quarters of copper global use, telecommunications, building construction, transportation and industrial machinery. Copper is also an important metal in non-electrical applications such as plumbing and roofing and, when alloyed with zinc to form brass, in many industrial and consumer applications.

Copper is an internationally traded commodity with prices principally determined by the major metal exchanges, the Commodities Exchange, or "COMEX", in New York and the London Metal Exchange or "LME." Copper is usually found in nature in association with sulfur. Pure copper metal is generally produced from a multistage process, beginning with the mining and concentrating of low-grade ores containing copper sulfide minerals, and followed by smelting and electrolytic refining to produce a pure copper cathode. An increasing share of copper is produced from acid leaching of oxidized ores. Copper is one of the oldest metals ever used and has been one of the most important materials in the development of civilization.

BUSINESS REPORTING SEGMENTS:

Our management views Southern Copper as having three reportable segments and manages it on the basis of these segments.

The three segments identified are groups of individual mines, each of which constitutes an operating segment with similar economic characteristics, type of products, processes and support facilities, regulatory environments, employee bargaining contracts and currency risks. In addition, each mine within the individual group earns revenues from similar types of customers for their products and services and each group incurs expenses independently, including commercial transactions between groups.

Inter-segment sales are based on arm's length prices at the time of sale. These may not be reflective of actual prices realized by the Company due to various factors, including additional processing, timing of sales to outside customers and transportation cost. Added to the segment data is information regarding the Company's sales. The segments identified by the Company are:

- 1.

- Peruvian

operations, which include the Toquepala and Cuajone mine complexes and the smelting and refining plants, including a precious metals plant, industrial

railroad and port facilities that service both mines. Sales of its products are recorded as revenue of our Peruvian mines. The Peruvian operations produce copper, with production of by-products of

molybdenum, silver and other materials.

- 2.

- Mexican

open-pit operations, which include the La Caridad and Buenavista mine complexes and the smelting and refining plants, including a precious metals plant and a

copper rod plant and support facilities that service both mines. Sales of its products are recorded as revenue of our Mexican mines. The Mexican open-pit operations produce copper, with production of

by-products of molybdenum, silver and other materials.

- 3.

- Mexican underground mining operations, which include five underground mines that produce zinc, copper, lead, silver and gold, a coal mine that produces coal and coke, and a zinc refinery. This group is identified as the IMMSA unit and sales of its products are recorded as revenue of the IMMSA unit.

6

Financial information is regularly prepared for each of the three segments and the results are reported to Senior Management on a segment basis. Senior Management focuses on operating income and on total assets as measures of performance to evaluate different segments and to make decisions to allocate resources to the reported segments. These are common measures in the mining industry.

Segment information is included in Item 2 "Properties," under the captions—"Metal Production by Segments" and "Ore Reserves." More information on business segment and segment financial information is included in Note 18 "Segment and Related Information" of our consolidated financial statements.

CAPITAL INVESTMENT PROGRAM AND EXPLORATION ACTIVITIES

For a description of our capital investment program, see Item 7 "Management's Discussion and Analysis of Financial Condition and Results of Operations—Capital Investment Program" and for our exploration activities, see Item 2 "Properties—Explorations Activities."

PRINCIPAL PRODUCTS AND MARKETS

Copper is primarily used in the building and construction industries, in the power generation and transmission industry, in electrical and electronic products and, to a lesser extent, in industrial machinery and equipment, consumer products and in the automotive and transportation industries. Molybdenum is used to toughen alloy steels and soften tungsten alloy and is also used in fertilizers, dyes, enamels and reagents. Silver is used for photographic, electrical and electronic products and, to a lesser extent, in brazing alloys and solder, jewelry, coinage, silverware and catalysts. Zinc is primarily used as a coating on iron and steel to protect against corrosion and is also used to make die cast parts, in the manufacturing of batteries and in the form of sheets for architectural purposes.

Our marketing strategy and annual sales planning emphasize developing and maintaining long-term customer relationships. Thus acquiring annual or other long-term contracts for the sale of our products is a high priority. Generally, 80% to 90% of our metal production is sold under annual or longer-term contracts. Sales prices are determined based on the prevailing commodity prices for the quotation period according to the terms of the contract.

We focus on the ultimate end-user customers as opposed to selling on the spot market or to trading companies. In addition, we devote significant marketing efforts to diversifying our sales both by region and by customer base. We also strive to provide superior customer service, including timely deliveries of our products. Our ability to consistently fulfill customer demand is supported by our substantial production capacity.

For additional information on sales please see "Revenue recognition" in Note 2 "Summary of Significant Accounting Policies" and Note 18 "Segment and Related Information" of our consolidated financial statements.

METALS PRICES

Prices for our products are principally a function of supply and demand and, with the exception of molybdenum, are established on COMEX and LME. Prices for our molybdenum products are established by reference to the publication Platt's Metals Week. Our contract prices also reflect any negotiated premiums and the costs of freight and other factors. From time to time, we have entered into hedging transactions to provide partial protection against future decreases in the market price of metals and we may do so under certain market conditions. For a further discussion of our products market prices, please see Item 7 "Management's Discussion and Analysis of Financial Condition and Results of Operations—Metal Prices."

7

The table below shows the high, low and average COMEX and LME per pound copper prices during the last 10 years:

| |

Copper (COMEX) | Copper (LME) | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Year

|

High | Low | Average | High | Low | Average | |||||||||||||

2007 |

3.75 | 2.40 | 3.23 | 3.77 | 2.37 | 3.23 | |||||||||||||

2008 |

4.08 | 1.25 | 3.13 | 4.08 | 1.26 | 3.16 | |||||||||||||

2009 |

3.33 | 1.38 | 2.35 | 3.33 | 1.38 | 2.34 | |||||||||||||

2010 |

4.44 | 2.76 | 3.43 | 4.42 | 2.76 | 3.42 | |||||||||||||

2011 |

4.62 | 3.05 | 4.01 | 4.60 | 3.08 | 4.00 | |||||||||||||

2012 |

3.97 | 3.28 | 3.61 | 3.93 | 3.29 | 3.61 | |||||||||||||

2013 |

3.78 | 3.03 | 3.34 | 3.74 | 3.01 | 3.32 | |||||||||||||

2014 |

3.43 | 2.84 | 3.12 | 3.37 | 2.86 | 3.11 | |||||||||||||

2015 |

2.95 | 2.02 | 2.51 | 2.92 | 2.05 | 2.50 | |||||||||||||

2016-1st Q |

2.29 |

1.94 |

2.11 |

2.31 |

1.96 |

2.12 |

|||||||||||||

2016-2nd Q |

2.28 | 2.03 | 2.13 | 2.29 | 2.04 | 2.15 | |||||||||||||

2016-3rd Q |

2.26 | 2.07 | 2.16 | 2.25 | 2.07 | 2.17 | |||||||||||||

2016-4th Q |

2.69 | 2.08 | 2.39 | 2.69 | 2.10 | 2.40 | |||||||||||||

2016 |

2.69 | 1.94 | 2.20 | 2.69 | 1.96 | 2.21 | |||||||||||||

The per pound COMEX copper price during the last 5 and 10 year periods averaged $2.96 and $3.09, respectively. The per pound LME copper price during the last 5 and 10 year periods averaged $2.95 and $3.09, respectively.

The table below shows the high, low and average per-pound, except silver, which is per ounce, market prices for our three principal by-products during the last 10 years:

| |

Silver (COMEX) | Molybdenum (Dealer Oxide Platt's Metals Week) |

Zinc (LME) | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Year

|

High | Low | Average | High | Low | Average | High | Low | Average | |||||||||||||||||||

2007 |

15.50 | 11.47 | 13.39 | 33.75 | 24.50 | 30.19 | 1.93 | 1.00 | 1.47 | |||||||||||||||||||

2008 |

20.69 | 8.80 | 14.97 | 33.88 | 8.75 | 28.42 | 1.28 | 0.47 | 0.85 | |||||||||||||||||||

2009 |

19.30 | 10.42 | 14.67 | 18.00 | 7.83 | 10.91 | 1.17 | 0.48 | 0.75 | |||||||||||||||||||

2010 |

30.91 | 14.82 | 20.18 | 18.60 | 11.75 | 15.60 | 1.14 | 0.72 | 0.98 | |||||||||||||||||||

2011 |

48.58 | 26.81 | 35.18 | 17.88 | 12.70 | 15.33 | 1.15 | 0.79 | 0.99 | |||||||||||||||||||

2012 |

37.14 | 26.25 | 31.19 | 14.80 | 10.90 | 12.62 | 0.99 | 0.80 | 0.88 | |||||||||||||||||||

2013 |

32.41 | 18.53 | 23.82 | 11.95 | 9.12 | 10.26 | 0.99 | 0.81 | 0.87 | |||||||||||||||||||

2014 |

22.05 | 15.39 | 19.04 | 15.05 | 8.75 | 11.30 | 1.10 | 0.88 | 0.98 | |||||||||||||||||||

2015 |

18.35 | 13.67 | 15.68 | 9.40 | 4.30 | 6.59 | 1.09 | 0.66 | 0.88 | |||||||||||||||||||

2016-1st Q |

16.02 |

13.74 |

14.87 |

5.55 |

5.10 |

5.27 |

0.84 |

0.73 |

0.76 |

|||||||||||||||||||

2016-2nd Q |

18.58 | 14.94 | 16.83 | 8.60 | 5.30 | 6.89 | 0.95 | 0.79 | 0.87 | |||||||||||||||||||

2016-3rd Q |

20.67 | 18.48 | 19.59 | 7.55 | 6.40 | 6.94 | 1.08 | 0.94 | 1.02 | |||||||||||||||||||

2016-4th Q |

18.80 | 15.70 | 17.12 | 7.05 | 6.30 | 6.58 | 1.32 | 1.01 | 1.14 | |||||||||||||||||||

2016 |

20.67 | 13.74 | 17.10 | 8.60 | 5.10 | 6.42 | 1.32 | 0.73 | 0.95 | |||||||||||||||||||

8

The per ounce COMEX silver price during the last 5 and 10 year periods averaged $21.37 and $20.52, respectively. The per pound Platt's Metals Week Dealer Oxide molybdenum price during the last 5 and 10 year periods averaged $9.44 and $14.76, respectively. The per pound LME zinc price during the last 5 and 10 year periods averaged $0.91 and $0.96, respectively.

COMPETITIVE CONDITIONS

Competition in the copper market is based primarily on price and service basis, with price being the most important factor when supplies of copper are ample. Our products compete with other materials, including aluminum and plastics. For additional information, see Item 1A "Risk Factors—The copper mining industry is highly competitive."

LABOR FORCE

As of December 31, 2016, we had 13,414 employees, approximately 73.4% of whom are unionized and represented by eight different labor unions. In recent years we have experienced a positive labor environment in our operations in Mexico and Peru, which is allowing us to increase productivity as well as helping us achieve the goals of our capital expansion program.

Peru

73% of our 4,562 Peruvian employees were unionized at December 31, 2016. Currently, there are five separate unions, one large union and four smaller unions. In the first quarter of 2016, the Company signed three-year agreements with all five unions. These agreements include, among other things, annual salary increases of 5% for each of the three years.

In the last six years, the Peruvian operations has experienced a stable labor environment without major labor stoppages.

Employees of the Toquepala and Cuajone units reside in townsites, where we have built 3,700 houses and apartments. We also have 90 houses at Ilo for staff personnel. Housing, together with maintenance and utility services, is provided at minimal cost to most of our employees. Our townsite and housing complexes include schools, medical facilities, churches, social clubs and recreational facilities. We also provide shopping, banking and other services at the townsites.

Mexico

74.3% of our 8,760 Mexican employees were unionized at December 31, 2016, represented by three separate unions. Under Mexican law, the terms of employment for unionized workers are set forth in collective bargaining agreements. Mexican companies negotiate the salary provisions of collective bargaining agreements with the labor unions annually and negotiate other benefits every two years. We conduct negotiations separately at each mining complex and each processing plant.

Our Taxco and San Martin mines in Mexico have been on strike since July 2007. For a discussion of labor matters reference is made to the information contained under the caption "Labor matters" in Note 13 "Commitments and Contingencies" of the consolidated financial statements.

Employees of La Caridad and Buenavista units reside in townsites at Nacozari and Cananea, where we have built approximately 2,000 and 275 houses and apartments, respectively. Most of the employees of the IMMSA unit reside on the grounds of the mining or processing complexes in which they work and where we have built approximately 900 houses and apartments. Housing, together with maintenance and utility services, is provided at minimal cost to most of our employees. Our townsites and housing complexes include educational and medical facilities, churches, social clubs, shopping centers, banking and other services. Through 2007, the Buenavista unit provided health care services to employees and retired unionized employees and their families through its own hospital at the

9

Buenavista unit. In 2010, the Company signed an agreement with the Secretary of Health of the State of Sonora to provide these services to its retired workers and their families. The new workers of Buenavista receive health services through the Mexican Institute of Social Security as is the case for all Mexican workers.

FUEL, ELECTRICITY AND WATER SUPPLIES

The principal raw materials used in our operations are fuel, electricity and water. We use natural gas to power boilers and generators, and for metallurgical processes at our Mexican operations and diesel fuel to power mining equipment. We believe that sources of fuel, electricity and water are readily available. The prices of these raw materials may fluctuate outside of our control, therefore we focus our efforts to reduce these costs through cost and energy saving measures.

Energy is the principal cost in mining, so the concern for its conservation and efficient usage is very important. We have energy management committees at most of our mines, which meet periodically to discuss consumption and to develop measures directed at saving energy. Also, alternative sources are being analyzed at the corporate level, from both traditional and renewable energy sources. This has helped us to develop a culture of energy conservation directed at the sustainability of our operations.

Peru:

Fuel: In Peru, we obtain fuel primarily from local production. The Company believes that adequate supplies of fuel are available in Peru.

Electricity: We currently receive power from Engie Energia Peru S.A., "Engie" (formerly Enersur S.A.) under a power purchase agreement through April 2017. In June 2014, we entered into a power purchase agreement for 120 megawatt ("MW") with the state company Electroperu S.A., which will supply energy for our Peruvian operations for twenty years starting on April 17, 2017 and ending on April 30, 2037. In July 2014, we entered into a power purchase agreement for 120MW with a private power generator Kallpa, which will supply energy for our Peruvian operations for ten years starting on April 17, 2017 and ending on April 30, 2027. In May 2016, we signed an additional power purchase agreement for a maximum of 80MW with Kallpa, under which Kallpa will supply energy for the operations related to the Toquepala Expansion and other minor projects for ten years starting on May 1, 2017 and ending after ten years of commercial operation of the Toquepala Expansion or on April 30, 2029; whichever happens first. In addition, we feel confident that additional power can be obtained from the Peruvian national grid, should the need arise.

Additionally, we have nine megawatts of power generation capacity from two small hydro-generating installations at Cuajone. Power is distributed over a 224-kilometer closed loop transmission circuit, which is interconnected with the Peruvian network.

Water: We have water rights or licenses for up to 1,950 liters per second from well fields at the Huaitire, Vizcachas and Titijones aquifers and surface water rights from the Suches lake and two small water courses, Quebrada Honda and Quebrada Tacalaya. We believe these water sources are sufficient to supply the needs of our operating units at Toquepala and Cuajone. At Ilo, we have desalination plants that produce water for industrial use and domestic consumption that we believe are sufficient for our current and projected needs.

Mexico:

Fuel: In Mexico, fuel is purchased directly from Petroleos Mexicanos ("PEMEX"), the state oil monopoly.

The La Caridad unit imports natural gas from the United States through its pipeline (between Douglas, Arizona and Nacozari, Sonora), which allows us to import natural gas from the United States

10

at market prices and thereby reduce operating costs. Several contracts with PEMEX and the United States provide us with the option of using a monthly or daily fixed price for our natural gas purchases.

Natural gas is used for metallurgical processes, to power furnaces, converters, casting wheels, boilers and electric generators. Diesel oil is a backup for all these uses. We use diesel oil to power mining equipment at our operations.

Electricity: Electricity is used as the main energy source at our mining complexes. We purchase most of our electricity from Mexico Generadora de Energia S. de R. L. ("MGE"), a subsidiary of Grupo Mexico which has two power plants designed to supply power to La Caridad and Buenavista units. It is expected that MGE will supply approximately 12% of its power output to third party energy users. These plants are natural gas-fired combined cycle power generating units, with a net total capacity of 516.2 megawatts. In 2012, we entered into a power supply agreement with MGE through 2032. The first plant was completed in 2013 and the second, in the second quarter of 2014. MGE has the authorization for the interconnection with the Mexican electrical system to start operations at the second plant. The first plant began to supply power to the Company in December 2013, and the second plant began to supply power in June 2015.

We also purchase electricity from the Comision Federal de Electricidad (the Federal Electricity Commission or the "CFE"), the state's electrical power producer. In addition, we recover some energy from waste heat boilers at the La Caridad smelter. Accordingly, a significant portion of our operating costs in Mexico is dependent upon the pricing policies of CFE, as well as PEMEX, which reflect government policy, as well as international market prices for crude oil, natural gas and conditions in the refinery markets.

Some of the mining operations also purchase electricity from EOLICA el RETIRO, S.A.P.I de C.V. a windfarm energy producer that is an indirect subsidiary of Grupo Mexico. On August of 2013, IMMSA and other of the mining operations of the Company signed a purchase agreement and in late 2014 started to purchase electricity. Most of the purchases where made by IMMSA, due to the nature of the producer there is not a set amount of KWh contracted. In 2016 the total purchases were of approximately 34.7 million KWh.

Water: In Mexico, water is deemed a public property and industries not connected to a public service water supply must obtain a water concession from Comision Nacional del Agua (the National Water Commission or the "CNA"). Water usage fees are established in the Ley Federal de Derechos (the Federal Rights Law), which distinguishes several availability zones with different fees per unit of volume according to each zone, with the exception of Mexicana de Cobre. All of our operations have one or several water concessions and pump out the required water from wells. Mexicana de Cobre pumps water from the La Angostura dam, which is close to the mine and plants. At our Buenavista facility, we maintain our own wells and pay the CNA for water usage. Water conservation committees have been established in each plant in order to conserve and recycle water. Water usage fees are updated on a yearly basis and have been increasing in recent years.

ENVIRONMENTAL MATTERS

For a discussion of environmental matters reference is made to the information contained under the caption "Environmental matters" in Note 13 "Commitments and Contingencies" of the consolidated financial statements.

11

MINING RIGHTS AND CONCESSIONS

Peru:

We have 171,056 hectares in concessions from the Peruvian government for our exploration, exploitation, extraction and production operations, at various sites, as follows:

| |

Toquepala | Cuajone | Ilo | Other | Total | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

(hectares) |

|||||||||||||||

Plants |

300 | 456 | 421 | — | 1,177 | |||||||||||

Operations |

22,762 | 21,255 | 4,525 | 39,359 | 87,901 | |||||||||||

Exploration |

— | — | — | 81,979 | 81,979 | |||||||||||

| | | | | | | | | | | | | | | | | |

Total |

23,062 | 21,711 | 4,946 | 121,338 | 171,057 | |||||||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

We believe that our Peruvian concessions are in full force and in effect under applicable Peruvian laws and that we are in compliance with all material terms and requirements applicable to these concessions. The concessions have indefinite terms, subject to our payment of concession fees of up to $3.00 per hectare annually for the mining concessions and a fee based on nominal capacity for the processing concessions. Fees paid during 2016, 2015 and 2014, were approximately $1.3 million, $1.7 million and $1.2 million, respectively. We have two types of mining concessions in Peru: metallic and non-metallic concessions.

In 2011, the Peruvian Congress approved an amendment to the mining royalty charge. The new mining royalty charge is based on operating income margins with graduated rates ranging from 1% to 12% of operating profits, with a minimum royalty charge assessed at 1% of net sales. If the operating income margin is 10% or less, the royalty charge is 1% and for each 5% increment in the operating income margin, the royalty charge rate increases by 0.75%, up to a maximum of 12%. In 2016, 2015 and 2014, we made provisions of $16.8 million, $22.9 million and $32.4 million, respectively.

At the same time the Peruvian Congress amended the mining royalty charge, it enacted a new tax for the mining industry. This tax is also based on operating income and its rates range from 2% to 8.4%. For additional information see Note 8 "Income Taxes" to the consolidated financial statements.

Mexico:

In Mexico we have 530,056 hectares in concessions from the Mexican government for our exploration and exploitation activities as outlined on the table below.

| |

IMMSA | La Caridad | Buenavista | Projects | Total | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

(hectares) |

|||||||||||||||

Mine concessions |

254,204 | 102,699 | 93,706 | 79,447 | 530,056 | |||||||||||

We believe that our Mexican concessions are in full force and in effect under applicable Mexican laws and that we are in compliance with all material terms and requirements applicable to these concessions. Under Mexican law, mineral resources belong to the Mexican nation and a concession from the Mexican federal government is required to explore or mine mineral reserves. Mining concessions have a 50-year term that can be renewed for another 50 years. Holding fees for mining concessions can be from $0.30 to $7.40 per hectare depending on the beginning date of the mining concession. Fees paid during 2016, 2015 and 2014 were approximately $5.4 million, $5.6 million and $5.7 million, respectively. In addition, all of our operating units in Mexico have water concessions that are in full force and effect. Although ownership is not required in order to explore or mine a concession, we generally own the land related to our Mexican concessions. We also own all of the processing facilities of our Mexican operations and the land on which they are constructed.

In December 2013, the Mexican government enacted a new law which, among other things, established a mining royalty charge of 7.5% on earnings before taxes as defined by Mexican tax regulations and an additional royalty charge of 0.5% over gross income from sales of gold, silver and platinum. These charges were effective January 2014 and are deductible for income tax purposes.

12

Every investor or potential investor in Southern Copper Corporation should carefully consider the following risk factors.

Financial risks

Our financial performance is highly dependent on the price of copper and the other metals we produce.

Our financial performance is significantly affected by the market prices of the metals that we produce, particularly the market prices of copper, molybdenum, zinc and silver. Historically, these prices have been subject to wide fluctuations and are affected by numerous factors out of our control, including international economic and political conditions, levels of supply and demand, the availability and costs of substitutes, inventory levels maintained by users, actions of participants in the commodities markets and currency exchange rates. In addition, the market prices of copper and certain other metals have on occasion been subject to rapid short-term changes.

In the last three years, approximately 78.0% of our revenues came from the sale of copper, 6.0% came from molybdenum and 9.0% came from silver and zinc. Please see the distribution of our revenues per product on Item 7 "Management's Discussion and Analysis of Financial Condition and Results of Operations" caption "Results of operations—net sales" on page 80.

See also historical average price of our products on Item 1 Business caption "Metals prices".

We cannot predict whether metals prices will rise or fall in the future. Future declines in metals prices, and in particular copper, will have an adverse impact on our results of operations and financial condition. In very adverse market conditions, we might consider curtailing or modifying some of our mining and processing operations.

Our business requires levels of capital investments which we may not be able to maintain.

Our business is capital intensive. Specifically, the exploration and exploitation of copper and other metal reserves, mining, smelting and refining costs, the maintenance of machinery and equipment and compliance with laws and regulations require significant capital investments. We must continue to invest capital to maintain or increase the amount of copper reserves that we exploit and the amount of copper and other metals we produce. We cannot assure you that we will be able to maintain our production levels to generate sufficient cash, or that we have access to sufficient financing to continue our exploration, exploitation and refining activities at or above present levels.

Restrictive covenants in the agreements governing our indebtedness and the indebtedness of our Minera Mexico subsidiary may restrict our ability to pursue our business strategies.

Our financing instruments and those of our Minera Mexico subsidiary include financial and other restrictive covenants that, among other things, limit our and Minera Mexico's abilities to incur additional debt and sell assets. If either we or our Minera Mexico subsidiary do not comply with these obligations, we could be in default under the applicable agreements which, if not addressed or waived, could require repayment of the indebtedness immediately. Our Minera Mexico subsidiary is further limited by the terms of its outstanding notes, which also restrict the Company's applicable incurrence of debt and liens. In addition, future credit facilities may contain limitations on our incurrence of additional debt and liens, on our ability to dispose of assets, or on our ability to pay dividends to our common stockholders.

13

We may not pay a significant amount of our net income as cash dividends on our common stock in the future.

We distributed a significant amount of our net income as dividends since 1996 through 2014. Our dividend practice is subject to change at the discretion of our Board of Directors at any time. The amount that we pay in dividends is subject to a number of factors, including our results of operations, financial condition, cash requirements, tax considerations, future prospects, legal restrictions, contractual restrictions in credit agreements, limitations imposed by the government of Peru, Mexico or other countries where we have significant operations and other factors that our Board of Directors may deem relevant. In light of our capital investment program and global economic conditions, it is possible that future dividend distributions will be reduced from the levels of recent years.

Our ability to recognize the benefits of deferred tax assets is dependent on future cash flows and taxable income.

We recognize the expected future tax benefit from deferred tax assets when the tax benefit is considered to be more likely than not of being realized, otherwise, a valuation allowance is applied against deferred tax assets. Assessing the recoverability of deferred tax assets requires management to make significant estimates related to expectations of future taxable income. Estimates of future taxable income are based on forecasted cash flows from operations and the application of existing tax laws in each jurisdiction. To the extent that future cash flows and taxable income differ significantly from estimates, our ability to realize the deferred tax assets could be impacted. In the future, our estimates could change requiring a valuation allowance or impairment of our deferred tax assets. Additionally, future changes in tax laws could limit our ability to obtain the future tax benefits represented by our deferred tax assets.

Operational risks

Our actual reserves may not conform to our current estimates of our ore deposits and we depend on our ability to replenish ore reserves for our long-term viability.

There is a degree of uncertainty attributable to the calculation of reserves. Until reserves are actually mined and processed, the quantity of ore and grades must be considered as estimates only. The proven and probable ore reserves data included in this report are estimates prepared by us based on evaluation methods generally used in the mining industry. We may be required in the future to revise our reserves estimates based on our actual production. We cannot assure you that our actual reserves conform to geological, metallurgical or other expectations or that the estimated volume and grade of ore will be recovered. Market prices of our metals, increased production costs, reduced recovery rates, short-term operating factors, royalty charges and other factors may render proven and probable reserves uneconomic to exploit and may result in revisions of reserves data from time to time. Reserves data are not indicative of future results of operations. Our reserves are depleted as we mine. We depend on our ability to replenish our ore reserves for our long-term viability. We use several strategies to replenish and increase our ore reserves, including exploration and investment in properties located near our existing mine sites and investing in technology that could extend the life of a mine by allowing us to cost-effectively process ore types that were previously considered uneconomic. Acquisitions may also contribute to increase ore reserves and we review potential acquisition opportunities on a regular basis. However, we cannot assure you that we will be able to continue with our strategy to replenish reserves indefinitely.

Our operations are subject to risks, some of which are not insurable.

The business of mining, smelting and refining copper, zinc and other metals is subject to a number of risks and hazards, including industrial accidents, labor disputes, unusual or unexpected geological

14

conditions, changes in the regulatory environment, environmental hazards, weather and other natural phenomena, such as seismic activity. Such occurrences could result in damage to, or destruction of, mining operations resulting in monetary losses and possible legal liability. In particular, surface and underground mining and related processing activities present inherent risks of injury to personnel and damage to equipment. We maintain insurance against many of these and other risks, which in certain circumstances may not provide adequate coverage. Insurance against certain risks, including certain liabilities for environmental damage or hazards as a result of exploration and production, is not generally available to us or other companies within the mining industry. Nevertheless recent environmental legal initiatives have considered future regulations regarding environmental damage insurance. In case such regulations come into force, we will have to analyze the need to obtain such insurance. We do not have, and do not intend to obtain, political risk insurance. These or other uninsured events may adversely affect our financial condition and the results of operations.

Changes in the demand level for our products and copper sales agreements could adversely affect our revenues.

Our financial results are subject to fluctuations on the level of industrial and consumer demand for the refined, semi-refined metal products and concentrates we sell, as well as global economic slow-downs or recessions. Also, changes in technology, industrial processes, concerns over weaknesses in the global economy and consumer habits may affect the level of demand to the extent that those increase or decrease the need for our metal products. Likewise, our revenues could be adversely affected by events of force majeure that could have a negative impact on our sales agreements. These events include acts of nature, labor strikes, fires, floods, wars, transportation delays, government actions or other events that are beyond the control of the parties of the agreement.

Interruptions of energy supply or increases in energy costs, shortages of water supply, critical parts, equipment, skilled labor and other production costs may adversely affect our results of operations.

We require substantial amounts of fuel oil, electricity, water and other resources for our operations. Fuel, gas and power costs constituted approximately 30%, 32% and 35% of our total production cost in 2016, 2015 and 2014, respectively. We rely upon third parties for our supply of the energy resources consumed in our operations so that prices for and availability of energy resources may be subject to change or curtailment, due to, among other things, new laws or regulations, imposition of new taxes or tariffs, interruptions in production by suppliers, worldwide price levels and market conditions. Regarding water consumption, although each operation currently has sufficient water rights to cover its operational demands, the loss of some or all water rights for any of our mines or operations, in whole or in part, or shortages of water to which we have rights could require us to curtail or shut down mining production and could prevent us from pursuing expansion opportunities. In addition, future shortages of critical parts, equipment and skilled labor could adversely affect our operations and development projects.

Our Company is subject to health and safety laws which may restrict our operations, result in operational delays or increase our operating costs and adversely affect our financial results of operations.

We are required to comply with occupational health and safety laws and regulations in Peru and Mexico where our operations are subject to periodic inspections by the relevant governmental authorities. These laws and regulations govern, among others, health and safety work place conditions, including high risk labor and the handling, storage and disposal of chemical and other hazardous substances. We believe our operations are in compliance in all material respects with applicable health and safety laws and regulations in the countries in which we operate. Compliance with these laws and regulations and new or existing regulations that may be applicable to us in the future could increase our operating costs and adversely affect our financial results of operations and cash flows.

15

Our efforts are focused on the health and safety of our workforce in order to consistently improve performance and compliance through the implementation of occupational health programs, adequate training and safety incentives at our operations. Despite the Company's efforts, we are not exempt from accidents. These are reported to Mexican and Peruvian authorities as required. Regarding non-fatal accidents, in the last three years, the Company's Dart rate (rate to measure workplace injuries severe enough to warrant Day Away from work, job Restrictions and/or job Transfers) was much lower than the MSHA Dart rate (the MSHA Dart rate is published by the U.S.'s Mine Safety and Health Administration, and is used as an industry benchmark).

In 2016, 2015 and 2014 we had six, one and eight fatalities, respectively, in Mexico and Peru. The amounts paid to the Mexican and Peruvian authorities for reportable accidents did not have an adverse effect on our results. Under Mexican and Peruvian law penalties and fines for safety violations are generally monetary, but in certain cases may lead to the temporary or permanent shutdown of the affected facility or the suspension or revocation of permits or licenses. Also, violations of security and safety laws and regulations in our Peruvian operations can be considered a crime, punishable with a sentence of up to 10 years of prison.

Our metals exploration efforts are highly speculative in nature and may be unsuccessful.

Metals exploration is highly speculative in nature. It involves many risks and is frequently unsuccessful. Once mineralization is discovered, it may take a number of years from the initial phases of drilling until production is possible, during which time the economic feasibility of production may change. Substantial expenditures are required to establish proven and probable ore reserves through drilling, to determine metallurgical processes to extract the metals from the ore and, in the case of new properties, to construct mining and processing facilities. We cannot assure you that our exploration programs will result in the expansion or replacement of current production with new proven and probable ore reserves.

Development projects have no operating history upon which we can base estimates of proven and probable ore reserves and estimates of future cash operating costs. Estimates are, to a large extent, based upon the interpretation of geological data obtained from drill holes and other sampling techniques, and feasibility studies that derive estimates of cash operating costs based upon anticipated tonnage and grades of ore to be mined and processed, the configuration of the ore body, expected recovery rates of the mineral from the ore, comparable facility and equipment operating costs, anticipated climatic conditions and other factors. As a result, actual cash operating costs and economic returns based upon development of proven and probable ore reserves may differ significantly from those originally estimated. Moreover, significant decreases in actual or expected prices may mean reserves, once found, will be uneconomical to produce.

We may be adversely affected by challenges relating to slope stability.

Our open-pit mines get deeper as we mine them, presenting certain geotechnical challenges including the possibility of slope failure. If we are required to decrease pit slope angles or provide additional road access to prevent such a failure, our stated reserves could be negatively affected. Furthermore, hydrological conditions relating to pit slopes, renewal of material displaced by slope failures and increased stripping requirements could also negatively affect our stated reserves. We have taken actions in order to maintain slope stability, but we cannot assure you that we will not have to take additional action in the future or that our actions taken to date will be sufficient. Unexpected failure or additional requirements to prevent slope failure may negatively affect our results of operations and financial condition, as well as have the effect of diminishing our stated ore reserves.

16

We may be adversely affected by labor disputes.

In the last several years we have experienced a number of strikes or other labor disruptions that have had an adverse impact on our operations and operating results. As of December 31, 2016, unions represented approximately 73.4% of our workforce. Currently, we have labor agreements in effect for our Mexican and Peruvian operations.

Our Taxco and San Martin mines in Mexico have been on strike since July 2007. It is expected that operations at these mines will remain suspended until these labor issues are resolved.

We cannot assure you when these strikes will be settled, or that in the future we will not experience strikes or other labor related work stoppages that could have a material adverse effect on our financial condition and results of operations.

Our mining or metal production projects may be subject to additional costs due to community actions and other factors.

In recent years, worldwide mining activity has been pressured by neighboring communities for financial commitments to fund social benefit programs and infrastructure improvements. Our projects in Peru are not exempt from these pressures. Our Tia Maria project in Peru has experienced delays while trying to resolve issues with community groups.

It appears that it is becoming a part of the Peruvian mining environment that in order to obtain acceptance from local communities for projects in their localities, demands for substantial investments in community infrastructure and upgrades must be met in order to proceed with the mining projects.

We are confident that we will move forward with the Tia Maria project. However, we cannot assure you when and that we will not continue to incur additional costs for community infrastructure and upgrades in order to obtain the approval of current or future mining projects.

Environmental, regulatory response to climate change, and other regulations may increase our costs of doing business, restrict our operations or result in operational delays.

Our exploration, mining, milling, smelting and refining activities are subject to a number of Peruvian and Mexican laws and regulations, including environmental laws and regulations, and certain industry technical standards. Additional matters subject to regulation include, but are not limited to, concession fees, transportation, production, water use and discharge, power use and generation, use and storage of explosives, surface rights, housing and other facilities for workers, reclamation, taxation, labor standards, mine safety and occupational health.

Environmental regulations in Peru and Mexico have become increasingly stringent over the last decade and we have been required to dedicate more time and money to compliance and remediation activities. Furthermore, the Mexican authorities have become more rigorous and strict in enforcing Mexican environmental laws. We expect additional laws and regulations will be enacted over time with respect to environmental matters.

Please refer to Note 13 "Commitments and Contingencies—Environmental matters" of our financial statements for further information on this subject.

The potential physical impacts of climate change on our operations are highly uncertain, and would be particular to the geographic location of our facilities. These may include changes in rainfall patterns, water shortages, changing sea levels, changing storm patterns and intensities, and changing temperatures. These effects may adversely impact the cost, production and financial performance of our operations.

17

We are aware of fluctuations in weather patterns in the areas where we operate. Aligned with government efforts, we are working in measuring its carbon footprint in order to reduce any contribution to greenhouse gases generated by our operations. Similarly, we evaluate our water demand, as weather changes may result in increase/decrease scenarios that affect our needs.

The development of more stringent environmental protection programs in Peru and Mexico and in relevant trade agreements could impose constraints and additional costs on our operations requiring us to make significant investments in the future. We cannot assure you that current or future legislative, regulatory or trade developments will not have an adverse effect on our business, properties, operating results, financial condition or prospects.

Our mining and metal production projects may subject us to new risks.

Our Company is in the midst of a large expansion program, which may subject us to additional risks of industrial accidents. While we believe our contractors employ safety standards and other procedures to ensure these projects are completed with proper governance, it is possible that the increased activity occurring at our sites could cause accidents of an environmental nature or danger to human life.

In August 2014, our new SX-EW plant in Mexico had an industrial accident caused by a rock slide, coupled with a construction defect in the seal of a pipe at the new leaching system containment dam, which caused a spill of copper sulfate solution in to the Bacanuchi River, a tributary of the Sonora River. As a result of this accident the Company absorbed charges of $45.0 million and $91.4 million in its 2015 and 2014 results, respectively. In addition, there are a number of collective action lawsuits and civil action lawsuits, filed against the Company in Mexico´s federal courts and the state courts of Sonora. Also a number of constitutional lawsuits have been filed against various governmental authorities and against the Company. These lawsuits are seeking damages and requesting remedial actions to restore the environment. The Company believes that it is not possible to determine the extent of the damages sought and considers the lawsuits without merit. However the Company cannot offer any assurances that the outcome of these lawsuits will not have an adverse effect on the Company.

While this is an unusual event in the Company's history, we cannot offer assurance that an accident related to our project development program will not occur again in the future and cause environmental damage or damage that causes harm or loss of life.

Our business depends upon information technology systems which may be adversely affected by disruptions, damage, failure and risks associated with implementation and integration.

Our operations depend upon information technology systems which may be subject to disruption, damage or failure from different sources, including, without limitation, installation of malicious software, computer viruses, security breaches, cyber-attacks and defects in design. In recent years, cybersecurity incidents have increased in frequency and include, but are not limited to, malicious software, attempts to gain unauthorized access to data and other electronic security breaches that could lead to disruptions in systems, unauthorized release of confidential or otherwise protected information and the corruption of data. We believe that we have implemented appropriate preventative measures to mitigate potential risks by implementing a certified IT service management system with the necessary controls that are frequently reviewed and tested, including a risk matrix that considers all the possible threats with an impact and probability analysis, actions to avoid or mitigate them and the corresponding testing plan. However, given the unpredictability of the timing, nature and scope of information technology disruptions, we could potentially be subject to manipulation or improper use of our systems and networks, operational delays, the compromising of confidential or otherwise protected information, destruction or corruption of data, security breaches, financial losses from remedial actions, any of which

18

could have a material adverse effect on our cash flows, competitive position, financial condition or results of operations.

Other risks

Applicable law restricts the payment of dividends from our Minera Mexico subsidiary to us.

Our subsidiary, Minera Mexico, is a Mexican company and, as such, may pay dividends only out of net income that has been approved by the shareholders. Shareholders must also approve the actual dividend payment, after mandatory legal reserves have been created and losses for prior fiscal years have been satisfied. These legal constraints may limit the ability of Minera Mexico to pay dividends to us, which in turn, may have an impact on our ability to pay stockholder dividends or to service debt.

In 2014, our management identified a material weakness in our internal control over financial reporting, which could have resulted in material misstatements in our future financial statements and may have adversely affected our business and stock price.

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. In 2014, our management identified a material weakness in our internal control over financial reporting related to ineffective design of processes and procedures to restrict access to key financial systems and records to appropriate users.

A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement in our annual or interim financial statements will not be prevented or detected on a timely basis. As a result of the material weakness discussed above, our management concluded that our internal control over financial reporting was not effective as of December 31, 2014.

Although we have remedied the ineffectiveness of our internal control over financial reporting, we cannot assure you that an additional material weakness may not occur in the future.

Global and local market conditions, including the high competitiveness in the copper mining industry, may adversely affect our profitability.

Our industry is cyclical by nature and fluctuates with economic cycles. Therefore, we are subject to the risks arising from adverse changes in domestic and global economic and political conditions, such as lower levels of consumer and corporate confidence, decreased business investment, increased unemployment, reduced income and asset values in many areas, currency volatility and limited availability of credit and access to capital. Additionally, we face competition from other copper mining and producing companies around the world; significant competition exists to acquire properties producing or capable of producing copper and other metals as well as consolidation among some of our main competitors that make them more diversified than we are.

We cannot assure you that changes in market conditions, including competition, will not adversely affect us to compete in the future on the basis of price or other factors with companies that may benefit from future favorable trading or other arrangements.

We are controlled by Grupo Mexico, which exercises control over our affairs and policies and whose interests may be different from yours.

At December 31, 2016, Grupo Mexico owned indirectly 88.9% of our capital stock. Certain of our and Minera Mexico's officers and directors are also directors and/or officers of Grupo Mexico and/or of its affiliates. We cannot assure you that the interests of Grupo Mexico will not conflict with our minority stockholders.

19

Grupo Mexico has the ability to determine the outcome of substantially all matters submitted for a vote to our stockholders and thus exercises control over our business policies and affairs, including the following:

- •

- the composition of our Board of Directors and, as a result, any determinations of our Board with respect to our business direction and policy,

including the appointment and removal of our officers;

- •

- determinations with respect to mergers and other business combinations, including those that may result in a change of control;

- •

- whether dividends are paid or other distributions are made and the amount of any dividends or other distributions;

- •

- sales and dispositions of our assets;

- •

- the amount of debt financing that we incur; and

- •

- the approval of capital projects.

We cannot assure you that increased financial obligations of Grupo Mexico or AMC resulting from financings or for other reasons will not result in our parent corporations obtaining loans, increased dividends or other funding from us.

In addition, we have in the past engaged in, and expect to continue to engage in, transactions with Grupo Mexico and its other affiliates which are related party transactions and may present conflicts of interest. For additional information regarding the share ownership of, and our relationships with, Grupo Mexico and its affiliates, see Note 17 "Related Party Transactions."

Unanticipated litigation or negative developments in pending litigation or with respect to other contingencies may adversely affect our financial condition and results of operations.

We are currently, and may in the future become, subject to litigation, arbitration or other legal proceedings with other parties. If decided adversely to the Company, these legal proceedings, or others that could be brought against us in the future, may adversely affect our financial position or prospects. For further detailed discussion of pending litigation, please see Note 13 "Commitment and Contingencies—Litigation matters".

International Risks

We are a company with substantial assets located outside of the United States. We conduct production operations in Peru and Mexico and exploration activities in these countries as well as in Chile, Argentina and Ecuador. Accordingly, in addition to the usual risks associated with conducting business in foreign countries, our business may be adversely affected by political, economic and social uncertainties in each of these countries. Such risks include possible expropriation or nationalization of property, confiscatory taxes or royalties, possible foreign exchange controls, changes in the national policy toward foreign investors, extreme environmental standards, etc.

Our insurance does not cover most losses caused by the above described risks. Consequently, our production, development and exploration activities in these countries could be substantially affected by factors out of control, some of which could materially and adversely affect our financial position or results of operations.

20

Risks Associated with Doing Business in Peru and Mexico

There is uncertainty as to the termination and renewal of our mining concessions.

Under the laws of Peru and Mexico, mineral resources belong to the state and government and concessions are required in both countries to explore for or exploit mineral reserves. In Peru, our mineral rights derive from concessions from Ministry of Energy and Mines ("MINEM") for our exploration, exploitation, extraction and/or production operations. In Mexico, our mineral rights derive from concessions granted, on a discretionary basis, by the Ministry of Economy, pursuant to Mexican mining law and regulations thereunder.

Mining concessions in both Peru and Mexico may be terminated if the obligations of the concessioner are not satisfied. In Peru, we are obligated to pay certain fees for our mining concession. In Mexico, we are obligated, among other things, to explore or exploit the relevant concession, to pay any relevant fees, to comply with all environmental and safety standards, to provide information to the Ministry of Economy and to allow inspections by the Ministry of Economy. Any termination or unfavorable modification of the terms of one or more of our concessions, or failure to obtain renewals of such concessions subject to renewal or extensions, could have a material adverse effect on our financial condition and prospects.

Peruvian economic and political conditions may have an adverse impact on our business.

A significant part of our operations are conducted in Peru. Accordingly, our business, financial condition or results of operations could be affected by changes in economic or other policies of the Peruvian government or other political, regulatory or economic developments in the country. During the past several decades, Peru has had a succession of regimes with differing policies and programs. Past governments have frequently intervened in the nation's economy and social structure. Among other actions, past governments have imposed controls on prices, exchange rates and local and foreign investments, as well as limitations on imports, have restricted the ability of companies to dismiss employees and have prohibited the remittance of profits to foreign investors.

In more recent years Peru has had political and social stability. The Peruvian government's economic policies reduced inflation and the Peruvian economy has experienced significant growth.

Because we have significant operations in Peru, we cannot provide any assurance that political developments and economic conditions in Peru and/or other factors will not have a material adverse effect on market conditions, prices of our securities, our ability to obtain financing and our results of operations and financial condition.

Mexican economic and political conditions, as well as drug-related violence, may have an adverse impact on our business.

The Mexican economy is highly sensitive to economic developments in the United States, mainly because of its high level of exports to this market. In the last quarter of 2015, the international economy was affected by a general appreciation of the U.S. dollar that was caused by the difference between the growth rhythm and the expectations on the monetary position of the United States regarding the main advanced economies and the majority of emerging economies. Accordingly, the Bank of Mexico expects higher growth in 2016 due to the improved dynamism of the U.S. economy. Gross domestic product grew by 2.5% in 2015, 2.3 in 2016 and is expected to grow between 1.5% and 2.5% in 2017. Other risks in Mexico are increases in taxes on the mining sector and higher royalties. As has occurred in other metal producing countries, the mining industry may be perceived as a source of additional fiscal revenue.

In addition, security institutions in Mexico are under significant stress, as a result of drug-related violence. This situation creates potential risks especially for transportation of minerals and finished

21

products, which affect a small part of our production. However, drug-related violence has had a limited impact on our operations as it has tended to concentrate outside our areas of production. If this were to change, the potential risks to our operations might increase.

Because we have significant operations in Mexico, we cannot provide any assurance that political developments and economic conditions as well as drug-related violence, in Mexico will not have a material adverse effect on market conditions, prices of our securities, on our ability to obtain financing, and on our results of operations and financial condition.

Peruvian inflation and fluctuations in the sol exchange rate may adversely affect our financial condition and results of operations.

Although the U.S. dollar is our functional currency and our revenues are primarily denominated in U.S. dollars, due to the countries we operate, portions of our operating costs are denominated in Peruvian soles. Accordingly, when inflation or deflation in Peru is not offset by a change in the exchange rate of the sol, our financial position, results of operations, cash flows and the market price of our common stock could be affected.

Over the past several years, Peru has experienced one of its best economic periods. Inflation in 2016, 2015 and 2014 was 3.2%, 4.4% and 3.2%, respectively. The value of the sol has appreciated against the U.S. dollar 1.6% in 2016, and it has depreciated 14.2% in 2015, and 6.9% in 2014. Although the Peruvian government's economic policy reduced inflation and the economy has experienced significant growth in recent years, we cannot assure you that inflation will not increase from its current level or that such growth will continue in the future at similar rates or at all. Additionally a global financial economic crisis, could negatively affect the Peruvian economy.

To manage the volatility related to the risk of currency rate fluctuations, we may enter into forward exchange contracts. We cannot assure you, however, that currency fluctuations will not have an impact on our financial condition and results of operations.

Mexican inflation, restrictive exchange control policies and fluctuations in the peso exchange rate may adversely affect our financial condition and results of operations.

Although all of our Mexican operations' sales of metals are priced and invoiced in U.S. dollars, a substantial portion of its costs are denominated in pesos. Accordingly, when inflation in Mexico increases without a corresponding depreciation of the peso, the net income generated by our Mexican operations is adversely affected. The annual inflation rate in Mexico was 3.4% in 2016, 2.1% in 2015 and 4.1% in 2014. The Bank of Mexico expects inflation in 2017 to be above the publicly announced target of 3%.

At the same time, the peso has been subject in the past to significant volatility, which may not have been proportionate to the inflation rate and may not be proportionate to the inflation rate in the future. The value of the peso to the U.S. dollar decreased by 20.1% in 2016, 16.9% in 2015, and 12.6% in 2014.