Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - Stagwell Inc | v384405_ex99-3.htm |

| EX-99.1 - EXHIBIT 99.1 - Stagwell Inc | v384405_ex99-1.htm |

| 8-K - FORM 8-K - Stagwell Inc | v384405_8k.htm |

July 24, 2014 Management Presentation Second Quarter & YTD 2014

2 FORWARD LOOKING STATEMENTS & OTHER INFORMATION This presentation, including our “ 2014 Financial Outlook”, contains forward - looking statements . The Company’s representatives may also make forward - looking statements orally from time to time . Statements in this presentation that are not historical facts, including statements about the Company’s beliefs and expectations, earnings guidance, recent business and economic trends, potential acquisitions, estimates of amounts for deferred acquisition consideration and “put” option rights, constitute forward - looking statements . These statements are based on current plans, estimates and projections, and are subject to change based on a number of factors, including those outlined in this section . Forward - looking statements speak only as of the date they are made, and the Company undertakes no obligation to update publicly any of them in light of new information or future events, if any . Forward - looking statements involve inherent risks and uncertainties . A number of important factors could cause actual results to differ materially from those contained in any forward - looking statements . Such risk factors include, but are not limited to, the following : • risks associated with severe effects of international, national and regional economic downturn ; • the Company’s ability to attract new clients and retain existing clients; • the spending patterns and financial success of the Company’s clients; • the Company’s ability to remain in compliance with its debt agreements and the Company’s ability to finance its contingent pa yme nt obligations when due and payable, including but not limited to those relating to “put” option rights and deferred acquisition co nsideration; • the successful completion and integration of acquisitions which compliment and expand the Company’s business capabilities; an d • foreign currency fluctuations. The Company’s business strategy includes ongoing efforts to engage in material acquisitions of ownership interests in entities in the marketing communications services industry . The Company intends to finance these acquisitions by using available cash from operations and through incurrence of bridge or other debt financing, either of which may increase the Company’s leverage ratios, or by issuing equity, which may have a dilutive impact on existing shareholders proportionate ownership . At any given time the Company may be engaged in a number of discussions that may result in one or more material acquisitions . These opportunities require confidentiality and may involve negotiations that require quick responses by the Company . Although there is uncertainty that any of these discussions will result in definitive agreements or the completion of any transactions, the announcement of any such transaction may lead to increased volatility in the trading price of the Company’s securities . Investors should carefully consider these risk factors and the additional risk factors outlined in more detail in the Annual Report on Form 10 - K under the caption “Risk Factors” and in the Company’s other SEC filings .

3 • Solid operating performance continued in the second quarter – results ahead of expectations • Sustained industry - leading organic revenue growth from award - winning partner companies • Strong growth of Net Income attributable to MDC Partners, Adjusted EBITDA, and Adjusted EBITDA Available for General Capital Purposes • Excellent new business performance, and a pipeline full of increasingly large and global opportunities • Strong progress on international growth strategy • Increasing fiscal 2014 outlook for Adjusted EBITDA and Adjusted EBITDA Available for General Capital Purposes • Significant cash generation; increasing quarterly dividend SECOND QUARTER 2014 SUMMARY

4 • Industry - leading organic revenue growth of 7.0% • Revenue increased 10.5% to $317.7 million from $287.5 million • Net Income attributable to MDC Partners increased 67.8% to $16.5 million from $9.8 million • Adjusted EBITDA increased 9.5% to $48.8 million from $44.6 million • Adjusted EBITDA margin at 15.4% versus 15.5% a year ago • Net new business wins of $53.7 million • Adjusted EBITDA Available for General Capital Purposes increased 14.6% to $31.0 million from $27.1 million • Raising quarterly dividend by 5.6% to $0.19 SECOND QUARTER 2014 FINANCIAL HIGHLIGHTS

5 • Industry - leading organic revenue growth of 7.3% • Revenue increased 10.3% to $610.3 million from $553.1 million • Net Income attributable to MDC Partners increased $41.0 million to $7.6 million from a loss of $33.3 million • Adjusted EBITDA increased 13.0% to $85.3 million from $75.4 million • Adjusted EBITDA margin increased 40 basis points to 14.0% from 13.6% • Net new business wins of $78.3 million • Adjusted EBITDA Available for General Capital Purposes increased 21.6% to $51.7 million from $42.5 million YEAR - TO - DATE 2014 FINANCIAL HIGHLIGHTS

6 Note: Actuals may not foot due to rounding CONSOLIDATED REVENUE AND EARNINGS (US$ in millions, except percentages) 2014 2013 2014 2013 Revenue 317.7$ 287.5$ 10.5 % 610.3$ 553.1$ 10.3 % Operating Expenses Cost of services sold 200.2 189.7 5.5 % 391.9 367.5 6.6 % Office and general expenses 78.6 60.8 29.1 % 156.7 128.2 22.3 % Depreciation and amortization 10.7 9.5 13.1 % 22.0 19.0 16.1 % Operating Profit 28.2 27.5 39.7 38.4 Other, net 7.3 (2.9) 0.8 (0.2) Interest expense and finance charges (13.9) (10.4) (26.6) (22.8) Loss on redemption of notes 0.0 0.0 0.0 (55.6) Interest income 0.0 0.1 0.1 0.2 Income tax expense (benefit) 3.4 1.7 3.0 (12.5) Equity in earnings of non-consolidated affiliates 0.1 0.1 0.1 0.1 Income (Loss) from Continuing Operations 18.4 12.7 11.0 (27.3) Loss from discontinued operations, net of taxes (0.2) (1.3) (0.3) (3.5) Net Income (Loss) 18.2 11.3 10.7 (30.8) Net income attributable to non- (1.7) (1.5) (3.1) (2.5) controlling interests Net Income (Loss) Attributable to MDC Partners Inc. 16.5$ 9.8$ 7.6$ (33.3)$ % Change Three Months Ended June 30, Six Months Ended June 30, % Change

7 • Q2 2014 revenue of $317.7 million represents 10.5% YoY growth • Strength across disciplines and geographies including Advertising, Media, Insights, Strategic Communications & PR, Design, CRM and International SUMMARY OF SEGMENT RESULTS - REVENUE Note: Actuals may not foot due to rounding (US$ in millions, except percentages) 2014 2013 2014 2013 Revenue Strategic Marketing Services 221.0$ 200.7$ 10.1 % 427.0$ 384.1$ 11.2 % Performance Marketing Services 96.7 86.8 11.4 % 183.3 169.0 8.5 % Total Revenue 317.7$ 287.5$ 10.5 % 610.3$ 553.1$ 10.3 % % Change Three Months Ended June 30, Six Months Ended June 30, % Change

8 ORGANIC REVENUE GROWTH BY SEGMENT Note: Actuals may not foot due to rounding • Strategic Marketing Services continues to deliver exceptional organic growth, increasing 10.4% in the quarter, and +11.5% year - to - date • Modest decline in Performance Marketing Services; good sequential trend Strategic Performance Weighted Strategic Performance Weighted Marketing Marketing Average Marketing Marketing Average Services Services Total Services Services Total Organic Growth 10.4% -0.9% 7.0% 11.5% -2.3% 7.3% Acquisition Growth 0.0% 13.6% 4.1% 0.0% 12.4% 3.8% Foreign Exchange Impact -0.2% -1.3% -0.6% -0.4% -1.6% -0.8% Total 10.1% 11.4% 10.5% 11.2% 8.5% 10.3% Three Months Ended June 30, Six Months Ended June 30,

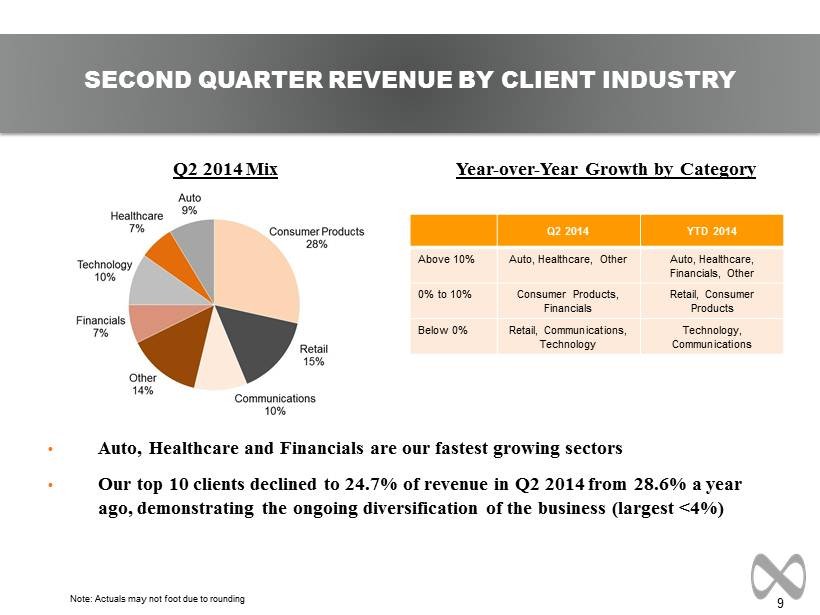

9 Q2 2014 Mix Year - over - Year Growth by Category • Auto, Healthcare and Financials are our fastest growing sectors • Our top 10 clients declined to 24.7% of revenue in Q2 2014 from 28.6% a year ago, demonstrating the ongoing diversification of the business (largest <4%) SECOND QUARTER REVENUE BY CLIENT INDUSTRY Note: Actuals may not foot due to rounding Q2 2014 YTD 2014 Above 10% Auto, Healthcare, Other Auto, Healthcare, Financials, Other 0% to 10% Consumer Products, Financials Retail, Consumer Products Below 0% Retail, Communications, Technology Technology, Communications

10 ORGANIC GROWTH HIGHLIGHTS SUSTAINED MARKET SHARE GAINS Note: Peers include Omnicom, IPG, WPP, Havas and Publicis . WPP and Havas have not yet reported 2Q 2014 results and therefore are not included in the peer aggregate for the most recent quarter.

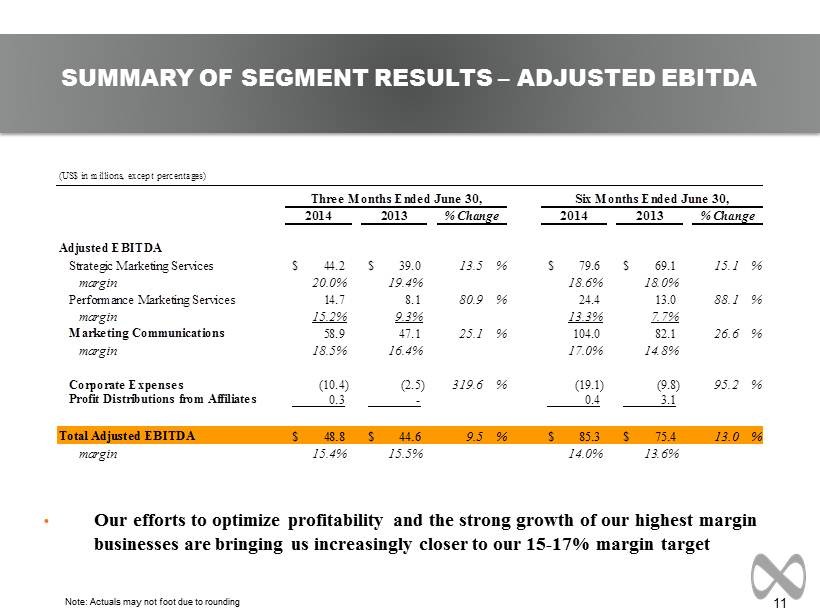

11 Note: Actuals may not foot due to rounding • Our efforts to optimize profitability and the strong growth of our highest margin businesses are bringing us increasingly closer to our 15 - 17% margin target SUMMARY OF SEGMENT RESULTS – ADJUSTED EBITDA (US$ in millions, except percentages) 2014 2013 2014 2013 Adjusted EBITDA Strategic Marketing Services 44.2$ 39.0$ 13.5 % 79.6$ 69.1$ 15.1 % margin 20.0% 19.4% 18.6% 18.0% Performance Marketing Services 14.7 8.1 80.9 % 24.4 13.0 88.1 % margin 15.2% 9.3% 13.3% 7.7% Marketing Communications 58.9 47.1 25.1 % 104.0 82.1 26.6 % margin 18.5% 16.4% 17.0% 14.8% Corporate Expenses (10.4) (2.5) 319.6 % (19.1) (9.8) 95.2 % Profit Distributions from Affiliates 0.3 - 0.4 3.1 Total Adjusted EBITDA 48.8$ 44.6$ 9.5 % 85.3$ 75.4$ 13.0 % margin 15.4% 15.5% 14.0% 13.6% % Change Three Months Ended June 30, Six Months Ended June 30, % Change

12 Note: Actuals may not foot due to rounding ADJUSTED EBITDA AVAILABLE FOR GENERAL CAPITAL PURPOSES (1) Capital Expenditures, net represents capital expenditures net of landlord reimbursements . (2) Cash Interest, net & Other represents the quarterly accrual of cash interest under our Senior Notes . (3) Adjusted EBITDA Available for General Capital Purposes is a non - GAAP measure, and represents funds available for repayment of de bt, acquisitions, deferred acquisition consideration, dividends, and other general corporate initiatives. (US$ in millions) 2014 2013 2014 2013 Adjusted EBITDA $48.8 $44.6 $85.3 $75.4 Net Income Attibutable to Noncontrolling Interests (1.7) (1.5) (3.1) (2.5) Capital Expenditures, net (1) (3.2) (6.6) (6.2) (9.2) Cash Taxes (0.0) (0.1) (0.1) (0.2) Cash Interest, net & Other (2) (12.8) (9.3) (24.1) (21.0) Adjusted EBITDA Available for General Capital Purposes (3) $31.0 $27.1 $51.7 $42.5 Three Months Ended June 30, Six Months Ended June 30,

13 AVAILABLE LIQUIDITY (US$ in millions) December 31, 2013 June 30, 2014 Commitment Under Facility $225.0 $225.0 Drawn - - Undrawn Letters of Credit 4.9 5.0 Funds Available Under Facility $220.1 $220.0 Total Cash & Cash Equivalents 102.0 72.3 Liquidity $322.1 $292.3

14 • We are raising our full year outlook given the superior performance in the first half and our expectations for the continued momentum across the portfolio 2014 FINANCIAL OUTLOOK Note: See appendix for definitions of non - GAAP measures 2014 2014 2014 Implied 2013 Initial Guidance Revised Guidance 1Q Revised Guidance 2Q Year over Year Actuals February 20, 2014 April 24, 2014 July 24, 2014 Change Revenue $1.15 billion $1.230 - $1.255 billion $1.245 - $1.270 billion $1.245 - $1.270 billion +8.4% to +10.5% Adjusted EBITDA $159.4 million $177 - $181 million $181 - $185 million $184 - $188 million +15.4% to +17.9% Adjusted EBITDA Margin 13.9% 14.4% 14.5% to 14.6% 14.8% +90 basis points Adjusted EBITDA Available for $91.6 million $104 - $108 million $106 - $110 million $108 - $112 million +18.0% to +22.3% General Capital Purposes

15 APPENDIX

16 TEMPORAL PUT OBLIGATIONS AND IMPACT ON EBITDA Incremental (US$ in millions) Cash Stock Total EBITDA in Period 2014 1.6 0.0 1.6 1.8 2015 3.6 0.0 3.6 1.9 2016 3.5 0.1 3.6 0.1 2017 4.3 0.0 4.3 0.9 Thereafter 3.7 1.5 5.2 0.0 Total $16.7 $1.6 $18.3 $4.7 Effective Multiple 3.9x Estimated Put Impact at June 30, 2014 Payment Consideration

17 Note: Actuals may not foot due to rounding SUMMARY OF CASH FLOW Note: Actuals may not foot due to rounding (US$ in millions) 2014 2013 Cash flows provided by continuing operating activities $33.1 $55.8 Discontinued operations (0.3) (1.7) Net cash provided by operating activities $32.8 $54.1 Cash flows used in continuing investing activities ($58.3) ($9.0) Discontinued operations 0.0 (0.0) Net cash used in investing activities ($58.3) ($9.0) Net cash used in continuing financing activities ($3.8) ($28.4) Effect of exchange rate changes on cash and cash equivalents ($0.3) $0.4 Net increase (decrease) in cash and cash equivalents ($29.7) $17.0 Six Months Ended June 30,

18 Note: Actuals may not foot due to rounding DEFINITION OF NON - GAAP MEASURES Adjusted EBITDA: Adjusted EBITDA is a non - GAAP measure, that represents operating profit plus depreciation and amortization, stock - based compensation, acquisition deal costs, deferred acquisition consideration adjustments, and profit distributions from affiliates. Organic Growth: Organic revenue growth is a non - GAAP measure that refers to growth in revenues from sources other than acquisitions or foreign exchange impacts. Adjusted EBITDA Available for General Capital Purposes: Adjusted EBITDA Available for General Capital Purposes is a non - GAAP measure, and represents funds available for repayment of debt, acquisitions, deferred acquisition consideration, dividends, and other general corporate initiatives . Net Bank Debt or Net Debt: Debt due pertaining to the revolving credit facility plus debt pertaining to the Senior Notes less total cash and cash equivalents. Note: A reconciliation of Non - GAAP to US GAAP reported results has been provided by the Company in the tables included in the earnings release issued on July 24, 2014.

MDC Partners Innovation Centre 745 Fifth Avenue, Floor 19 New York, NY 10151 646 - 429 - 1800 www.mdc - partners.com