Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - ANGIODYNAMICS INC | an31070560-8k.htm |

| EX-99.1 - PRESS RELEASE - ANGIODYNAMICS INC | an31070560-ex99_1.htm |

EXHIBIT 99.2

Q4 FY2014 Conference Call July 23, 2014 AngioDynamics, the AngioDynamics logo and other trademarks displayed in this presentation are trademarks owned and used by AngioDynamics, Inc. © Copyright 2014 AngioDynamics, Inc. All rights reserved. *

Forward-Looking Statements Notice Regarding Forward Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements regarding AngioDynamics’ expected future financial position, results of operations, cash flows, business strategy, budgets, projected costs, capital expenditures, products, competitive positions, growth opportunities, plans and objectives of management for future operations, as well as statements that include the words such as “expects,” “reaffirms” “intends,” “anticipates,” “plans,” “believes,” “seeks,” “estimates,” “optimistic,” or variations of such words and similar expressions, are forward-looking statements. These forward looking statements are not guarantees of future performance and are subject to risks and uncertainties. Investors are cautioned that actual events or results may differ from AngioDynamics’ expectations. Factors that may affect the actual results achieved by AngioDynamics include, without limitation, the ability of AngioDynamics to develop its existing and new products, technological advances and patents attained by competitors, future actions by the FDA or other regulatory agencies, domestic and foreign health care reforms and government regulations, results of pending or future clinical trials, overall economic conditions, the results of on-going litigation, the effects of economic, credit and capital market conditions, general market conditions, market acceptance, foreign currency exchange rate fluctuations, the effects on pricing from group purchasing organizations and competition, the ability of AngioDynamics to integrate purchased businesses, as well as the risk factors listed from time to time in AngioDynamics’ SEC filings, including but not limited to its Annual Report on Form 10-K for the year ended May 31, 2013. AngioDynamics does not assume any obligation to publicly update or revise any forward-looking statements for any reason. In the United States, NanoKnife has been cleared by the FDA for use in the surgical ablation of soft tissue. NanoKnife has not been cleared for the treatment or therapy of a specific disease or condition. This document may discuss the use of NanoKnife for specific clinical indications for which it is not cleared in the United States at this time. Notice Regarding Non-GAAP Financial Measures Management uses non-GAAP measures to establish operational goals, and believes that non-GAAP measures may assist investors in analyzing the underlying trends in AngioDynamics’ business over time. Investors should consider these non-GAAP measures in addition to, not as a substitute for or as superior to, financial reporting measures prepared in accordance with GAAP. In this news release, AngioDynamics has reported Average Daily Sales (ADS) growth, which is calculated as a growth rate of total sales per shipping day as compared to the prior year quarter; EBITDA (income before interest, taxes, depreciation and amortization); adjusted EBITDA; adjusted net income and adjusted earnings per share. Management uses these measures in its internal analysis and review of operational performance. Management believes that these measures provide investors with useful information in comparing AngioDynamics’ performance over different periods. By using these non-GAAP measures, management believes that investors get a better picture of the performance of AngioDynamics’ underlying business. Management encourages investors to review AngioDynamics’ financial results prepared in accordance with GAAP to understand AngioDynamics’ performance taking into account all relevant factors, including those that may only occur from time to time but have a material impact on AngioDynamics’ financial results. Please see the tables that follow for a reconciliation of non-GAAP measures to measures prepared in accordance with GAAP. *

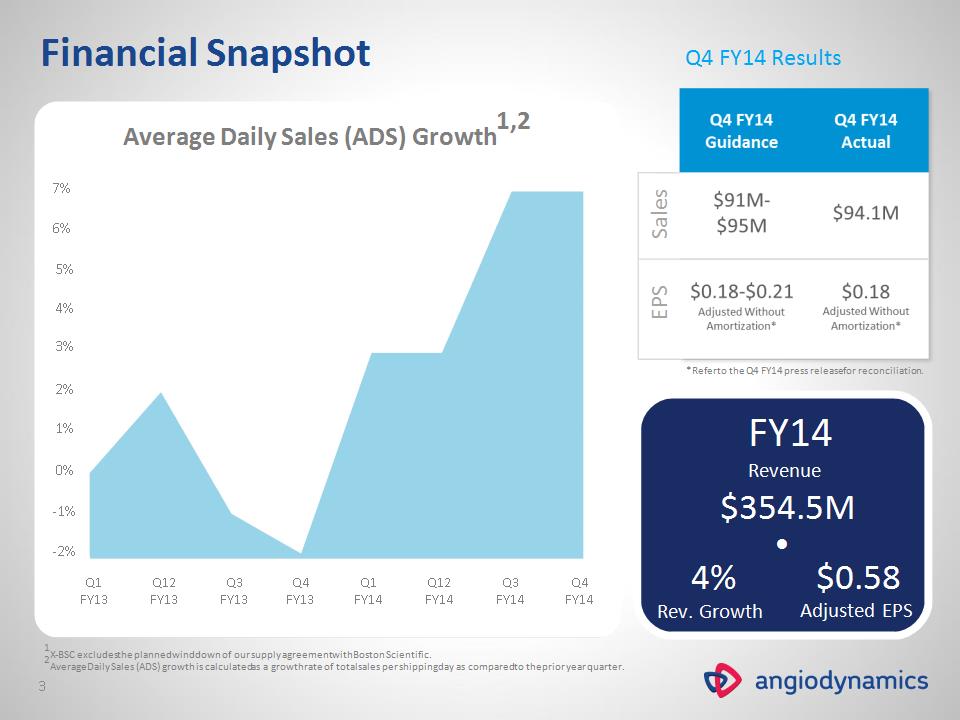

Financial Snapshot * -2% -1% 0% 1% 2% 3% 4% 5% 6% 7% Q1 FY13 Q12 FY13 Q3 FY13 Q4 FY13 Q1 FY14 Q12 FY14 Q3 FY14 Q4 FY14 Average Daily Sales (ADS) Growth1,2 FY14 Revenue $354.5M Q4 FY14 Results EPS Sales 1X-BSC excludes the planned wind down of our supply agreement with Boston Scientific. 2Average Daily Sales (ADS) growth is calculated as a growth rate of total sales per shipping day as compared to the prior year quarter. *Refer to the Q4 FY14 press release for reconciliation. 4% Rev. Growth • $0.58 Adjusted EPS

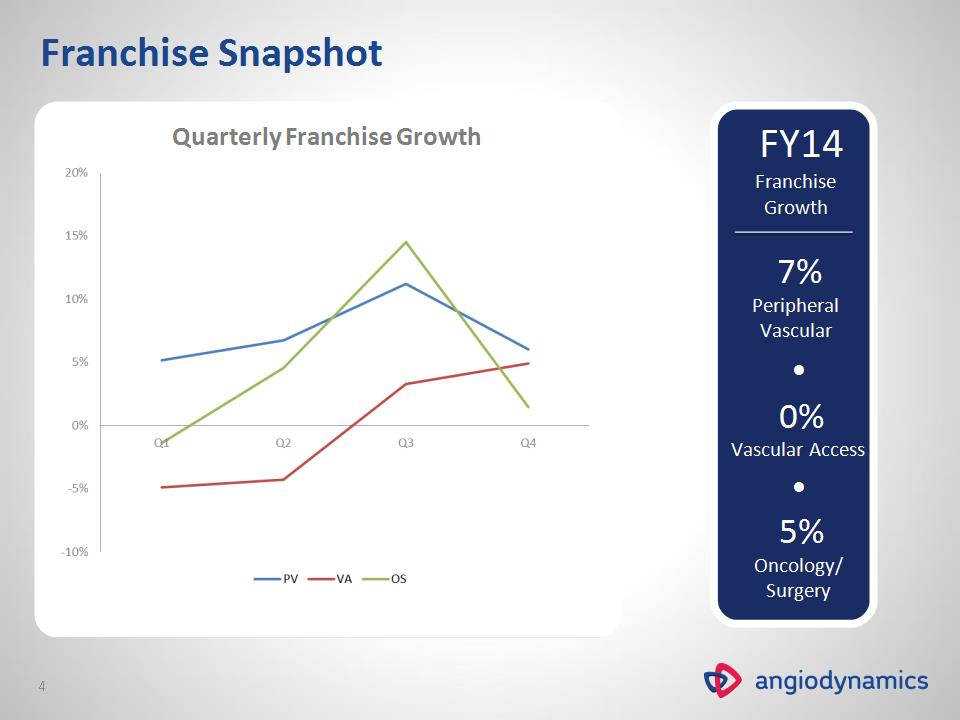

Franchise Snapshot * Quarterly Franchise Growth FY14 Franchise Growth 7% Peripheral Vascular • 0% Vascular Access • 5% Oncology/ Surgery

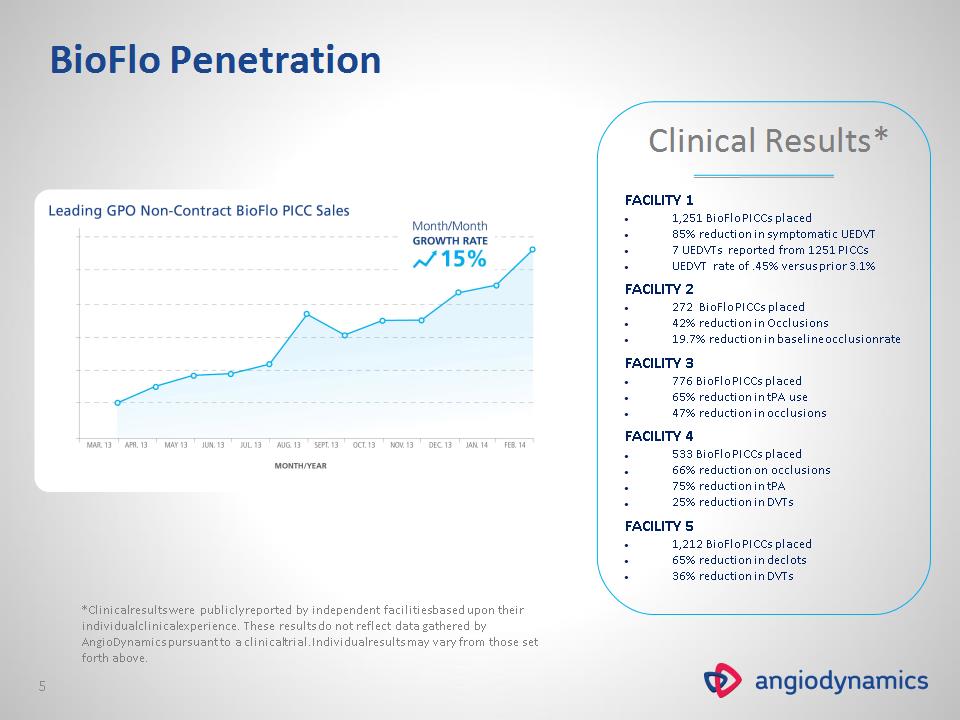

BioFlo Penetration FACILITY 1 1,251 BioFlo PICCs placed 85% reduction in symptomatic UEDVT 7 UEDVTs reported from 1251 PICCs UEDVT rate of .45% versus prior 3.1% FACILITY 2 272 BioFlo PICCs placed 42% reduction in Occlusions 19.7% reduction in baseline occlusion rate FACILITY 3 776 BioFlo PICCs placed 65% reduction in tPA use 47% reduction in occlusions FACILITY 4 533 BioFlo PICCs placed 66% reduction on occlusions 75% reduction in tPA 25% reduction in DVTs FACILITY 5 1,212 BioFlo PICCs placed 65% reduction in declots 36% reduction in DVTs Clinical Results* * *Clinical results were publicly reported by independent facilities based upon their individual clinical experience. These results do not reflect data gathered by AngioDynamics pursuant to a clinical trial. Individual results may vary from those set forth above.

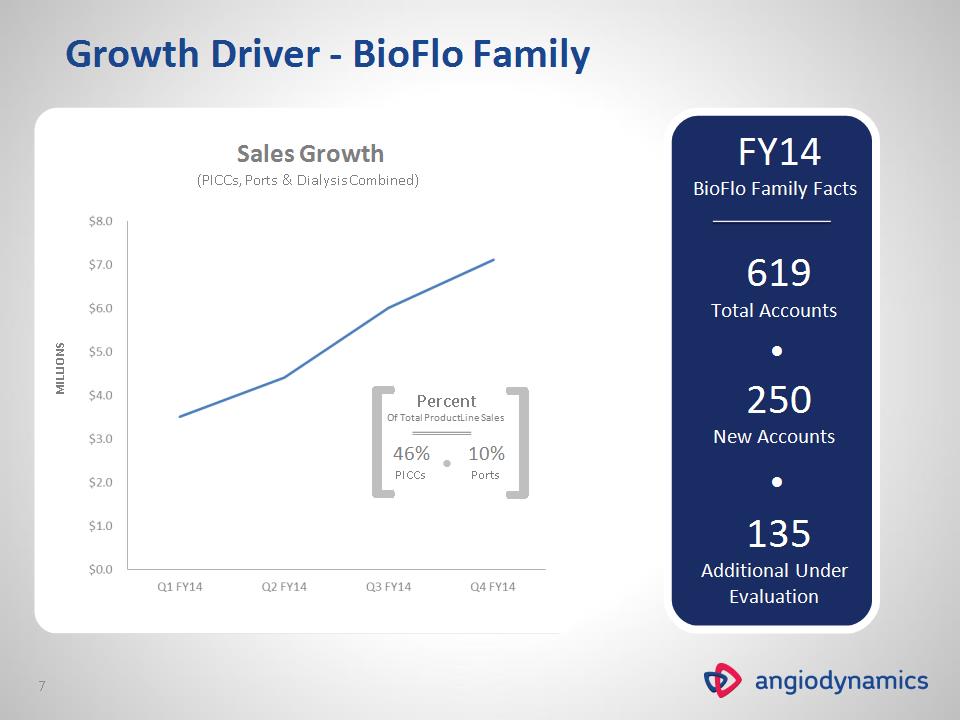

wth Driver – BioFlo Family * [ Sales Growth (PICCs, Ports & Dialysis Combined) MILLIONS FY14 BioFlo Family Facts 619 Total Accounts • 135 Additional Under Evaluation Percent Of Total Product Line Sales 46% PICCs • ] 10% Ports • 250 New Accounts

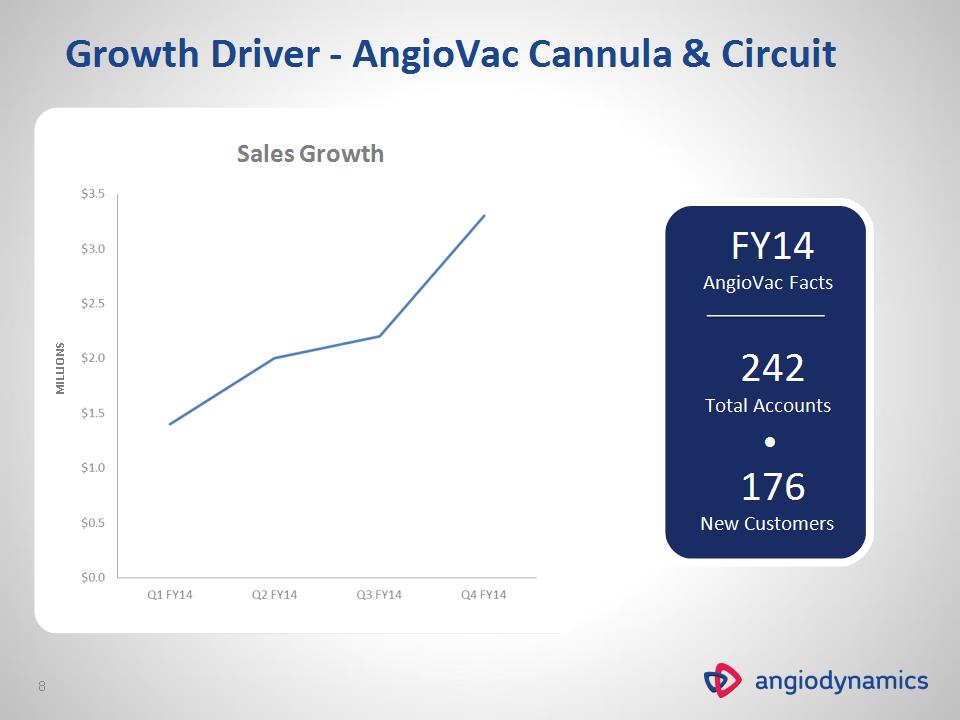

rowth Driver – AngioVac Cannula & Circuit * Sales Growth MILLIONS FY14 AngioVac Facts 242 Total Accounts • 176 New Customers

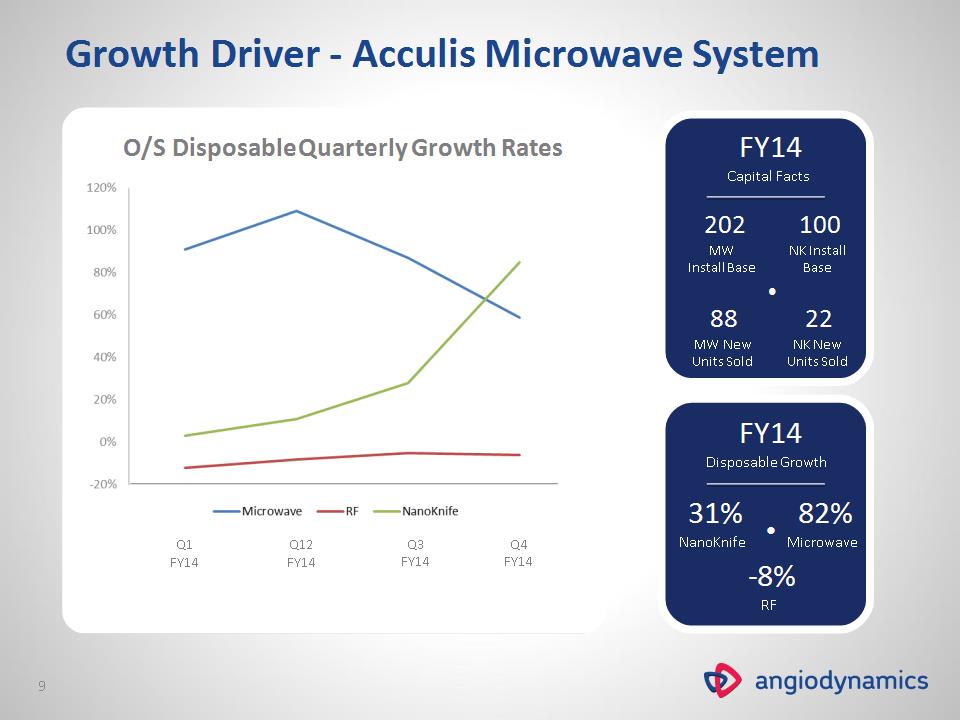

Growth Driver – Acculis Microwave System * FY14 Capital Facts 202 MW Install Base • 88 MW New Units Sold FY14 Disposable Growth 31% NanoKnife • 82% Microwave O/S Disposable Quarterly Growth Rates Q1 FY14 Q12 FY14 Q3 FY14 Q4 FY14 -8% RF 100 NK Install Base 22 NK New Units Sold

AngioDynamics, the AngioDynamics logo and other trademarks displayed in this presentation are trademarks owned and used by AngioDynamics, Inc. © Copyright 2012 AngioDynamics, Inc. All rights reserved. *