Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WILLIAMS COMPANIES, INC. | d742101d8k.htm |

| EX-10.1 - EX-10.1 - WILLIAMS COMPANIES, INC. | d742101dex101.htm |

| EX-99.1 - EX-99.1 - WILLIAMS COMPANIES, INC. | d742101dex991.htm |

The

Williams Companies, Inc. Williams agrees to acquire a 50% GP interest and 55.1

million LP units in

ACMP from Global Infrastructure Partners

Investor Conference Call

June

16

th

,

2014

Alan Armstrong, Chief Executive Officer

Don Chappel, Chief Financial Officer

Exhibit 99.2

©

2014 The Williams Companies, Inc. All rights reserved.

|

©

2014 The Williams Companies, Inc. All rights reserved.

2

Our

reports,

filings,

and

other

public

announcements

may

include

"forward-looking

statements"

within

the

meaning

of

Section

27A

of

the

Securities

Act

of

1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. These forward-looking statements relate to anticipated

financial performance, management's plans and objectives for future

operations, business prospects, outcome of regulatory proceedings, market conditions and

other matters. We make these forward-looking statements in reliance on the safe

harbor protections provided under the Private Securities Litigation Reform Act

of 1995. All statements, other than statements of historical facts, included in

this report that address activities, events or developments that we expect, believe or

anticipate will exist or may occur in the future, are forward-looking statements.

Forward-looking statements can be identified by various forms of words such

as "anticipates," "believes," "seeks," "could,"

"may," "should," "continues," "estimates,"

"expects," "forecasts," "intends," "might," "goals," "objectives,"

"targets," "planned," "potential," "projects,"

"scheduled," "will," "assumes," "guidance," "outlook," "in service date" or other

similar expressions. These

forward-looking statements are based on management's beliefs and assumptions and

on information currently available to management and include, among others,

statements regarding: Forward-looking Statements

•

The closing of, and the sources of funding for, the anticipated transaction with certain Global

Infrastructure Partners funds (the “GIP Purchase”);

•

Expected production increases in in the producing areas served Access Midstream Partners, L.P.

(“ACMP”), as well as its levels of cash distributions with respect to general partner

interests, incentive distribution rights, and limited partner interests;

•

Increases in our fee-based revenues as a percentage of our gross margin following the GIP

Purchase;

•

Planned increases in our dividends following the GIP Purchase; •

The timing of the drop-down of our remaining NGL & Petchem Services assets and projects; •

The completion of the proposed merger (the “Proposed Merger”) of ACMP and Williams Partners

L.P. (“WPZ”), including the approval of the Proposed Merger by the conflicts committees

of each partnership and the exchange ratio to be utilized in the Proposed Merger;

•

The benefits of the Proposed Merger to unitholders of ACMP and WPZ, respectively, and to our

stockholders;

•

The operations, performance, levels of distributions, and distribution coverage of the merged

partnership following the Proposed Merger;

•

Our future credit ratings and the future credit ratings of WPZ and ACMP; •

The expected timing for the restart of WPZ’s Geismar, Louisiana, olefins plant; •

The expected timing of receipt and amounts of proceeds from insurance claims related to the Geismar

plant;

•

Amounts and the nature of future capital expenditures; •

Expansion and growth of our business and operations; •

Financial condition and liquidity;

•

Business strategy;

•

Cash flow from operations or results of operations, including cash flow per share following the GIP

Purchase;

•

The levels of dividends to stockholders; •

Natural gas, natural gas liquids and olefins, supply, prices and demand; and •

Demand for our services

|

©

2014 The Williams Companies, Inc. All rights reserved.

3

Whether we will receive necessary regulatory approvals, or be required to make any

divestitures, under provisions of the Hart-Scott-Rodino Antitrust

Improvements Act of 1976, as amended, to consummate the GIP Purchase;

Whether ACMP will produce sufficient cash flows following the GIP Purchase to provide

the level of cash distributions we expect; ACMP’s reliance on a limited

number of customers for a substantial majority of its revenues; Whether any

nationally-recognized credit rating agency issues a decrease in our credit ratings or the credit ratings of ACMP or WPZ;

Our ability to achieve our expected increases in the levels of quarterly

dividends; Potential fluctuations in the market prices of WPZ’s or

ACMP’s common units following our announcement of the Proposed Merger;

Approval of the Proposed Merger, including by the conflicts committees of ACMP and

WPZ; Our

ability

to

successfully

integrate

the

businesses

of

ACMP

and

WPZ

in

order

to

achieve

the

expected

benefits

of

the

Proposed

Merger;

Our ability to recover expected insurance proceeds related to the Geismar

plant; Whether we have sufficient cash to enable us to pay current and expected

levels of dividends; Availability of supplies, market demand and volatility of

prices; Inflation,

interest

rates,

fluctuation

in

foreign

exchange

rates,

and

general

economic

conditions

(including

future

disruptions

and

volatility

in

the

global

credit markets and the impact of these events on our customers and suppliers);

The strength and financial resources of our competitors and the effects of

competition; Whether we are able to successfully identify, evaluate and execute

investment opportunities; Our ability to acquire new businesses and assets and

successfully integrate those operations and assets into our existing businesses, as well as

successfully expand our facilities;

Development of alternative energy sources;

The

impact

of

operational

and

development

hazards

and

unforeseen

interruptions;

Costs of, changes in, or the results of laws, government regulations (including

safety and environmental regulations), environmental liabilities, litigation,

and rate proceedings;

Our costs and funding obligations for defined benefit pension plans and other

postretirement benefit plans; Changes in maintenance and construction

costs; Changes in the current geopolitical situation;

Our exposure to the credit risk of our customers and counterparties;

Risks

related

to

financing,

including

restrictions

stemming

from

our

debt

agreements,

future

changes

in

our

credit

ratings

and

the

availability

and

cost

of capital;

The amount of cash distributions from and capital requirements of our investments and

joint ventures in which we participate; Risks associated with weather and

natural phenomena, including climate conditions; Acts of terrorism, including

cybersecurity threats and related disruptions; and Additional risks described

in our filings with the Securities and Exchange Commission. Forward-looking

Statements (continued) •

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

Forward-looking statements are based on numerous assumptions, uncertainties and

risks that could cause future events or results to be materially different from

those stated or implied in this report. Many of the factors that will determine

these results are beyond our ability to control or predict. Specific factors

that could cause actual results to differ from results contemplated by the

forward-looking statements include, among others, the following: |

©

2014 The Williams Companies, Inc. All rights reserved.

4

Given the uncertainties and risk factors that could cause our actual results to differ

materially from those contained in any forward-looking statement, we

caution investors not to unduly rely on our forward-looking statements. We

disclaim any obligations to and do not intend to update the above list or to

announce publicly the result of any revisions to any of the forward-looking

statements to reflect future events or developments. In

addition

to

causing

our

actual

results

to

differ,

the

factors

listed

above

may

cause

our

intentions

to

change

from

those

statements

of

intention

set

forth

in

this

announcement.

Such

changes

in

our

intentions

may

also

cause

our

results

to

differ.

We

may

change

our

intentions,

at

any

time

and

without

notice,

based upon changes in such factors, our assumptions, or otherwise.

Investors are urged to closely consider the disclosures and risk

factors in our annual report on Form 10-K filed with the SEC on Feb. 26, 2014,

and each of our quarterly reports on Form 10-Q available from our offices

or from our website at www.williams.com. Forward-looking Statements

(continued) |

©

2014 The Williams Companies, Inc. All rights reserved.

5

Williams

Announces

Acquisition

of

Additional

Interests

in

ACMP

Williams has agreed to acquire the 50% general partner interest and 55.1 million

limited partner units in Oklahoma City-based Access Midstream Partners, LP

(NYSE: ACMP) held by certain Global Infrastructure Partners funds

(“GIP”) for $5.995 billion in cash Note:

1

Dividends and distributions subject to respective board approval

2

A more detailed schedule reconciling this non-GAAP measure is provided in this

presentation Increasing

Access

Midstream

Partners

ownership

to

100%

of

GP

and

50%

of

LP

via

acquisition

Planning

Williams

3Q

2014

dividend

up

32%

1

to

$0.56

1

,

or

$2.24

1

on

an

annualized

basis;

$2.46

1

for

2015,

with

follow-on

annual

dividend

growth

of

approximately

15%

1

through

2017

Accelerating transformation of Williams to pure-play GP holding-company

structure Proposing

subsequent

merger

of

Williams

Partners

and

Access

Midstream

Partners;

if

consummated,

creates

industry-leading

MLP

with

expected

2015

adjusted

EBITDA

2

of

approximately

$5

billion,

strong

coverage

and

10%

1

-

12%

1

annual

LP

distribution

growth

rate

through 2017

Expecting

2015

distributions

for

merged

MLP

to

be

at

least

25%

1

above

Access

Midstream

Partners’

current

2015

distribution

guidance;

up

more

than

40%

1

vs.

current

2014

Guidance

Acquisition of Access Midstream GP and LP interests is subject to regulatory

approvals and not contingent on the merger of the two partnerships

|

©

2014 The Williams Companies, Inc. All rights reserved.

6

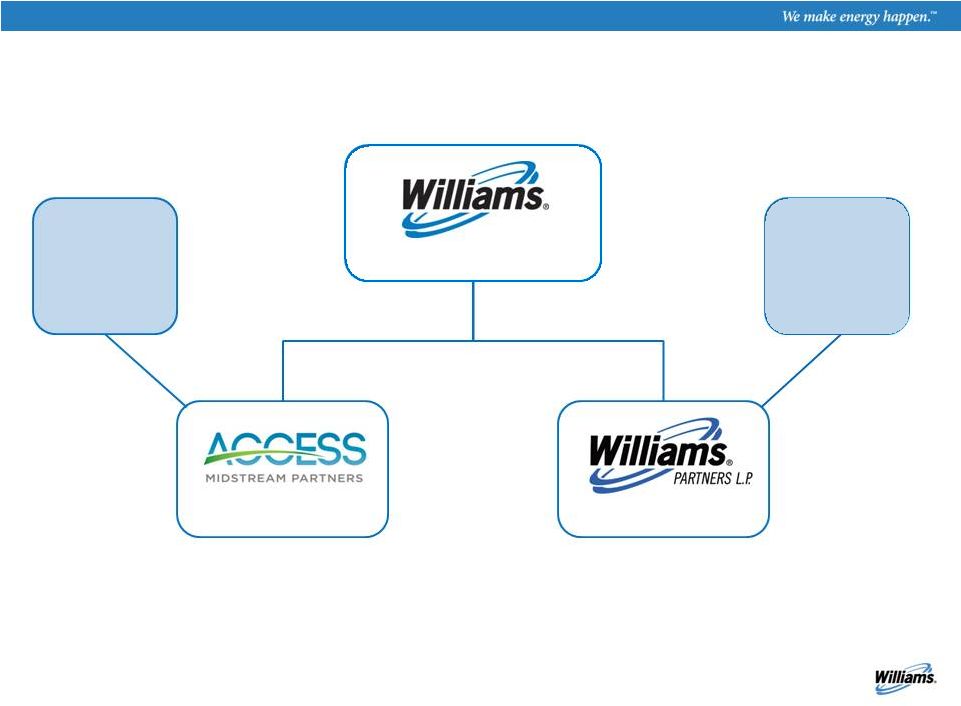

WMB to Become One of the Largest Publicly

Traded General Partner Holding Companies

NYSE: WMB

NYSE: ACMP

NYSE: WPZ

100% of GP Interest,

IDRs

100% of GP Interest,

IDRs

50% LP

Interest

64% LP

Interest

Public

Unitholders

Public

Unitholders

50% LP

Interest

36% LP

Interest

WMB expects to gain full control of ACMP with an enhanced growth

profile

and the ability to recognize benefits from simplifying the ACMP ownership

structure |

©

2014 The Williams Companies, Inc. All rights reserved.

7

Transaction Highlights

•

Williams expects the acquisition to increase fee-based revenues to more than

80% of its gross margin as a result of Access Midstream Partners’

fee-based revenues

•

The

acquisition

is

expected

to

increase

Williams’

cash

flow

per

share

as

a

result

of

rapid

growth in Access Midstream Partners’

business, which drives attractive growth in its

GP / IDR and LP cash distributions

•

In

connection

with

this

acquisition,

Williams

expects

to

receive

tax

benefits

consistent

with

those recognized from the December 2012 initial investment in Access Midstream

Partners •

Williams

expects

the

acquisition

to

deliver

immediate

and

future

dividend

growth

for

Williams’

shareholders and to further enhance its presence in attractive growth basins

•

Williams plans to fund approximately half of the $5.995 billion acquisition with

equity and the remainder with a combination of long-term debt, revolver

borrowings and cash on hand •

To complete Williams’

transition to a pure-play GP holding company, Williams plans to

accelerate the drop-down of remaining NGL & Petchem Services assets and

projects to late 2014 or early 2015

•

The proposed merger of Williams Partners and Access Midstream Partners, if

consummated, would create an industry-leading, large-scale MLP with

substantial positions across the midstream business

|

©

2014 The Williams Companies, Inc. All rights reserved.

8

Our Strategy –

More Relevant Than Ever

Big Picture

•

Be

the

premier

provider

of

reliable

large-scale

infrastructure

designed

to

maximize

the

opportunities

created by the vastly greater supply of natural gas and natural gas products now

known to exist in North America's unconventional resource plays

Underpinned by Scale, Competitive Advantage

•

Be

big

–

the

No.

1

or

2

largest

–

in

gathering,

processing

and

transportation

in

basins

and

markets

where we operate

•

Grow position in areas where we have unique competitive advantages

•

Maximize returns in established markets where we have the No. 1 or No. 2

position Strategy is Well-Aligned with the Commodity Environment

•

Well-positioned to capture current opportunities associated with ethane

cracking •

Rapidly growing fee-based business

•

Low

prices

grow

demand

in

natural

gas,

NGLs,

olefins

–

all

infrastructure-constrained

•

Natural gas products price-advantaged against crude and naptha products

Today's announcement further enhances our ability to execute on our strategy

|

©

2014 The Williams Companies, Inc. All rights reserved.

9

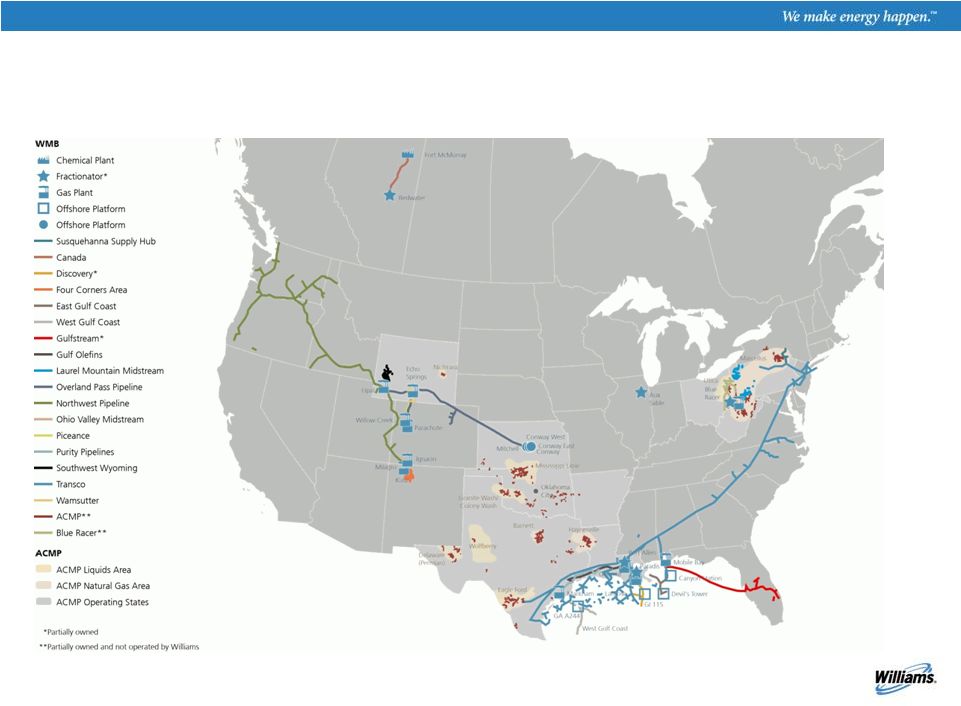

Fortifies WMB's Impressive Footprint with Assets

in Major Supply Basins Across the U.S. |

©

2014 The Williams Companies, Inc. All rights reserved.

10

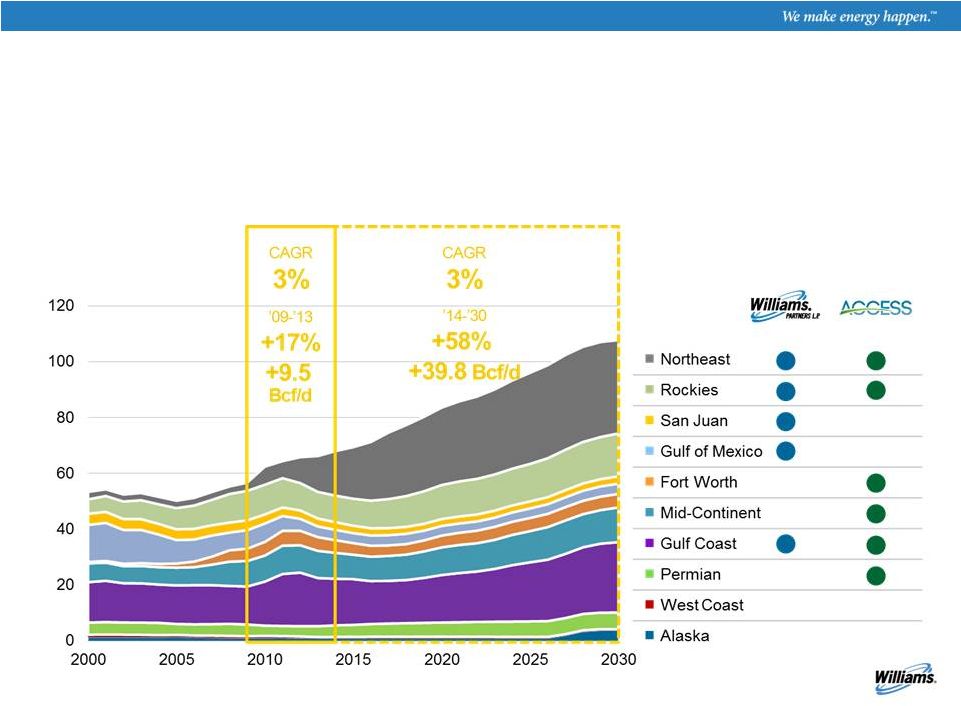

Well-Positioned to Benefit From Supply Growth

NATURAL GAS –

U.S. SUPPLY GROWTH (Bcf/d)

Note: Excludes Canadian import volumes of

approximately 4.5 Bcf/d (at 2014 levels) Source: Wood

Mackenzie North America Gas Service •

Leadership position in major supply basins across the U.S.

•

Strengthens position as the premier natural gas infrastructure player in the U.S.,

with gas gathering volumes directly operated doubling

|

©

2014 The Williams Companies, Inc. All rights reserved.

11

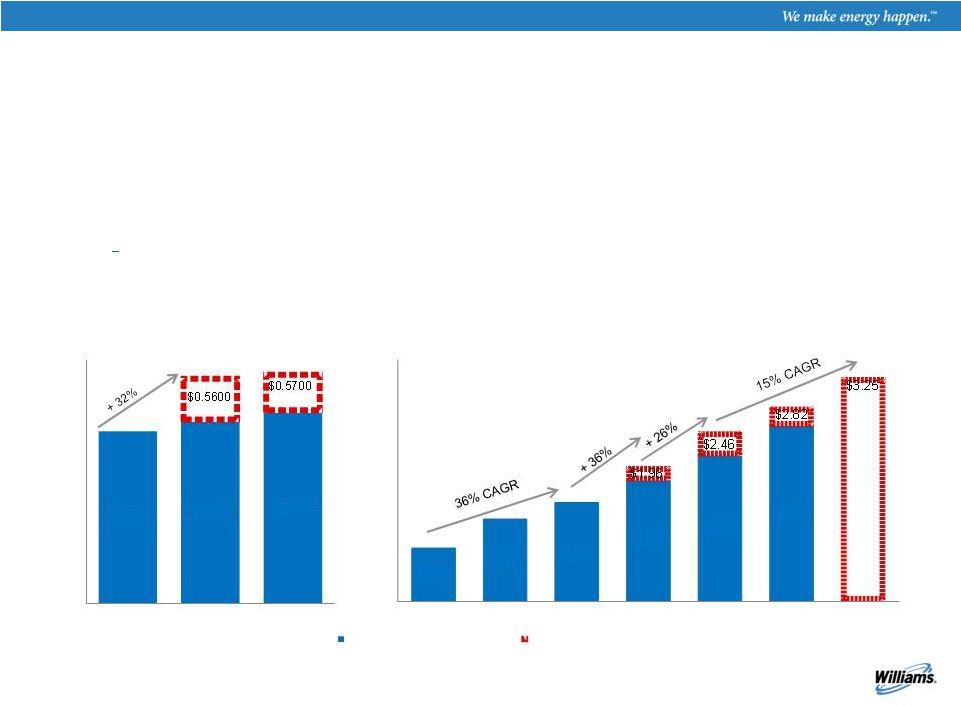

Acquisition Expected to be Significantly

Accretive to Williams' Dividend per Share

•

Expected to result in growing GP and LP distributions, creating additional cash

coverage and providing for higher / sustained dividend growth

•

Williams

plans

to

increase

its

third-quarter

2014

dividend

32%

1

to

$0.56

1

,

or

$2.24

1

on

an

annualized

basis,

with

annual

dividend

growth

thereafter

of

approximately

15%

1

through

2017

Williams expects the transaction to close in Q3 2014

•

Targeting

2015

dividend

of

approximately

$2.46

1

per

share,

representing

an

increase

of

$0.35,

or

16.6%, from our 2015 guidance of $2.11

Quarterly Dividends

Annual Dividends

Note:

1

Dividends subject to board approval

$0.4250

$0.4475

$0.4700

$0.00

$0.10

$0.20

$0.30

$0.40

$0.50

$0.60

Q2 2014A

Q3 2014E

Q4 2014E

$0.78

$1.20

$1.44

$1.75

$2.11

$2.54

$0.00

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

2011A

2012A

2013A

2014E

2015E

2016E

2017E

Actuals and Previous Guidance

New Guidance |

©

2014 The Williams Companies, Inc. All rights reserved.

12

In

addition

to

WMB's

acquisition

of

GIP's

interests

in

ACMP,

WMB

is

seeking

to merge

WPZ and ACMP creating a premier, large-cap MLP with industry leading scale and

diversification

Natural Gas Pipelines: Transco, Northwest and Gulfstream represent the nation's

premier interstate pipeline Natural Gas Gathering and Processing:

Large-scale positions in growing natural gas supply areas in major NGL

and Petrochemical Services: Unique downstream presence on Gulf Coast and in western Canada

•

Assuming the merger is consummated in 2014, the merged MLP is expected to have a

2015 distribution increase of at

least

25%

1

above

Access

Midstream

Partners’

current

guidance

of

$2.79

1

per

unit

up

more

than

40%

1

vs.

current

2014

Guidance,

with

a

best-in-class

distribution

growth

rate

of

10%

1

to

12%

1

through

2017

and

strong

coverage

•

Williams expects the merged partnership will be a synergistic business combination

that is well-positioned to benefit from the ongoing energy

infrastructure super-cycle with an operating footprint that connects the best supplies with

the best markets

•

Combines the stability of Access Midstream Partners' current contract portfolio

with Williams Partners' enhanced long-term growth opportunities and

development expertise •

Acquisition of Access Midstream GP and LP interests is subject to regulatory

approvals and not contingent on the merger of the two partnerships

3

2

1

Note:

1

Distributions subject to board approval

Proposed WPZ / ACMP Merger Creates Premier

MLP

system

shale and unconventional producing areas

provides differentiated long-term growth

•

Creates one of the largest MLPs with leading positions across the three key

components of the midstream sector: |

©

2014 The Williams Companies, Inc. All rights reserved.

13

Expected Proposed Merger Benefits to ACMP

•

Significantly broadened customer base, enhanced business platform, expanded

technical and operational expertise, and additional opportunities to sustain

long-term growth •

If the proposed merger is consummated in 2014:

Expected

increase

in

2015

distributions

of

at

least

25%

1

above

Access

Midstream

Partners’

current

2015

distribution

guidance.

This

represents

an

increase

of

more

than

40%

1

above

current

2014

distribution guidance

Expected

increase

in

2016

distributions

of

at

least

20%

1

above

Access

Midstream

Partners’

current

2016 distribution guidance

Expected

best-in-class

10%

1

to

12%

1

annual

distribution

growth

rate

in

each

2016

and

2017

Distribution

coverage

2

is

estimated

to

be

approximately

1.2x

in

2015

and

at

or

above

1.1x

through

2017

•

Expected to improve credit ratings to strong BBB investment grade levels which

lowers debt cost and increases access to capital

•

Expected to increase trading liquidity and broaden appeal to investors as a core

MLP holding Note:

1

Distributions subject to board approval

2

A definition of this non-GAAP measure is provided in this presentation

|

©

2014 The Williams Companies, Inc. All rights reserved.

14

Expected Proposed Merger Benefits to WPZ

•

Expected increased scale and diversification with substantial operating footprint

in major supply-growth basins in the U.S., creating one of the most

substantial growth platforms in the industry

•

Significantly broadens customer base, enhances business platform, expands technical

and operational expertise, and drives opportunities to sustain long-term

growth •

Proposed merger exchange ratio of 0.85 Access Midstream Partners

units for each Williams

Partners unit would provide unitholders with an expected immediate premium

Williams Partners unitholders will also have the option to take either a

one-time special payment of $0.81 per unit, or an equivalent

value of additional common units of Access Midstream Partners, to

compensate

for

a

lower

expected

per

unit

LP

cash

distribution

in

2015

•

Williams Partners unitholders will receive Access Midstream Partners units with pro

forma best-in-class

distribution

growth

and

significant

cash

coverage

–

with

the

combined

MLP

expected to benefit from attractive equity valuation

•

Stronger

credit

profile

expected

upon

integration

of

Access

Midstream

Partners’

100%

fee-based business

Note:

1

Distributions subject to board approval

1 |

©

2014 The Williams Companies, Inc. All rights reserved.

15

Expected Proposed Merger Benefits to WMB

•

Provides opportunity to enhance and streamline operations,

business-development, commercial and support capabilities

•

Further simplifies the corporate structure

•

Aligns Williams Partners and Access Midstream Partners unitholders

•

Expected to increase efficiency in capital allocation to growth opportunities

•

Increased growth visibility expected to drive higher Williams valuation

|

©

2014 The Williams Companies, Inc. All rights reserved.

16

•

Williams expects the acquisition to increase fee-based revenues to more than

80% of its gross margin as a result of Access Midstream Partners’

fee-based revenues

•

The

acquisition

is

expected

to

increase

Williams’

cash

flow

per

share

as

a

result

of

rapid

growth in Access Midstream Partners’

business, which drives attractive growth in its

GP / IDR and LP cash distributions

•

In

connection

with

this

acquisition,

Williams

expects

to

receive

tax

benefits

consistent

with

those recognized from the December 2012 initial investment in Access Midstream

Partners •

Williams

expects

the

acquisition

to

deliver

immediate

and

future

dividend

growth

for

Williams’

shareholders and to further enhance its presence in attractive growth basins

•

Williams plans to fund approximately half of the $5.995 billion acquisition with

equity and the remainder with a combination of long-term debt, revolver

borrowings and cash on hand •

To complete Williams’

transition to a pure-play GP holding company, Williams plans to

accelerate the drop-down of remaining NGL & Petchem Services assets and

projects to late 2014 or early 2015

•

The proposed merger of Williams Partners and Access Midstream Partners, if

consummated, would create an industry-leading, large-scale MLP with

substantial positions across the midstream business

Summary Benefits |

Non-GAAP Disclaimer

©

2014 The Williams Companies, Inc. All rights reserved.

|

©

2014 The Williams Companies, Inc. All rights reserved.

18

This

presentation

includes

combined

adjusted

EBITDA

for

Williams

Partners

and

Access

Midstream

Partners

for

2015

and

cash

distribution

coverage ratio, which are non-GAAP financial measures as defined under the rules

of the SEC. For

Williams

Partners

L.P.

we

define

adjusted

EBITDA

as

net

income

(loss)

attributable

to

partnership

before

income

tax

expense,

net

interest

expense, depreciation and amortization expense, equity earnings from investments and

allowance for equity funds used during construction, adjusted for equity

investments cash distributions to partnership and certain other items management believes affect the comparability of

operating results.

Access

Midstream

Partners

defines

adjusted

EBITDA

as

net

income

(loss)

before

income

tax

expense,

interest

expense,

depreciation

and

amortization

expense

and

certain

other

items

management

believes

affect

the

comparability

of

operating

results.

For

Williams

Partners

L.P.

we

also

calculate

the

ratio

of

distributable

cash

flow

to

the

total

cash

distributed

(cash

distribution

coverage

ratio).

This measure reflects the amount of distributable cash flow relative to our cash

distribution. We define distributable cash flow as net income plus

depreciation and amortization and cash distributions from our equity investments less our earnings from our equity investments,

income attributable to noncontrolling interests and maintenance capital expenditures.

We also adjust for payments and/or reimbursements under omnibus agreements

with Williams and certain other items. This

presentation

is

accompanied

by

a

reconciliation

of

adjusted

EBITDA

to

its

nearest

GAAP

financial

measure.

Management

uses

this

financial measure because it is an accepted financial indicator used by investors to

compare company performance. In addition, management believes that this

measure provides investors an enhanced perspective of the operating performance of the partnership's assets and the cash

that

the

business

is

generating.

Adjusted

EBITDA

is

not

intended

to

represent

cash

flows

for

the

period,

nor

is

it

presented

as

an

alternative

to net income or cash flow from operations. It should not be considered in isolation

or as substitutes for a measure of performance prepared in accordance with

United States generally accepted accounting principles Non-GAAP

Disclaimer |

©

2014 The Williams Companies, Inc. All rights reserved.

19

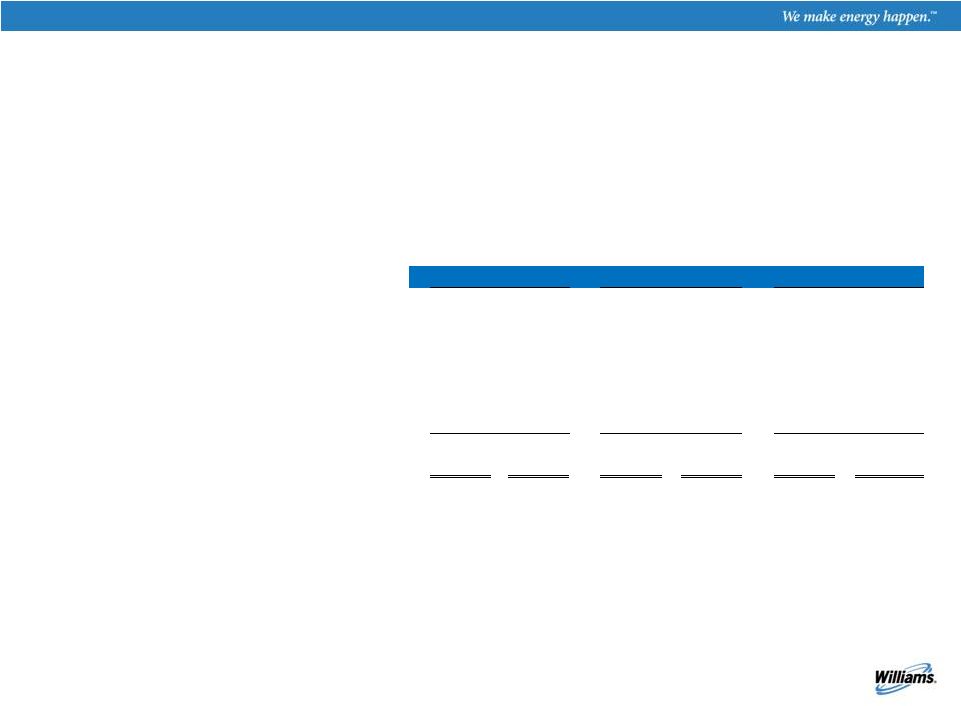

Net Income After Tax Reconciliation to Adjusted

EBITDA

Williams

Access

Partners

Midstream

Combined*

Low

High

Low

High

Low

High

Net income after tax attributable to partnership

1,755

$

2,105

$

470

$

645

$

Net interest expense

645

665

225

175

Income tax expense

45

55

5

5

Equity earnings from investments

(310)

(340)

-

-

Equity investments cash distributions to partnership

360

400

-

-

Depreciation & amortization (DD&A)

1,010

1,060

550

525

Equity allowance for funds used during construction

(90)

(100)

-

-

Adjusted EBITDA attributable to partnership

3,415

$

3,845

$

1,250

$

1,350

$

4,665

$

5,195

$ |