Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - RigNet, Inc. | d739809d8k.htm |

Exhibit 99.1

| ASSOCIATION FOR CORPORATE GROWTH River Oaks Country Club June 10, 2014 |

| Forward-looking Statements 2 Certain statements made in this presentation may constitute "forward-looking statements" within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995 - that is, statements related to the future, not past, events. Forward-looking statements are based on current expectations and include any statement that does not directly relate to a current or historical fact. In this context, forward-looking statements often address our expected future business and financial performance, and often contain words such as "anticipate," "believe," "intend," "expect," "plan" or other similar words. Forward-looking statements included in this presentation include, without limitation, statements regarding future average bandwidth for offshore rigs, future ultra-deep water rig supply, projected revenue, EBITDA and UFCF numbers for RigNet and anticipated benefits of our acquisition of the Inmarsat Energy Broadband business. These forward-looking statements involve certain risks and uncertainties that ultimately may not prove to be accurate. Actual results and future events could differ materially from those anticipated in such statements. Factors that could cause actual results to differ materially from those contemplated in our forward-looking statements include, among others: adverse changes in economic conditions in the markets we operate; the extent, timing and overall effects of competition in our industry; the impact of new, emerging or competing technologies; material changes in the communications industry that could adversely affect vendor relationships with equipment and network suppliers and customer relationships with wholesale customers; unfavorable results of litigation or intellectual property infringement claims asserted against us; unanticipated increases or other changes in our future cash requirements; risks associated with the integration of the Inmarsat Energy Broadband business as a stand-alone subsidiary and/or the ability to realize anticipated synergies, cost savings and growth opportunities from this acquisition; the effects of federal and state legislation, and rules and regulations governing the communications industry; the impact of equipment failure, natural disasters or terrorist acts; and those additional factors set forth under the caption "Risk Factors" and other factors described in our filings with the SEC, including under the section "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our Form 10-K for the fiscal year December 31, 2013, which is incorporated by reference herein. RigNet undertakes no obligation and does not intend to update these forward-looking statements to reflect events or circumstances occurring after this press release. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. All forward-looking statements are qualified in their entirety by this cautionary statement. In addition to U.S. GAAP financials, this presentation includes certain non-GAAP financial measures. These non- GAAP measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. Definitions of these non-GAAP measures and reconciliations between certain GAAP and non-GAAP measures are included in the appendix to this presentation. |

| TODAY'S DISCUSSION 3 Preparing for Monetization: 2007 - 2010 (Private Equity-Backed Phase) Life as a Public Company: 2010 - 2014 (Sarbanes Oxley and more) Importance of Culture and Values to High Performance and Alignment Liquidity Event: 2010 (Trade Sale, Recap or IPO) Founded in 2001, RigNet (NASDAQ: RNET) is a leading provider of remote communications, systems integration and collaborative applications to the oil and gas industry, both offshore and onshore, around the world Strategy evolution: Three-legged Stool to Technology Solutions Provider The Early Years: 2000 - 2006 (Startup Phase) |

| RigNet Provides Mission Critical Remote Communications to the Oil and Gas industry 4 Provide mission critical remote communications services to the oil and gas industry Offers Best-in-class solutions for all remote communications requirements Provide managed services to 1,100+ sites in over 45 countries on six continents(1) Partner with our customers' IT departments to serve remote end users and develop new services Multiple revenue growth streams including additional sites, ARPU growth, secondary tenants and more Low customer churn, stable end- user pricing and high barriers-to- entry Majority of revenues from recurring, multi-tenant revenue model under long-term contracts (1) As of March 31, 2014 Note: As of December 31, 2013 Global, Diversified Presence U.S. vs. international revenue split International 83% US 17% |

| Three smiling Norwegians Cracking the code Challenges of managing high growth Compliance risks in Third World countries Bringing in outside capital/investors 5 THE EARLY YEARS: 2000 - 2006 |

| New management team Peeking under rocks Professionalizing the business: processes, systems, people Fits and starts: Oslo Bors to NASDAQ; US GAAP to IFRS back to US GAAP Preparing for the dual track while always being for sale 6 PREPARING FOR MONETIZATION: 2007 - 2010 |

| Delays in listing: PE syndicate squabbles; worldwide recession in late 2008/2009; BP Macando spill in 2010 Dual track process Pivoting to IPO The roadshow The Opening Bell at NASDAQ (RNET) 7 LIQUIDITY EVENT: 2010 |

| Independent public board versus private equity board: achieving balance of guidance and governance Sarbanes Oxley: financial controls Courting public investors: phone calls; 1x1s, conferences, non-deal roadshows Positives: firepower for deals; financial credibility for customers; public equity as a recruitment/retention tool Negatives: open kimono (only public company in our space) to customers, competitors and employees; SOX very painful for a small company, but it has made us stronger 8 LIFE AS A PUBLIC COMPANY: 2010 - 2014 |

| Three-legged Stool strategy: new growth runways by entering vertical market adjacencies (adding maritime and government to our core energy market) Traditional move made by many providers However, maritime and government not as attractive Return to core upstream energy market focus, but with new growth runways by entering near-adjacencies of production and energy maritime Drilling rigs, productions facilities, energy maritime vessels (rigs, platforms, vessels) Life of the Field: drilling through production Maintains upstream energy focus while broadening growth potential Return to broadened upstream energy focus endorsed by outside consulting studies Deepening the roots in upstream energy: Technology Solutions Provider strategy - adding solutions that enhance reservoir value, reduce NPT and improve safety where a remote communications network adds additional value Asset tracking / utilization Supply chain / logistics Subsea communications Crew welfare 9 STRATEGY EVOLUTION AS A PUBCO |

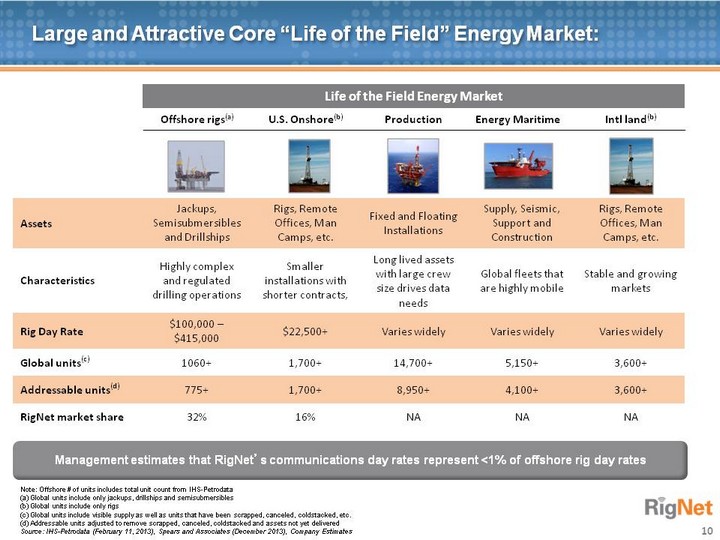

| Large and Attractive Core "Life of the Field" Energy Market: 10 Life of the Field Energy Market Life of the Field Energy Market Life of the Field Energy Market Life of the Field Energy Market Life of the Field Energy Market Offshore rigs(a) U.S. Onshore(b) Production Energy Maritime Intl land(b) Assets Jackups, Semisubmersibles and Drillships Rigs, Remote Offices, Man Camps, etc. Fixed and Floating Installations Supply, Seismic, Support and Construction Rigs, Remote Offices, Man Camps, etc. Characteristics Highly complex and regulated drilling operations Smaller installations with shorter contracts, Long lived assets with large crew size drives data needs Global fleets that are highly mobile Stable and growing markets Rig Day Rate $100,000 - $415,000 $22,500+ Varies widely Varies widely Varies widely Global units(c) 1060+ 1,700+ 14,700+ 5,150+ 3,600+ Addressable units(d) 775+ 1,700+ 8,950+ 4,100+ 3,600+ RigNet market share 32% 16% NA NA NA Management estimates that RigNet's communications day rates represent <1% of offshore rig day rates Note: Offshore # of units includes total unit count from IHS-Petrodata (a) Global units include only jackups, drillships and semisubmersibles (b) Global units include only rigs (c) Global units include visible supply as well as units that have been scrapped, canceled, coldstacked, etc. (d) Addressable units adjusted to remove scrapped, canceled, coldstacked and assets not yet delivered Source: IHS-Petrodata (February 11, 2013), Spears and Associates (December 2013), Company Estimates |

| As RigNet has grown, its top-down, autocratic management style has come under increasing pressure Groundswell of support for a more empowered and aligned organization Firm belief that great companies have great performance and great cultures that unleash the full potential of each employee In workshops around the world involving a third of our employees, we crafted a new high-performance culture and set of core values Integrity; Respect for People; Passion for Excellence; Teamwork; and Safety Multi-year journey, but well worth the investment 11 IMPORTANCE OF THE SOFT STUFF |

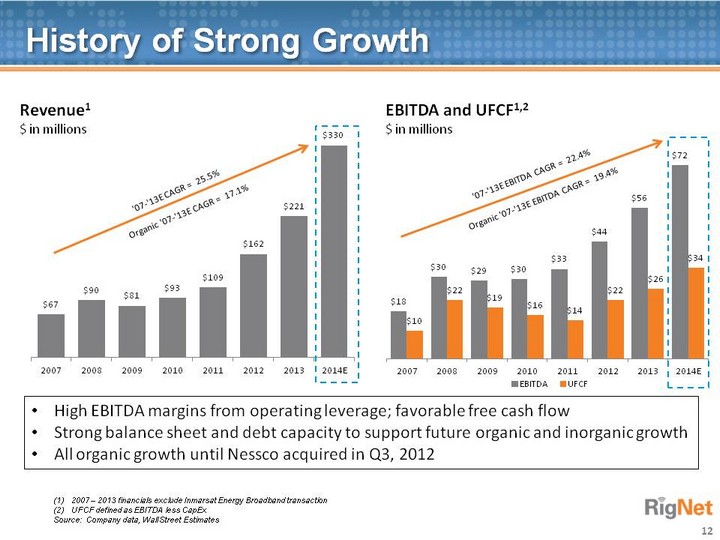

| History of Strong Growth 12 Revenue1 $ in millions 2007 - 2013 financials exclude Inmarsat Energy Broadband transaction UFCF defined as EBITDA less CapEx Source: Company data, Wall Street Estimates High EBITDA margins from operating leverage; favorable free cash flow Strong balance sheet and debt capacity to support future organic and inorganic growth All organic growth until Nessco acquired in Q3, 2012 EBITDA and UFCF1,2 $ in millions (CHART) (CHART) |

| (CHART) Growth Driven by Market Share Gains 13 Global Market Share by Revenue RigNet is the only major provider to have grown market share over the past few years - RigNet's managed services model is preferred to transport providers RigNet delivers on criteria important to demanding oil and gas customers RigNet is the last remaining independent global provider of remote communications to the oil and gas industry after recent provider consolidation wave Customer quote from recent industry study: "RigNet is flexible, pragmatic, responsive and they smell like oil people" (a) 2013 shows RigNet and Stratos market share combined to illustrate RigNet's acquisition of the Inmarsat Energy Broadband business Source: Various; Company analysis Industry Ranking vs. Key Success Criteria Global Footprint Strong Value-Added Solutions Strong Network Reliability Strong Customer Support Strong ^ '05-'13 |

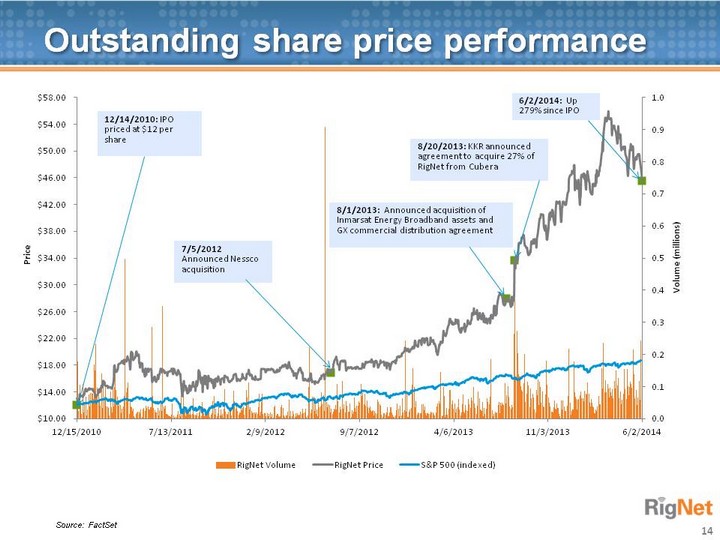

| Outstanding share price performance 14 Source: FactSet (CHART) |

| RigNet Strategic Transaction with Inmarsat Energy 15 On February 3, RigNet paid $25MM U.S. in an all cash acquisition financed through a new credit facility and cash on hand Goal is to raise the acquired business' margins and growth rates over time to levels more comparable to RigNet existing operations Combined organization to benefit from scale, robust product offering and best in class customer service RigNet to become a key energy distributor for Inmarsat's Global Xpress and L-band offerings Provides privileged global access to L-band offerings and one of the leading new-generation high-throughput satellite platforms, GX, ensuring that RigNet will always be positioned to provide the best communications solution to its customers GX will offer greater bandwidth and lower costs for the oil and gas market, enabling more apps at the edge Global Xpress platform is expected to be globally operational in 2015 2012 revenue of $68MM growing at 5% 2014E EBITDA ~$5.0MM(1) (CHART) Acquisition of Energy Broadband Business (1) Does not include run-rate synergies (CHART) |

| Best-in-Class Remote Access Technologies Across the Globe... Distribution partnership with Inmarsat for market leading, highly mobile and secure mobile satellite services MSS1 Cellular (3G, 4G) Access to remote fiber installations providing high speed / low latency connections for critical remote assets Fiber Microwave / WiMAX1 VSAT Largest Microwave network in the GoM providing high throughput low latency line of site connectivity to drilling rigs and production platforms; WiMAX overlay provides mobility services to energy maritime and other assets Relationships with purpose built cellular networks servicing the U.S. Land energy market Relationships with all major satellite owners including GX partnership with Inmarsat allowing RigNet to provide the most reliable connectivity worldwide 16 The oil and gas industry is remote, mobile and variable, with the reliance on technology greater than ever. RigNet provides managed communications services that free customers to focus on finding and producing oil and gas: Reliable communications around the world, supporting rig productivity, safety and crew welfare Technology flexibility - providing best-of-breed solutions that best meet customers' needs Local customer support for rapid deployment and resolution (1) Microwave and WiMAX network and L-band DP relationship acquired as part of Inmarsat Energy Broadband transaction which closed in February 2014 |

| ...Combined with a Fully Managed Connectivity Solution for the Oil and Gas Market 17 Complete managed services solution for Global Connectivity SOLUTIONS A rich portfolio of innovative products and collaborative solutions that allow for improved performance, minimized risk and increased efficiency HARDWARE Remotely managed appliances CONNECTIVITY fully managed communication solution with multiple connectivity technologies for best performance capabilities Managed Solution with 24x7 Support |

| RigNet Investment Highlights 18 Strong Organic Growth within the Oil and Gas Industry Growing and Attractive Market Runway High Operating Leverage / Free Cash Flow Proven Ability to Take Market Share from the Competition Founded in 2001, RigNet (NASDAQ: RNET) is a leading provider of remote communications, systems integration and collaborative applications to the oil and gas industry, both offshore and onshore, around the world Strong balance sheet with significant debt capacity to support growth Access to Best in Class Remote Communications Assets Across the Globe |

| THANK YOU 19 |