Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT OF MATERIAL EVENTS OR CORPORATE CHANGES - MAGNUM HUNTER RESOURCES CORP | a14-15124_18k.htm |

| EX-10.1 - EX-10.1 - MAGNUM HUNTER RESOURCES CORP | a14-15124_1ex10d1.htm |

EXHIBIT 99.1

Notice to U.S. Shareholders. The offer described in this document is for the securities of a non-U.S. company. The offer is subject to disclosure requirements of a country that are different from those of the United States. You should be aware that the offeror may purchase securities otherwise than under the offer, such as in open market or privately negotiated purchases.

10 June 2014

Intention to Make a Takeover Offer for Ambassador Oil and Gas Limited by Magnum Hunter Resources Corporation

· Magnum Hunter Resources Corporation, a US corporation whose common stock is traded on the New York Stock Exchange (Magnum Hunter), announces its intention to make a conditional off-market takeover offer for Ambassador Oil and Gas Limited (Ambassador).

· The Offer consideration will be one (1) share of Magnum Hunter common stock for every 27.8 Ambassador shares.

· The Offer implies a value of A$0.34(1) per Ambassador share based on the closing sales price of Magnum Hunter common stock on the NYSE of US$8.84 on Monday 9 June 2014, the last trading day prior to this announcement.

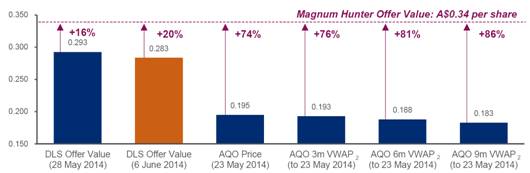

· The Magnum Hunter Offer represents a 20% premium to the current implied value of the offer announced by Drillsearch Energy Limited on 28 May 2014 (Drillsearch Offer) and a 74% premium to the closing price of Ambassador shares of $0.195 on Friday 23 May 2014, the trading day prior to Ambassador entering into a trading halt before the announcement of the Drillsearch Offer.

Magnum Hunter (NYSE:MHR) today announces its intention to make an off-market takeover offer, via a wholly-owned subsidiary, for all of the ordinary shares in Ambassador (Magnum Hunter Offer).

Magnum Hunter is an independent oil and natural gas company engaged in the exploration for and the exploitation, acquisition, development and production of crude oil, natural gas and natural gas liquids resources in the United States. Magnum Hunter is also engaged in midstream and oil field services operations, primarily in West Virginia and Ohio. Magnum Hunter’s common stock is listed for trading on the New York Stock Exchange and as at the close of trading on 9 June 2014 had a market capitalization of approximately US$1.75 billion.

Significant premium to Ambassador’s historical trading prices and Drillsearch Offer

The Magnum Hunter Offer represents strong value for Ambassador shareholders, and is priced at a significant premium to the Drillsearch Offer and Ambassador’s historical trading prices.

(1) Calculated based on an exchange rate of 1.069 Australian Dollars per 1.00 US Dollar, as published by Bloomberg at approximately 5:30pm Eastern United States time on 9 June 2014.

(2) VWAPs calculated to 23 May 2014, the trading day prior to Ambassador entering a trading halt before the announcement of the Drillsearch Offer.

Ambassador shareholders will be offered one (1) share of Magnum Hunter common stock for every 27.8 Ambassador shares. The Offer implies a value of A$0.34(1) per Ambassador share based on the closing price of Magnum Hunter common stock of US$8.84 on Monday 9 June 2014, the trading day prior to this announcement.

The implied Magnum Hunter Offer price represents a substantial premium of:

· 74% to the closing price of Ambassador shares of $0.195 on Friday 23 May 2014, the trading day prior to Ambassador entering into a trading halt pending announcement of the Drillsearch Offer;

· 76% to the 3 month historical volume weighted average price (VWAP) of Ambassador shares of $0.193;

· 81% to the 6 month VWAP of Ambassador shares of $0.188;

· 86% to the 9 month VWAP of Ambassador shares of $0.183; and

· 20% to the implied value of the Drillsearch Offer as of 6 June 2014.

Magnum Hunter will seek to engage with the Board of Ambassador to obtain its support for and recommendation of the Magnum Hunter Offer given the compelling value offered to Ambassador shareholders.

Magnum Hunter in the US and the Cooper Basin

Magnum Hunter is currently active in three unconventional shale resource plays in the United States: (a) the Marcellus Shale in West Virginia and Ohio; (b) the Utica Shale in southeastern Ohio and western West Virginia; and (c) the Williston Basin/Bakken Shale in North Dakota. Magnum Hunter is also engaged in midstream and oil field services operations, primarily in West Virginia and Ohio, related exclusively to its shale development activities in this region.

Magnum Hunter is a major shareholder of New Standard Energy Limited (New Standard), the joint venture partner of Ambassador in PEL 570 in the Cooper Basin in South Australia. Magnum Hunter acquired its equity position in News Standard in connection with a sale by Magnum Hunter of certain of its oil and gas properties in the Eagle Ford Shale in South Texas to a wholly-owned subsidiary of New Standard, in January 2014.

In determining to take an equity position in New Standard in connection with the sale transaction, Magnum Hunter was attracted to the development potential of the Cooper Basin, and PEL 570 in particular from a geological perspective. The existing midstream infrastructure within the Cooper Basin and the substantial underutilized existing and under construction LNG facilities in Australia provide a unique investment opportunity for future gas discoveries. Magnum Hunter and New Standard have formed a strategic and technical alliance with a core focus on growing and developing New Standard’s Australian business, which alliance will be strengthened by Magnum Hunter’s acquisition of Ambassador.

Mr. Gary C. Evans, Chairman of the Board and Chief Executive Officer of Magnum Hunter commented:

“The Board of Directors and management team of Magnum Hunter recently made a decision to increase our exposure to a very specific region in Australia where we have already established a presence. Our decision was made based upon a combination of factors, which include the following: (i) geological interpretation; (ii) substantial land position (shale scale); (iii) existing infrastructure; (iv) gas price and immediate exposure to international takeaway markets; (v) and most importantly, significant upside potential for our shareholders. We are not budgeting any cash expenditures on behalf of Magnum Hunter surrounding this investment in Australia for calendar year 2014. We believe that the knowledge we have gained over the past five years in successfully exploring the Eagle Ford, Bakken, Marcellus and Utica Shale Plays is transferrable to the Cooper Basin of Australia. As we have learned from our exposure to shale plays in the United States, early movers have the greatest opportunity for eventual success.”

By accepting Magnum Hunter shares in exchange for Ambassador shares, Ambassador shareholders retain exposure to the upside potential of Ambassador’s assets and also gain exposure to:

· A US public oil and natural gas company focused on growing reserves, production volumes and cash flow, primarily in the Marcellus Shale and Utica Shale plays in the Appalachian Basin in West Virginia and Ohio and the Bakken Shale play in the Williston Basin in North Dakota.

· Magnum Hunter’s senior management team, which has extensive energy sector experience and significant expertise in the principal operational disciplines in Magnum Hunter’s core unconventional resource plays.

· Three of the top-tier shale plays in the US — the Marcellus, Utica and Bakken Shales — in which Magnum Hunter holds total net acreage of approximately 300,000 acres.

· Onshore US production, with an expected 2014 exit production rate of 32,500 boe/d.

· Magnum Hunter’s majority-owned midstream operations in West Virginia and Ohio, consisting primarily of a gas gathering system supporting the development of existing and anticipated future Marcellus Shale and Utica Shale acreage positions.

Impact of Transaction on Magnum Hunter’s Common Stock

Ambassador currently has approximately 142.1 million shares outstanding. At the offer ratio, Magnum Hunter plans to issue approximately 5.1 million shares of common stock in order to acquire 100% of Ambassador, equivalent to approximately 2.6% of Magnum Hunter’s outstanding shares of common stock as of 9 June 2014. Ambassador shareholders will own approximately 2.5% of the outstanding shares of common stock of Magnum Hunter as of 9 June 2014 (and pro forma for the issuance of shares pursuant to the Magnum Hunter Offer) if Magnum Hunter acquires 100% of Ambassador.

Bid Conditions

The Magnum Hunter Offer will be subject to certain terms and conditions which are summarised in Schedule 1. The full conditions to the Magnum Hunter Offer will be set out in the Bidder’s Statement which Magnum Hunter expects to dispatch to Ambassador shareholders as soon as possible. Ambassador will be required to issue a Target’s Statement to Ambassador shareholders following dispatch of Magnum Hunter’s Bidder’s Statement.

Indicative timetable

The Bidder’s Statement is expected to be lodged with ASIC, Ambassador and released to the ASX as soon as practicable and dispatched to Ambassador shareholders as soon as possible thereafter.

A Target’s Statement will also need to be dispatched by Ambassador to Ambassador shareholders in accordance with the required timetable set out in the Corporations Act 2001.

Advisors

Magnum Hunter’s legal advisers are Norton Rose Fulbright (Australia) and Bracewell & Giuliani LLP (US).

—Ends—

For further information please contact:

Magnum Hunter Resources Corporation

ir@magnumhunterresources.com

Chris Benton

Vice President, Finance and Capital Markets

+1 (0) 832-203-4539

Cham King

Assistant Vice President, Investor Relations

+1 (0) 832-203-4560

About Magnum Hunter

Magnum Hunter is an independent oil and natural gas company engaged in the exploration for and the exploitation, acquisition, development and production of crude oil, natural gas and natural gas liquids resources in the United States. Magnum Hunter is currently active in three unconventional shale resource plays in the United States: (a) the Marcellus Shale in West Virginia and Ohio; (b) the Utica Shale in southeastern Ohio and western West Virginia; and (c) the Williston Basin/Bakken Shale in North Dakota. Magnum Hunter is also engaged in midstream and oil field services operations, primarily in West Virginia and Ohio. Magnum Hunter’s common stock is listed for trading on the New York Stock Exchange and as at the close of trading on 9 June 2014 had a market capitalization of approximately US$1.75 billion. Magnum Hunter is a major shareholder of New Standard, the joint venture partner of Ambassador in PEL 570.

About Ambassador:

Ambassador Oil & Gas Limited is a diversified unconventional oil and gas exploration company with assets in Australia and the US.

PEL 570, in the Cooper Basin in South Australia, has independently identified potential gas in place of up to 20 trillion cubic feet contained in unconventional rock and coal seams. The permit is situated in the northern end of the gas prone Patchawarra trough which is characterised by low-C02 levels and higher liquids content, particularly in the northern regions of the basin. It covers 2400 km(2), is close to infrastructure and remains a key target for unconventional gas exploitation. The Cooper Basin is linked to the east coast gas market by an existing gas pipeline network providing Cooper Basin gas with direct access to Queensland Liquefied Natural Gas projects near Gladstone currently under construction and the wider Australian East coast market.

In the US, Ambassador has acquired highly prospective oil and gas exploration leases in emerging, oil prone, resource plays in Colorado. Ambassador holds a parcel of leases in Colorado totalling 3,327 net acres and has recently exercised an option to acquire a further net 9,350 acres in Colorado.

The foregoing information regarding Ambassador is derived from information in Ambassador’s public reports.

Schedule 1 — Offer Terms and Conditions

1 Definitions:

(1) Ambassador means Ambassador Oil and Gas Limited (ASX:AQO).

(2) Ambassador Board means the board of directors of Ambassador.

(3) Ambassador Group means Ambassador and each of its subsidiaries (as defined under the Corporations Act).

(4) Ambassador Shares means a fully paid ordinary share in Ambassador.

(5) Announcement Date means 10 June 2014, being the date of announcement of the Magnum Hunter Offer.

(6) ASX means ASX Limited or the securities exchange operated by it (as applicable).

(7) Corporations Act means the Corporations Act 2001 (Cth).

(8) Encumbrance means:

(a) a security interest;

(b) an easement, restrictive covenant, caveat or similar restriction over property;

(c) any other interest or arrangement of any kind that in substance secures the payment of money or the performance of an obligation, or that gives a creditor priority over unsecured creditors in relation to any property (including a right to set off or withhold payment of a deposit or other money);

(d) a right of any person to purchase, occupy or use an asset (including under an option, agreement to purchase, licence, lease or hire purchase);

(e) any other thing that prevents, restricts or delays the exercise of a right over property, the use of property or the registration of an interest in or dealing with property; or

(f) an agreement to create anything referred to above or to allow any of them to exist.

(9) Farm-out Agreement means the farm-out agreement between Ambassador and New Standard in relation to PEL 570, announced on the ASX by Ambassador on 10 December 2013.

(10) Magnum Hunter means Magnum Hunter Resources Corporation (NYSE:MHR).

(11) Magnum Hunter Group means Magnum Hunter and each of its subsidiaries (as defined under the Corporations Act).

(12) New Standard means New Standard Energy Limited. (ASX:NSE).

(13) Offers means the Magnum Hunter Offer and each of the other offers made by a wholly-owned subsidiary of Magnum Hunter in the same terms for Ambassador Shares and includes a reference to those offers as varied in accordance with the Corporations Act.

(14) Offer Period means the period commencing on [·] and ending at [·] pm (Sydney time) on [·].

(15) Public Authority means any government or any governmental, semi-governmental, administrative, statutory or judicial entity, authority or agency, whether in Australia or elsewhere, including the ACCC (but excluding the Takeovers Panel, ASIC and any court that hears or determines proceedings under section 657G or proceedings commenced by a person specified in section 659B(1) of the Corporations Act in relation to the Takeover Bid). It also includes any self-regulatory organisation established under statute or any stock exchange.

(16) Takeover Bid means the takeover bid constituted by the Offers.

2 Conditions:

(a) Minimum acceptance condition

Before the end of the Offer Period, Magnum Hunter (or its wholly owned subsidiary) has a relevant interest in more than 50.1% (by number) of the Ambassador Shares on issue at that time.

(b) No prescribed occurrences

None of the following events happens during the period beginning on the Announcement Date and ending at the end of the Offer Period:

(i) Ambassador converts all or any of its shares into a larger or smaller number of shares;

(ii) Ambassador or a subsidiary of Ambassador resolves to reduce its share capital in any way;

(iii) Ambassador or a subsidiary of Ambassador:

(A) enters into a buy-back agreement; or

(B) resolves to approve the terms of a buy-back agreement under section 257C(1) or 257D(1) of the Corporations Act;

(iv) Ambassador or a subsidiary of Ambassador issues shares or grants an option over its shares, or agrees to make such an issue or grant such an option;

(v) Ambassador or a subsidiary of Ambassador issues, or agrees to issue, convertible notes;

(vi) Ambassador or a subsidiary of Ambassador disposes, or agrees to dispose, of the whole, or a substantial part, of its business or property;

(vii) Ambassador or a subsidiary of Ambassador grants, or agrees to grant, a security interest in the whole, or a substantial part, of its business or property;

(viii) Ambassador or a subsidiary of Ambassador resolves to be wound up;

(ix) a liquidator or provisional liquidator of Ambassador or of a subsidiary of Ambassador is appointed;

(x) a court makes an order for the winding up of Ambassador or of a subsidiary of Ambassador;

(xi) an administrator of Ambassador, or of a subsidiary of Ambassador, is appointed under section 436A, 436B or 436C of the Corporations Act;

(xii) Ambassador or a subsidiary of Ambassador executes a deed of company arrangement; or

(xiii) a receiver, or a receiver and manager, is appointed in relation to the whole, or a substantial part, of the property of Ambassador or of a subsidiary of Ambassador.

(c) No material adverse change to Ambassador

During the period beginning on the Announcement Date and ending at the end of the Offer Period, no event or series of related events occurs which has or is likely to have a material adverse effect on the assets and liabilities, financial position and performance, profitability or prospects of the Ambassador Group taken as a whole, including:

(i) any event or series of related events which has or is likely to have the effect of diminishing the consolidated net assets of the Ambassador Group as set out in the consolidated balance sheet of Ambassador at 31 December 2013 by at least $500,000; or

(ii) termination or frustration of the Farm-out Agreement,

but does not include:

(iii) any matter, event, circumstance or change directly resulting from any actions taken (or omitted to be taken) following and in accordance with a written request from Magnum Hunter or with Magnum Hunter’s written consent; or

(iv) any matter, event or circumstance arising from changes in economic or business conditions which impact on Ambassador and its competitors in a similar manner.

(d) No regulatory action

During the period beginning on the Announcement Date and ending at the end of the Offer Period:

(i) there is not in effect any preliminary or final decision, order or decree issued by a Public Authority;

(ii) no action or investigation is instituted, or threatened, by any Public Authority with respect to Ambassador or any subsidiary of Ambassador; and

(iii) no application is made to any Public Authority (other than an application by any company within the Magnum Hunter Group, an application under section 657G of the Corporations Act or an application commenced by a person specified in section 659B(1) of the Corporations Act in relation to the Takeover Bid), in consequence of, or in conjunction with, the Takeover Bid, which restrains, prohibits or impedes or threatens to restrain, prohibit or impede, or may otherwise materially adversely impact upon, the making of the Takeover Bid or the completion of any transaction contemplated by this Announcement or the Bidder’s Statement or seeks to require the divestiture by Magnum Hunter of any Ambassador Shares, or the divestiture of any assets by a company within the Ambassador Group.

(e) Conduct of business

None of the following events happens (each, a Prohibited Transaction) during the period beginning on the Announcement Date and ending at the end of the Offer Period:

(i) a company within the Ambassador Group:

(A) acquires or disposes of;

(B) agrees to acquire or dispose of; or

(C) offers, proposes, announces a bid or tenders for, any business, asset, interest in a joint venture, entity or undertaking, the value of which exceeds $500,000;

(ii) a company within the Ambassador Group creates any Encumbrance over the whole or a substantial part of its business or property (other than a lien which arises by operation of law or legislation securing an obligation not yet due and consistent with past practice);

(iii) any person is appointed to the Ambassador Board, other than those nominated by Magnum Hunter;

(iv) a company within the Ambassador Group:

(A) increases the remuneration of, or otherwise varies the employment arrangements with, any of its directors or employees; or

(B) accelerates the rights of any of its directors or employees to compensation or benefits of any kind,

other than as a result of contracted arrangements that are consistent with past practice and in effect as at 1 May 2014;

(v) a company within the Ambassador Group pays any of its directors or employees a termination or retention payment;

(vi) a company within the Ambassador Group:

(A) enters into any contract or commitment involving revenue or expenditure by the Ambassador Group of more than $500,000 over the term of the contract or commitment;

(B) terminates or amends in a material manner any contract material to the conduct of the Ambassador Group’s business or which involves revenue or expenditure of more than $500,000 over the term of the contract;

(C) waives any material third party default; or

(D) accepts as a settlement or compromise of a material matter (relating to an amount in excess of $500,000) less than the full compensation due to the Ambassador Group;

(vii) a company within the Ambassador Group undertakes or agrees to undertake capital expenditure in excess of $500,000 in aggregate;

(viii) a company within the Ambassador Group enters into or resolves to enter into a transaction with any related party of Ambassador as defined in section 228 of the Corporations Act; or

(ix) a company within the Ambassador Group borrows or agrees to borrow any money, but a Prohibited Transaction does not include any matter, the undertaking of which Magnum Hunter has approved in writing.

(f) No other party has acquired control

During the period beginning on the Announcement Date and ending at the end of the Offer Period, no party other than a member of the Magnum Hunter Group has acquired a relevant interest in more than 45% (by number) of the issued shares of Ambassador.