Attached files

| file | filename |

|---|---|

| 8-K - 8-K - KAPSTONE PAPER & PACKAGING CORP | a14-13687_18k.htm |

Exhibit 99.1

|

|

From Integration to Optimization Roger W. Stone, KapStone Chairman and Chief Executive Officer Matt Kaplan, KapStone President Andrea Tarbox, Chief Financial Officer Tim Keneally, President, Container Division Tonie Meyers, Vice President, Sales and Marketing Randy Nebel, President, Mill Division May 28, 2014 |

|

|

Forward-Looking Statements The information in this presentation and statements made during this presentation may contain certain forward-looking statements within the meaning of federal securities laws. These statements reflect management’s expectations regarding future events and operating performance. Risk Factors These forward-looking statements involve a number of risks and uncertainties. A list of the factors that could cause actual results to differ materially from those expressed in, or underlying, any forward-looking statements can be found in the Company’s filings with the Securities and Exchange Commission, such as its annual and quarterly reports. The Company disclaims any obligation to revise or update such statements to reflect the occurrence of events after the date of this presentation. Non-GAAP Financial Measures This presentation refers to non-U.S. GAAP financial information. A reconciliation of those numbers to U.S. GAAP financial measures is available on the company’s website at KapStonePaper.com under Investors. Forward Looking Statements 2 |

|

|

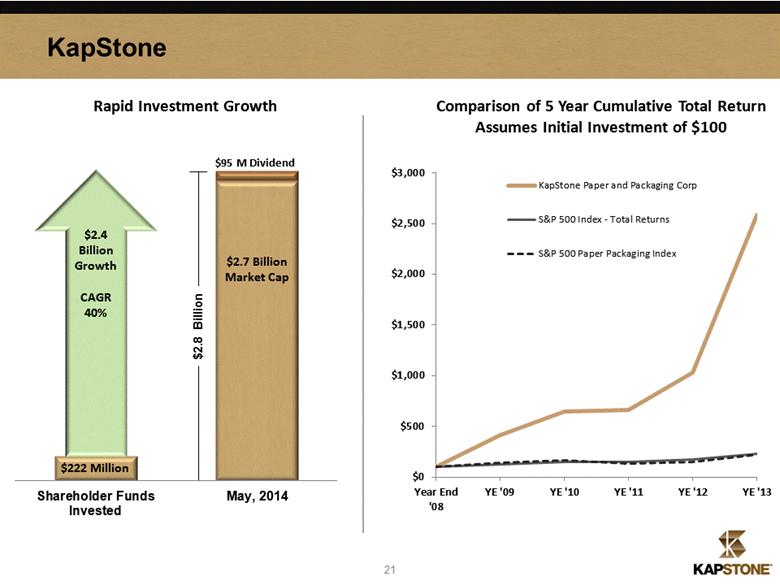

3 The Building of KapStone US Corrugated Inc. Purchase Price $332 million 6.4 Xs TTM Adj. EBITDA IP’s kraft paper business Purchase Price $204 million 3.3 Xs TTM Adj. EBITDA MWV’s kraft paper business Purchase Price $466 million 5.8 Xs TTM Adj. EBITDA Jan 1, 2007 Jul 1, 2008 Oct 31, 2011 Longview Fibre Purchase Price $1.025 billion 6.1 Xs TTM Adj. EBITDA(1) Jul 18, 2013 Four acquisitions in seven years 40% investment CAGR since first acquisition; $2.4 billion growth from initial $0.2 billion investment Successfully completed key aspects of recent integration efforts While some additional work remains, much of the heavy lifting on integration is complete; we are tracking nicely to our anticipated synergy targets which have expanded from our original estimate Longview acquisition provided scale, resources and a national footprint With our enhanced ability to service national and large regional customer base, combined with a broader, experienced management team and workforce, we are well positioned for the future Moving into an era of enterprise optimization There is significant potential to improve our cost structure while making meaningful productivity gains through noncapital initiatives and a focused strategic plan (1) Longview acquisition at 4.3 Xs based upon annualized adjusted EBITDA since acquisition 2009 2010 2011 |

|

|

4 Mill Division Randy Nebel, President, Mill Division |

|

|

5 Well Positioned in Key Markets and Shipping Lanes |

|

|

Machine Max trim (inches) 2014 Plan production (tons per day) Grades Basis weight range Basis weight avg. (Q1’14) Other capabilities PAPER (lbs/3,000 sq ft) LV-5 185 180 Lightweight specialties 20 – 60 # 33.4# Limited colors, bleached, soft calendered, wet strength LV-12 242 477 Lightweight specialties 25 – 68 # 42.8# Converting, high recycled content, light-weight containerboard RR-3 227 577 Lightweight papers, Converting/Dunnage 40 – 78 # 49.5# Lightweight Linerboard LV-11 236 581 FibreShield, TEAKraft 38 – 65 # 51.4# Extensible, multiwall, wet strength, light-weight containerboard BOARD/OTHER (lbs/1,000 sq ft) LV-10 242 1238 Linerboard/CM 23 – 45 # 32.1# Heavy-weight Kraft papers CP-1 174 667 100% recycled linerboard/CM 23 – 42 # 32.2# Durasorb (recycled) CHS-3 249 936 Lightweight Linerboard/UPL 25 – 47 # 32.4# Rolled Pulp RR-4 230 681 Lightweight Linerboard/UPL 20 – 38 # 33.3# Kraft papers/Converting CHS-2 229 702 Durasorb 23 – 72 # 40.0# Corrugating Medium/Rolled Pulp LV-7 168 830 Linerboard 42 – 90 # 51.5# Saturating, UKP, wet strength CHS-1 229 895 KraftPak, Linerboard 41 – 84 # 56.6# Rolled Pulp Paper Machine Specifications Provide Great Flexibility |

|

|

7 Mill Division Focus Significant operations opportunities Improve safety, reduce injuries and environmental impacts Reduce energy usage Reduce labor costs in absolute dollars Reduce pulping and specialty chemical costs Reduce transportation expense Product mix improvement Increase our ability to produce high strength lightweight paper and containerboard Leverage our technology infrastructure to drive cost out of the system Discretionary capital priority Small, rapid payback projects Energy projects Labor productivity Production capacity |

|

|

8 Summary Our mill division will bring a significant increase in EBITDA by lowering costs in energy, labor, chemicals and standardizing processes across the division Capital will be employed as a springboard to significant non-capital improvements We will focus on positioning our mills to be top quartile cost in producing high strength, lightweight paper and containerboard |

|

|

9 Sales Tonie Meyers, Vice President, Sales and Marketing |

|

|

10 KapStone Product Segmentation We are a brown paper oriented company with a high percentage of virgin fiber production Half of our external sales is comprised of kraft liner, medium and our ultra-performance grades Kraft papers makes up nearly a third of our external sales Annual external sales will exceed 2.0 million tons (1) Annualized based on 2013 external tons sold, including Longview for full calendar year |

|

|

11 Kraft Papers We like our kraft paper markets! We are the largest kraft producer in North America Our chosen markets are steady or growing Export markets are improving for Kraft Paper grades Focused on customer satisfaction Nationwide footprint and redundant capabilities provide a wider service platform |

|

|

12 Containerboard We are the leader in light-weighting Ultra-performance liner and medium Manage our planned mix purposefully Focused upon margin per machine hour Strategy produces greater yield and value to customer Marketplace remains disciplined where supply = demand Optimistic for the near future, and prepared for the long-term |

|

|

13 Kraft Sales Summary Our industry continues to demonstrate remarkable discipline in matching supply to market demand Specialty grades are stable to growing Runway for KraftPak and Export Kraft paper DuraSorb continues to be an excellent business Converter consolidation in domestic Kraft paper will provide market stability Continue to market Ultra Performance Linerboard |

|

|

14 Container Division Tim Keneally, President, Container Division |

|

|

15 Well Positioned in Key Markets and Shipping Lanes |

|

|

16 Container Division Focus on Customers Focus on growing our local business thru innovation, service and quality Take advantage of our national footprint to satisfy strategic customers who want options Develop a graphic’s strategy to satisfy customer/prospects Right weight demand increasing due to our ultra performance liners 31# and Below 50# and Above Offer packaging solutions through the KapStone Advantage Alliance Process Sales organization with support from design to become solution providers |

|

|

17 Container Division Focus on Operations Best in class operations for safety & environmental stewardship Courage to care / hazard recognition Engage our workforce and team leaders through more effective training and gainsharing Improve uptime on corrugators and converting equipment through aggressive maintenance programs and operator training. Invest strategic capital to enhance quality and reduce costs Share best practices through our manufacturing excellence organization Partner with our strategic suppliers (raw material, equipment) to enhance competitive position Reduce transportation costs |

|

|

Compelling Platform with Room for Growth Matt Kaplan, KapStone President |

|

|

19 KapStone Integration progress has exceeded our expectations Excited about our portfolio of projects and initiatives These optimization activities will support our long term strategy in multiple areas: Improve costs Increase productivity and production Solidify our KapStone approach to business Reinforce our platform for exceptional service to our customer Empower and leverage our talented workforce Enhance our ability to efficiently integrate any future acquisitions |

|

|

20 Rapid cash generation with LTM Adjusted Free cash flow through March, 2014 of $210 million Debt to EBITDA leverage ratio is rapidly improving (1) 3.8 times - July 18, 2013 (2) 2.7 times - March, 31 2014 (1) Calculated per bank agreement (2) Closing date of Longview acquisition Extraordinary Growth – Sales and Adjusted EBITDA *Analysts’ Consensus |

|

|

21 KapStone $222 Million $2.7 Billion Market Cap $2.4 Billion Growth CAGR 40% Comparison of 5 Year Cumulative Total Return Assumes Initial Investment of $100 Rapid Investment Growth |

|

|

22 Summary Think Big – Act Small Keen Focus on Customer and Employee Satisfaction |