Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Synthetic Biologics, Inc. | v379740_8k.htm |

May 2014 NYSE MKT: SYN

Forward - Looking Statements This presentation includes forward - looking statements on Synthetic Biologics’ current expectations and projections about future events . In some cases forward - looking statements can be identified by terminology such as "may," "should," "potential," "continue," "expects," "anticipates," "intends," "plans," "believes,“ "estimates,” “indicates,” and similar expressions . These statements are based upon current beliefs, expectations and assumptions and are subject to a number of risks and uncertainties, many of which are difficult to predict and include statements regarding our clinical trials, our establishment of collaborations and our execution of our growth strategy . The forward - looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those set forth or implied by any forward - looking statements . Important factors that could cause actual results to differ materially from those reflected in Synthetic Biologics’ forward - looking statements include, among others, a failure of our product candidates to be demonstrably safe and effective, a failure to initiate clinical trials and if initiated, a failure to achieve the desired results, a failure to obtain regulatory approval for our product candidates or to comply with ongoing regulatory requirements, regulatory limitations relating to our ability to promote or commercialize our product candidates for the specific indications, a lack of acceptance of our product candidates in the marketplace, a failure of us to become or remain profitable, a failure to establish collaborations, our inability to obtain or maintain the capital or grants necessary to fund our research and development activities, a loss of any of our key scientists or management personnel, and other factors described in Synthetic Biologics’ annual report on Form 10 - K for the year ended December 31 , 2013 , subsequent quarterly reports on Form 10 - Qs and any other filings we make with the SEC . The information in this presentation is provided only as of the date presented, and Synthetic Biologics undertakes no obligation to update any forward - looking statements contained in this presentation on account of new information, future events, or otherwise, except as required by law . 2 NYSE MKT: SYN

Investment Proposition • Portfolio of anti - infective biologics and drugs targeting specific pathogens that cause serious infections and diseases ̶ Innovative, first - in - class product candidates for prevention and treatment ̶ Large markets ̶ Shorter treatment period may reduce clinical trial duration • Clinical - stage ̶ Multiple sclerosis (MS) – Positive Phase II topline results presented at American Academy of Neurology (AAN) in April 2014 ̶ Prevention of Clostridium difficile (C. difficile , C. diff) infections ̶ Constipation - predominant irritable bowel syndrome (C - IBS) • Strategic collaboration with Intrexon Corporation (NYSE: XON) ̶ Pertussis ( whooping cough) – Positive preclinical research findings reported in April 2014 ̶ Acinetobacter infections (potentially lethal infection increasing in ICUs and military injuries ) ̶ Novel autoimmune target for subset of IBS • Experienced management team and advisors 3 NYSE MKT: SYN NYSE MKT: SYN

Management Team 4 • Jeffrey Riley, CEO Pfizer, Nichols Institute (Quest), SmithKline Beecham, QIC • C. Evan Ballantyne , CFO Clinical Data, Inc., Avedro , ZymeQuest , ACNielsen, IMS • John Monahan, Ph.D., EVP R&D Avigen , Somatix , Triton Biosciences, Hoffman - LaRoche • Michael Kaleko, M.D., Ph.D ., SVP R&D Genetic Therapy, Inc. (Novartis), Advanced Vision Therapies (currently known as Wellstat Ophthalmics ) • Joseph Sliman, M.D., M.P.H., SVP Clinical/Regulatory Vanda Pharmaceuticals, Inc., MedImmune , Inc., Dynport Vaccine • Lewis Barrett, SVP Commercial Strategy Pfizer , Wyeth Pharmaceuticals NYSE MKT: SYN

Product Pipeline 5 NYSE MKT: SYN C - Cedars - Sinai Medical Center collaboration I - Intrexon Corporation collaboration T - The University of Texas at Austin collaboration Completed Planned - 2014 Therapeutic Area Product Candidate Biologic Agent/ Drug Compound Discovery Preclinical Phase I Phase II Phase III Relapsing - remitting m ultiple sclerosis Trimesta TM Oral estriol Cognitive dysfunction in multiple sclerosis Trimesta TM Oral estriol C. difficile infection SYN - 004 Oral enzyme Constipation - predominant IBS (C - IBS) SYN - 010 C Oral drug Pertussis (whooping cough) SYN - 005 I,T Monoclonal antibody Acinetobacter infections SYN - 001 I Monoclonal antibody IBS (a utoimmune target) SYN - 007 I Biologics

Estriol Pregnancy hormone linked to decreased MS relapse rates • Estriol − Hormone produced by placenta during pregnancy with highest level in 3 rd trimester − Large safety database exists from prior foreign approvals for treatment of post - menopausal symptoms • Landmark observational study published in New England Journal of Medicine 1 − Relapse rates in 254 women diagnosed with MS prior to pregnancy ▪ Significantly reduced in 3 rd trimester of pregnancy (p<0.001) * ▪ Significantly increased three months post - partum (p<0.001) * • Principal investigator evaluating Trimesta TM (oral estriol): Rhonda Voskuhl , M.D., Professor of Neurology, Director of UCLA MS Program ̶ Pilot trial (n=6): demonstrated an 82% decrease in both the number and volume of brain lesions over 6 months (p - values < 0.02 ) ** ,2 ̶ Phase II trial: 158 women randomized in 16 - center, investigator - initiated, double - blind, placebo - controlled U.S. trial 3 ▪ $8 million+ grant funding supporting trial, predominantly from National MS Society and NIH 6 * C ompared to pre - pregnancy levels ** Compared to 6 month baseline measurement NYSE MKT: SYN

MS: Relapsing - Remitting MS Phase II Results of Trimesta TM (oral estriol) • Topline results presented at 2014 AAN by Dr. Voskuhl demonstrated ̶ Statistically significant 47% decrease in annualized MS relapse rate at 12 months with Trimesta+Copaxone ® compared to placebo+Copaxone ® ( p=0.03 / powered for significance level 0.05) ̶ 32% decrease in annualized relapse rate at 24 months with Trimesta+Copaxone ® compared to placebo+Copaxone ® (p=0.15 / powered for significance level 0.10) ▪ Per study protocol, investigators anticipated a 29% decrease in relapse rate at both 12 and 24 months ̶ Clinically significant near - normalization of cognitive scores at 12 months of therapy with Trimesta+Copaxone ® ▪ Unique neuroprotective effect of oral estriol highly significant to MS community ̶ Trimesta + Copaxone ® was generally safe and well tolerated • Next planned steps for Trimesta for relapsing - remitting MS ̶ Demonstrated therapeutic potential and safety of oral estriol support ongoing strategic partnering efforts ̶ Lead principal investigator, Dr. Voskuhl , to report detailed study results (2H 2014) 7 NYSE MKT: SYN

MS: Market • 400,000 MS patients in U.S. (~2.3 million worldwide) 4 • $14.1 billion current estimated worldwide sales 5 • Issued U.S. patent includes claims for use of Trimesta in combination with Copaxone ® Trimesta Opportunity – Oral add - on MS therapy 8 NYSE MKT: SYN Teva/Copaxone $4.178 30% Biogen Idec/Avonex $2.929 21% Merck KGaA/Rebif $2.425 17% Biogen Idec/Tysabri $1.703 12% Bayer/Betaseron $1.512 11% Novartis/Extavia $0.159 1% Novartis/Gilenya $1.195 8% Copaxone ® is a registered trademark of Teva Pharmaceutical Industries Ltd.

MS: Cognitive Dysfunction Phase II Clinical Trial of Trimesta TM 9 NYSE MKT: SYN • Randomized, double - blind, placebo - controlled clinical trial of female MS patients at UCLA 6 − Enrollment ongoing − Trimesta TM versus matching placebo over one year with all patients remaining on st andard FDA - approved MS treatment, including Copaxone ® , Avonex ® , Betaseron ® , Extavia ® , Rebif ® , Gilenya ® , Aubagio ® and Tecfidera ® • Pilot trial conducted by Dr. Voskuhl demonstrated a 14% improvement in Paced Auditory Serial Addition Test ( PASAT) cognitive testing scores ( p = 0.04) in relapsing - remitting MS patients at 6 months of therapy versus continued cognitive deterioration 7 • Majority of ongoing costs funded by philanthropic foundations, including Skirball Foundation

Emerging Consensus on the Microbiome 10 SYN building portfolio of targeted, pathogen - specific novel drugs “Infections were the second leading cause of death worldwide in 2002 , killing nearly 15 million people – almost 1 in 3 deaths across the globe ” Brad Spellberg, M.D., Rising Plague 8 “ Your gut or inner ecosystem , is made up of 100 trillion bacteria … composed of both “good” beneficial bacteria and “bad ” pathogenic bacteria. When this balance is disrupted your health is compromised … the number one problem is antibiotics .” theNUTRITIONpractice 9 NYSE MKT: SYN

Rebirth of Anti - Infective Sector SYN: Building a robust portfolio of targeted anti - infectives 11 NYSE MKT: SYN • January 2014 AstraZeneca and FOB Synthesis R&D agreement for novel antibiotics • December 2013 SYN collaborates with Cedars - Sinai to reduce the impact of methane producing organisms on C - IBS • December 2013 The Medicines Company acquires Rempex Pharmaceuticals for $474M • November 2013 Shire acquires ViroPharma for $4.2B • November 2013 Roche returns to antibiotics field with $ 560M Polyphor Phase I deal • September 2013 CDC issues statement: Growing threat of antibiotic resistant “superbugs” • July 2013 Cubist acquires Trius for $ 707M and Optimer for $ 535M • May 2013 GSK wins $200M federal contract to develop new antibiotics • December 2012 SYN acquires prevention of C. difficile infection clinical program including Phase II data (1 st generation candidate) • 2012 - 2013 FDA granted QIDP designation*: Cubist, Trius , Tetraphase , Rib - X , Durata , etc. • October 2012 GAIN Act effective • August 2012 SYN executes collaboration with Intrexon Corp (NYSE: XON) to develop mAbs to treat Pertussis and Acinetobacter infections * Qualified infectious disease product (QIDP) is a designation under the GAIN Act.

Clinical Success Rates by Therapeutic Area 10 Phase I through Food & Drug Administration approval Aligns with SYN’s focus on the development of novel anti - infectives 12 NYSE MKT: SYN 0% 5% 10% 15% 20% 25% Nervous System Cardiovascular Respiratory Oncology Musculoskeletal Anti-Infective 8% 9% 10% 19% 20% 24%

13 • 24 million patients administered IV antibiotics annually in the U.S. 11 – 1.1 million patients infected with C. diff annually 12 – Patients with C. diff hospitalized approximately 4 - 7 extra days 13 – $ 8.2 billion in costs associated with C. diff - related stays in hospital 14 – 30,000 C. diff - related deaths annually 15 • IV antibiotics may be excreted into gastrointestinal (GI) tract where they can upset the natural balance of the microbiome • This imbalance can result in the overgrowth of disease - causing bacteria such as C . diff • Toxigenic C . diff causes diarrhea , colitis and may result in death C. d ifficile (C. diff) Infections Leading cause of hospital - acquired infections NYSE MKT: SYN There are currently no approved products for the prevention of C. difficile infections

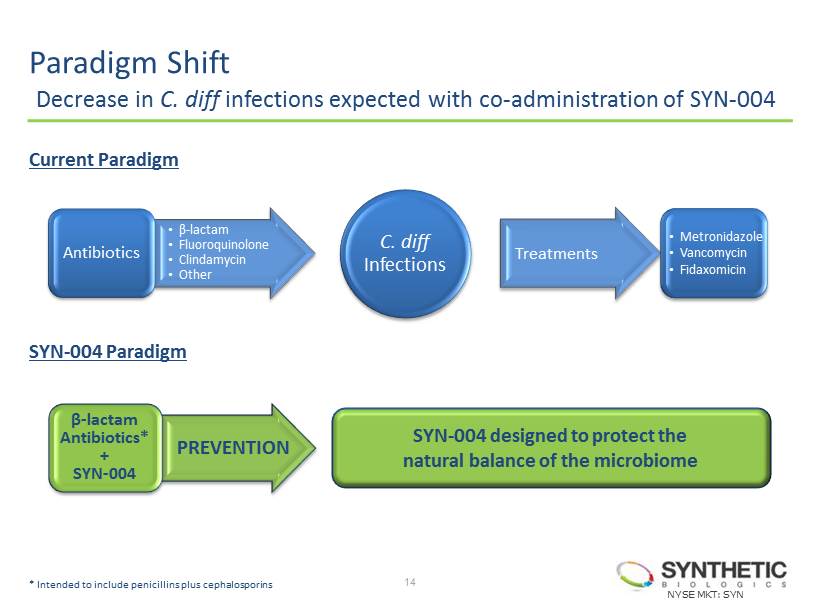

Paradigm Shift Decrease in C. diff infections expected with co - administration of SYN - 004 NYSE MKT: SYN 14 Antibiotics Treatments • β - lactam • Fluoroquinolone • Clindamycin • Other • Metronidazole • Vancomycin • Fidaxomicin Current Paradigm SYN - 004 Paradigm C. diff Infections β - lactam Antibiotics* + SYN - 004 SYN - 004 designed to protect the natural balance of the microbiome PREVENTION * I ntended to include penicillins plus cephalosporins

15 SYN - 004 Prophylactic treatment for prevention of C. diff infections • 1 st generation candidate studied in four Phase I and one Phase II clinical trials of 112 patients and 143 healthy normal subjects ̶ Preserved the normal intestinal microflora when co - administered with IV ampicillin or piperacillin • SYN - 004, a 2 nd generation oral candidate intended to expand activity to include penicillins plus certain cephalosporins • SYN - 004 patent pending on compositions of matter and methods of use through 2031 • Next planned steps for SYN - 004 for the prevention of C. diff infections ̶ Complete cGMP manufacturing for Phase I and II trials (June 2014 ) ̶ Initiate 28 - day bridging toxicology study (June 2014 ) ̶ File IND to support initiation of Phase Ia and Ib clinical trials (2H 2014 ) ̶ Topline data from Phase Ia and Ib trials (late 2014) ̶ Initiate Phase II efficacy (1H 2015) NYSE MKT: SYN To view the animated SYN - 004 video, please visit: http://www.syntheticbiologics.com/SYN - 004 .

SYN - 004: Market Potential Intended to target certain IV β - lactam antibiotics NYSE MKT: SYN 16 14.4M patients 18 26.5M prescriptions 17 117.6M doses of “SYN - 004 target” β - lactam antibiotics purchased by U.S. hospitals to fill patient prescriptions 16 * Based on U.S. market data in 2012 ** Estimate based on the following assumptions: 5 day prescription x 4 “SYN - 004 tablets”/day x $25/”SYN - 004 tablet” x 26.5M prescriptions of “SYN - 004 target” β - lactam antibiotics in 2012 SYN - 004 Potential U.S. Market ~ $13.3 Billion ** *

17 • Mark Pimentel, M.D., of Cedars - Sinai is a leading investigator in field ̶ Identified clinical significance of unique antibiotic in treating diarrhea - predominant IBS (D - IBS) in collaboration with Salix • Clear link between intestinal methane production and disease • Methane levels in C - IBS are significantly higher than in other forms of IBS and in healthy people • Methane slows intestinal transit causing constipation, bloating and abdominal pain • Microbiome - related research and clinical trials also show a strong link between intestinal methane and metabolic diseases such as obesity and diabetes Constipation - Predominant Irritable Bowel Syndrome (C - IBS) Role of methanogens NYSE MKT: SYN

18 • Development of differentiated formulations of non - antibiotic FDA - approved oral drug candidates for ultimate product registration via potential expedited pathways is underway • Inhibiting methane production significantly relieves constipation and improves patients’ lives ̶ Strong association between constipation and high - level methane breath tests ̶ Optimize therapeutic outcome by stratifying patients with high level breath test for treatment with SYN - 010 • Treat the cause of C - IBS, not just the symptoms ̶ Current therapies for C - IBS are sub - optimal – essentially laxatives • Long - term maintenance strategy ̶ Antibiotic approaches are temporary, less effective and prone to resistance • Additional clinical studies show that methane is significantly associated with obesity and blood glucose levels ̶ Methane ablation may have utility in treating obesity and diabetes SYN - 010: Inhibit Methane Production Novel opportunity to target underlying cause of disease NYSE MKT: SYN

19 • Up to $10 billion in direct costs to the U.S. healthcare system and up to $20 billion in indirect costs 19 • 40 million IBS patients in the U.S. 20 – ~13.2 million C - IBS patients in the U.S. 21 • ~$2.7 billion market expected by 2020 22 • Major IBS players include ‒ Salix ( rifaximin ) for D - IBS ‒ Ironwood/Forest ( linaclotide ) and Synergy ( plecanatide ) for C - IBS ▪ However, Ironwood’s product causes diarrhea in 19% of patients in the Phase III trial 23 • Next planned steps for SYN - 010 for C - IBS ̶ Initiate in vivo /PK/PD studies (1H 2014) ̶ Initiate Phase II clinical trial (2H 2014 ) ̶ Topline data from Phase II trial (mid - 2015) SYN - 010: Market Potential Significant patient population affected by C - IBS NYSE MKT: SYN

Pertussis Millions of whooping cough cases globally per year • Despite aggressive vaccination strategies, incidence of Pertussis is increasing 24,25 ̶ Less effective vaccine introduced in the 1990s ̶ Non - compliance with standard vaccinations ̶ ~41,000 cases per year in the U.S. 26 • Unvaccinated infants most vulnerable • 50 million worldwide cases of whooping cough each year 27 ̶ 300,000 deaths worldwide 27 (primarily infants) • Antibiotics are not effective in treating disease symptoms ̶ May eliminate B. pertussis bacteria from the respiratory tract ̶ Does not neutralize pertussis toxin • Pertussis toxin is a major cause of disease virulence ̶ Paralyzes immune system which can predispose infants to severe pneumonia ̶ Causes the white blood cell count to increase may block blood flow through the lungs 20 NYSE MKT: SYN

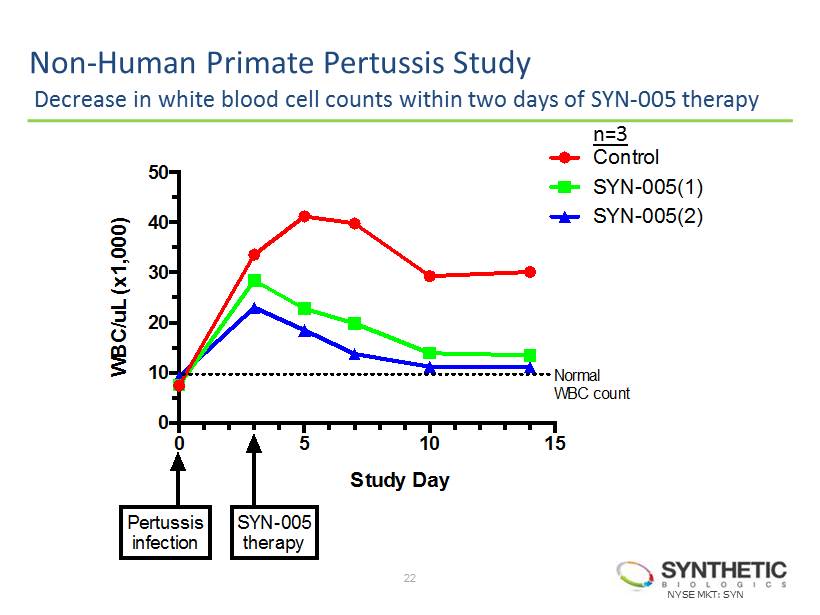

SYN - 005: Monoclonal Antibody ( mAb ) Combination Designed to target and neutralize the pertussis toxin • Exclusive Channel Collaboration with Intrexon Corporation • Collaboration with researchers at The University of Texas at Austin • Humanized two antibodies to form SYN - 005 • In vitro studies demonstrated ̶ High affinity binding to and potent neutralization of the toxin • Positive preclinical research findings ̶ Mitigated the elevation of white blood cell counts in non - human primate and murine studies • Next planned steps for SYN - 005 for the treatment of Pertussis ̶ Request Orphan Drug designation (2H 2014) ̶ File an Investigational New Drug (IND) application to support a Phase I clinical trial (1H 2015) ̶ Initiate Phase II trial, with topline results expected (2H 2015) 21 NYSE MKT: SYN

0 5 10 15 0 10 20 30 40 50 Study Day W B C / u L ( x 1 , 0 0 0 ) Control SYN-005(1) SYN-005(2) SYN-005 therapy Normal WBC count Pertussis infection Non - Human Primate Pertussis Study Decrease in white blood cell counts within two days of SYN - 005 therapy 22 NYSE MKT: SYN n=3

Acinetobacter Infections Infections increasing due to this pandrug - resistant gram - negative bacterium • M ortality rates as high as 43% reported 28 • Billion dollar market opportunity 29 • Survives on dry surfaces for up to 36 days ̶ Survives twice as long as non - biofilm - forming pathogens 30 • Acinetobacter infection profile ̶ 2.6% of hospital acquired infections 31 ̶ 7 % of ICU respiratory tract infections 31 ̶ Key infection sites include: lungs, heart, blood, urinary tract, CNS, skin and soft tissues • Increasing cause of trauma - related infections in wounded military personnel and victims of natural disasters 32 • Ongoing mAb development collaboration with Intrexon Corporation 23 NYSE MKT: SYN

Corporate Snapshot • Cash balance (as of 3/31/14) : ~$11.2 million • Current Price : $1.37 (as of 5/22/14) • 52 Week Range: $0.95 - $3.64 • Average Volume (3 months): 1,735,950 • Shares Outstanding: ~58.5 million (as of 5/12/14) • Options Outstanding: ~4.5 million * • Warrants Outstanding: ~963,000 ** • Market Capitalization: ~$80 million • Offices in Rockville, Maryland 24 NYSE MKT: SYN NYSE MKT: SYN * As of 3/31/14 weighted average exercise price is $1.91 ** As of 3/31/14 weighted average exercise price is $2.15

1H 2015 Pertussis File IND for human trials 2H 2014 C. difficile Initiate Phase Ia and Ib clinical trials 2H 2014 Multiple Sclerosis R. Voskuhl , M.D., report detailed Phase II results 2H 2014 Pertussis Request Orphan Drug designation 2H 2014 C - IBS Initiate Phase II clinical trial 2H 2014 C. difficile File IND for human trials Key Milestones 25 NYSE MKT: SYN Timeline

SYN Slide Deck – 5.27.2014 – FINAL NYSE MKT: SYN May 2014

References Slide 6: 1 Pr egnancy I n M ultiple S clerosis (PRIMS) Study; Confavreux , C., Hutchinson, M., Hours, M.M., Cortinvis - Tourniaire , P., Moreau, T., and the Pregnancy in MS Group (1998). Rate of Pregnancy - Related Relapse in Multiple Sclerosis. New England Journal of Medicine , 339, 285 - 291. 2 Sicotte , NL, Liva , SM, Klutch , R, Pfeiffer, P, Bouvier , S, Odesa , S, Wu, TC, Voskuhl , RR . Treatment of multiple sclerosis with the pregnancy hormone estriol. Ann Neurol. 2002 Oct;52(4):421 - 8. 3 www.clinicaltrials.gov/ct2/show/NCT00451204 Slide 7 : Copaxone ® is a registered trademark of Teva Pharmaceutical Industries Ltd. Slide 8 : 4 National Multiple Sclerosis Society. http:// www.nationalmssociety.org 5 Credit Suisse. Multiple Sclerosis - Evolution or Revolution Report. March 18, 2013. Slide 9 : 6 www.clinicaltrials.gov/ct2/show/NCT01466114 7 Sicotte , NL, Liva , SM, Klutch , R, Pfeiffer, P, Bouvier , S, Odesa , S, Wu, TC, Voskuhl , RR . Treatment of multiple sclerosis with the pregnancy hormone estriol. Ann Neurol. 2002 Oct;52(4):421 - 8. Copaxone ® is a registered trademark of Teva Pharmaceutical Industries Ltd. Avonex ® is a registered trademark of Biogen Idec. Betaseron ® is a registered trademark of Bayer. Extavia ® is a registered trademark of Novartis AG. Rebif ® is a registered trademark of EMD Serono , Inc. and Pfizer Inc. Gilenya ® is a registered trademark of Novartis AG. Aubagio ® is a registered trademark of Genzyme Corporation. Tecfidera ® is a registered trademark of Biogen Idec. Slide 10 : 8 Spellberg, B. Rising Plague: The Global Threat from Deadly Bacteria and Our Dwindling Arsenal to Fight Them. Copyright 2009. 9 theNUTRITIONpractice , http://thenutritionpractice.com.au/heal/get - better / . Accessed February 2, 2014. 27 NYSE MKT: SYN

References 28 Slide 12 : 10 Bank of America as reported in Wall Street Journal, November 6, 2013, C - 18. Slide 13 : 11 - 12 This information is an estimate derived from the use of information under license from the following IMS Health Incorporated inf ormation service: CDM Hospital database for full year 2012. IMS expressly reserves all rights, including rights of copying, distribution and republic ation. 13 (APIC) National Prevalence Study of Clostridium difficile in U.S. Healthcare Facilities. November 11, 2008. http://hospitalacquiredinfections.blogspot.com/2008/12/november - 11 - 2008 - association - for.html . 14 Agency for Healthcare Research and Quality. Healthcare and Cost Utilization Project. Statistical Brief #124. Clostridium difficile Infections (CDI) in Hospital Stays, 2009. January 2012. Available at http://www.hcup - us.ahrq.gov/reports/statbriefs/sb124.pdf . 15 U.S. Department of Health & Human Services. Agency for Healthcare Research and Quality. January 25, 2012. Available at http://www.ahrq.gov/news/nn/nn012512.htm . Accessed November 5, 2012. Slide 16 : 16 - 18 This information is an estimate derived from the use of information under license from the following IMS Health Incorporated inf ormation service: CDM Hospital database for full year 2012. IMS expressly reserves all rights, including rights of copying, distribution and republic ation. Slide 19 : 19 Hulisz , D. The burden of illness of irritable bowel syndrome: current challenges and hope for the future. J Manag Care Pharm. 2004 Jul - Aug;10(4):299 - 309 . 20 GlobalData EPI Database Report – Prevalent Cases, March 2014. 21 American College of Gastroenterology website : http://patients.gi.org/topics/irritable - bowel - syndrome/# tabs3 Accessed : May 14, 2014. 22 http://ibs.about.com/b/2012/01/13/timeline - for - new - ibs - drugs.htm 23 http://www.pharmatimes.com/Article/10 - 09 - 14/Almirall_s_IBS_constipation_drug_impresses_in_Phase_III.aspx?rl=1&rlurl=/12 - 01 - 05/IBS_drug_market_set_to_more_than_quadruple_by_2020.aspx NYSE MKT: SYN

References 29 Slide 20 : 24 Misegades LK, Winter K, Harriman K, Talarico J, Messonnier NE, Clark TA, Martin SW, Association of childhood pertussis with receipt of 5 doses of pertussis vaccine by time since last vaccine dose, California, 2010. JAMA, 2012 Nov 28;308(20):2126 - 32. 25 Centers for Disease Control and Prevention. Pertussis Epidemic – Washington, 2012. Morbidity and Mortality Weekly Report. July 20, 2012. 26 Centers for Disease Control and Prevention. 2012 Provisional Pertussis Surveillance Report. January 4, 2013. 27 World Health Organization. Pertussis: Immunization surveillance, assessment and monitoring. http://www.who.int/immunization_monitoring/diseases/pertussis_surveillance/en/ Slide 23 : 28 Falagas , ME, Bliziotis , LA, and Siempos , II. Attributable mortality of Acinetobacter baumannii infections in critically ill patients: a systematic review of matched cohort and case - control studies. Critical Care 2006, 10:R48. 29 Barrett, L. Former VP of US Marketing and Global Business Manager Infectious Diseases at Wyeth. Guest Blog, Antibiotic Market s a nd SPLU. http://antibiotics - theperfectstorm.blogspot.com/2012/03/antibiotic - markets - and - splu - guest.html . March 20, 2012. 30 Espinal P, Martí S, Vila J. Effect of biofilm formation on the survival of Acinetobacter baumannii on dry surfaces. J Hosp Infect. 2012 Jan; 80(1):56 - 60. Epub 2011 Oct 4. 31 Jones, M, et al. Emerging resistance among bacterial pathogens in the intensive care unit – a European and North American Survei llance study (2000 - 2002). Ann Clin Microbiol Antimicrob ; 3(14).; Wisplinghoff , H, et al. Nosocomial Bloodstream Infections in US Hospitals: Analysis of 24,179 Cases from a Prospective Nationwide Surveillance Study. Clin Infect Dis 2004; 39(3): 309 - 17.; Wachter , K. Step Aside, MRSA, Here Comes Acinetobacter . OB. GYN. News, January 15, 2006. 32 Camp, C and Tatum, OL. A Review of Acinetobacter baumannii as a Highly Successful Pathogen in Times of War. LABMEDICINE. November 2010, Vol. 41, Number 11. NYSE MKT: SYN