Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Extended Stay America, Inc. | d732714d8k.htm |

| EX-99.1 - EX-99.1 - Extended Stay America, Inc. | d732714dex991.htm |

Exhibit 99.2

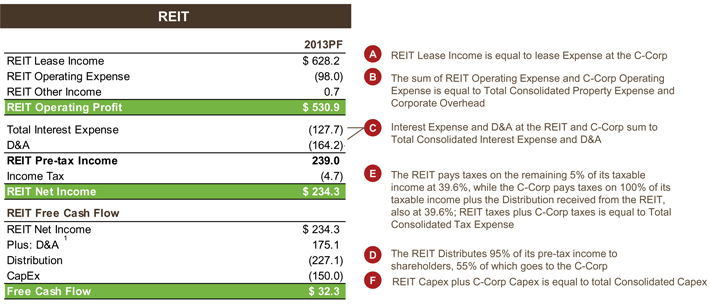

| REIT Entity Level Cash Flows — 2013 PF |

|

Pro Forma Adjustments:

| • | Proposed term loan in place and mezzanine debt repaid as of 1/1/13 |

| • | Conversion to paired share structure complete as of 1/1/13 |

| • | Existing lease agreement effective as of 1/1/13 |

| • | Excludes items the company adds backs for purposed of calculating Adjusted EBITDA: restructuring expenses, acquisition transaction expenses, asset impairment, non-cash equity compensation, IPO related costs, and loss on disposal of assets |

| • | Excludes write-off of deferred financing costs associated with paydown of mezz debt |

| • | Total REIT Capital Expenditures assumed at $150MM (with maintenance capital expenditures 5% of revenue) |

| • | No borrowings under REIT or C Corp revolver |

| 1 | Depreciation and Amortization in the REIT Free Cash Flow section includes amortization of deferred financing costs, a component of interest expense on the P&L. |

44