Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PBF Energy Inc. | annualreport8-k.htm |

PBF Energy Annual Shareholders’ Meeting May 21, 2014

2 Safe Harbor Statements This presentation contains forward-looking statements made by PBF Energy Inc. (the “Company” or “PBF”) and its management. Such statements are based on current expectations, forecasts and projections, including, but not limited to, anticipated financial and operating results, plans, objectives, expectations and intentions that are not historical in nature. Forward-looking statements should not be read as a guarantee of future performance or results, and may not necessarily be accurate indications of the times at, or by which, such performance or results will be achieved. Forward-looking statements are based on information available at the time, and are subject to various risks and uncertainties that could cause the Company’s actual performance or results to differ materially from those expressed in such statements. Factors that could impact such differences include, but are not limited to, changes in general economic conditions; volatility of crude oil and other feedstock prices; fluctuations in the prices of refined products; the impact of disruptions to crude or feedstock supply to any of our refineries, including disruptions due to problems with third party logistics infrastructure; effects of litigation and government investigations; the timing and announcement of any potential acquisitions and subsequent impact of any future acquisitions on our capital structure, financial condition or results of operations; changes or proposed changes in laws or regulations or differing interpretations or enforcement thereof affecting our business or industry, including any lifting by the federal government of the restrictions on exporting U.S. crude oil; actions taken or non-performance by third parties, including suppliers, contractors, operators, transporters and customers; adequacy, availability and cost of capital; work stoppages or other labor interruptions; operating hazards, natural disasters, weather-related delays, casualty losses and other matters beyond our control; inability to complete capital expenditures, or construction projects that exceed anticipated or budgeted amounts; inability to successfully integrate acquired refineries or other acquired businesses or operations; effects of existing and future laws and governmental regulations, including environmental, health and safety regulations; and, various other factors. Forward-looking statements reflect information, facts and circumstances only as of the date they are made. The Company assumes no responsibility or obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information after such date.

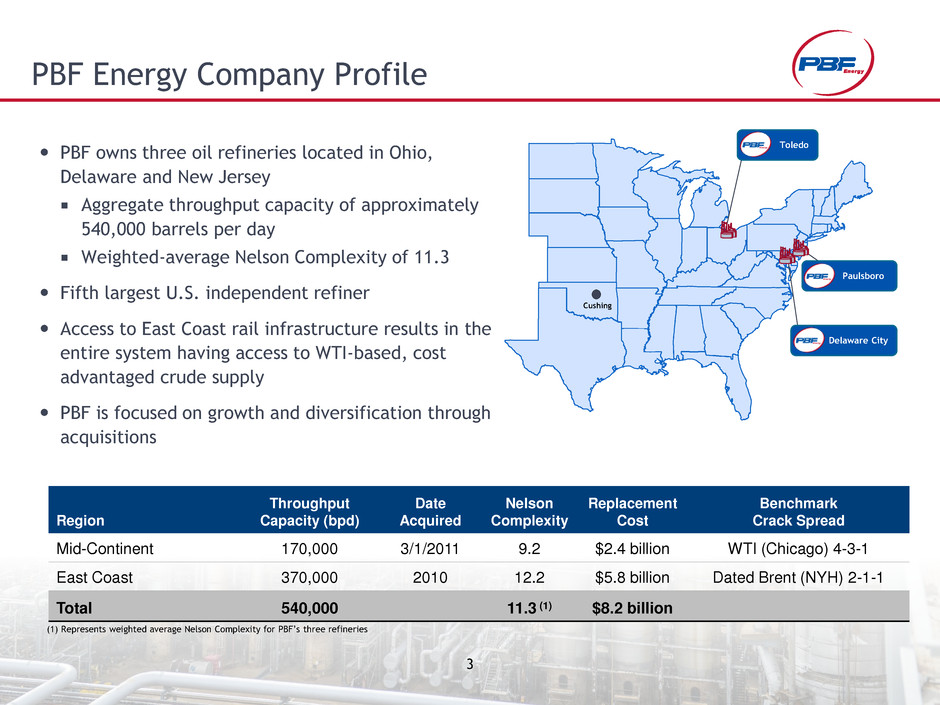

3 PBF Energy Company Profile PBF owns three oil refineries located in Ohio, Delaware and New Jersey Aggregate throughput capacity of approximately 540,000 barrels per day Weighted-average Nelson Complexity of 11.3 Fifth largest U.S. independent refiner Access to East Coast rail infrastructure results in the entire system having access to WTI-based, cost advantaged crude supply PBF is focused on growth and diversification through acquisitions Cushing Toledo Paulsboro Delaware City Region Throughput Capacity (bpd) Date Acquired Nelson Complexity Replacement Cost Benchmark Crack Spread Mid-Continent 170,000 3/1/2011 9.2 $2.4 billion WTI (Chicago) 4-3-1 East Coast 370,000 2010 12.2 $5.8 billion Dated Brent (NYH) 2-1-1 Total 540,000 11.3 (1) $8.2 billion (1) Represents weighted average Nelson Complexity for PBF’s three refineries

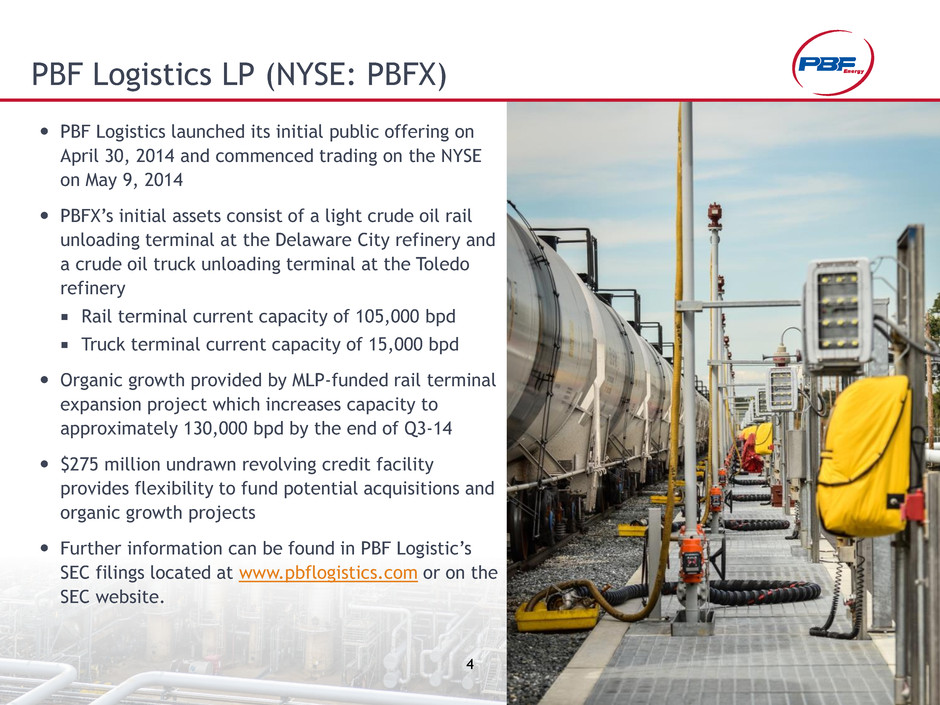

4 PBF Logistics launched its initial public offering on April 30, 2014 and commenced trading on the NYSE on May 9, 2014 PBFX’s initial assets consist of a light crude oil rail unloading terminal at the Delaware City refinery and a crude oil truck unloading terminal at the Toledo refinery Rail terminal current capacity of 105,000 bpd Truck terminal current capacity of 15,000 bpd Organic growth provided by MLP-funded rail terminal expansion project which increases capacity to approximately 130,000 bpd by the end of Q3-14 $275 million undrawn revolving credit facility provides flexibility to fund potential acquisitions and organic growth projects Further information can be found in PBF Logistic’s SEC filings located at www.pbflogistics.com or on the SEC website. PBF Logistics LP (NYSE: PBFX)

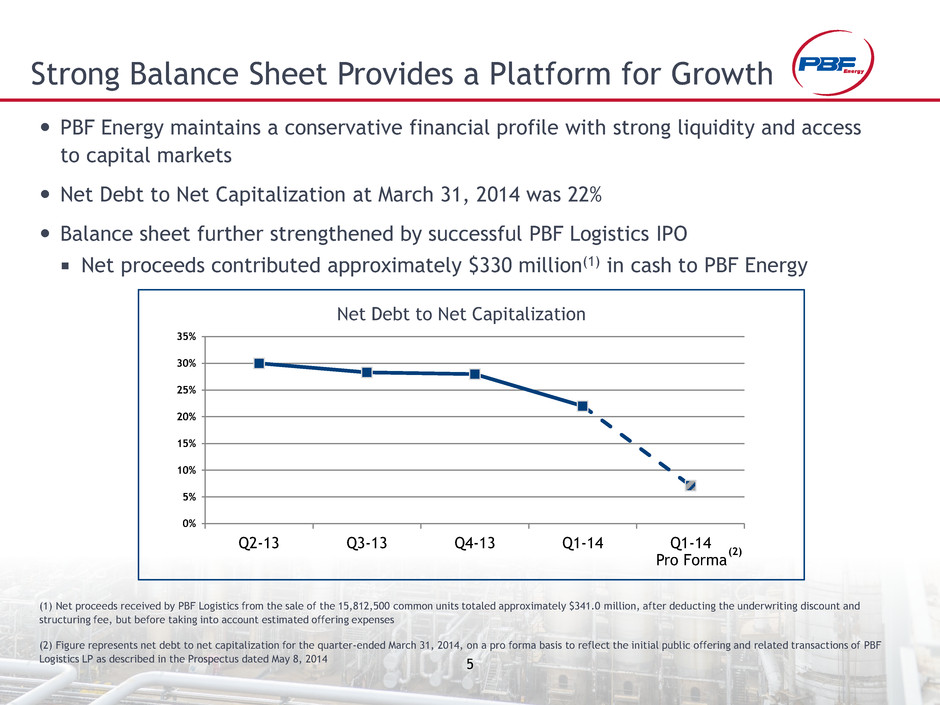

5 PBF Energy maintains a conservative financial profile with strong liquidity and access to capital markets Net Debt to Net Capitalization at March 31, 2014 was 22% Balance sheet further strengthened by successful PBF Logistics IPO Net proceeds contributed approximately $330 million(1) in cash to PBF Energy Strong Balance Sheet Provides a Platform for Growth 0% 5% 10% 15% 20% 25% 30% 35% Q2-13 Q3-13 Q4-13 Q1-14 Q1-14 (1) Net proceeds received by PBF Logistics from the sale of the 15,812,500 common units totaled approximately $341.0 million, after deducting the underwriting discount and structuring fee, but before taking into account estimated offering expenses (2) Figure represents net debt to net capitalization for the quarter-ended March 31, 2014, on a pro forma basis to reflect the initial public offering and related transactions of PBF Logistics LP as described in the Prospectus dated May 8, 2014 Net Debt to Net Capitalization (2) Pro Forma

6 PBF’s 2014 margin improvement initiatives *Figures provided do not indicate a full year of margin contribution in 2014 but are estimates based on a full year of operations using historical prices and subject to change based on project completion timelines, cost of RINs, market and other factors and as such actual results may differ from the amounts above Total margin uplift...........~$170 million/yr* Improved East Coast distillate yield Converted 100% of 2000ppm Heating Oil production into either Ultra Low Sulfur Diesel (ULSD) or Ultra Low Sulfur Heating Oil (ULSHO) Based on 2013 pricing, this is a potential margin increase of $3.00 per barrel on these distillate barrels Could impact 20 million barrels per year Optimized commercial operations PBF now sells its products on the East Coast directly to the market Achieving, on average, 50 cents per barrel higher netback Toledo process improvements New crude tank improves feedstock flexibility and minimizes disruptions Increased jet fuel production and sales by 15% to 20% Improved FCC performance and yield following turnaround ......................................margin uplift...........~$60 million/yr* ........................................margin uplift...........~$50 million/yr* .............................................margin uplift...........~$60 million/yr*

7 Safety of Rail Operations PBF will lead the way on rail safety New-style DOT-111A rail cars, also referred to as CPC-1232, ordered after October 1, 2011 are the most recent design and include thicker shells, half-head shields, and protective coverings over the top fittings and improved pressure relief valves As of April 1, 2014, all Bakken crude oil delivered to our Delaware City refinery will be transported in the new-style DOT-111A rail cars Effective June 30, 2014, 100% of the Canadian crude unloading activities at Delaware City will be from new-style DOT-111A rail cars PBF supports increased efforts by rail companies to enhance operating practices, increase rail inspection and maintenance activities to ensure the safe transport of all crude oil

8 Increasing Shareholder Value in 2014 Operate safely and efficiently Maintain capital discipline and conservative balance sheet Invest in margin improvement projects Grow through strategic acquisitions Return cash to investors

9