Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Santander Consumer USA Holdings Inc. | d729662d8k.htm |

| Exhibit 99.1

|

Exhibit 99.1

Santander Consumer USA Holdings Inc.

Investor Presentation

©2014 Santander Consumer USA Holdings Inc.

|

|

IMPORTANT INFORMATION

Forward-Looking Statements

This presentation may contain forward-looking statements. Any statements about our expectations, beliefs, plans, predictions, forecasts, objectives, assumptions, or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases such as “anticipates,” “believes,” “can,” “could,”

“may,” “predicts,” “potential,” “should,” “will,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “intends,” and similar words or phrases. Accordingly, these statements are only predictions and involve estimates, known and unknown risks, assumptions, and uncertainties that could cause actual results to differ materially from those expressed in them. SCUSA’s actual results could differ materially from those anticipated in such forward-looking statements as a result of several factors more fully described under the caption “Risk Factors” and elsewhere in the annual report on Form 10-K and/or quarterly reports on Form 10-Q filed by SCUSA with the Securities and Exchange Commission. Any or all of our forward-looking statements in this presentation may turn out to be inaccurate. The inclusion of this forward-looking information should not be regarded as a representation that the future plans, estimates, or expectations contemplated by SCUSA will be achieved. SCUSA has based these forward-looking statements largely on SCUSA’s current expectations and projections about future events and financial trends that SCUSA believes may affect SCUSA’s financial condition, results of operations, business strategy, and financial needs. There are important factors that could cause SCUSA’s actual results, level of activity, performance, or achievements to differ materially from the results, level of activity, performance, or achievements expressed or implied by the forward-looking statements, including, but not limited to, the following: (1) adverse economic conditions in the United States and worldwide may negatively impact SCUSA’s results; (2) SCUSA’s business could suffer if its access to funding is reduced; (3) SCUSA faces significant risks implementing its growth strategy, some of which are outside SCUSA’s control; (4) SCUSA’s agreement with Chrysler Group LLC may not result in currently anticipated levels of growth and is subject to certain performance conditions that could result in termination of the agreement; (5) SCUSA’s business could suffer if it is unsuccessful in developing and maintaining relationships with automobile dealerships; (6) SCUSA’s financial condition, liquidity, and results of operations depend on the credit performance of SCUSA’s loans; (7) loss of SCUSA’s key management or other personnel, or an inability to attract such management and personnel, could negatively impact SCUSA’s business; (8) future changes in SCUSA’s relationship with Banco Santander, S.A. could adversely affect SCUSA’s operations; and (9) SCUSA operates in a highly regulated industry and continually changing federal, state, and local laws and regulations could materially adversely affect SCUSA’s business.

©2014 Santander Consumer USA Holdings Inc.

|

|

AGENDA 3

Corporate and Strategic Overview

Credit, Originations and Underwriting

Servicing and Operations

Compliance

Appendix

©2014 Santander Consumer USA Holdings Inc.

|

|

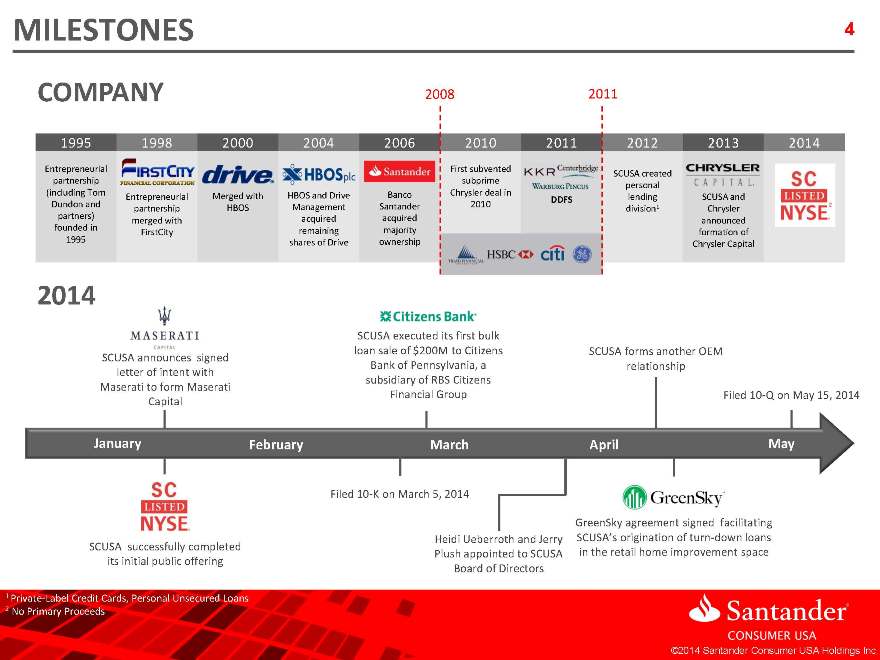

MILESTONES 4

COMPANY

2008 2011

1995 1998 2000 2004 2006 2010 2011 2012 2013 2014

Entrepreneurial First subvented SCUSA created

partnership subprime personal

(including Tom Entrepreneurial HBOS and Drive Banco Chrysler deal in DDFS lending SCUSA and

Dundon and partnership HBOS Management Santander 2010 division1 Chrysler 2

partners) merged with acquired acquired announced

founded in FirstCity remaining majority formation of

1995 shares of Drive ownership Chrysler Capital

2014

SCUSA executed its first bulk

SCUSA announces signed loan sale of $200M to Citizens SCUSA forms another OEM

letter of intent with Bank of Pennsylvania, a relationship

subsidiary of RBS Citizens

Maserati to form Maserati

Capital Financial Group Filed 10-Q on May 15, 2014

January February March April May

Filed 10-K on March 5, 2014

GreenSky agreement signed facilitating

Heidi Ueberroth and Jerry SCUSA’s origination of turn-down loans

SCUSA successfully completed Plush appointed to SCUSA in the retail home improvement space

its initial public offering

Board of Directors

1 Private-Label Credit Cards, Personal Unsecured Loans

2 No Primary Proceeds

©2014 Santander Consumer USA Holdings Inc.

|

|

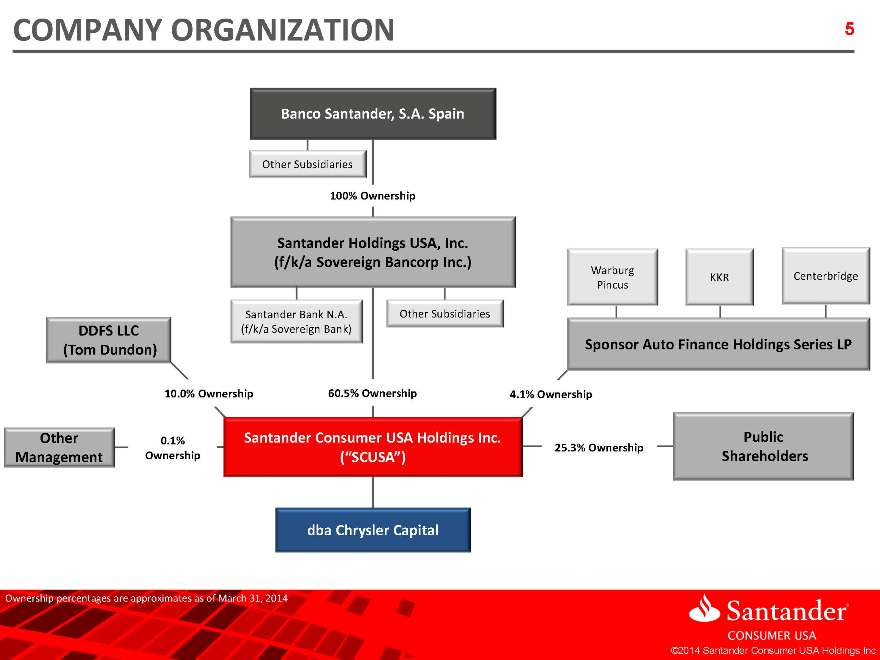

company organization

Banco santander

other subsidiaries

100%

ownership

DDFS LLC

OTHER MANAGEGTEMENT

PUBLIC SHARESHOLDERS

WARBURG

KKR

CENTERBRIDG

|

|

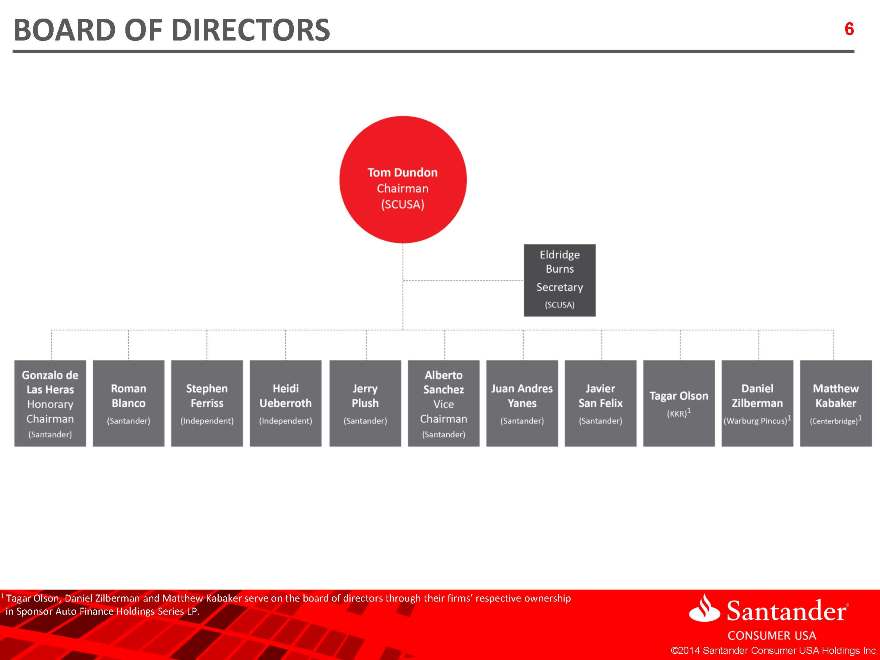

BOARD OF DIRECTORS 6

1 Tagar Olson, Daniel Zilberman and Matthew Kabaker serve on the board of directors through their firms’ respective ownership in Sponsor Auto Finance Holdings Series LP. ©2014 Santander Consumer USA Holdings Inc.

|

|

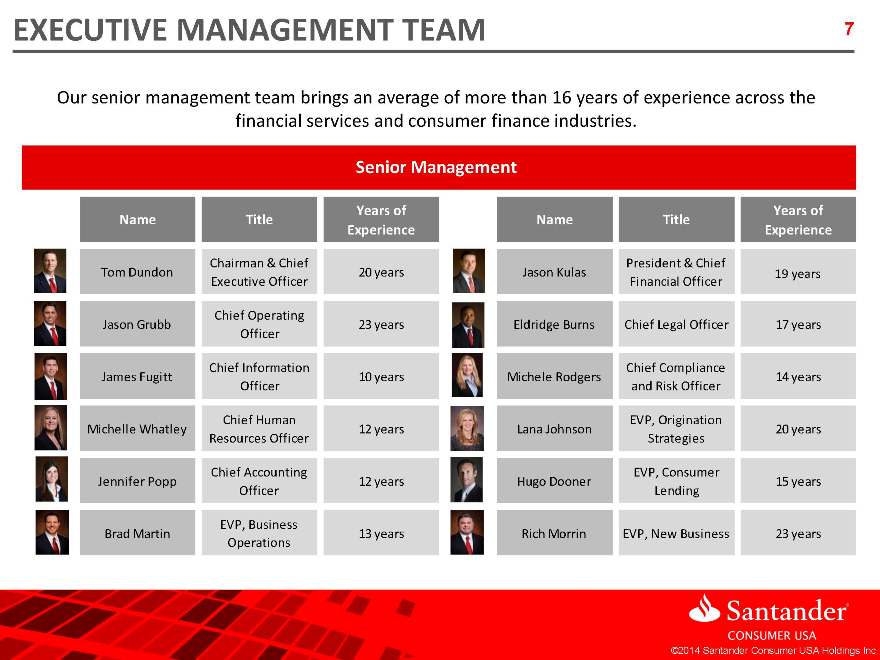

EXECUTIVE MANAGEMENT TEAM 7

Our senior management team brings an average of more than 16 years of experience across the financial services and consumer finance industries.

Senior Management

Name Title Years of Experience Name Title Years of Experience Tom Dundon Chairman & Chief Executive Officer 20 years Jason Kulas President & Chief Financial Officer 18 years Jason Grubb Chief Operating Officer 23 years Eldridge Burns Chief Legal Officer 17 years James Fugitt Chief Information Officer 10 years Michele Rodgers Chief Compliance and Risk Officer 14 years Michelle Whatley Chief Human Resources Officer 12 years Lana Johnson EVP, Origination Strategies 20 years Jennifer Popp Chief Accounting Officer 12 years Hugo Dooner EVP, Consumer Lending 15 years Brad Martin EVP, Business Operations 13 years Rich Morrin EVP, New Business 23 years

|

|

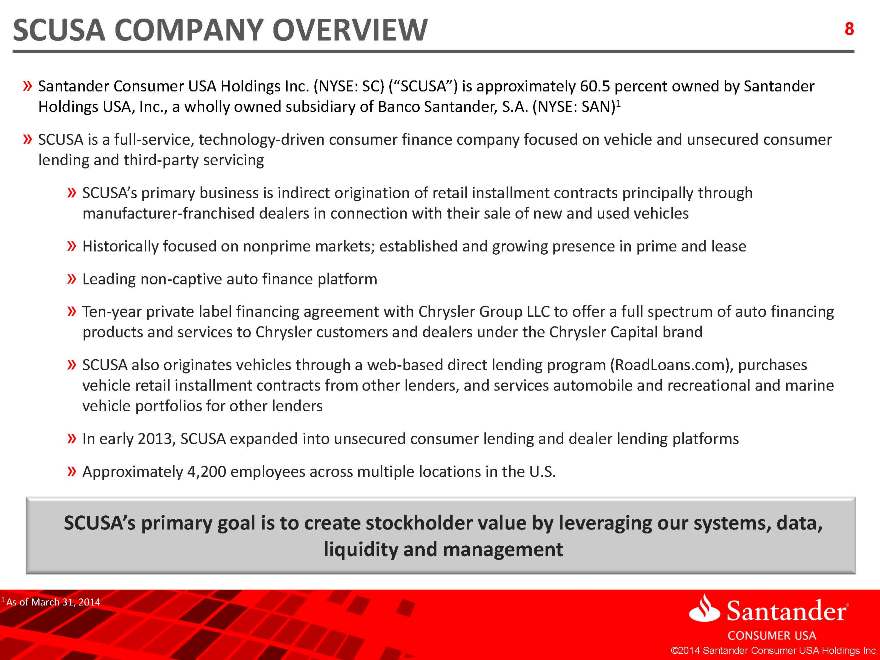

SCUSA COMPANY OVERVIEW 8

Santander Consumer USA Holdings Inc. (NYSE: SC) (“SCUSA”) is approximately 60.5 percent owned by Santander Holdings USA, Inc., a wholly owned subsidiary of Banco Santander, S.A. (NYSE: SAN)1

»SCUSA is a full-service, technology-driven consumer finance company focused on vehicle and unsecured consumer lending and third-party servicing

»SCUSA’s primary business is indirect origination of retail installment contracts principally through manufacturer-franchised dealers in connection with their sale of new and used vehicles

»Historically focused on nonprime markets; established and growing presence in prime and lease

»Leading non-captive auto finance platform

»Ten-year private label financing agreement with Chrysler Group LLC to offer a full spectrum of auto financing products and services to Chrysler customers and dealers under the Chrysler Capital brand

»SCUSA also originates vehicles through a web-based direct lending program (RoadLoans.com), purchases vehicle retail installment contracts from other lenders, and services automobile and recreational and marine vehicle portfolios for other lenders

»In early 2013, SCUSA expanded into unsecured consumer lending and dealer lending platforms

»Approximately 4,200 employees across multiple locations in the U.S.

SCUSA’s primary goal is to create stockholder value by leveraging our systems, data, liquidity and management

| 1 |

|

As of March 31, 2014 |

|

|

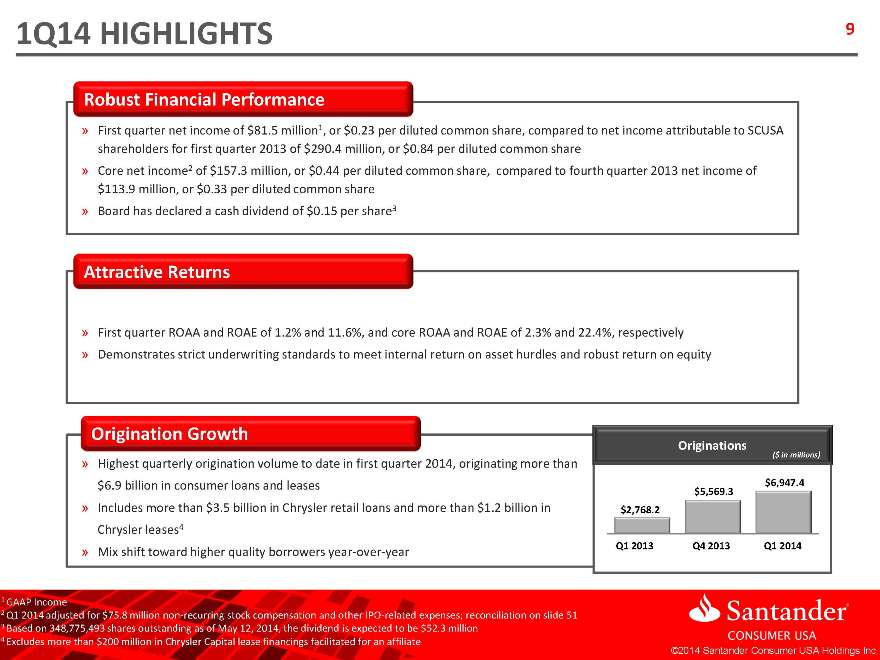

1Q14 HIGHLIGHTS 9

Robust Financial Performance

First quarter net income of $81.5 million1, or $0.23 per diluted common share, compared to net income attributable to SCUSA shareholders for first quarter 2013 of $290.4 million, or $0.84 per diluted common share

»Core net income2 of $157.3 million, or $0.44 per diluted common share, compared to fourth quarter 2013 net income of $113.9 million, or $0.33 per diluted common share

»Board has declared a cash dividend of $0.15 per share3

Attractive Returns

First quarter ROAA and ROAE of 1.2% and 11.6%, and core ROAA and ROAE of 2.3% and 22.4%, respectively

»Demonstrates strict underwriting standards to meet internal return on asset hurdles and robust return on equity

Origination Growth

Highest quarterly origination volume to date in first quarter 2014, originating more than $6.9 billion in consumer loans and leases

»Includes more than $3.5 billion in Chrysler retail loans and more than $1.2 billion in Chrysler leases4

»Mix shift toward higher quality borrowers year-over-year

Originations ($ in millions)

$2,768.2

$5,569.3

$6,947.4

Q1 2014

Q4 2013

Q1 2013

| 1 |

|

GAAP Income |

2 Q1 2014 adjusted for $75.8 million non-recurring stock compensation and other IPO-related expenses; reconciliation on slide 50

| 3 |

|

Based on 348,775,493 shares outstanding as of May 12, 2014, the dividend is expected to be $52.3 million |

| 4 |

|

Excludes more than $200 million in Chrysler Capital lease financings facilitated for an affiliate ©2014 Santander Consumer USA Holdings Inc. |

|

|

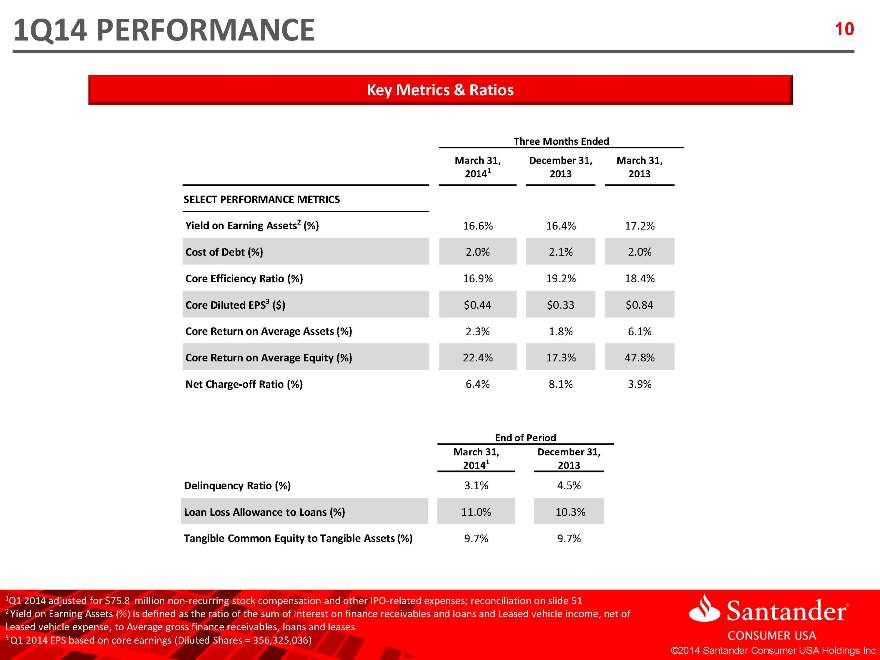

1Q14 PERFORMANCE 10

Key Metrics & Ratios

Three Months Ended

March 31, 20141

December 31, 2013

March 31, 2013

SELECT PERFORMANCE METRICS

Yield on Earning Assets2 (%)

16.6%

16.4%

17.2%

Cost of Debt (%)

2.0%

2.1%

2.0%

Core Efficiency Ratio (%)

16.9%

19.2%

18.4%

Core Diluted EPS3 ($)

$0.44

$0.33

$0.84

Core Return on Average Assets (%)

2.3%

1.8%

6.1%

Core Return on Average Equity (%)

22.4%

17.3%

47.8%

Net Charge-off Ratio (%)

6.4%

8.1%

3.9%

End of Period

March 31, 20141

December 31, 2013

Delinquency Ratio (%)

3.1%

4.5%

Loan Loss Allowance to.Loans (%)

11.0%

10.3%

Tangible Common Equity to Tangible Assets (%)

9.7%

9.7%

1Q1 2014 adjusted for $75.8 million non-recurring stock compensation and other IPO-related expenses; reconciliation on slide 50

2 Yield on Earning Assets (%) is defined as the ratio of the sum of Interest on finance receivables and loans and Leased vehicle income, net of Leased vehicle expense, to Average gross finance receivables, loans and leases

| 3 |

|

Q1 2014 EPS based on core earnings (Diluted Shares = 356,325,036) ©2014 Santander Consumer USA Holdings Inc. |

|

|

OUR BUSINESS 11

Business Operations

SCUSA’s primary goal is to create stockholder value by leveraging our systems, data, liquidity and management

Strong financial performance driven by positive core business trends

»Improved credit performance and asset quality

»Optimized funding and liquidity position and strong capital generation

Strategy

Our growth strategy is to increase market presence in the consumer finance industry while deploying our capital and funding efficiently

»Continue growing presence in prime markets and dealer lending platform through Chrysler Capital1 and in unsecured consumer lending through existing and new relationships

»Capitalize on increasing consumer loan demand, deep and sustained access to committed funding, and abundant partners and OEM2 relationships to drive originations

»Focus on continued integration and utilization of advanced technology platforms to maintain an industry-leading efficiency ratio and provide a competitive edge

| 1 |

|

Chrysler Capital is a dba of Santander Consumer USA Holdings Inc. 2 Original equipment manufacturer ©2014 Santander Consumer USA Holdings Inc. |

|

|

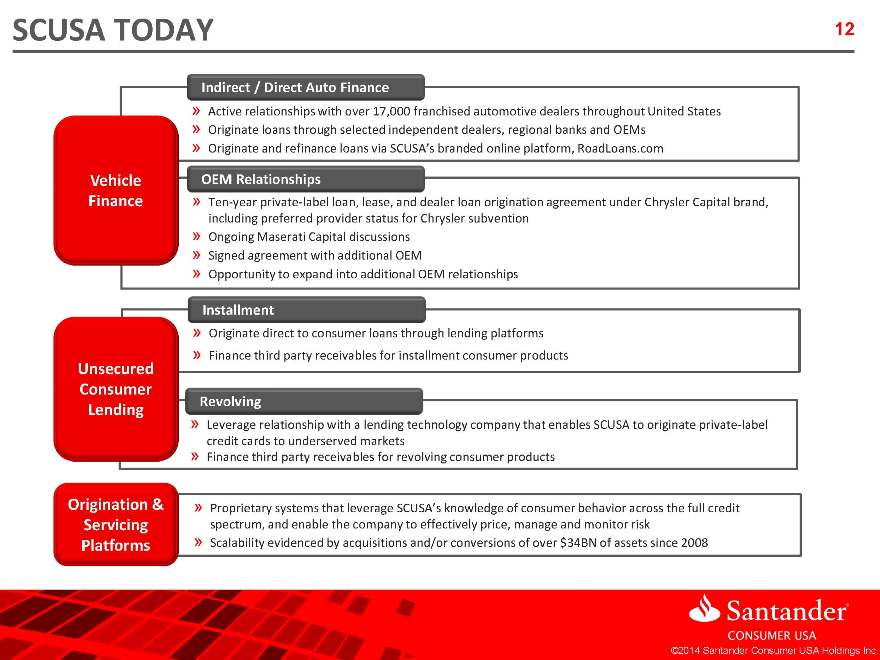

SCUSA TODAY 12

Vehicle Finance

Indirect / Direct Auto Finance

Active relationships with over 17,000 franchised automotive dealers throughout United States

»Originate loans through selected independent dealers, regional banks and OEMs

»Originate and refinance loans via SCUSA’s branded online platform, RoadLoans.com

OEM Relationships

Ten-year private-label loan, lease, and dealer loan origination agreement under Chrysler Capital brand, including preferred provider status for Chrysler subvention

»Ongoing Maserati Capital discussions

»Signed agreement with additional OEM

»Opportunity to expand into additional OEM relationships

Unsecured Consumer Lending

Installment

Originate direct to consumer loans through lending platforms

»Finance third party receivables for installment consumer products

Revolving

Leverage relationship with a lending technology company that enables SCUSA to originate private-label credit cards to underserved markets

»Finance third party receivables for revolving consumer products

Origination & Servicing Platforms

Proprietary systems that leverage SCUSA’s knowledge of consumer behavior across the full credit spectrum, and enable the company to effectively price, manage and monitor risk

»Scalability evidenced by acquisitions and/or conversions of over $34BN of assets since 2008 ©2014 Santander Consumer USA Holdings Inc.

|

|

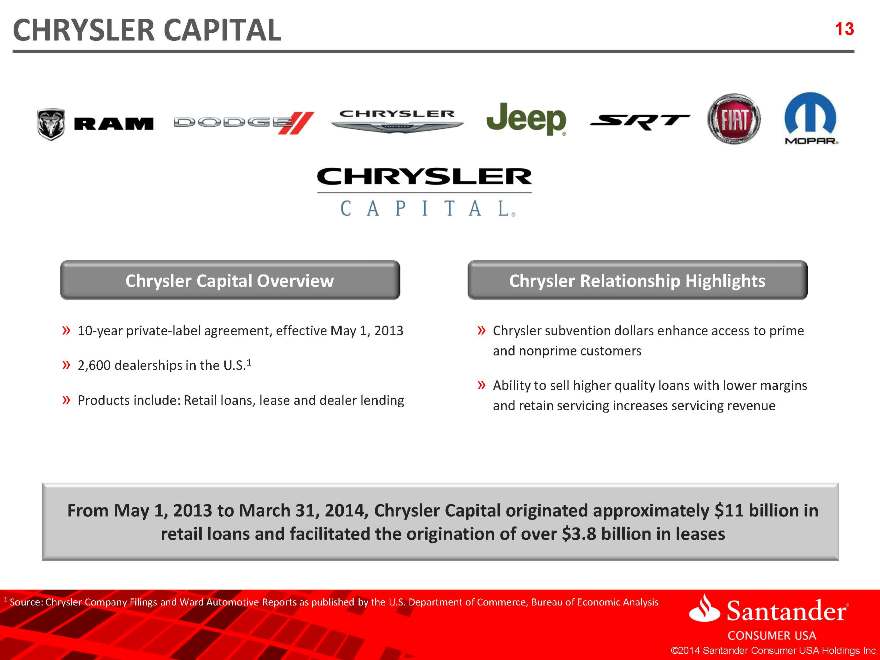

CHRYSLER CAPITAL 13

Chrysler Capital Overview Chrysler Relationship Highlights

10-year private-label agreement, effective May 1, 2013

»2,600 dealerships in the U.S.1

»Products include: Retail loans, lease and dealer lending

»Chrysler subvention dollars enhance access to prime and nonprime customers

»Ability to sell higher quality loans with lower margins and retain servicing increases servicing revenue

From May 1, 2013 to March 31, 2014, Chrysler Capital originated approximately $11 billion in retail loans and facilitated the origination of over $3.8 billion in leases

1 Source: Chrysler Company Filings and Ward Automotive Reports as published by the U.S. Department of Commerce, Bureau of Economic Analysis ©2014 Santander Consumer USA Holdings Inc.

|

|

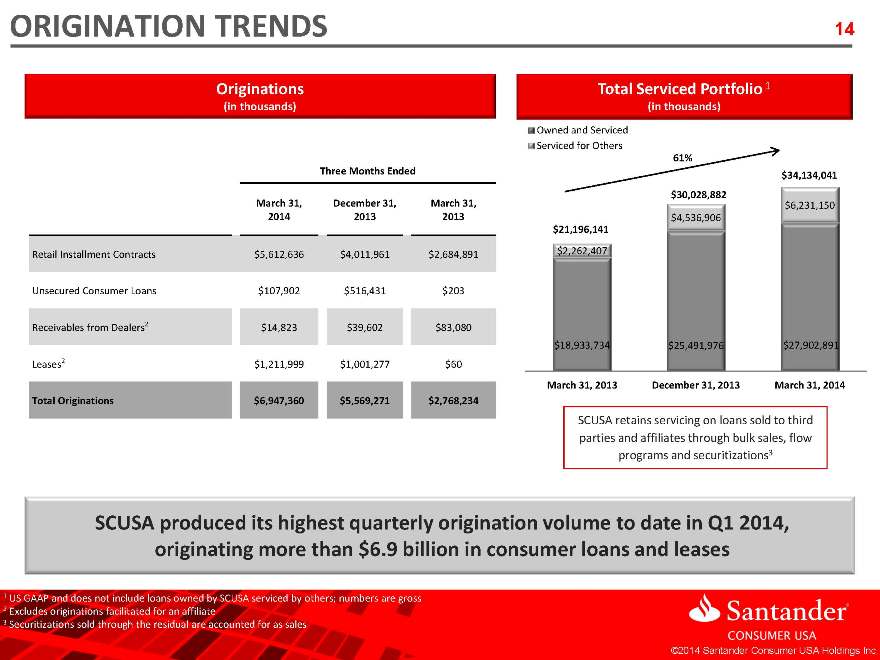

ORIGINATION TRENDS 14

Originations (in thousands)

Originations (in thousands) Three Months Ended

March 31,

2014 December 31,

2013 March 31,

2013

Retail Installment Contracts $5,612,636 $4,011,961 $2,684,891

Unsecured Consumer Loans $107,902 $516,431 $203

Receivables from Dealers2 $14,823 $39,602 $83,080

Leases2 $1,211,999 $1,001,277 $60

Total Originations $6,947,360 $5,569,271 $2,768,234

Total Serviced Portfolio 1 (in thousands)

Owned and Serviced

Serviced for Others

61%

$21,196,141

$2,262,407

$18,933,734

$30,028,882

$4,536,906

$25,491,976

$34,134,041

$6,231,150

$27,902,891

March 31, 2013

December 31, 2013

March 31, 2014

SCUSA retains servicing on loans sold to third parties and affiliates through bulk sales, flow programs and securitizations3

SCUSA produced its highest quarterly origination volume to date in Q1 2014, originating more than $6.9 billion in consumer loans and leases

| 1 |

|

US GAAP and does not include loans owned by SCUSA serviced by others; numbers are gross |

| 2 |

|

Excludes originations facilitated for an affiliate |

| 3 |

|

Securitizations sold through the residual are accounted for as sales ©2014 Santander Consumer USA Holdings Inc. |

|

|

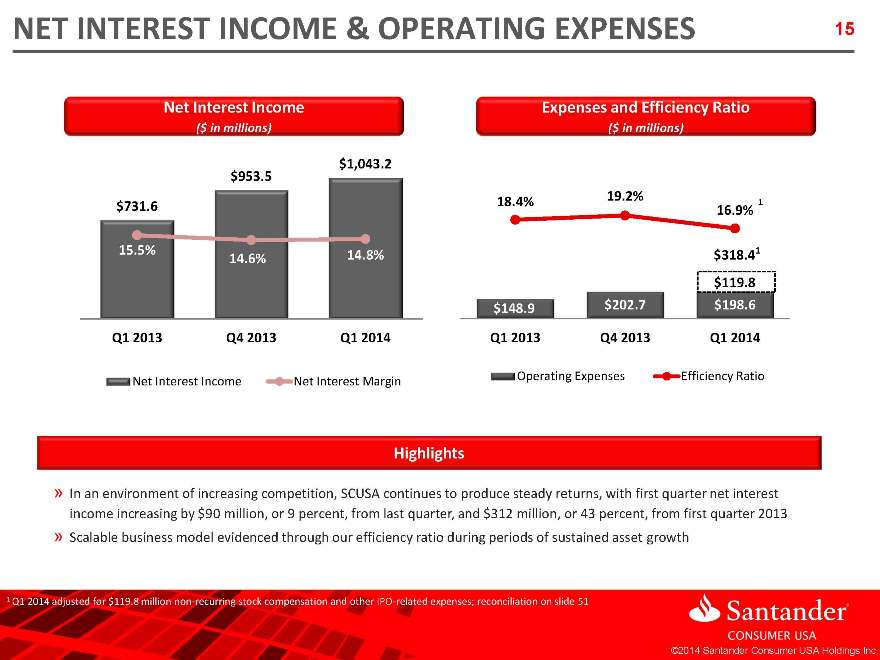

NET INTEREST INCOME & OPERATING EXPENSES 15

Net Interest Income ($ in millions)

Expenses and Efficiency Ratio ($ in millions)

$731.6

15.5%

$953.5

14.6%

$1,043.2

14.8%

Q1 2013

Q4 2013

Q1 2014

Net Interest Income

Net Interest Margin

18.4% 19.2% 16.9% 1

$318.4 11 2014 adjusted for $119.8 million non-recurring stock compensation and other IPO-related expenses; reconciliation on slide 50

$119.8 $148.9 $202.7 $198.6

Q1 2013

Q4 2013

Q1 2014

Operating Expenses

Efficiency Ratio

Highlights

In an environment of increasing competition, SCUSA continues to produce steady returns, with first quarter net interest income increasing by $90 million, or 9 percent, from last quarter, and $312 million, or 43 percent, from first quarter 2013

»Scalable business model evidenced through our efficiency ratio during periods of sustained asset growth

1 Q1 2014 adjusted for $119.8 million non-recurring stock compensation and other IPO-related expenses; reconciliation on slide 50

©2014 Santander Consumer USA Holdings Inc.

|

|

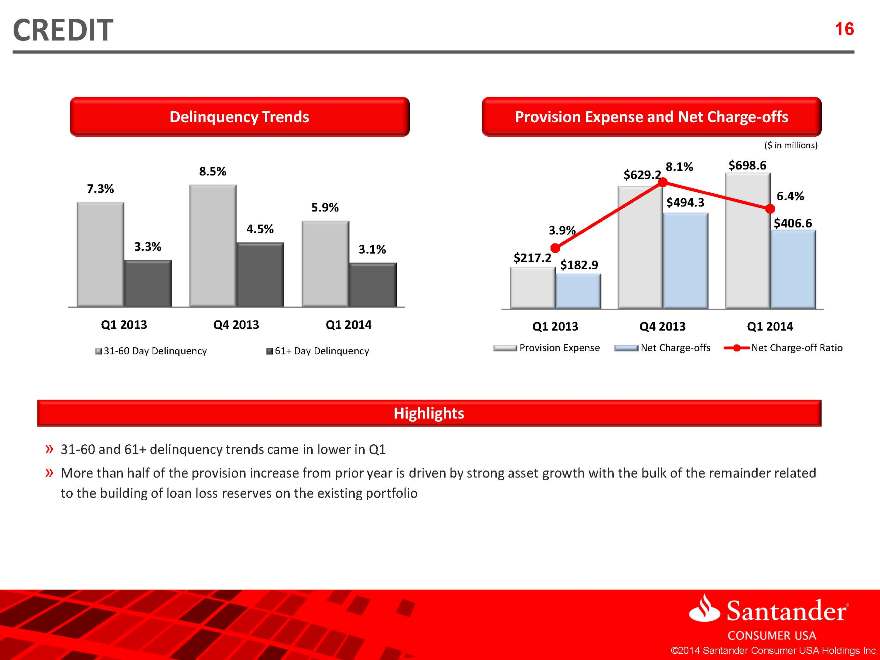

CREDIT 16

Delinquency Trends

7.3% 8.5% 5.9% 3.3% 4.5% 3.1%

Q1 2013

Q4 2013

Q1 2014

Provision Expense and Net Charge-offs

($ in millions)

$217.2

$629.2 $698.6 $182.9 $494.3 $406.6

3.9% 8.1%

6.4%

Q1 2013

Q4 2013

Q1 2014

Provision Expense

Net Charge-offs

Net Charge-off Ratio

Highlights

31-60 and 61+ delinquency trends came in lower in Q1

»More than half of the provision increase from prior year is driven by strong asset growth with the bulk of the remainder related to the building of loan loss reserves on the existing portfolio

©2014 Santander Consumer USA Holdings Inc.

|

|

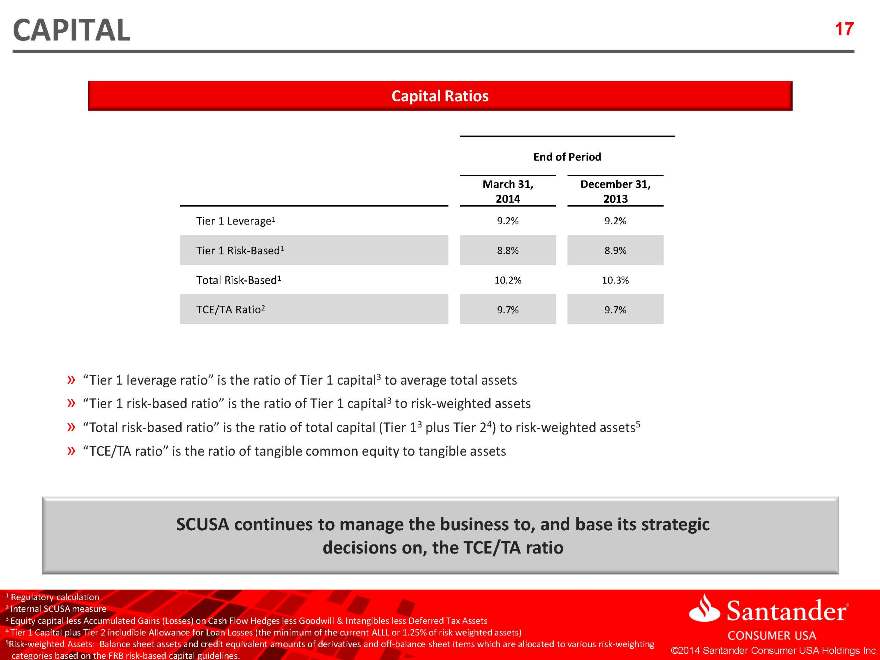

CAPITAL 17

Capital Ratios

End of Period

March 31,

2014 December 31,

2013

Tier 1 Leverage1 9.2% 9.2%

Tier 1 Risk-Based1 8.8% 8.9%

Total Risk-Based1 10.2% 10.3%

TCE/TA Ratio2 9.7% 9.7%

“Tier 1 leverage ratio” is the ratio of Tier 1 capital3 to average total assets

»“Tier 1 risk-based ratio” is the ratio of Tier 1 capital3 to risk-weighted assets

»“Total risk-based ratio” is the ratio of total capital (Tier 13 plus Tier 24) to risk-weighted assets5

»“TCE/TA ratio” is the ratio of tangible common equity to tangible assets

SCUSA continues to manage the business to, and base its strategic decisions on, the TCE/TA ratio

1 Regulatory calculation 2 Internal SCUSA measure 3 Equity capital less Accumulated Gains (Losses) on Cash Flow Hedges less Goodwill & Intangibles less Deferred Tax Assets 4 Tier 1 Capital plus Tier 2 includible Allowance for Loan Losses (the minimum of the current ALLL or 1.25% of risk weighted assets) 5Risk-weighted Assets: Balance sheet assets and credit equivalent amounts of derivatives and off-balance sheet items which are allocated to various risk-weighting categories based on the FRB risk-based capital guidelines.

©2014 Santander Consumer USA Holdings Inc.

|

|

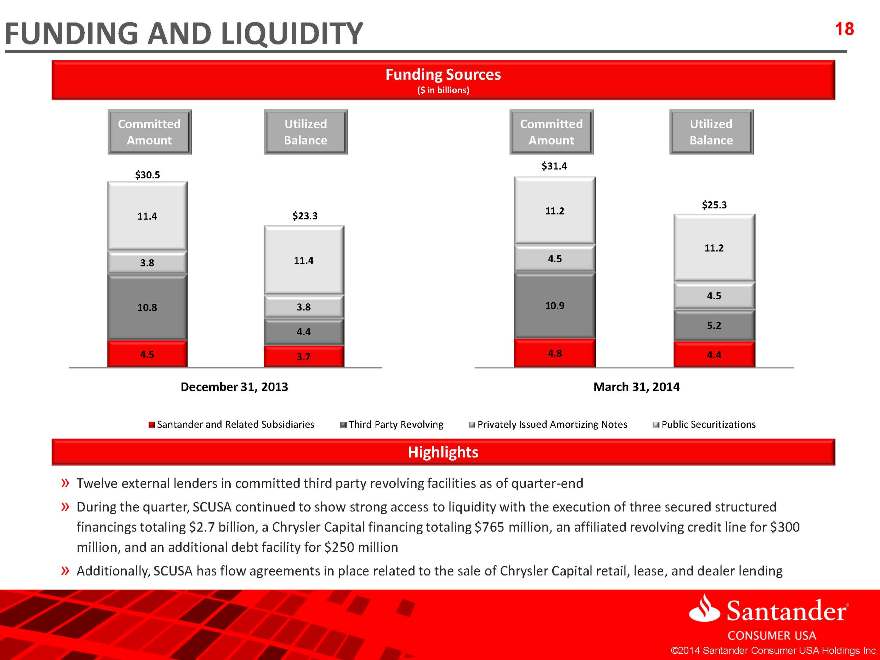

FUNDING AND LIQUIDITY 18

Funding Sources

($ in billions)

Committed Amount

Utilized Balance

Committed Amount

Utilized Balance

$30.5

11.4

3.8

10.8

4.5

$23.3

11.4

3.8

4.4

3.7

December 31, 2013

$31.4

11.2

4.5

10.9

4.8

$25.3

11.2

4.5

5.2

4.4

March 31, 2014

Santander and Related Subsidiaries

Third Party Revolving

Privately Issued Amortizing Notes

Public Securitizations

Highlights

Twelve external lenders in committed third party revolving facilities as of quarter-end

»During the quarter, SCUSA continued to show strong access to liquidity with the execution of three secured structured financings totaling $2.7 billion, a Chrysler Capital financing totaling $765 million, an affiliated revolving credit line for $300 million, and an additional debt facility for $250 million

»Additionally, SCUSA has flow agreements in place related to the sale of Chrysler Capital retail, lease, and dealer lending

©2014 Santander Consumer USA Holdings Inc.

|

|

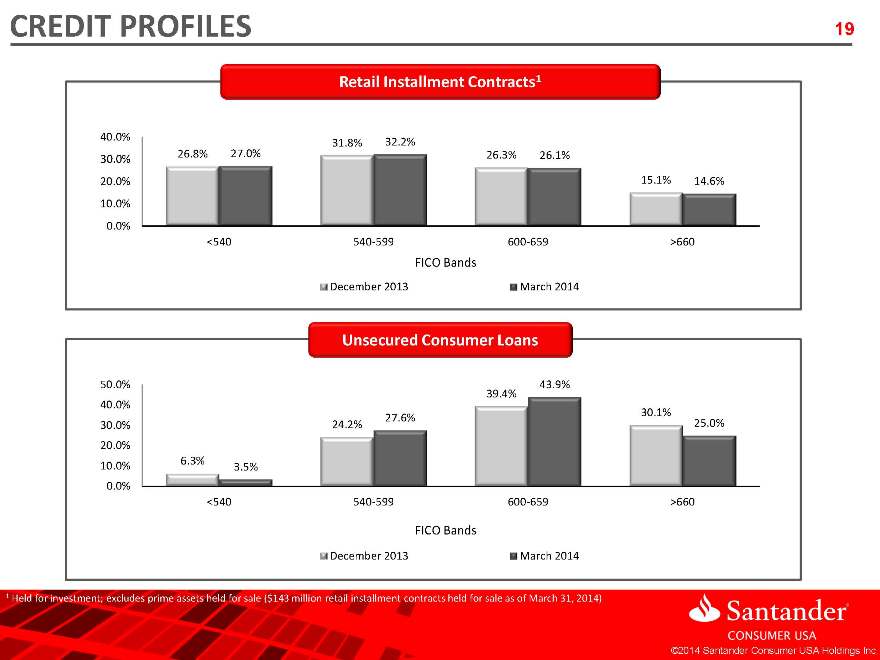

CREDIT PROFILES

19

26.8% 31.8% 26.3% 15.1%

27.0%

32.2%

26.1% 14.6%

0.0%

10.0%

20.0%

30.0%

40.0%

<540

540-599

600-659

>660

December 2013

March 2014Retail Installment Contracts1 FICO Bands Unsecured Consumer Loans

6.3%

24.2%

39.4%

30.1% 3.5% 27.6% 43.9% 25.0%

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

<540

540-599

600-659

>660

December 2013

March 2014

FICO Bands

| 1 |

|

Held |

19

Held for investment; excludes prime assets held for sale ($143 million retail installment contracts held for sale as of March 31, 2014) ©2014 Santander Consumer USA Holdings Inc.

©2014 Santander Consumer USA Holdings Inc. Corporate and Strategic Overview Servicing and Operations Credit, Originations and Underwriting

|

|

AGENDA

20

Compliance

Appendix

©2014 Santander Consumer USA Holdings Inc.

|

|

ORIGINATIONS OVERVIEW 21

Originations works hand in hand with many different credit partners, in both the prime and nonprime sectors. Due to the sheer number of relationships we offer various options. This type of service is appealing to both external and internal customers. Below is a list of our products and business channels.

Products

Retail/indirect

Customers goes to dealership and applies for loan. Loan is closed in the dealership on a retail.

Leasing

At the end of customer doesn’t own vehicle

Commercial Retail/ Lease

Automobile financing for business

Fleet Retail/Lease

More than one automobile is financed at a time

Direct Lending

Purchase customers applies on lie then go to a dealership with approval packet

Refinancing Customers automobile loans, customers can receive cash back and/or lower payments

Private Label

Indirect loans made on behalf of other financial establishments. All communications to and from dealerships are on behalf of the financial institution that we are representing, this includes phone calls both in and outbound

©2014 Santander Consumer USA Holdings Inc.

|

|

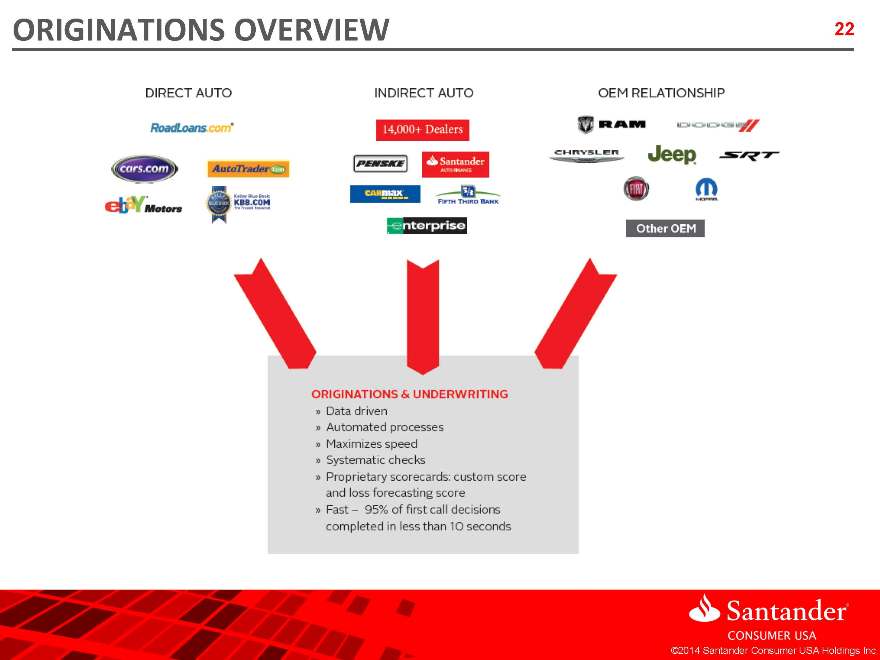

Originations Overview 22

Direct Auto Indirect Auto OEM Relationship

Originations & Underwriting

Data driven

Automated process

Maximizes speed

Systematic checks

Proprietary score cards custom score and loss forecasting score

Fast-95% of first call decisions completed is less than 10 seconds

©2014 Santander Consumer USA Holdings Inc.

|

|

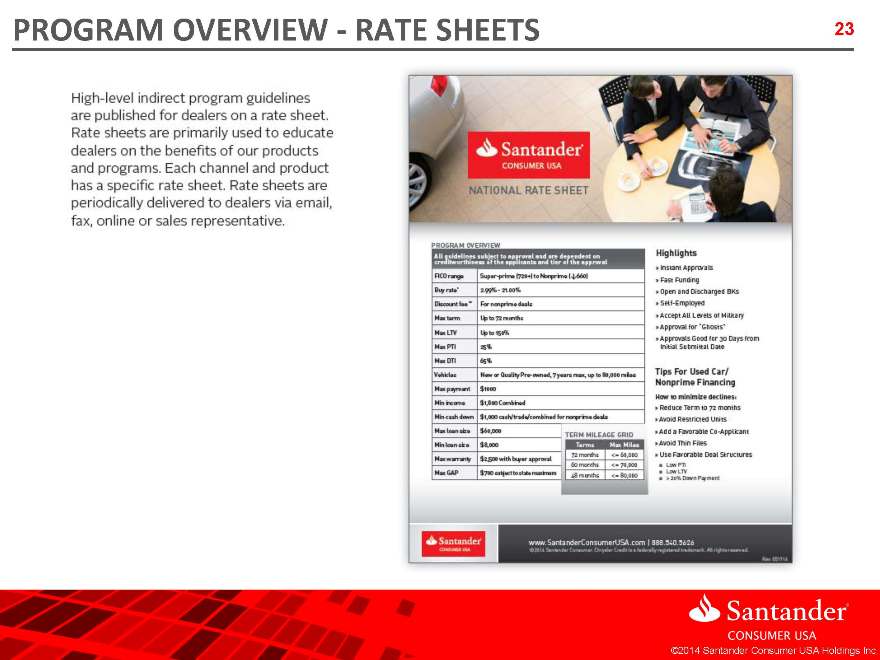

Program Overview Rate Sheets 23

High-level indirect program guidelines are published for dealers on a rate sheet. Rate sheets are primarily used to educate dealers on the benefits of our products and programs. Each channel and product has a specific rate sheet. Rate sheets are periodically delivered to dealers via email, fax, onlie or sales representative.

©2014 Santander Consumer USA Holdings Inc.

|

|

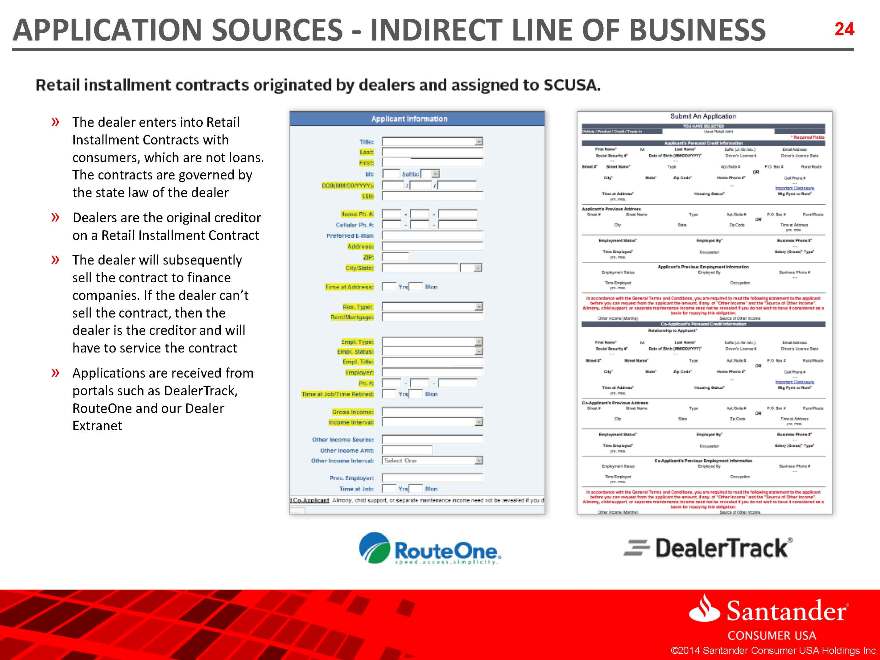

Applications Sources –Indirect line of business 24

Retail installment contracts originated by dealers and assigned to scusa.

The dealer enters into Retail Installment Contracts with consumers, which are not loans. The contracts are governed by the state law of the dealer

Dealers are the original creditor on a Retail Installment Contract

The dealer will subsequently sell the contract to finance companies. If the dealer can’t sell the contract, then the dealer is the creditor and will have to service the contract

Applications are received from portals such as Dealer Track, Route One and our Dealer Extranet

|

|

APPLICATION SOURCES—DIRECT LINE OF BUSINESS

25

SCUSA makes loans directly to consumers

Consumers enter into a Note and Security Agreement (NSA) with SCUSA. The contracts are governed by state law of the consumer

» SCUSA is the original creditor on the NSA

» There are two-party agreements and Dealers are not part of the contract

©2014 Santander Consumer USA Holdings Inc.

|

|

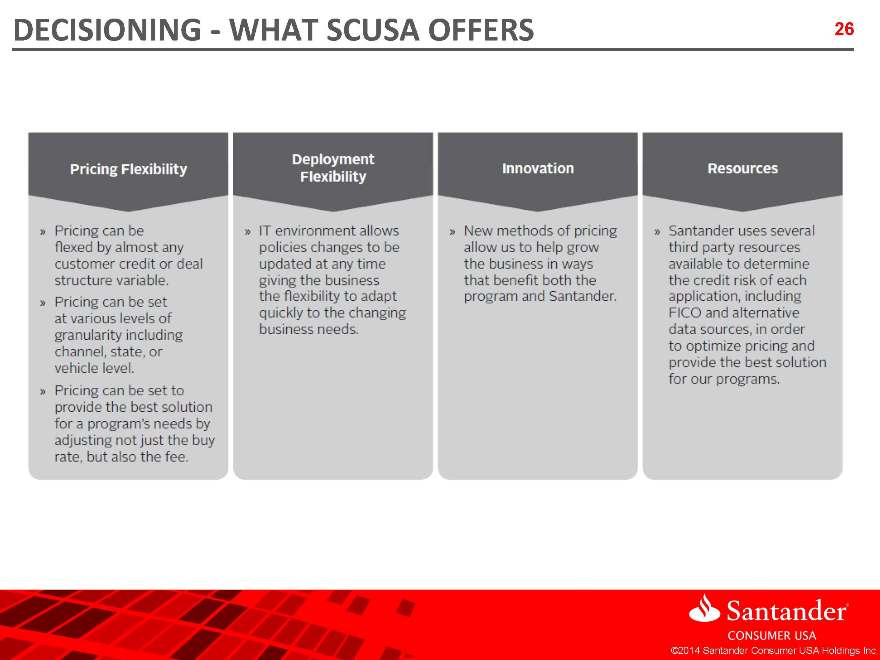

DECISIONING—WHAT SCUSA OFFERS 26

©2014 Santander Consumer USA Holdings Inc.

|

|

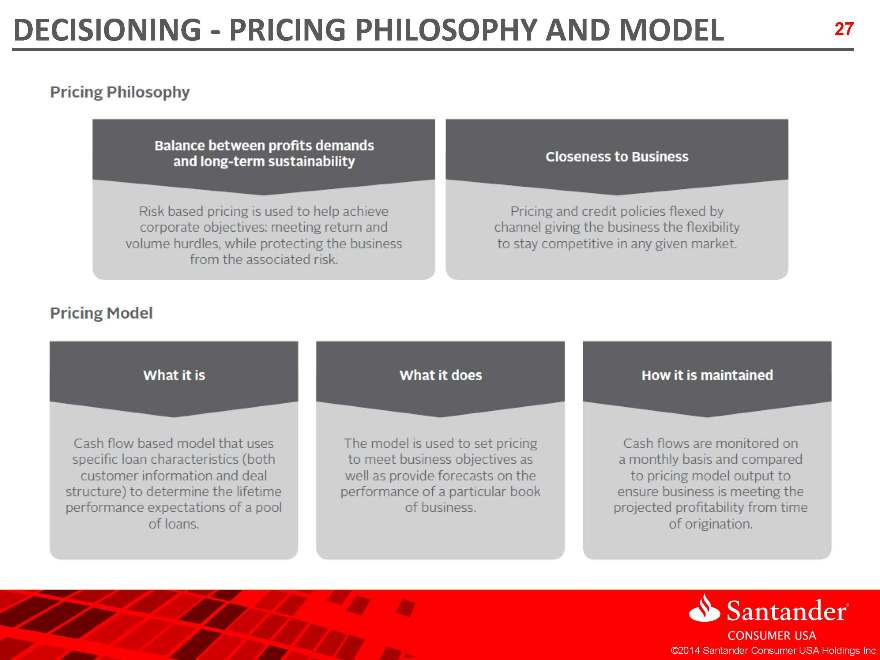

DECISIONING—PRICING PHILOSOPHY AND MODEL 27

©2014 Santander Consumer USA Holdings Inc.

|

|

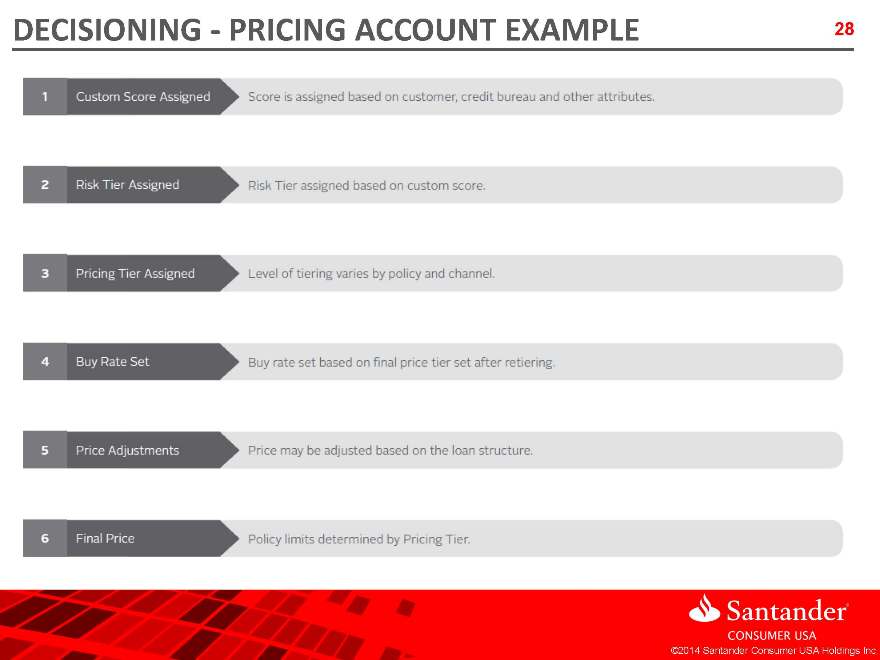

DECISIONING—PRICING ACCOUNT EXAMPLE

©2014 Santander Consumer USA Holdings Inc.

28

|

|

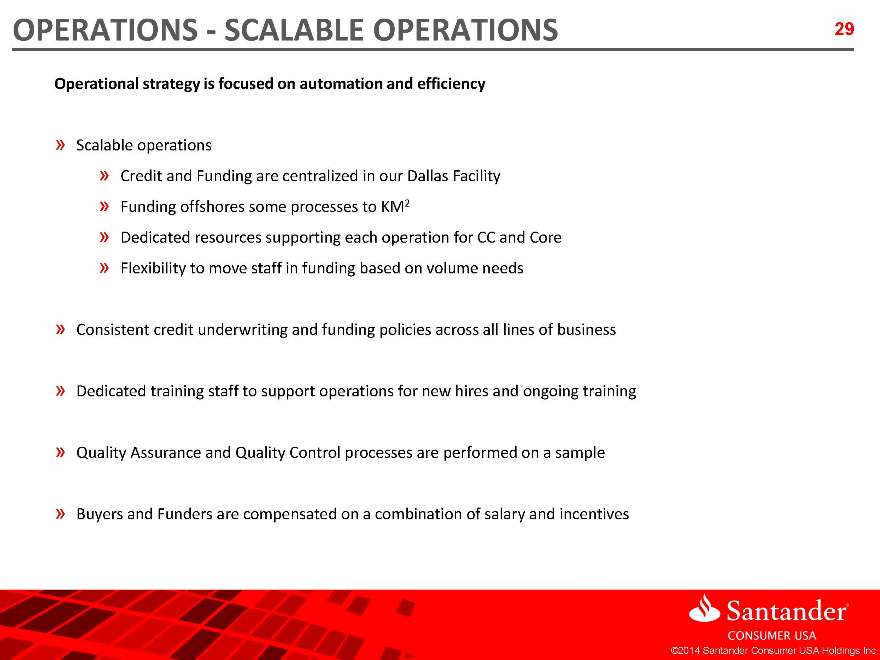

OPERATIONS—SCALABLE OPERATIONS 29 Operational strategy is focused on automation and efficiency

»Scalable operations

»Credit and Funding are centralized in our Dallas Facility

»Funding offshores some processes to KM2

»Dedicated resources supporting each operation for CC and Core

»Flexibility to move staff in funding based on volume needs

»Consistent credit underwriting and funding policies across all lines of business

»Dedicated training staff to support operations for new hires and ongoing training

»Quality Assurance and Quality Control processes are performed on a sample

»Buyers and Funders are compensated on a combination of salary and incentives

©2014 Santander Consumer USA Holdings Inc.

|

|

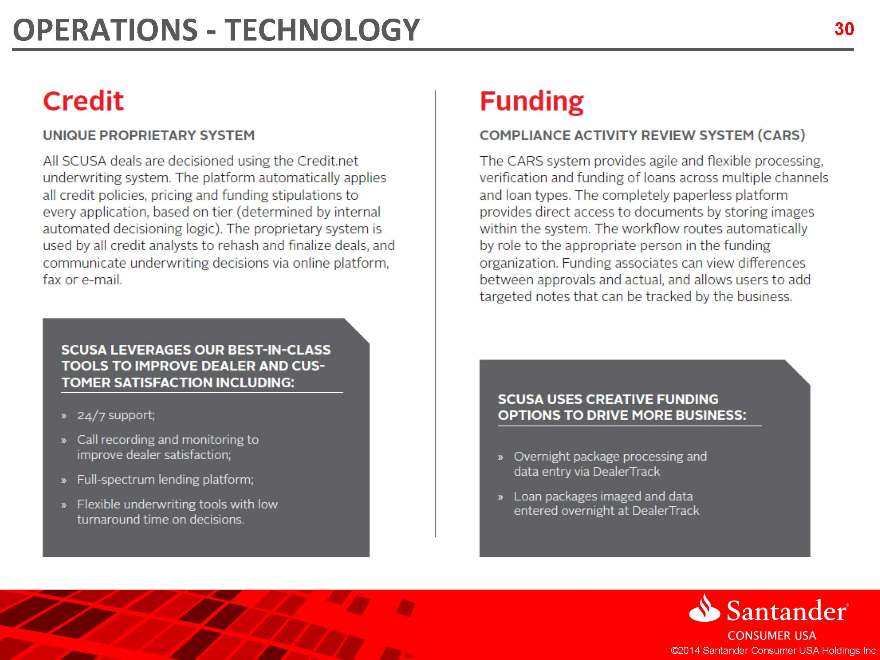

OPERATIONS—TECHNOLOGY 30

©2014 Santander Consumer USA Holdings Inc.

|

|

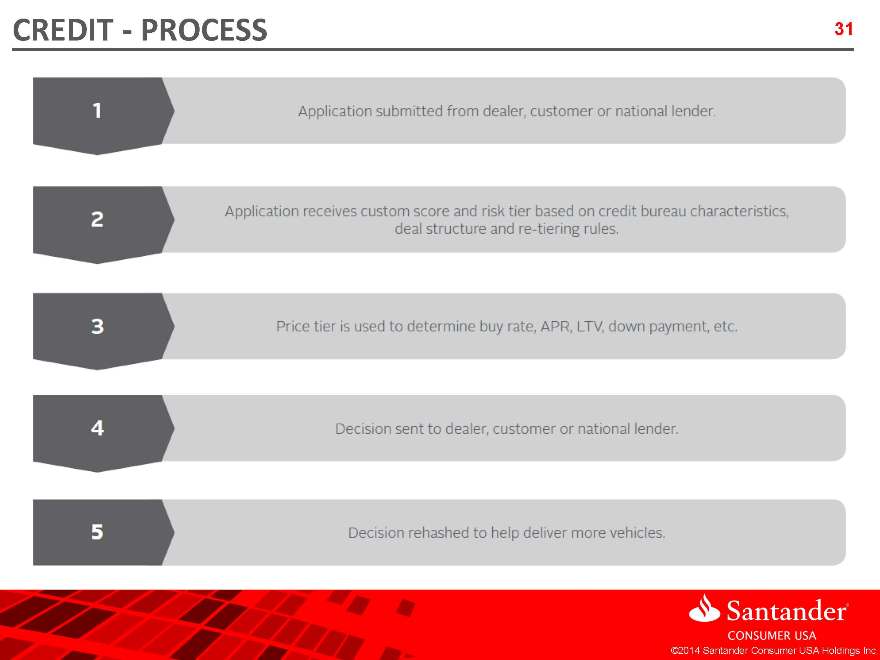

CREDIT – PROCESS 31

©2014 Santander Consumer USA Holdings Inc.

|

|

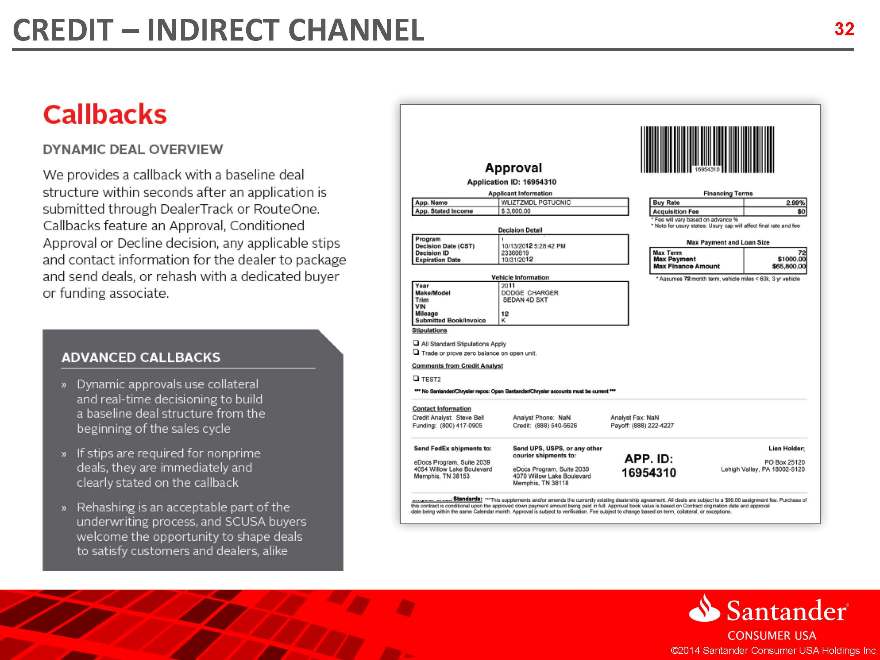

CREDIT – INDIRECT CHANNEL 32

©2014 Santander Consumer USA Holdings Inc.

|

|

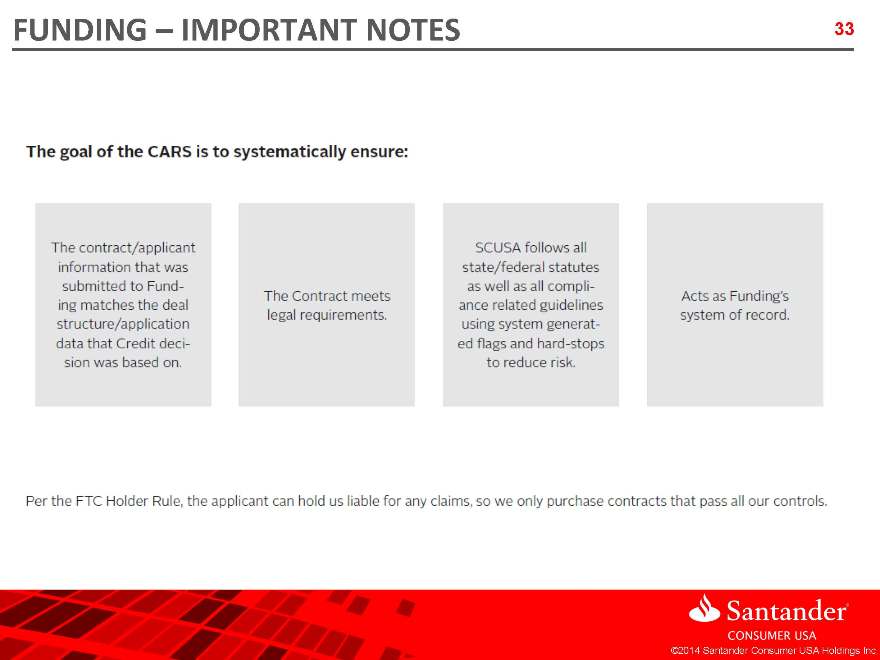

FUNDING – IMPORTANT NOTES 33

©2014 Santander Consumer USA Holdings Inc.

|

|

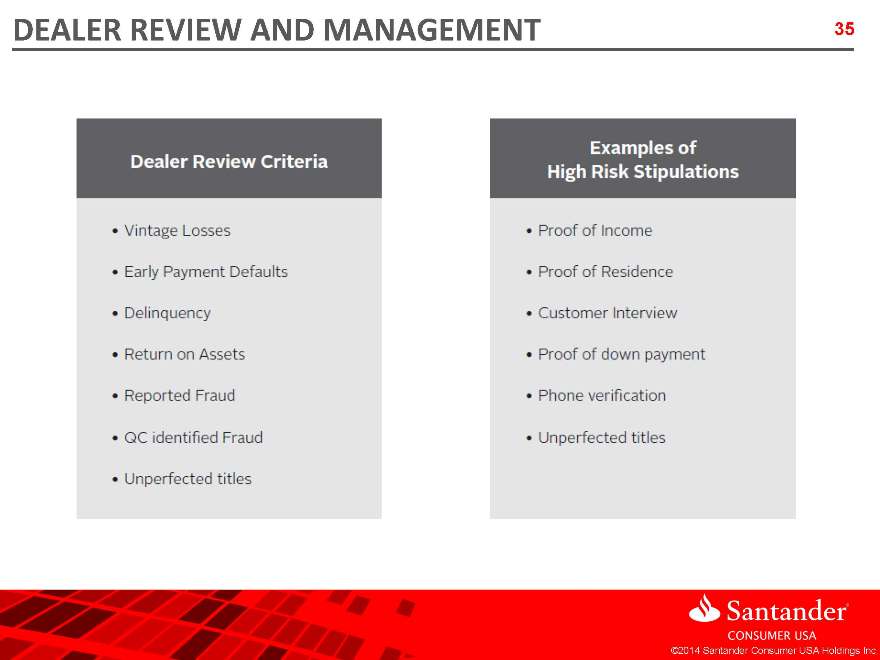

DEALER REVIEW AND MANAGEMENT 34

Onboarding and Annual Review Process

»Dealer Management receives dealer agreements to onboard new dealerships

»Conducts due diligence on dealership and dealer principals through Federal Reserve, Secretary of State, Better Business Bureau, Dunn and Bradstreet, Dow Jones and OFAC

»Conduct annual reviews on active dealerships Dealer Performance Management

»All dealers are reviewed monthly to determine if portfolios are performing to expectations and monitored for fraud

»High Risk Dealers (HRD) have increased stipulations and potentially more restrictive credit policies

»Good Dealers receive fewer stipulations

|

|

DEALER REVIEW AND MANAGEMENT 35

©2014 Santander Consumer USA Holdings Inc.

|

|

AGENDA 36

Corporate and Strategic Overview

Credit, Originations and Underwriting

Servicing and Operations

Servicing and Operations

Compliance

Appendix

©2014 Santander Consumer USA Holdings Inc.

LOAN SERVICING OVERVIEW

SCUSA is focused maintaining an industry leading loan-servicing platform that maximizes efficiency and minimizes the need for customer contact.

The platform provides loan-servicing tools, utilizing a best-in-class proprietary account management and collection technology system for a superior customer service experience.

»Model driven account management strategies based on custom scores and predictive modeling.

»Strategies leverage application characteristics, refreshed credit data and customer behavior to apply risk-driven treatment.

»Robust process and cutting-edge technology maximize efficiency, consistent loan treatment and cost control. The anchor system is the proprietary My Supervisor platform, which integrates a suite of account management tools into one system of record.

»Automated Customer Correspondence

»Interactive Voice Response System

»Rules-Driven Point and Click Dialing System

»Speech Analytics Software

»Repossession Management Tool

»Remarketing Management Tool

»Predictive Dialer

»Proprietary Scoring Engine

»Customized Account Routing

»Escalation Management Tool

»Demographic Management

»Agent Call Recording

©2014 Santander Consumer USA Holdings Inc.

|

|

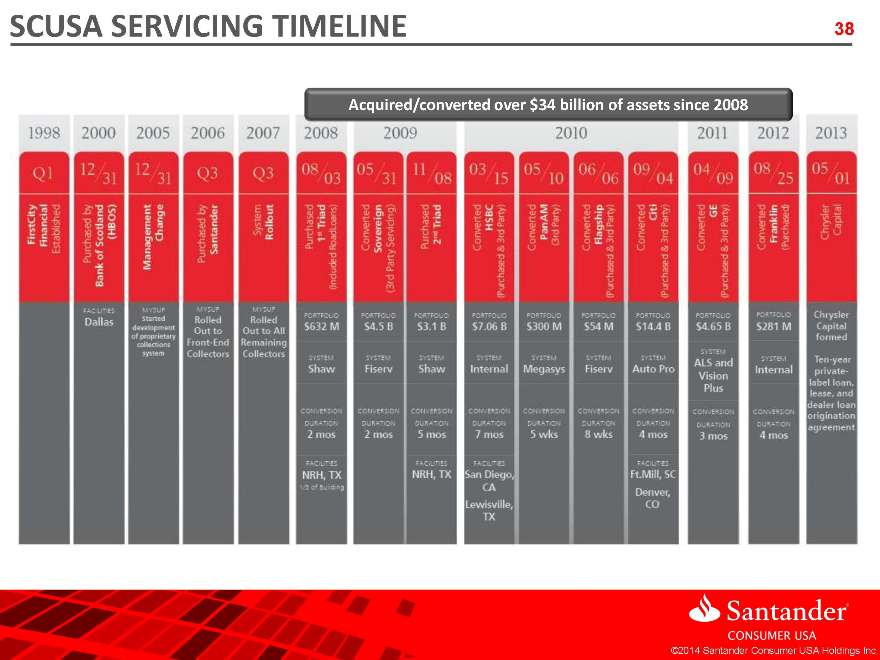

SCUSA SERVICING TIMELINE

38

Acquired/converted over $34 billion of assets since 2008

|

|

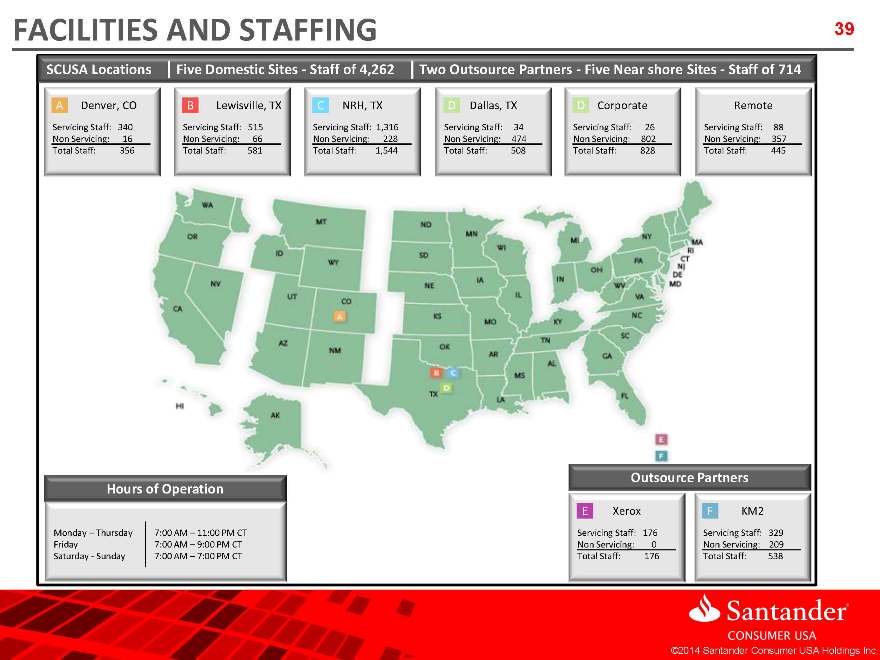

FACILITIES AND STAFFING

39

SCUSA Locations

Five Domestic Sites—Staff of 4,262

Two Outsource Partners—Five Near shore Sites—Staff of 714

A Denver, CO

Servicing Staff: 340

Non Servicing: 16

Total Staff: 356

B Lewisville, TX Servicing Staff: 515 Non Servicing: 66 Total Staff: 581

C NRH, TX

Servicing Staff: 1,316

Non Servicing: 228

Total Staff: 1,544

D Dallas, TX Servicing Staff: 34 Non Servicing: 474 Total Staff: 508

D Corporate

Servicing Staff: 26

Non Servicing: 802

Total Staff: 828

Remote Servicing Staff: 88 Non Servicing: 357 Total Staff: 445

Hours of Operation

Monday – Thursday 7:00 AM – 11:00 PM CT Friday 7:00 AM – 9:00 PM CT Saturday—Sunday 7:00 AM – 7:00 PM CT

Outsource Partners

E Xerox

Servicing Staff: 176

Non Servicing: 0

Total Staff: 176

©2014 Santander Consumer USA Holdings Inc.

F KM2 Servicing Staff: 329 Non Servicing: 209 Total Staff: 538

|

|

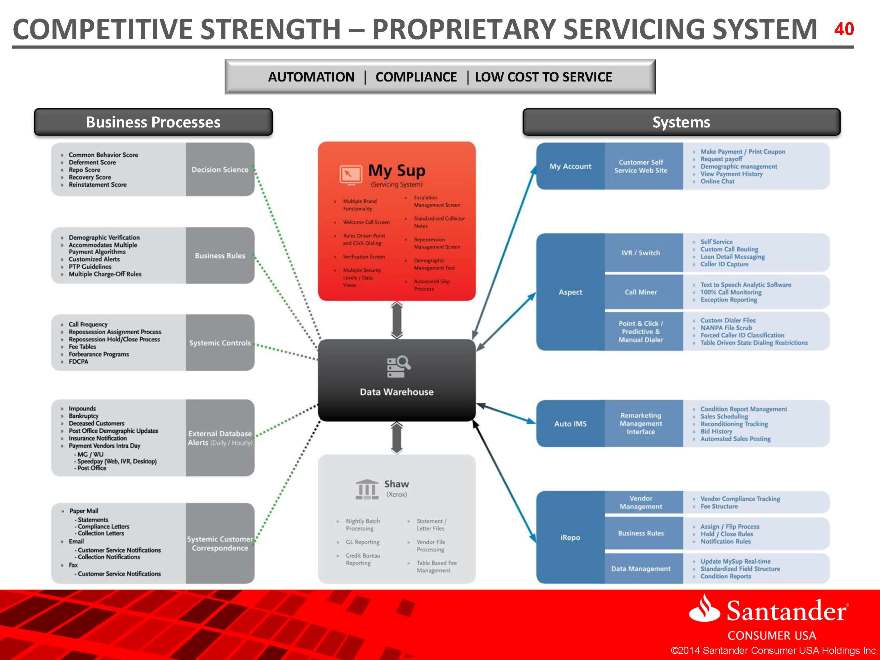

COMPETITIVE STRENGTH – PROPRIETARY SERVICING SYSTEM

40

AUTOMATION COMPLIANCE LOW COST TO SERVICE

Business Processes

Systems

|

|

41

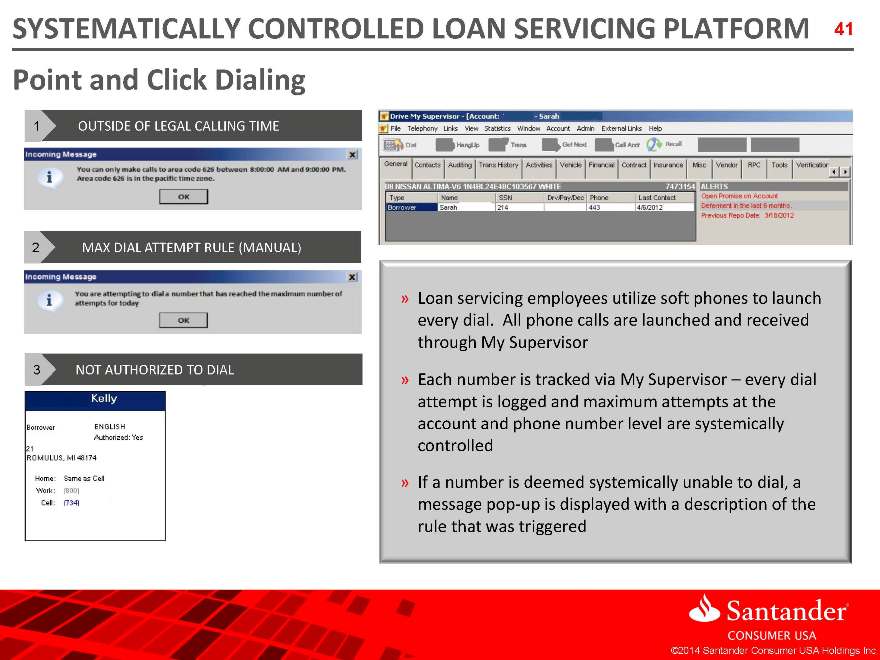

SYSTEMATICALLY CONTROLLED LOAN SERVICING PLATFORM

Point and Click Dialing

40

| 1 |

|

OUTSIDE OF LEGAL CALLING TIME |

| 2 |

|

MAX DIAL ATTEMPT RULE (MANUAL) |

| 3 |

|

NOT AUTHORIZED TO DIAL |

Loan servicing employees utilize soft phones to launch every dial. All phone calls are launched and received through My Supervisor

»Each number is tracked via My Supervisor – every dial attempt is logged and maximum attempts at the account and phone number level are systemically controlled

»If a number is deemed systemically unable to dial, a message pop-up is displayed with a description of the rule that was triggered

|

|

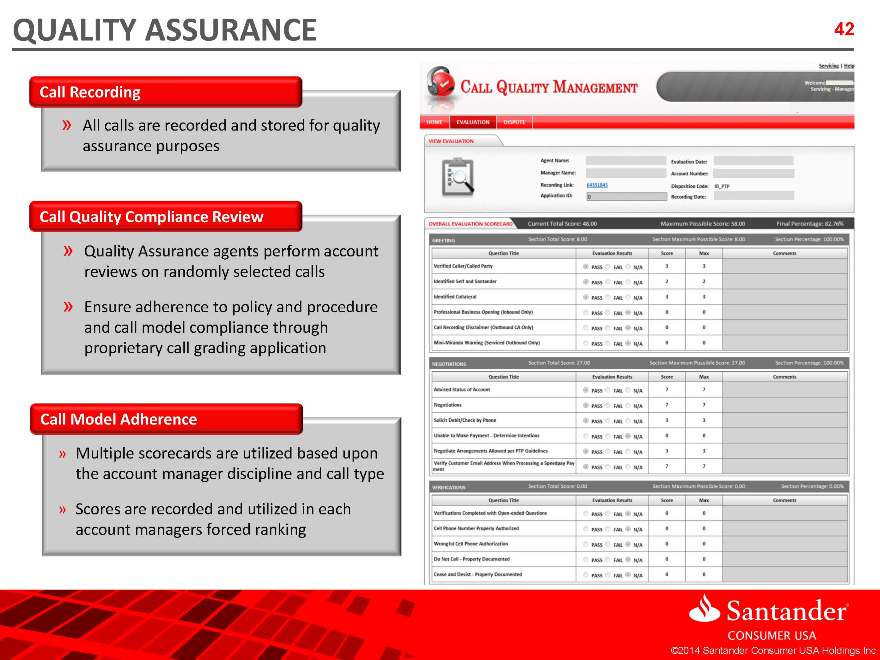

QUALITY ASSURANCE 42

Call Recording

All calls are recorded and stored for quality assurance purposes

Call Quality Compliance Review

Quality Assurance agents perform account reviews on randomly selected calls

»Ensure adherence to policy and procedure and call model compliance through proprietary call grading application

Call Model Adherence

Multiple scorecards are utilized based upon the account manager discipline and call type

»Scores are recorded and utilized in each account managers forced ranking

©2014 Santander Consumer USA Holdings Inc.

|

|

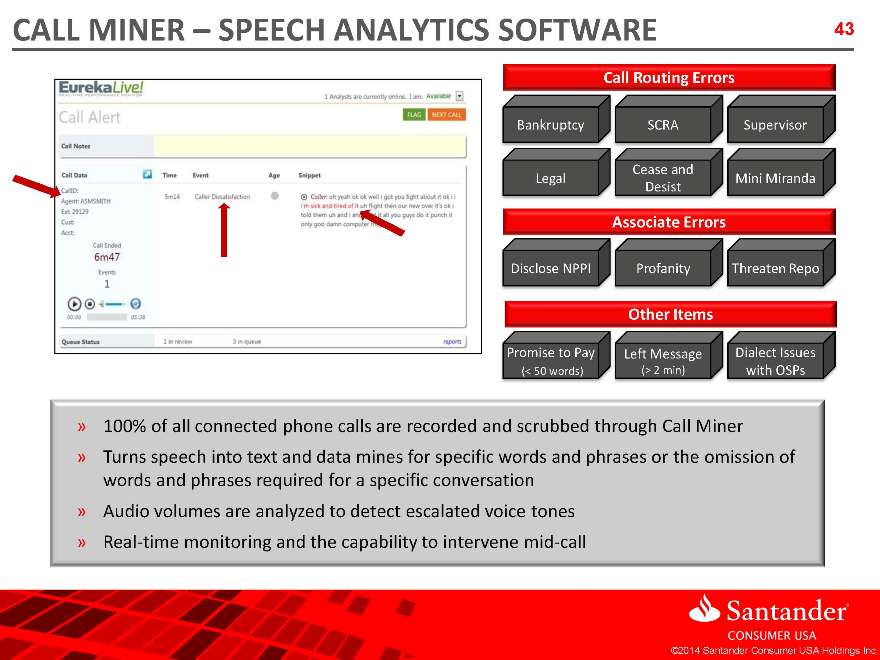

43 CALL MINER – SPEECH ANALYTICS SOFTWARE

Call Routing Errors

Bankruptcy

SCRA Supervisor

Legal

Cease and Desist

Mini Miranda

Associate Errors

Disclose NPPI

Profanity

Threaten Repo

Other Items

Promise to Pay (< 50 words)

Left Message

Left Messag(> 2 min)

Dialect Issues

Dialect Issues

with OSPs

100% of all connected phone calls are recorded and scrubbed through Call Miner

» Turns speech into text and data mines for specific words and phrases or the omission of words and phrases required for a specific conversation

» Audio volumes are analyzed to detect escalated voice tones

» Real-time monitoring and the capability to intervene mid-call

Santaner consumer USA hoLDING INC

©2014 Santander Consumer USA Holdings Inc.

|

|

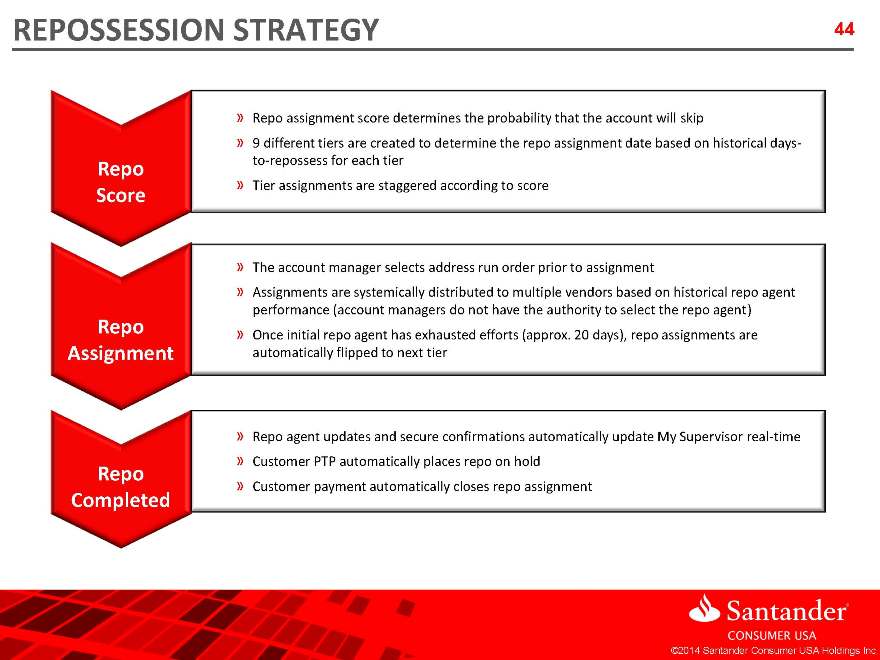

REPOSSESSION STRATEGY 44

Repo

Score

Repo assignment score determines the probability that the account will skip

»9 different tiers are created to determine the repo assignment date based on historical days-to-repossess for each tier

»Tier assignments are staggered according to score

Repo Assignment

The account manager selects address run order prior to assignment

»Assignments are systemically distributed to multiple vendors based on historical repo agent performance (account managers do not have the authority to select the repo agent)

»Once initial repo agent has exhausted efforts (approx. 20 days), repo assignments are automatically flipped to next tier

Repo

Repo Completed

Repo agent updates and secure confirmations automatically update My Supervisor real-time

»Customer PTP automatically places repo on hold

»Customer payment automatically closes repo assignment

©2014 Santander Consumer USA Holdings Inc.

|

|

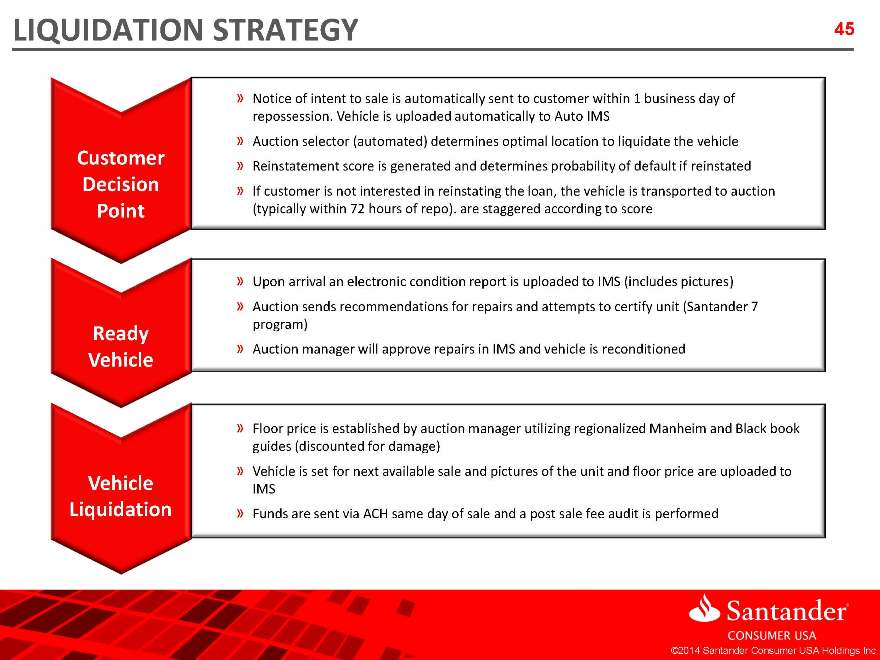

LIQUIDATION STRATEGY 45

Customer Decision Point

Notice of intent to sale is automatically sent to customer within 1 business day of repossession. Vehicle is uploaded automatically to Auto IMS

»Auction selector (automated) determines optimal location to liquidate the vehicle

»Reinstatement score is generated and determines probability of default if reinstated

»If customer is not interested in reinstating the loan, the vehicle is transported to auction (typically within 72 hours of repo). are staggered according to score

Ready Vehicle

Upon arrival an electronic condition report is uploaded to IMS (includes pictures)

»Auction sends recommendations for repairs and attempts to certify unit (Santander 7 program)

»Auction manager will approve repairs in IMS and vehicle is reconditioned

Vehicle Liquidation

Floor price is established by auction manager utilizing regionalized Manheim and Black book guides (discounted for damage)

»Vehicle is set for next available sale and pictures of the unit and floor price are uploaded to IMS

»Funds are sent via ACH same day of sale and a post sale fee audit is performed

©2014 Santander Consumer USA Holdings Inc.

|

|

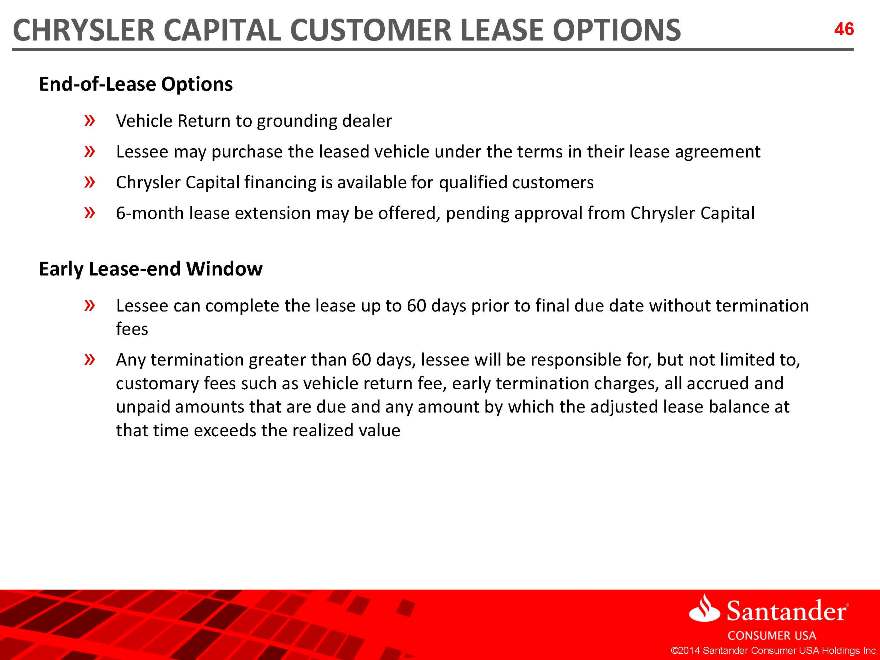

CHRYSLER CAPITAL CUSTOMER LEASE OPTIONS 46

End-of-Lease Options

»Vehicle Return to grounding dealer

»Lessee may purchase the leased vehicle under the terms in their lease agreement

»Chrysler Capital financing is available for qualified customers

»6-month lease extension may be offered, pending approval from Chrysler Capital Early Lease-end Window

»Lessee can complete the lease up to 60 days prior to final due date without termination fees

»Any termination greater than 60 days, lessee will be responsible for, but not limited to, customary fees such as vehicle return fee, early termination charges, all accrued and unpaid amounts that are due and any amount by which the adjusted lease balance at that time exceeds the realized value

©2014 Santander Consumer USA Holdings Inc.

|

|

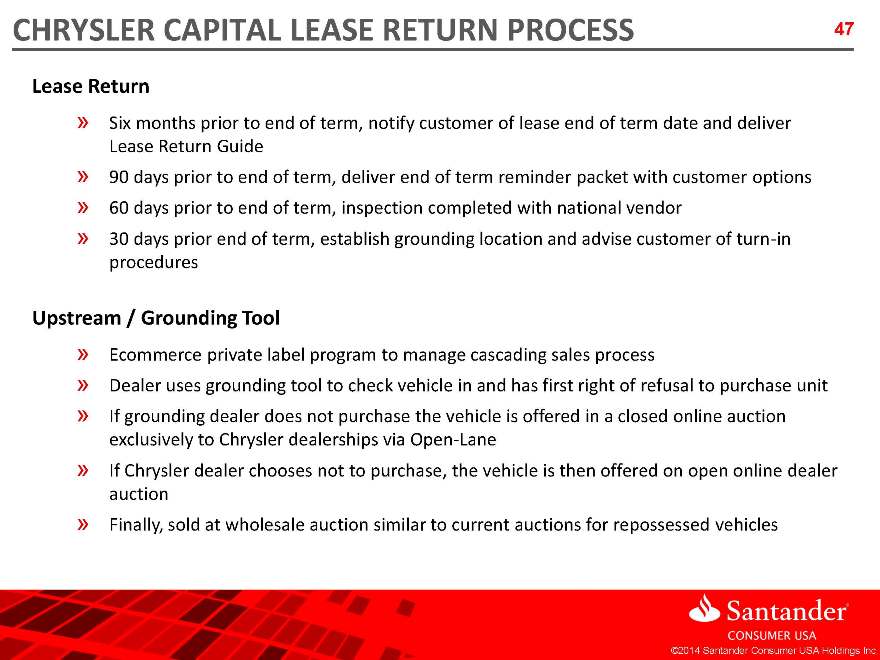

CHRYSLER CAPITAL LEASE RETURN PROCESS 47

Lease Return

»Six months prior to end of term, notify customer of lease end of term date and deliver Lease Return Guide

»90 days prior to end of term, deliver end of term reminder packet with customer options

»60 days prior to end of term, inspection completed with national vendor

»30 days prior end of term, establish grounding location and advise customer of turn-in procedures Upstream / Grounding Tool

»Ecommerce private label program to manage cascading sales process

»Dealer uses grounding tool to check vehicle in and has first right of refusal to purchase unit

»If grounding dealer does not purchase the vehicle is offered in a closed online auction exclusively to Chrysler dealerships via Open-Lane

»If Chrysler dealer chooses not to purchase, the vehicle is then offered on open online dealer auction

»Finally, sold at wholesale auction similar to current auctions for repossessed vehicles

©2014 Santander Consumer USA Holdings Inc.

|

|

AGENDA 48

Corporate and Strategic Overview

Credit, Originations and Underwriting

Servicing and Operations

Compliance

Appendix

©2014 Santander Consumer USA Holdings Inc.

|

|

COMPLIANCE PROGRAM 49

Stemming from big bank ownership since 2000, SCUSA’s established compliance program plays a pivotal role in daily operations

»Why?

»Responsibility of assuring day to day compliance with applicable laws and regulations rests with SCUSA’s individual business units, their officers, and employees.

»All officers and employees need to fully understand the related laws and regulations applicable to their department, product, and job function.

»Violations of regulations may result in disciplinary actions, up and including termination of employment.

»Managers must ensure that they have a thorough understanding of the legal requirements that pertain to their departments, and develop adequate policies, procedures, and controls to mitigate compliance risk.

»SCUSA’s Compliance Management Program consists of:

»Organization and Governance

»Policies and Procedures

»Risk Assessments

»Formalized Monitoring and Testing

»Fair Lending

»BSA/AML Compliance

»Complaint Monitoring and Trending

»Comprehensive Training Program

»Board and Management oversight

»Regulatory Monitoring

»Change Management

©2014 Santander Consumer USA Holdings Inc.

|

|

AGENDA 50

Corporate and Strategic Overview

Credit, Originations and Underwriting

©2014 Santander Consumer USA Holdings Inc.

Servicing and Operations

Compliance

Appendix

|

|

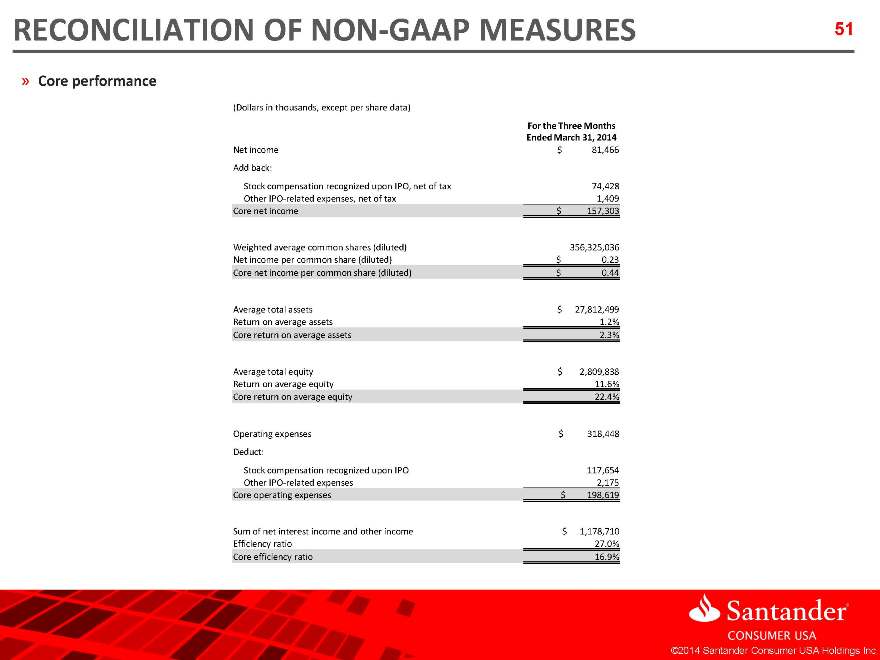

RECONCILIATION OF NON-GAAP MEASURES 51

Core performance

(Dollars in thousands, except per share data)

For the Three Months Ended March 31, 2014

Net income $ 81,466

Add back:

Stock compensation recognized upon IPO, net of tax 74,428

Other IPO-related expenses, net of tax 1,409

Core net income $ 157,303

Weighted average common shares (diluted) 356,325,036

Net income per common share (diluted) $ 0.23

Core net income per common share (diluted) $ 0.44

Average total assets $ 27,812,499

Return on average assets 1.2%

Core return on average assets 2.3%

Average total equity $ 2,809,838

Return on average equity 11.6%

Core return on average equity 22.4%

Operating expenses $ 318,448

Deduct:

Stock compensation recognized upon IPO 117,654

Other IPO-related expenses 2,175

Core operating expenses $ 198,619

Sum of net interest income and other income $ 1,178,710

Efficiency ratio 27.0%

Core efficiency ratio 16.9%

©2014 Santander Consumer USA Holdings Inc.

|

|

Santander

CONSUMER USA