Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Endo International plc | d729095d8k.htm |

Exhibit 99.1

Endo International plc

UBS Global Healthcare Conference

May 21, 2014

©2014 Endo Pharmaceuticals Inc. All rights reserved.

Forward Looking Statements; Non-GAAP Financial Measures

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and Canadian securities legislation. Statements including words such as “believes,” “expects,” “anticipates,” “intends,” “estimates,” “plan,” “will,” “may,” “look forward,” “intend,” “guidance,” “future” or similar expressions are forward-looking statements. Because these statements reflect our current views, expectations and beliefs concerning future events, these forward-looking statements involve risks and uncertainties. Although Endo believes that these forward-looking statements and information are based upon reasonable assumptions and expectations, readers should not place undue reliance on them, or any other forward looking statements or information in this news release. Investors should note that many factors, as more fully described in the documents filed by Endo with securities regulators in the United States and Canada including under the caption “Risk Factors” in Endo’s and EHSI’s Form 10-K, Form 10-Q and Form 8-K filings, as applicable, with the Securities and Exchange Commission and with securities regulators in Canada on System for Electronic Document Analysis and Retrieval (“SEDAR”) and as otherwise enumerated herein or therein, could affect Endo’s future financial results and could cause Endo’s actual results to differ materially from those expressed in forward-looking statements contained in EHSI’s Annual Report on Form 10-K. The forward-looking statements in this presentation are qualified by these risk factors. These are factors that, individually or in the aggregate, could cause our actual results to differ materially from expected and historical results. Endo assumes no obligation to publicly update any forward-looking statements, whether as a result of new information, future developments or otherwise, except as may be required under applicable securities law.

This presentation may refer to non-GAAP financial measures, including adjusted diluted EPS, that are not prepared in accordance with accounting principles generally accepted in the United States and that may be different from non-GAAP financial measures used by other companies. Investors are encouraged to review Endo’s current report on Form 8-K filed with the SEC for Endo’s reasons for including those non-GAAP financial measures in this presentation. Reconciliation of non-GAAP financial measures to the nearest comparable GAAP amounts have been provided within the appendix at the end of this presentation.

©2014 Endo Pharmaceuticals Inc. All rights reserved.

1

Today’s Agenda

§ Company Strategy and First Year Progress

§ Core Business Growth

§ M&A Program

§ Near Term Objectives and Progress

§ 2014 Financial Guidance

Q&A

©2014 Endo Pharmaceuticals Inc. All rights reserved.

2

Endo’s strategic direction

Build a leading global specialty healthcare company

Focus on maximizing the value of each of our core businesses

Participate in specialty areas offering above average growth and favorable margins

Transform operating model to maximize growth potential and cash flow generation

Continue our commitment to serving our patients and customers

Maximize shareholder value by adapting to market realities

and customer changes

@2014 Endo Pharmaceuticals Inc. All rights reserved.

3

Endo Operating Model

Lean, efficient operating model

Performance metrics aligned with shareholder interests

M&A an important component of building & growing the business long term

Agnostic on therapeutic areas, but with focus in specialty areas

Focused, de-risked R&D

Streamlined and diversified organization with quick decision making

©2014 Endo Pharmaceuticals Inc. All rights reserved.

4

Delivering Our Strategy – A Year in Review

§ Strengthened talent and organization

§ Implemented a Lean Operating Model to achieve $325 million in savings

§ Completed/initiated multiple accretive, value-creating transactions

§ Closed Boca Pharmacal, Paladin Labs and Sumavel® DosePro® deals

§ Announced acquisition of Somar

§ Increased strategic focus

§ Completed the divestiture of HealthTronics

§ Agreements in principle to settle substantial majority of mesh liability

§ Sharpened R&D focus on near-term priorities

§ Enhanced capital structure flexibility

Delivering on our financial targets

©2014 Endo Pharmaceuticals Inc. All rights reserved.

5

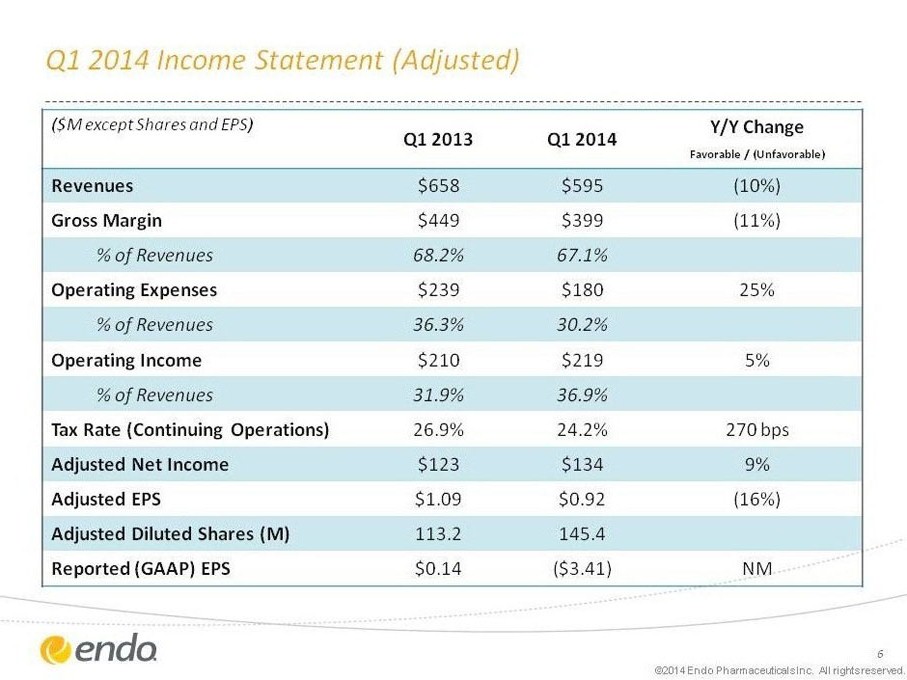

Q1 2014 Income Statement (Adjusted)

($M except Shares and EPS) Q1 2013 Q1 2014 Y/Y Change

Favorable / (Unfavorable)

Revenues $658 $595 (10%)

Gross Margin $449 $399 (11%)

% of Revenues 68.2% 67.1%

Operating Expenses $239 $180 25%

% of Revenues 36.3% 30.2%

Operating Income $210 $219 5%

% of Revenues 31.9% 36.9%

Tax Rate (Continuing Operations) 26.9% 24.2% 270 bps

Adjusted Net Income $123 $134 9%

Adjusted EPS $1.09 $0.92 (16%)

Adjusted Diluted Shares (M) 113.2 145.4

Reported (GAAP) EPS $0.14 ($3.41) NM

©2014 Endo Pharmaceuticals Inc. All rights reserved.

6

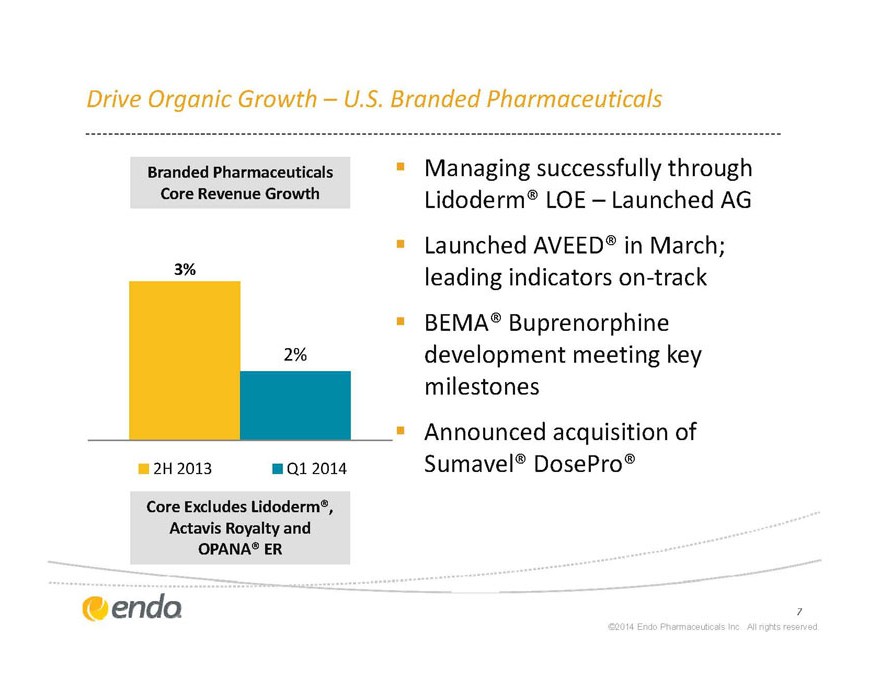

Drive Organic Growth – U.S. Branded Pharmaceuticals

Core Excludes Lidoderm®, Actavis Royalty and OPANA® ER

§ Managing successfully through Lidoderm® LOE – Launched AG

§ Launched AVEED® in March; leading indicators on-track

§ BEMA® Buprenorphine development meeting key milestones

Announced acquisition of Sumavel® DosePro®

©2014 Endo Pharmaceuticals Inc. All rights reserved.

7

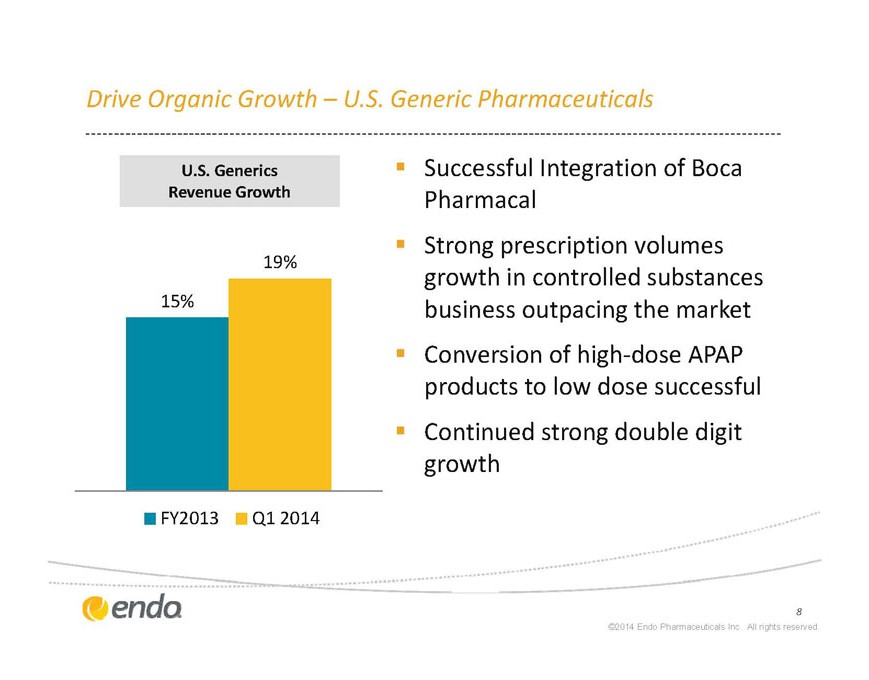

Drive Organic Growth – U.S. Generic Pharmaceuticals

U.S. Generics

Revenue Growth

§ Successful Integration of Boca Pharmacal

§ Strong prescription volumes growth in controlled substances business outpacing the market

§ Conversion of high-dose APAP products to low dose successful

Continued strong double digit growth

©2014 Endo Pharmaceuticals Inc. All rights reserved.

8

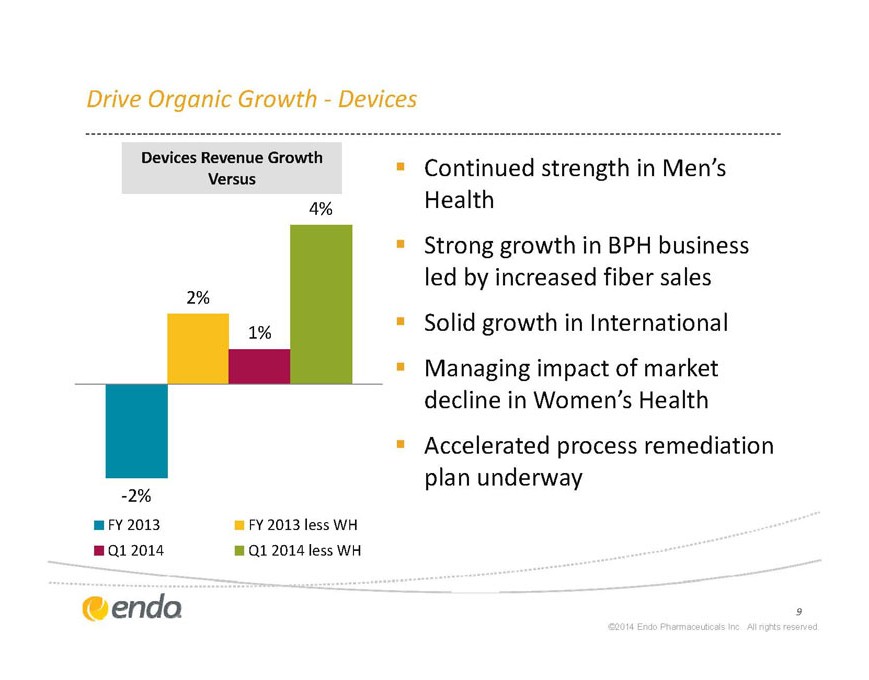

Drive Organic Growth – Devices

Devices Revenue Growth

§ VersusContinued strength in Men’s Health

§ Strong growth in BPH business led by increased fiber sales

§ Solid growth in International

§ Managing impact of market decline in Women’s Health

Accelerated process remediation plan underway

©2014 Endo Pharmaceuticals Inc. All rights reserved.

9

Drive Organic Growth – International Pharmaceuticals

§ March 2014 performance on-track with internal expectations

§ Established Irish Trading Company (Endo Ventures)

§ Supports ability to complete transactions through Ireland

§ Key functions in-place and actively recruiting for management positions

§ Continuing to optimize corporate structure

§ Progress in Paladin business development

In licensing projects (e.g., ZertaneTM )

©2014 Endo Pharmaceuticals Inc. All rights reserved.

10

Our M&A Strategy

§ Focused on near-term accretive, value creating transactions

§ Rigorous evaluation governed by key financial measures

§ Deal-related synergies primarily from operating improvements

§ Therapeutically agnostic, but focused on specialty opportunities

§ Positioned to evaluate global opportunities

Committed to a flexible capital structure

©2014 Endo Pharmaceuticals Inc. All rights reserved.

11

Recent M&A Progress – Sumavel® DosePro®

§ Sumavel DosePro expands portfolio of branded pharmaceuticals products

§ Logical fit with existing U.S. Branded Pharmaceuticals commercial structure

§ Potential to add value through greater focus

Announced close of acquisition on May 19, 2014.

©2014 Endo Pharmaceuticals Inc. All rights reserved.

12

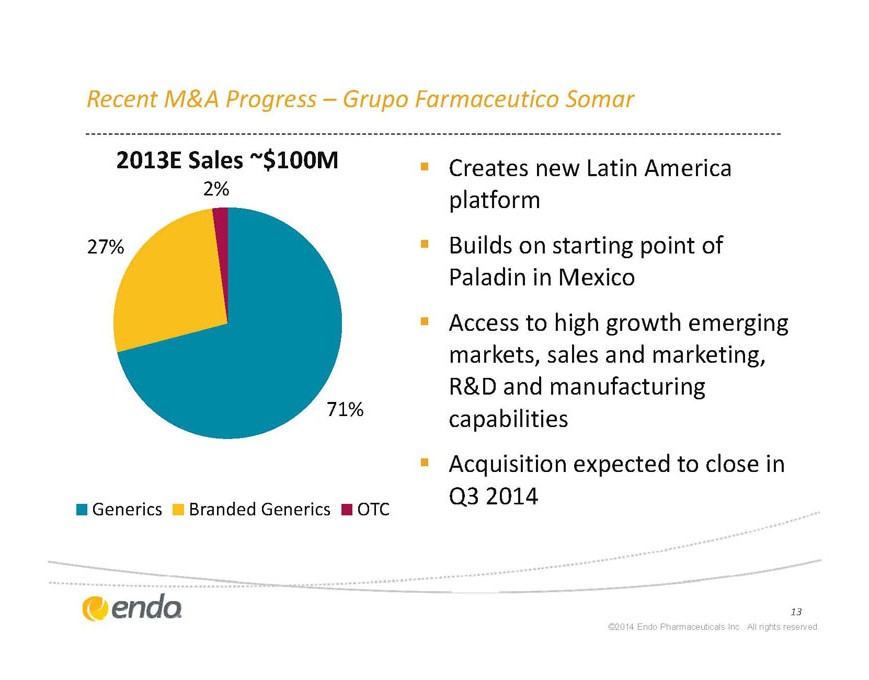

Recent M&A Progress – Grupo Farmaceutico Somar

§ Creates new Latin America platform

§ Builds on starting point of Paladin in Mexico

§ Access to high growth emerging markets, sales and marketing, R&D and manufacturing capabilities

§ Acquisition expected to close in Q3 2014

§ ©2014 Endo Pharmaceuticals Inc. All rights reserved.

13

Near-Term Priorities

Meet Financial Targets

Drive Organic Growth Through Our Core Business

Establish New Corporate Structure

Implement Lean Operating Model

Complete 2-3 Near-term Accretive, Value-creating Transactions

Increase Value of Pipeline and Launch Products

Maximize Balance Sheet Flexibility

Develop Organization and Culture Aligned with New Strategy

Enhance Continued Focus on Quality, Compliance and Risk

©2014 Endo Pharmaceuticals Inc. All rights reserved.

14

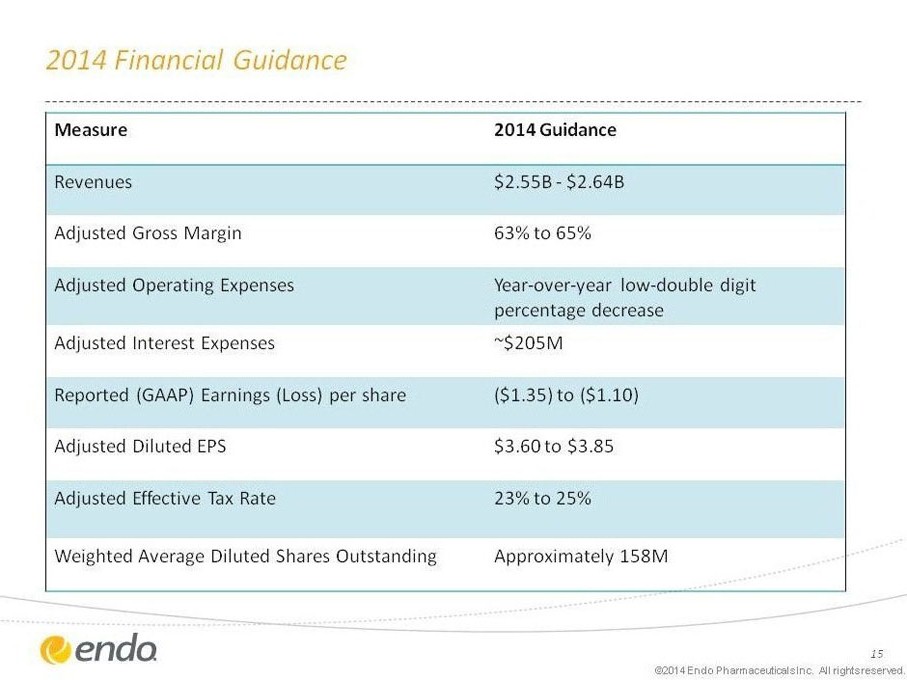

2014 Financial Guidance

Measure 2014 Guidance

Revenues $2.55B - $2.64B

Adjusted Gross Margin 63% to 65%

Adjusted Operating Expenses Year-over-year low-double digit percentage decrease

Adjusted Interest Expenses ~$205M

Reported (GAAP) Earnings (Loss) per share ($1.35) to ($1.10)

Adjusted Diluted EPS $3.60 to $3.85

Adjusted Effective Tax Rate 23% to 25%

Weighted Average Diluted Shares Outstanding Approximately 158M

©2014 Endo Pharmaceuticals Inc. All rights reserved.

15

Summary Wrap-up

§ Executing strategy announced in June 2013

§ Reducing impact of historical challenges

§ Convertible Notes

§ Mesh liability

§ LIDODERM® loss of exclusivity

§ Deploying capital to accretive, value-creating opportunities

§ Sale of HealthTronics

§ Boca Pharmacal, Paladin Labs and Sumavel® DosePro® (completed)

§ Grupo Farmaceutico Somar (announced)

§ Enhancing operational focus on organic growth drivers

§ Sharpening R&D focus on near-term opportunities

§ Meeting our Financial Targets

Recently raised 2014 Revenue and Adjusted EPS Financial Guidance

©2014 Endo Pharmaceuticals Inc. All rights reserved.

16

Appendix

©2014 Endo Pharmaceuticals Inc. All rights reserved.

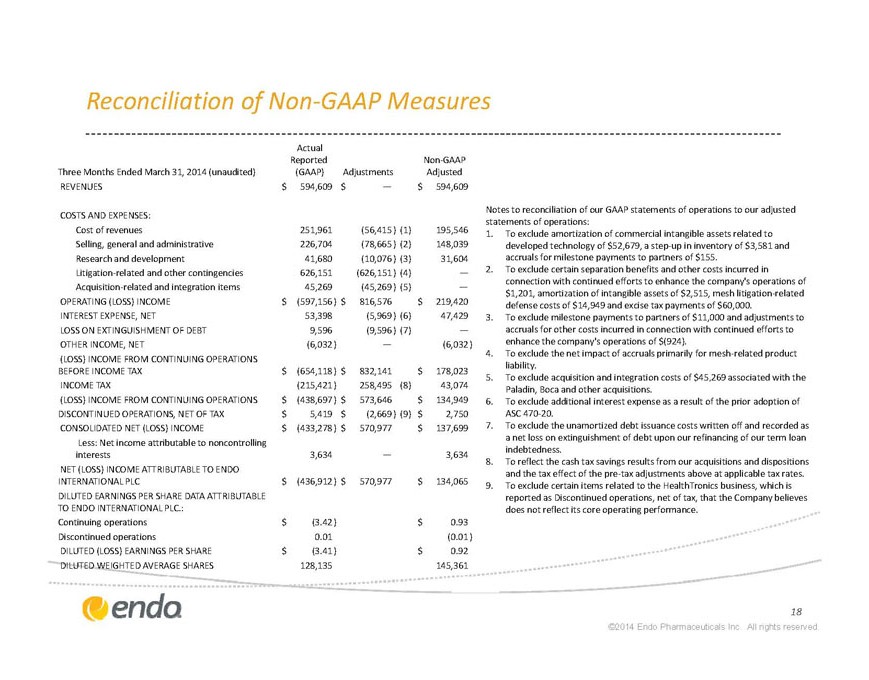

Reconciliation of Non-GAAP Measures

Notes to reconciliation of our GAAP statements of operations to our adjusted statements of operations: Three Months Ended March 31, 2014 (unaudited) Actual Reported (GAAP) Adjustments Non-GAAP Adjusted REVENUES $594,609 $— $594,609 COSTS AND EXPENSES: Cost of revenues 251,961 (56,415) (1) 195,546 Selling, general and administrative 226,704 (78,665) (2) 148,039 Research and development 41,680 (10,076) (3) 31,604 Litigation-related and other contingencies 626,151 (626,151) (4) — Acquisition-related and integration items 45,269 (45,269) (5) — OPERATING (LOSS) INCOME $(597,156) $816,576 $219,420 INTEREST EXPENSE, NET 53,398 (5,969) (6) 47,429 LOSS ON EXTINGUISHMENT OF DEBT 9,596 (9,596) (7) — OTHER INCOME, NET (6,032) — (6,032) (LOSS) INCOME FROM CONTINUING OPERATIONS BEFORE INCOME TAX $(654,118) $832,141 $178,023 INCOME TAX (215,421) 258,495 (8) 43,074 (LOSS) INCOME FROM CONTINUING OPERATIONS $(438,697) $573,646 $134,949 DISCONTINUED OPERATIONS, NET OF TAX $5,419 $(2,669) (9) $2,750 CONSOLIDATED NET (LOSS) INCOME $(433,278) $570,977 $137,699 Less: Net income attributable to noncontrolling interests 3,634 — 3,634 NET (LOSS) INCOME ATTRIBUTABLE TO ENDO INTERNATIONAL PLC $(436,912) $570,977 $134,065 DILUTED EARNINGS PER SHARE DATA ATTRIBUTABLE TO ENDO INTERNATIONAL PLC.: Continuing operations $(3.42) $0.93 Discontinued operations 0.01 (0.01) DILUTED (LOSS) EARNINGS PER SHARE $(3.41) $0.92 DILUTED WEIGHTED AVERAGE SHARES 128,135 145,361

1. To exclude amortization of commercial intangible assets related to developed technology of $52,679, a step-up in inventory of $3,581 and accruals for milestone payments to partners of $155.

2. To exclude certain separation benefits and other costs incurred in connection with continued efforts to enhance the company’s operations of $1,201, amortization of intangible assets of $2,515, mesh litigation-related defense costs of $14,949 and excise tax payments of $60,000.

3. To exclude milestone payments to partners of $11,000 and adjustments to accruals for other costs incurred in connection with continued efforts to enhance the company’s operations of $(924).

4. To exclude the net impact of accruals primarily for mesh-related product liability.

5. To exclude acquisition and integration costs of $45,269 associated with the Paladin, Boca and other acquisitions.

6. To exclude additional interest expense as a result of the prior adoption of ASC 470-20.

7. To exclude the unamortized debt issuance costs written off and recorded as a net loss on extinguishment of debt upon our refinancing of our term loan indebtedness.

8. To reflect the cash tax savings results from our acquisitions and dispositions and the tax effect of the pre-tax adjustments above at applicable tax rates.

To exclude certain items related to the HealthTronics business, which is reported as Discontinued operations, net of tax, that the Company believes does not reflect its core operating performance.

©2014 Endo Pharmaceuticals Inc. All rights reserved.

18

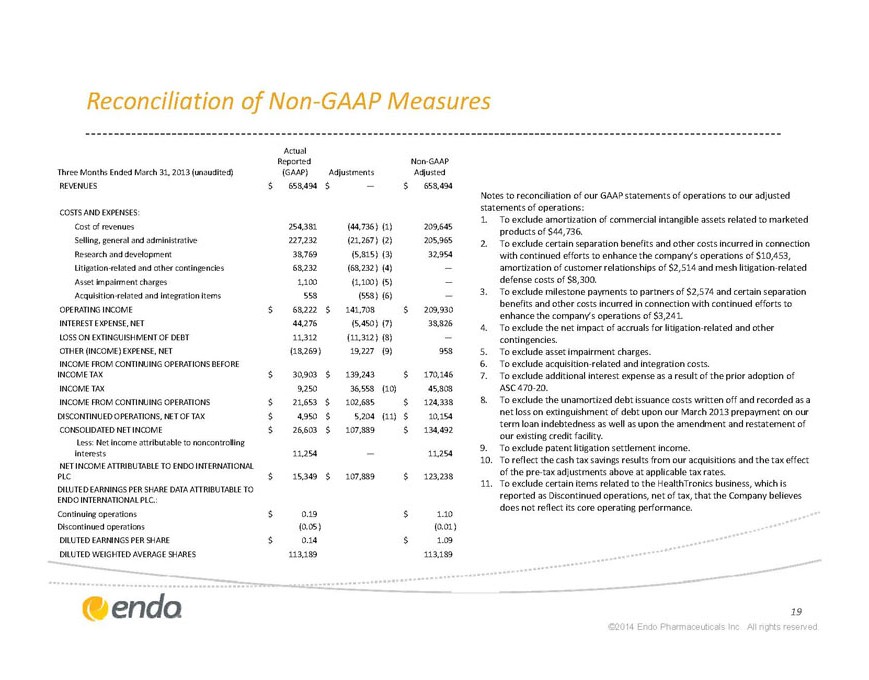

Reconciliation of Non-GAAP Measures

Notes to reconciliation of our GAAP statements of operations to our adjusted statements of operations:

Three Months Ended March 31, 2013 (unaudited) Actual Reported (GAAP) Adjustments Non-GAAP Adjusted REVENUES $658,494 $— $658,494 COSTS AND EXPENSES: Cost of revenues 254,381 (44,736)(1) 209,645 Selling, general and administrative 227,232 (21,267)(2) 205,965 Research and development 38,769 (5,815)(3) 32,954 Litigation-related and other contingencies 68,232 (68,232)(4) — Asset impairment charges 1,100 (1,100)(5) — Acquisition-related and integration items 558 (558)(6) — OPERATING INCOME $68,222 $141,708 $209,930 INTEREST EXPENSE, NET 44,276 (5,450)(7) 38,826 LOSS ON EXTINGUSHMENT OF DEBT 11,312 (11,312)(8) — OTHER (INCOME) EXPENSE, NET (18,269) 19,227(9) 958 INCOME FROM CONTINING OPERATIONS BEFORE INCOME TAX $30,903 $139,243 $170,146 INCOME TAX 9,250 36,558(10) 45,808 INCOME FROM CONTINUING OPERATIONS $21,653 $102,685 $124,338 DISCONTINUED OPERATIONS, NET OF TAX $4,950 $5,204(11) $10,154 CONSOLIDATED NET INCOME $26,603 $107,889 $134,492 Less: Net income attributable to noncontrolling interests 11,254 — 11,254 NET INCOME ATTRIBUTABLE TO ENDO INTERNATIONAL PLC $15,349 $107,889 $123,238 DILUTED EARNINGS PER SHARE DATA ATTRIBUTABLE TO ENDO INTERNATIONAL PLC.: Continuing operations $0.19 $1.10 Discontinued operations

(0.05) (0.01) DILUTED EARNINGS PER SHARE $0.14 $1.09 DILUTED WEIGHTED AVERAGE SHARES 113,189 113,189 1. To exclude amortization of commercial intangible assets related to marketed products of $44,736. 2. To exclude certain separation benefits and other costs incurred in connection with continued efforts to enhance the company’s operatons of $10,453, amortization of customer relationships of $2,514 and mesh litigation-related defense costs of $8,300.

3. To exclude milestone payments to partners of $2,574 and certain separation benefits and other costs incurred in connection with continued efforts to enhance the company’s operations of $3,241.

4. To exclude the net impact of accruals for litigation-related and other contingencies.

5. To exclude asset impairment charges.

6. To exclude acquisition-related and integration costs.

7. To exclude additional interest expense as a result of the prior adoption of ASC 470-20.

8. To exclude the unamortized debt issuance costs written off and recorded as a net loss on extinguishment of debt upon our March 2013 prepayment on our term loan indebtedness as well as upon the amendment and restatement of our existing credit facility.

9. To exclude patent litigation settlement income.

10. To reflect the cash tax savings results from our acquisitions and the tax effect of the pre-tax adjustments above at applicable tax rates.

To exclude certain items related to the HealthTronics business, which is reported as Discontinued operations, net of tax, that the Company believes does not reflect its core operating performance.

©2014 Endo Pharmaceuticals Inc. All rights reserved.

19

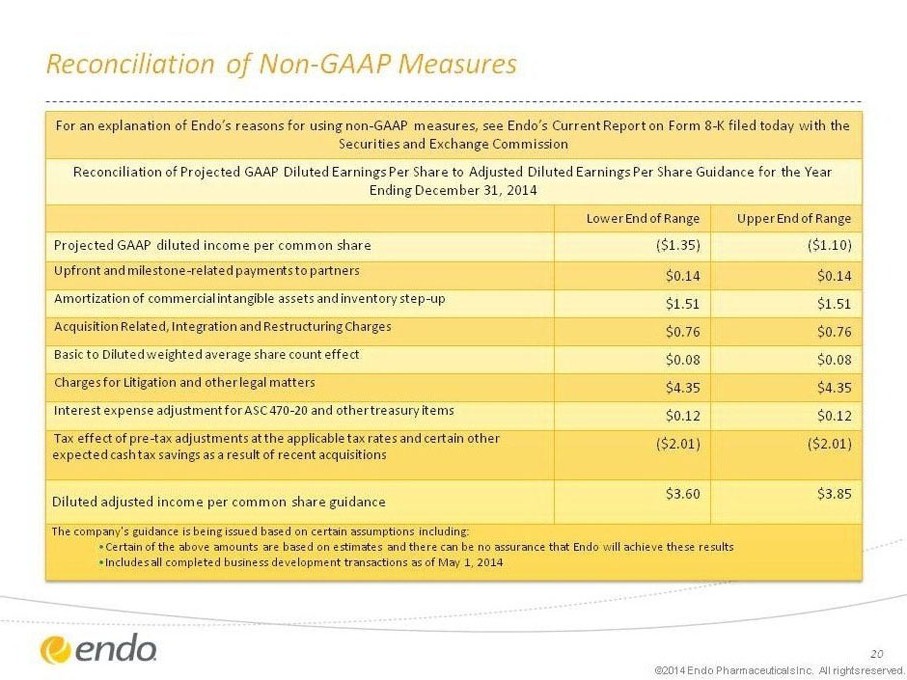

Reconciliation of Non-GAAP Measures

For an explanation of Endo’s reasons for using non-GAAP measures, see Endo’s Current Report on Form 8-K filed today with the Securities and Exchange Commission

Reconciliation of Projected GAAP Diluted Earnings Per Share to Adjusted Diluted Earnings Per Share Guidance for the Year Ending December 31, 2014

Lower End of Range Upper End of Range

Projected GAAP diluted income per common share ($1.35) ($1.10)

Upfront and milestone-related payments to partners $0.14 $0.14

Amortization of commercial intangible assets and inventory step-up $1.51 $1.51

Acquisition Related, Integration and Restructuring Charges $0.76 $0.76

Basic to Diluted weighted average share count effect $0.08 $0.08

Charges for Litigation and other legal matters $4.35 $4.35

Interest expense adjustment for ASC 470-20 and other treasury items $0.12 $0.12

Tax effect of pre-tax adjustments at the applicable tax rates and certain other expected cash tax savings as a result of recent acquisitions ($2.01) ($2.01)

Diluted adjusted income per common share guidance $3.60 $3.85

The company’s guidance is being issued based on certain assumptions including:

• Certain of the above amounts are based on estimates and there can be no assurance that Endo will achieve these results

• Includes all completed business development transactions as of May 1, 2014

• ©2014 Endo Pharmaceuticals Inc. All rights reserved.

20

Endo International plc

UBS Global Healthcare Conference

May 21, 2014

©2014 Endo Pharmaceuticals Inc. All rights reserved.