Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DEAN FOODS CO | d729655d8k.htm |

FOCUS

May 2014

Exhibit 99.1 |

The following

statements made in this presentation are “forward-looking” and are made

pursuant to the safe harbor provision of the Private Securities Litigation Reform Act

of 1995: statements relating to (1) projected sales (including specific product lines and the

company as a whole), profit margins, net income, earnings per share, free cash flow and debt

covenant compliance, (2) our regional and national branding initiatives, (3) our

innovation, and research and development plans, (4) commodity prices and other input costs, (5)

our cost-savings initiatives, including plant closures and route reductions, and our

ability to accelerate any such initiatives, (6) our plans related to our leverage, (7)

our planned capital expenditures, (8) the status of our litigation matters, (9) the impact of divestitures

including the sale of Morningstar and tax payments related thereto and the divestiture and

spin-off of our former subsidiary, The WhiteWave Foods Company, (10) our dividend

policy, and (11) possible repurchases of shares of our common stock. These statements

involve risks and uncertainties that may cause results to differ

materially from those set forth in this presentation. Financial

projections

are based on a number of assumptions. Actual results could be materially different than

projected if those assumptions are erroneous. The cost and supply of commodities

and other raw materials are determined by market forces over which we have limited or no control.

Sales, operating income, net income, debt covenant compliance, financial performance and

adjusted earnings per share can vary based on a variety of economic, governmental and

competitive factors, which are identified in our filings with the Securities and Exchange

Commission, including our most recent Forms 10-K and 10-Q (which can be accessed on

our website at www.deanfoods.com or on the website of the Securities and Exchange

Commission at www.sec.gov). Our ability to profit from our branding initiatives depends on a

number of factors including consumer acceptance of our products.

The declaration and payment of cash dividends under our dividend

policy remains at the sole discretion of the Board of Directors or a committee thereof and

will depend upon our financial results, cash requirements, future prospects, applicable

law and other factors that may be deemed relevant by the Board or such committee.

All forward-looking statements in this presentation speak only as of the date of

this presentation. We expressly disclaim any obligation or undertaking to release

publicly any updates or revisions to any such statements to reflect any change in our expectations with regard

thereto or any changes in the events, conditions or circumstances on which any such statement

is based. Certain non-GAAP financial measures contained in this presentation,

including adjusted diluted earnings per share, free cash flow, adjusted free cash flow,

adjusted

EBITDA, consolidated adjusted operating income and consolidated adjusted net income, are from

continuing operations and have been adjusted to eliminate the net expense or net gain

related to certain items identified in our earnings press release, including the

Morningstar divestiture and the spin-off of our former subsidiary, The WhiteWave Foods

Company. A full reconciliation of these measures calculated according to GAAP and

on an adjusted basis is contained in such press release, which is publicly available on our

website at www.deanfoods.com.

2

Forward-looking Statements |

Today’s agenda Who we

are Business strategy and company advantages

Financial performance

Conclusion

3 |

Who

we are Largest U.S. processor and distributor of

fluid milk with 50+ trusted regional brands

Manufacturing facilities: 70+

Total employees: 18,000 ; HQ: Dallas

Volume ~ 2.8B gallons annually

Best-in-class nationwide refrigerated

DSD distribution system

More than 2/3 of U.S. households

purchase a Dean

Foods

branded

product

annually

¹

NYSE:DF

$1.4B

²

Mkt

Cap

Revenues: $9.0+B

4

1.

Source IRI

2.

As of 5/15/2014 |

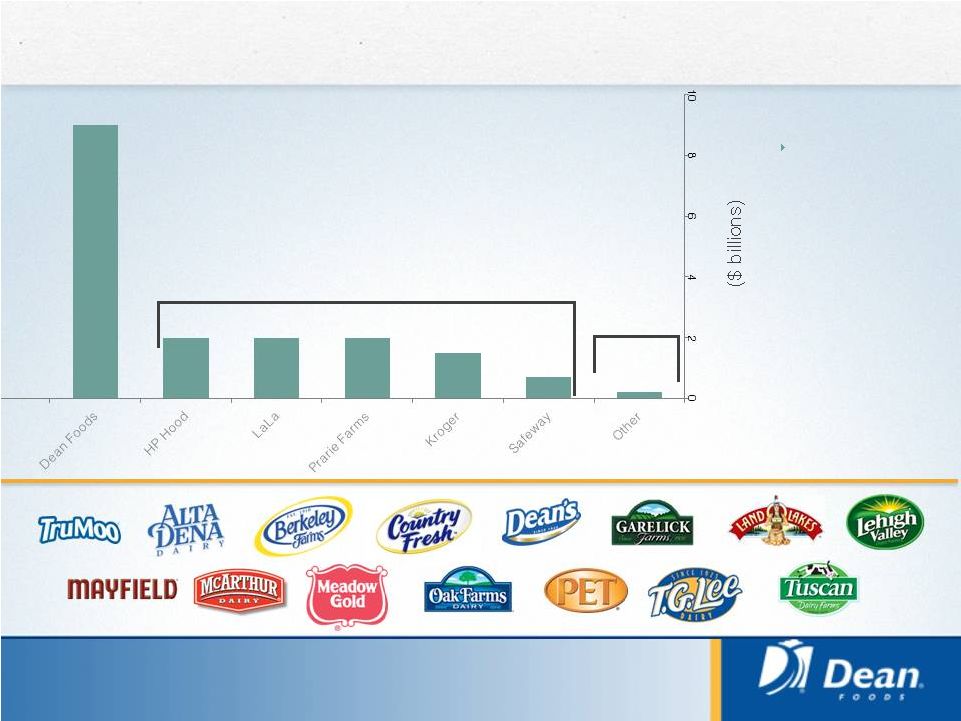

Scale: Dean Foods is the largest player in milk

We have the

#1 or #2

position, as

measured by

sales of

branded white

milk, in 80% of

the IRI defined

geographies

in which we

operate

36%

34%

30%

~150 Players

averaging 0.2%

share each

5 |

Today’s agenda Who we

are Business strategy and company advantages

Financial performance

Conclusion

6 |

Operational imperatives

Never compromise on quality, safety or customer service

Volume

Performance

Cost

Productivity

Effective

Pricing

Drive volume growth

at appropriate

economic returns

Gain share through

low cost, high service,

valued brands model

Augment volumes

with differentiated

products like TruMoo

®

Build on unique

opportunities to create

a cost-advantaged

position

Expedite closure of

under-utilized plants,

routes

Use cost savings to

enable future growth

Improve pricing tools

and protocols to

ensure pass-through

of commodity inflation

Reduce commodity-

driven volatility

Protect margins

7 |

Distribution:

Broad nationwide distribution across channels

The country’s only

coast-to-coast processor and distributor of fresh milk* 8

* Totals are based on DF fluid milk volumes

Schools 6%

Foodservice and

Other 15%

Small Format 12%

Large Format 67% |

Brands:

Growing TruMoo

9

Flavored milk is a $1B category, and

TruMoo is the largest flavored milk brand

TruMoo is Dean

Foods’ largest

national brand at approximately $650M of retail

and school sales in 2013

No high fructose corn syrup, lower total

sugar, low fat, all the great nutrition of

milk

Launching TruMoo Protein nationally

in 2H 2014 |

Dean

Foods: Focused, disciplined, profitable

Extend our sustainable competitive advantages

Our relative size and capabilities afford us significant advantages versus our

competitive set –

we plan to extend those advantages

Continued focus on cost, volume outperformance, effective pricing

Lay the foundation for longer-term growth

Focus on cash flow generation and total shareholder returns

10 |

Today’s agenda

Who we are

Business strategy and company advantages

Financial performance

Conclusion

11 |

Fluid milk

share performance 12

Dean Foods Share

Recent wins continue to positively

impact volumes in Q1

Small format volume plus 7.6%

versus prior year

11 consecutive quarters of

growth in the dollar channel

Dean’s share of Branded White

Milk at retail increased 130 basis

points

versus

prior

year

[2]

Remain cautious on fluid milk

category volumes

Historic high raw milk prices

SNAP benefit reductions

2012

2013

2014

DF fluid milk volume up 1.1% excluding RFP and customer vertical

integration impact

–

significantly better than 2.1% category decline

Dean Fluid Milk Share

USDA Fluid Milk Volume YoY

[1]

1

1Q14 USDA includes March month estimates based on Federal Milk

Marketing Order receipts and Class I utilization. 2

Source: IRI

|

Volume and operating profit performance

Adjusted Operating Income per Gallon ($)

* See Reconciliation of Non-GAAP Financial Measures in our earnings releases for

the

relevant

quarters

and

in

the

appendix

to

this

presentation

for

computations

and reconciliations

$48

$7

$74

13

$65

$42 |

In 2013,

milk supply fell in export regions, reducing supply on the international market

14

Milk prices

were low

Feed costs

were high

Weather

was poor

* Source: Rabobank |

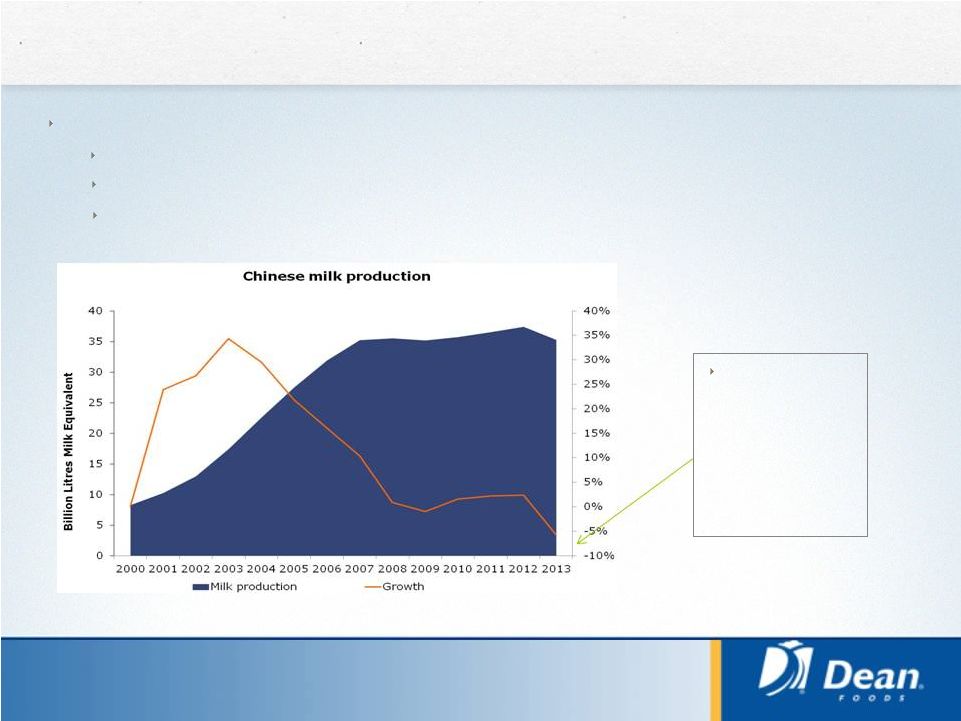

Meanwhile,

Chinese milk production fell heavily 15

Drivers:

Structural: high costs of production

Medium term: exit of small farmers, challenges of operating large farms

Temporary: weather and disease

Milk

production

appears to

have fallen

around 6%

in 2013

* Source: Rabobank |

US milk

prices were thus driven up in line with international market pricing

16

Exports have surged

U.S. stocks have been reduced

Commodity prices dragged up by world market

* Source: Rabobank |

Focus on cash flow generation & total shareholder returns

Future Shareholder Returns

Mid-single Avg EBIT Growth

Liability Mgmt

Cap-Ex Reduction Over Time

Productivity

Investment

Growth

Investment

Debt Paydown

Share

Repurchase and

Regular Dividend

17

We expect at least $125 million of Adjusted 2014 Free Cash Flow before one-time

items and litigation payments

Next 3-5

Years

We

define

Adjusted

Free

Cash

Flow

as

Free

Cash

Flow

adjusted

for

the

impact

on

operating

cash

flows

related

to

certain significant or non-recurring items, including income taxes paid on the

divestiture of Morningstar; litigation payments; payments associated with

our restructuring, reorganization and realignment activities Immediate Shareholder

Returns Free

Cash

Flow

Growth |

2014

Expectations At least $0.60 per share

Approximately

$150

–

175

million

FY 13 Capital

Expenditures

FY 14 Adjusted

Diluted EPS*

18

($0.02) –

($0.08) per share

Q2

Adjusted

Diluted

EPS*

* See Reconciliation of Non-GAAP Financial Measures in the Q1

2014 earnings release earnings tables for computation

2014 Considerations:

Challenging volume overlaps through Q2

All time high class I raw milk prices

At least $125 million

FY 13 Adjusted FCF |

Today’s agenda

19

Who we are

Business strategy and company advantages

Financial performance

Conclusion |

Summary

We have built sustainable competitive advantages

through our scale and capabilities. We are working to

extend these advantages.

We are putting pieces in place to build for the future

through:

Reducing and variablizing our cost structure

Improving pricing tools and protocols to reduce volatility

Increasing R&D and innovation efforts

We believe profit growth, combined with a focus on

free cash flow generation and rewarding shareholders

will result in superior returns

We aim to be a sustainable creator of value for

shareholders

Thank you for your interest

20 |

Appendix:

Reconciliation of Non-GAAP Financial Measures

21

Three months ended

March 31, 2014

Asset write-downs

Facility closing,

and (gain) loss on

reorganization &

Morningstar

WhiteWave

Other

Income

sale of assets

realignment costs

sale

spin-off

adjustments

tax

GAAP

(a)

(b)

(c)

(d)

(e)

(f)

Adjusted

*

Operating income (loss):

Dean Foods

3,753

$

426

$

3,654

$

-

$

-

$

(979)

$

-

$

6,854

$

Facility closing and reorganization

costs (977)

-

977

-

-

-

-

-

Litigation settlements

2,521

-

-

-

-

(2,521)

-

-

Total operating income

5,297

426

4,631

-

-

(3,500)

-

6,854

-

-

Interest expense

15,023

-

-

-

-

(446)

-

14,577

Other income, net

(321)

-

-

-

-

-

-

(321)

Income tax expense

387

-

-

-

-

-

(3,200)

(2,813)

Income (loss) from continuing operations

(9,792)

426

4,631

-

-

(3,054)

3,200

(4,589)

-

-

Income from discontinued operations, net of tax

836

-

-

-

-

(836)

-

-

Net income (loss) attributable to Dean Foods Company

(8,956)

$

426

$

4,631

$

-

$

-

$

(3,890)

$

3,200

$

(4,589)

$

-

-

Diluted earnings (loss) per share

(0.09)

$

-

$

0.05

$

-

$

-

$

(0.04)

$

0.03

$

(0.05)

$

-

-

Three months ended

March 31, 2013

Asset write-downs

Facility closing,

and (gain) loss on

reorganization and

Morningstar

WhiteWave

Other

Income

sale of assets

realignment costs

sale

spin-off

adjustments

tax

GAAP

(a)

(b)

(c)

(d)

(e)

(f)

Adjusted

*

Operating income (loss):

Dean Foods

69,321

$

-

$

4,620

$

-

$

$

290

$

-

$

74,231

$

Facility closing and reorganization costs

(5,610)

-

5,610

-

-

-

-

Impairment of long-lived assets

(33,915)

33,915

-

-

-

-

-

Total operating income

29,796

33,915

10,230

-

290

-

74,231

-

-

Interest expense

59,649

-

-

(29,430)

(3,261)

(518)

-

26,440

Other expense, net

165

-

-

-

-

-

-

165

Income tax expense (benefit)

(9,278)

-

-

-

-

-

27,375

18,097

Income (loss) from continuing operations

(20,740)

33,915

10,230

29,430

3,261

808

(27,375)

29,529

-

-

Income from discontinued operations, net of tax

516,537

-

-

(492,571)

(24,272)

306

-

-

Net income attributable to non-controlling interest in discontinued

operations (3,192)

-

-

-

3,192

-

-

-

Net income attributable to Dean Foods Company

492,605

$

33,915

$

10,230

$

(463,141)

$

(17,819)

$

1,114

$

(27,375)

$

29,529

$

-

-

Diluted earnings per share (g)

5.30

$

0.36

$

0.11

$

(4.98)

$

(0.19)

$

0.01

$

(0.30)

$

0.31

$

-

-

-

- |

Appendix:

Reconciliation of Non-GAAP Financial Measures (cont)

22

DEAN FOODS COMPANY

Reconciliation of GAAP to Pro Forma Adjusted Earnings

(Unaudited)

(In thousands, except per share data)

Twelve months ended

December 31, 2013

Asset write-downs

Facility closing,

Deal, integration

Loss on early

Disposition of

and (gain) loss on

reorganization &

and separation

retirement of

WWAV common

Morningstar

WhiteWave

Other

Income

sale of assets

realignment costs

costs

debt

stock

sale

spin-off

adjustments

tax

GAAP

(a)

(b)

(c)

(d)

(e)

(f)

(g)

(h)

(i)

Adjusted

*

Operating income (loss):

Dean Foods

202,720

$

4,926

$

10,787

$

10,558

$

-

$

-

(545)

$

-

$

-

$

-

$

228,446

$

Facility closing and reorganization costs

(27,008)

-

27,008

-

-

-

-

-

-

-

-

Litigation settlements

1,019

-

-

-

-

-

-

-

(1,019)

-

-

Impairment of long-lived assets

(43,441)

43,441

-

-

-

-

-

-

-

-

-

Other operating loss

(2,494)

2,494

-

-

-

-

-

-

-

-

-

Total operating income

130,796

50,861

37,795

10,558

-

-

(545)

-

(1,019)

-

228,446

-

-

Interest expense

200,558

-

-

-

-

(649)

(29,430)

(66,684)

(7,109)

-

96,686

Gain on disposition of WhiteWave common stock

(415,783)

-

-

-

-

415,783

-

-

-

-

-

Loss on early retirement of debt

63,387

-

-

-

(63,387)

-

-

-

-

-

-

Other income, net

(400)

-

-

-

-

-

-

-

-

-

(400)

Income tax expense (benefit)

(42,325)

-

-

-

-

-

-

-

-

92,544

50,219

Income from continuing operations

325,359

50,861

37,795

10,558

63,387

(415,134)

28,885

66,684

6,090

(92,544)

81,941

-

-

Income from discontinued operations, net of tax

493,998

-

-

-

-

-

(491,887)

(2,815)

704

-

-

Net income attributable to non-controlling interest in discontinued

operations (6,179)

-

-

-

-

-

-

-

6,179

-

-

Net income attributable to Dean Foods Company

813,178

$

50,861

$

37,795

$

10,558

$

63,387

$

(415,134)

$

(463,002)

$

63,869

$

12,973

$

(92,544)

$

81,941

$

Diluted earnings per share

8.58

$

0.54

$

0.40

$

0.11

$

0.67

$

(4.38)

$

(4.89)

$

0.67

$

0.14

$

(0.98)

$

0.86

$

$

|

FOCUS

May 2014

|