Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - APOLLO INVESTMENT CORP | d728849d8k.htm |

Wells Fargo 2014 Specialty Finance Conference

May 21, 2014

Information is as of March 31, 2014 except as otherwise noted.

It should not be assumed that investments made in the future will

be profitable or will equal the performance of investments in this document.

Exhibit 99.1 |

Disclaimers, Definitions, and Important Notes

1

Past Performance

Past performance is not indicative nor a guarantee of future returns,

the realization of which is dependent on many factors, many of which are beyond Apollo’s control. Net returns give effect to all fees and

expenses. Unless otherwise noted, information included herein is

presented as of the date indicated on the cover page and may change at any time without notice.

Forward-Looking Statements

We make forward-looking statements in this presentation and other

filings we make with the SEC within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. Forward-looking statements are

subject to substantial risks and uncertainties, many of which are difficult to predict and are generally beyond our control. These forward-looking

statements include information about possible or assumed future results

of our business, financial condition, liquidity, results of operations, plans and objectives, including information about our ability to generate

attractive returns while attempting to mitigate risk. When used in this

release, the words "believe," "expect,” "anticipate," "estimate," "plan," "continue," "intend," "should," "may" or similar expressions, are

intended to identify forward-looking statements. Statements

regarding the following subjects, among others, may be forward-looking: the return on equity; the yield on investments; the ability to borrow to finance

The forward-looking statements are based on our beliefs,

assumptions and expectations of our future performance, taking into account all information currently available to us. Forward-looking statements are not

predictions of future events. These beliefs, assumptions and

expectations can change as a result of many possible events or factors, not all of which are known to us. Some of these factors are described in the

company's filings with the Securities and Exchange Commission. If a

change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-

looking statements. Any forward-looking statement speaks only as of

the date on which it is made. New risks and uncertainties arise over time, and it is not possible for us to predict those events or how they may

affect us. Except as required by law, we are not obligated to, and do

not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. This

Target IRR and MOIC

Targeted IRR is presented solely for the purpose of providing insight

into Apollo Investment Corporation’s (“AIC’s” or the “Fund’s) investment objectives, detailing its anticipated risk and reward characteristics

and for establishing a benchmark for future evaluation of the

Fund’s performance. Targeted IRR is not a predictor, projection or guarantee of future performance. There can be no assurance Apollo’s targets will be

met or that Apollo will be successful in finding investment

opportunities that meet these anticipated return parameters. There is no guarantee as to the quality of any investment or the adequacy of Apollo’s

methodology for estimating future returns. Target returns should

not be used as a primary basis for an investor’s decision to invest the Fund. Targeted returns are presented gross of all fees and expenses.

The multiple of investment cost (MOIC) is derived from dividing the sum

of the estimated remaining value and realized proceeds by the amount invested. The MOIC is presented gross and does not reflect the

effect of management fees, incentive compensation, certain expenses or

taxes.

Credit Rating Disclaimer

Apollo, its affiliates, and third parties that provide information to

Apollo, such rating agencies, do not guarantee the accuracy, completeness, timeliness or availability of any information, including ratings, and are

not responsible for any errors or omissions (negligent or otherwise),

regardless of the cause, or the results obtained from the use of such content. Apollo, its affiliates and third party content providers give no

express or implied warranties, including, but not limited to, any

warranties of merchantability or fitness for a particular purpose or use, and they expressly disclaim any responsibility or liability for direct, indirect,

incidental, exemplary, compensatory, punitive, special or consequential

damages, costs expenses, legal fees or losses (including lost income or profits and opportunity costs) in connection with the use of the

information herein. Credit ratings are statements of opinions and

not statements of facts or recommendations to purchase, hold or sell securities. They do not address the suitability of securities for investment

assets; and risks associated with investing in real

estate assets, including changes in business conditions and the general economy.

presentation may contain statistics and other data that in some cases

has been obtained from or compiled from information made available by third-party service providers.

purposes and should not be relied on as investment advice.

Neither Apollo nor any of its respective affiliates have any responsibility to update any of the information provided in this summary document. |

Disclaimers, Definitions, and Important Notes

2

AUM Definition

Assets Under Management (“AUM”) – refers to the

investments we manage or with respect to which we have control, including capital we have the right to call from our investors pursuant to their capital

commitments to various funds. Our AUM equals the sum of: (i) the fair

value of our private equity investments plus the capital that we are entitled to call from our investors pursuant to the terms of their capital

commitments plus non-recallable capital to the extent a fund is

within the commitment period in which management fees are calculated based on total commitments to the fund; (ii) the net asset value of our capital

markets funds, other than certain senior credit funds, which are

structured as collateralized loan obligations or certain collateralized loan obligation and collateralized debt obligation credit funds that have a fee

generating basis other than mark-to-market asset values, plus

used or available leverage and/or capital commitments; (iii) the gross asset values or net asset values of our real estate entities and the structured portfolio

vehicle investments included within the funds we manage, which includes

the leverage used by such structured portfolio vehicles; (iv) the incremental value associated with the reinsurance investments of the

portfolio company assets that we manage; and (v) the fair value of any

other investments that we manage plus unused credit facilities, including capital commitments for investments that may require pre-qualification

before investment plus any other capital commitments available for

investment that are not otherwise included in the clauses above. Our AUM measure includes AUM for which we charge either no or nominal fees.

Our definition of AUM is not based on any definition of AUM contained

in our operating agreement or in any of our Apollo fund management agreements. We consider multiple factors for determining what should

be included in our definition of AUM. Such factors include but are not

limited to (1) our ability to influence the investment decisions for existing and available assets; (2) our ability to generate income from the

underlying assets in our funds; and (3) the AUM measures that we use

internally or believe are used by other investment managers. Given the differences in the investment strategies and structures among other

alternative investment managers, our calculation of AUM may differ from

the calculations employed by other investment managers and, as a result, this measure may not be directly comparable to similar measures

Important Notes Regarding the Use of Index Comparisons

There are significant differences between the Fund’s investments

and the indices described. For instance, the Fund may use leverage and invest in securities or financial instruments that have a greater degree of risk

and volatility, as well as less liquidity, than those securities

contained in the indices. Moreover, the indices do not reflect the reinvestment of income or dividends and the indices are not subject to any of the fees or

expenses of the Fund. It should not be assumed that the Fund will

invest in any specific securities that comprise the indices, nor should it be understood to mean there is a correlation between the Fund’s returns and

Index Definitions (Source: Bloomberg)

MSCI US REIT (RMZ) The MSCI US Reit Index is a price-only index,

which MSCI began calculating on June 20, 2005. Previously, this index (then known as the Morgan Stanley REIT Index) was calculated and

maintained by the AMEX. The AMEX began calculating the index with a

base level of 200, as of December 30, 1994.

S&P 500 (SPX) Standard and Poor's 500 Index is a

capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate

market value of 500 stocks representing all major industries. The index

was developed with a base level of 10 for the 1941- 43 base period.

NASDAQ Composite (CCMP) The NASDAQ Composite Index is a broad-based

capitalization-weighted index of stocks in all three NASDAQ tiers: Global Select, Global Market and Capital Market. The index was

developed with a base level of 100 as of February 5, 1971.

KBW Bank Index (BKX) The KBW Bank Index is a modified cap-weighted

index consisting of 24 exchange- listed and National Market System stocks, representing national money center banks and leading

regional institutions. The index is intended to reflect the evolving

financial sector and was developed with a base value of 250 as of October 21, 1991. Effective March 22, 2004, the index had a 10:1 split.

Financial Select SPDR (XLF) Financial Select Sector SPDR

Fund is an exchange-traded fund incorporated in the USA. The Fund's objective is to provide investment results that, before expenses, correspond to the

performance of The Financial Select Sector. The Index includes

financial services firms whose business' range from investment management to commercial & business banking.

presented by other investment managers.

the indices’ performance. The indices are included for

information purposes only. |

Agenda

3

Introduction to Apollo Investment Corporation

BDC Industry Opportunity

Investment Portfolio & Strategy

Conclusion |

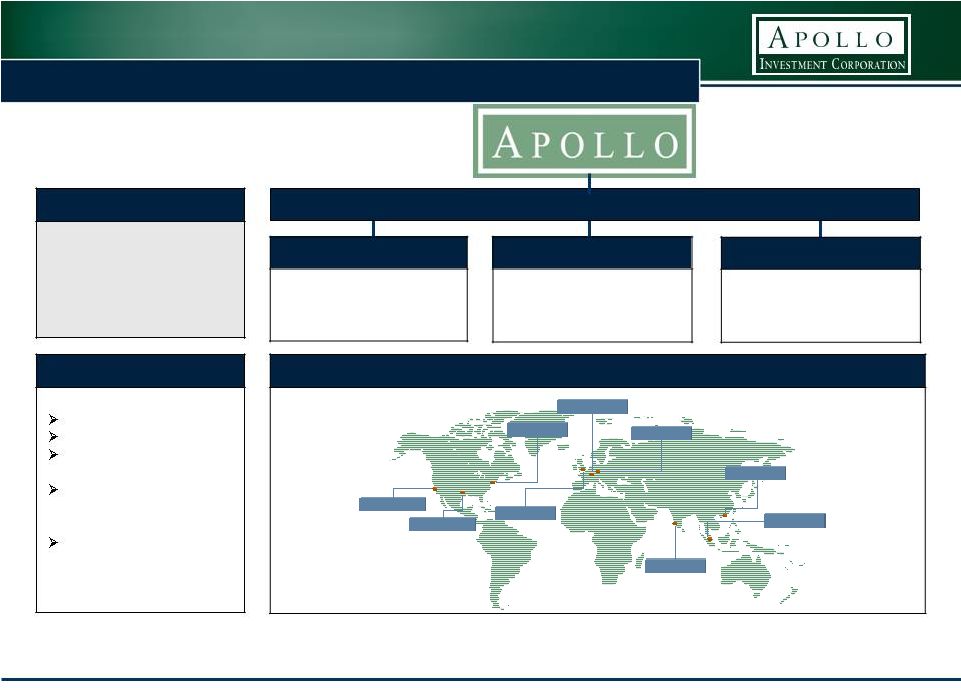

Middle Market

Lender

Primarily provides debt solutions to U.S. middle market companies with a focus on

directly originated proprietary investments Target investment

characteristics: (i) commitment & hold size ranges from between $20 million and $250 million and (ii)

companies with annual revenues between $50 million and $2 billion

Since IPO in April 2004 and through March 31, 2014, invested $13.1 billion in 291

portfolio companies Publicly traded business development company

(“BDC”) (NASAQ: AINV) treated as a regulated investment company (“RIC”) for

tax purposes

Significant

Competitive

Advantages

Apollo affiliation provides significant

benefits -

expertise, investment

opportunities, market insights

Multi-channel sourcing capabilities

Able to invest in all levels of the capital

structure –

flexible mandate

Experienced management team

Investment grade credit ratings provide

favorable access to debt markets

(2)

Scale allows for underwriting larger

investments with commensurate hold

sizes

Externally

Managed by

Apollo Global

Management

Externally managed by an affiliate of Apollo Global Management, LLC, a

leading alternative asset manager with $159 billion of AUM

(3)

with expertise in private equity, credit and real estate

Apollo Global Management, LLC founded in 1990

Investment

Objective

Generate current income and capital appreciation

Risk-adjusted philosophy with emphasis on illiquid non-investment grade

debt Required

to

distribute

at

least

90%

of

net

investment

income

and

cumulative

net

realized

capital

gains

payable

each

year

$0.80

per

share

annual

dividend

(most

recent

quarterly

dividend

annualized)

(4)

Introduction to Apollo Investment Corporation

4

(1) At fair value. (2) See credit rating disclaimer at beginning of presentation. (3) See

definition of AUM at beginning of presentation. (4) There can be no assurances that AINV’s dividend will remain at the current level. |

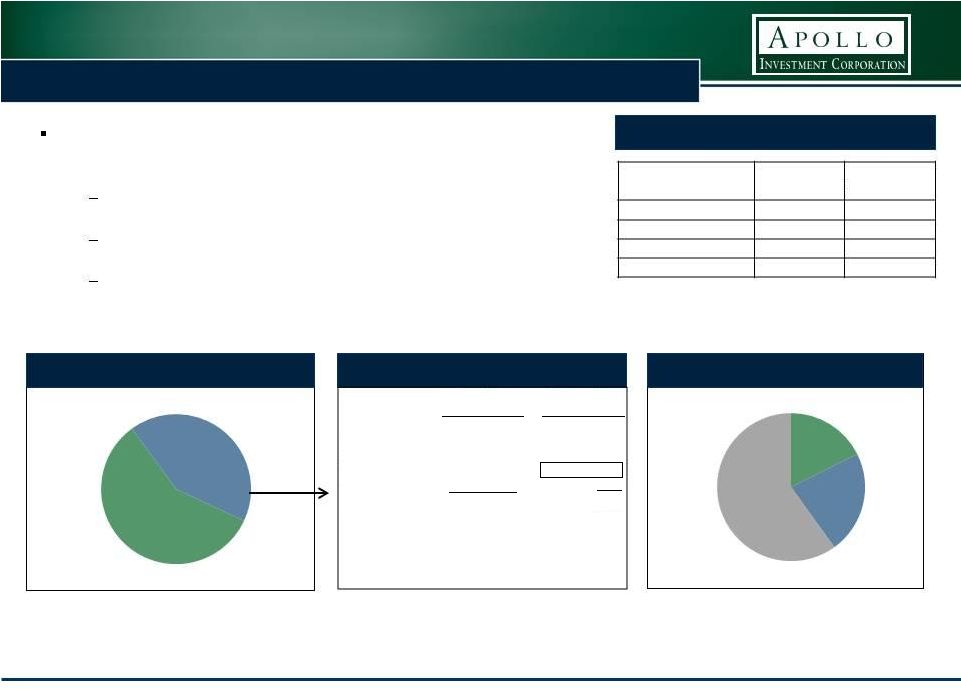

Company Snapshot

5

Select Financial Data

(1)

Investment Portfolio

$3.5 bn

# of Portfolio Companies

111

Debt Outstanding

$1.37 bn

Net Assets

$2.05 bn

Net leverage Ratio

(2)

0.68x

Net Asset Value Per Share

$8.67

Most Recent Quarterly

Dividend

(3)

$0.20

Market Information

(4)

Market Capitalization

$1.9 bn

Share Price

$8.06

Price-to-Book

0.93x

Dividend Yield

(5)

9.9%

LTM $494

~ 30% of portfolio in specialty verticals

35 different industries in portfolio

(1) As of March 31, 2014. (2) Net leverage ratio is defined as debt outstanding

plus payable for investments purchased and cash equivalents, plus due to custodian, less receivable for investments sold, less cash equivalents, less

cash, less foreign currency, divided by total net assets. (3) Declared a dividend of $0.20 per

common share on May 20, 2014 to stockholders of record as of June 20, 2014. (4) As of May 19, 2014. (5) Most recent quarterly dividend

annualized divided by share price. (6) At current costs. Exclusive of securities on

non-accrual status. (7) On a fair value basis. |

Agenda

6

Introduction to Apollo Investment Corporation

BDC Industry Opportunity

Investment Portfolio & Strategy

Conclusion |

The Evolution of BDCs

7

While still focused on U.S. middle market lending, many BDCs have

evolved into a more institutionalized business model with a

focus on sound risk management and increasing differentiation amongst

strategies. Asset Mix

Concentration

Average Investment % Equity

Average Investment % Equity

2.7%

1.9%

Funding & Leverage

Credit Ratings

Average Rating

Average Rating

Unrated

BBB

Valuation & Returns

Lower valuations despite improved

returns

Investment grade status facilitating

the issuance of long-term, unsecured

debt (including converts, institutional

& retail notes)

BDCs have reduced their exposure

to unsecured debt by about half

Increased reliance on term funding

with increased, but still low, leverage

as portfolios have ramped &

seasoned

BDCs has diversified their portfolios,

with less concentrated exposures

60%

30%

1%

9%

Secured debt

Unsecured debt

Structured products

Equity & other

63%

18%

9%

10%

Secured debt

Unsecured debt

Structured products

Equity & other

90%

0.47x

Revolver Borrowing % Total Debt

Debt-to-Equity Ratio

33%

0.68x

Revolver Borrowing % Total Debt

Debt-to-Equity Ratio

6%

1.09x

ROE

Price-to-Book

13%

1.04x

ROE

Price-to-Book

Based on major BDC peers public as of December 2007 (AINV, ARCC, BKCC,

PNNT and PSEC). Pre Financial Crisis as of December 31, 2007. Today as of March 31, 2014. Average investment size based on total investment

portfolio divided by number of portfolio companies. Credit Ratings

– see credit rating disclaimer at beginning of presentation. Return on Equity (ROE) based on LTM results. Price-to-Book based on average price vs. average

book value over LTM. Source: SNL, FactSet, Company data.

|

Lending Environment & BDCs Filling the Void

8

$3.2

$7.0

$10.7

$16.2

$25.1

$19.7

$19.6

$25.1

$30.2

$36.5

$45.7

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

5 year CAGR

18%

10 year CAGR

30%

Total

Assets

of

Publicly-Traded

BDCs

(in

billions)

(2)

$14.9

$14.0

2007

2013

Total Assets for Financial Firms (in trillions)

Decreased ~ $900

billion or 6%

$681

$335

2007

2013

Level 3 Assets for Financial Firms (in billions)

Decreased ~ $350

billion or 51%

(1) Financial firms include: Bank of America, Bear Stearns,

Citigroup , Countrywide Financial, Credit Suisse, Deutsche Bank, Goldman Sachs, JPMorgan, Merrill Lynch, Morgan Stanley, Washington Mutual and

Wells Fargo & Co . (2) Based on calendar year. Includes the

following BDCs: ACAS, ACSF, AINV, ARCC, BKCC, CMFN, CPTA, FDUS, FSC, FSFR, GAIN,GARS, GBDC, GLAD, GSVC, HCAP, HRZN, HTGC,

KCAP, KIPO, MAIN, MCC, MCGC, MRCC, MVC, NGPC, NMFC, OFS, PFLT, PNNT,

PSEC, SAR, SCM, SLRC, SUNS, TCAP, TCPC, TCRD, TICC, TINY, TPVG, TSLX and WHF. Source: Bloomberg.

A variety of recent bank regulations have driven large financial firms

to reduce assets. While BDCs have grown significantly, they

remain small relative to the contraction in bank credit, leaving them

with more room to run. |

Regulatory Reform Is Changing the Lending Landscape

9

Key Dates

Description

Impact

Risk-based

Capital Ratios

Basel III

Phase-in

2015-2019

Higher risk weightings on non-investment grade

securities

Capital surcharge for SIFI’s

Common equity, Tier 1 and Total Capital ratios are

7.0%, 8.5% and 10.5%, respectively

SIFI buffer 1% to 2.5%

Supplementary

Leverage Ratio

Implementation

January 2018

Leverage ratio captures many off balance sheet

exposures including unfunded commitments

Capital surcharge for 8 U.S. global systemically

important banks (“G-SIBs”) and their U.S. insured

depository institutions (“IDI”)

At least 5% for GSIBs and 6% for IDI subsidiaries

vs. 3% for others

Leveraged

Lending

Guidance

Guidance Effective

May 2013

More Specific

Guidelines Issued

December 2013

Annual

Reviews

Expected

to Begin

May 2014

Increases universe of what is considered a

leveraged

loan

Establishes minimum lending standards

Changes

in “criticized loan”

rules may make

underwriting higher leverage transactions (i.e. LBOs)

more difficult for the largest banks

‘No exceptions policy’

on new issuance

Leveraged

lending definition:

Senior Debt-to-EBITDA > 3:1

Total Debt-to EBITDA > 4:1

Loans levered > 6x considered “criticized”

50% repayment standard over 5 to 7 year period

Regulators monitoring covenant

-lite and PIK-toggle

structures

Risk Retention

Rules

Expected

to be

finalized by

end of 2015

Requires CLO managers to retain an economic

interest without selling or hedging for the life of the

securitization

Manager must own 5% of securitization or some

percentage of each underlying

loan

The Volcker

Rule

Finalized

December 2013

Implementation

July 2017

Prohibits banks from sponsoring a covered fund

(e.g., hedge fund, private equity fund)

Limits banks’

fund ownership interest

Banks may not invest more than 3% of Tier 1 capital

in covered

funds

Banks cannot represent

more than 3% of the total

capital of a given covered fund

We believe the evolving bank regulatory environment will limit banks’ willingness and / or

ability to make leveraged loans, which should result in new opportunities for non-bank

capital providers, such as BDCs |

10

Comparison & Composition of Returns

across Financial Institutions

BDCs generally generate

superior yields from their

balance sheet, with

comparable (or better)

credit losses

BDC expenses are generally

lower than those of other

financial institutions leading

to significantly higher ROAs

BDC generally operate with

significantly lower leverage,

with the potential for

superior ROEs on both an

absolute and risk-adjusted

basis

“Net revenue” is revenue net of both interest expense and

credit items. “Credit items” include all loan loss provisions, securities impairments, gain or loss on sale of loans and available-for-sale securities and other

dispositions. “Expenses” exclude interest expense;

advisory fees include management and incentive fees paid by externally-managed BDCs. Capital markets banks include GS, MS, BAC, C, JPM, WFC. Regional banks include

136 banks with assets between $2 billion and $10 billion. Based on

last 12 months of results. |

Agenda

Introduction to Apollo Investment Corporation

BDC Industry Opportunity

Investment Portfolio & Strategy

Conclusion

11 |

Investment Process

12

Experienced investment team

31 Opportunistic Credit

investment professionals

with avg 13 years of

experience

Ability to execute direct / non-

sponsor transactions with a

focus on specialty verticals

Financial sponsors

Long-term relationships

Transactions with > 100

sponsors

53% of portfolio is

sponsored-backed

(1)

No origination restrictions

Apollo affiliation

Coverage and experience

Market insights

Proprietary research

Apollo’s credit segment AUM

~$101 billion

(2)

Risk-adjusted investment

philosophy

Preservation of capital

Strong asset coverage

Extensive due diligence

Knowledge sharing across

Apollo platform

Access to management

teams of private equity

portfolio companies

Draft term sheet

Investment Committee Review

Iterative process

Extensive quarterly portfolio

reviews

Internal risk rating system

Covenant compliance

Board observation rights

Independent 3rd party valuation

for non-quoted investments

Provide managerial assistance

Increased monitoring of

problem investments

Watch list committee

Generally seek to:

Negotiate transaction

Structuring and terms

Strong covenants, collateral

package, prepayment

protection, Board seat or

observation rights

Seek Investment Committee

approval

Weekly meetings to discuss

and vote on new deals

Comprised of senior

personnel from across Apollo

Multi-Channel

Sourcing Engine

Focus on Risk-Adjusted

Returns

Protect Downside Risk

Comprehensive and Regular

Review and Dialog

(1) At fair value. (2) As of March 31, 2014. See

definition of AUM at beginning of presentation. Deal Sourcing

Underwriting & Due

Diligence

Structuring, Pricing &

Approval

Portfolio Monitoring

Dedicated professionals for

managing problem

investments

limit borrower concentration

to <5%

limit industry concentration

to <10% |

Portfolio Positioning

13

Reduced

Borrower

Concentration

(1)

Yield

on

Debt

Portfolio

(3)

Improved

Credit

Quality

(2)

Developed

Specialty

Verticals

(1)

Specialty Verticals as % of Portfolio

Focus

on

Floating

Rate

(1)

Floating Rate as % of Debt Portfolio

Emphasis

on

Secured

Lending

(1)

Secured Debt as % of Portfolio

(1) On a fair value basis. (2) Source: company data.

Includes all portfolio company investments except structured products, common equities and warrants. Also excludes select investments where debt-to-EBITDA is not a

relevant average metric or data is not available. Metrics at close

and weighted average by cost. (3) Weighted average, at current cost, exclusive of securities on non-accrual status. |

Industry Fundamentals

Strategy

%

Portfolio

Yield

(1)

Target

Returns

Oil & Gas

5x increase in annual capital

spending to develop shale

resources

Traditional capital providers

have reduced exposure

Houston office

Secured lending against North

American producing upstream oil

and gas reserves (PDPs)

Apollo’s Natural Resources

platform provides additional

support

11.8%

12.5%

15-25% IRR

and 1.4x

MOIC over a

2+ year hold

(2)

Aircraft

Leasing

Positive trends of passenger

traffic growth, air traffic has

grown roughly 2x GDP

Movement of aircraft from

airlines’

balance sheets to

dedicated lessor balance

sheets

35% of global fleet under

operating lease

Dedicated portfolio company

(Merx Aviation)

Generally targeting used current

generation Boeing and Airbus

commercial aircraft

12.2%

12.0%

Mid-teen

return with

good

downside

protection

Structured

Products

(3)

Regulatory reform prompting

financial institutions to

decrease exposure to certain

assets, including middle

market loans

Strategic relationships with

middle market loan originators

Broaden exposure to diversified

portfolios of directly originated

middle market loans

Apollo’s Structured Credit Group

provides additional support

5.5%

13.5%

14% -

19%

Total Specialty Verticals

29.5%

12.5%

Specialty Verticals

We have been expanding our capabilities in select industries 1) with a

strong demand for capital, 2) where traditional capital has fled,

3) with significant barriers to entry, and 4) in which the Apollo

platform has expertise. 14

(1) As of March 31, 2014. At current cost. On yielding

investments.. (2) See disclaimer at beginning of presentation for important information regarding target returns and MOIC. (3) Excludes Other. |

How We Are Investing in the Current Environment

15

(1) Source: S&P Capital IQ and Bloomberg. (2)

Other includes exit financing, general recap, corporate purpose, DIP, cap ex and IPO. (3) BofA Merrill Lynch US High Yield Indices.

Loan volume

increasing, but still well

below pre-crisis levels

Meaningful recent pick

up in sponsor activity

while refinancing

remains elevated

Loan pricing trending

down, but spread

between middle market

and large corporate

issuers widened

Credit spreads continue

to compress but remain

above pre-credit crisis

levels

With this market

backdrop, we are focused

on opportunities that are:

unrated

illiquid

complex

2

4

4

3

1

1

2

3 |

Introduction to Apollo Investment Corporation

BDC Industry Opportunity

Investment Portfolio & Strategy

Conclusion

Agenda

16 |

Strategic Priorities

Remain prudent, selective and opportunistic

Continue to identify mispriced risk

Pursue opportunities emerging from bank

regulation

Continue to optimize portfolio

Redeploy lower yielding assets

Increase exposure to floating rate assets

Optimize usage of non-qualified assets

Develop additional specialty verticals

17

9.9%

3.7%

2.0%

1.3%

1.9%

1.6%

AINV (1)

MSCI US REIT Index

(RMZ Index)

S&P 500

NASDAQ Composite

KBW Bank Index

Financial Select Sector SPDR (Fund) (XLF)

Dividend Yield for Alternative Investments

(2) (3)

(1) There can be no assurances that AINV’s dividend will remain at the current

level. (2) As of May 19, 2014. (3) See important note regarding indices on Disclaimer page at beginning of presentation. |

Appendices

18 |

Financial Highlights

$ in thousands, except per share amount

OPERATING RESULTS

Three months ended

March 31, 2014

Three months ended

December 31, 2013

Three months ended

September 30, 2013

Three months ended

June 30, 2013

Three months ended

March 31, 2013

Net investment income

$49,612

$49,683

$49,586

$52,367

$42,066

Net realized and unrealized gain (loss) on assets

$20,293

$56,055

$26,839

$(33,563)

$23,755

Net increase in net assets from operations

$96,905

$105,738

$76,425

$18,804

$65,821

Net investment income per share

$0.22

$0.22

$0.22

$0.25

$0.21

Net realized and unrealized gain (loss) per share

$0.09

$0.25

$0.12

$(0.16)

$0.12

Earnings

per

share

–

basic

(1)

$0.31

$0.47

$0.34

$0.09

$0.32

Earnings

per

share

–

diluted

(2)

$0.30

$0.45

$0.33

$0.09

$0.31

Dividend declared per common share

$0.20

$0.20

$0.20

$0.20

$0.20

19

SELECT BALANCE SHEET DATA

March 31, 2014

December 31, 2013

September 30, 2013

June 30, 2013

March 31, 2013

Investment portfolio

$3.48 billion

$3.18 billion

$3.03 billion

$3.04 billion

$2.85 billion

Debt outstanding

$1.37 billion

$1.26 billion

$1.08 billion

$1.13 billion

$1.16 billion

Net assets

$2.05 billion

$1.93 billion

$1.86 billion

$1.83 billion

$1.68 billion

Net asset value per share

$8.67

$8.57

$8.30

$8.16

$8.27

Debt-to-equity

0.67 x

0.66 x

0.58 x

0.61 x

0.69 x

Net leverage ratio

(3)

0.68 x

0.65 x

0.62 x

0.66 x

0.70 x

(1) Numbers may not sum due to rounding. (2) In applying the

if-converted method, conversion shall not be assumed for purposes of computing diluted EPS if the effect would be anti-dilutive. (3) The Company’s net leverage ratio is

defined as debt outstanding plus payable for investments purchased and

cash equivalents, plus due to custodian, less receivable for investments sold, less cash equivalents, less cash, less foreign currency, divided by total net assets. |

Financial Highlights (continued)

PORTFOLIO ACTIVITY

(1)

Three months ended

March 31, 2014

Three months ended

December 31, 2013

Three months ended

September 30, 2013

Three months ended

June 30, 2013

Three months ended

March 31, 2013

Investments made during period

$986 million

$630 million

$412 million

$788 million

$428 million

Investments sold

$(323) million

$(293) million

$(284) million

$(105) million

$(98) million

Net investment activity before repayments

$663 million

$337 million

$127 million

$683 million

$330 million

Investments repaid

$(404) million

$(251) million

$(186) million

$(475) million

$(131) million

Net investment activity

$259 million

$86 million

$(59) million

$208 million

$199 million

Number of new portfolio companies

26

21

12

23

10

Number of investments in existing portfolio companies

18

22

18

23

9

Number of exited portfolio companies

16

13

13

10

2

Number of portfolio companies at period end

111

101

93

94

81

WEIGHTED AVERAGE YIELDS

(2)

March 31, 2014

December 31, 2013

September 30, 2013

June 30, 2013

March 31, 2013

Secured debt

10.8%

11.3%

11.1%

11.4%

11.2%

Unsecured debt

11.5%

11.5%

11.7%

11.8%

12.7%

Total debt portfolio

11.1%

11.4%

11.3%

11.6%

11.9%

Portfolio Composition

(fair value)

March 31, 2014

December 31, 2013

September 30, 2013

June 30, 2013

March 31, 2013

1

st

lien

27%

27%

27%

22%

16%

2

nd

lien

29%

24%

25%

26%

28%

Total secured debt

56%

51%

52%

48%

44%

Unsecured debt

27%

32%

34%

39%

43%

Structured products and other

6%

7%

6%

6%

7%

Preferred equity

3%

3%

N/M

N/M

N/M

Common equity and warrants

8%

7%

8%

7%

6%

20

(1) Numbers may not sum due to rounding.(2) On a cost basis, exclusive

of investments on non-accrual status. |

Despite the high level of purchases, sales, and repayments over the

past year and a half, we have generally been able to maintain

the portfolio yield by shifting into more senior less liquid assets.

Investment Activity and Yields

21

Note: Numbers may not sum due to rounding. (1) Based on debt

investments on current cost basis. (2) On total debt portfolio, exclusive of investments on non-accrual status.

LTM

New Investments

2,816

$

Sales

(1,006)

$

Repayments

(1,316)

$

Net Investment Activity

494

$

$428

$788

$412

$630

$986

($98)

($105)

($284)

($293)

($323)

($131)

($475)

($186)

($251)

($404)

Mar-13

Jun-13

Sep-13

Dec-13

Mar-14

New Investments

Sales

Repayments

Quarterly Investment Activity (in $ millions)

11.8%

11.9%

11.6%

11.3%

11.4%

11.1%

11.5%

10.5%

10.4%

10.6%

10.1%

11.7%

10.0%

10.3%

9.4%

9.9%

12.3%

13.4%

11.9%

11.9%

Mar-13

Jun-13

Sep-13

Dec-13

Mar-14

Portfolio Yield (eop) (2)

New Investments

Sales

Repayments

Yield on Investment Activity

(1) |

22

Leverage Ratio

We have consistently operated within our target leverage range of 0.50x

to 0.75x over the past five quarters. The target leverage

range considers the impact of a potential market shock to the fair

value of the portfolio, and the potential funding of off balance sheet

arrangements, while adhering to our regulatory asset coverage

requirement. 0.69 x

0.61 x

0.58 x

0.66 x

0.67 x

0.70 x

0.66 x

0.62 x

0.65 x

0.68 x

0.45 x

0.50 x

0.55 x

0.60 x

0.65 x

0.70 x

0.75 x

0.80 x

Mar-13

Jun-13

Sep-13

Dec-13

Mar-14

Debt

-to-equity

Net Leverage Ratio (1)

Leverage Ratio

Average

Debt-to-equity

0.64x

Net Leverage Ratio

0.64x

(1)

The Company’s net leverage ratio is defined as debt outstanding

plus payable for investments purchased and cash equivalents, plus due to custodian, less receivable for investments sold, less cash equivalents, less cash

less foreign currency, divided by total net assets.

|

Diversification of Funding Sources

Funding Sources

Facility Size

(2)

Interest Rate

Final

Maturity

Date

SENIOR SECURED

FACILITY

$602 million

outstanding

($1.25 billion

commitments)

LIBOR + 200 bps

with no LIBOR floor

Aug-2018

(3)

SENIOR SECURED

NOTES

$225 million

6.25%

Oct-2015

$29 million

(Series A)

5.875%

Sep-2016

$16 million

(Series B)

6.25%

Sep-2018

2042 SENIOR

UNSECURED NOTES

$150 million

6.625%

Oct-2042

2043 SENIOR

UNSECURED NOTES

$150 million

6.875%

July-2043

CONVERTIBLE NOTES

$200 million

5.75%

Jan-2016

TOTAL DEBT

OUTSTANDING

$1,372 million

The weighted average annual interest cost for the year ended March 31,

2014 was 4.95%.

(1)

23

$1,677

$1,833

$1,865

$1,925

$2,052

$150

$300

$300

$300

$300

$200

$200

$200

$200

$200

$536

$355

$312

$491

$602

$270

$270

$270

$270

$270

$2,833

$2,958

$2,947

$3,186

$3,424

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

Mar-13

Jun-13

Sep-13

Dec-13

Mar-14

Retail Unsecured Notes

Convertible Unsecured Notes

Credit Facility (drawn)

Senior Secured Notes

Funding Sources

(1) Exclusive of 0.57% for amortization of debt issuance costs.

(2) As of March 31, 2014. (3) The facility will begin to amortize in August 2017. |

Access to Apollo Global Management, LLC Platform

24

Principal Investment Businesses

(1)

(1)

See

definition

of

AUM

at

the

beginning

of

the

presentation.

Numbers

are

approximate.

As

of

March

31,

2014.

Includes

both

fee-generating

and

non-fee

generating

AUM.

Includes

$1.1

billion

of

commitments

that

have

yet to be deployed to an Apollo fund. (2) Includes funds and

strategic investment vehicles that are denominated in Euros and translated into U.S. dollars at an exchange rate of €1.00 to $1.38 as of March 31, 2014.

Los Angeles

New York

London

Singapore

Frankfurt

Luxembourg

Mumbai

Hong Kong

Houston

Global Footprint

Investment Approach

Value-oriented

Contrarian

Integrated investment

platform

Opportunistic across

market cycles and capital

structures

Focus on nine core

industries

Firm Profile

(1)

Founded:

1990

AUM:

$159

bn

Employees:

761

Inv. Prof.:

302

Private Equity

$48bn

AUM

Credit

(2)

$101bn

AUM

Real Estate

$9bn

AUM |

Interest Rate Exposure

25

(1) On a fair value basis. (2) Income-bearing investment

portfolio. Interest Rate Sensitivity

AIC has taken several steps to prepare its balance sheet for higher

interest rates by having a significant portion of its portfolio

in floating rate assets and issuing fixed rate debt.

$1.3 billion or 42% of the income-bearing portfolio was floating

rate at 3/31/14 up from 39% at 12/31/13

(1)

Issued $150 million of 30-year fixed rate senior unsecured notes

during the fiscal year

only 18% of funding sources (the drawn portion of the revolving

credit facility) are directly sensitive to interest rates

Floating Rate Debt Floor Breakdown

(1) (2)

Fixed

Rate

58%

Floating

Rate

42%

Investment Portfolio

(1) (2)

Floating

Rate

Credit

Facility

18%

Fixed

Rate

Debt

22%

Common

Equity

60%

Funding Sources

Basis Point Change

Annual Net

Income

(in thousands)

Annual

Net

Income per Share

Up

400

basis

points

$21,748

$0.092

Up

300

basis

points

$15,874

$0.067

Up

200

basis

points

$10,583

$0.045

Up

100

basis

points

$(510)

$(0.002)

Fair Value

($ millions)

% of Floating

Rate Portfolio

No Floor

31

3%

< 1.25%

507

40%

>1.25% to < 1.75%

550

43%

>1.75

177

14%

Total

1,265

100% |

Investments on Non-Accrual Status

26

Company

Industry

Investment

Par Amount

(000’s)

Cost

(000’s)

Fair Value

(000’s)

Gryphon Colleges Corporation

(Delta Educational Systems)

(2 investments)

Education

Preferred Stock, 13.50% PIK

Preferred Stock, 12.50% PIK

N/A

$34,549

$13,802

Investments on non-accrual status as of March 31, 2014

0.8%

0.3%

0.3%

0.4%

0.4%

0.0%

0.5%

1.0%

1.5%

2.0%

Percentage of Portfolio on Non

-Accrual Status

(based on fair value)

4.9%

1.1%

1.1%

1.1%

1.0%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

9.0%

10.0%

Percentage of Portfolio on Non

-Accrual Status

(based on cost) |

Target Play (Location)

Williston Basin (aka Bakken)

Permian Basin (aka Bone

Spring)

Utica (American Energy)

Gulf of Mexico (Bennu)

Mississippian Play

Woodbine (East Texas)

Alaska -

North Slope and

Cook Inlet

Building Specialist Origination: Oil & Gas

27

Compelling Industry Fundamentals

5x increase (from $50 billion to $250 billion in 10 years) in

annual capital spending to develop shale resources

Many capital providers to energy industry have reduced

exposure (e.g., banks and hedge funds) since the 2008-09

financial crisis

Total US and global oil and gas capex 1972-present

(1)

Investment Thesis / Strategy

Focus on secured lending against North American

producing upstream oil and gas reserves

Emphasis on significant asset coverage

using

downside case assumptions

Lend against

PDPs

producing reserves) rather than PUDs (proved

un-developed reserves) or acreage

First lien, perfected mortgages on real property

interest

Exploitation rather than exploration

Structured with enhanced financial covenants

Strong upside participation through equity kicker

Mezzanine-like returns with “first dollar”, senior risk

Target Returns: 15-25% IRR and >1.5x MOIC

over a 2+ year hold

(2)

Target Investment Size: $20 to $100 million

Require borrowers to hedge ~75% of expected PDP

production for 2

-3 years

Leverage

Apollo

Natural

Resource

Partners’

private

equity

team / platform

(1) Source: CitiResearch. (2) See disclaimer at beginning of presentation for important

information regarding target returns and MOIC.

(proved developed

US Oil & Gas Total Capital Expenditures in

2010$ (lhs)

Total Global Spending by Top 9 Majors in

2010$ (rhs)

$bn

Previous peak in 1981:

$200bn

Current peak in 2012:

$302bn

6-fold increase in

capex spending

at same time

as 3-4 fold

increase in

costs

0

50

100

150

200

250

300

350

0

20

40

60

80

100

120

140

160

180

200

$bn |

Investment Thesis / Strategy

Generally targeting used current generation Boeing and Airbus

commercial aircraft that remain in demand and / or have engine

commonality with a larger worldwide fleet

–

Target mid-teen returns with strong downside protection

(2)

–

Older aircraft transactions expected to be protected by the

underlying “metal”

value

of the aircraft

Average transaction size expected to range from $15 to $50 million,

depending on number and age of the aircraft; transaction timeframes will

vary widely but generally target 3 -

5 years

Without a central clearinghouse for aircraft trading the market is

inefficient, so nimbly deploying an opportunistic, transaction driven

strategy while leveraging strong relationships and specialized knowledge

creates attractive investment opportunities

Total aircraft strategy could grow to be ~10% of portfolio

Favorable Industry Dynamics

Building Specialist Origination: Aircraft Leasing

We

established

an

operating

subsidiary

–

Merx

Aviation

Finance,

LLC

–

to

participate

in

aircraft

leasing

transactions

which

is

led

by an experienced aircraft investment team.

We

believe

AIC’s

participation

in

the

aircraft

leasing

space

is

expected

to

provide

“mezzanine-like”

returns

with better than “mezzanine-like”

downside protection

Global air traffic has grown at roughly 2x global GDP and is expected

to continue to grow at a similar rate

(1)

–

Emerging

markets,

including

China

and

India,

are

expected

to

drive future growth

(1)

–

To support the increased air traffic, commercial aircraft fleet

has doubled

over last 20 years and is expected to double over

next 20 years

(1)

–

Stabilizes the value of older aircraft which must keep flying to

service enhanced aircraft demands

Movement of aircraft from airlines’

balance sheets to dedicated

lessor

balance

sheets

–

~ 35% of the global aircraft fleet is currently under operating

leases,

up by a factor of 7 over the last 20 years

(1)

–

Demand for use of operating leases by airlines is increasing

as airlines seek (i) to free-up capital, (ii) focus on core

competency of operating flights, and (iii) transfer / reduce residual

risk

(1)

Traditional capital providers to the space

(other than new deliveries)

have

been

pulling

back,

providing

an

attractive

capital

entry

point

–

Notable participants who have shrunk their balance sheets

recently include European banks and large investment banks,

which have pulled back from the used aircraft market as capital

requirements have increased

28

(1) Source: Deutsche Bank research. (2) See disclaimer at

begnning of presentation for important information regarding target returns. |